- Home

- »

- Food Additives & Nutricosmetics

- »

-

Malic Acid Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Malic Acid Market Size, Share & Trends Report]()

Malic Acid Market Size, Share & Trends Analysis Report By Product (L-Malic Acid, D-Malic Acid), By Application (Food & Beverages, Pharmaceuticals), By Region (Europe, Asia Pacific), And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-371-3

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Specialty & Chemicals

Report Overview

The global malic acid market size was valued at USD 216.21 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. Increasing demand for malic acid in the food & beverage industry for enhancing flavor is expected to drive the industry growth over the forecast period. Malic acid is one of the most preferred acidulants and flavoring agents in the food processing industry. It has excellent blending and flavor-enhancing properties and has a wide range of applications in the food & beverage industry. The rapid growth of the food and beverage processing industries, particularly in emerging economies of China, India, Brazil, and Thailand, is estimated to positively impact market growth over the forecast period.

Malic acid is an organic acid with the molecular formula C4H6O5. It was derived in 1785 by a famous German-Swedish Chemist, Carl Wilhelm Scheele, from apple juice. Malic acid has good antioxidants and high acidic capacity. Malic acid does not have any pungent smell. Compared to citric and lactic acids, it has a softer taste, natural flavor, and longer retention time. Malic acid prices in Asia Pacific have traditionally been low on account of their low production costs in the region. Government incentives and a large number of small-scale producers that cater to regional as well as overseas demand benefit China, which is a major malic acid producer in the region. Improvement in downstream demand coupled with stable benzene and butane prices, especially in China, is estimated to drive the market.

Product Insights

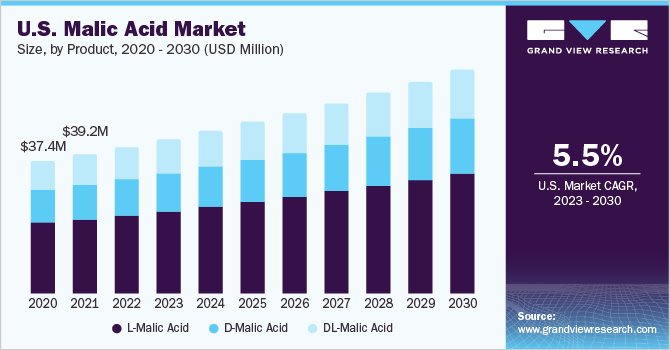

L-malic acid dominated the industry in 2022 and accounted for the highest share of more than 53.40%of the overall revenue. This is attributed to its growing inclusion in several end-use industries, such as food & beverages and pharmaceuticals. In the food & beverages industry, L-malic acid is used as a sour conditioner and gives a flavor similar to the natural flavor of fruits. It is also used as a yeast growth-promoting agent by accelerating the fermentation mechanism. The growing importance of L-malic acid in treating heart diseases is expected to propel the segment growth over the forecast year.It is soluble in ethanol, methanol, ether, and water.

The chemical name of L-malic acid is L-hydroxy butane diacid with a molecular weight of 134.09 g/mol. There are various methods to produce L-malic acid including acid hydrolysis of polymalic acid, one-step fermentation, and enzymatic transformation of fumaric acid to l-malate. The D-malic acid product segment is estimated to register a significant volumetric CAGR during the forecast period. It is used in the food & beverages industry as a food additive to enhance flavor. The food additive market is expected to grow due to new product launches by food and beverage manufacturers. The use of D-malic acid is less common than L-malic acid and is particularly not used in infant foods, as infants cannot metabolize the same.

