- Home

- »

- Conventional Energy

- »

-

Lithium-ion Battery Market Size, Share, Industry Report 2033GVR Report cover

![Lithium-ion Battery Market Size, Share & Trends Report]()

Lithium-ion Battery Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Lithium Cobalt Oxide, Lithium Iron Phosphate), By Application (Consumer Electronics), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-601-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lithium-ion Battery Market Summary

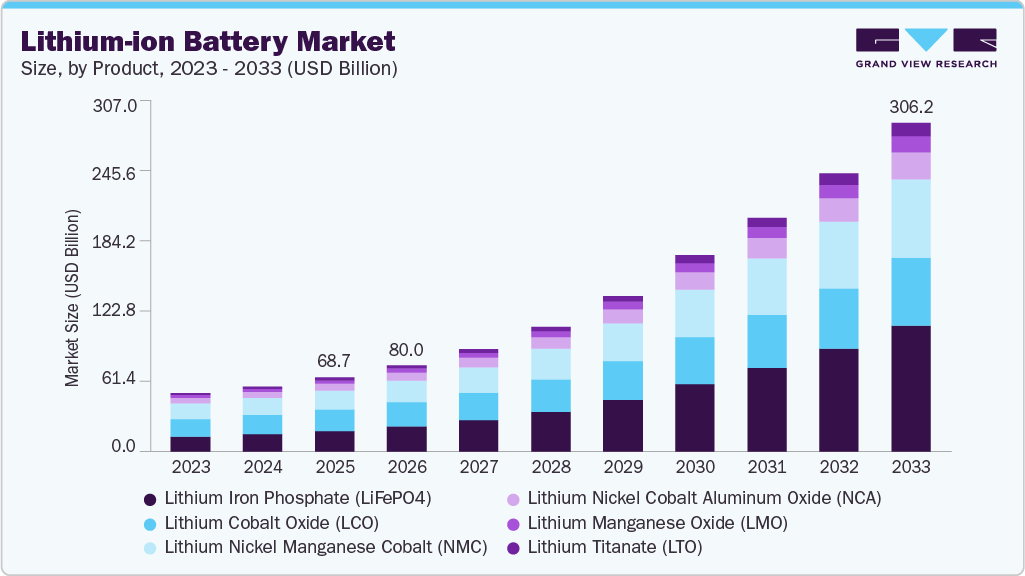

The global lithium-ion battery market size was estimated at USD 68.66 billion in 2025 and is projected to reach USD 306.24 billion by 2033, growing at a CAGR of 21.1% from 2026 to 2033. Market growth is driven by increasing adoption of electric vehicles, rising deployment of renewable energy and energy storage systems, and growing demand for efficient, high-energy-density battery technologies across automotive, industrial, and consumer electronics applications.

