- Home

- »

- Next Generation Technologies

- »

-

Smart Glass Market Size & Share, Industry Report, 2030GVR Report cover

![Smart Glass Market Size, Share & Trends Report]()

Smart Glass Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (PDLC, SPD, Electrochromic, Thermochromic, Photochromic), By Application, By Control Mode (Rheostats, Remote), By Region, And Segment Forecasts

- Report ID: 978-1-68038-213-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Glass Market Summary

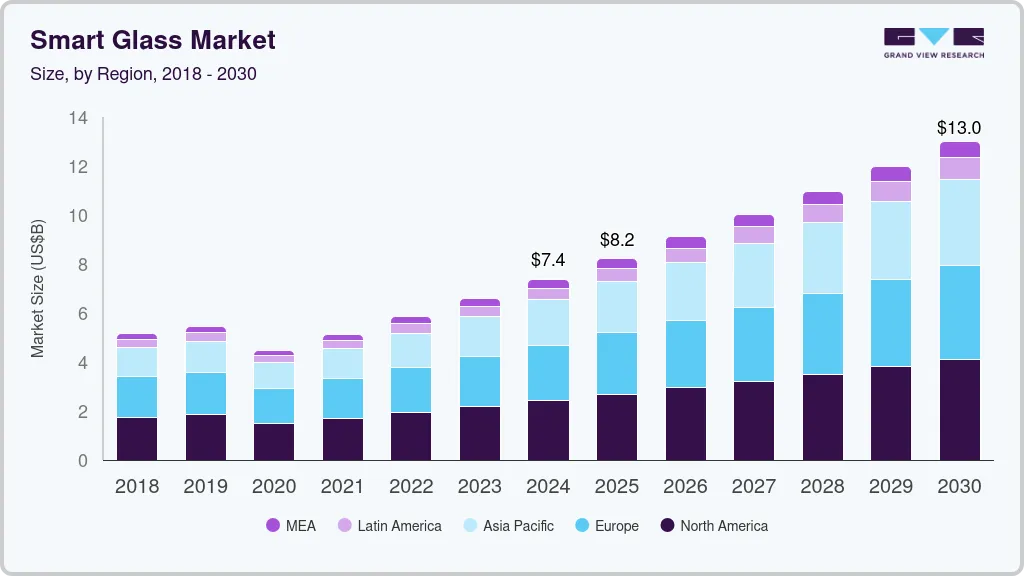

The global smart glass market size was estimated at USD 7.38 billion in 2024 and is estimated to reach USD 13.01 billion by 2030, growing at a CAGR of 9.6% from 2025 to 2030. The industry is gaining traction amid a global shift toward energy-efficient and sustainable building solutions.

Key Market Trends & Insights

- The smart glass market in North America generated the highest revenue share, accounting for more than 32% in 2024.

- The U.S. smart glass market held a dominant position in 2024.

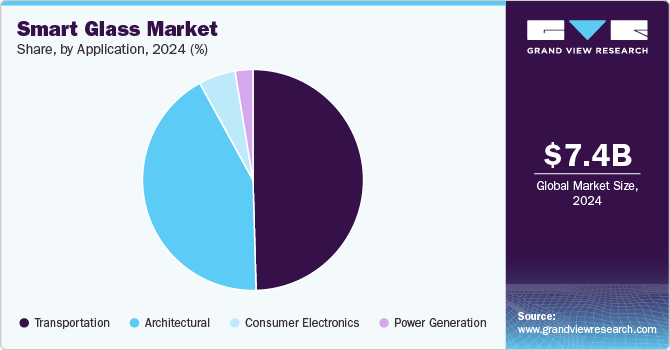

- By application, the transportation application segment accounted for the largest market share in 2024.

- By control mode, the switches segment accounted for a significant market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.38 Billion

- 2030 Projected Market Size: USD 13.01 Billion

- CAGR (2025-2030): 9.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Smart glass reduces energy consumption by controlling heat and light transmission, lowering reliance on artificial lighting and air conditioning. Rising energy costs, stricter environmental regulations, and the push for green building certifications are accelerating adoption. Additionally, the demand for connected, intelligent infrastructure is positioning smart glass as a key component in modern commercial and residential construction.Automakers are increasingly integrating smart glass into sunroofs, windows, and rear-view mirrors to enhance user comfort and safety. The smart glass industry is benefiting from demand for advanced driver assistance systems (ADAS) and luxury vehicle features. By allowing adjustable tint and glare reduction, smart glass improves the driving experience. Electrically switchable smart glass is gaining traction among premium and electric vehicle manufacturers. This trend signifies a strong automotive segment expansion for the smart glass industry.

