- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Compounding Market Size And Share Report, 2030GVR Report cover

![Plastic Compounding Market Size, Share & Trends Report]()

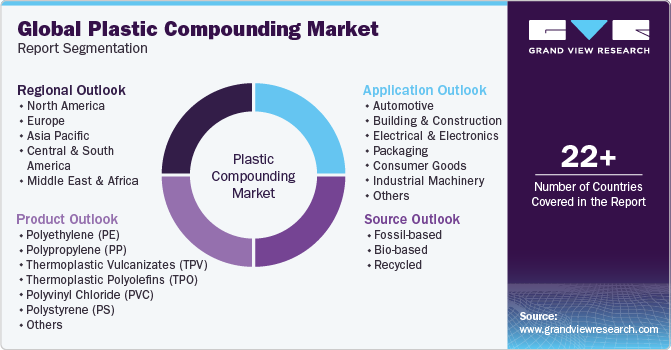

Plastic Compounding Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Fossil-based, Bio-based, Recycled), By Product, By Application (Automotive, Aerospace & defense), By Region, And Segment Forecasts

- Report ID: 978-1-68038-446-8

- Number of Report Pages: 195

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic Compounding Market Summary

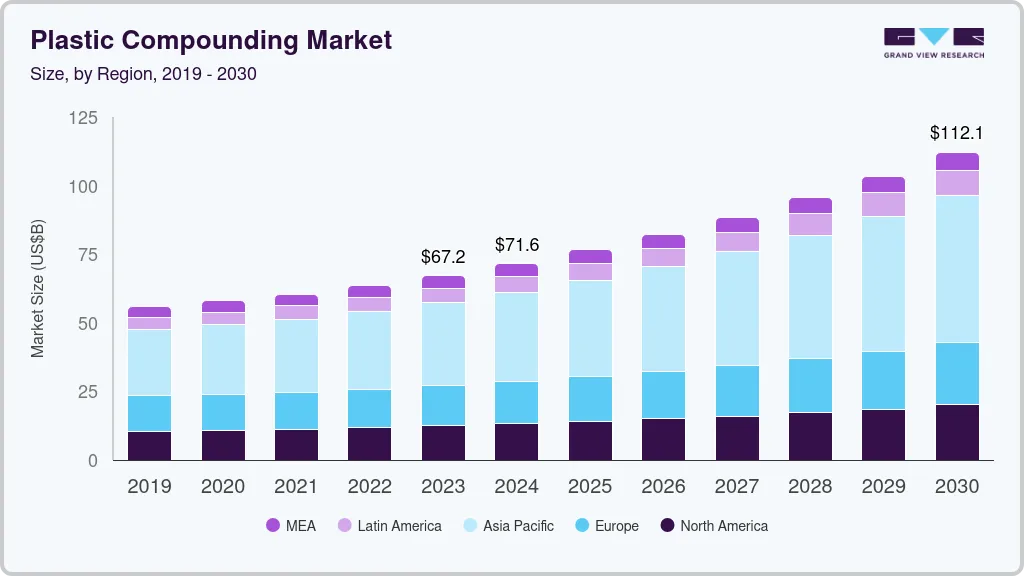

The global plastic compounding market size was estimated at USD 67.17 billion in 2023 and is projected to reach USD 112.08 billion by 2030, growing at a CAGR of 7.4% from 2024 to 2030. Increasing substitution for natural rubber, wood, metals, glass, and concrete by plastic is expected to drive the growth of the plastic compounding industry over the forecast period.

Key Market Trends & Insights

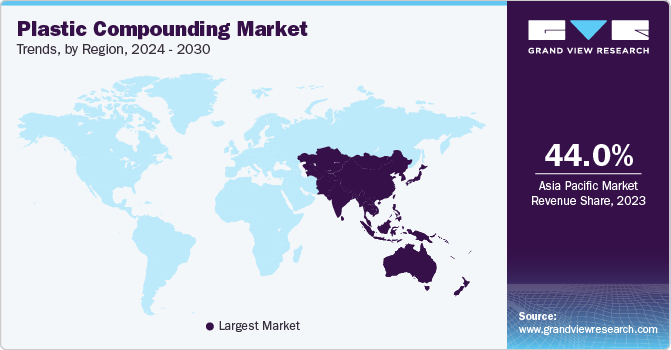

- The Asia Pacific dominated the market and held a revenue share of over 44.0% in 2023.

- The Europe held a revenue share of above 21.0% in 2023.

- Based on source, the fossil-based compounded plastics dominated the segmentation in 2023 with a market revenue share of above 56.0%.

- Based on product, the polypropylene (PP) dominated the segmentation in 2023 with a market revenue share of above 29.0%.

