- Home

- »

- Power Generation & Storage

- »

-

Battery Recycling Market Size, Share, Industry Report, 2033GVR Report cover

![Battery Recycling Market Size, Share & Trends Report]()

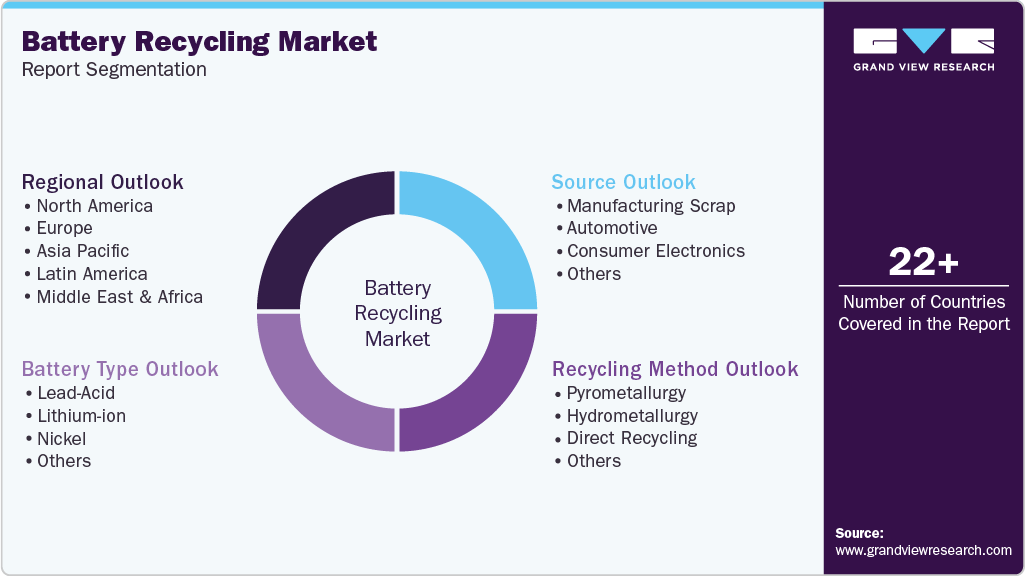

Battery Recycling Market (2026 - 2033) Size, Share & Trends Analysis Report By Source (Manufacturing Scrap, Automotive, Consumer Electronics), By Battery Type (Lead-acid, Lithium-ion, Nickel), By Recycling Method, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-624-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Battery Recycling Market Summary

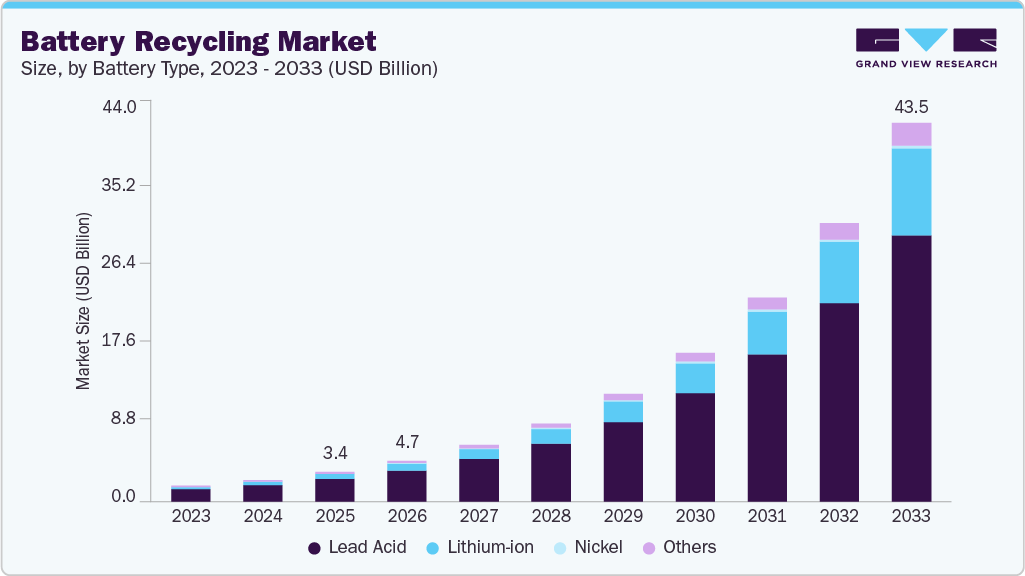

The global battery recycling market size was estimated at USD 3.41 billion in 2025 and is projected to reach USD 43.47 billion by 2033, growing at a CAGR of 37.7% from 2026 to 2033. Industry growth is primarily driven by the rapid expansion of electric vehicles, renewable energy storage systems, and consumer electronics, which are significantly increasing the volume of end-of-life batteries.

