- Home

- »

- Healthcare IT

- »

-

Laboratory Information Management System Market Report, 2033GVR Report cover

![Laboratory Information Management System Market Size, Share & Trends Report]()

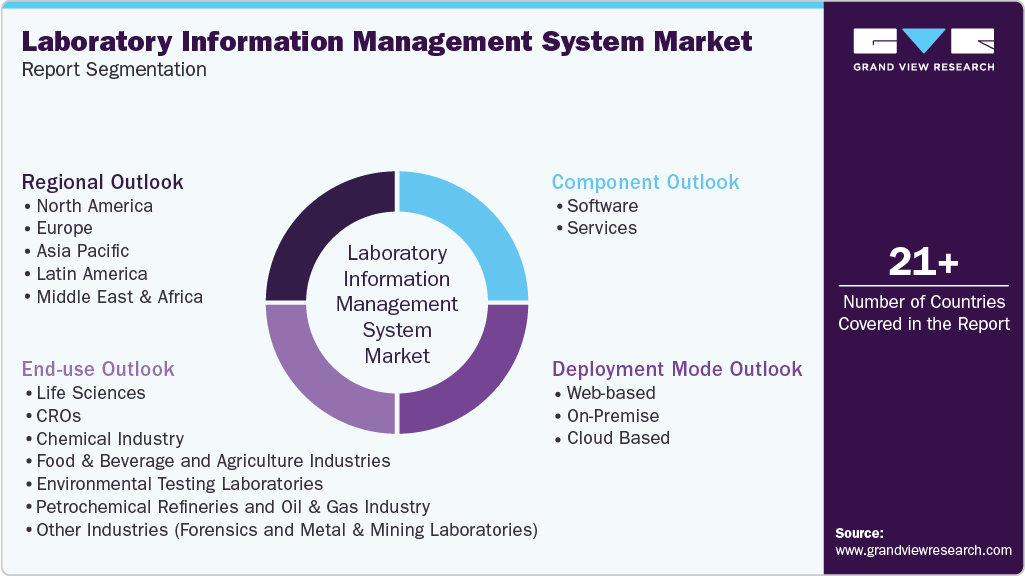

Laboratory Information Management System Market (2026 - 2033) Size, Share & Trends Analysis Report By Deployment Mode (On premise, Cloud based, Web hosted), By Component (Software, Services), By End Use (Life Sciences, CROs), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-595-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Laboratory Information Management System Market Summary

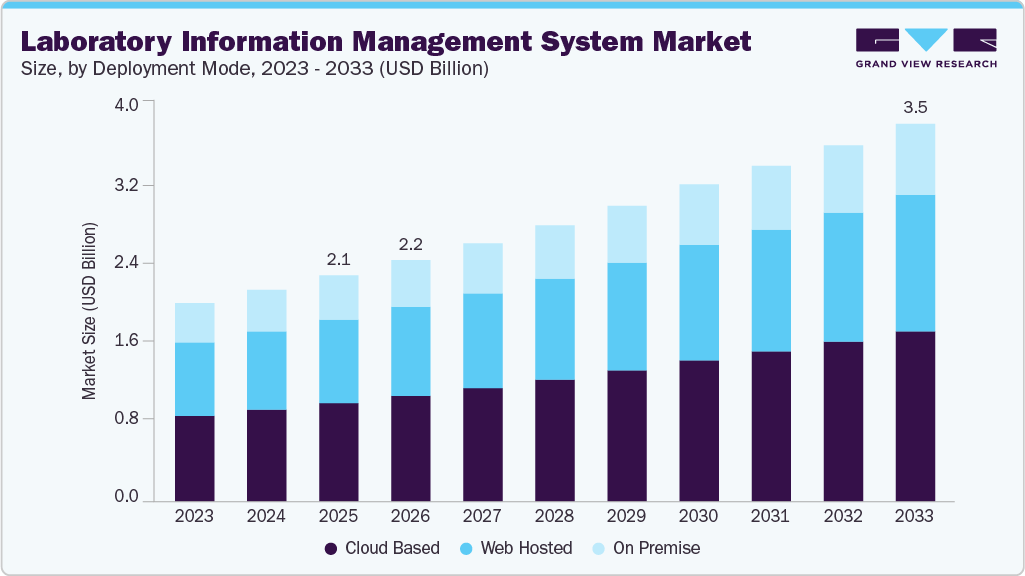

The global laboratory information management system market size was estimated at USD 2.08 billion in 2025 and is projected to reach USD 3.48 billion by 2033, growing at a CAGR of 6.60% from 2026 to 2033. Technological advancements pertinent to pharmaceutical laboratories and a rise in demand for lab automation are expected to fuel the demand for these systems in the coming years.

