- Home

- »

- Healthcare IT

- »

-

Electronic Lab Notebook Market Size, Industry Report. 2030GVR Report cover

![Electronic Lab Notebook Market Size, Share & Trends Report]()

Electronic Lab Notebook Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Cross Disciplinary, Specific), By Delivery Mode, By License, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-323-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electronic Lab Notebook Market Summary

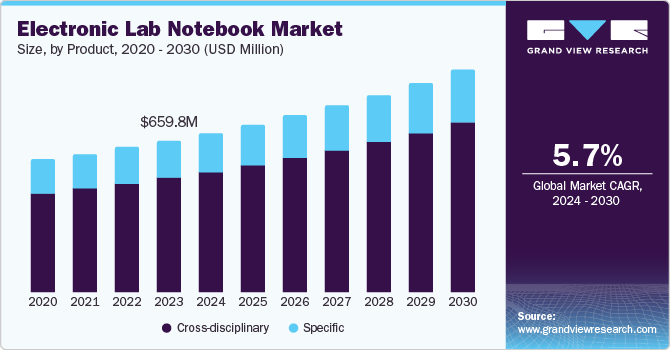

The global electronic lab notebook market size was valued at USD 659.8 million in 2023 and is projected to reach USD 966.2 million by 2030, growing at a CAGR of 5.7% from 2024 to 2030. Increased demand for laboratory informatics and automation is expected to fuel the adoption of ELN. The benefits of electronic lab notebooks, such as process optimization, improved regulatory compliance, reduced labor cost, improved data quality, and faster delivery, are some of the major factors driving the growth.

Key Market Trends & Insights

- North America dominated the electronic lab notebook market in 2023.

- The U.S. electronic lab notebook market dominated the North American market with a share of 80.5% in 2023.

- By product, The cross-disciplinary segment dominated the market and accounted for a share of 75.2% in 2023

- By delivery mode, Web-hosted/ Cloud-based segment accounted for the largest market revenue share of 80.2% in 2023.

- By license, The proprietary segment dominated the market and accounted for a share of 60.2% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 659.8 Million

- 2030 Projected Market Size: USD 966.2 Million

- CAGR (2024-2030): 5.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Electronic lab notebooks allow users to retrieve the stored information for later use and share it with others. It is a substitute for physical lab notebooks and helps organize and secure data effectively. Researchers in healthcare organizations heavily use electronic lab notebooks to gather data, analyze, and share results and procedures in research and development laboratories. For instance, in June 2024, Dotmatics introduced an upgrade in its enterprise electronic lab notebook and data discovery platform, which is expected to help streamline workflows, enhance productivity, and improve overall user experience.

Moreover, these technologies are increasingly being adopted in research institutes and universities to enhance their research & development capabilities, driving further demand in the market. This has led to the launch of new and advanced products for academic research. For instance, in July 2024, Scilligence proudly introduced ELN4edu, an electronic lab notebook (ELN) expected to advance academic research collaboration and streamline experimentation processes. Such developments are expected to drive further demand in the market.

Product Insights

The cross-disciplinary segment dominated the market and accounted for a share of 75.2% in 2023 due to the extensive utilization of interdisciplinary electronic lab notebooks. The R&D labs prefer flexible electronic lab notebooks owing to the broad scope of their research requirements, user-friendliness, and ability to cater to multiple disciplines. It also comes with other advantages, including reduced IT costs, consistent standards across the organization, secure data storage, and collaborative data-gathering procedures. For instance, in May 2024, Sapio Sciences announced the launch of Sapio ELN. This electronic laboratory notebook software has an advanced toolkit for molecular biology, which is integrated with integrated with its multimodal registration to assist scientists in bridging the small molecule-large molecule divide and foster innovation in pharmaceuticals and biotechnology.

The specific segment is expected to grow significantly, with a CAGR of 5.0% over the forecast period. This type is only relevant to a particular field of study and is most relevant to the study topic. Compared to interdisciplinary research, the data is more protected. Sharing data is limited to a specific team, enhancing the efficiency of a single research unit. For instance, Sapio Sciences provides electronic lab notebooks to cater to specific needs such as clinical diagnostic ELN, In Vivo ELN, Histopathology ELN, and others.