Key Market Trends & Insights

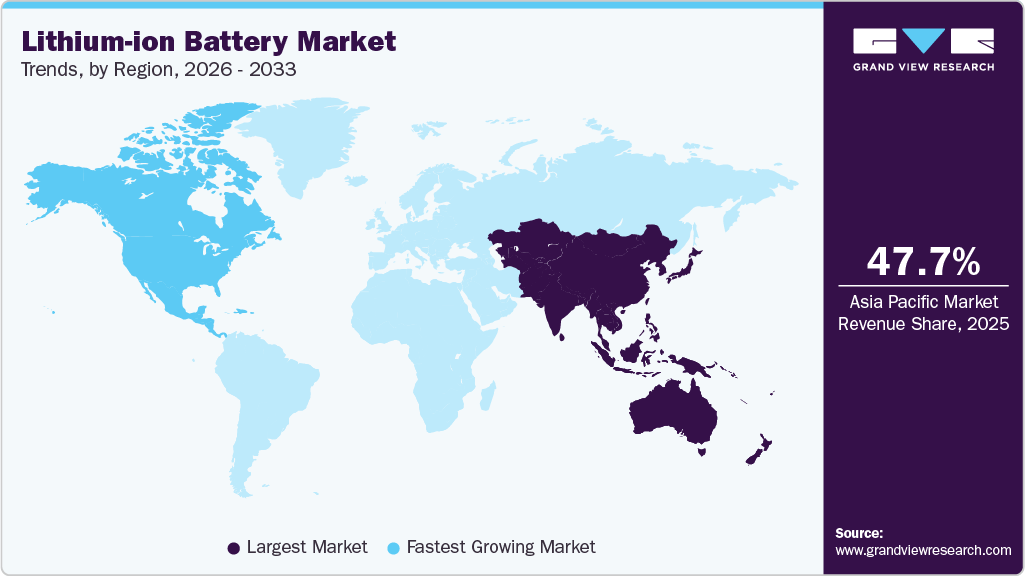

- Asia Pacific lithium-ion battery market held the largest share of 47.7% of the global market in 2025.

- The lithium-ion battery market in the U.S. is expected to grow significantly over the forecast period.

- By product, lithium cobalt oxide (LCO) held the highest market share of 29.2% in 2025.

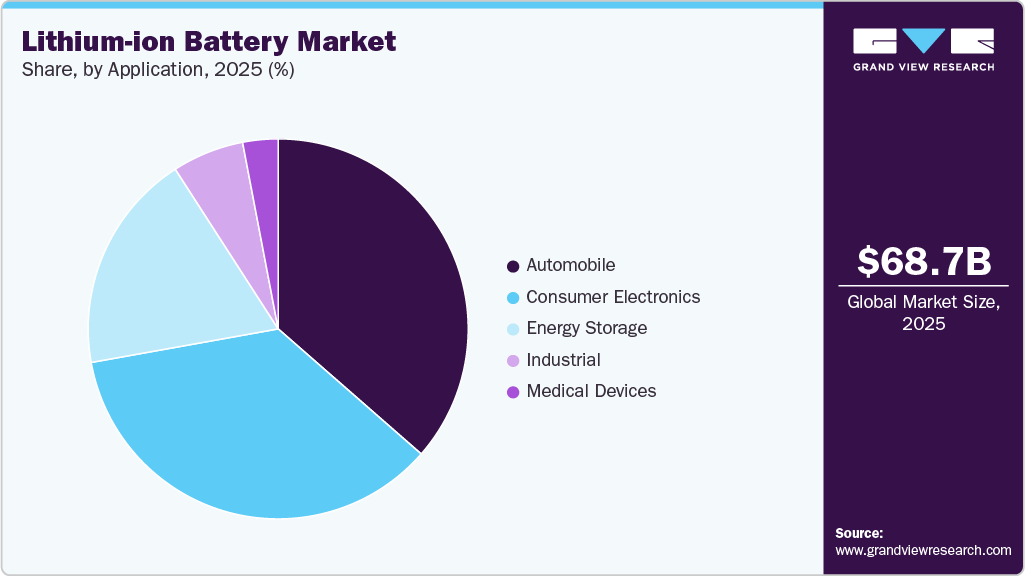

- Based on the application, the automotive segment accounted for the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 68.66 Billion

- 2033 Projected Market Size: USD 306.24 Billion

- CAGR (2026-2033): 21.1%

- Asia Pacific: Largest market in 2025

- North America: Fastest growing market

Continued advancements in battery chemistry, along with declining manufacturing costs and improvements in safety and performance, are further supporting demand for advanced lithium-ion batteries. Moreover, the growing focus on grid-scale energy storage, electric mobility, and clean energy integration, particularly in regions such as the Asia Pacific, North America, and Europe, is accelerating the adoption of high-performance lithium-ion batteries designed for long cycle life, fast charging, and thermal stability. Ongoing technological developments in cathode and anode materials, battery management systems, and manufacturing processes continue to enhance efficiency, reduce costs, and reinforce market expansion.

