- Home

- »

- Advanced Interior Materials

- »

-

Lignin Market Size, Share And Growth Analysis Report, 2030GVR Report cover

![Lignin Market Size, Share & Trend Report]()

Lignin Market Size, Share & Trend Analysis Report By Product (Lignosulfonates, Kraft Lignin, Organosolv Lignin, Others), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-422-2

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Advanced Materials

Lignin Market Size & Trends

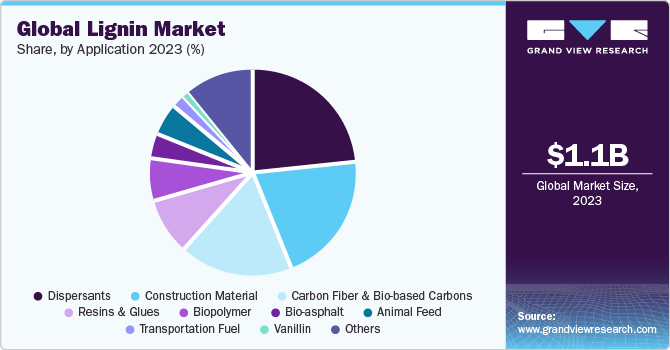

The global lignin market size was estimated at USD 1.08 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030. Increasing demand for lignin in animal feed and natural products is anticipated to drive growth. The product is widely utilized in the production of macromolecules used in the development of bitumen, biofuels, and bio-refinery catalysts. This factor is likely to support market growth. COVID-19 had a negative impact on the market. This was because of the shutdown of the manufacturing facilities and plants owing to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. In other words, the industry faced a backlash owing to disruptions in the value chain, including workforce losses, raw material supply, trade and logistics, and uncertain consumer demand.

Manufacturers in the lignin market are making efforts to recover from the losses. However, the increase in production and demand for concrete additives and rising demand for lignin as an organic additive is a positive sign. The market's future is brighter owing to the increased proliferation of the Internet and e-commerce channels.

Lignin is manufactured by traditional processes of blending certain specific chemicals to create lignin, cellulose, and sweet liquor from wood and their products. This process involves the use of biomass pretreatment process from all plant sources, including hardwood, softwood, sawdust, low-grade wood chips, and hemp. Extracting lignin from black liquor is one of the most convenient options to ensure that the capacity of the boiler does not hamper pulp production.

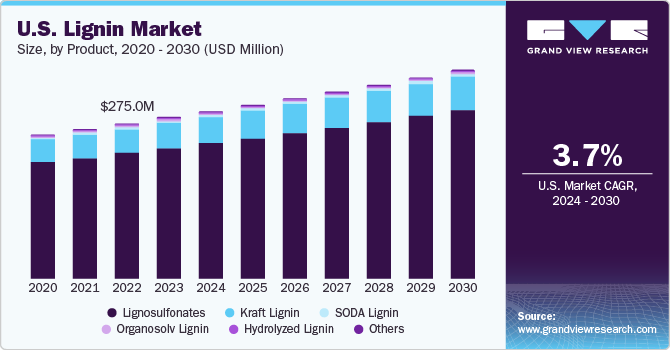

The market for lignin in North America is led by the U.S. owing to an extensively developed manufacturing industry and government initiatives. In the U.S., the demand for lingo-sulphonates accounted for the largest market share of over 75.0% in 2023. In addition, the well-established market for the production of pulp and paper in North America is likely to increase the market value of lignin.

The rising trend of using lignin as fuel for burning in multiple applications like dispersants, binders, and adhesives is anticipated to augment the market growth in the forthcoming years. On a macro-level, factors such as increasing construction expenditure and rising demand for automobiles, electronics, and equipment manufacturing are expected to support the demand for lignin.