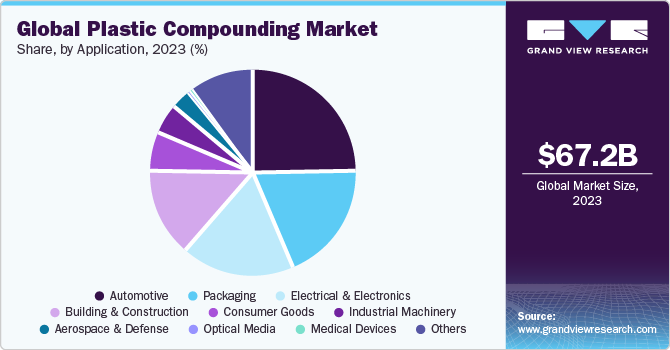

- Based on application, the automotive sub-segment dominated segmentation in 2023 with a market revenue share above 25.0%.

Market Size & Forecast

- 2023 Market Size: USD 67.17 Billion

- 2030 Projected Market Size: USD 112.08 Billion

- CAGR (2024-2030): 7.4%

- Asia Pacific: Largest market in 2023

The demand for plastic is rising due to its use in various industrial applications because of its ability to form desired shapes and easy molding. Plastic fittings are considered very easy to install compared to metal or wood fittings. These fittings are available in a wide range of color combinations, which adds to their aesthetic appeal. Moreover, plastic fittings can be sealed very tightly, thus creating a barrier to external unwanted factors like dust or water. The properties of plastic compounds can drive its market growth in the coming years. Plastic compounding process involves various stages, such as determining additives ratio, high-speed mixing via twin screw extruders and other plastic compounding machines, melt mixing, and cooling before final pellet cutting and packaging.

The U.S. dominated the North American market for plastic compounding in 2023 and is expected to continue its dominance over the forecast period. The demand for plastic compounding in the country is majorly generated from the expanding automotive industry coupled with the rise in a number of construction activities. Capacity addition and plant expansion by automotive companies in the U.S. are further expected to augment the demand for plastics compounding.

Polyethylene Terephthalate (PET) is expected to be one of the fastest-growing segments in the U.S. plastics market due to its high demand from the packaging sector. PET is mostly used in the production of bottles and contributes to a significant market share in plastics industry. Most PET processors in the U.S. are increasingly focusing on implementing Good Manufacturing Practices (GMPs) in an attempt to optimally utilize available resources, conserve resources, and increase production efficiency. These initiatives are further expected to boost the market growth of PET over the forecast period.

Rising demand for plastic compounded resins in comparison to the traditional plastic resins across various industries including automotive and others has provided an opportunity for the plastic compounding market to propel globally. Compared to traditional materials such as rubber or metals, the usage of plastic compounded goods in automotive applications helps minimize fuel consumption by reducing the density and weight of cars. Over the projected period, rising consumer awareness of consumer safety and health concerns in different industries such as electronics, healthcare, wire & cable, construction, and automotive is expected to increase global demand for plastic compounding for manufacturing of plastic compounded resins.

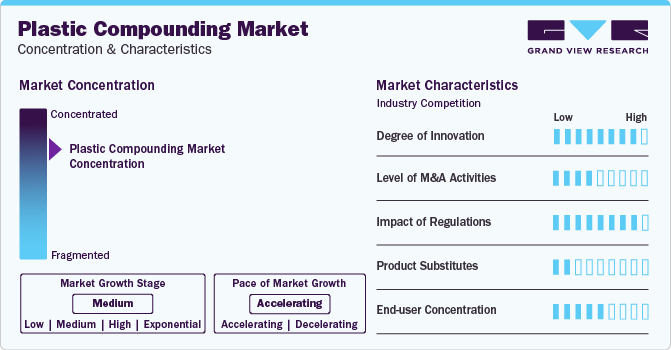

Market Concentration & Characteristics

The global plastic compounding market is highly consolidated in nature with the presence of various key players such as BASF SE, SABIC, Dow Inc., DuPont de Nemours, Inc., LyondellBasell Industries Holdings B.V., RTP Company, and Kingfa SCI. & TECH. CO., LTD. as well as a few medium and small regional players operating in different parts of the world. The global players face intense competition from each other as well as from the regional players who have strong distribution networks and good knowledge about suppliers & regulations.

The companies in the market compete on the basis of product quality offered and the technology used for the production of plastics. Major players, in particular, compete on the basis of application development capability and new technologies used in product formulation. Established players such as BASF SE are investing in research & development activities to formulate new and advanced plastics compounds, which gives them a competitive edge over the other players.