Drivers, Opportunities & Restraints

The global lithium-ion battery industry is primarily driven by rising adoption of electric vehicles, increasing deployment of renewable energy, and growing demand for efficient and reliable energy storage solutions. Increasing global electricity consumption and the need to stabilize grids with high renewable penetration are encouraging investments in advanced battery technologies. Stringent emission regulations and government incentives supporting electrification are further accelerating adoption across transportation, grid-scale, and commercial applications.

Opportunities in the lithium-ion battery industry are expanding with the rapid growth of grid-scale and distributed energy storage systems, increasing investments in EV charging infrastructure, and rising demand from commercial and industrial sectors. Technological advancements in battery chemistries, such as LFP and solid-state batteries, along with improvements in battery management systems, offer significant potential to enhance performance and reduce costs. Expansion of manufacturing capacity in emerging markets also presents additional growth opportunities.

However, the market faces several restraints, including high raw material costs, supply chain volatility for lithium, cobalt, and nickel, and recycling and sustainability challenges. Safety concerns related to thermal runaway and evolving regulatory requirements can impact deployment timelines. Additionally, dependence on critical mineral supply and geopolitical risks may constrain long-term market growth despite strong demand fundamentals.

Product Insights

The Lithium Cobalt Oxide (LCO) segment held the largest revenue share, accounting for approximately 29.2% in 2025, driven by its high energy density and strong performance in compact electronic applications. LCO batteries are widely used in consumer electronics such as smartphones, laptops, tablets, and wearable devices, where lightweight design and high power output are critical. Continued demand for portable electronic devices, along with ongoing miniaturization trends and performance enhancements, is supporting the adoption of LCO-based lithium-ion batteries. Advancements in cell design and battery management systems are further improving efficiency and safety, reinforcing the segment’s leading position in the market.

The Lithium Iron Phosphate (LiFePO₄) segment is expected to register the fastest growth, expanding at a CAGR of approximately 25.9% over the forecast period, driven by rising adoption in electric vehicles and stationary energy storage systems. LiFePO₄ batteries offer superior thermal stability, longer cycle life, and enhanced safety compared to cobalt-based chemistries, making them increasingly attractive for large-scale and high-duty applications. Growing deployment of renewable energy projects, grid-scale energy storage, and cost-sensitive EV platforms is accelerating demand for LiFePO₄ technology. Continuous improvements in energy density and manufacturing efficiency are further strengthening the segment’s rapid growth trajectory.

Application Insights

The automotive segment accounted for the largest revenue share, approximately 36.4% in 2025, driven by the rapid adoption of electric vehicles and increasing electrification of passenger and commercial transportation. Lithium-ion batteries are widely used in electric cars, buses, and two-wheelers due to their high energy density, long cycle life, and improved cost competitiveness. Supportive government policies, emission reduction targets, and expanding EV charging infrastructure are further accelerating battery demand across global automotive markets. Continuous advancements in battery chemistry, thermal management, and energy efficiency continue to reinforce the dominance of the automotive segment in the market.

The energy storage segment is expected to register the fastest growth, expanding at a CAGR of approximately 24.2% over the forecast period, supported by the rising deployment of renewable energy and increasing demand for grid stability solutions. Lithium-ion batteries are increasingly adopted in utility-scale, commercial, and residential energy storage systems to manage intermittency, enable peak shifting, and enhance grid resilience. Growing investments in solar and wind projects, along with supportive energy storage policies and declining battery costs, are accelerating adoption. Technological improvements in battery management systems, safety, and scalability are further strengthening growth prospects for energy storage applications.

Regional Insights

North America is expected to register the fastest CAGR of approximately 21.8% over the forecast period, driven by accelerating EV adoption, expanding energy storage deployments, and strong policy support for domestic battery manufacturing. Federal and state-level incentives promoting clean transportation, renewable energy integration, and localized supply chains are encouraging large-scale investments in lithium-ion battery production. Increasing demand from automotive, energy storage, and commercial applications is further supporting rapid market growth across the region.