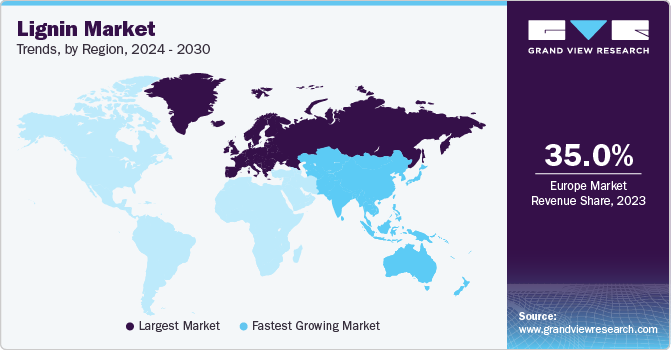

In Europe, a favorable regulatory framework for using lignin in various commercial applications is expected to be a key factor driving market growth. Asia Pacific, on the other hand, is anticipated to witness the fastest growth over the forecast period due to rapid industrialization and rising demand for electronics and automobiles.

Numerous players operating in the market engage in the complete service for lignin and its applications. For instance, Nippon Paper is engaged in pulp and paper manufacturing and derives lignin during the pulping process. In addition, the company is engaged in forest cultivation and industrial plantations.

Market Concentration & Characteristics

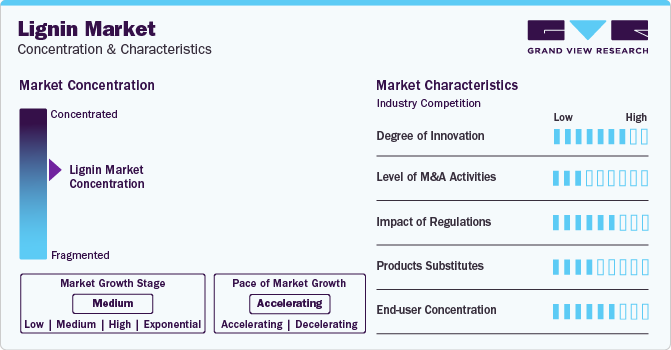

The market growth stage is medium, and the pace of market growth is accelerating. The global lignin market is moderately consolidated as major players have a significant market share, in terms of revenue, through domestic and international projects. Players adopt collaboration strategies to increase the reach of their products in the market and increase the availability of their products & services in diverse geographical areas.

The market is characterized by a high degree of innovation as numerous applications are being researched by various institutes in collaboration with companies present in the industry. Additionally, advances in technology are enabling the development of new and innovative methods for lignin extraction and processing, which can increase efficiency and reduce costs.

The use of lignin is monitored by numerous regulatory agencies across several nations. Few of the regulatory bodies include U.S. Department of Agriculture, U.S. Food & Drugs Administration (FDA), and European Commission. The following bodies covers the establishment of guidelines related the application, production, and trade of lignin around the world.

Lignin can be easily substituted by petrochemicals. In addition, bio-based polymers including bioethanol, bio-PP and bio-propylene can be used as platform substitutes to lignin. Furthermore, different products of lignin can substitute each other in numerous applications as they have comparable molecular structures and performs similar function. As a result, the threat of substitutes is anticipated to be high over the forecast period.

Product Insights

Lignosulfonates emerged as the largest product segment in the market in 2023 and is estimated to maintain its dominance over the forecast period. Increased application of concrete mixtures in China, India, and the U.S. on account of improvements in the construction sector is anticipated to fuel demand for lignosulfonates, thereby supporting the growth of the product segment.

Kraft lignin demand is expected to be promoted as a raw material for the production of the aforementioned chemically derived products owing to its application as an intermediate to manufacture numerous compounds, including cement additives, biofuels, BTX, activated carbon, phenolic resins, carbon fibers, and vanillin. Increasing awareness towards reducing reliance on crude oil has forced chemical manufacturers manufacturing BTX, phenolic resins, and carbon fibers to deploy bio-based raw materials.

Increasing demand for manufacturing various potential products, including activated carbon, carbon fiber, phenol derivatives, vanillin, and phenolic resins, will boost organosolv lignin demand over the next seven years. However, the lack of industrial processes for manufacturing organosolv lignin is expected to hamper growth. Rising R&D related to the product in developing countries, including India and China, is expected to boost organosolv lignin demand over the forecast period.

