- Home

- »

- Advanced Interior Materials

- »

-

High Temperature Insulation Market Size & Share Report, 2030GVR Report cover

![High Temperature Insulation Market Size, Share & Trends Report]()

High Temperature Insulation Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Ceramic Fiber, Insulating Firebrick, Calcium Silicate), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-037-8

- Number of Report Pages: 138

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global high temperature insulation market size was valued at USD 6.34 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2022 to 2030. The market is expected to be driven by increasing environmental concerns, which have led to the imposition of strict environment-protection regulations by governments across the globe.

Growing awareness regarding the benefits of high-temperature insulation, including resistance to high temperatures and thermal shocks, low thermal conductivity, environmental benefits, and cost efficiency, is also likely to propel the market growth over the forecast period. In addition, insulation can protect equipment and help achieve extremely high or low temperatures with reduced accident risks.

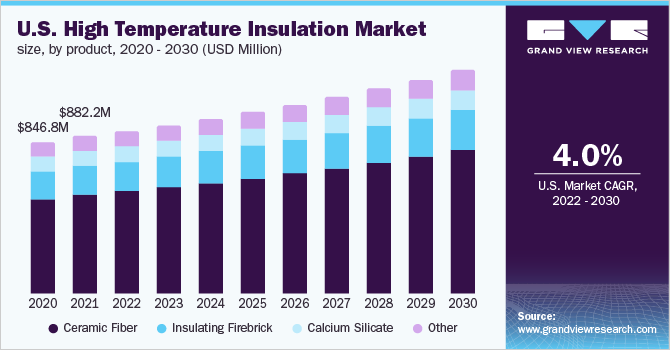

The market for high temperature insulation in the U.S. is expected to grow significantly over the forecast period owing to high significant investments by the government and companies to increase the manufacturing rate and production capacities in various industries such as cement, iron and steel, glass, and ceramics.

The market is likely to grow substantially with the increasing demand for customized high-temperature insulation products across application industries including cement, petrochemicals, ceramics, iron and steel, aluminum, and powder metallurgy. Furthermore, prominent players in the industry are aiming to achieve optimum growth by introducing enhanced insulation products with the implementation of the latest technologies.

The COVID-19 situation across the globe has posed a challenging factor to the market. High-temperature insulation product manufacturers provide customized solutions to end-users in order to meet their exact requirements; however, production has been impacted owing to the suspension of industrial operations. However, the industrial operations are regaining their positions for production, and thus are anticipated to upscale the demand for insulation products in their respective facilities.

Product Insights

The ceramic fiber segment held the largest revenue share of over 60.0% in 2021. Ceramic fiber is used as an insulating material owing to its ability to withstand high temperature and thermal shock resistance. These fibers are primarily used as refractory materials to work at a temperature between 1000ºC and 1400ºC. Ceramic fiber is found in the form of bulk fibers, blankets, felts, paper, textiles, and vacuum formed or cast-shaped.

Insulating firebrick was the second-largest product segment in terms of both revenue and volume in 2021. The growing demand for insulating bricks is attributed to their numerous applications in the iron and steel industry including ductwork in direct reduction processes and reheat furnaces, blast furnace stoves, coke oven backup insulation, ladles, and tundishes.

The demand for calcium silicate is expected to grow owing to its widespread application in petrochemical plants, electric/steam power plants, and refineries. The product is used to insulate high-temperature pipes and equipment. In addition, it is extensively used for various fire endurance applications.

High-temperature insulation products are used in various manufacturing and processing applications under controlled operating temperatures to achieve high efficiency in various end-use industries such as petrochemical, ceramics, cement, glass, iron and steel, and aluminum.

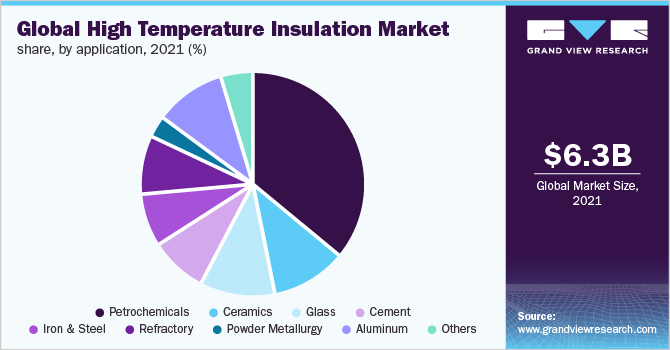

Application Insights

The petrochemicals application segment accounted for the largest revenue share of over 35.0% in 2021. The growth of the segment can be attributed to the extensive usage of insulation materials in a variety of applications and settings in petrochemical plants.

High-temperature insulation materials made from ceramics provide high-dimensional stability and a temperature-controlled environment in various applications. Increasing use of products in thermal applications such as thermocouple protection tubes, furnace tubes, insulators, crucibles, kiln furniture, furnace fittings, nozzles, filters, and batts is expected to propel the demand for ceramics over the forecast period.

The glass application segment emerged as the second-largest segment in 2021. In addition, the increasing use of smart glass in the transportation, consumer electronics, and architecture industries is further adding to the growth prospects of the glass manufacturing industry, thereby propelling the demand for high-temperature insulation products in the glass segment.

The cement segment is driven by the increasing use of high-temperature insulation products such as calcium silicate, mica, and insulating fiber bricks in the form of silicate boards, pipes insulation, and ceramic fiber boards and blankets in the cement industry. The aforementioned products are used to minimize the energy consumption in the furnaces while producing cement clinkers.