Key Market Trends & Insights

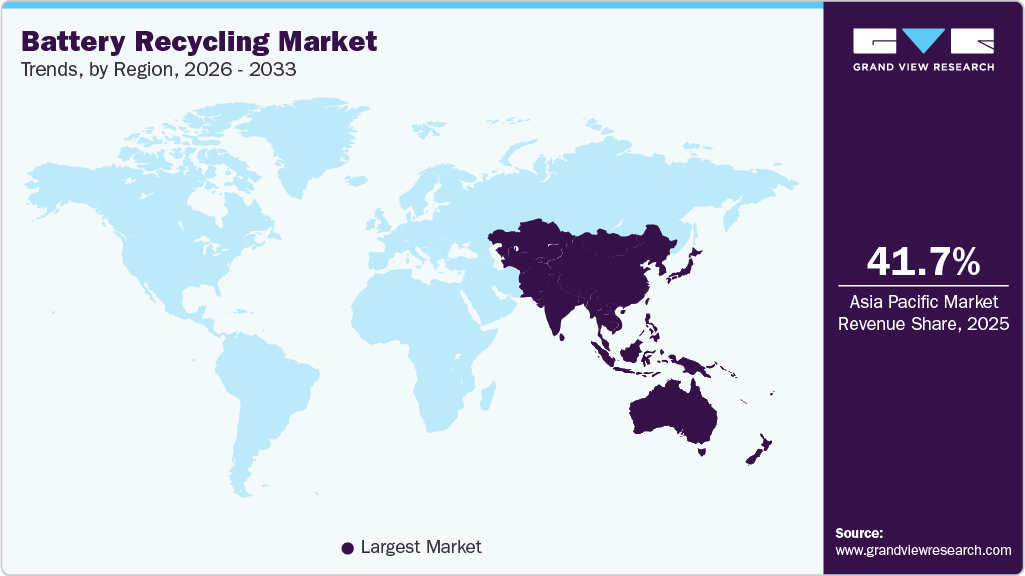

- Asia Pacific held the largest revenue share of 41.7% in the global battery recycling market.

- The global battery recycling market in China is expected to register significant CAGR over the forecast period.

- Based on source, the manufacturing scrap segment held the highest market share in 2025.

- Based on battery type, the lead-acid segment held the highest market share in 2025.