Delivery Mode Insights

Web-hosted/ Cloud-based segment accounted for the largest market revenue share of 80.2% in 2023. There is an increasing need for scalable and flexible solutions to unify and harmonize scientific data across platforms, which is a major driver for segment growth. Cloud-based platforms offer real-time data sharing, seamless collaboration, and access from any location, which is likely to increase their adoption. In October 2023, Sapio Sciences introduced Sapio Jarvis. This scientific data cloud delivers ELN, LIMS, and enterprise scientific data management capabilities in a single platform. Such developments are further expected to drive demand in the market.

The on-premises segment is expected to grow significantly, with a CAGR of 4.7% during the forecast period. Organizations, such as pharmaceutical companies, are the main players in the market, prioritizing functionality over cost-efficiency. These companies primarily handle important information, which drives them to use the on-premises approach, which offers increased security with full control over quality and no outside interference. In addition, on-site installations allow for the live tracking of company operations. These deployments ensure the security of data by utilizing only authorized software solutions from third-party vendors. Therefore, these advantages of using on-premises deployment are expected to drive their demand over the forecast period.

License Insights

The proprietary segment dominated the market and accounted for a share of 60.2% in 2023. Proprietary licenses offer enhanced customization and integration capabilities that align with unique organizational workflows and regulatory requirements, providing a competitive edge to companies by ensuring robust data protection and compliance. The source code is guarded by the owner of the software and includes some major features. Therefore, these licenses are considered more secure than open source, which is expected to drive their demand in the market.

The open segment is expected to grow significantly, with a CAGR of 5.2% during the forecast period. The source can be modified, used, and distributed according to specified conditions. Scientists can utilize open-source software to organize, analyze, and strategize experiments, in addition to accessing pertinent data. One example of an open source is Indigo ELN. It is based on Pfizer’s internal chemistry electronic lab notebook, CeN.

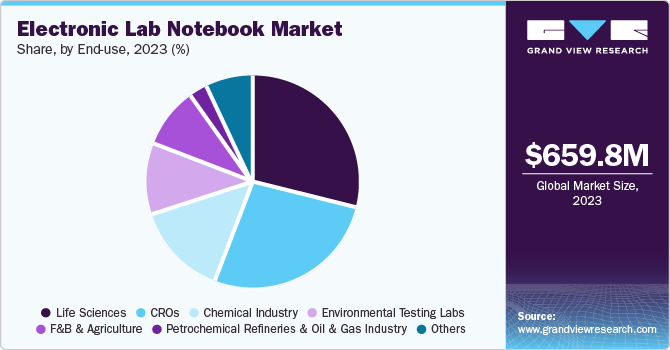

End Use Insights

The life sciences segment accounted for the largest market revenue share of 28.6% in 2023. The growing complexity of research and development in the life sciences segment has driven the need for robust data management solutions. ELNs offer streamlined workflows and improved collaboration, making them indispensable for life science organizations. In November 2023, SciNote electronic lab notebook (ELN) entered into a partnership with Ganymede, a cloud infrastructure provider for life sciences and manufacturing industries, aiming to streamline instrument integration and scientific data reporting by automatically entering experimental results into notebook entries. This partnership is expected to help enhance efficiency and workflow management in the life sciences and drive segmental growth.

The CROs segment is projected to grow at the fastest CAGR of 6.4% over the forecast period. The need for applying fast, accurate, and certified procedures is rising throughout the pharmaceutical segment due to the creation of new materials for treating diseases, vaccines, genetic therapies, biosimilars, and personalized medicine. This makes the laboratories scale up on the R&D, with the applications and interfaces of higher throughput and connectivity being provided by automation. This increases the need to establish efficient workflows, driving demand in the pharmaceutical sector, which is expected to segment growth.

Regional Insights

North America dominated the electronic lab notebook market in 2023. The market in North America is growing due to the increasing attention on drug development and research and the large number of leading vendors in the region. According to the article published by the Congressional Budget Office in April 2021, the FDA approved about 38 new drugs annually between 2010 and 2019. Such a rise in drug and vaccine approvals, along with an increase in investments in drug research and development, has led to a high demand among pharmaceutical and biotechnology companies in the region.

U.S. Electronic Lab Notebook Market Trends

The U.S. electronic lab notebook market dominated the North American market with a share of 80.5% in 2023. The presence of major players coupled with increasing healthcare activities are boosting research and development in the country, which is driving the need for electronic lab notebooks. For instance, in June 2022, the Research Space electronic laboratory notebook system was made available to the University of Nebraska faculty and laboratory groups to manage documents. This increasing adoption of ELN is expected to drive market growth in the U.S.