The smart glass industry is evolving with its integration into smart home and building management systems. These glasses can be remotely controlled via smartphones or voice assistants, enhancing user convenience. As homes become smarter, consumers seek seamless, responsive environments, boosting smart glass adoption. IoT compatibility enables real-time adjustment of light transmission based on external conditions. This trend is positioning smart glass as a core component of next-generation home automation.

Hospitals are deploying smart glass in ICUs, patient rooms, and operating theaters to ensure hygiene and patient privacy. The smart glass industry is experiencing rising demand due to its touchless operation and antimicrobial surface benefits. Unlike traditional curtains or blinds, smart glass offers instant opacity control and is easier to sterilize. Healthcare providers are also using smart glass to create calm environments for patients. This trend reflects the industry's growing footprint in the medical sector.

Smart city developments worldwide are integrating intelligent infrastructure, and the smart glass industry is a crucial enabler. Smart glass contributes to energy management, aesthetic appeal, and comfort in public and commercial spaces. Urban planners are incorporating it into transit stations, municipal buildings, and digital signage. These projects often receive government funding, which accelerates the deployment of advanced materials such as smart glass. The trend supports long-term demand driven by urbanization and innovation..

Technology Insights

The electrochromic segment captured the largest market share of over 61% in 2022. This growth is driven by rising demand for advanced light control and energy efficiency. Electrochromic glass stands out for its smooth, adjustable tinting, enabling precise modulation of light and glare while minimizing energy use. Its long lifespan and low power consumption make it a preferred choice for commercial applications like curtain walls and high-performance façades. At the same time, luxury automotive and aerospace sectors are increasingly adopting electrochromic windows and sunroofs to enhance passenger comfort. The trend reflects a broader market shift toward customizable, user-driven smart glass solutions that support both performance and sustainability.

The SPD segment is expected to witness the fastest CAGR of over 10% from 2025 to 2030, reflecting rising interest in dynamic light and privacy control. SPD technology is gaining momentum across high-end residential, commercial, and automotive sectors for its ability to provide real-time tint adjustment. Known for its rapid switching speed, SPD smart glass enables instant glare reduction and privacy while maintaining access to natural light. Its growing use in automotive sunroofs and large architectural windows signals a trend toward more responsive, user-centric glass solutions that enhance comfort and energy efficiency in modern design.

Application Insights

The transportation application segment accounted for the largest market share in 2024, driven by the growing adoption of smart glass technologies such as electrochromic and SPD glass across the automotive, aviation, and rail industries. These advanced glass solutions are being integrated into vehicle windows, sunroofs, and cockpit displays to enhance passenger comfort, reduce glare, and optimize energy efficiency. In the automotive sector, electrochromic windows provide on-demand privacy, UV protection, and energy savings, while in aviation, smart glass offers adjustable tinting to control cabin temperature, helping airlines reduce fuel consumption and improve the overall passenger experience.

The power generation segment is expected to witness the fastest CAGR from 2025 to 2030, driven by the need for energy-efficient and sustainable solutions. Smart glass technologies, such as electrochromic and photovoltaic glass, are being integrated into solar power systems and energy-efficient buildings to optimize light transmission and reduce energy consumption. In solar power plants, smart glass is used to enhance the efficiency of solar panels by adjusting light absorption based on weather conditions. Moreover, power generation facilities are adopting smart glass to regulate temperatures, reduce cooling costs, and enhance thermal performance. This trend reflects the industry's increasing role in renewable energy solutions and environmental sustainability within the power generation sector.

Control Mode Insights

The switches segment accounted for a significant market share in 2024, driven by growing demand for on-demand privacy and light control. Switchable glass technologies-such as electrochromic, SPD, and liquid crystal are increasingly being integrated into both residential and commercial environments. These solutions allow users to instantly shift between transparent and opaque states at the push of a button, eliminating the need for traditional blinds or curtains. In offices and conference rooms, switchable glass enhances privacy while maintaining a sleek, modern design. Adoption is also expanding in sectors like healthcare, luxury residential, and automotive, where the focus is on combining aesthetics, functionality, and energy efficiency. This trend underscores the shift toward versatile, tech-enabled glazing solutions that cater to evolving design and comfort needs.

