- Home

- »

- Next Generation Technologies

- »

-

Advanced Analytics Market Size And Share Report, 2030GVR Report cover

![Advanced Analytics Market Size, Share, & Trends Report]()

Advanced Analytics Market (2025 - 2030) Size, Share, & Trends Analysis Report By Type, By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-997-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Advanced Analytics Market Summary

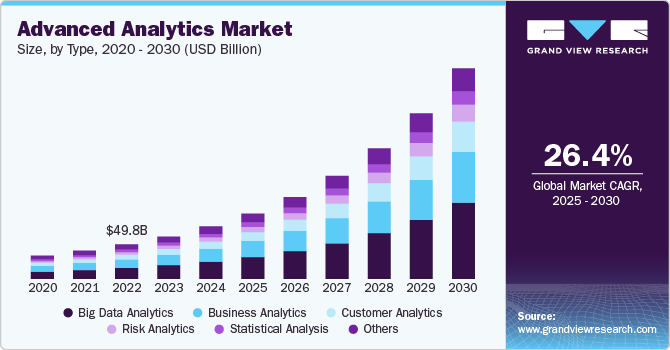

The global advanced analytics market size was estimated at USD 75.89 billion in 2024 and is projected to reach USD 305.42 billion by 2030, growing at a CAGR of 26.4% from 2025 to 2030. The growth of the advanced analytics market is primarily driven by the increasing demand for data-driven decision-making across industries.

Key Market Trends & Insights

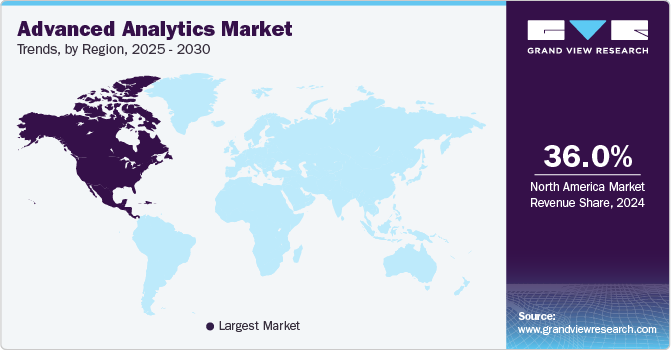

- North America held the major share of over 36% of the advanced analytics market in 2024.

- The advanced analytics market in the U.S. is expected to grow significantly from 2025 to 2030.

- By type, the big data analytics segment accounted for the largest market share of over 32% in 2024.

- By deployment, the cloud segment accounted for the largest market share of over 62% in 2024.

- By enterprise size, The large enterprise segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 75.89 Billion

- 2030 Projected Market Size: USD 305.42 Billion

- CAGR (2025-2030): 26.4%

- North America: Largest market in 2024

Organizations are recognizing the value of leveraging vast amounts of structured and unstructured data to gain insights, optimize operations, and improve customer experiences. The proliferation of big data, advancements in artificial intelligence (AI) and machine learning (ML) technologies, and the growing adoption of cloud computing have further accelerated this trend. In addition, the rise in digital transformation initiatives and the need for real-time analytics to address competitive pressures and evolving market demands are key factors contributing to the expansion of the advanced analytics market.

The increasing demand for data-driven decision-making is a significant driver of advanced analytics market growth as organizations seek to harness the power of data to gain actionable insights and improve business outcomes. As businesses face more complex and competitive environments, the ability to analyze large volumes of data in real-time becomes critical for strategic decision-making. Advanced analytics tools, such as predictive modeling, machine learning, and data visualization, enable companies to forecast trends, optimize processes, and enhance customer experiences with greater precision and speed. This shift towards data-centric strategies is pushing organizations across sectors, from finance to healthcare to retail, to invest heavily in advanced analytics solutions, thereby fueling market expansion.