Increasing demand for manufacturing various potential products, including activated carbon, carbon fiber, phenol derivatives, vanillin, and phenolic resins, is expected to fuel the demand for kraft lignin products market over the forecast period. An increase in the manufacturing of carbon fiber, activated carbon, vanillin, phenol derivatives, and phenolic resins is expected to boost the demand for organosolv lignin.

Application Insights

Based on applications, the dispersants segment led the market with a revenue share of over 20% in 2023. Lignin-based dispersants are stabilizers and dispersants in concrete, ceramics, and drilling fluids. The dispersant properties of lignin are due to its unique chemical structure, which allows it to interact with and disperse particles in a variety of environments.

Europe and North America are the leading markets for lignin-based dispersants due to their well-established pulp and paper industries, which generate large quantities of lignin as a byproduct. The availability of lignin in these regions has led to significant research and development to find new use cases for this material, which is expected to enhance market growth over the forecast period.

The transportation fuel application segment is forecasted to grow at the fastest CAGR of 8.2% over the coming years. Lignin is becoming an increasingly popular alternative to petroleum-based products as it is abundant and renewable. As the second most abundant biopolymer in nature after cellulose, lignin is widely available as a byproduct of the paper and pulp industry. This makes it a sustainable and renewable material that can produce a wide range of products; this is expected to boost its market demand.

Lignin demand is increasingly being seen in construction applications due to its unique properties that make it a valuable ingredient in building materials. In recent years, there has been a growing interest in using lignin as a sustainable alternative to synthetic materials in construction applications. Using lignin in construction materials can reduce reliance on synthetic materials derived from non-renewable resources and have a significant environmental impact.

Regional Insights

Europe was the largest market for lignin consumption in 20232, with a revenue share of over 35%. Regulatory norms for restricting greenhouse gas emissions coupled with the prominent production base of biopolymers in France, Belgium, Germany, and the Netherlands are anticipated to fuel the demand. Increasing demand for lightweight motor vehicles coupled with the presence of significant vehicle manufacturing facilities is expected to influence the regional product demand positively. Additionally, ascending aromatic applications and extensive R&D by prominent players are expected to benefit the growth.

The U.S. Environmental Protection Agency (EPA) has announced financial assistance to promote the growth of biopolymers and bio-refinery, which is expected to fuel the demand for lignin. Moreover, shifting trends in the chemical manufacturing industry for using bio-based raw materials in manufacturing processes is projected to promote the application of bio-refinery and, thus, fuel the demand for lignin as a catalyst.

Asia Pacific is expected to register the fastest CAGR from 2024 to 2030. Rising trends for the manufacturing of products through bio-based sources are predicted to drive regional demand in the forthcoming years. Prominent market players in the region are producing pulp and paper products, which are anticipated to augment lignin production.

In Central & South America, high-grade lignin is expected to proliferate over the forecast period. Growing demand for vanillin for the manufacture of fragrances, flavorings, cosmetics, and skin-care products on account of the growing demand for natural ingredients in the food & beverages and skin-care industry is expected to benefit the market demand over the forecast period. In addition, Latin American countries have substantial forest covers that strengthen the raw material supply and drive the market growth of lignin in the region.

Key Companies & Market Share Insights

The market players are expected to witness a low threat of new entrants owing to the capital-intensive nature of the market. The key players are well-equipped with innovative technologies and advanced machinery to offer engineering solutions, which requires a high initial investment. However, the rising demand for innovative solutions will open new avenues for market entrants.

-

In May 2023, UPM Biochemicals along with URSA announced the introduction of more eco-friendly building insulation to help limit CO2 emissions and energy consumption. As per this deal, URSA was entrusted with producing sustainable glass wool developed with an advanced binder incorporating UPM’s BioPiva™ lignin.

-

In May 2023, Metsä Group’s Metsä Fibre, in cooperation with ANDRITZ, planned to develop a modified lignin product demonstration plant. The aim of this initiative was to build the process to detach lignin from black liquor in the production of pulp and to further fabricate it for new application areas.

-

In March 2023, Metsä Group announced plans to co-develop a new renewable product associated with the forest industry with Kemira, by 2027. The goal of this transaction was to curate a fossil-free raw material that is in line with the strategic sustainability of Metsä with targets to achieve zero fossil emissions in production and have absolutely fossil-free products by 2030.

