- Home

- »

- Healthcare IT

- »

-

Digital Pathology Market Size, Share, Industry Report, 2033GVR Report cover

![Digital Pathology Market Size, Share & Trends Report]()

Digital Pathology Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Academic Research, Disease Diagnosis), By Product (Software, Device), By End Use (Diagnostic Labs, Hospitals), And Segment Forecasts

- Report ID: 978-1-68038-386-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Pathology Market Summary

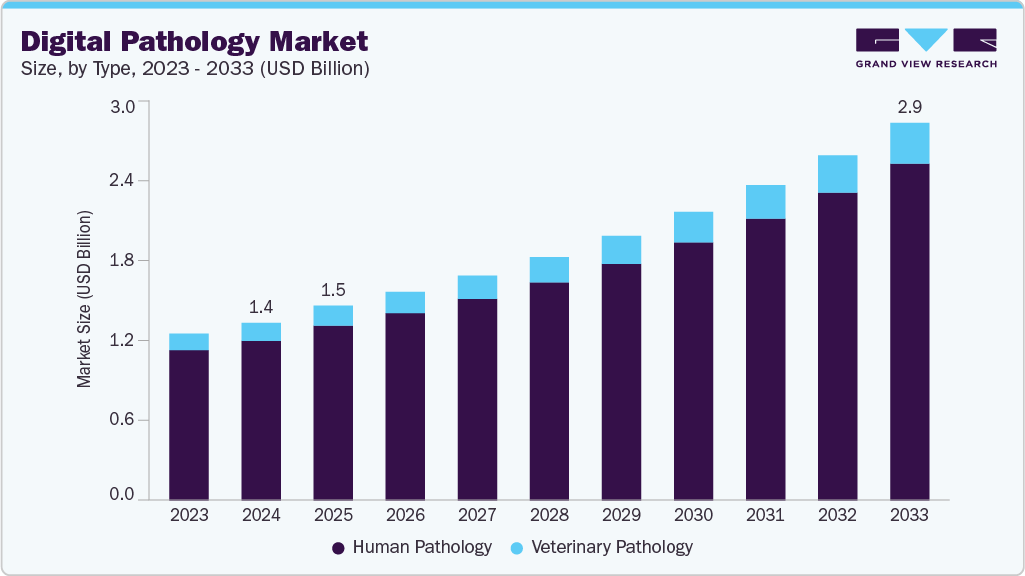

The global digital pathology market size was estimated at USD 1.53 billion in 2025 and is projected to reach USD 2.97 billion by 2033, growing at a CAGR of 8.6% from 2026 to 2033. This is attributed to rising prevalence of cancer, increasing focus on improving the efficiency of workflow, and growing demand for faster diagnostic tools.

Key Market Trends & Insights

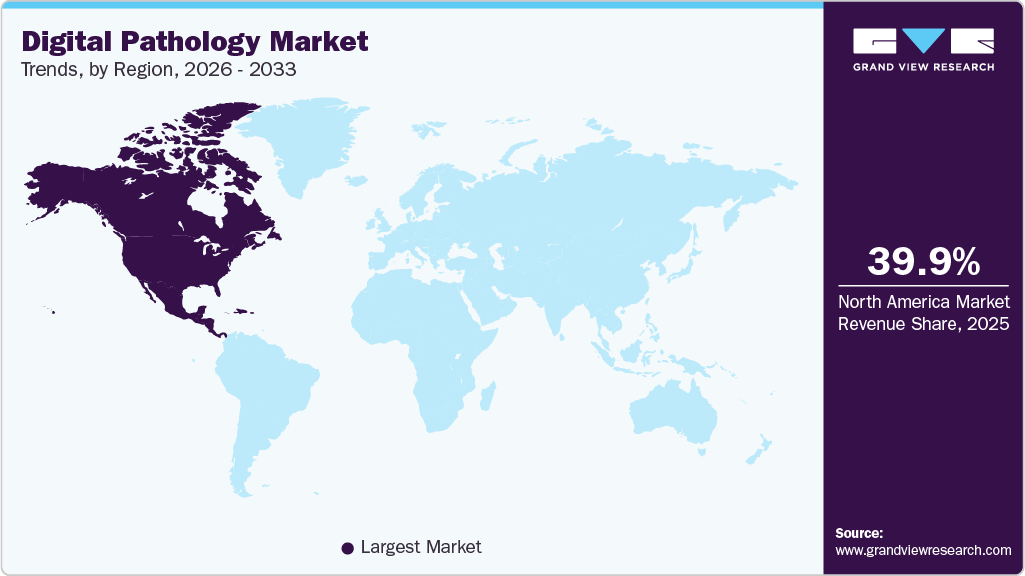

- North America dominated the global digital pathology market with the largest revenue share of 39.92% in 2025.