U.S. Lithium-ion Battery Market Trends

The U.S. represents the largest market within North America, supported by rapid growth in electric vehicle sales, large utility-scale energy storage projects, and expanding battery manufacturing capacity. Policy initiatives such as clean energy tax credits and funding under federal energy transition programs are accelerating investments in battery gigafactories and domestic supply chains. Strong demand from automotive OEMs, data centers, and renewable energy developers continues to drive adoption of advanced lithium-ion battery technologies, reinforcing the U.S. market’s growth trajectory.

Asia-Pacific Lithium-ion Battery Market Trends

Asia-Pacific held the largest share, accounting for approximately 47.7% of the global lithium-ion battery market in 2025, driven by strong manufacturing capacity, rapid electric vehicle adoption, and large-scale deployment of energy storage systems. Countries such as China, Japan, and South Korea dominate the region due to the presence of leading battery manufacturers, well-established supply chains, and continuous technological innovation. Rising demand from consumer electronics, electric mobility, and grid-scale energy storage, supported by government incentives and clean energy policies, continues to strengthen the region’s market leadership.

Europe Lithium-ion Battery Market Trends

The lithium-ion battery market in Europe is supported by aggressive decarbonization targets, widespread EV adoption, and increasing investments in renewable energy storage. Countries such as Germany, France, the UK, and the Nordics are focusing on building regional battery ecosystems to reduce import dependence. EU regulations promoting zero-emission mobility and grid flexibility are driving consistent demand for lithium-ion batteries across automotive and stationary storage applications.

Latin America Lithium-ion Battery Market Trends

The lithium-ion battery market in Latin America is witnessing emerging growth, driven by the gradual adoption of electric mobility and the increasing deployment of renewable energy projects paired with storage systems. Countries such as Brazil, Chile, and Mexico are integrating lithium-ion batteries to support solar and wind capacity expansion. Growing focus on grid reliability, energy access, and clean transportation is expected to support steady market development over the forecast period.

Middle East & Africa Lithium-ion Battery Market Trends

The lithium-ion battery market in the Middle East & Africa is in an early growth phase, supported by investments in renewable energy projects, grid modernization, and electric mobility initiatives. Gulf countries are deploying lithium-ion batteries alongside large-scale solar projects to enhance grid stability, while parts of Africa are adopting batteries for off-grid and microgrid applications. Increasing focus on energy diversification and sustainability is expected to gradually drive lithium-ion battery adoption across the region.

Key Lithium-ion Battery Company Insights

Some of the key players operating in the global Lithium-ion Battery market include Contemporary Amperex Technology Co., Ltd. (CATL) and LG Energy Solution Ltd., among others.

-

Contemporary Amperex Technology Co., Ltd. (CATL) is the world’s largest lithium-ion battery manufacturer and a leading supplier of advanced battery solutions for electric vehicles and stationary energy storage systems. The company offers a broad portfolio of lithium-ion technologies, including lithium iron phosphate (LFP) and nickel-based chemistries, designed for high energy density, long cycle life, and enhanced safety. CATL plays a critical role in utility-scale battery energy storage projects, renewable energy integration, and large-format battery deployments worldwide. Its strong focus on innovation, vertical integration, and global manufacturing expansion positions CATL as a dominant force in the lithium-ion battery market.

-

LG Energy Solution Ltd. is a major global supplier of lithium-ion batteries for electric vehicles, grid-scale energy storage systems, and commercial and industrial applications. The company specializes in advanced battery chemistries such as NMC and NCMA, offering high performance, reliability, and long operational life. LG Energy Solution has a strong presence across North America, Europe, and Asia, supported by large-scale manufacturing facilities and long-term supply agreements with leading automotive and energy companies. Continuous investments in next-generation battery technologies, safety enhancements, and capacity expansion reinforce the company’s position as a key contributor to the global lithium-ion battery ecosystem.

