- Home

- »

- Renewable Chemicals

- »

-

Lactic Acid Market Size And Share, Industry Report, 2033GVR Report cover

![Lactic Acid Market Size, Share & Trends Report]()

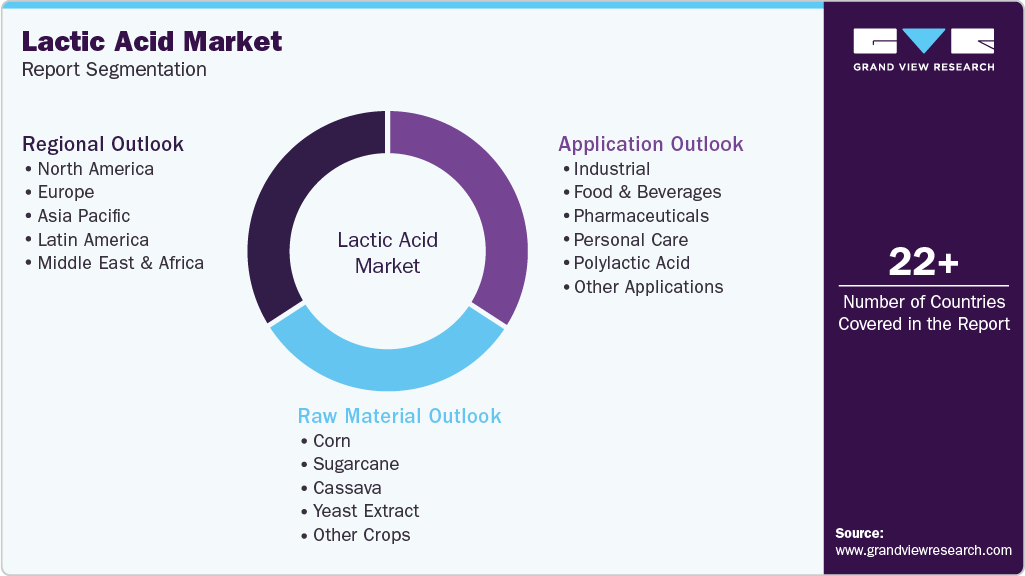

Lactic Acid Market (2026 - 2033) Size, Share & Trends Analysis Report By Raw Material (Corn, Sugarcane, Cassava, Yeast Extract), By Application (Pharmaceuticals, Personal Care, Industrial, Food & Beverages, Polylactic Acid), By Region, And Segment Forecasts

- Report ID: 978-1-68038-126-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2025

- Forecast Period: 2026 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lactic Acid Market Summary