- The digital pathology market in Asia Pacific is expected to grow at the fastest CAGR from 2026 to 2033.

- By type, the human pathology segment led the market with the largest revenue share of 89.83% in 2025.

- By product, the software segment led the market with the largest revenue share of 42.88% in 2025.

- By application, the academic research segment led the market with the largest revenue share of 45.76% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.53 Billion

- 2033 Projected Market Size: USD 2.97 Billion

- CAGR (2026-2033): 8.6%

- North America: Largest market in 2025

Moreover, rising investments in healthcare aided by major key players operating in the market focusing on new launches, increasing adoption of telepathology, and an increasing focus on drug discovery and precision medicine is propelling the market growth.The digital pathology industry is predominantly driven by the growing prevalence of chronic diseases such as cancer. As a consequence of the high prevalence of cancer, pathologists require pathology data that can facilitate customizing of therapies for patients. Therefore, digital pathology is increasingly preferred by pathologists, as it accelerates the diagnosis rate, enhances diagnostic accuracy, and provides therapeutic recommendations to improve patient outcomes. For instance, a 2024 study published in Breast Cancer Research highlights the application of deep learning models such as ResNet50, Transformer, and Hover-net in enhancing image enhancement, segmentation, and classification for breast cancer diagnosis. Such instances signify the growth potential of the market.

Rising adoption of healthcare IT solutions is fueling the demand for digital pathology solutions. Organizations are increasingly implementing them to cut costs, streamline processes, overcome resource bottlenecks, and facilitate efficient content sharing. A growing necessity for collaborations and the expanding use of digital documentation across various scientific disciplines also drives the demand. In addition, factors such as heightened adoption to enhance laboratory efficiency, a surge in teleconsultations, and increased applications in companion diagnostics and drug discovery are expected to contribute to the market's growth.

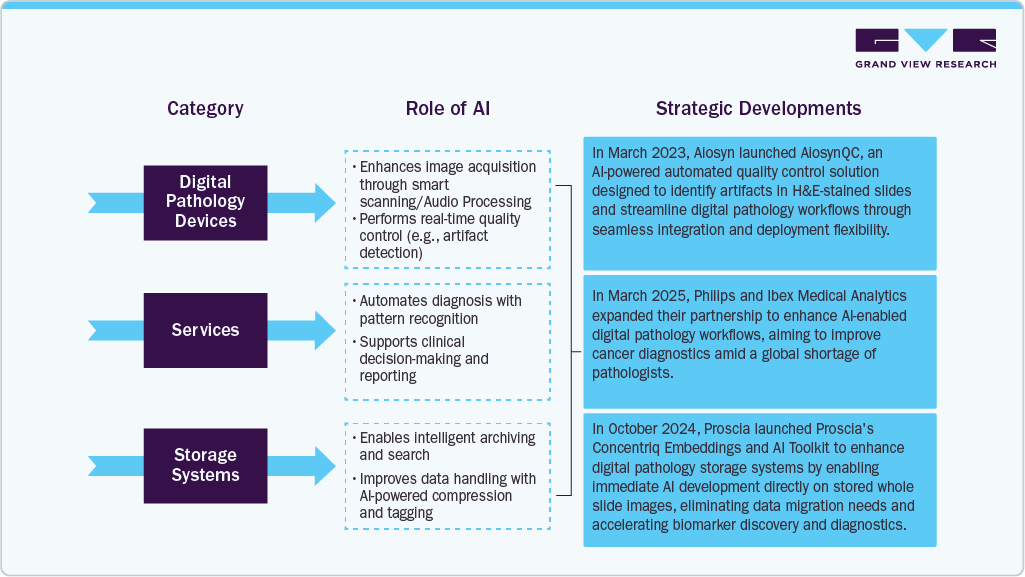

Additionally, AI is being leveraged to enhance the analysis of digital images. Previously, pathologists had to identify regions of interest within tissue samples manually, but AI is now automating this process. This shift reduces the reliance on manual labor, minimizing the risk of human error and promoting greater automation in pathology practices.