Europe Electronic Lab Notebook Market Trends

The electronic lab notebook market in Europe was identified as a lucrative region in 2023. The increasing adoption of lab automation. Cloud-based electronic lab notebook systems and the expansion of the key market players in the region are driving the market growth in Europe. For instance, in September 2023, LabWare announced the opening of its new office in Wageningen, The Netherlands. This is likely to help in the development of digital infrastructure and automation solutions in the region and foster market growth.

Germany's electronic lab notebook market is expected to grow rapidly in the coming years. The increasing R&D investments in the life science sector in Germany are contributing to the expansion of the country's market. For instance, in April 2024, Merck KGaA announced an investment of approximately USD 333.75 million for the development of a new life sciences research center in Germany. Such developments in the country are likely to drive the demand for lab automation and boost market growth.

Asia Pacific Electronic Lab Notebook Market Trends

The electronic lab notebook market in the Asia Pacific region is expected to grow at the fastest CAGR of 7.7% over the forecast period. The presence of growing economies such as India and China and increasing initiatives and investments by government and private players to improve the healthcare infrastructure in the region is expected to drive market growth in the region.

India is expected to grow significantly over the forecast period owing to the increasing emphasis on research and development and investments by key players in the healthcare sector. For instance, in April 2022, Thermo Fisher Scientific Inc. announced the expansion of its research and development and engineering facility in Hyderabad, India. This is likely to increase the demand for advanced equipment, such as electronic lab notebooks.

Key Electronic Lab Notebook Company Insights

Some key companies in the electronic lab notebook market include LabWare, SciY, Thermo Fisher Scientific Inc. and others. Organizations are prioritizing expanding their customer base to gain a competitive advantage in the industry. Hence, prominent players are implementing various strategic actions such as mergers, acquisitions, and collaborations with other significant firms.

-

LabWare is a leading global provider of laboratory information management systems (LIMS) and electronic lab notebooks (ELN). The company offers robust, scalable solutions to enhance laboratory operations and streamline data management. It includes an advanced ELN system that facilitates efficient data capture, collaboration, and compliance.

-

Benchling provides cloud-based software solutions for biotechnology research and development. The company offers products such as electronic lab notebook (ELN), which facilitates automated workflows, real-time tracking results linked to data and samples, storage, and other features to enhance research. The platform integrates a variety of applications, such as molecular biology, experimental design, and data management to improve productivity and accelerate innovation in research.

Key Electronic Lab Notebook Companies:

The following are the leading companies in the electronic lab notebook market. These companies collectively hold the largest market share and dictate industry trends.

- LabWare

- SciY

- Thermo Fisher Scientific Inc.

- Benchling.

- LabVantage Solutions Inc

- Abbott

- LabLynx LIMS (Laboratory Information Management System)

- Agilent Technologies, Inc.

- Dassault Systèmes

Recent Developments

-

In May 2024, LabVantage Solutions, Inc. has revealed the acquisition of SEIN Infotech South Korea, a software innovator known for its strong EHS management applications. This strategic expansion in the Asia-Pacific region strengthens LabVantage's environmental compliance services and allows them to offer a unique informatics platform with EHS management solutions for the global energy and chemical sectors.

-

In May 2023, Avantor, Inc. entered into an agreement with Labguru to integrate the inventory manager and e-commerce channel of Avantor, Inc. into the electronic lab notebook (ELN) and lab information management software (LIMS) of Labguru. This is expected to help in providing scientists with access to a wide range of products needed at lab bench.

Electronic Lab Notebook Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 692.8 million

Revenue forecast in 2030

USD 966.2 million

Growth rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Delivery Mode, License, End Use, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, Saudi Arabia, UAE, Kuwait and South Africa

Key companies profiled

LabWare; SciY; Fisher Scientific Inc.; Benchling; LabVantage Solutions Inc.; Abbott; LabLynx LIMS (Laboratory Information Management System); Agilent Technologies, Inc.; Dassault Systèmes

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electronic Lab Notebook Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electronic lab notebook market report based on product, delivery mode, license, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cross-disciplinary

-

Specific

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premise

-

Web-hosted/ Cloud-based

-

-

License Outlook (Revenue, USD Million, 2018 - 2030)

-

Proprietary

-

Open

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Life Sciences

-

CROs

-

Chemical Industry

-

F&B and Agriculture

-

Environmental Testing Labs

-

Petrochemical Refineries & Oil and Gas Industry

-

Other Industries

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.