-

In February 2023, Nippon Paper Industries Co., Ltd. entered into a strategic collaboration with Sumitomo Corporation and Green Earth Institute Co., Ltd. for the first commercial production of cellulosic bioethanol produced from woody biomass and its development into biochemical products in Japan. The collaboration was aimed at utilizing Japan's profuse forest resources to safeguard energy security and self-sufficiency while contributing to the country's efforts for building a decarbonized society.

Key Lignin Companies:

- Stora Enso

- West Fraser

- UPM Biochemicals

- Sweetwater Energy

- Borregaard LignoTech

- Rayonier Advanced Material

- Domsjo Fabriker

- Changzhou Shanfeng Chemical Industry Co Ltd

- Domtar Corporation

- Nippon Paper Industries Co., Ltd

- Metsa Group

- The Dallas Group of America, Inc

- Liquid Lignin Company

- Burgo Group S.p.A

- Valmet Corporation

Lignin Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.08 billion

Revenue forecast in 2030

USD 1.47 billion

Growth Rate

CAGR of 4.4% from 20243 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; U.K.; Spain; China; Japan; India; Indonesia; Japan; Malaysia; Brazil, South Africa.

Key companies profiled

Stora Enso, West Fraser, UPM Biochemicals, Sweetwater Energy, Borregaard LignoTech, Rayonier Advanced Material, Domsjo Fabriker, Changzhou Shanfeng Chemical Industry Co Ltd, Domtar Corporation, Nippon Paper Industries Co., Ltd, Metsa Group, The Dallas Group of America, Inc., Liquid Lignin Company, Burgo Group S.p.A, Valmet Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lignin Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the lignin market on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Lignosulfonates

-

Kraft Lignin

-

Organosolv Lignin

-

Hydrolyzed Lignin

-

SODA Lignin

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Construction Material

-

Transportation Fuel

-

Biopolymer

-

Polyurethane Foam

-

Others

-

-

Bio-asphalt

-

Resins & Glues

-

Dispersants

-

Carbon Fiber & Bio-based Carbons

-

Vanillin

-

Animal Feed

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lignin market size was estimated at USD 1.04 billion in 2022 and is expected to reach USD 1.08 billion in 2023.

b. The global lignin market is expected to grow at a compound annual growth rate a CAGR of 4.9% from 2023 to 2030 to reach USD 1.47 billion by 2030.

b. Europe dominated the lignin market with a share of 38.8% in 2022. This is attributable to the presence of a favorable regulatory framework for the use of lignin in a wide array of commercial applications.

b. Some of the key players operating in the Lignin market include Stora Enso, West Fraser, UPM Biochemicals, Sweetwater Energy, Borregaard LignoTech, Rayonier Advanced Material, Domsjo Fabriker, Changzhou Shanfeng Chemical Industry Co Ltd, Domtar Corporation, Nippon Paper Industries Co., Ltd, Metsa Group, The Dallas Group of America, Inc., Liquid Lignin Company, Burgo Group S.p.A, and Valmet Corporation

b. Key factors driving the lignin market growth include the increasing demand for lignin in dust control applications and construction activities.

Table of Contents

Chapter 1. Lignin Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Assumptions

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Lignin Market: Executive Summary

