- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Insulated Packaging Market Size, Industry Report, 2033GVR Report cover

![Insulated Packaging Market Size, Share & Trends Report]()

Insulated Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Corrugated Cardboards, Metal, Glass, Plastic), By Packaging Type (Rigid, Flexible, Semi-Rigid), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-202-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Insulated Packaging Market Summary

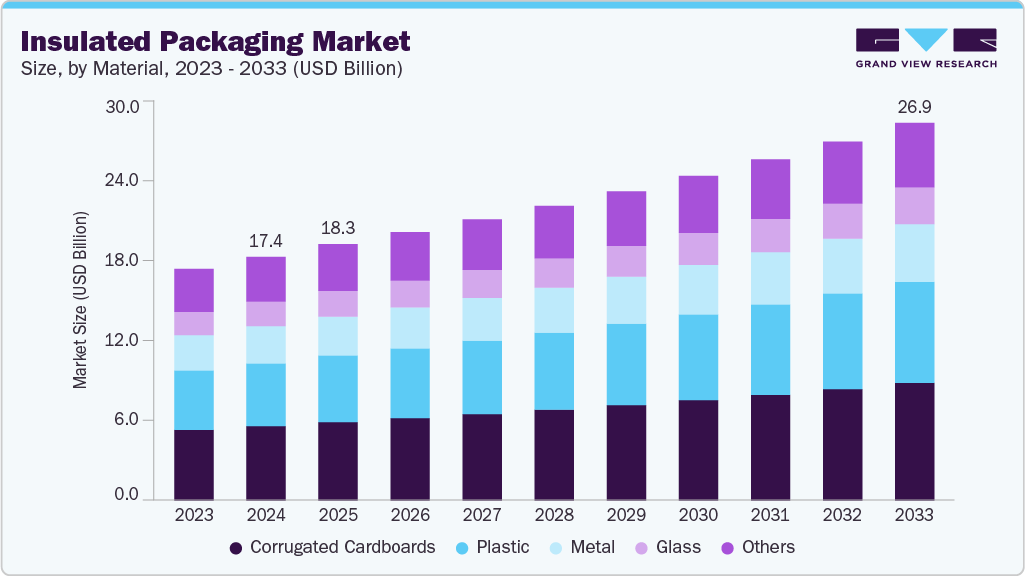

The global insulated packaging market size was estimated at USD 17.41 billion in 2024 and is projected to reach USD 26.99 billion by 2033, expanding at a CAGR of 5.0% from 2025 to 2033. The global insulated packaging market is driven by the rising demand for temperature-sensitive products, including pharmaceuticals and food, requiring safe transportation.

Key Market Trends & Insights

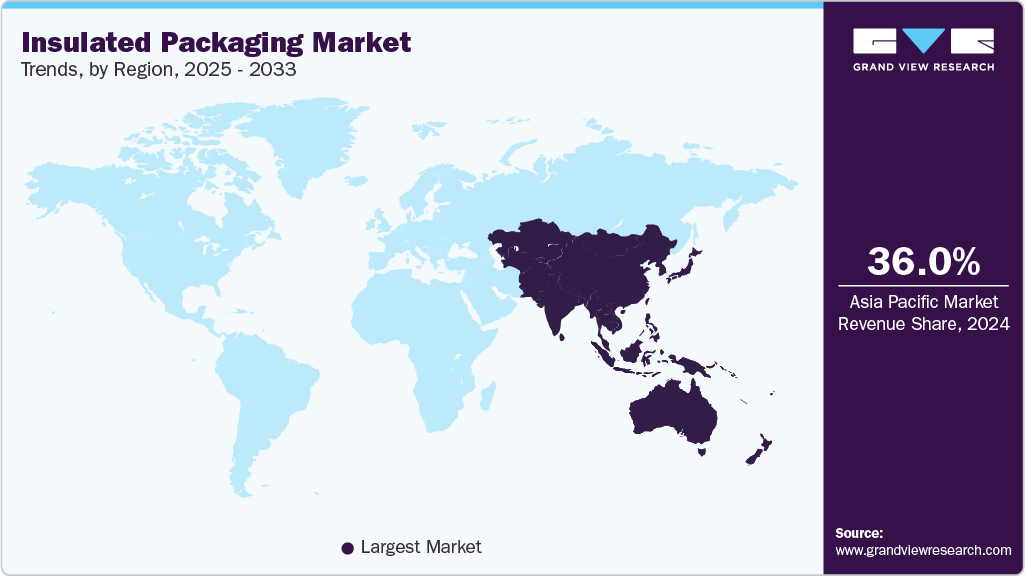

- Asia Pacific dominated the insulated packaging market with the largest revenue share of over 36.0% in 2024.