The proliferation of big data, along with advancements in artificial intelligence (AI) and machine learning (ML) technologies, is a pivotal factor driving the growth of the advanced analytics market. As organizations generate and collect vast amounts of data from diverse sources, traditional data processing methods often need to be revised to extract valuable insights. AI and ML technologies enable the efficient analysis of large, complex datasets, uncovering patterns, trends, and correlations that were previously difficult to detect. These technologies empower businesses to automate decision-making processes, enhance predictive capabilities, and deliver personalized customer experiences at scale. In addition, the integration of AI and ML into advanced analytics tools has streamlined data analysis workflows, reduced human error, and increased the accuracy of outcomes, further accelerating the adoption of advanced analytics solutions across industries.

Type Insights

The big data analytics segment accounted for the largest market share of over 32% in 2024, owing to its ability to process and analyze vast amounts of structured and unstructured data from multiple sources. As organizations continue to generate increasingly large datasets, traditional analytical tools are often insufficient for handling the volume, velocity, and variety of this information. Big data analytics solutions offer the scalability, flexibility, and computational power needed to manage and derive actionable insights from these extensive datasets. These solutions also enable organizations to identify trends, forecast outcomes, and make informed decisions, driving their widespread adoption across industries such as finance, healthcare, retail, and manufacturing.

The customer analytics segment is expected to grow at a significant rate during the forecast period. The adoption of customer analytics is primarily driven by the growing emphasis on delivering personalized experiences and enhancing customer satisfaction. Businesses are increasingly leveraging customer analytics to understand consumer behavior, preferences, and purchasing patterns, which allows them to tailor marketing efforts, product offerings, and customer service. In a competitive market environment, companies seek to differentiate themselves by providing individualized experiences that foster loyalty and retention. The rise of digital platforms and e-commerce, coupled with advancements in AI and machine learning, has further fueled the adoption of customer analytics, as businesses can now analyze vast amounts of customer data in real-time to optimize engagement strategies and improve overall customer experience.

Deployment Insights

The cloud segment accounted for the largest market share of over 62% in 2024, due to its scalability, flexibility, and cost-efficiency. Cloud solutions allow organizations to access advanced analytics tools without the need for substantial upfront investments in hardware or infrastructure, making them particularly attractive for companies seeking rapid deployment and easy scalability. The cloud enables real-time data processing seamless integration with existing systems and supports collaboration across geographically dispersed teams. In addition, the subscription-based model of cloud services reduces capital expenditure and allows businesses to pay only for the resources they use, further driving the widespread adoption of cloud-based advanced analytics solutions across industries.

The on-premise segment is expected to grow at a significant rate during the forecast period. The adoption of on-premise advanced analytics solutions is primarily driven by organizations that require heightened control, security, and customization. Companies operating in highly regulated industries such as finance, healthcare, and government often prioritize data security and compliance with strict regulatory frameworks, which makes on-premise deployment more suitable for their needs. On-premise solutions also allow businesses to fully customize their analytics infrastructure to meet specific operational requirements and ensure data sovereignty. While cloud-based analytics is growing, some organizations prefer on-premise deployments to maintain full control over their data environment, reduce potential security risks, and adhere to stringent governance policies.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share in 2024. Large enterprises dominated the advanced analytics market by enterprise size segment due to their extensive resources, complex operations, and vast data volumes. These organizations typically manage large-scale, multifaceted operations that generate significant amounts of structured and unstructured data, requiring advanced analytics solutions to derive actionable insights. In addition, large enterprises have the financial capacity to invest in cutting-edge technologies, dedicated data teams, and sophisticated infrastructure, enabling them to leverage advanced analytics for enhanced decision-making, operational efficiency, and competitive advantage. Their need for real-time analytics to navigate global markets and drive innovation further solidifies their leadership in this market segment.