Key Market Trends & Insights

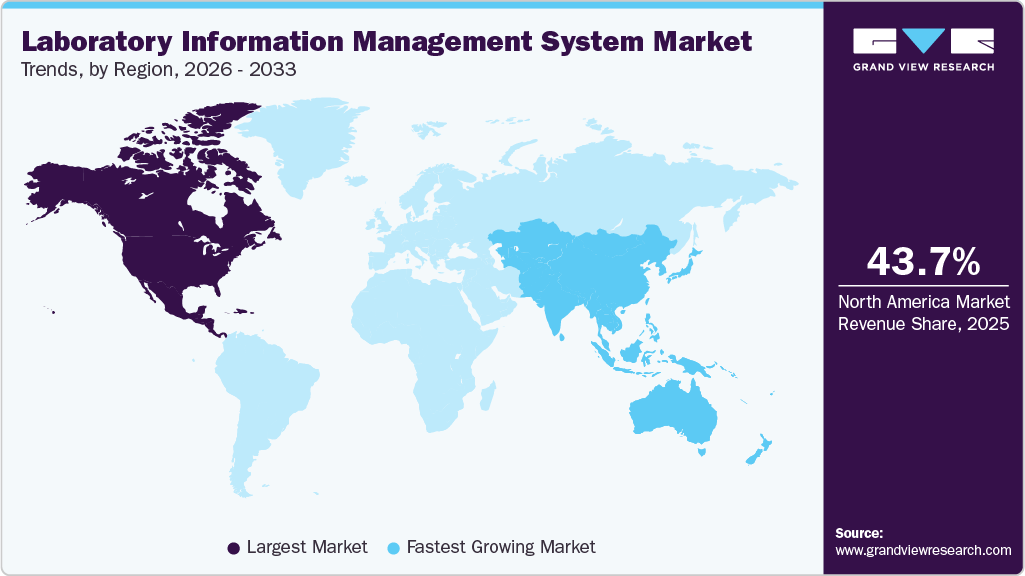

- North America laboratory information management system (LIMS) industry held the largest share of 43.68% in 2025.

- The laboratory information management system (LIMS) industry in the U.S. held the largest share in the North American region in 2025.

- By deployment mode, the cloud-based segment dominated the market with a revenue share of 43.85% in 2025.

- By component, the services segment accounted for the largest revenue share of 58.46% in 2025.

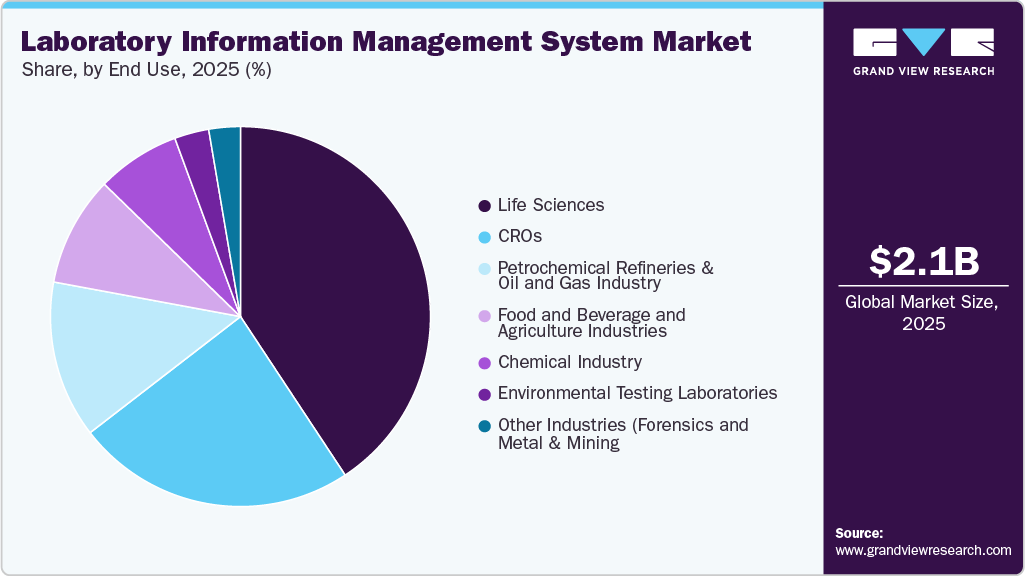

- By end use, the life science companies segment dominated the market with a revenue share of 40.71% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.08 Billion