The remote segment is expected to witness the fastest CAGR from 2025 to 2030, reflecting the growing adoption of smart glass in isolated and specialized environments. As demand increases for real-time privacy and environmental control, smart glass is emerging as a key solution in remote offices, research facilities, and secure government buildings. These installations benefit from smart glass’s ability to instantly switch opacity, replacing traditional shading systems while maintaining sleek, modern aesthetics. Integration with building management systems is also expanding, enabling automated control over light, glare, and heat, critical for locations facing extreme or unpredictable weather.

Regional Insights

The smart glass market in North America generated the highest revenue share, accounting for more than 32% in 2024. The market in the region is witnessing strong momentum due to increased adoption in automotive sunroofs and building energy efficiency upgrades. Technological advancements in electrochromic and SPD-based glass are driving innovation across industries. The region also benefits from high consumer awareness and government incentives for sustainable construction. Leading players are expanding their presence via collaborations and product innovation to strengthen their footprint.

U.S. Smart Glass Market Trends

The U.S. smart glass market held a dominant position in 2024.In the U.S., demand for smart glass is being fueled by the green building movement and smart city initiatives. Major tech firms and automotive OEMs are integrating smart glazing into premium vehicle lines and commercial infrastructure. Investment in R&D and collaborations with startups are catalyzing smart glass integration in consumer electronics. The U.S. continues to dominate North American revenues owing to high technology penetration and early adoption.

Europe Smart Glass Market Trends

The Europe smart glass market was identified as a lucrative region in 2024.Europe remains a key innovator in the smart glass space with robust R&D activities and environmental regulations supporting adoption. Applications in architectural glazing, public transport, and heritage building renovations are expanding rapidly. The region sees active participation from local players such as Saint-Gobain and AGC. Government policies encouraging energy efficiency and net-zero buildings are boosting the smart glass market.

The U.K. smart glass market is growing with rising interest in home automation and sustainable construction. Smart glazing solutions are increasingly seen in residential developments and commercial retrofits. Startups and academic institutions are collaborating to develop advanced electrochromic materials. Post-Brexit innovation funding and urban redevelopment projects further support market acceleration.

Smart glass market in Germany is emerging as a leader in smart glass adoption, driven by automotive giants and strict energy efficiency standards. Manufacturers are integrating smart glass into EVs and high-end commercial projects. Industry 4.0 and the strong focus on sustainability are propelling demand for intelligent façade systems. The country also hosts key innovators and suppliers of smart glazing technologies.

Asia-Pacific Smart Glass Market Trends

The smart glass market in the Asia Pacific region is expected to grow at the highest CAGR of over 11% from 2025 to 2030. Asia Pacific is experiencing rapid growth in the smart glass market, fueled by urbanization and infrastructure modernization. Countries such as China, India, and South Korea are investing heavily in smart buildings and transportation systems. The presence of global electronics and automotive manufacturing hubs supports scalable production. Local government support and increased awareness are encouraging widespread adoption.

China smart glass market is booming thanks to large-scale commercial construction and smart transportation projects. Local companies are investing in electrochromic R&D to reduce dependency on imports. The integration of smart glass in high-speed trains and airports is gaining momentum. China’s dual focus on innovation and environmental sustainability makes it a pivotal growth engine in the Asia Pacific region.

Smart glass market in India is witnessing a rising demand for smart glass in luxury real estate, hospitality, and smart city initiatives. Increasing disposable income and awareness of green technologies are fueling the market. Domestic startups are partnering with global players to localize production and reduce costs. Government incentives for energy-efficient buildings are creating strong tailwinds for market expansion.

Key Smart Glass Company Insights

Some of the key players operating in the smart glass market include AGC Inc. and Saint-Gobain

-

AGC Inc. is a global leader in glass manufacturing, offering a comprehensive range of smart glass solutions, including electrochromic and thermochromic technologies. The company focuses on integrating smart glass into energy-efficient buildings and next-generation mobility applications. AGC’s robust R&D capabilities and partnerships with automotive and architectural leaders position it as a key innovator in the sector. Its extensive global footprint supports large-scale production and distribution across multiple regions.