The small & medium enterprise (SME) segment is expected to grow at a significant rate during the forecast period. The adoption of advanced analytics among SMEs is driven by the increasing accessibility of analytics tools and the need to remain competitive in a data-driven business environment. Cloud-based analytics platforms and software-as-a-service (SaaS) models have lowered the barriers to entry, allowing SMEs to deploy advanced analytics solutions without the need for significant upfront investments in infrastructure. These tools enable SMEs to optimize processes, improve customer experiences, and make data-informed decisions similar to their larger counterparts. In addition, as SMEs face growing competition, the ability to use data for strategic insights, cost reduction, and targeted marketing is becoming crucial, prompting them to adopt advanced analytics to stay agile and competitive.

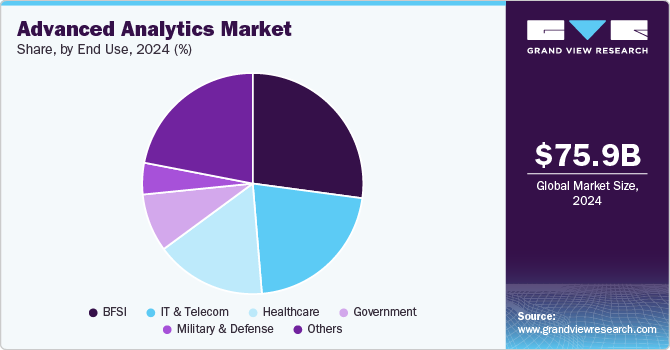

End Use Insights

The BFSI end use segment accounted for the largest market share in 2024, owing to its heavy reliance on data for risk management, fraud detection, and customer insights. Financial institutions generate vast amounts of transactional, behavioral, and market data, which are critical for making informed decisions, managing risks, and complying with regulatory requirements. Advanced analytics tools enable BFSI organizations to detect fraud in real-time, assess credit risk, optimize investment strategies, and personalize customer services. In addition, the need to enhance operational efficiency and navigate complex financial markets has driven the BFSI sector to invest significantly in advanced analytics solutions, further solidifying its leadership in this market segment.

The healthcare segment is expected to grow at a significant rate during the forecast period. The adoption of advanced analytics in the healthcare sector is driven by the growing need for data-driven insights to improve patient outcomes, optimize clinical operations, and reduce costs. Healthcare providers and organizations are increasingly leveraging advanced analytics to analyze large datasets, such as patient records, clinical trial data, and population health statistics, to identify patterns and trends that can enhance diagnostics, treatment plans, and preventive care. Furthermore, advancements in artificial intelligence and machine learning are enabling predictive analytics, which can foresee patient risks and optimize resource allocation. As healthcare systems face increasing pressure to deliver better care with limited resources, the adoption of advanced analytics is becoming crucial for improving both efficiency and patient care quality.

Regional Insights

North America held the major share of over 36% of the advanced analytics market in 2024. The advanced analytics market in North America is characterized by the strong adoption of AI and machine learning technologies across industries. The region’s emphasis on digital transformation, coupled with the presence of leading technology providers and a highly developed IT infrastructure, is driving the demand for advanced analytics. The financial services, healthcare, and retail sectors are leading the charge, leveraging analytics for real-time insights, operational efficiency, and personalized services.

U.S. Advanced Analytics Trends

The advanced analytics market in the U.S. is expected to grow significantly from 2025 to 2030. In the U.S., the advanced analytics market is dominated by the demand for data-driven decision-making across key sectors such as BFSI, healthcare, and retail. The U.S. leads in innovation and investment in AI, big data, and cloud-based analytics platforms, with companies increasingly adopting analytics to enhance business intelligence, streamline operations, and optimize customer experiences. The push towards automation and real-time analytics is a defining trend in the U.S. market.

Europe Advanced Analytics Trends

The advanced analytics market in Europe is growing significantly at a CAGR of over 25% from 2025 to 2030. In Europe, the advanced analytics market is driven by stringent data protection regulations such as GDPR, pushing organizations to adopt secure and compliant analytics solutions. The region also seeing significant growth in industries such as manufacturing, finance, and automotive, where predictive analytics is being used to enhance production processes, risk management, and customer engagement. Sustainability and the integration of analytics in green technologies are emerging trends in the European market.