- The insulated packaging market in China is expected to grow at a substantial CAGR of 5.8% from 2025 to 2033.

- By material, the plastic segment is expected to grow at a considerable CAGR of 5.4% from 2025 to 2033 in terms of revenue.

- By packaging type, the flexible segment is expected to grow at a considerable CAGR of 5.3% from 2025 to 2033 in terms of revenue.

- By application, the pharmaceutical segment is expected to grow at a considerable CAGR of 5.4% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 17.41 Billion

- 2033 Projected Market Size: USD 26.99 Billion

- CAGR (2025-2033): 5.0%

- Asia Pacific: Largest market in 2024

In addition, growing e-commerce and cold chain logistics are boosting the need for efficient thermal protection solutions. The growth of the global cold chain logistics sector is a major driver for the insulated packaging market. With the rising consumption of temperature-sensitive products such as pharmaceuticals, vaccines, frozen foods, and perishable beverages, there is a critical need to maintain product integrity during storage and transportation. For instance, the distribution of COVID-19 vaccines required specialized insulated containers to maintain ultra-low temperatures, highlighting the essential role of insulated packaging in preserving efficacy. Companies such as Sonoco ThermoSafe and Cold Chain Technologies have expanded their product lines to cater to this surge, demonstrating the direct link between cold chain logistics growth and insulated packaging demand.

The surge in e-commerce, especially in the food and grocery sectors, has accelerated the adoption of insulated packaging. Consumers increasingly expect fresh and high-quality food delivered to their doorsteps, which has driven retailers and delivery platforms to invest in temperature-controlled packaging solutions. For example, companies like Amazon Fresh and Instacart use insulated liners, thermal bags, and gel packs to maintain food quality during transit. This trend is particularly strong in regions like North America and Europe, where online grocery sales have seen double-digit growth, directly boosting the insulated packaging market.

The pharmaceutical and biotechnology sectors are key contributors to the growth of insulated packaging. With the increasing production and distribution of biologics, vaccines, and other temperature-sensitive drugs, regulatory compliance and product safety have become paramount. Insulated packaging solutions, including reusable foam containers, vacuum-insulated panels, and phase-change materials, ensure temperature stability during storage and transport. For example, the shipment of mRNA vaccines during the pandemic relied heavily on advanced insulated packaging technologies, which has led to long-term investments in this sector.