2.1. Market Outlook

2.2. Segmental Outlook

2.3. Competitive Insights

Chapter 3. Lignin Market: Variables, Trends, and Scope

3.1. Penetration & Growth Prospect Mapping

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Trends

3.2.2. Manufacturing Trends

3.2.3. Sales Channel Analysis

3.3. Regulatory Framework

3.4. Technology Overview

3.5. Lignin Market - Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Industry Challenges

3.6. Business Environmental Tools Analysis: Lignin Market

3.6.1. Porter’s Five Forces Analysis

3.6.1.1. Bargaining Power of Suppliers

3.6.1.2. Bargaining Power of Buyers

3.6.1.3. Threat of Substitution

3.6.1.4. Threat of New Entrants

3.6.1.5. Competitive Rivalry

3.6.2. PESTLE by SWOT

3.6.2.1. Political Landscape

3.6.2.2. Economic Landscape

3.6.2.3. Social Landscape

3.6.2.4. Technology Landscape

3.6.2.5. Environmental Landscape

3.6.2.6. Legal Landscape

3.7. Market Disruption Analysis

Chapter 4. Lignin Market: Product Estimates & Trend Analysis

4.1. Definition & Scope

4.2. Lignin Market: Product Movement Analysis, 2022 & 2030

4.3. Lignosulfonates

4.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.4. Kraft lignin

4.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.5. Organosolv lignin

4.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.6. Hydrolyzed Lignin

4.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.7. SODA Lignin

4.7.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.8. Others

4.8.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Chapter 5. Lignin Market: Application Estimates & Trend Analysis

5.1. Definition & Scope

5.2. Lignin Market: Application Movement Analysis, 2022 & 2030

5.3. Construction Material

5.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

5.4. Transportation Fuel

5.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

5.5. Biopolymer

5.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

5.5.2. Polyurethane Foam

5.5.3. Others

5.6. Bio-asphalt

5.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

5.7. Resins & Glues

5.7.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

5.8. Dispersants

5.8.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

5.9. Carbon Fiber & Bio-based Carbons

5.9.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

5.10. Animal Feed

5.10.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

5.11. Vanillin

5.11.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

5.12. Others

5.12.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Chapter 6. Lignin Market: Regional Estimates & Trend Analysis

6.1. Definition & Scope

6.2. Lignin Market: Regional Snapshot, 2022 & 2030

6.3. Lignin Market: Regional movement analysis, 2022 & 2030

6.4. North America

6.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.4. U.S.

6.4.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.4.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.4.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.5. Canada

6.4.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.5.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.4.5.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.6. Mexico

6.4.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.6.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.4.6.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5. Europe

6.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.5.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5.4. Germany

6.5.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.4.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.5.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5.5. UK

6.5.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.5.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.5.5.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5.6. France

6.5.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.6.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.5.6.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5.7. Italy

6.5.7.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.7.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.5.7.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5.8. Spain

6.5.8.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.8.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.5.8.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.6. Asia Pacific

6.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.6.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.6.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.6.4. China

6.6.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.6.4.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.6.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.6.5. India

6.6.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.6.5.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.6.5.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.6.6. Japan

6.6.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.6.6.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.6.6.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.6.7. Indonesia

6.6.7.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.6.7.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.6.7.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.6.8. Malaysia

6.6.8.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.6.8.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.6.8.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.7. Central & South America

6.7.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.7.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.7.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.7.4. Brazil

6.7.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.7.4.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.7.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.8. Middle East & Africa

6.8.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.8.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.8.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

6.8.4. South Africa

6.8.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.8.4.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