Application Insights

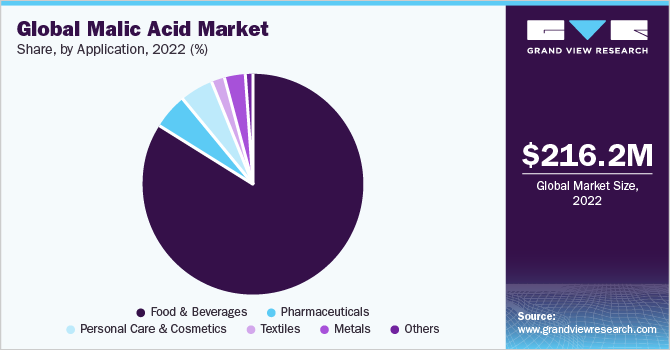

The food & beveragesegment dominated the industry in 2022 and accounted for the largest share of more than 83.90% of the overall revenue. This is attributed to increasing product demand from the food and beverage industry, especially in the Asian and Middle Eastern markets, as a result of the rising domestic consumption of food & beverage products due to a well-established network of retail outlets, the launch of new products, and population growth. The personal care & cosmetics segment is projected to register a significant CAGR during the forecast period. The growing demand for personal care & cosmetic products is attributed to the rising awareness about self-care and increasing disposable income, especially in Asia Pacific along with changing lifestyles.

According to a report published by India Brand Equity Foundation, the cosmetics, beauty, and grooming market is expected to reach USD 20 billion by 2025. In the pharmaceutical industry, only about 5% of malic acid is used for manufacturing a variety of syrups and tablets due to its functionality like better assimilation and absorption in the body. Malic acid helps reduce the effects of anti-cancer drugs on human body cells. Malic acid is used to stabilize medicines and in formulations of amino acid solutions to treat diseases like hypertension, liver disease, uremia, anaemia, and many others.In the textile industry, malic acid does not produce any unpleasant smelllike other chemicals. It is also used as a textile finishing chemical to impart desired wrinkle-free characteristics to fabrics.

In the textiles industry, chemicals are used as complexing agents, sequestering agents, emulsifiers, dispersing agents, wetting agents as well as colorants, such as dyes, dye-protective agents, pH regulators, leveling agents, UV absorbers, and finishing agents. The use of chemicals in the textile industry makes the process easier and imparts the desired appearance to fabrics.Other segments include setting retardant in plasters and cement in combination with tartaric acid. It helps improve setting time & strength andenhance slump retention. It is also used to solubilize aluminum phosphate in the soil. The increasing construction activities across the globe are expected to boost product demand in the manufacturing of plasters and cement. In Canada, construction is one of the major contributors to the economy.

Regional Insights

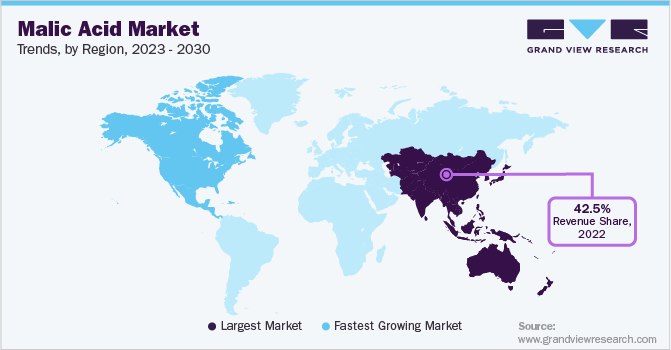

Asia Pacific dominated the industry in 2022 with the largest share of more than 42.50% of the overall revenue. The demand for malic acid in the region is influenced by food & beverages, personal care & cosmetics, and pharmaceutical applications. China, India, and Japan are the key manufacturing countries in the region. The growing population in countries, such as India and China, coupled with the rise in income level and purchasing power parity, has led to the high demand for the above-mentioned industry products. In addition, a rapidly growing number of food & beverage start-ups, especially in India, is projected to boost the demand for malic acid in several industries over the forecast period.

Application demand in North America is projected to expand at a significant CAGR from 2023 to 2030. The consumption of products in food & beverages, pharmaceutical, personal care & cosmetics end-uses is more prevalent in developed countries and this is likely to pave the way for the market in near future in North America. North America is characterized by the presence of food & beverage and pharmaceutical industries, such as Pfizer Inc., Abbott, Bristol-Myers Squibb Company, Merck Sharp & Dohme Corp. The growing pharmaceuticals industry in countries like Mexico and the U.S. is also expected to boostproduct demand.

