- Home

- »

- Healthcare IT

- »

-

Laboratory Informatics Market Size, Industry Report, 2030GVR Report cover

![Laboratory Informatics Market Size, Share & Trends Report]()

Laboratory Informatics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (LIMS, ELN, SDMS, LES, EDC & CDMS, CDS, ECM), By Delivery Mode, By Component, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-193-1

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Laboratory Informatics Market Summary

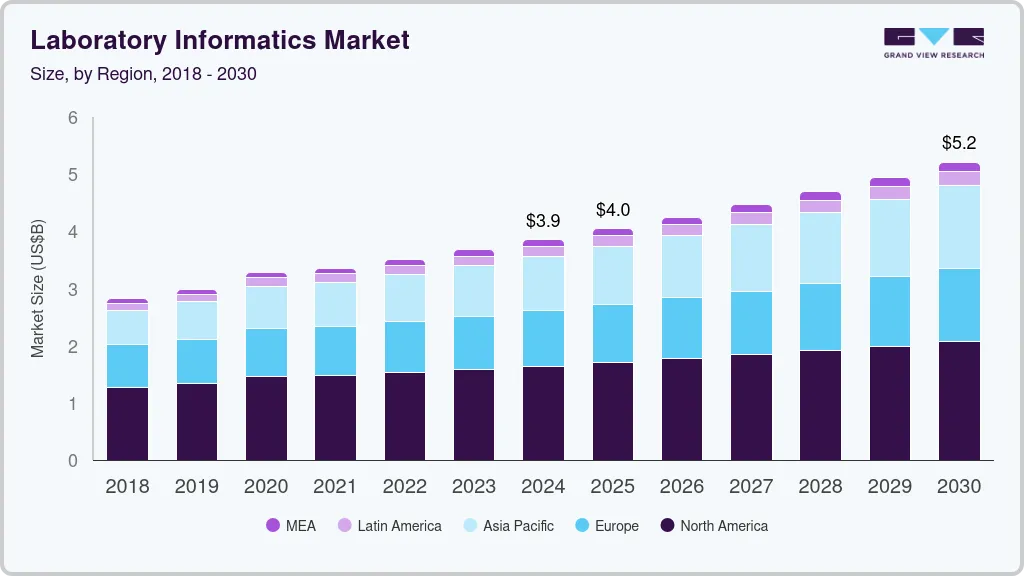

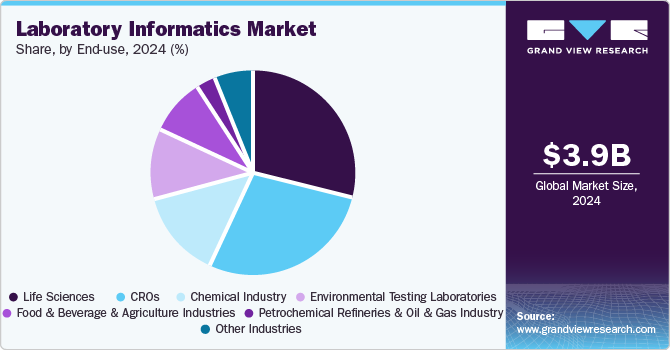

The global laboratory informatics market size was estimated at USD 3.9 billion in 2024 and is projected to reach USD 5.21 billion by 2030, growing at a CAGR of 5.17% from 2025 to 2030. Rising demand for laboratory automation drives adoption, fueled by advancements in molecular genomics, genetic testing, and personalized medicine.

Key Market Trends & Insights

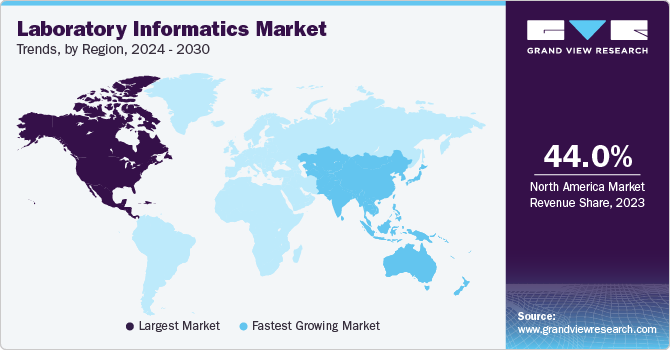

- North America laboratory informatics market held the largest share of 42.55% in 2024.