6.8.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company Categorization

7.3. Company Market Positioning

7.4. Vendor Landscape

7.4.1. List of key distributors and channel partners

7.5. Company Market Share Analysis, 2023

7.6. Company Heat Map Analysis

7.7. Strategy Mapping

7.7.1. COLLABORATION

7.7.2. NEW LAUNCHES

7.7.3. PARTNERSHIPS

7.7.4. CLOSURE

7.8. Company Listings

7.8.1. Stora Enso

7.8.1.1. Company overview

7.8.1.2. Financial performance

7.8.1.3. Product benchmarking

7.8.1.4. Strategic initiatives

7.8.2. West Fraser

7.8.2.1. Company overview

7.8.2.2. Financial performance

7.8.2.3. Product benchmarking

7.8.2.4. Strategic initiatives

7.8.3. UPM Biochemicals

7.8.3.1. Company overview

7.8.3.2. Financial performance

7.8.3.3. Product benchmarking

7.8.3.4. Strategic initiatives

7.8.4. Sweetwater Energy

7.8.4.1. Company overview

7.8.4.2. Financial performance

7.8.4.3. Product benchmarking

7.8.4.4. Strategic initiatives

7.8.5. Borregaard LignoTech

7.8.5.1. Company overview

7.8.5.2. Financial performance

7.8.5.3. Product benchmarking

7.8.5.4. Strategic initiatives

7.8.6. Rayonier Advanced Material

7.8.6.1. Company overview

7.8.6.2. Financial performance

7.8.6.3. Product benchmarking

7.8.6.4. Strategic initiatives

7.8.7. Domsjo Fabriker

7.8.7.1. Company overview

7.8.7.2. Financial performance

7.8.7.3. Product benchmarking

7.8.7.4. Strategic initiatives

7.8.8. Changzhou Shanfeng Chemical Industry Co Ltd

7.8.8.1. Company overview

7.8.8.2. Financial performance

7.8.8.3. Product benchmarking

7.8.8.4. Strategic initiatives

7.8.9. Domtar Corporation

7.8.9.1. Company overview

7.8.9.2. Financial performance

7.8.9.3. Product benchmarking

7.8.9.4. Strategic initiatives

7.8.10. Nippon Paper Industries Co., Ltd

7.8.10.1. Company overview

7.8.10.2. Financial performance

7.8.10.3. Product benchmarking

7.8.10.4. Strategic initiatives

7.8.11. Metsa Group

7.8.11.1. Company overview

7.8.11.2. Financial performance

7.8.11.3. Product benchmarking

7.8.11.4. Strategic initiatives

7.8.12. The Dallas Group of America, Inc

7.8.12.1. Company overview

7.8.12.2. Financial performance

7.8.12.3. Product benchmarking

7.8.12.4. Strategic initiatives

7.8.13. Liquid Lignin Company

7.8.13.1. Company overview

7.8.13.2. Financial performance

7.8.13.3. Product benchmarking

7.8.13.4. Strategic initiatives

7.8.14. Burgo Group S.p.A

7.8.14.1. Company overview

7.8.14.2. Financial performance

7.8.14.3. Product benchmarking

7.8.14.4. Strategic initiatives

7.8.15. Valmet Corporation

7.8.15.1. Company overview

7.8.15.2. Financial performance

7.8.15.3. Product benchmarking

7.8.15.4. Strategic initiatives

List of Tables

Table 1 Lignin market estimates & forecast, by product 2018 - 2030 (Kilotons) (USD Million)

Table 2 Lignin market estimates & forecast, by application 2018 - 2030 (Kilotons) (USD Million)

Table 3 North America Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 4 North America Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 5 North America Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Table 6 U.S. Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 7 U.S. Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 8 U.S. Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Table 9 Canada Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 10 Canada Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 11 Canada Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Table 12 Mexico Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 13 Mexico Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 14 Mexico Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Table 15 Europe Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 16 Europe Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 17 Europe Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Table 18 Germany Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 19 Germany Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 20 Germany Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Table 21 France Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 22 France Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 23 France Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Table 24 Italy Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 25 Italy Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 26 Italy Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Table 27 U.K. Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 28 U.K. Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 29 U.K. Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Table 30 Spain Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 31 Spain Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 32 Spain Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Table 33 Asia Pacific Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 34 Asia Pacific Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 35 Asia Pacific Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Table 36 China Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 37 China Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 38 China Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Table 39 India Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 40 India Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 41 India Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Table 42 Japan Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 43 Japan Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 44 Japan Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Table 45 Indonesia Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 46 Indonesia Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 47 Indonesia Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Table 48 Malaysia Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 49 Malaysia Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 50 Malaysia Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Table 51 Central & South America Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 52 Central & South America Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 53 Central & South America Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Table 54 Brazil Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 55 Brazil Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 56 Brazil Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Table 57 Middle East & Africa Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 58 Middle East & Africa Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 59 Middle East & Africa Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Table 60 South Africa Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 61 South Africa Lignin Market Estimates & Forecasts, By Product, 2018 - 2030 (Kilotons) (USD Million)

Table 62 South Africa Lignin Market Estimates & Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