Key Companies & Market Share Insights

Global companies are also focusing on capacity expansions, signing partnership agreements with distributors, and various other operational strategies to gain an edge in the competitive market. For instance, companies, such as Nacalai Tesque, Inc., are acquiring established distributors across the globe based on their channel and presence in the market to enhance their product placement and, in turn, capture a broader share in a particular region. These competitive strategies are likely to reflect higher rivalry in the coming years.Some of the global manufacturers include Lonza, Polynt, Thirumalai Chemicals Ltd., Anhui Sealong, and Biotechnology Co., Ltd. Companies are observed to adopt various strategies to compete and mark their presence in the global market.

For instance, prominent manufacturers tend to consolidate either by merging or acquiring distributors in other untapped regions to gain higher profit margins or to seek the synergistic effect of marketing and sales. Medium- to small-sized companies are more focused on increasing their global footprint through signing distributorship agreements. The global industry had been characterized by the monopoly of a few companies to fulfill the demands of end-use industries. However, with revolutionized market orientation, in terms of sales channel efficiency, the monopoly was revoked. However, new market entrants sought quick profits by direct sales to end-use industries, whereas the established multinationals were facing identity crises due to complicated distribution chains. Some of the prominent participants in the global malic acid market include:

-

Bartek Ingredients Inc.

-

Fuso Chemical Co., Ltd.

-

Isegen South Africa (Pty.), Ltd.

-

Anhui Sealong Biotechnology Co., Ltd.

-

Thirumalai Chemicals Ltd.

-

Yongsan Chemicals

-

Polynt

-

Lonza

-

Prinova Group LLC

-

Nacalai Tesque, Inc.

-

Guangzhou ZIO Chemical Co., Ltd.

Malic Acid Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 227.22 million

Revenue forecast in 2030

USD 324.71 million

Growth rate

CAGR of 5.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Russia; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Bartek Ingredients Inc.; Fuso Chemical Co., Ltd.; Isegen South Africa (Pty), Ltd.; Anhui Sealong Biotechnology Co., Ltd.; Thirumalai Chemicals Ltd.; Yongsan Chemicals; Polynt; Lonza; Prinova Group LLC; Nacalai Tesque, Inc.; Guangzhou ZIO Chemical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Malic Acid Market Report Segmentation

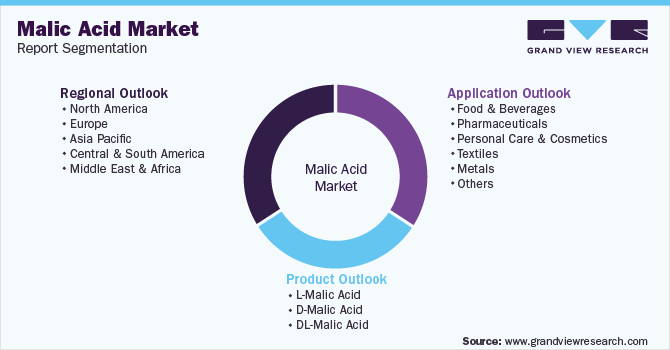

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global malic acid market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

L-Malic Acid

-

D-Malic Acid

-

DL-Malic Acid

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Pharmaceuticals

-

Personal Care & Cosmetics

-

Textiles

-

Metals

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global malic acid market size was estimated at USD 216.21 million in 2022 and is expected to reach USD 227.22 million in 2023.

b. The global malic acid market is expected to grow at a compound annual growth rate of 5.2% from 2023 to 2030 to reach USD 324.71 million by 2030.

b. Asia Pacific dominated the malic acid market with a share of 42.55% in 2022. This is attributable to food & beverages, personal care & cosmetics, & pharmaceutical applications.

b. Key players in the malic acid market are Lonza, Thirumalai Chemicals Ltd., Nacalai Tesque, Inc., Bartek Ingredients Inc., Fuso Chemical Co., Ltd., Isegen South Africa (Pty), Ltd., Anhui Sealong Biotechnology Co., Ltd., Yongsan Chemicals, Polynt, Prinova Group LLC, Guangzhou ZIO Chemical Co., Ltd.

b. Increase in consumption of food and beverages and bakery & confectionery coupled with rising demand for personal care & cosmetic products is expected to drive the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."