Asia Pacific Advanced Analytics Trends

The advanced analytics market in the Asia Pacific is growing significantly at a CAGR of over 27% from 2025 to 2030. The Asia Pacific advanced analytics market is growing rapidly due to increasing digitalization across industries and the rise of e-commerce and fintech sectors. Countries such as China, India, and Japan are adopting advanced analytics to improve operational efficiency, customer engagement, and innovation. The region’s focus on smart city initiatives and the adoption of AI-driven solutions in public services and healthcare are also driving the market’s expansion.

Key Advanced Analytics Company Insights

Key players operating in the advanced analytics market include Alteryx, Inc., Google, IBM Corporation, Microsoft, Oracle, Salesforce, Inc., SAP SE, SAS Institute Inc., Teradata Corporation, and TIBCO Software Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In September 2024, Oracle announced its intention to introduce the Oracle Intelligent Data Lake as a foundational element of the Oracle Data Intelligence Platform. This enhancement will enable organizations to utilize data more effectively from diverse sources within a unified experience, integrating orchestration, analytics, data warehouses, and artificial intelligence-all powered by Oracle Cloud Infrastructure (OCI). The forthcoming addition of the Intelligent Data Lake will enhance the capabilities and scope of Oracle’s Data Intelligence Platform, which already includes comprehensive integration with Oracle Autonomous Data Warehouse, HeatWave, Oracle Analytics Cloud, AI services, and third-party services, thereby allowing organizations to meet all their data requirements. The Oracle Intelligent Data Lake is anticipated to be available in limited release in 2025.

-

In May 2023, At the Tableau Conference, Salesforce, inc. revealed the next generation of Tableau, now run by Einstein generative AI technology. With the introduction of Tableau Pulse and Tableau GPT, both business users and analysts can automate data analysis, predict user needs, and automatically generate actionable insights. In addition, the new Salesforce Data Cloud integration for Tableau will enable the seamless incorporation of customer data into Tableau, providing a unified, single view for faster, more comprehensive insights.

Key Advanced Analytics Companies:

The following are the leading companies in the advanced analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Alteryx, Inc.

- IBM Corporation

- Microsoft

- Oracle

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Teradata Corporation

- TIBCO Software Inc.

Advanced Analytics Report Scope

Report Attribute

Details

Market size in 2025

USD 94.63 billion

Revenue forecast in 2030

USD 305.42 billion

Growth rate

CAGR of 26.4% from 2025 to 2030

Actual data

2018 - 2023

Base year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, enterprise size, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Alteryx, Inc.; Google; IBM Corporation; Microsoft; Oracle; Salesforce, Inc.; SAP SE; SAS Institute Inc.; Teradata Corporation; TIBCO Software Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Advanced Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the advanced analytics market report based on type, enterprise size, deployment, end use, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Big Data Analytics

-

Business Analytics

-

Customer Analytics

-

Risk Analytics

-

Statistical Analysis

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government

-

Healthcare

-

Military & Defense

-

IT & Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The major factors driving the growth of the advanced analytics market are the advent of machine learning and Artificial Intelligence (AI) to offer personalized customer experiences, the increasing popularity of online shopping, and rising social network penetration.

b. The global advanced analytics market size was estimated at USD 75.89 billion in 2024 and is expected to reach USD 94.63 billion in 2025.

b. The global advanced analytics market is expected to grow at a compound annual growth rate of 26.4% from 2025 to 2030 to reach USD 305.42 billion by 2030.

b. The big data analytics segment accounted for the largest share of over 32% in 2024 in the advanced analytics market.

b. Some key players operating in the advanced analytics market include Altair Engineering, Inc.; Fair Isaac Corporation; IBM Corporation; KNIME; Microsoft Corporation; Oracle Corporation; RapidMiner, Inc.; SAP SE; SAS Institute Inc.; and Trianz.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.