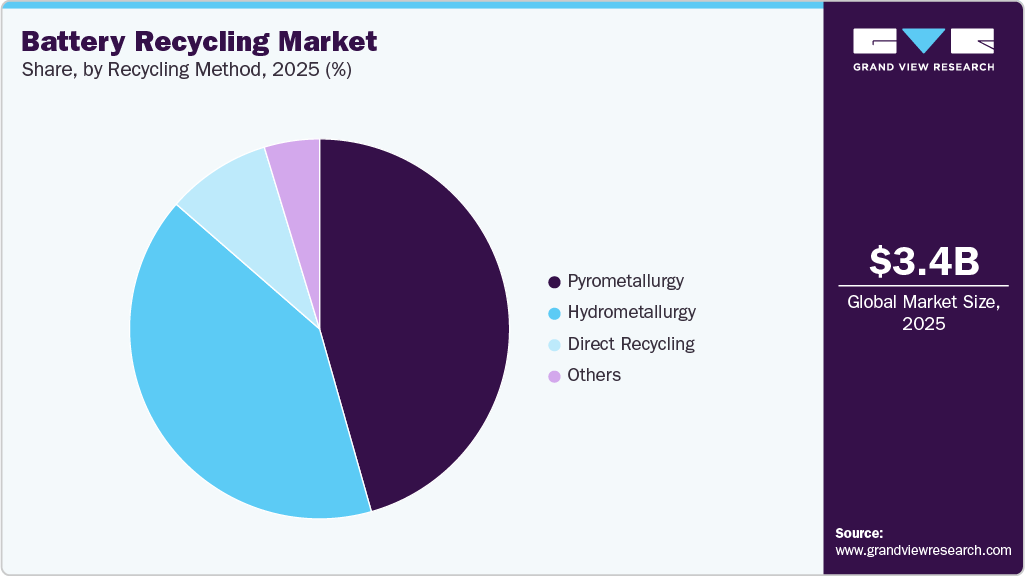

- Based on recycling method, the pyrometallurgy segment held the highest market share of over 45% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 3.41 Billion

- 2033 Projected Market Size: USD 43.47 Billion

- CAGR (2026-2033): 37.7%

- Asia Pacific: Largest market in 2025

Stringent environmental regulations on battery disposal, extended producer responsibility (EPR) frameworks, and government mandates promoting sustainable waste management are compelling manufacturers and recyclers to invest in advanced recycling infrastructure. Additionally, rising concerns over supply chain security for critical raw materials such as lithium, cobalt, nickel, and lead are accelerating recycling adoption as a strategic alternative to primary mining.

Technological advancements in hydrometallurgical and direct recycling processes are improving recovery rates, cost efficiency, and material purity, making recycled battery materials increasingly competitive with virgin sources. Governments across North America, Europe, and the Asia-Pacific are supporting the market through subsidies, recycling targets, and policies aligned with circular economy and decarbonization goals. Growing collaborations between battery manufacturers, automotive OEMs, and recycling companies are further strengthening closed-loop supply chains, positioning battery recycling as a critical pillar of the global clean energy and electric mobility ecosystem.

Drivers, Opportunities & Restraints

The industry is primarily driven by the rapid growth of electric vehicles, renewable energy storage systems, and consumer electronics, which is leading to a sharp increase in end-of-life batteries. Stringent environmental regulations on battery disposal, extended producer responsibility (EPR) policies, and government mandates supporting circular economy frameworks are compelling manufacturers and recyclers to invest in battery recycling solutions. In addition, rising demand for critical raw materials such as lithium, cobalt, nickel, and lead, combined with supply chain risks and price volatility of virgin materials, is encouraging greater reliance on recycled battery materials.

Despite these drivers, the market faces several restraints. High capital investment requirements for advanced recycling facilities, complex and evolving regulatory compliance, and technical challenges associated with safely recycling diverse battery chemistries can limit market expansion. Collection inefficiencies, transportation risks for hazardous battery waste, and inconsistent recycling infrastructure across regions also constrain growth, particularly in emerging markets.

The industry presents strong opportunities through advancements in hydrometallurgical, pyrometallurgical, and direct recycling technologies that improve recovery efficiency and material purity. Growing collaborations between battery manufacturers, automotive OEMs, utilities, and recyclers are enabling closed-loop supply chains, while increasing investments in lithium-ion battery recycling and energy storage applications are expanding the market’s long-term potential.

Source Insights

The manufacturing scrap segment accounted for the largest revenue share of 55.2% in the global battery recycling industry, driven by the high volume of production waste generated during battery cell and pack manufacturing. Scrap materials such as electrode cuttings, defective cells, and off-spec components offer a consistent, high-purity feedstock with well-known chemistry, making them easier and more cost-efficient to recycle compared to end-of-life batteries. As battery manufacturing capacity expands globally, particularly for lithium-ion batteries used in EVs and energy storage, recyclers are increasingly partnering with manufacturers to establish closed-loop systems, supporting material recovery, yield optimization, and supply chain resilience.

The automotive segment is expected to register the fastest CAGR of 42.3% over the forecast period, fueled by the rapid adoption of electric vehicles and the growing volume of end-of-life EV batteries. Accelerated EV penetration, tightening regulations on battery disposal, and automaker commitments to sustainability and circular economy practices are driving strong demand for automotive battery recycling. Additionally, OEMs are increasingly integrating recycled materials into new battery production to reduce raw material costs and carbon footprints, further strengthening growth prospects for this segment.

