- Home

- »

- Power Generation & Storage

- »

-

Electrolytic Manganese Dioxide Market Size Report, 2030GVR Report cover

![Electrolytic Manganese Dioxide Market Size, Share & Trends Report]()

Electrolytic Manganese Dioxide Market (2024 - 2030) Size, Share & Trends Analysis Report, By Application (Batteries, Water Treatment), By Region (North America, Europe, Asia Pacific, CSA, MEA), And Segment Forecasts

- Report ID: 978-1-68038-555-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electrolytic Manganese Dioxide Market Summary

The global electrolytic manganese dioxide market size was estimated at USD 1.57 billion in 2023 and is projected to reach USD 2.55 billion by 2030, growing at a CAGR of 7.3% from 2024 to 2030. This growth is attributed to the rising demand for EMD in battery applications, particularly lithium-ion batteries for electric vehicles and consumer electronics.

Key Market Trends & Insights

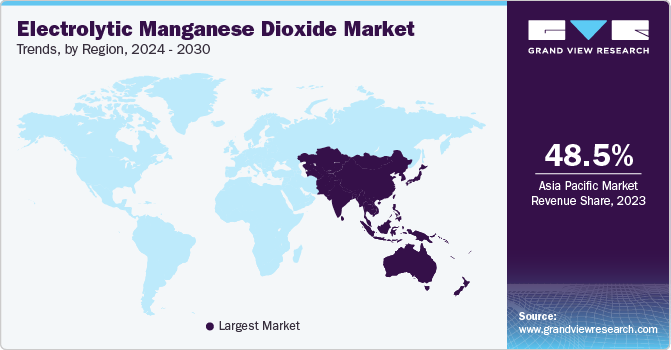

- Asia Pacific electrolytic manganese dioxide market dominated the global market with a revenue share of 48.5% in 2023.

- China dominated the Asia Pacific market and accounted for the largest revenue share in 2023.

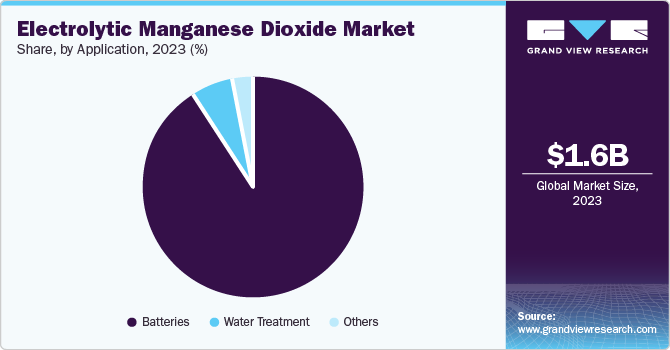

- Based on application, the batteries segment dominated the market and accounted for the largest revenue share of 91.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.57 Billion

- 2030 Projected Market Size: USD 2.55 Billion

- CAGR (2024-2030): 7.3%

- Asia Pacific: Largest market in 2023

In addition, the increasing focus on renewable energy storage solutions and advancements in battery technology are propelling market expansion. Furthermore, the growing emphasis on sustainable practices and the need for high-purity manganese compounds in various industrial applications also fuel the demand for electrolytic manganese dioxide(EMD) globally.

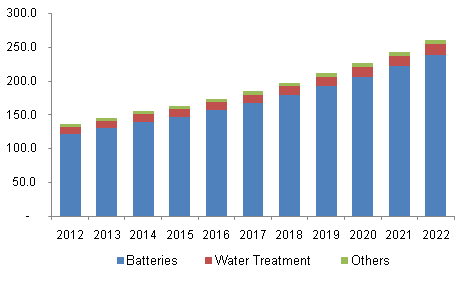

The demand for portable devices is expected to influence the market growth positively. Batteries retain the potential to absorb damage and fluctuations and provide a constant power supply to electric and electronic devices. Increasing demand for power backups in emerging economies, such as Vietnam, China, and India, is expected to accelerate in the coming years. In addition, the growing acceptance of hybrid and electric vehicles coupled with the government incentives for the promotion of EV technology is projected to propel the growth of battery and electric car industries. Moreover, volatile gasoline prices positively impact the EV demand, compelling the battery service networks to enhance and surpass the gasoline-fueling infrastructure.

Furthermore, increased demand for renewable energy sources has led to increased demand for batteries for energy storage. The rise in the renewable energy sectors, such as solar and wind power, has increased the demand for batteries to store the electricity produced by solar and wind power. Major companies have invested in research and development activities to manufacture portable and efficient energy storage batteries. Moreover, the rise in the production of alkaline batteries used in devices such as flashlights, toys, and remote controls has also led to the growth of the EMD market.

Application Insights

Batteries dominated the market and accounted for the largest revenue share of 91.5% in 2023 attributed to the demand for lithium-ion, zinc-carbon, and alkaline batteries. Alkaline batteries are designed to deliver long-lasting performance and are used in various electronic products, such as clocks, radios, and remote controls. The high run time and productivity have led alkaline batteries to showcase the highest market penetration. Military applications have driven demand for alkaline batteries, contributing to the EMD market growth. Lithium-ion batteries offer extended power storage and are used in all portable instruments, including toys, digital diaries, iPods, artificial pacemakers, calculators, and wrist and stopwatches. Furthermore, the increasing demand for electric vehicles will drive the lithium-ion battery market in the forthcoming years.