To maintain strong and healthy competitive environment across the marketspace, the global plastic compounding companies manufacturing compounded plastics have implemented various strategic initiatives such as acquisition & merger, new product launch, production expansion, and various others. For instance, in October 2023, Covestro AG launched their new mechanical recycling polycarbonate compounding production unit in Shanghai, China with a plastic compounding capacity of 25 kilotons per annum.

Source Insights

Fossil-based compounded plastics dominated the source segmentation in 2023 with a market revenue share of above 56.0%. This growth rate is attributed to the major utilization of petrochemical-based plastics from major end-use industries such as automotive, building & construction, medical, packaging, and others, for which fossils act as raw materials. Furthermore, the derivation of petrochemical from fossil fuels and further manufacturing of plastics is highly convenient and economic for the manufacturers in comparison to the manufacturing of their counter parts such as bio-based plastics.

Followed by recycled plastics with a market revenue share of more than 30.0% in 2023, owing to the rise in demand for recycled plastics from end-use industries in line with the increasing concerns regarding environmental damage caused due to increased consumption of virgin plastics, along with companies moving towards sustainability and circular economy. This has propelled the plastic recyclers to increase their recycling capacities across the globe in recent years.

Additionally, bio-based plastics have gained popularity in recent years owing to the rising governmental concerns to reduce landfilling, including programs such as U.S. 2030 Food Loss and Waste Reduction Goal, and expanding composting infrastructure are anticipated to augment the demand for compostable bags or bio-based bags used for the collection of food leftovers and other organic waste material over the forecast period.

Product Insights

Polypropylene (PP) dominated the product segmentation in 2023 with a market revenue share of above 29.0%. Polypropylene can be processed using any of the thermoplastic processing methods including injection molding, extrusion blow molding, and general-purpose extrusion. It has good fatigue and chemical & temperature resistance. Although, polypropylene is vulnerable to oxidative degradation in contact with copper and certain other materials. This has made it a popular material in developed and emerging economies for several application industries.

Automotive is the largest application segment for polypropylene (PP) compounds due to their high impact resistance and ease of maintenance. The rise of auto manufacturing in the Asian and Latin American markets has fueled the growth of the automotive sector, both in terms of vehicle sales and domestic production. Consumption of plastic compounds in automotive applications is expected to increase significantly over the forecast period due to continued growth in the automotive output market as well as regulatory trends forcing manufacturers to must reduce vehicle weight and improve energy efficiency.

Followed by polyethylene (PE) with a market revenue share of above 21.0% in 2023. Polyethylene compounds are widely used in various industries such as automotive, construction, electrical & electronics, and packaging. PE is an integral material for the packaging industry. Construction is the leading application market for polyethylene compounds with a significant market share in the global market.

Application Insights

Automotive sub-segment dominated the application segmentation in 2023 with a market revenue share above 25.0%. Exterior body parts, wiper arm casings and housings, bumpers, moldings, ignition, front grilles, cladding, roof trim, and other automobile applications all use PP and PET compounds. Low thermal expansion, high stiffness, lightweight, dimensional stability, moisture resistance, exceptional scratch resistance, and impact resistance in low temperatures are just a few of the properties that these materials possess.

Several grades of PP and PET compounds have been developed over the past years to meet diverse performance requirements. The growing demand for sustainable materials in this segment has been a major driver for lightweight plastic. In addition, the implementation of emission norms and vehicular weight regulations in the automotive industry owing to rising greenhouse gas emissions is anticipated to propel the demand for global automotive plastic compounding over the forecast period.

Followed by packaging with a market revenue share above 18.0% in 2023. Demand for compounded plastics in the packaging industry is driven by mass consumption in major economies such as China, India, Germany, the United States, and Brazil. Various regulatory agencies have established guidelines for packaging materials for food contact applications. The polypropylene formulation provides a cost-effective packaging solution that helps improve impact strength, flexibility, transparency, and process efficiency. The high demand for polyethylene in the packaging industry has contributed significantly to the growth of the plastic compounding market.

Regional Insights

Asia Pacific dominated the market and held a revenue share of over 44.0% in 2023 owing to the favorable conditions in Asia Pacific, such as increasing manufacturing output, booming e-commerce market, and favorable demographics, are promising. Investments in six Asian economies (China, Thailand, Indonesia, India, Vietnam, and Malaysia) for developing talent, improving infrastructure, and supply chain facilities are expected to drive the market growth.

Increasing demand for consumer goods such as refrigerators and washing machine in countries such as India, Vietnam, the Philippines, China, and Thailand is expected to fuel the demand for plastic compounding in these applications. Growing demand for automotive in the region coupled with favorable FDI norms by governments is further projected to facilitate investment in the Asia Pacific. In addition, low manufacturing cost in China and India as compared to Europe is expected to propel the use of plastic compounding in automobiles.