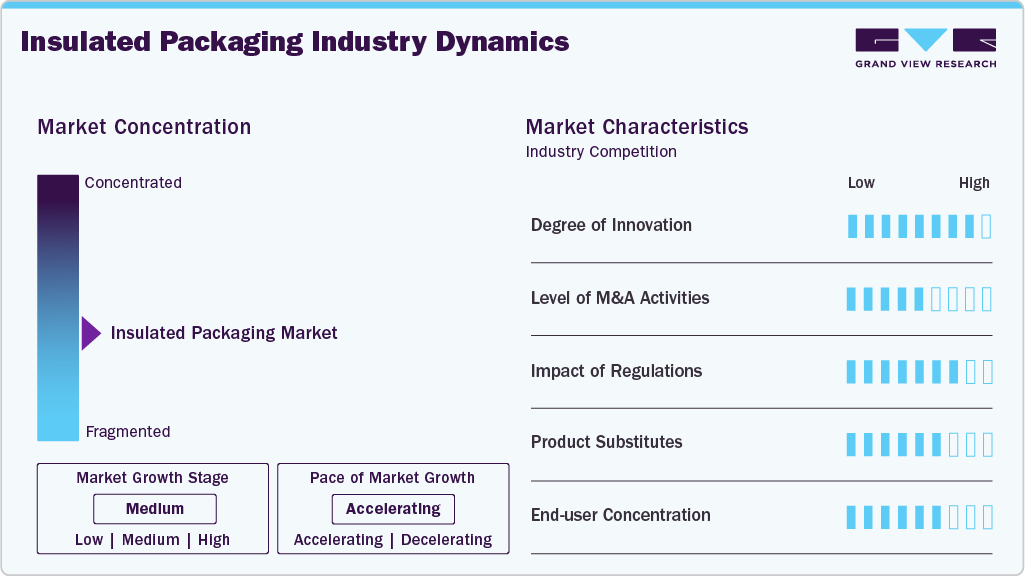

Market Concentration & Characteristics

The insulated packaging industry is characterized by a large number of global, regional, and local players competing across multiple sectors such as food, pharmaceuticals, and e-commerce. While major multinational companies such as Sonoco ThermoSafe, Cold Chain Technologies, Cryopak, and Sealed Air dominate certain high-value segments, a large number of small and medium-sized manufacturers cater to niche markets, especially regional food delivery and last-mile logistics. This fragmentation results in intense price competition and drives companies to innovate in materials, design, and technology to differentiate their products.

Innovation is a core characteristic of the insulated packaging industry. Companies are continuously investing in advanced thermal insulation materials, reusable and eco-friendly packaging, and smart packaging solutions equipped with IoT sensors for temperature monitoring. For example, vacuum-insulated panels, phase-change materials (PCMs), and biodegradable foams are becoming increasingly common. This innovation focus is critical, as the market’s end-users-particularly pharmaceuticals and perishable food sectors-require high-performance solutions to ensure product integrity and compliance with strict regulatory standards.

Material Insights

The corrugated cardboards segment recorded the largest market revenue share of over 30.0% in 2024. Corrugated cardboard is one of the most widely used materials in insulated packaging due to its lightweight nature, cost-effectiveness, and recyclability. It is commonly used for shipping perishable goods such as frozen foods, pharmaceuticals, and temperature-sensitive beverages. The material can be combined with inner liners or insulating inserts, such as foam or polyethylene, to enhance thermal protection. Its versatility allows it to be customized in different shapes, thicknesses, and insulation levels depending on the product requirements. The e-commerce boom has led to a surge in demand for protective and insulated shipping cartons, further boosting the adoption of corrugated cardboard.

The plastic segment is expected to grow at the fastest CAGR of 5.4% during the forecast period. Plastic is extensively used in insulated packaging due to its high durability, moisture resistance, and ability to maintain temperature over extended periods. Types of plastic used include expanded polystyrene (EPS), polypropylene (PP), and polyethylene (PE), often in the form of rigid containers, trays, or flexible films. Plastic insulated packaging is particularly popular in the food and pharmaceutical industries for transporting frozen and refrigerated products. The increasing need for lightweight, durable, and long-lasting packaging solutions drives the adoption of plastics.

Packaging Type Insights

The rigid packaging segment recorded the largest market revenue share of over 43.0% in 2024. Rigid insulated packaging includes containers made from solid, durable materials such as expanded polystyrene (EPS), polyurethane (PU) panels, and hard plastics. These containers are designed to maintain the temperature of perishable goods, pharmaceuticals, or temperature-sensitive chemicals during transport. They are widely used for shipping vaccines, biological samples, frozen foods, and high-value electronics that require robust thermal protection. The rigid nature of these containers ensures structural stability, stackability, and long-term reusability, making them suitable for both domestic and international logistics.

The flexible packaging segment is expected to grow at the fastest CAGR of 5.3% during the forecast period. Flexible insulated packaging comprises materials such as aluminum foils, bubble wraps, thermal blankets, and insulated liners that are lightweight and adaptable. These are typically used for packaging food delivery items, ready-to-eat meals, perishable groceries, and consumer healthcare products. Flexible insulation offers convenience in storage, reduces transportation weight, and can conform to irregularly shaped items, making it ideal for last-mile delivery and urban logistics.