- The laboratory informatics market in U.S. held the largest share in 2024.

- Based on product, the laboratory information management systems (LIMS) segment dominated the market with a revenue share of 50.40% in 2024.

- Based on components, the services segment accounted for the largest revenue share of 56.60% in 2024.

- Based on delivery mode, the web-based segment dominated the market with a revenue share of 42.91% in 2024.

- Based on end use, the life science companies segment dominated the market with a revenue share of 28.90% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.9 Billion

- 2030 Projected Market Size: USD 5.21 Billion

- CAGR (2025-2030): 5.17%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The shift toward cancer genomics and increased patient engagement further accelerates this trend. Cloud-based lab informatics is becoming the norm, with user-friendly software and a growing number of startups in the sector. Research labs increasingly adopt cloud, mobile, and voice technologies, boosting demand for lab informatics solutions.

Laboratory informatics solutions are being adopted across healthcare, pharmaceuticals, biotechnology, and contract research organizations, driven by the need for enhanced efficiency, error reduction, and data management. Laboratory information systems are increasingly used in biobanks, academic research institutes, and CROs due to their advantages, including process optimization, regulatory compliance, intellectual property protection, reduced throughput time, and paperless data management.

The rise of robotics and process automation in healthcare has made laboratory operations more reproducible and efficient, allowing faster experiment setup, execution, and analysis. High-throughput systems enable rapid evaluation of experimental results, boosting overall laboratory productivity. In addition, advancements in laboratory equipment are accelerating the transition from manual data evaluation to automated methods, improving accuracy and speed. For instance, in May 2023, FreeLIMS introduced an updated cloud-based LIMS with multiple modules and enhanced functionality to support automation, data management, and regulatory compliance, further driving the adoption of laboratory informatics solutions in modern research environments.

Furthermore, laboratories increasingly seek to adopt advanced technology infrastructure to support new initiatives, remove inefficiencies, and improve service offerings. Among products, LIMS has the highest growth potential and ability to capture the market, followed by Electronic Lab Notebooks (ELN) and Enterprise Content Management (ECM). Other products have comparatively low growth potential and the ability to gain market share. The high growth potential and market-capturing ability of LIMS can be attributed to the growth of value-based healthcare and increased demand for new interoperability & information-sharing/reporting requirements.

Case Study

Problem Statement: The Garvan Institute of Medical Research, a leading Australian medical research organization, faced challenges in managing the vast amounts of data generated by its genomics research. To address this, the institute implemented a comprehensive laboratory informatics solution from Autoscribe Informatics.

-

Garvan's researchers generated massive volumes of genomic data that needed to be efficiently stored, organized, and accessed.

-

The institute's previous systems were unable to keep up with the growing data demands, leading to inefficiencies and delays in research.

-

Garvan needed a flexible, scalable informatics platform to integrate with its existing laboratory workflows and instrumentation.

Solution: Garvan deployed Autoscribe's Matrix Gemini LIMS to centralize data management and streamline research operations. The LIMS provided the institute with the following capabilities:

-

Automated sample tracking and management

-

Seamless integration with lab instruments and equipment

-

Customizable workflows to support Garvan's unique research processes

-

Robust data storage and retrieval to facilitate collaboration & analysis

Outcomes:

-

The implementation of the Matrix Gemini LIMS has enabled Garvan to:

-

Improve the efficiency and productivity of its genomics research

-

Enhance data integrity and traceability through automated sample management

-

Facilitate collaboration among researchers by providing centralized access to data

-

Achieve greater visibility and control over its laboratory operation

Analyst Insights

The Garvan Institute of Medical Research case study in Australia illustrates the transformative impact that laboratory informatics can have on academic research organizations. By implementing a comprehensive LIMS solution, the institute was able to streamline its genomics research, enhance data integrity, and facilitate collaboration among its researchers. The growing demand from such organizations is contributing to market growth.