- 2033 Projected Market Size: USD 3.48 Billion

- CAGR (2026-2033): 6.60%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Advancements in R&D labs, especially in pharmaceutical and biotechnological laboratories, are anticipated to positively grow the industry. In addition, low cost of implementation, efficient time management, and compliance with GDP, GCP & GMP are other major factors driving Laboratory Information Management System (LIMS) industry growth.The rapid pace of technological innovation in pharmaceutical laboratories is significantly driving the adoption of Laboratory Information Management Systems (LIMS). Pharmaceutical research requires the handling and analyzing of large datasets generated through high-throughput screening (HTS), next-generation sequencing (NGS), mass spectrometry, and other sophisticated analytical techniques. These advancements demand digital tools capable of managing complex workflows, ensuring data integrity, and facilitating regulatory compliance.

Moreover, industries such as pharmaceuticals, biotechnology, and food & beverage are subject to stringent regulations (e.g., FDA, ISO 17025). LIMS solutions help organizations maintain compliance by ensuring data accuracy, traceability, and audit readiness. The need to streamline laboratory workflows, reduce manual errors, and increase throughput has led to the adoption of LIMS. For instance, in April 2025, AstraZeneca implemented Sapio Sciences' LIMS to track trends, identify bottlenecks, and anticipate risks, thereby reducing manual errors and enhancing productivity.

Furthermore, LIMS platforms are evolving to integrate artificial intelligence (AI), machine learning (ML), and cloud-based infrastructure, offering real-time data access, automated decision-making, and enhanced scalability. For instance, in October 2024, Xybion launched Pristima Web 10.0, a new and enhanced AI-powered web-based SaaS platform designed to optimize preclinical research. This version includes advanced features that facilitate the creation of effective protocols and integrates various lab execution needs into a single, unified system.

"With Pristima Web 10.0, we are setting a new industry standard in preclinical LIMS, while directly addressing laboratories that are struggling with severe limitations and inefficiencies found in other LIMS systems. We've taken the approach of putting the laboratory scientists first by working directly with them when designing the intelligent array of features found in Pristima Web 10.0.”

-Dr. Pradip Banerjee, Chairman and CEO of Xybion.

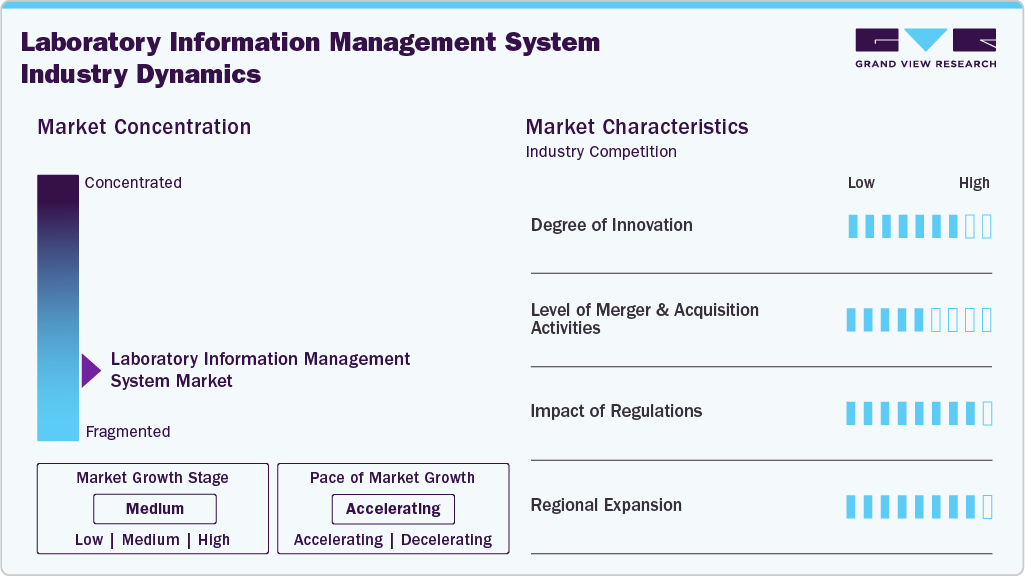

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the laboratory information management system industry is fragmented, with many players entering the market. The degree of innovation is high, and the level of mergers & acquisitions activities is moderate. Moreover, the impact of regulations on industry and the regional expansion is high.