AI in Digital Pathology Market

The use of AI-enabled digital pathology has gained momentum in recent years. The growing need to lower healthcare costs, the increasing importance of big data in healthcare, the rising adoption of precision medicine, and declining hardware costs are some factors expected to drive the market. In addition, the increasing applicability of AI-based tools in medical care and the rise in venture capital investments can be attributed to the growing demand for this technology. Integration of AI and digital pathology represents a transformative era with remarkable analytical capabilities.

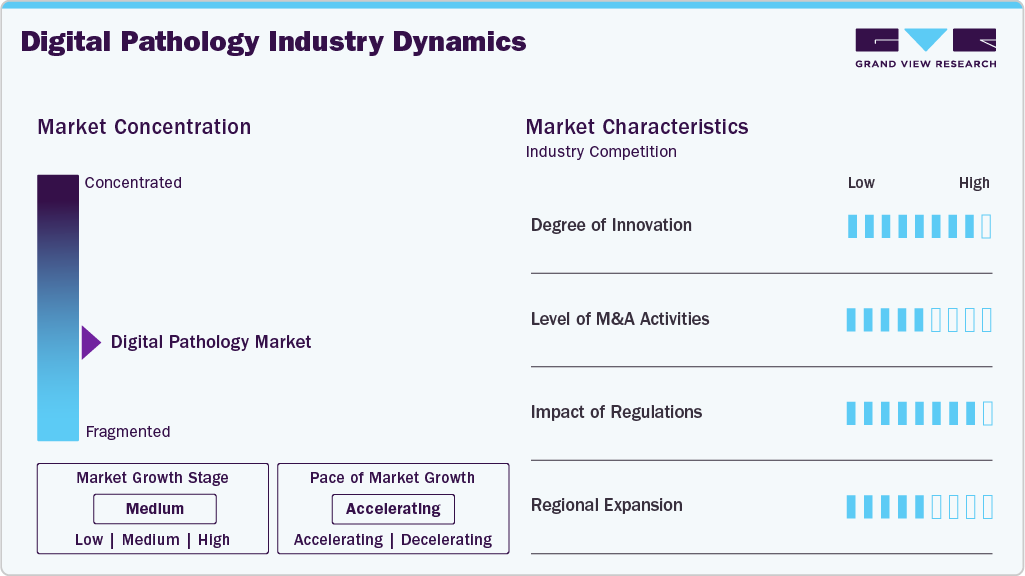

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, the impact of regulations, the level of partnership and collaboration activities, the degree of innovation, and regional expansion. For instance, the digital pathology industry is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry are high. However, the regional expansion observes moderate growth.

The degree of innovation in the digital pathology industry is high, driven by propelled by advancements in artificial intelligence (AI), machine learning (ML), and cloud-based technologies. The market is experiencing significant innovation as numerous players introduce new products characterized by rapid technological advancements, such as artificial intelligence and data analytics, for the rapid digitalization of pathology processes. For instance, in May 2024, Indica Labs released new version 4.0 of its HALO, HALO AI, and HALO Link software, offering researchers and pathologists advanced AI-powered tissue analysis.

The level of mergers & acquisitions in the digital pathology industry is moderate, driven by the industry's rapid growth and the need for companies to enhance their technological capabilities and market reach. For instance, in February 2023, Fujifilm acquired the global digital pathology business of Inspirata, including its Dynamyx digital pathology system.

The impact of regulations on the digital pathology industry is high. The market is governed by several stringent regulations designed to ensure data integrity, security, patient privacy, and compliance with clinical trial standards. The primary regulations governing the market include the U.S. FDA, HIPAA, Clinical Laboratory Improvement Amendments, etc.

The level of regional expansion in digital pathology industry is moderate due to increasing demand for digital solutions in developing countries. For instance, In March 2023, Hamamatsu entered into a multi-year distribution partnership with Siemens Healthineers, wherein Hamamatsu will supply NanoZoomer slide scanners to facilitate Siemens Healthineers' digital pathology expansion efforts across the Americas and Europe

IMP Diagnostics, one of Portugal’s leading private pathology labs, embarked on a digital transformation journey to modernize operations, improve efficiency, and prepare for a tech-driven future in diagnostics.

