- Home

- »

- Next Generation Technologies

- »

-

Enterprise Content Management Market Size Report, 2030GVR Report cover

![Enterprise Content Management Market Size, Share & Trends Report]()

Enterprise Content Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (Cloud And On-Premise), By Enterprise Size, By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-103-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Enterprise Content Management Market Summary

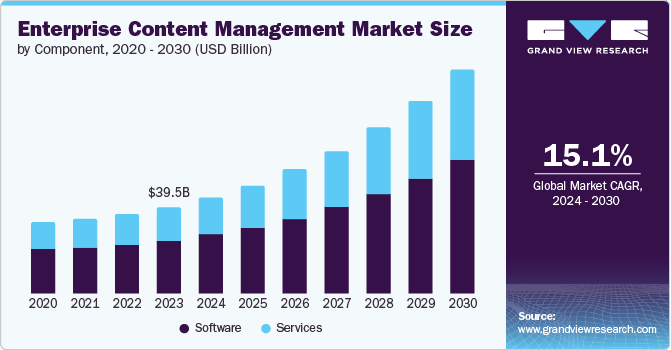

The global Enterprise Content Management (ECM) market was valued at USD 39.46 billion in 2023 and is projected to reach USD 102.01 billion by 2030, growing at a CAGR of 15.1% from 2024 to 2030. The increasing volume of digital content organizations generate propels the demand for enterprise content management (ECM) solutions.

Key Market Trends & Insights

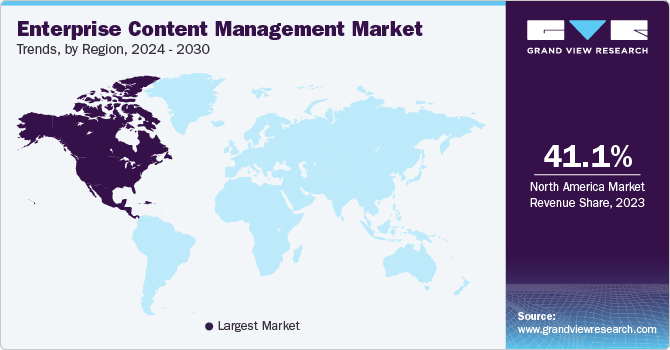

- North America accounted for the largest market revenue share of 41.1% in 2023.

- The Asia Pacific region is projected to experience the highest CAGR over the forecast period.

- By component, software dominated the market in 2023 with a 61.6% share.

- By enterprise size, the large enterprise segment is expected to register the fastest CAGR over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 39.46 billion

- 2030 Projected Market Size: USD 102.01 billion

- CAGR (2024-2030): 15.1%

- North America: Largest market in 2023

With the proliferation of digital data from various sources, such as emails, documents, images, and videos, businesses seek robust ECM platforms to efficiently manage, store, and retrieve this content. As a result, the need for ECM systems that offer scalable storage, advanced search capabilities, and seamless integration with existing business applications has surged, stimulating market growth.Organizations across industries face stringent regulatory requirements for data privacy, security, and retention. Consequently, there is a growing need for ECM platforms that provide features such as audit trials, access controls, encryption, and records management to ensure compliance with industry standards and regulations. This compliance-driven demand is a significant growth driver for the ECM market as businesses prioritize implementing robust content management systems to mitigate legal and regulatory risks.

Moreover, the accelerating trend of digital transformation and cloud adoption is contributing to the expansion of the ECM market. As businesses strive to modernize their operations and leverage cloud-based technologies for enhanced agility and scalability, the demand for cloud-based ECM solutions has surged.

Furthermore, the increasing need for paperless workplaces is fueled by the advantages of converting documents into digital format, enabling individuals to save files on a local server or in the cloud. The digital folders stored in a repository occupy less space than a physical records archive. Enterprise content management systems provide advanced security features, particularly regarding data accessibility. In addition, improved compliance and audit control help meet regulatory requirements and enhance information governance. By centralizing document storage, implementing access controls, and enabling secure collaboration, ECM solutions help organizations maintain data integrity and reduce risks related to non-compliance. The growing demand for compliance and audit management solutions is propelling the expansion of the enterprise content management market as companies focus on implementing strong governance measures to maneuver through a more intricate regulatory landscape.