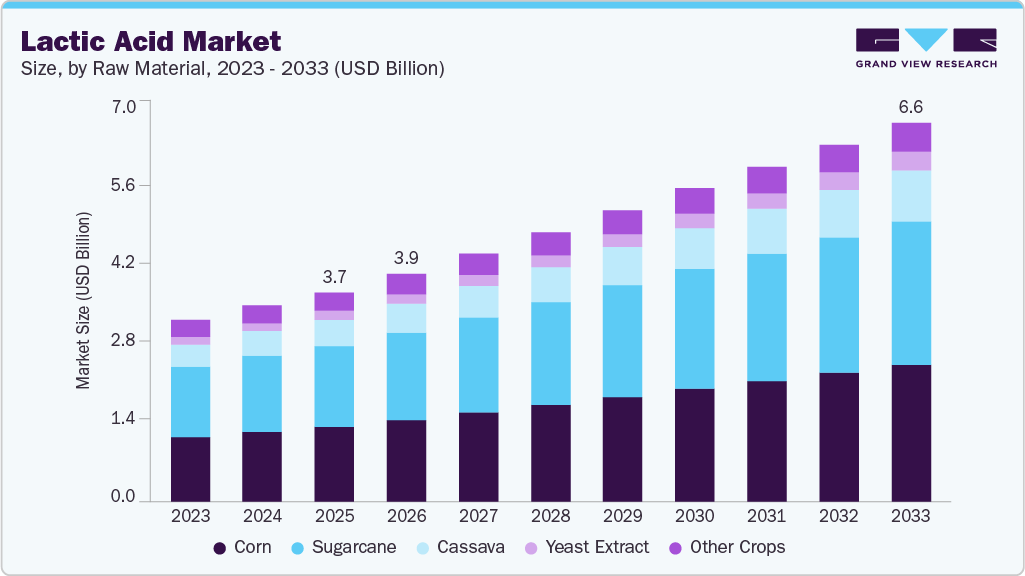

The global lactic acid market size was estimated at USD 3,682.4 million in 2025 and is projected to reach USD 6,653.7 million by 2033, growing at a CAGR of 7.7% from 2026 to 2033. Growing consumer and regulatory push toward sustainable materials is accelerating the adoption of lactic acid as a key building block for bioplastics, cosmetics, and food ingredients.

Key Market Trends & Insights

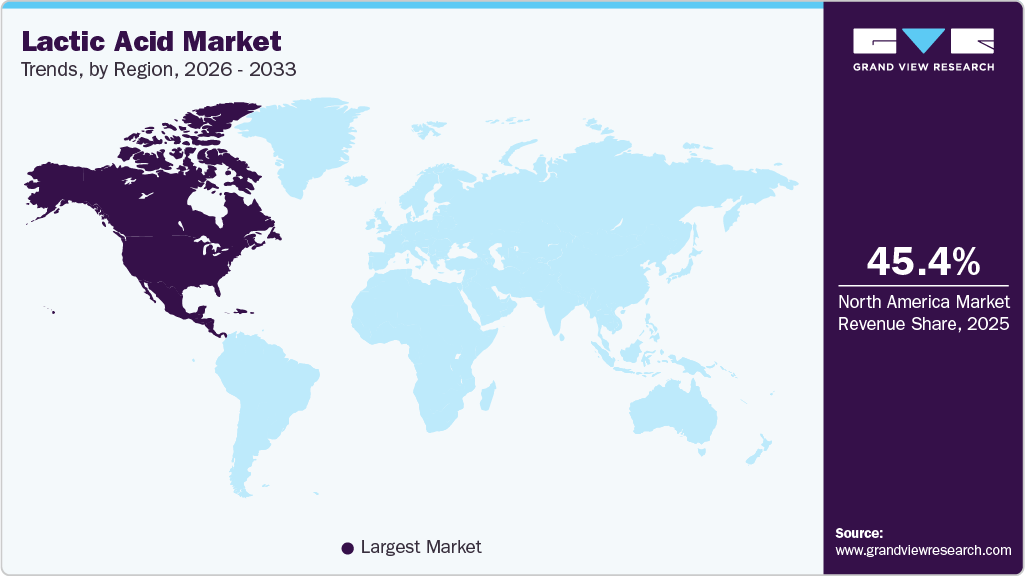

- North America dominated the lactic acid market with the largest revenue share of 45.4% in 2025.

- U.S. held over 91.6% revenue share of the North America lactic acid market.