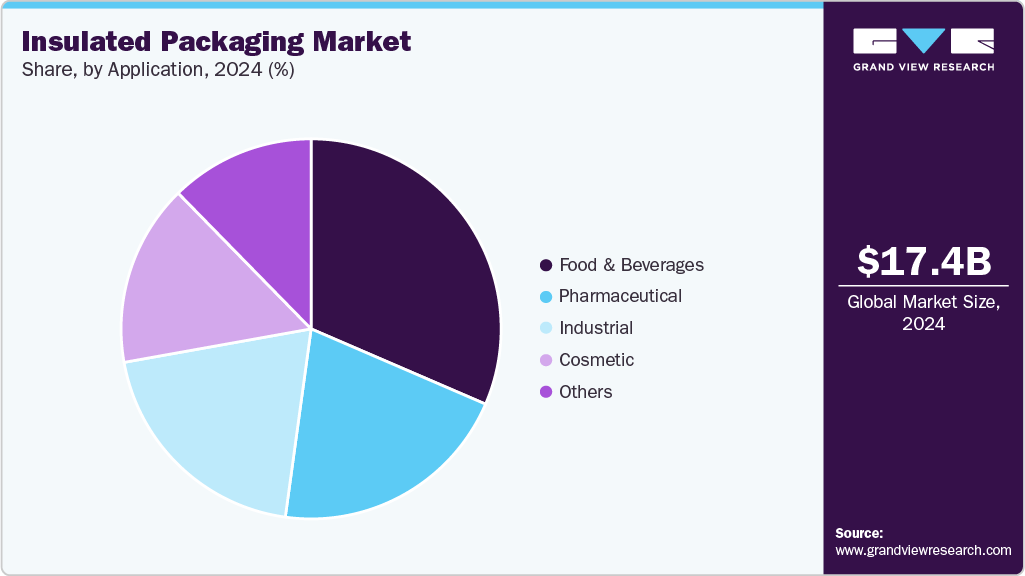

Application Insights

The food & beverage segment recorded the largest market share of over 31.0% in 2024. Insulated packaging in the food & beverage sector is widely used to maintain the temperature of perishable items such as dairy products, frozen foods, fresh produce, and beverages during storage and transportation. The rise of e-commerce, online grocery delivery, and meal kit services has further amplified the need for reliable temperature-controlled packaging. The primary drivers for this segment include the increasing consumer demand for fresh and frozen food delivered at the right temperature, rising awareness of food safety standards, and the expansion of cold chain logistics.

The pharmaceutical segment is projected to grow at the fastest CAGR of 5.4% during the forecast period. In the pharmaceutical sector, insulated packaging is critical for the safe transportation of temperature-sensitive products such as vaccines, biologics, insulin, and other drugs that require cold chain storage. Packaging solutions include refrigerated shippers, thermal blankets, phase-change materials, and temperature-monitoring devices. The industry relies on strict regulatory standards to ensure drug efficacy and patient safety. The key drivers are the increasing production and distribution of biologics and vaccines.

Region Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 36.0% in 2024 and is expected to grow at the fastest CAGR of 5.6% over the forecast period. This positive outlook is due to its massive population, rapid urbanization, and the explosive expansion of its middle class. This economic transformation has created an unprecedented demand for perishable goods, including fresh food, pharmaceuticals, and vaccines, which require reliable temperature-controlled logistics. Furthermore, the region is the world's manufacturing hub, producing a significant portion of the globe's pharmaceuticals and temperature-sensitive electronics, necessitating robust export packaging solutions. The e-commerce sector, particularly in China and India, is also a monumental growth driver, as online grocery delivery and meal kit services become mainstream, all requiring insulated shippers to maintain product integrity from warehouse to doorstep.

North America Insulated Packaging Market Trends

North America is a mature yet consistently high-growth market, driven by its advanced, highly regulated pharmaceutical and biotechnology sectors and the world's most dominant e-commerce ecosystem. The region has strict regulations from the FDA (Food and Drug Administration) governing the transport of pharmaceuticals and food products, mandating the use of validated insulated packaging solutions to ensure compliance and patient safety. This has led to the high adoption of advanced active packaging systems and sophisticated temperature-monitoring technologies. In addition, the consumer culture, with an expectation for next-day delivery of everything from gourmet meal kits to premium pet food, creates massive, consistent demand for reliable cold chain packaging from companies such as Amazon and major grocery chains.

The U.S. drives the market through its unparalleled spending power, a massive and innovative life sciences industry, and a culture that deeply values convenience. It is home to the world's largest pharmaceutical and biotech companies (e.g., Pfizer, Johnson & Johnson), which spend heavily on premium packaging for high-value drugs, clinical trial materials, and cell & gene therapies that often require deep-cold (-80°C) shipping. The "Amazon Effect" has conditioned consumers to expect everything at their doorsteps instantly, making the U.S. the epicenter of innovation for insulated packaging that is both highly protective and designed for easy, out-of-the-box consumer experience.