The lab faced multiple challenges, including the need to integrate digital pathology without disrupting existing workflows, overcoming resistance from staff used to traditional microscopy, managing the massive volume of data generated by digitized slides, and making significant investments in high-end scanners and IT infrastructure.

IMP adopted a strategic, phased approach. First, they introduced a 2D barcode tracking system to streamline sample handling, assembled a multidisciplinary team to lead the transition, and engaged with vendors and international labs to learn best practices. By starting with partial digitization and scaling up gradually, they allowed staff time to adapt. Comprehensive training programs ensured pathologists and technicians were comfortable with the new digital tools.

As a result, IMP Diagnostics achieved faster turnaround times, enhanced diagnostic accuracy through real-time remote collaborations, improved workflow efficiency, and increased staff satisfaction. The digital infrastructure also laid the foundation for the future integration of AI tools, positioning the lab as a model for successful digital pathology transformation in the private sector.

Product Insights

The software segment led the market with the largest revenue share of 42.88% in 2025 and is anticipated to witness at the fastest CAGR from 2026 to 2033. This growth is attributed to the rising number of cancer cases, with key players focusing on the development of novel digital pathology systems in the industry. For instance, in August 2021, Xybion Corp. launched Pristima XD Digital Pathology, which helps provide improved lab throughput and streamlines workflows. In January 2019, F. Hoffmann-La Roche Ltd. launched uPath enterprise software, for improving performance, speed, and use for digital pathology. Such innovative incorporation of integrated software helps in improving workflows.

The device segment is anticipated to grow at the fastest CAGR during the forecast period. The device segment includes a slide management system and a scanner. The segment's growth is attributed to the increasing adoption of digital pathology in academic research activities, which offers enhanced resolution. For instance, in June 2022, F. Hoffmann-La Roche Ltd. received a CE marking for its VENTANA DP 600 slide scanner, a next-generation, high-capacity slide scanner that generates high-resolution digital images of stained tissue samples to aid in cancer diagnosis and treatment planning.

Type Insights

The human pathology segment accounted for the largest market revenue share in 2025. The adoption of digital pathology to reduce turnaround time for disease diagnosis and enhance lab productivity is fueling segment growth. In addition, the rising prevalence of chronic diseases in humans has increased the demand for digital pathology.

The veterinary segment is anticipated to experience at the fastest CAGR over the forecast period. The implementation of digital pathology in the veterinary sector is facilitated by fewer restrictions on veterinary diagnoses using virtual scanned slides. Furthermore, the proactive push for automation is driving the demand for the use of digital pathology in the veterinary field.

Therapeutic Area Insights

The oncology segment led the market with the largest revenue share of 52.02% in 2025. driven by the increasing prevalence of cancer and the growing need for precise, efficient, and quantitative analysis of tumor tissues. For instance, according to the National Cancer Institute, cancer is among the leading causes of death worldwide. In 2022, there were almost 20 million new cases and 9.7 million cancer-related deaths globally. In addition, the growing adoption of digital pathology for tumor classification, biomarker discovery, and companion diagnostics, along with advancements in AI- and ML-based image analytics, is significantly enhancing diagnostic accuracy and workflow efficiency.

The cardiovascular segment is anticipated to witness at the fastest CAGR from 2026 to 2033, owing to the increasing prevalence of heart diseases, growing adoption of AI-enabled image analysis for tissue characterization, and rising use of digital pathology in cardiovascular research and biomarker discovery. The demand for precise histopathological assessment in cardiac tissue studies and drug development further supports segment expansion

Application Insights

The academic research segment led the market with the largest revenue share of 45.76% in 2025, owing to the continual research in the development of cancer therapies and high adoption of digital pathology in various research studies. A number of academic research institutes are collaborating with digital pathology providers to incorporate the technology into research activities. In November 2022, the University Medical Center Utrecht entered into a partnership with Paige for the deployment of the company’s application in clinical use and to conduct a clinical health economics study to support reimbursement and adoption of AI applications in pathology.

