- Home

- »

- Organic Chemicals

- »

-

Flow Chemistry Market Size, Share & Growth Report, 2030GVR Report cover

![Flow Chemistry Market Size, Share & Trends Report]()

Flow Chemistry Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Pharmaceuticals, Chemicals, Academia & Research, Petrochemicals), By Reactor Type (CSTR, Plug Flow Reactor, Microreactor, Packed-Bed Reactor), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-711-7

- Number of Report Pages: 154

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flow Chemistry Market Summary

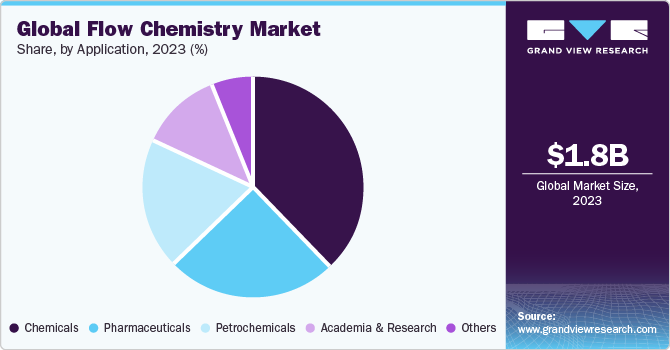

The global flow chemistry market size was estimated at USD 1.76 billion in 2023 and is projected to reach USD 3.75 billion by 2030, growing at a CAGR of 11.6% from 2024 to 2030. Increasing awareness surrounding sustainable development and the growing pharmaceutical and chemical industries are some of the key driving factors for industry growth.

Key Market Trends & Insights

- Asia Pacific dominated the global flow chemistry market with the largest revenue share of more than 36.3% in 2023.

- By reactor type, the continuous stirred tank reactor (CSTR) segment led the market with the largest revenue share of over 36.4% in 2023.

- By application, the pharmaceuticals application segment is expected to expand at a significant CAGR over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 1.76 Billion

- 2030 Projected Market Size: USD 3.75 Billion

- CAGR (2024-2030): 11.6%

- Largest Market: Asia Pacific

The COVID-19 pandemic resulted in an oil price collapse, leading to a narrowing of feedstock cost advantages for chemical companies. This resulted in decreased demand for reactors in the chemical industry, which generates a major part of the industry's revenue. Moreover, these effects were felt by the petrochemical and pharmaceutical industries, thus negatively impacting the market growth.

The pandemic exposed the pharmaceutical supply chain in the U.S., leading to many companies setting up manufacturing facilities. The U.S. Food and Drug Administration (FDA) is advocating the use of flow chemistry for Active Pharmaceutical Ingredients (APIs) production. This is expected to boost the country's industrial growth.

The use of continuous flow methods in this technology for extraction, chromatography, and reactions with supercritical fluids provides several advantages over the batch process. Moreover, the use of green solvents such as methanol and acetone can be safely carried out in a flow reactor under high pressure and elevated temperatures.

Smaller equipment sizes, decreased waste, lower costs, and faster time to market for new medications are expected to fuel the growth. Increased investment in R&D by reactor manufacturers and end-users is projected to drive the market. Several benefits of flow chemical reactors over batch reactors are expected to augment the industry growth.

The market's competitive landscape is driven by technological innovation for the use of flow chemistry. Companies in the industry are extensively spending on R&D and creating products to optimize the manufacturing procedure and increase the yield to be synthesized. Global demand for fine chemicals and specialized chemicals has driven manufacturers to create partnerships with end-users, which is likely to promote growth.