The degree of innovation in the industry is high. The market is experiencing significant innovation as numerous providers introduce new products to meet demand for scientific data integration solutions in various industries. For instance, in March 2025, LabVantage Solutions launched version 8.9 of its leading LIMS platform, designed to enhance laboratory efficiency and data management. This update introduces new features and improvements to accelerate efficiency and speed, improve usability and automation, automate regulatory compliance and data management processes, and streamline and manage complex workflows.

“The 8.9 upgrades not only empower every member of the lab and enhance productivity but also strengthen our platform’s data management efficiencies-an essential foundation for the next generation of SaaS solutions with embedded AI agents.”

-Mikael Hagstroem, CEO of LabVantage Solutions

The level of merger & acquisition in the industry is moderate due to a rise in acquisition of emerging players by major players to increase their capabilities, expand product portfolios, and improve competencies.

The impact of regulations on the market is high. The primary objective of a laboratory is to ensure the generation of high-quality and reliable experimental data that complies with the industry's regulatory guidelines. The combination of technological advancements, stringent regulatory needs, and increasing commercial pressures has resulted in the rapid generation of vast amounts of data from various aspects, including research and development, quality assurance, and manufacturing. This is creating significant challenges for data management processes and conventional documentation requirements, particularly in regulated environments such as the life sciences sector.

The level of regional expansion in the industry is high due to increasing demand for laboratory information management system solutions in developing countries. For instance, in November 2025, Clinisys partnered with Right Click Info, LLC (RCI) to distribute its cloud-based Clinisys Laboratory Solution (CLS), a GenAI-powered LIMS/LIS platform, in Latin America and the Caribbean.

Deployment Mode Insights

Based on deployment mode, the cloud-based segment dominated the market with a revenue share of 43.85% in 2025 and is expected to grow at the fastest CAGR during the forecast period. Cloud-based deployment enables access to data from multiple access points. In a rapidly expanding remote work culture, the flexibility provided by features like virtual access points is a crucial factor contributing to the dominance of the cloud-based product segment. Furthermore, the reduction of the IT workforce, along with cost-effective data management and streamlined deployment processes, are additional factors that positively influence the growth of this segment.

Moreover, the web-based segment is anticipated to grow significantly over the forecast period, owing to the high adoption of web-hosted LIMS among consumers. These LIMS solutions are suitable for various laboratories, including R&D departments, manufacturing companies, public utilities, and environmental, chemical, contract, and QC labs.

Component Insights

Based on component, the services segment accounted for the largest revenue share of 58.46% in 2025 and is projected to grow at the fastest CAGR from 2026 to 2033. This is due to an increase in the need for LIMS implementation, integration, maintenance, validation, and support. Moreover, high demand for LIMS outsourcing solutions is expected to drive segment growth. Large pharmaceutical research labs often witness a lack of resources and skills required for the deployment of analytics. Thus, these services are outsourced. This outsource is likely to involve short-term, project-based, or long-term contracts. These services are offered in the form of packages, and these packages include compliance with promotional spending, social media analytics, predictive analytics for medical device failure, benchmarking services, and others.

End Use Insights

Based on end use, the life science companies segment dominated the market with revenue share of 40.71% in 2025. This is owing to the high adoption of LIMS in pharmaceutical, biopharmaceutical, and biotechnology companies. Lack of skilled staff, demand for higher productivity, cost efficiency, and increasing demand for biobanks and biorepositories are expected to bolster the growth of this segment.

The Contract Research Organizations (CROs) segment is expected to register the fastest CAGR from 2026 to 2033. This rapid growth can be attributed to the increase in demand for outsourcing by pharmaceutical and biotechnological companies. Various associated advantages such as cost efficiency, a necessity to maintain focus on core competencies, and mutual benefits to both contractor and client, are anticipated to drive segment growth over the forecast period.

Regional Insights

North America laboratory information management system industry held the largest revenue share of 43.68% in 2025. An increase in the number of biobanks and biorepositories has fueled the need for LIMS, thus propelling its adoption over the years. Moreover, the presence of established pharmaceutical companies & research laboratories and higher awareness about LIMS among end users are expected to drive its demand in the region.