The disease diagnosis segment is anticipated to witness the fastest CAGR from 2025 to 2033, owing to the increasing prevalence of chronic diseases, and the increasing focus of manufacturers on the development of rapid and novel diagnostic techniques for ease in the circulation of inter and intra-departmental information. Digital adoption of technologies helps in improving and enhancing the efficiency of disease diagnosis and, hence, improving therapeutics. For instance, in April 2022, PreciseDx entered into a collaboration with The Michael J. Fox Foundation for the launch of AI-enabled digital pathology technology for the diagnosis of Parkinson's disease before severe symptoms are seen in patients.

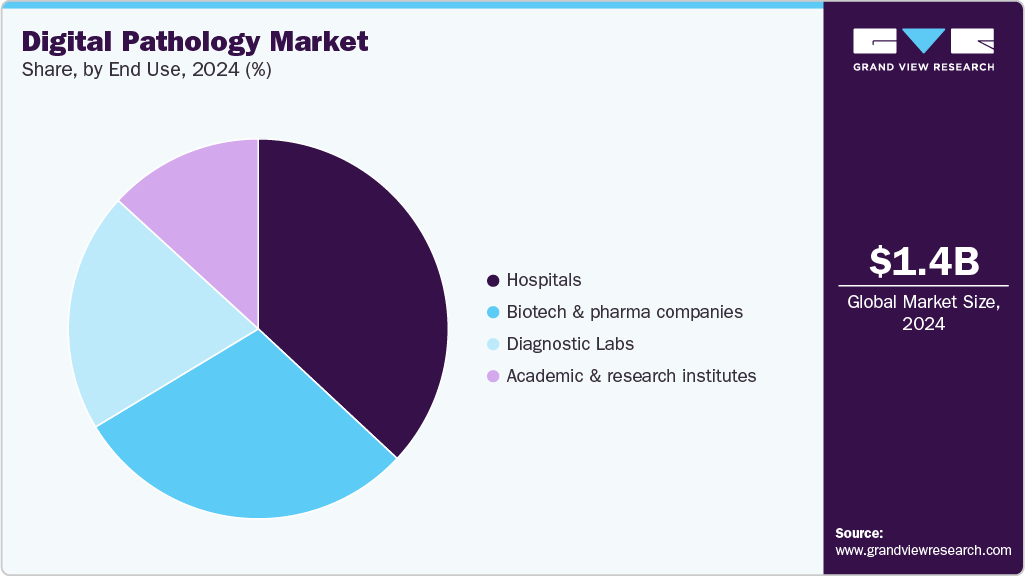

End Use Insights

The hospitals segment led the market with the largest revenue share of 37.15% in 2025. Hospitals are the most preferred healthcare setting for disease diagnosis and care. Developments in hospital laboratories are crucial to address the evolving needs of patients, with more hospitals aiming to provide a wide range of services within their settings.Several hospitals are implementing digital scanning techniques to enhance patient compliance and expedite diagnosis. For instance, in March 2023, Ibex (Ibex Medical Analytics) received a PathLAKE contract to provide AI-enabled solutions at 25 NHS trusts, supporting cancer diagnosis.

The diagnostic labs segment is expected to grow at the fastest CAGR from 2026 to 2033, owing to increasing focus on drug development, preclinical GLP pathology, and oncology clinical trials. Moreover, the increasing prevalence of cancer and the adoption of digital pathology in diagnostic labs are fueling the market growth. For instance, in January 2022, Inform Diagnostics launched FullFocus, a digital pathology viewer developed by Paige in its laboratory, utilizing AI tools to streamline logistics and achieve faster results.

Regional Insights

North America dominated the global digital pathology market with the largest revenue share of 39.92% in 2025, due to increasing government initiatives leading to the development of technologically advanced pathologies, continual deployment of R&D investments, rising adoption of digital imaging, and the presence of key market players in the region focusing on providing better solutions to the population. For instance, in March 2023, PathAI launched AISight, a digital pathology platform across the U.S. in 13 leading health systems, reference laboratories, medical centers, and independent pathology organizations to participate in the Early Access Program. Moreover, the increasing use of digital pathology in academic research and disease diagnosis is propelling market growth.