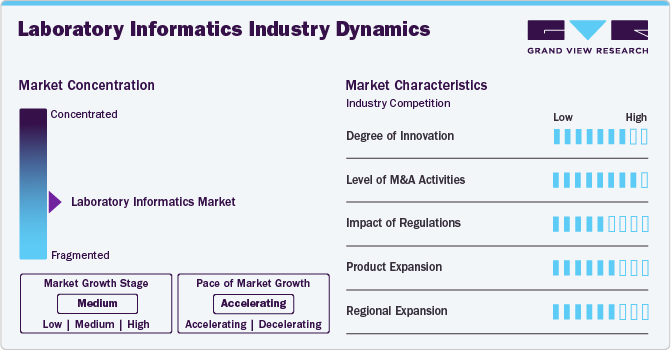

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaboration activities, degree of innovation, and regional expansion. For instance, the laboratory informatics industry is fragmented, with many service providers entering the market. The degree of innovation is high, and the level of mergers & acquisitions activities is moderate. The impact of regulations on the industry is high, and the regional expansion of the industry is moderate.

The industry is highly innovative. The market is experiencing significant innovation as numerous providers introduce new products to meet the demand for scientific data integration solutions in various industries. For instance, in May 2024, Thermo Fisher Scientific Inc. launched Applied Biosystems Axiom BloodGenomiX Array and Software. This innovative solution is designed for precise blood genotyping in clinical studies.

The industry's level of merger and acquisition is moderate due to a rise in major players acquiring emerging players to increase their capabilities, expand product portfolios, and improve competencies. For instance, in December 2023, PerkinElmer Inc. acquired Covaris, a company that develops solutions to drive life science innovations. This acquisition is intended to boost Covaris’ growth and expand PerkinElmer’s life sciences portfolio in the rapidly growing diagnostics market.

The impact of regulations on the market is high. The primary objective of a laboratory is to ensure the generation of high-quality and reliable experimental data that complies with the industry's regulatory guidelines. Technological advancements, stringent regulatory needs, and increasing commercial pressures have rapidly generated vast amounts of data from various aspects, including research and development, quality assurance, and manufacturing. This creates significant challenges for data management processes and conventional documentation requirements, particularly in regulated environments such as the life sciences sector.

The industry's regional expansion is moderate due to the increasing demand for laboratory informatics solutions in developing countries. For instance, in February 2024, LabWare opened a new office in central Seoul, Korea. This expansion represents a significant step forward in its global mission to deliver world-leading laboratory informatics solutions to customers worldwide.

Product Insights

Based on product, the laboratory information management systems (LIMS) segment dominated the market with a revenue share of 50.40% in 2024. This is attributed to the increasing demand for efficient data management and automation in laboratories across various industries, such as healthcare, pharmaceuticals, biotechnology, and environmental testing. LIMS solutions offer comprehensive functionalities, including sample tracking, data analysis, compliance with regulatory standards, and integration with laboratory instruments, which enhances productivity, accuracy, & data integrity. In October 2023, Sapio Sciences introduced Sapio Jarvis, the first scientific data cloud specifically designed for scientists. Sapio Jarvis consolidates various lab data and integrates it with scientific context to speed up drug development processes by utilizing advanced analytics & artificial intelligence.

Enterprise Content Management (ECM) is anticipated to grow significantly over the forecast year. The adoption of ECM is increasing over time as it offers integrated and comprehensive solutions to meet the growing challenges in the healthcare industry. ECM offers a centralized approach to capturing, creating, organizing, accessing, and analyzing an organization’s entire ecosystem of media, knowledge assets, and electronic documents. Companies offering ECM services include consultation, design, implementation, and maintenance of these software solutions.

Delivery Mode Insights

Based on delivery mode, the web-based segment dominated the market with a revenue share of 42.91% in 2024. Labs utilizing the internet and web-based services have unparalleled accessibility, allowing lab operations to be managed and monitored from even the most remote locations using just a single monitoring device. This capability is especially advantageous for geographically dispersed research teams and organizations with multiple lab sites.