U.S. Laboratory Information Management System Market Trends

U.S. laboratory information management system industry held the largest share in 2025 due to technology advancements, regulatory demands, and complex operations. In addition, growing demand for LIMS in genomic and cancer research studies is further expected to drive this market in the country. For instance, in October 2024, the Ellison Institute of Technology Los Angeles (EIT Los Angeles) deployed Sapio Sciences’ LIMS platform to accelerate cancer research and streamline its complex research operations.

Europe Laboratory Information Management System Market Trends

Europe laboratory information management system industry is anticipated to grow significantly over the forecast period. Increasing adoption of LIMS to meet regulatory requirements, a growing need for automation, and technological advancements are key factors propelling market growth. Companies are partnering with research centers to provide LIMS, enhancing operational efficiency and accelerating patient treatment advancements. For instance, in December 2025, the Wellcome Sanger Institute adopted Sapio LIMS as its central platform in a multi-year digital lab transformation, replacing legacy patchwork systems. It unifies genomics workflows across Core Operations, providing real-time sample tracking, QC data access, workflow automation, and instrument integration for cellular/genomic research.

"Sapio Sciences is honored to work alongside the Wellcome Sanger Institute as they continue shaping the future of genomic science. Sanger helped set the standard for large-scale genomics, and they have very clear expectations for their scientific enablement. With this project, we will work together to put Sapio LIMS at the center of their lab operations, cut out avoidable friction in day-to-day work, and give teams better visibility of the data, workflows and resources that drive their science."

- Mike Hampton, Chief Commercial Officer at Sapio Sciences.

UK laboratory information management system industryis expected to grow significantly over the forecast period owing to increasing government funding, robust investments in life science industry, and rising demand for laboratory automation. For instance, in March 2024, NHS Scotland boards (NHS Fife, Shetland, Orkney) went live with Magentus' Evolution vLab LIMS, connecting labs across sites for streamlined workflows in histopathology, microbiology, blood sciences.

“This has been a true partnership with Magentus, working collaboratively to improve and advance our laboratory systems and ensuring they are fit for the future.

“Not only will this implementation be of great benefit locally, but it also represents a big step for laboratory medicine in Scotland, paving the way for greater efficiency, collaboration and connection across NHS Scotland boards.”

-Robyn Gunn, NHS Fife Head of Laboratory Services

Germany laboratory information management system industry dominated the Europe market with the largest share in 2025, owing to the increasing laboratory automation, digitalization of laboratory data, and stringent regulations across industries. Moreover, the growing mergers, acquisitions, partnerships, and collaborations among key players to expand capabilities and market reach. For instance, in September 2024, LabVantage Solutions partnered with Henkel to create a new integrated LIMS platform to accelerate digital transformation in research and development.

Asia Pacific Laboratory Information Management System Market Trends

Asia Pacific laboratory information management system industry is expected to witness the fastest CAGR over the forecast period, owing to the rising demand from pharmaceutical manufacturers seeking to improve efficiency and reduce costs. Increasing investments in R&D, especially in pharmaceutical and biotechnology industries, CROs & CDMOs, and a growing focus on laboratory automation are boosting the need for outsourcing, thus creating growth opportunities in the market.

China laboratory information management system industry held the largest share in 2025. Increasing research and development in life sciences, robust presence of life science companies, and technological advancements are key factors contributing to market growth.

India laboratory information management system industry is expected to grow significantly over the forecast period. This growth is driven by the increasing demand for outsourcing and laboratory automation. In addition, India is considered as pharmacy of the world owing to the robust presence of pharmaceutical and biopharmaceutical companies, thereby contributing to market growth.

Latin America Laboratory Information Management System Market Trends

Latin America laboratory information management system industry is anticipated to grow significantly due to increasing investments in healthcare infrastructure, growing focus on laboratory automation, and increasing research and development.

Middle East & Africa Laboratory Information Management System Market Trends

Middle East & Africa laboratory information management system industry is expected to grow significantly over the forecast period. This growth can be attributed to the rising adoption of cloud-based solutions, stringent regulatory requirements, and technological advancements. in October 2022, Revol successfully implemented its no-code Laboratory Information Management System (LIMS) platform, Revol LIMS 5.0, in various projects across the Gulf Cooperation Council (GCC). This web-based solution aims to enhance laboratory management efficiency and streamline operations.

Key Laboratory Information Management System Company Insights

The market is highly fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

Key Laboratory Information Management System Companies:

The following key companies have been profiled for this study on the laboratory information management system market.