U.S. Digital Pathology Market Trends

The digital pathology market in the U.S. accounted for the largest market revenue share in North America in 2025, driven by the presence of well-established healthcare infrastructure & high per capita healthcare expenditure in the U.S. is a major factor contributing to the high adoption rate of advanced digital pathology systems. Growing approval of AI-powered tools designed by AI-based, digital pathology-focused companies to identify invasive breast cancer and skin lesions is another factor boosting the market growth in the country.

Europe Digital Pathology Market Trends

The digital pathology market in Europe is anticipated to grow at a significant CAGR during the forecast period. High prevalence of chronic diseases, such as cancer and cardiovascular conditions, along with a large number of diagnostic imaging centers in Europe, propels the market growth. The presence of government initiatives for continued research and development (R&D) in digital pathology is another key factor driving the growth of this market. The European Institute of Biomedical Imaging Research has invested more than USD 66.84 million in biomedical imaging research over the past decade.

The UK digital pathology market is expected to witness growth opportunities over the coming years. The growth is attributed to the increasing preference for digital pathology due to its associated benefits. These benefits include easier access to slides, reduced risk of errors, and rapid diagnosis. The growing number of cancer cases in the UK is also a high-impact rendering driver for digital pathology in the UK.

The digital pathology market in Germany is driven by consistent efforts by public and private organizations to promote awareness with respect to digital pathology in Germany. For example, the Digital Pathology Commission of the Federal Association of German Pathologists has developed guidelines for digital diagnostics and virtual microscopy, which are recommended for implementation in routine pathology procedures.

Asia Pacific Digital Pathology Market Trends

The digital pathology market in the Asia Pacific is expected to grow at the fastest CAGR from 2026 to 2033. This growth is attributed to rapid digitalization, a growing focus on investments in the medical field, and increasing digital imaging penetration in developing economies. The region shows an increasing prevalence of cancer, which propels the need for novel treatment options, further boosting market growth. In March 2023, Qritive entered into a collaboration with Corista for the integration of AI using the company’s DP3, a DICOM-compliant pathology software in digital pathology. Such initiatives help provide better patient care through novel treatment options, ultimately reducing laboratory costs.

The Japan digital pathology market growth is attributed to technological developments in the field of digital pathology. Moreover, approval for novel technologies is anticipated to fuel the adoption of advanced digital pathology platforms. Government and nongovernment organizations are taking steps to increase the diagnosis rate for early cancer intervention is further contributing to the market growth.

The digital pathology market in China is experiencing rapid growth. Key players operating in the market are focusing on capitalizing on opportunities owing to the growing patient pool and unmet medical needs in the country is contributing to the growth of the digital pathology industry in China. For instance, In June 2023, Aignostics, a prominent AI-driven pathology company, and Virchow Laboratories, a renowned pathology lab chain in China, announced a strategic partnership aimed at enhancing the integration of AI technology in pathology practices across China for both research & clinical applications.

Latin America Digital Pathology Market Trends

The digital pathology market in Latin America held a significant share in 2025. The growth is attributed to various factors such as increasing healthcare awareness, availability of technically advanced procedures for the diagnosis & treatment of fatal diseases, and the rising prevalence of cancer in this region. Moreover, collaborations and partnerships between local pathology laboratories and international digital pathology solution providers further propel market expansion.

Middle East and Africa Digital Pathology Market Trends

The digital pathology market in the Middle East and Africa is influenced by the unmet need for pathology services in the world. Pathology informatics in Africa has mainly focused on telepathology applications, primarily with European collaborators, to seek expert consultation and outsource their work. Furthermore, the African region has witnessed a transformation in digital pathology due to the introduction of computers in healthcare, coupled with advanced networking technologies such as the internet.

Key Digital Pathology Company Insights

The companies operating in this market are focusing on strategic partnerships, collaborations with other organizations, and innovative solutions. Furthermore, the market players are undertaking strategies such as acquisitions, new product launches, joint ventures and agreements, and expansion in other regions to increase their market outreach.

Key Digital Pathology Companies:

The following are the leading companies in the digital pathology market. These companies collectively hold the largest market share and dictate industry trends.

- Leica Biosystems Nussloch GmbH (Danaher)

- Hamamatsu Photonics, Inc.

- Koninklijke Philips N.V.

- Olympus Corporation

- F. Hoffmann-La Roche Ltd.

- ContextVision AB

- Mikroscan Technologies, Inc.

- Epredia (3DHISTECH Ltd.)