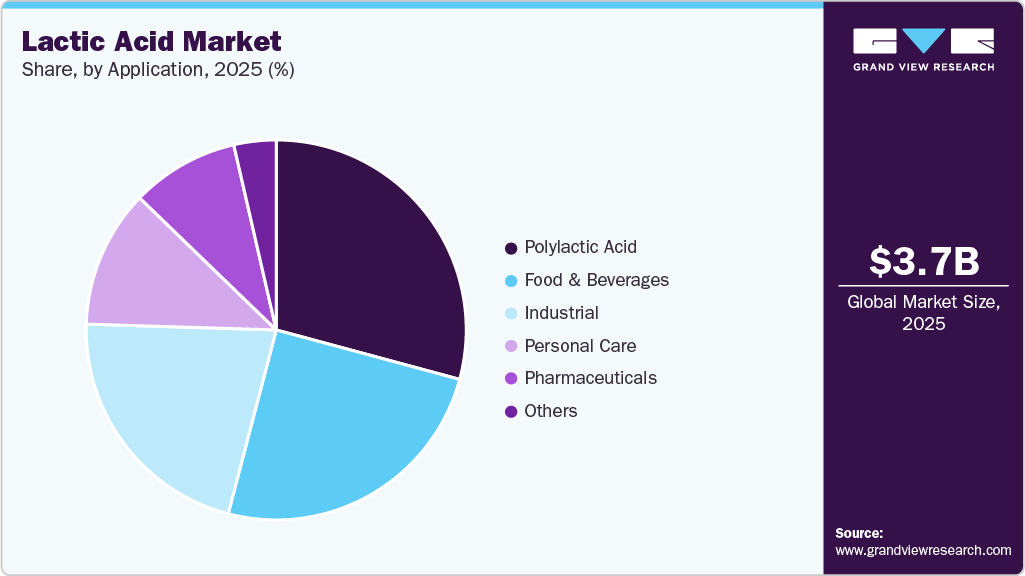

- By application, polylactic acid dominated the lactic acid market with a revenue share of 29.2% in 2025.

- By raw material, the sugarcane segment accounted for the largest revenue share of 38.6% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 3,682.4 Million

- 2033 Projected Market Size: USD 6,653.7 Million

- CAGR (2026-2033): 7.7%

- North America: Largest market in 2025

Its versatility across end-use industries is strengthening its market penetration, while manufacturers scale production capacities to meet expanding global demand. The rising focus on clean-label and functional nutrition is boosting lactic acid utilization as a preservative, acidity regulator, and flavor enhancer. As brands shift toward natural formulation frameworks, lactic acid’s safety profile and multifunctionality are positioning it as a preferred ingredient across premium food and beverage categories.

Surging global investments in PLA-based bioplastic production are opening high-value opportunities for lactic acid manufacturers. Strategic collaborations, downstream integration, and capacity expansions can enable players to capture rising demand from packaging, 3D printing, and sustainable materials markets.

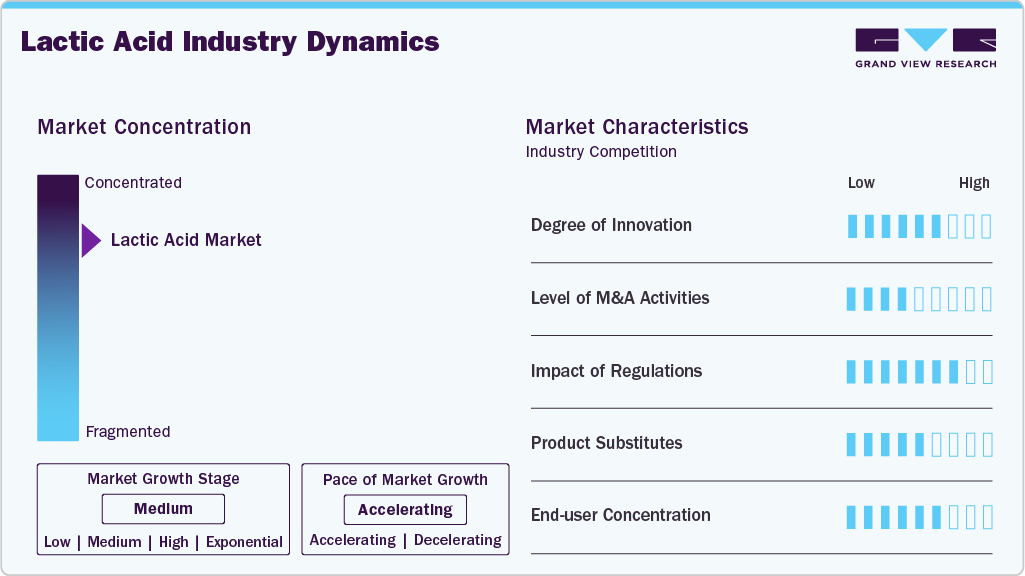

Market Concentration & Characteristics

The industry is characterized by a concentrated competitive landscape where a few established players dominate due to their advanced fermentation technologies and global distribution networks. Their scale-driven efficiencies allow them to maintain pricing power and influence supply reliability, creating a competitive moat that limits rapid entry from smaller manufacturers.