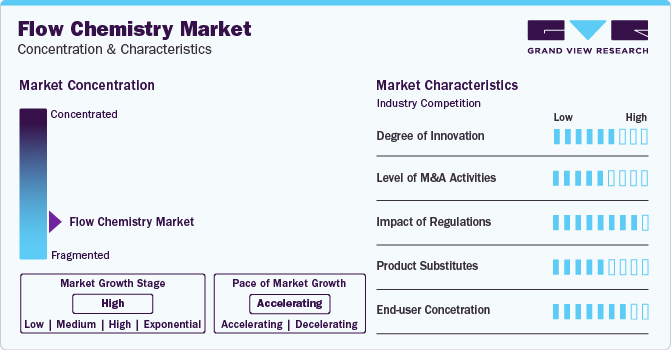

Market Concentration & Characteristics

The market growth stage is medium and the pace of growth is accelerating. The global flow chemistry market is highly competitive owing to the presence of both multinational and local manufacturers. The competitive environment in the market is driven by innovation in technology for the use of flow chemistry. Companies are investing heavily in R&D as well as developing instruments to optimize the production method and improve the yield of the product that is to be synthesized.

Research and new product development are a few of the factors driving the flow chemistry industry’s growth. Companies are tying up with educational institutions along with their in-house R&D facilities to develop processes and technologies that offer a sustainable advantage in the future. New product launches are further creating upswings for the market growth for flow chemistry instruments.

Various rules and regulations govern the manufacturing and distribution of flow chemistry products across the world. Regional and international standards such as ISO and the International Electrotechnical Commission specify the general and safety protocols for the flow chemistry reactors.

The end-user concentration is high in the market for flow chemistry with the presence of industry players from different end-use industries such as chemicals, pharmaceuticals, R&D, and petrochemicals.

The market is characterized by the presence of large multinational companies catering to global demand. Many market players undergo acquisitions to expand their reach in order to increase their market share. For instance, in November 2022, Snapdragon was acquired by Cambrex, which will accelerate the growth of the company in the flow chemistry field.

Reactor Type Insights

The continuous stirred tank reactor (CSTR) segment led the market and accounted for over 36.4% share of the global revenue in 2023. Factors responsible for this are high adoption, simple construction, good temperature control, low cost, and adaptability to two-phase runs. Moreover, the increasing use of CSTR in water and wastewater applications is likely to boost industry growth. A plug flow reactor, also known as a tubular reactor, is one of the most commonly used reactors for gas phase reactions. The absence of moving parts, high conversion rate per reactor volume, simple mechanism, and low maintenance lead to a low overall cost of production from these reactors, which is likely to propel their demand.

The microreactor segment is estimated to expand at a lucrative CAGR in terms of revenue over the forecast period. The demand for microreactors in pharmaceutical and fine chemicals due to their low footprint, the requirement of less capital commitment, and the safe processing of highly reactive and hazardous processes is expected to boost industry growth. Microwave-assisted organic synthesis has witnessed significant focus over the past years on account of its fast reaction rate, low byproducts and high yield, high purity of the products, easy scale-up, and ease of use. Microwave-assisted continuous reactors have been utilized mainly for academic and laboratory applications due to size limitations.

Application Insights

The chemicals segment led the market in terms of revenue share in 2023 on account of the increased use of environmentally friendly technologies such as flow chemistry in order to reduce greenhouse emissions. Moreover, an increase in demand for specialty chemicals from the automotive industry is expected to positively impact the industry's growth. Numerous companies in the pharmaceutical industry have been trying to maintain collaboration between the industry and academic sectors. Academia & research are likely to introduce new methodologies for manufacturing chemicals and APIs, which is expected to augment the demand for reactors in this segment over the forecast period.

The pharmaceuticals application segment is expected to expand at a significant CAGR over the forecast period. Factors such as increasing demand for the optimization of drug development and demand to reduce the time taken for drug launch are expected to boost the demand for this equipment in pharmaceutical applications.

Regional Insights

The strong presence of key players in North America and well-established companies in the end-user landscape is expected to have a positive impact on the growth of the market. The increase in chemical and pharmaceutical production and a rise in investments in research and development in flow chemistry, especially in continuous processes, are some of the key factors fueling the industry growth in the region.

