- Home

- »

- Plastics, Polymers & Resins

- »

-

Malaysia Plastic Compounding Market Share Report, 2030GVR Report cover

![Malaysia Plastic Compounding Market Size, Share & Trends Report]()

Malaysia Plastic Compounding Market (And Segment Forecasts 2023 - 2030) Size, Share & Trends Analysis Report By Product (Polyethylene, Polypropylene, Thermoplastic Vulcanizates, ABS, PU, PVC, PC, PA, TPE), By End-use

- Report ID: GVR-1-68038-377-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

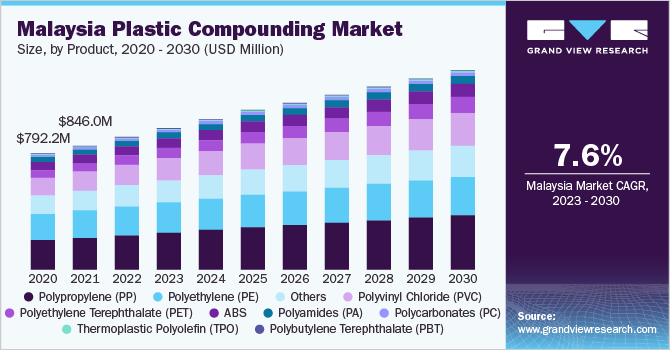

The Malaysia plastic compounding market size was valued at USD 905.2 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.6% from 2023 to 2030. Growing acceptance of lightweight, energy-efficient vehicles to combat depleting fossil fuel resources has led to high industry growth in recent years. Malaysia has witnessed significant economic growth along with a rapidly expanding manufacturing sector & favorable external trade government policies to encourage regional development. A positive economic outlook driven by high technology & capital-intensive industries in the region is expected to augment product demand as well.

Continuous technological advancements in rubber tapping & growing demand from end-use industries such as construction, packaging, consumer goods, and automotive have spurred investments from European & Chinese manufacturers in the Malaysian plastics sector.

Compounded plastics exhibit superior properties such as flexibility, low density, lightweight, improved barrier resistance, and high aesthetic appeal. These attributes allow for better steering wheels, handles & interiors in automotive applications, contributing to industry growth.

Furthermore, the Malaysian automotive sector is consuming large amounts of plastics to create safer, more fuel-efficient & inexpensive MUV/SUV models by utilizing sustainable materials. These factors are expected to create a positive outlook for new entrants with technologically advanced infrastructure and innovative products over the near future.

Increasing consumer disposable income, favorable government policies, availability of a skilled workforce, sound economic fundamentals, and well-developed infrastructural facilities are some key factors attracting major international players to invest in Malaysia. Such factors are likely to result in a vibrant economy-boosting consumer purchasing power which is anticipated to have a positive impact on compounding trends in Malaysia.

Product Insights

Polyethylene (PE) is a highly penetrated segment accounting for 25% market share in 2022 since it is one of the most widely used synthetic resins for food & retail packaging and automobile fuel tanks. The introduction of innovative, recycled PE has fostered a transition in the Malaysian plastics sector, with numerous useful applications being developed for such sustainable materials.

Energy-efficient vehicles (EEV) are increasingly utilizing cross-linked PE (XLPE) foams for diverse automotive applications including seatbacks, liners, air condition ducks, dashboard padding, windshields & truck liners. These factors are also contributing to segment growth.

Polyethylene terephthalate (PET) compounds find application in numerous end-use industries such as automotive, packaging & labeling, textiles, stationery, medical equipment & construction. Increasing R&D activities to develop diverse PET compound grades with high rigidity & scratch resistance properties is a key factor contributing to segment growth in Malaysia.

Cross-linked PE (XLPE) foams are consumed in various automotive components owing to lower fogging value lightness and weight saving, flexibility, excellent thermal properties, and chemical resistance. XLPE finds application in seatbacks, liners, air condition ducts, dashboard padding, wing mirror seals, door panels, windshields, and truck liners.

TPE polymers offer both thermoplastic and rubber properties which makes them stretchable and retain their original shape providing a longer life compared to other materials. TPE is recyclable and requires little or no compounding leading to improved consistency in both raw materials and fabricated articles.

TPE is utilized in numerous end-use industries including automotive, household goods, building & construction, footwear, and medical & hygiene. In the automotive sector, TPE finds its application primarily in suspension bushings due to its greater resistance to deformation compared to regular rubber bushings. The bumper fascia, grommets, strut cover bellows, clean air ducts, and airbag covers are other components in vehicles wherein TPE is extensively utilized.