Component Insights

Software dominated the market and accounted for a share of 61.6% in 2023. The increasing need for efficient document management and collaboration tools propels the demand for ECM software. As organizations grapple with the challenges of managing vast amounts of digital content, there is a growing emphasis on deploying ECM software that offers advanced document management features, version control, access controls, and seamless collaboration capabilities.

Services segment is expected to register the fastest CAGR of 15.6% during the forecast period. The increasing trend towards data management consulting and risk management is contributing to the rapid growth of the services segment within the ECM market. Organizations seek ECM services beyond traditional content management capabilities to encompass strategic consulting, risk assessment, and data governance expertise.

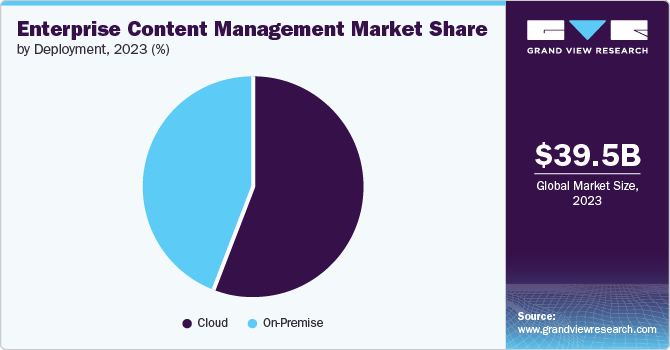

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2023. Cloud-based ECM offers benefits such as disaster recovery, flexibility, and reduced network traffic, enabling organizations to enhance user experience and operational efficiency. As businesses seek to leverage cloud technologies to optimize their content management strategies and improve agility, the demand for cloud-based ECM solutions is on the rise, fueling market growth. The increasing emphasis on remote work environments and the need for seamless access to content from any location drive the uptake of cloud-based ECM solutions. As organizations embrace remote collaboration and flexible work arrangements, the demand for ECM solutions that facilitate remote access, seamless collaboration, and efficient content management is surging.

The on-premise segment is anticipated to grow significantly over the forecast period. Organizations, especially those in highly regulated industries such as finance and healthcare, prioritize keeping sensitive data on-premise to maintain control over security protocols and ensure compliance with industry regulations. By managing ECM solutions on-premise, companies can implement customized security measures, restrict access to sensitive information, and mitigate data breaches or non-compliance risks.

Enterprise Size Insights

The Small and Medium Enterprise (SMEs) segment dominated the market in 2023. SMEs increasingly recognize the importance of efficient ECM solutions to streamline their operations, enhance productivity, and ensure compliance with regulations. As SMEs expand their operations and digital footprint, they require scalable ECM systems to accommodate their evolving needs without incurring significant costs.

Large enterprise segment is expected to register the fastest CAGR during the forecast period due to the extensive amounts of data that need to be organized, regulations that need to be followed, widespread teams that require collaboration tools, and the constant need for strong security measures. Cloud-based ECM solutions are appealing because they provide scalability, cost-effectiveness, and simplified deployment for data-heavy organizations.

Application Insights

BFSI accounted for the largest market revenue share in 2023. As financial institutions face more stringent data security, privacy, and compliance regulations, there is a growing need for robust enterprise content management solutions to ensure regulatory adherence and mitigate risks. This drives the adoption of ECM systems in the BFSI segment as they offer features like secure document storage, audit trails, and compliance monitoring.

The healthcare industry is expected to register the fastest CAGR during the forecast period. With stringent regulations such as HIPAA (Health Insurance Portability and Accountability Act) in place to protect patient information, healthcare organizations are turning to ECM solutions to ensure compliance with these regulations while safeguarding sensitive data from breaches and unauthorized access.

Regional Insights

The North America enterprise content management market accounted for the largest market revenue share of 41.1% in 2023. ECM has become increasingly vital for organizations in North America due to the growing volume of digital content and the need for efficient information management. Organizations are pressured to adhere to data privacy regulations such as GDPR and HIPAA, driving the demand for ECM solutions that ensure secure storage, retrieval, and management of sensitive information while maintaining compliance with regulatory standards.