Battery Type Insights

The lead-acid battery segment held the largest revenue share of 77.5% in 2025, supported by its well-established recycling infrastructure and high collection rates across automotive, industrial, and backup power applications. Lead-acid batteries are among the most recycled consumer products globally due to regulatory mandates, standardized designs, and the economic viability of lead recovery. The closed-loop nature of lead-acid recycling, where recovered lead is repeatedly reused in new batteries, continues to ensure steady feedstock availability and strong market dominance.

The lithium-ion battery segment is expected to register the fastest CAGR of 43.9% over the forecast period, driven by the rapid expansion of electric vehicles, energy storage systems, and consumer electronics. Increasing volumes of end-of-life lithium-ion batteries, combined with rising demand for critical materials such as lithium, cobalt, and nickel, are accelerating investments in advanced recycling technologies. Growing regulatory focus on safe lithium-ion battery disposal and the development of closed-loop supply chains by EV manufacturers are further strengthening growth prospects for this segment.

Recycling Method Insights

The pyrometallurgy segment accounted for the largest revenue share of 45.6% in 2025, driven by its widespread adoption and ability to process mixed and contaminated battery streams at scale. This method is particularly effective for recycling lead-acid and lithium-ion batteries, as it can handle diverse chemistries with relatively simple pre-treatment requirements. Established infrastructure, operational reliability, and proven metal recovery capabilities make pyrometallurgy the preferred choice for large-volume recyclers, especially in regions with mature recycling ecosystems.

The hydrometallurgy segment is expected to register the fastest CAGR of 41.3% over the forecast period, supported by its higher metal recovery efficiency and lower environmental impact compared to thermal processes. Hydrometallurgical techniques enable the selective recovery of high-purity lithium, cobalt, nickel, and manganese, making them well-suited for next-generation lithium-ion battery recycling. Increasing regulatory pressure to reduce emissions and waste, along with growing demand for battery-grade recycled materials, is accelerating the adoption of hydrometallurgy across advanced recycling facilities.

Regional Insights

The battery recycling market in Asia Pacific held the largest revenue share of 41.7% in 2025, driven by the concentration of battery manufacturing hubs and EV production across China, Japan, South Korea, and India. Governments in the region have implemented strict battery collection, traceability, and recycling mandates to address environmental risks and reduce reliance on imported raw materials. China’s comprehensive producer responsibility framework and India’s evolving battery waste management rules are creating a structured and scalable recycling ecosystem, ensuring steady feedstock availability and long-term market stability.

The Asia Pacific region is also expected to register the fastest CAGR of 38.8% over the forecast period, supported by accelerating EV adoption, expansion of battery gigafactories, and rising deployment of renewable energy storage systems. Increasing public and private investments in recycling capacity, combined with cost-competitive operations and strong policy alignment with circular economy objectives, are reinforcing Asia Pacific’s position as both the largest and fastest-growing battery recycling market globally.

North America Battery Recycling Market Trends

The battery recycling market in North America represents a significant share, supported by strong regulatory frameworks, high EV adoption, and well-established recycling infrastructure. The region’s growth is driven by stringent environmental regulations, extended producer responsibility (EPR) programs, and increasing pressure on automakers and battery manufacturers to secure domestic supplies of critical materials such as lithium, cobalt, and nickel. The presence of leading battery recyclers, growing investments in advanced recycling technologies, and government funding under clean energy and supply chain resilience initiatives continue to strengthen market development across the region.

U.S. Battery Recycling Market Trends

The battery recycling market in the U.S. is anchored by federal and state-level regulations governing hazardous waste management and battery disposal, along with policy support for electric mobility and domestic critical mineral sourcing. Rapid growth in electric vehicle sales, large-scale deployment of energy storage systems, and expanding battery manufacturing capacity are significantly increasing the volume of manufacturing scrap and end-of-life batteries. Initiatives under the Inflation Reduction Act (IRA) and Department of Energy (DOE) funding programs are further accelerating investments in lithium-ion battery recycling and closed-loop supply chains.

Europe Battery Recycling Market Trends

The battery recycling market in Europe is driven by one of the world’s most stringent regulatory frameworks, led by the EU Battery Regulation and circular economy policies. These regulations mandate high collection and recycling efficiency rates, minimum recycled content in new batteries, and strict traceability requirements across the battery value chain. Growing EV penetration, coupled with strong emphasis on carbon footprint reduction and sustainable sourcing of critical materials, is accelerating investments in advanced recycling technologies across countries such as Germany, France, and the Nordic region.