- Visiopharm A/S

- Huron Technologies International Inc.

- CellaVision

- HANGZHOU ZHIWEI INFORMATION TECHNOLOGY CO. LTD. (MORPHOGO)

- West Medica Produktions- und Handels- GmbH (West Medica)

- aetherAI

- IBEX (IBEX MEDICAL ANALYTICS)

- SigTuple Technologies Private Limited

- Morphle Labs, Inc

- Bionovation Biotech, Inc.

- Scopio labs

- SigTuple Technologies Private Limited

- Inspirata, Inc

- Path Hub

- Sectra AB

- Agfa-Gevaert Group

- OptraScan

- Agilent Technologies, Inc.

- KFBIO

Some of the Players in the AI in Digital Pathology Market:

- Aiosyn

- Proscia Inc

- EVIDENT

- Aignostics, Inc.

- Aiforia

- Dedalus S.p.A

- Qritive

- Mindpeak GmbH

- CGI Inc.

- Gestalt

Recent Developments

-

In January 2025, Leica Biosystems enhanced its Aperio GT 450 digital pathology scanner by introducing features such as DICOM-compatible files with 20x/40x magnification, Z-Stacking, Manual Scan, Extended Focus, and Default Calibration. Further the Aperio iQC software employs AI to detect digital and histological artifacts, streamlining workflows and improving efficiency in digital pathology.

Leica Biosystems is not just enhancing a product; we're revolutionizing Digital Pathology.

-Vice President of Digital Pathology at Leica Biosystems.

-

In November 2023, Leica Biosystems announced three significant software upgrades for the Aperio GT 450 scanner. These upgrades, comprising a patent-pending quality control feature, aim to enhance image quality and offer more versatile scanning options in research environments. The new features include Automatic Narrow Stripe Scanning, Z-Stack Scanning, and 20x Magnification.

Digital pathology offers a significant advantage for laboratory scientists in cancer research. The growing amount of research performed will be empowered by the accessibility and efficiencies afforded by this technology”.

-said Naveen Chandra, Vice President of Digital Pathology at Leica Biosystems.

-

In November 2023, Owkin broadened the accessibility of its AI diagnostic for colorectal cancer by integrating it with Sectra. This integration of Owkin’s MSIntuit CRC1 diagnostic into the digital pathology solution from Sectra is aimed to streamline MSI screening and enhance access to immunotherapies for patients with colorectal cancer.

“We are thrilled that Owkin's AI diagnostic portfolio is now able to benefit from the integration with Sectra, a global leader for image management. We share with Sectra a commitment to vendor neutrality, to enable the broadest possible access to and maximum patient impact from innovative and best-in-class digital pathology solutions. This approach means that many more pathologists and patients can benefit from AI-powered, streamlined laboratory processes and testing and focus on improving patient access to targeted precision therapies.

-Meriem Sefta, Chief Diagnostics Officer

-

In October 2023, Pramana and Gestalt announced the availability of an integrated AI-powered platform and digital pathology solutions, combining digital pathology, AI, image analysis, and DICOM into a streamlined, single, comprehensive offering.

“The relationship between Gestalt and Pramana has evolved quickly due to our combined commitment to bring advanced technological solutions to healthcare that improve accuracy, efficiency, and stay on top of technological advancements”.

- Lisa-Jean Clifford, Gestalt COO and Chief Strategy Officer

-

In September 2022, Hamamatsu Photonics and Proscia partnered to expedite the implementation of digital pathology at the corporate level.

“This collaboration between Hamamatsu and Proscia will provide a true open ecosystem to the market to increase digital pathology adoption”

- Akiyoshi Mabuchi, Manager Business Planning, Systems Division at Hamamatsu

-

In July 2021, Olympus Corporation partnered with Grundium Ltd. to incorporate its X Line objectives into Grundium’s Ocus portable slide scanners to facilitate easy creation and sharing of digital slides.

“Working with Olympus has been very easy from the start. It feels great to be making an impact on digital pathology together. Grundium Ocus® microscope scanners combined with top-level Olympus optics are a great fit to enable medical professionals to work faster and easier.”

- Davide D’Incau, Grundium Sales Director.