Key Lithium-ion Battery Companies:

The following are the leading companies in the lithium-ion battery market. These companies collectively hold the largest market share and dictate industry trends.

- BYD Co., Ltd.

- CALB (China Aviation Lithium Battery Co., Ltd.)

- Contemporary Amperex Technology Co., Ltd. (CATL)

- EVE Energy Co., Ltd.

- LG Energy Solution Ltd.

- Panasonic Holdings Corporation

- Samsung SDI Co., Ltd.

- SK On Co., Ltd.

- Tesla, Inc.

- Toshiba Corporation

Recent Developments

-

In July 2025, Panasonic Energy Co., Ltd. officially began operations at its new lithium-ion battery manufacturing facility in De Soto, Kansas, USA, marking a major expansion of its North American production footprint. The state-of-the-art plant focuses on the mass production of advanced 2170 cylindrical lithium-ion battery cells for electric vehicles (EVs) and is expected to reach an annual capacity of approximately 32 GWh, significantly boosting Panasonic’s ability to meet rising regional EV demand.

Lithium-ion Battery Market Report Scope

Report Attribute

Details

Market Definition

The Lithium-ion Battery market represents the total revenue generated from the design, manufacturing, and deployment of lithium-ion battery cells, modules, packs, and energy storage systems across electric vehicles, consumer electronics, and stationary energy storage applications.

Market size value in 2026

USD 80.03 billion

Revenue forecast in 2033

USD 306.24 billion

Growth rate

CAGR of 21.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in GWh; revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Italy; U.K.; Germany; Spain; France; China; India; Japan; South Korea; Australia; Brazil; Paraguay; Columbia; South Africa; UAE; Egypt; Saudi Arabia

Key companies profiled

Contemporary Amperex Technology Co., Ltd. (CATL); LG Energy Solution Ltd.; Panasonic Holdings Corporation; Samsung SDI Co., Ltd.; BYD Co., Ltd.; SK On Co., Ltd.; Tesla, Inc.; CALB (China Aviation Lithium Battery Co., Ltd.); EVE Energy Co., Ltd.; Toshiba Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lithium-ion Battery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global lithium-ion battery market report on the basis of product, application, and region:

-

Product Outlook (Volume, GWh; Revenue, USD Million, 2021 - 2033)

-

Lithium cobalt oxide (LCO)

-

Lithium iron phosphate (LFP)

-

Lithium Nickel Cobalt Aluminum Oxide (NCA)

-

Lithium Manganese Oxide (LMO)

-

Lithium Titanate

-

Lithium Nickel Manganese Cobalt (LMC)

-

-

Application Outlook (Volume, GWh; Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Consumer Electronics

-

Industrial

-

Energy Storage Systems

-

Medical Devices

-

-

Regional Outlook (Volume, GWh; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Paraguay

-

Columbia

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global Lithium-ion Battery market size was estimated at USD 68.66 billion in 2025 and is expected to reach USD 80.03 billion in 2026.

b. The global Lithium-ion Battery market is expected to grow at a compound annual growth rate of 21.1% from 2026 to 2033 to reach USD 306.24 billion by 2033.

b. Based on the product segment, lithium cobalt oxide (LCO) held the largest revenue share of more than 29.2% in 2025.

b. Some of the key players operating in the global Lithium-ion Battery market include Contemporary Amperex Technology Co., Ltd. (CATL), LG Energy Solution Ltd., Panasonic Holdings Corporation, Samsung SDI Co., Ltd., BYD Co., Ltd., SK On Co., Ltd., Tesla, Inc., CALB (China Aviation Lithium Battery Co., Ltd.), EVE Energy Co., Ltd., and Toshiba Corporation, among others.

b. The Lithium-ion Battery market is primarily driven by the rapid growth of electric vehicles, increasing integration of renewable energy, and rising demand for efficient energy storage solutions. Supportive government policies, declining battery costs, and advancements in battery technology are further accelerating market adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.