Europe Insulated Packaging Market Trends

Europe's insulated packaging market is propelled by its strong and integrated cross-border trade, the world's most stringent environmental regulations, and a highly conscious consumer base demanding fresh, high-quality, and sustainably delivered products. The EU's GDP (Good Distribution Practice) guidelines for pharmaceuticals create a non-negotiable requirement for reliable temperature-controlled logistics across its 27 member states, fostering an advanced market for compliant packaging solutions. Furthermore, European consumers have a strong preference for fresh, locally sourced, and organic food, which often requires temperature assurance during transport from farm to specialized retailers. The region's leadership in the circular economy also drives innovation in bio-based, compostable, and reusable insulating materials.

Key Insulated Packaging Company Insights

The competitive environment of the insulated packaging industry is moderately fragmented, with a mix of global players, regional manufacturers, and niche solution providers competing across food & beverages, pharmaceuticals, and industrial applications. Key players such as Sonoco ThermoSafe, Smurfit Westrock, and Cold Chain Technologies, focus on innovation in sustainable and high-performance insulation materials, while smaller regional players often compete on cost-effectiveness and local distribution networks. Strategic collaborations, mergers & acquisitions, and technological advancements in biodegradable foams, vacuum-insulated panels, and phase change materials are intensifying competition.

-

In November 2024, Nature-Pack showcased a significant advancement in insulated packaging at Pack Expo 2024 by introducing Fibrease cellulose wood foam, a sustainable alternative designed to replace conventional plastic-based foam solutions. Fibrease, crafted from renewable cellulose fibers, offers high thermal insulation and cushioning performance while being compostable and recyclable, aligning with growing demands for environmentally friendly packaging.

-

In June 2024, ProAmpac launched FiberCool, a patent-pending, kerbside-recyclable insulated bag for food and grocery delivery. It offers up to 30% better temperature retention than standard paper bags, is easy to recycle, saves storage space, reduces food waste, and features a one-piece, brandable design available in multiple sizes for diverse retailer needs.

Key Insulated Packaging Companies:

The following are the leading companies in the insulated packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Sonoco ThermoSafe

- Smurfit Westrock

- Lifoam

- Cold Chain Technologies

- Ranpak

- Exeltainer

- TEMPACK

- Huhtamaki

- Thermal Packaging Solutions Ltd.

- Insulated Products Corporation

- IPG

- Cold Ice Inc.

- MARKO FOAM PRODUCTS

Insulated Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.33 billion

Revenue forecast in 2033

USD 26.99 billion

Growth rate

CAGR of 5.0% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Material, packaging type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Sonoco ThermoSafe; Smurfit Westrock; Lifoam; Cold Chain Technologies; Ranpak; Exeltainer; TEMPACK; Huhtamaki; Thermal Packaging Solutions Ltd.; Insulated Products Corporation; IPG; Cold Ice Inc.; MARKO FOAM PRODUCTS

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insulated Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global insulated packaging market report based on material, packaging type, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Corrugated Cardboards

-

Metal

-

Glass

-

Plastic

-

Others

-

-

Packaging Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Rigid

-

Flexible

-

Semi-Rigid

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Pharmaceutical

-

Industrial

-

Cosmetic

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global insulated packaging market was estimated at around USD 17.41 billion in the year 2024 and is expected to reach around USD 18.33 billion in 2025.

b. The global insulated packaging market is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2033 to reach around USD 26.99 billion by 2033.

b. Corrugated Cardboard emerged as a dominating product segment with a value share of around 30% in the year 2024 owing to its high impact strength, bending resistance, tear resistance, and burst strength.

b. The key market player in the insulated packaging market includes Sonoco ThermoSafe; Smurfit Westrock; Lifoam; Cold Chain Technologies; Ranpak; Exeltainer; TEMPACK; Huhtamaki; Thermal Packaging Solutions Ltd.; Insulated Products Corporation; IPG; Cold Ice Inc.; and MARKO FOAM PRODUCTS

b. The global insulated packaging market is driven by the rising demand for temperature-sensitive products, including pharmaceuticals and food, requiring safe transportation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.