The water treatment segment is projected to grow considerably during the forecast period. EMD is used in electrodes in water treatment plants to separate waste and impurities from water and ensure safe drinking. Due to its high surface area and electrical conductivity, it is an effective performance chemical used in water treatment applications. Furthermore, EMD is employed in both industrial and municipal water treatment facilities. Mining, chemicals, and power generation heavily rely on efficient water treatment processes.

Regional Insights

The Asia Pacific electrolytic manganese dioxide market dominated the global market with a revenue share of 48.5% in 2023, owing to the increasing demand for battery applications and electronic products. The region is the highest producer of EMD, which significantly caters to the rising demand for energy storage systems and the automotive electronics sector. Furthermore, major manufacturing companies and abundant raw materials in the region have contributed to the growth, as companies can produce primary and secondary batteries in large quantities.

The electrolytic manganese dioxide market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2023 attributed to major manufacturing companies' presence and rising demand for EVs and energy storage systems. Major EV companies have manufacturing units in this country due to the easy availability of raw materials and cheap labor. This aids in the mass production of the vehicles. Furthermore, the rising demand for electronic products has contributed to the growth of the EMD market in this country.

Europe Electrolytic Manganese Dioxide Market Trends

Europe electrolytic manganese dioxide market accounted for a significant revenue share of in 2023 attributed to the growing demand for EV and battery-operated electronic device applications. European governments have steadily invested in lithium-ion battery charging stations to enhance vehicle sustainability. This is expected to increase the demand for battery-operated vehicles in the coming years. In addition, companies have increasingly sought to improve their market expansion by launching an electric variant of their vehicles. Furthermore, growth in the renewable sectors, such as solar and wind energy, has led to an increased demand for energy storage systems.

North America Electrolytic Manganese Dioxide Market Trends

The North America electrolytic manganese dioxide marketis expected to witness a significant growth rate over the forecast period attributed to rising demand for EVs and battery-operated devices. Growth in the manufacturing sector of primary and secondary batteries has also led to market growth in this region. Furthermore, rising water contamination levels have led to increased demand for water purification systems.

U.S. Electrolytic Manganese Dioxide Market Trends

The electrolytic manganese dioxide market in the U.S. is expected to witness substantial growth over the forecast period, owing to the presence of major EV manufacturing companies and rising demand for battery-operated devices. Major EV companies such as Tesla and Lucid Motors have increasingly focused on market expansion by launching various models of EVs in the country. Moreover, the presence of a wide network of charging stations has resulted in consumers shifting to EVs as they are cost-effective and environment-friendly.

Key Electrolytic Manganese Dioxide Company Insights

Some of the key players operating in the global electrolytic manganese dioxide market are TOSOH BIOSCIENCE LLC, South Manganese Investment Limited, Vibrantz, Mesa Minerals Partners, and others. These companies have increasingly adopted sustainable strategies to procure high-quality raw materials for long-term benefits. These key participants have adopted an organic strategy of using advanced technologies and integrating value chains to accomplish economies of scale and higher profit margins. Mergers, acquisitions, and joint ventures are some of the new strategies expected to be implemented by the companies for higher market penetration.

-

Vibrant is a global provider of specialty chemicals and mineral solutions. The company offers products for various applications, including aerospace, animal nutrition, industrial coatings, electronic components, and health and personal care. Its dielectric powders, manganese minerals, and colorants enhance product safety, durability, and vibrancy.

-

Cegasa specializes in electrochemical energy storage solutions. The company is known for zinc-air batteries, which are ideal for low-current applications with long life and minimal maintenance. Their products maximize crop production, support electronic devices, and contribute to sustainability.

Key Electrolytic Manganese Dioxide Companies:

The following are the leading companies in the electrolytic manganese dioxide market. These companies collectively hold the largest market share and dictate industry trends.

- Tosoh Bioscience LLC

- South Manganese Investment Limited

- Vibrantz

- Mesa Minerals Partners

- METAL POWDER GROUP

- Cegasa

- Borman Specialty Materials

- BariteWorld

- Moil Limited

- Tronox Holdings Plc.

- RecycLiCo Battery Materials Inc.

Recent Developments

-

In December 2023, Vibrantz Technologies announced a long-term agreement with Eramet in which Eramet agreed to supply manganese ore required for the production of various manganese technologies for lithium-ion batteries. The agreement was made to improve Vibrantz Technologies’ production of manganese-based battery technologies.

Electrolytic Manganese Dioxide Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.67 billion

Revenue forecast in 2030

USD 2.55 billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, France, Sweden, Poland, Hungary, China, India, Japan, South Korea, Brazil

Key companies profiled

Tosoh Bioscience LLC; South Manganese Investment Limited; Vibrantz; Mesa Minerals Partners; METAL POWDER GROUP; Cegasa; Borman Specialty Materials; BariteWorld; Moil Limited; Tronox Holdings Plc.; RecycLiCo Battery Materials Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electrolytic Manganese Dioxide Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electrolytic manganese dioxide market report based on application and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Batteries

-

Water Treatment

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Sweden

-

Poland

-

Hungary

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.