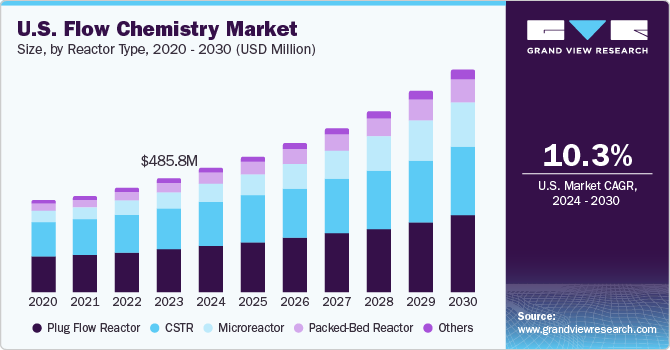

U.S. Flow Chemistry Market Trends

The U.S. flow chemistry market accounts for the largest revenue share of more than 75% in North America in 2023. The U.S. is increasing its domestic production and manufacturing capacities, which is expected to drive the demand for the flow chemistry products over the forecast period.

Asia Pacific Flow Chemistry Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of more than 36.3% in 2023, which is significantly attributed to well-established manufacturing sectors such as chemicals, pharmaceuticals, petrochemicals, etc. An increase in government expenditure on pharmaceutical production due to an increase in demand for generic drugs, coupled with the promising outlook for the chemical and petrochemical industries, is likely to augment industry growth in the region.

The China flow chemistry market held the largest share of 48.1% in Asia Pacific in 2023, mainly attributed to well-established chemicals, pharmaceutical production facilities, and research laboratories. China is actively investing in expanding its manufacturing capacities across various verticals to strengthen its position in global trade.

The flow chemistry market in India is poised to witness thefastest growth in the region over the forecast period. This is attributed to various government tax breaks and financial support for small businesses in the manufacturing sector.

Europe Flow Chemistry Market Trends

The flow chemistry market in Europe is anticipated to grow at a lucrative CAGR from 2024 to 2030. The European Commission is introducing various expansion strategies, such as funding support in the chemical industry, which are anticipated to drive market growth. In February 2024, the European Commission introduced guidance on funding for supporting the chemical industry through the Transition Pathway of the Chemical Industry.

The Germany flow chemistry market held the largest share of over 33.3% in Europe in 2023. Germany continues to hold the largest share in industrial manufacturing and research & laboratory activities. In 2022, according to the European Commission, total R&D expenditure by Germany reached USD 130.88 billion, increasing from USD 121.75 billion in 2021.

The flow chemistry market in the UK is expected to grow positively during the forecast period with companies' increasing industrial activities and expansion strategies. For instance, in July 2023, a new project was introduced in the UK by Mitsubishi Chemical Group for the SoarnoL ethylene vinyl alcohol copolymer (EVOH) facility.

Central and South America Flow Chemistry Market Trends

The flow chemistry market in Central and South America is anticipated to witness promising opportunities over the forecast period with the increasing FDIs and government support. The pharmaceutical industry is poised to show lucrative growth prospects with the changing landscape in the regional healthcare industry.

The Brazil flow chemistry market held the largest share of over 40% in 2023 in Central and South America, owing to the flourishing industrial sector and new investments. For instance, in November 2023, Petrobras introduced plans to invest USD 102.0 billion in the country’s fertilizer and renewable energy.

Middle East & Africa Flow Chemistry Market

The flow chemistry market in the Middle East and Africa is expected to register significant growth over the forecast period. The increasing establishment of the diverse industrial and manufacturing sectors in the region is likely to drive the demand for flow chemistry over the forecast period. For instance, in July 2023, Iraq announced plans to launch the Nibras project, consisting of the production of the largest petrochemical plant in the region in a joint venture with Royal Dutch Shell.

The Saudi Arabia flow chemistry market held the largest revenue share of over 34.0% in 2023. The country is planning to invest in non-oil industries in order to diversify its economic landscape. In July 2023, an investment of around USD 8.4 billion was announced in a new green hydrogen plant.

Key Flow Chemistry Company Insights

The global market includes large-scale reactors and microreactor flow chemistry manufacturers. Key players focus on inorganic growth strategies, such as joint ventures and mergers and acquisitions, to sustain the competition and capture a larger market share. Moreover, they maintain their competitive position in this market by offering superior distribution channels and enhanced services.