- Thermo Fisher Scientific Inc.

- Siemens

- LabVantage Solutions Inc.

- LabWare

- PerkinElmer Inc.

- Abbott

- Autoscribe Informatics

- Illumina, Inc.

- Labworks

- LabLynx, Inc.

- Computing Solutions, Inc.

- CloudLIMS.com (LabSoft LIMS)

- Ovation

- LABTRACK

- AssayNet Inc.

Recent Developments

-

In October 2025, InstantGMP launched a fully integrated LIMS within its GMP manufacturing platform for pharma, biotech, and supplements. Key features include Master/Active Test Protocols, diverse result types (quantitative, qualitative, and images), barcode-based sample tracking, real-time sync of inventory/batch records, automated COA generation, and Part 11 compliance.

-

In October 2025, STARLIMS launched QM Essentials, a cloud-based SaaS LIMS for small- and mid-sized batch manufacturers in the pharma, food/beverage, and consumer products industries.

“With the QM Essentials LIMS, we’re bringing STARLIMS’ decades of expertise to smaller manufacturers who face the same quality and compliance pressures as large enterprises, but need a less complex solution. QM Essentials allows SMBs to improve lab efficiency, productivity, and traceability with a cost-effective, scalable LIMS designed to do more, with less.”

- Lauren Whitsell, Chief Product & Operations Officer at STARLIMS.

-

In May 2025, Datacor, Inc. acquired Baytek International, a leader in LIMS and QC software, to enhance process manufacturing solutions. The move fosters regulatory compliance, quality assurance, and lab management across industries such as chemicals and engineering.

-

In March 2024, Genseq integrated Sapio LIMS platform to enhance its next-generation sequencing services. This partnership aims to optimize laboratory operations and improve data management, enabling Genseq to deliver high-quality sequencing results efficiently.

“Because we provide cutting-edge sequencing services, it was important to us to find a modern LIMS that could support our workflows end to end without requiring extensive and time-consuming customization,”

-Patrick Buckley, Chief Scientific Officer, at Genseq

“The Sapio platform enables us to carry out consistent, reproducible work and automates key tasks so that our scientists can focus on delivering the best results possible to our clients as quickly as possible.”

-

In July 2023, LIMS Wizards partnered with LabTwin to introduce LabTwin's innovative voice-activated digital lab assistant to North American market.

-

In December 2022, LabVantage Solutions, Inc. released Version 8.8 of its flagship LIMS platform, which features a multitude of upgrades across all components. These factors are expected to boost the growth of the market over the forecast period.

“LabVantage 8.8 exemplifies our dual commitment to both major upgrades to our flagship LIMS platform and to continuous improvements, with the goal of providing our customers with an ever easier, safer, smarter, more flexible and more reliable system that enables the digital transformation of their laboratory,”

-Mikael Hagstroem, Chief Executive Officer at LabVantage Solutions.

Laboratory Information Management System Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.23 billion

Revenue forecast in 2033

USD 3.48 billion

Growth rate

CAGR of 6.60% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment mode, component, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Siemens; LabVantage Solutions Inc.; LabWare; PerkinElmer Inc.; Abbott; Autoscribe Informatics; Illumina, Inc.; Labworks; LabLynx, Inc.; Computing Solutions, Inc.; CloudLIMS.com (LabSoft LIMS); Ovation; LABTRACK; AssayNet Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laboratory Information Management System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global laboratory information management system market report based on deployment mode, component, end use, and region:

-

Deployment Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Web-based

-

On-Premise

-

Cloud Based

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Life Sciences

-

CROs

-

Chemical Industry

-

Food & Beverage and Agriculture Industries

-

Environmental Testing Laboratories

-

Petrochemical Refineries and Oil & Gas Industry

-

Other Industries (Forensics and Metal & Mining Laboratories)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The cloud-based segment dominated the global LIMS market and accounted for the largest revenue share of over 43.50% in 2025.

b. The services segment led the global laboratory information management system market and accounted for the largest revenue share of over 58.46% in 2025.

Which end-use segment held the largest share in the laboratory information management system market?b. The life sciences segment dominated the global LIMS market and accounted for the largest revenue share of over 40.71% in 2025.

b. The global laboratory information management system market size was estimated at USD 2.08 billion in 2025 and is expected to reach USD 2.23 billion in 2026.

b. The global laboratory information management system market is expected to grow at a compound annual growth rate of 6.60% from 2026 to 2033 to reach USD 3.48 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.