Latin America Battery Recycling Market Trends

The battery recycling market in Latin America is developing steadily, supported by rising automotive production, growing use of lead-acid batteries, and increasing environmental awareness. Countries such as Brazil and Mexico are key contributors, driven by expanding vehicle fleets, industrial backup power demand, and gradual tightening of waste management regulations. While lithium-ion recycling is still at an early stage, increasing EV adoption and government focus on resource efficiency are expected to strengthen long-term market growth.

Middle East & Africa Battery Recycling Market Trends

The battery recycling market in the Middle East & Africa (MEA) is in a nascent but emerging phase, driven primarily by rising demand for automotive batteries, power backup systems, and renewable energy storage. Growth is supported by increasing urbanization, expanding telecom and data center infrastructure, and initial regulatory efforts to manage hazardous waste. While recycling infrastructure remains limited in several countries, growing investments in clean energy projects and gradual policy development are expected to create new opportunities for battery recycling across the region over the forecast period.

Key Battery Recycling Companies Insights

Key players operating in the battery recycling market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Battery Recycling Companies:

The following are the leading companies in the battery recycling market. These companies collectively hold the largest market share and dictate industry trends.

- American Battery Technology Company

- Aqua Metals

- Call2Recycle

- Cirba Solutions

- East Penn Manufacturing Co.

- Ecobat

- Glencore Battery Recycling

- Gopher Resource

- Gravita India

- Umicore

Recent Developments

-

In November 2025, American Battery Technology Company (ABTC) was selected by the U.S. Environmental Protection Agency (EPA) to recycle end-of-life and damaged lithium-ion batteries from the largest lithium-ion battery cleanup project in U.S. history, following a grid-scale energy storage fire in California. The project is estimated to generate approximately USD 30 million in recovered material value, highlighting ABTC’s strengthening role in advancing domestic battery recycling capabilities and supporting a circular supply chain for EV and energy storage applications.

Battery Recycling Market Report Scope

Report Attribute

Details

Market Definition

The Battery Recycling market size represents the global revenue generated from the collection, processing, and recycling of end-of-life batteries across various chemistries. It includes the recovery and reuse of valuable materials such as lithium, cobalt, nickel, and lead for applications in automotive, energy storage, and consumer electronics.

Market size value in 2026

USD 4.71 billion

Revenue forecast in 2033

USD 43.47 billion

Growth rate

CAGR of 37.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Source, battery type, recycling method, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Poland; Norway; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

American Battery Technology Company; Aqua Metals; Call2Recycle; Cirba Solutions; East Penn Manufacturing Co.; Ecobat; Glencore Battery Recycling; Gopher Resource; Gravita India; Umicore

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Battery Recycling Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global battery recycling market report on the basis of source, battery type, recycling method, and region.

-

Source Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Manufacturing Scrap

-

Automotive

-

Consumer Electronics

-

Others

-

-

Battery Type Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Lead-Acid

-

Lithium-ion

-

Nickel

-

Others

-

-

Recycling Method Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Pyrometallurgy

-

Hydrometallurgy

-

Direct Recycling

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Norway

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global battery recycling market size was estimated at USD 3.41 billion in 2025 and is expected to reach USD 4.71 billion in 2026.

b. The global battery recycling market is expected to grow at a compound annual growth rate of 37.7% from 2026 to 2033 to reach USD 43.47 billion by 2033.

b. Based on the recycling method segment, Pyrometallurgy held the largest revenue share of over 45.6% in the battery Recycling market in 2025.

b. Some of the key vendors operating in the global battery recycling market include American Battery Technology Company, Aqua Metals, Call2Recycle, Cirba Solutions, East Penn Manufacturing Co., Ecobat, Glencore Battery Recycling, Gopher Resource, Gravita India, and Umicore, among others.

b. The key factors driving the battery recycling market include the rapid growth of electric vehicles and energy storage systems, increasing volumes of end-of-life batteries, and stringent environmental regulations on battery disposal. Rising demand for critical raw materials such as lithium, cobalt, nickel, and lead, along with government support for circular economy initiatives and sustainable supply chains, is further accelerating market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.