U.S. Enterprise Content Management Market Trends

The U.S. enterprise content management market dominated the North America market in 2023. The demand for advanced analytics capabilities is fueling the expansion of ECM solutions in the U.S. Businesses increasingly leverage data analytics to gain insights into customer behavior, operational efficiency, and market trends. ECM systems incorporating Artificial Intelligence (AI) and machine learning technologies enable organizations to extract valuable insights from their content repositories.

Europe Enterprise Content Management Market Trends

The Europe enterprise content management market was identified as a lucrative region in 2023. The ongoing digital transformation initiatives across various industries in Europe have propelled the growth of the ECM market. Businesses increasingly focus on digitizing their operations, automating workflows, and enhancing team collaboration. ECM systems enable digital transformation by centralizing document management, improving information retrieval processes, and facilitating seamless integration with other business applications.

The UK enterprise content management market is expected to grow rapidly in the coming years. As businesses accumulate vast amounts of data from various sources, including emails, documents, multimedia files, and social media, there is a pressing need for efficient content management solutions that can classify, organize, and retrieve information quickly and accurately. ECM systems equipped with advanced search functionalities, metadata tagging, and analytics capabilities empower organizations to extract valuable insights from their data repositories, drive innovation, and gain a competitive edge in the marketplace.

Asia Pacific Enterprise Content Management Market Trends

The Asia Pacific region is projected to experience the highest CAGR over the forecast period. As businesses in Asia Pacific continue to digitalize their operations, the demand for ECM systems has been on the rise. This trend is further fueled by the increasing adoption of cloud-based ECM solutions, which offer scalability, flexibility, and cost-effectiveness.

The Japan enterprise content management market is expected to grow rapidly in the coming years. The proliferation of mobile devices and the growing volume of digital content are shaping the demand for ECM solutions in Japan. As employees increasingly rely on smartphones, tablets, and laptops to access and share information on-the-go, ECM systems equipped with mobile-friendly interfaces and applications enable secure and convenient access to critical business content.

Key Enterprise Content Management Company Insights

Some of the key companies in the enterprise content management market include Microsoft Corporation, IBM Corporation, OpenText Corporation, Hyland Software, Inc., Alfresco Software, Inc., and M-Files Corporation. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

Microsoft Corporation provides a comprehensive suite of ECM solutions catering to modern businesses' diverse needs. From document management to collaboration tools to data protection, Microsoft's offerings empower organizations to manage their digital content while ensuring security and compliance efficiently.

-

IBM Corporation provides a full range of Enterprise Content Management (ECM) solutions through IBM FileNet. FileNet offers a centralized place to securely store and organize all your business data, such as documents, emails, images, and more.

Key Enterprise Content Management Companies:

The following are the leading companies in the enterprise content management market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft Corporation

- IBM Corporation

- OpenText Corporation

- Hyland Software, Inc.

- Alfresco Software, Inc.

- M-Files Corporation

- Oracle Corporation

- Box, Inc.

- Laserfiche

- DocuWare Corporation

Recent Developments

-

In January 2024, Microsoft announced the expansion of its Copilot feature, aiming to bring its full power to more people and businesses. This move signifies Microsoft’s commitment to enhancing productivity and collaboration through innovative AI technologies.

Enterprise Content Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 43.94 billion

Revenue forecast in 2030

USD 102.01 billion

Growth rate

CAGR of 15.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Japan, India, China, South Korea, Australia, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

Microsoft Corporation, IBM Corporation, OpenText Corporation, Hyland Software, Inc., Alfresco Software, Inc., M-Files Corporation, Oracle Corporation, Box, Inc., Laserfiche, DocuWare Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enterprise Content Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global enterprise content management market report based on component, deployment, enterprise size, application and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Document Management

-

Workflow Automation

-

Records Management

-

Digital Asset Management (DAM)

-

Content Analytics

-

Others

-

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-Premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small and Medium Enterprise (SMEs)

-

Large Enterprises

-

-

Application Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT and Telecommunication

-

Media and Entertainment

-

Government

-

Healthcare

-

Manufacturing

-

Retail

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.