Cloud-based is anticipated to grow at the fastest growth rate over the forecast year. This is due to its affordability, scalability, dependability, and sophisticated capabilities that meet healthcare's expanding storage and computational demands. The rise of cloud laboratories offers a chance to leverage AI and Machine Learning to refine experimental methods and improve data accuracy with algorithms. Its cooperative and compatible characteristics also simplify research activities, reduce repetitive tasks, and facilitate system sharing, enhancing research outcomes.

Component Insights

Based on components, the services segment accounted for the largest revenue share of 56.60% in 2024. This is attributed to the need for a flexible, expandable, and easy-to-use service-oriented LIMS for efficient data and process management. Many large pharma and research labs outsource advanced analytics due to internal skill and resource shortages. The lab informatics market provides services such as compliance, social analytics, manufacturing analytics, predictive and preventive maintenance, and benchmarking.

Software is anticipated to grow at the fastest growth rate over the forecast year due to the availability of technologically advanced software, such as SaaS, which offers effective information management solutions for laboratories. The software offered for laboratory informatics can perform critical functions such as data capture, storage, interpretation, and analysis. Periodic upgradation of this software is necessary to coordinate with the latest analytics methods.

End-use Insights

Based on end use, the life science companies segment dominated the market with a revenue share of 28.90% in 2024. The demand for laboratory informatics is increasing in the life sciences industry to develop innovative products and improve product quality and operational efficiency. The need for more virtual and electronic laboratories is increasing to fulfill these requirements. Laboratory informatics systems allow effective management of huge amounts of data and break down research & discovery silos. Increasing technological advances in healthcare owing to rising R&D in medicine are anticipated to fuel the demand for LIMS. The increasing adoption of LIMS in hospitals and research labs due to its growing application scope for patient engagement, workflow management, billing, patient health information tracking, and quality assurance is expected to augment the growth.

CROs is anticipated to grow at the fastest growth rate over the forecast year. The demand for efficient data management and regulatory compliance drives CROs to adopt advanced laboratory informatics solutions, such as ELN, LIMS, and SDMS. These technologies enable CROs to streamline workflows, ensure data integrity, enhance collaboration, and expedite the drug development process. With growth in the life sciences sector, the reliance on CROs for high-quality, cost-effective research solutions is also increasing.

Regional Insights

North America laboratory informatics market held the largest share of 42.55% in 2024. The field of laboratory informatics has undergone significant transformations in recent years, driven by a confluence of factors shaping the North American market. Rapid technological advancements, including measurement, digital, communication, and transportation technologies, have profoundly impacted how clinical laboratories are organized, staffed, and equipped. The increasing prevalence of point-of-care and critical care testing has necessitated real-time data availability and seamless information management to support clinical decision-making.

U.S. Laboratory Informatics Market Trends

The laboratory informatics market in U.S. held the largest share in 2024 due to technological advancement, regulatory demands, and complex operations. Innovations such as cloud computing, AI, and ML are revolutionizing data analysis and efficiency, which are essential for sectors from healthcare to environmental testing for enhanced decision-making and faster drug development.

Europe Laboratory Informatics Market Trends

The laboratory informatics marketin Europeis anticipated to grow significantly due to the increasing automation and digitalization of laboratory data, substantial R&D activities, the requirement for efficient and scalable management across various application industries, and technological advancements in laboratory solutions. The Digital Single Market Strategy, developed by the European Commission (EC), aims to provide consumers and businesses with access to online services and goods across Europe. This strategy is intended to create essential conditions for the growth of digital networks and related services, which in turn is expected to maximize the growth potential of the European economy. For instance, in April 2021, LabVantage Solutions, a prominent provider of laboratory informatics solutions, announced a collaboration with Holo4Med, a medical technology company, to expand its presence in the healthcare sector in Europe. Holo4Med will contribute to the continuity and efficiency of LabVantage Medical Suite services in the region through this strategic partnership.