-

Saint-Gobain is a longstanding industry pioneer, specializing in dynamic glass solutions under its SageGlass brand. The company provides smart glazing technologies for commercial, institutional, and residential buildings with an emphasis on sustainability and comfort. Its smart glass offerings contribute significantly to LEED-certified construction and energy efficiency goals. Saint-Gobain's vertically integrated operations ensure consistent quality and supply chain control.

Halio Inc. and Gauzy Ltd are some of the emerging participants in the smart glass market.

-

Halio Inc. specializes in electrochromic smart glass that offers fast tinting speeds and precise light control. The company targets sustainable building projects and collaborates with architects and developers to deliver next-gen solutions. Its glass solutions are designed to seamlessly integrate with IoT platforms, enhancing building intelligence. Backed by investments from major industry players, Halio is quickly gaining traction in the commercial real estate sector.

-

Gauzy Ltd. is an innovative material science company focused on developing light control glass using SPD (suspended particle device) and LC (liquid crystal) technologies. The company serves diverse sectors including automotive, architectural, and consumer electronics. Gauzy is known for its embedded smart film technologies and unique product customization capabilities. Its agility and R&D-driven approach enable it to bring novel solutions to market faster than traditional players.

Key Smart Glass Companies:

The following are the leading companies in the smart glass market. These companies collectively hold the largest market share and dictate industry trends.

- AGC Inc.

- ChromoGenics

- Corning Incorporated

- Gauzy Ltd.

- Gentex Corporation

- Guardian Industries Holdings, LLC

- Halio Inc.

- Merck KGaA (Merck Group)

- Nippon Sheet Glass Co. Ltd.

- PPG Industries Inc.

- RavenWindow

- Research Frontiers Inc.

- Saint Goblin S.A.

- Smartglass International

- VELUX Group

- View Inc.

- Polytronix Inc.

- Smart Glass Technologies LLC

Smart Glass Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.22 billion

Revenue forecast in 2030

USD 13.01 billion

Growth rate

CAGR of 9.6% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, control mode, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; China; Japan; India; South Korea; Australia; Brazil; Mexico; South Africa; Saudi Arabia

Key companies profiled

AGC Inc.; ChromoGenics; Corning Inc.; Gauzy Ltd. & Entities; Gentex Corp.; Guardian Industries Holdings, LLC; Halio Inc.; Merck KGaA (Merck Group); Nippon Sheet Glass Co. Ltd.; PPG Industries Inc.; RavenWindow; Research Frontiers Inc.; Saint Goblin S.A.; Smartglass International Ltd.; VELUX Group; View Inc.; Polytronix Inc.; Smart Glass Technologies LLC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Glass Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart glass market report based on technology, application, control mode, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Electrochromic

-

Polymer Dispersed Liquid Crystal (PDLC)

-

Suspended Particle Devices (SPD)

-

Thermochromics

-

Photochromic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Architectural

-

Residential Buildings

-

Commercial Buildings

-

-

Transportation

-

Automotive

-

Aircraft

-

Marine

-

-

Consumer Electronics

-

Power Generation

-

-

Control Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Rheostats

-

Switches

-

Remote

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart glass market size was estimated at USD 7.38 billion in 2024 and is expected to reach USD 8.22 billion in 2025

b. The global smart glass market is expected to grow at a compound annual growth rate of 9.6% from 2025 to 2030 to reach USD 13.01 billion by 2030.

b. The electrochromic technology segment dominated the global smart glass market with a share of over 61% in 2024. This is attributable to low driving voltage, high blockage ratio of UV and IV rays, and the capability to integrate with large glass panels.

b. Some of the key players in the global smart glass market include AGC Inc.; ChromoGenics; Corning Incorporated; Gauzy Ltd.; Gentex Corporation; Guardian Industries; Kinestral Technologies, Inc.; Nippon Sheet Glass Co., Ltd.; PPG Industries, Inc.; RavenWindow; Research Frontiers Inc.; Saint-Gobain S.A.; Smartglass International Limited; VELUX Group; View, Inc.; Vision Systems.

b. Key factors that are driving the smart glass market growth include surging demand for smart glass-based products, high adoption in the transportation sector, and favorable administrative initiatives for green building proposals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.