List of Figures

Fig. 1 Market Segmentation & Scope

Fig. 2 Information Procurement

Fig. 3 Primary Research Pattern

Fig. 4 Primary Research Process

Fig. 5 Market research approaches - Bottom-Up Approach

Fig. 6 Market research approaches - Top-Down Approach

Fig. 7 Market research approaches - Combined Approach

Fig. 8 Regional Outlook

Fig. 9 Segmental Outlook

Fig. 10 Competitive Outlook

Fig. 11 Lignin market - Value chain analysis

Fig. 12 Lignin: Market dynamics

Fig. 13 Lignin market driver impact analysis

Fig. 14 Lignin market restraint impact analysis

Fig. 15 Lignin market, by Product: Key Takeaways

Fig. 16 Lignin market: Product movement analysis, 2022 & 2030

Fig. 17 Lignin market, by Application: Key Takeaways

Fig. 18 Lignin market: Application movement analysis, 2022 & 2030

Fig. 19 Lignin market, by Region: Key Takeaways

Fig. 20 Lignin market: Region movement analysis, 2022 & 2030

Fig. 21 North America Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 22 U.S. Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 23 Canada Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 24 Mexico Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 25 Europe Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 26 Germany Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 27 France Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 28 Italy Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 29 U.K. Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 30 Spain Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 31 Asia Pacific Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 32 China Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 33 India Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 34 Japan Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 35 Indonesia Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 36 Malaysia Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 37 Central & South America Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 38 Brazil Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 39 Middle East & Africa Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 40 South Africa Lignin Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Lignin Market Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Lignosulfonates

- Kraft Lignin

- Organosolv Lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- Lignin Market Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- Lignin Market Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- North America

- North America Lignin Market, By Product

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- North America Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- U.S.

- U.S. Lignin Market, By Product

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- U.S. Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- U.S. Lignin Market, By Product

- Canada

- Canada Lignin Market, By Product

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- Canada Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- Canada Lignin Market, By Product

- Mexico

- Mexico Lignin Market, By Product

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- Mexico Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- Mexico Lignin Market, By Product

- North America Lignin Market, By Product

- Europe

- Europe Lignin Market, By Product

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- Europe Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- Germany

- Germany Lignin Market, By Product

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- Germany Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- Germany Lignin Market, By Product

- UK

- UK Lignin Market, By Product

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- UK Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- UK Lignin Market, By Product

- France

- France Lignin Market, By Product

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- France Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- France Lignin Market, By Product

- Italy

- Italy Lignin Market, By Product

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- Italy Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- Italy Lignin Market, By Product

- Spain

- Spain Lignin Market, By Product

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- Spain Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- Spain Lignin Market, By Product

- Europe Lignin Market, By Product

- Asia Pacific

- Asia Pacific Lignin Market, By Product

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- Asia Pacific Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- China

- China Lignin Market, By Product

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- China Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- China Lignin Market, By Product

- India

- India Lignin Market, By Product

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- India Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- India Lignin Market, By Product

- Japan

- Japan Lignin Market, By Product

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- Japan Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- Japan Lignin Market, By Product

- Indonesia

- Indonesia Lignin Market, By Product

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- Indonesia Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- Indonesia Lignin Market, By Product

- Malaysia

- Malaysia Lignin Market, By Product

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- Malaysia Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- Malaysia Lignin Market, By Product

- Asia Pacific Lignin Market, By Product

- Central & South America

- Central & South America Lignin Market, By Product

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- Central & South America Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- Brazil

- Brazil Lignin Market, By Services

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- Brazil Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- Brazil Lignin Market, By Services

- Central & South America Lignin Market, By Product

- Middle East & Africa

- Middle East & Africa Lignin Market, By Services

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- Middle East & Africa Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- South Africa

- South Africa Lignin Market, By Services

- Lignosulfonates

- Kraft lignin

- Organosolv lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

- South Africa Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Polyurethane Foam

- Others

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

- South Africa Lignin Market, By Services

- Middle East & Africa Lignin Market, By Services

- North America

Lignin Market Dynamics

Driver: Growing Demand For Dust Control

The growing urbanization has increased the demand for dust control techniques. Increasing air pollution has been a growing environmental concern worldwide. It has adversely affected residential, commercial, transport, agricultural, storage, and logistic industries and has resulted in high incidence of respiratory illnesses and accidents due to smog. Rising concern regarding the harmful effect of air pollution is creating substantial growth potential for effective and efficient dust control agents which is positively impacting the lignin market across the globe.

Lignin is gaining wide acceptance in dust control applications owing to its eco-friendly, non-toxic, and non-corrosive nature and excellent effectiveness on gravel roads. Unlike chloride-based solutions, lignin sulfonate-treated roads do not require additional time for the penetration of dust control agent which saves money and time. The environment friendly and economic nature of the product compared to traditionally used dust control solutions is significantly driving demand for lignin in these applications.