The UK laboratory informatics market is expected to grow significantly over the forecast period owing to increasing per capita income, rising healthcare costs, and the growing prevalence of chronic disorders that increase the need to adopt analytics services. Key trends in the UK include laboratories switching from standalone informatics systems to integrated platforms that are easier to use and maintain. There is a growing interest in converging laboratory informatics with AI and machine learning. Thus, UK laboratories are prioritizing investments in LIMS, AI, and automation to improve efficiency and data quality. 17% of European and U.S. lab decision-makers plan to invest in a new LIMS or expand their current LIMS from June 2024 to June 2025.

The laboratory informatics market in Germany held the largest share in 2024, owing to the increasing laboratory automation, digitalization of laboratory data, and stringent regulations across industries. Moreover, the growing mergers, acquisitions, partnerships, and collaborations among key players aim to expand capabilities and market reach. For instance, in October 2022, LabVantage Solutions, a leading provider of laboratory informatics solutions, merged with Biomax Informatics, a German company, to create innovative capabilities for the life sciences and biomanufacturing industries.

Asia Pacific Laboratory Informatics Market Trends

The laboratory informatics market in Asia Pacific is expected to witness the fastest growth over the forecast period. With the rising demand from pharmaceutical manufacturers seeking to improve efficiency and reduce costs. The presence of numerous CROs in fast-growing economies like India and China is expected to boost demand, complemented by the adoption of advanced technology-based laboratory information systems. Increased partnerships and collaborations among key regional players to drive market growth in the forecast period. For instance, in April 2024, Autoscribe Informatics, Inc. announced the expansion of its customer network in Asia Pacific by opening an office in Australia. This move supported the company’s growing LIMS business and enabled it to better serve the region in digitalizing laboratory information

China laboratory informatics market held the largest share in 2024, driven by the government's push for e-health services and national electronic health records. Technological advancements, such as AI, automation, and blockchain, are further enhancing lab informatics by improving predictive capabilities, data analytics, and patient outcomes.For instance, in February 2022, Sanomede Medical Technology Co., Ltd. And Roche Diagnostics China partnered to introduce the RS600 Lab Automation Software to the Chinese market. This emphasizes the increasing focus on laboratory automation and informatics solutions in China.

The laboratory informatics market in India is driven by the rising prevalence of cardiovascular and infectious diseases is driving significant growth in eClinical services and laboratory informatics solutions, supported by government initiatives like lifting import duties on clinical trial supplies and allowing the export of clinical trial specimens. The government's efforts to improve healthcare infrastructure and promote digital health, along with geographical expansion by companies.

Latin America Laboratory Informatics Market Trends

The laboratory informatics market in Latin Americais anticipated to grow significantly due to a growing demand for advanced healthcare amid an aging population and rising chronic diseases. Government and private sector investments, along with technological advancements, are driving the market, with significant growth expected in LIMS and ELN systems as awareness of laboratory automation's importance increases.

Brazil's laboratory informatics market is anticipated to grow significantly due to rising per capita income, increasing government medical and healthcare spending, improving access to private healthcare facilities, and fast-growing healthcare R&D.

Middle East & Africa Laboratory Informatics Market Trends

The laboratory informatics market in the Middle East & Africa is expected to grow significantly. The government is implementing laboratory informatics systems to enhance patient care, and hospitals are increasingly adopting these technologies. Market growth is driven by healthcare sector improvements, automation integration in labs, and increased public-private collaborations.

South Africa laboratory informatics market is anticipated to grow significantly due to significant investments and government initiatives in modernizing laboratory operations aim to improve healthcare outcomes and data accuracy, addressing the rising burden of infectious and noncommunicable diseases.

Key Laboratory Informatics Company Insights

The market is highly fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Technologically advanced platforms developed by companies, such as Software as a Service (SaaS), advanced products with the greater utility to gain an edge over competitors. A few emerging players include Artificial, Benchling, Synthace, and others.

Key Laboratory Informatics Companies:

The following are the leading companies in the laboratory informatics market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Agilent Technologies, Inc.

- IDBS

- LabLynx, Inc.

- LabVantage Solutions, Inc.