Followed by Europe with a market revenue share of above 21.0% in 2023. Growth in automotive production, high standard of living, and growing aging population, are significantly contributing towards a positive growth for plastic compounding in Europe. Well-developed infrastructure along with the presence of renowned automakers including Fiat, BMW, and Volkswagen among others are propelling the development of automotive market in this region which in turn is creating application scope of plastic compounding in this region.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In December 2023, Sirmax, an Italian plastic processor, announced their expansion of plastic compounding in India with a production capacity of 20 kilotons per annum. The plant is scheduled to be completely operational by the end of 2026.

- In November 2023, Borealis AG announced its expansion of mechanically recycled plastic compounding production, increasing its compounding capacity to over 50 kilotons per annum. This expansion was possible with the acquisition of Rialti S.p.A., an Italian polypropylene (PP) compounder of recyclates.

Key Plastic Compounding Companies:

- BASF SE

- SABIC

- Dow, Inc.

- KRATON CORPORATION

- LyondellBasell Industries Holdings B.V.

- DuPont de Nemours, Inc.

- RTP Company

- S&E Specialty Polymers, LLC (Aurora Plastics)

- Asahi Kasei Corporation

- Covestro AG

- Washington Penn

- Eurostar Engineering Plastics

- KURARAY CO., LTD.

- Arkema

- TEIJIN LIMITED

- LANXESS

- Solvay

- SO.F.TER

- Polyvisions, Inc.

- Ravago

Plastic Compounding Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 71.59 billion

Revenue forecast in 2030

USD 112.08 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Source, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Netherlands; China; India; Japan; South Korea; Singapore; Malaysia; Indonesia; Thailand; Vietnam; Australia; Brazil; Argentina; Saudi Arabia; United Arab Emirates (UAE); South Africa

Key companies profiled

BASF SE; SABIC; Dow, Inc.; KRATON CORPORATION; LyondellBasell Industries Holdings B.V.; DuPont de Nemours, Inc.; RTP Company; S&E Specialty Polymers, LLC (Aurora Plastics); Asahi Kasei Corporation; Covestro AG; Washington Penn; Eurostar Engineering Plastics; KURARAY CO., LTD.; Arkema; TEIJIN LIMITED; LANXESS; Solvay; SO.F.TER; Polyvisions, Inc.; Ravago; Heritage Plastics; Chevron Phillips Chemical Company LLC; Sumitomo Bakelite Co., Ltd.; Nova Polymers, Inc.; Adell Plastics, Inc.; Foster Corporation; MRC Polymers, Inc.; Flex Technologies; Dyneon GmbH & Co. KG; Kingfa SCI. & TECH. CO. LTD.; China XD Plastics, Co., Ltd.; Avient Corporation; Guangdong Silver Age Sci; China General Plastics Corporation (CGPC)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Compounding Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plastic compounding market report based on source, product, application, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fossil-based

-

Bio-based

-

Recycled

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Thermoplastic Vulcanizates (TPV)

-

Thermoplastic Polyolefins (TPO)

-

Polyvinyl Chloride (PVC)

-

Polystyrene (PS)

-

Polyethylene Terephthalate (PET)

-

Polybutylene Terephthalate (PBT)

-

Polyamide (PA)

-

Polycarbonate (PC)

-

Polyurethane (PU)

-

Polymethyl Methacrylate (PMMA)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Building & construction

-

Electrical & electronics

-

Packaging

-

Consumer goods

-

Industrial machinery

-

Medical devices

-

Optical media

-

Aerospace & defense

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Malaysia

-

Indonesia

-

Thailand

-

Vietnam

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global plastic compounding market size was estimated at USD 63.45 billion in 2022 and is expected to reach USD 67.17 billion in 2023.

b. The global plastic compounding market is expected to grow at a compound annual growth rate of 7.2% from 2023 to 2030 to reach USD 112.08 billion by 2030.

b. The polypropylene segment dominated the plastic compounding market with a share of 29.79% in 2022. This is attributable to the rising demand from the automotive industry owing to the high impact resistance and serviceability.

b. Some key players operating in the plastic compounding market include BASF SE, LyondellBasell Industries, N.V., and The Dow Chemical Company, SABIC, Asahi Kasei Plastics, Covestro (Bayer Material Science), and others.

b. Key factors that are driving the plastic compounding market growth include increasing incorporation of plastics as opposed to metals and alloys in automotive components and rising demand from the packaging, building & construction sectors.

b. The polypropylene (PP) product segment led the plastic compounding market, accounting for a revenue share of more than 29.79% in 2022.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.