Driver: Increasing Lignin Demand In Animal Feed

Lignin has its demand in animal feed industry also as it is used as a natural feed additive to improve animal digestibility. Lignin is commonly added to the feed of monogastric animals for various health benefits. Technology developments are able to alter the genetic composition of lignin to develop better compounds for animal feed. This has allowed producers to make more digestible crops and feed more forage crops to their livestock. Therefore, growth in the animal feed industry is expected drive lignin demand over the forecast period.

Animal feed is witnessing high demand worldwide owing to the rising focus on improving animal health and productivity. The increasing humanization of animals and growth in pet ownership is creating significant growth potential for the animal feed industry. Naturally derived products, such as saponins, tannins, organic acids, essential oils, flavonoids, and lignin, are popular animal feed additives. The ban on the use of antibiotics as animal growth promoters in Europe is another major reason for the growth of lignin demand.

Restraint: Lack Of Efficient And Cost-Effective Methods

The lack of efficient and cost-effective methods for large-scale production and processing of lignin is a major restraining factor of the lignin market. It is challenging to extract lignin from biomass sources and purify it in a form suitable for commercial applications as it is a complex and heterogeneous polymer. It is tightly bound to cellulose and hemicellulose in plant cell walls. Lignin is mostly produced as a by-product of the paper and pulp industry, and the quality and composition of the lignin obtained are highly dependent on the feedstock and the pulping process used. This can result in variability in lignin properties, which can limit its use in certain applications. So, the high cost of lignin production, processing, and transportation can also be a restraining factor for its market growth.

What Does This Report Include?

This section will provide insights into the contents included in this lignin market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Lignin market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Lignin market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the lignin market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for lignin market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of lignin market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Lignin Market Categorization:

The lignin market was categorized into three segments, namely product (Lignosulfonates, Kraft Lignin, Organosolv Lignin, Hydrolyzed Lignin, SODA Lignin), application (Construction Material, Transportation Fuel, Biopolymer, Bio-asphalt, Resins & Glues, Dispersants, Carbon Fiber & Bio-based Carbons, Vanillin, Animal Feed), and regions (North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa).

Segment Market Methodology:

The lignin market was segmented into product, application, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The lignin market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into sixteen countries, namely, the U.S.; Canada; Mexico; Germany; France; Italy; the UK; Spain; China; Japan; India; Indonesia; Japan; Malaysia; Brazil, South Africa..

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Lignin market companies & financials:

The lignin market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Stora Enso has a broad vertical lines, which includes: packaging solutions, biomaterials, wood products, paper, and energy.

-

West Fraser offers products in the verticals including lumber, engineered wood, plywood, pulp & paper, and renewable energy.

-

UPM Biochemicals provides solutions for various verticals, such as bio composites, biochemicals, pulp & paper, etc.

-

Sweetwater Energy is involved into Biochemicals, Biofuels, and Bio power. Its specialties are in next-generation biofuels, sugar, green chemicals, green materials, sustainability, microcrystalline cellulose, nano fibers, and clean lignin.

-

Borregaard LignoTech offers solutions under performance chemicals, dispersants, binders, agricultural chemicals, carbon materials.

-

Rayonier Advanced Material offers a range of products in its portfolio which include high purity cellulose, forest products, pulp and paper among others.

-

Domsjo Fabriker has various product lines including: specialty cellulose, lignin products, bio-based chemicals, energy, etc.

-

Changzhou Shanfeng Chemical Industry Co Ltd. provides various products and services including: chemical intermediaries, fine chemicals, pharmaceuticals intermediaries, environment protection, and custom manufacturing.

-

Domtar Corporation is operated under pulp and paper, personal care, biomaterials, power and energy, and sustainability.

- Nippon Paper Industries Co., Ltd. is involved under paper and paperboard, biomaterials, chemicals, energy, environmental services.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Lignin Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2023, historic information from 2018 to 2023, and forecast from 2024 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Lignin Market Report Assumptions:

-

The report provides market value for the base year 2023 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."