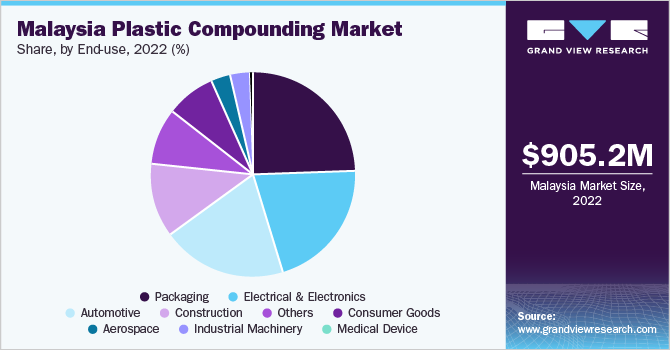

End-use Insights

The packaging & automotive industries dominate the plastic compounding market in Malaysia. The packaging segment accounted for 25% market share in 2022 as a result of consumers increasingly opting for pre-processed & packaged foods as a consequence of constrained meal preparation times.

The Malaysian government has also introduced numerous schemes to attract investments in the country’s automotive sector, such as the National Automotive Policy (NAP), and tax allowances & exemptions for promoters of ‘green technologies.’ Lightweight plastics are thus being utilized to a wider extent in the automotive sector in an attempt to lower carbon emissions & meet sustainability guidelines. The segment is anticipated to grow at over 7.3% in terms of volume.

Construction and electrical & electronics are some other relatively fast-growing applications since consumption has increased drastically following the miniaturization of components in these industries. Malaysia has witnessed an emergence of small-scale electrical components manufacturers & a versatile manufacturing landscape which in turn is projected to drive compounding activities for these applications.

Furthermore, the shift in the trend toward green buildings & sustainable infrastructure approach is also anticipated to drive bio-based plastics consumption in Malaysia. The government has launched several green movements to promote carbon footprint reduction & innovative bio-based technologies adoption. These factors have positively impacted the demand for high-performance polymers in construction applications.

Key Companies & Market Share Insights

Major international players such as BASF & Melchers Group have expanded engineering & compounding facilities in Malaysia owing to the availability of a low-cost skilled workforce & steadily increasing demand for high-quality durable industrial solutions. The industry is also witnessing several innovations from global manufacturers that are attempting to enter fast-growing Southeast Asian regions. Some prominent players in the Malaysia plastic compounding market include:

-

BASF Sdn Bhd

-

Melchers Malaysia

-

Helistrom Sdn Bhd

-

Polyplastics Asia Pacific Sdn Bhd

-

The Inabata Group

-

CIPC Resin

-

Sin Yong Guan & Co.

-

Eveready Manufacturing Pte Ltd.

-

Compounding and Coloring Sdn Bhd

-

Sheng Foong Plastic Industries Sdn Bhd.

Malaysia Plastic Compounding Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 964.0 million

Revenue forecast in 2030

USD 1,361.2 million

Growth Rate

CAGR of 5.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Key companies profiled

BASF Sdn Bhd; Melchers Malaysia; Helistrom Sdn Bhd; Polyplastics Asia Pacific Sdn Bhd; The Inabata Group

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Malaysia Plastic Compounding Market Report Segmentation

This report forecasts revenue and volume growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Malaysia plastic compounding market report based on product and end-use:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Thermoplastic Vulcanizates (TPV)

-

Thermoplastic Polyolefin (TPO)

-

Polyvinyl Chloride (PVC)

-

Polyethylene Terephthalate (PET)

-

Polybutylene Terephthalate (PBT)

-

Polyamides (PA

-

Polycarbonates (PC)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Construction

-

Electrical & Electronics

-

Packaging

-

Consumer Goods

-

Industrial Machinery

-

Medical Devices

-

Aerospace

-

Others

-

Frequently Asked Questions About This Report

b. The global Malaysia plastic compounding market size was estimated at USD 905.2 million in 2022 and is expected to reach USD 964.0 million in 2023.

b. The global Malaysia plastic compounding market is expected to grow at a compound annual growth rate of 5.1% from 2023 to 2030 to reach USD 1,361.2 million by 2030.

b. Packaging segment dominated the Malaysia plastic compounding market with a share of 24.9% in 2022. This is attributable to rising inclination of consumers towards pre-processed & packaged foods.

b. Some key players operating in the Malaysia plastic compounding market include BASF Sdn Bhd, Melchers Malaysia, Helistrom Sdn Bhd, Polyplastics Asia Pacific Sdn Bhd, The Inabata Group, CIPC Resin, Sin Yong Guan & Co., Eveready Manufacturing Pte Ltd., Compounding and Coloring Sdn Bhd & Sheng Foong Plastic Industries Sdn Bhd.

b. Key factors that are driving the market growth include increasing demand for lightweight, energy-efficient vehicles to combat depleting fossil fuel resources and expanding manufacturing sector in Malaysia.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.