- LabWare

- McKesson Corporation

- PerkinElmer, Inc.

- Thermo Fisher Scientific, Inc.

- Waters

Recent Developments

-

In February 2024, LabVantage Solutions, Inc., a provider of laboratory informatics solutions, now offers its advanced analytics, semantic search (AILANI), and purpose-built LIMS solutions within an integrated, digitally native ecosystem tailored to support R&D laboratory processes. This ecosystem enhances efficiency, productivity, decision-making, & collaboration and reduces operational costs.

-

In November 2023, Thermo Fisher Scientific Inc. partnered with Flagship Pioneering, a bioplatform innovation firm. This strategic partnership aims to develop and expand multiproduct platforms quickly, create new platform companies focusing on innovative biotech tools & capabilities, and broaden their existing supply relationship across life science tools, diagnostics, & services.

-

In September 2023, LabWare opened an office in Wageningen, The Netherlands. With this location, the company expanded its presence in six continents, with a network of over 40 offices.

-

In October 2022, LabVantage Solutions merged with Biomax Informatics, a software solutions and services provider, to enhance scientific discovery and product creativity and improve the provision of value-added services to customers. The company primarily serves the life sciences, healthcare, and information technologies sectors.

-

In December 2022, LabVantage Solutions, Inc. released version 8.8 of its LabVantage LIMS platform. This new version includes significant enhancements to its components, including the integrated Scientific Data Management System (SDMS), Electronic Laboratory Notebook (ELN), Laboratory Execution System (LES), and advanced analytics. These upgrades are designed to improve speed, accuracy, usability, and security, making it easier and more cost-effective for labs to deploy.

Laboratory Informatics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.05 billion

Revenue forecast in 2030

USD 5.21 billion

Growth rate

CAGR of 5.17% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, delivery mode, component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil,; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Abbott; Agilent Technologies, Inc.;IDBS; LabLynx, Inc.; LabVantage Solutions, Inc.; LabWare; McKesson Corporation; PerkinElmer, Inc.; Thermo Fisher Scientific, Inc.; Waters

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laboratory Informatics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global laboratory informatics market report based on product, delivery mode, component, end-use, and regions.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Laboratory Information Management Systems (LIMS)

-

Electronic Lab Notebooks (ELN)

-

Scientific Data Management Systems (SDMS)

-

Laboratory Execution Systems (LES)

-

Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

-

Chromatography Data Systems (CDS)

-

Enterprise Content Management (ECM)

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-based

-

On-Premise

-

Cloud Based

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Life Sciences

-

Pharmaceutical and Biotechnology Companies

-

Biobanks/Biorepositories

-

Contract Services Organizations

-

Molecular Diagnostics & Clinical Research Laboratories

-

Academic Research Institutes

-

-

CROs

-

Chemical Industry

-

Food & Beverage and Agriculture Industries

-

Environmental Testing Laboratories

-

Petrochemical Refineries and Oil & Gas Industry

-

Other Industries (Forensics and Metal & Mining Laboratories)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global laboratory informatics market size was estimated at USD 3.86 billion in 2024 and is expected to reach USD 4.05 billion in 2025.

b. The global laboratory informatics market is expected to grow at a compound annual growth rate of 5.17% from 2025 to 2030 to reach USD 5.21 billion by 2030.

b. The laboratory information management systems (LIMS) segment dominated the market with revenue share of 50.40% in 2024. This is attributed to increasing demand for efficient data management and automation in laboratories across various industries, such as healthcare, pharmaceuticals, biotechnology, and environmental testing.

b. The web-based segment dominated the market with revenue share of 42.91% in 2024. Unparalleled accessibility is provided to laboratories utilizing the internet and web-based services, allowing lab operations to be managed and monitored from even the most remote locations using just a single monitoring device.

b. Key players operating in the laboratory informatics market include Abbott; Agilent Technologies, Inc.; IDBS; LabLynx, Inc.; LabVantage Solutions, Inc.; LabWare; McKesson Corporation; PerkinElmer, Inc.; Thermo Fisher Scientific, Inc.; Waters

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.