Key Flow Chemistry Companies:

The following are the leading companies in the flow chemistry market. These companies collectively hold the largest market share and dictate industry trends.

- Am Technology

- Asahi Glassplant Inc.

- METTLER TOLEDO

- Vapourtec Ltd.

- ThalesNano Inc.

- H.E.L. Group

- Uniqsis Ltd.

- Ehrfeld Mikrotechnik BTS

- Future Chemistry Holding BV

- Corning Incorporated

- Parr Instrument Company

- Amar Equipment Pvt. Ltd.

- FABEX ENGINEERING PVT. LTD.

- Dalton Pharma Services

Recent Developments

-

In December 2023, AGI Group acquired Chemtrix B.V. This acquisition of Chemtrix B.V. is anticipated to scale up AGI Group's capabilities in the flow chemistry market for application in the pilot as well as the manufacturing field.

-

In July 2023, H.E.L Group announced a collaboration with IIT Kanpur to leverage sustainable energy driven by the institute. The objective of this initiative was to create new testing labs for conducting research in new chemistry development, battery storage, and thermal characteristics study.

Flow Chemistry Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.94 billion

Revenue forecast in 2030

USD 3.75 billion

Growth rate

CAGR of 11.6% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

April 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Reactor type, application, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Russia; Italy; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Am Technology; Asahi Glassplant Inc.; METTLER TOLEDO; Vapourtec Ltd.; ThalesNano Inc.; H.E.L. Group; Uniqsis Ltd.; Ehrfeld Mikrotechnik BTS; Future Chemistry Holding BV; Corning Incorporated; Parr Instrument Company; Amar Equipment Pvt. Ltd.; FABEX ENGINEERING PVT. LTD.; Dalton Pharma Services

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flow Chemistry Market Report Segmentation

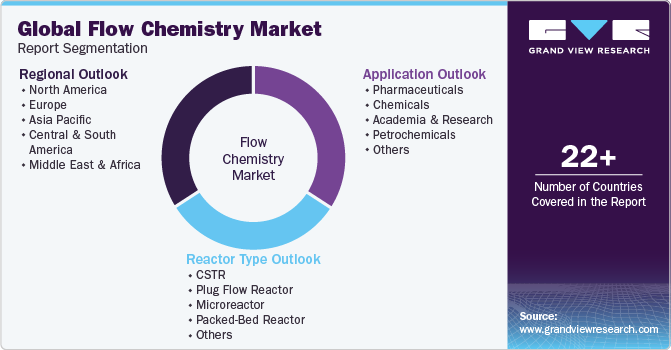

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flow chemistry market report based on reactor type, application, and region:

-

Reactor Type Outlook (Revenue, USD Million, 2018 - 2030)

-

CSTR

-

Plug Flow Reactor

-

Microreactor

-

Packed-Bed Reactor

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Chemicals

-

Academia & Research

-

Petrochemicals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Russia

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global flow chemistry market size was estimated at USD 1.76 billion in 2023 and is expected to be USD 1.94 billion in 2024.

b. The global flow chemistry market, in terms of revenue, is expected to grow at a compound annual growth rate of 11.6% from 2024 to 2030 to reach USD 3.75 billion by 2030.

b. Asia Pacific dominated the flow chemistry market with a revenue share of 35.6 in 2023. The rising manufacturing sector & industrialization is facilitating the demand for the flow chemistry in chemical and pharmaceutical industry.

b. Some of the key players operating in the flow chemistry market include Am Technology Asahi Glassplant Inc., METTLER TOLEDO, Vapourtec Ltd., ThalesNano Inc., H.E.L. Group, Uniqsis Ltd., Ehrfeld Mikrotechnik BTS, Future Chemistry Holding BV, Corning Incorporated, Parr Instrument Company, Amar Equipment Pvt. Ltd., FABEX ENGINEERING PVT. LTD., Dalton Pharma Services.

b. The key factors that are driving the flow chemistry market include the rising demand for pharmaceuticals, increasing industrial expansion, and technological advancements in the new instruments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.