Regional Insights

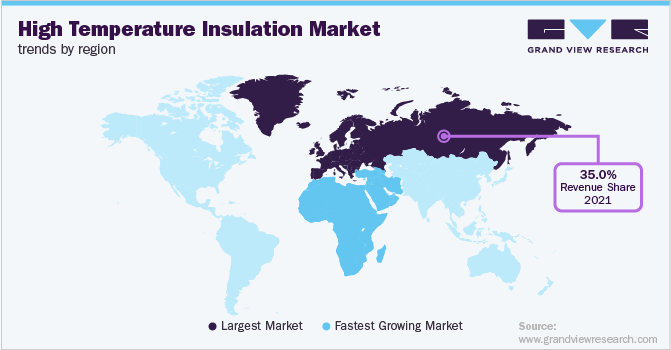

Europe dominated the market with a revenue share of over 35.0% in 2021. This can be attributed to the growing trend of industrialization in the region, coupled with various initiatives by the European Union (EU) for increasing the energy efficiency of the industries.

Asia Pacific is expected to witness significant growth over the forecast period owing to the high investments in the growth of various industries such as power generation, petrochemicals, glass, ceramics, and metallurgy.

The market in North America is expected to grow rapidly over the coming years owing to significant growth in demand from several end-use industries including petrochemicals, ceramics, glass, iron and steel, and cement. High temperature or elevated temperature insulation materials are widely used in these industries for boilers, furnaces, ducts, precipitators, and industrial ovens.

The usage of high-temperature insulation in the U.S. is expected to rise over the forecast period in the ceramics industry owing to emphasis by the United States Advanced Ceramics Association (USACA) on reducing heat emissions from ceramic factories. In addition, wide adoption in the well-developed iron and steel business in the country is expected to drive the product demand.

The Middle East and Africa region is expected to register the highest growth rate owing to the wide usage of high temperature insulation in the oil and gas industry. In addition, increased investments by governments in several countries including Saudi Arabia, Kuwait, UAE, and Qatar in the growth of non-oil industrial activities such as energy generation, glass, and ceramics are expected to drive the market over the coming years.

Key Companies & Market Share Insights

The global market exhibits a significant presence of various national and multinational companies, leading to intense market competition. However, the key manufacturers including Unifrax Corporation, Paroc Group, and Dyson Group hold a significant market share owing to their extensive product portfolio, wide geographic expansion, and strong brand identity.

Major product manufacturers opt for independent distribution in order to better serve their customers in case of customized products and increase their profit margin. Manufacturers also establish strategic relationships with distributors and provide solutions to end-users through direct or third-party distribution. Furthermore, strong R&D capabilities, strategic acquisition, expansion of production capabilities, and geographic expansion have strengthened the companies' market position. Some prominent players in the global high temperature insulation market include:

-

3M Company

-

ADL Insulflex Inc.

-

Zircar Zirconia, Inc.

-

Unifrax LLC

-

Morgan Advanced Materials

-

Almatis GmbH

-

Rath Group

-

Aspen Aerogels, Inc.

-

Hi-Temp Insulation, Inc.

-

Insulcon Group

-

Isolite Insulating Products Co., Ltd.

-

Pacor Inc.

-

Promat International NV

-

Pyrotek

-

M.E. SCHUPP Industriekeramik GmbH

High Temperature Insulation Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 6.65 billion

Revenue forecast in 2030

USD 10.57 billion

Growth rate

CAGR of 5.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Saudi Arabia

Key companies profiled

3M Company; ADL Insulflex Inc.; Zircar Zirconia; Inc.; Unifrax LLC; Morgan Advanced Materials; Almatis GmbH; Rath Group; Aspen Aerogels; Inc.; Hi-Temp Insulation; Inc.; Insulcon Group; Isolite Insulating Products Co.; Ltd.; Pacor Inc.; Promat International NV; Pyrotek

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

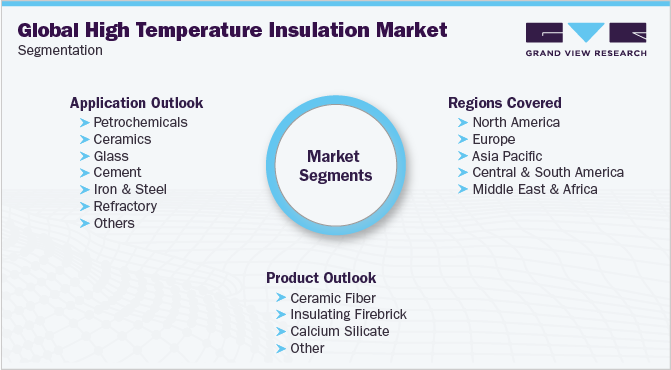

Global High Temperature Insulation Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global high temperature insulation market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Ceramic Fiber

-

Insulating Firebrick

-

Calcium Silicate

-

Other

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Petrochemicals

-

Ceramics

-

Glass

-

Cement

-

Iron & Steel

-

Refractory

-

Powder Metallurgy

-

Aluminum

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global high temperature insulation market size was estimated at USD 6.34 billion in 2021 and is expected to reach USD 6.65 billion in 2022.

b. The high temperature insulation market is expected to grow at a compound annual growth rate of 5.8% from 2022 to 2030 to reach USD 10.57 billion by 2030.

b. Europe dominated the high temperature insulation market with a share of 36% in 2021. This can be attributed to the growing trend of industrialization in the region, coupled with various initiatives by the European Union (EU) for increasing the energy efficiency of industries.

b. Some of the key players operating in the high temperature insulation market include 3M Company, ADL Insulflex Inc., Zircar Zirconia, Inc., Unifrax LLC, Morgan Advanced Materials, Almatis GmbH, Rath Group, Aspen Aerogels, Inc., Hi-Temp Insulation, Inc., Insulcon Group and Isolite Insulating Products Co., Ltd.

b. The key factors that are driving the high temperature insulation market include Increasing environmental concerns coupled with strict environment-protection regulations imposed by governments across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.