Digital Pathology Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1.64 billion

Revenue forecast in 2033

USD 2.97 billion

Growth rate

CAGR of 8.6% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR in % from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, therapeutic area, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Russia; Spain; Netherlands; Switzerland; Sweden; Denmark; Norway; Japan; China; India; Indonesia; Thailand; Australia; South Korea; Philippines; Malaysia; Singapore; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; Turkey; Iran; United Arab Emirates; Israel; Kuwait

Key companies profiled

Leica Biosystems Nussloch GmbH (Danaher); Hamamatsu Photonics, Inc.; Koninklijke Philips N.V.; Olympus Corporation; F. Hoffmann-La Roche Ltd.; ContextVision AB; Mikroscan Technologies, Inc.; Epredia (3DHISTECH Ltd.); Visiopharm A/S; Huron Technologies International Inc.; CellaVision; HANGZHOU ZHIWEI INFORMATION TECHNOLOGY CO. LTD. (MORPHOGO); West Medica Produktions- und Handels- GmbH (West Medica); aetherAI; IBEX (IBEX MEDICAL ANALYTICS); SigTuple Technologies Private Limited; Morphle Labs, Inc.; Bionovation Biotech, Inc.; Scopio labs; SigTuple Technologies Private Limited; Inspirata, Inc.; Path Hub; Sectra AB; Agfa-Gevaert Group; OptraScan; Agilent Technologies, Inc.; KFBIO

AI enabled solution providers-

Aiosyn; Proscia Inc.; EVIDENT; Aignostics, Inc.; Aiforia; Dedalus S.p.A; Qritive; Mindpeak GmbH; CGI Inc.; Gestalt

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Pathology Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global digital pathology market based on product, application, therapeutic area, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Device

-

Scanners

-

Slide Management Systems

-

-

Storage System

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Human Pathology

-

Veterinary Pathology

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Drug Discovery & Development

-

Academic Research

-

Disease Diagnosis

-

Cancer Cell Detection

-

Others

-

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Cardiovascular

-

Neurology

-

Others (Including dermatology, infectious diseases, gastrointestinal, etc.)

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Biotech & Pharma Companies

-

Diagnostic Labs

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Russia

-

Spain

-

Netherlands

-

Switzerland

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Indonesia

-

Thailand

-

Australia

-

South Korea

-

Philippines

-

Malaysia

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Turkey

-

Iran

-

United Arab Emirates

-

Israel

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global digital pathology market size was estimated at USD 1.53 billion in 2025 and is expected to reach USD 1.64 billion in 2026.

b. The global digital pathology market is expected to grow at a compound annual growth rate of 8.6% from 2026 to 2033 to reach USD 2.97 billion by 2033.

b. North America dominated the global digital pathology market with the largest revenue share of 39.92% in 2025. This is attributable to the deployment of R&D investments, supportive government initiatives, technologically advanced systems, rising adoption of digital imaging, and the presence of major players.

b. Some key players operating in the digital pathology market include Leica Biosystems Nussloch GmbH (Danaher); Hamamatsu Photonics, Inc.; Koninklijke Philips N.V.; Olympus Corp.; F. Hoffmann-La Roche Ltd.; Mikroscan Technologies, Inc.; Inspirata, Inc.; Epredia (3DHISTECH Ltd.); Visiopharm A/S; Huron Technologies International Inc.; ContextVision AB; HANGZHOU ZHIWEI INFORMATION TECHNOLOGY CO. LTD. (MORPHOGO); West Medica Produktions- und Handels- GmbH (West Medica); IBEX (IBEX MEDICAL ANALYTICS); SigTuple Technologies Private Limited; Morphle Labs, Inc.; Bionovation Biotech, Inc.; Scopio labs; Path Hub; Sectra AB; Agfa-Gevaert Group; OptraScan; Agilent Technologies, Inc.; KFBIO; CellaVision. Aiosyn; Proscia Inc.; EVIDENT; Aignostics, Inc.; Aiforia; Dedalus S.p.A; Qritive; Mindpeak GmbH; CGI Inc.; aetherAI; Gestalt

b. Key factors that are driving the digital pathology market growth include rising prevalence of cancer, increasing focus on improving the efficiency of workflow, and growing demand for faster diagnostic tools. Moreover, rising investments in healthcare aided by major key players operating in the market focusing on new launches, increasing adoption of telepathology, and an increasing focus on drug discovery and precision medicine is propelling the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.