This market operates on consistent industrial demand supported by its versatility across food, pharmaceuticals, personal care, and polymer applications. It is highly innovation-driven, with producers focusing on improving yield, purity, and process sustainability. As customer requirements shift toward specialized grades and compliant formulations, the market continues transitioning toward high-performance, value-added lactic acid solutions.

Raw Material Insights

The sugarcane raw material dominated the lactic acid market and accounted for the largest revenue share of 38.6% in 2025, due to its low-cost availability, high sugar yield, and efficient fermentation performance. Its strong supply base and compatibility with bio-based production make it a preferred raw material for large-scale manufacturers.

The yeast extract segment is expected to grow at the fastest CAGR of 10.0% from 2026 to 2033 during the forecast period, due to its ability to enhance fermentation efficiency and deliver higher lactic acid yields. Its rich nutrient profile supports stable microbial activity, enabling manufacturers to optimize productivity and improve process consistency. As producers prioritize cost-effective and performance-driven inputs, demand for yeast extract is accelerating across advanced lactic acid production lines.

Application insights

The polylactic acid application dominated the market and accounted for the largest revenue share of 29.2% in 2025, as global industries accelerate the shift toward sustainable and biodegradable materials. Its broad utility in packaging, textiles, automotive, and 3D printing drives consistent demand, while expanding investments in PLA production capacity strengthen its position as the primary growth engine within the lactic acid value chain.

The pharmaceuticals segment is expected to grow at a CAGR of 8.0% from 2026 to 2033 during the forecast period, as lactic acid gains traction in drug formulation, controlled-release systems, and medical-grade polymers. Rising demand for high-purity ingredients and biocompatible materials is accelerating its adoption, positioning lactic acid as a critical input for modern healthcare and advanced therapeutic applications.

Regional Insights

North America lactic acid market dominated with a revenue share of 45.4% in 2025. North America’s lactic acid market is advancing on the back of strong demand for bioplastics and clean-label ingredients across food, packaging, and healthcare industries. Supportive regulatory frameworks encouraging bio-based alternatives further elevate market traction. Manufacturers are scaling local production to reduce dependency on imports and meet rising sustainability targets.

U.S. Lactic Acid Market Trends

U.S. held over 91.6% revenue share of the North America lactic acid market. The lactic acid market in the U.S. benefits from high R&D intensity and rapid commercialization of bio-based polymers and specialty lactic acid grades. Strong consumer preference for natural, clean-label ingredients sustains demand across the food and personal care industries. Strategic collaborations among technology providers are further enhancing process efficiency and market scalability.

Europe Lactic Acid Market Trends

The lactic acid market in Europe is driven by stringent environmental policies that accelerate the transition from petrochemical materials to renewable, biodegradable solutions. High adoption in packaging, personal care, and industrial applications strengthens the region’s consumption base. Ongoing investments in circular bioeconomy initiatives continue to expand demand for lactic acid and its derivatives.

Germany lactic acid market is fueled by advanced industrial capabilities and a strong focus on sustainable materials within automotive, packaging, and medical sectors. High regulatory standards are pushing manufacturers toward bio-based ingredients like lactic acid. Continuous innovation in biopolymer technologies is reinforcing the country’s position as a key European growth hub.

Asia Pacific Lactic Acid Market Trends

The lactic acid market in Asia Pacific secured 26.1% of the market share in 2025. Asia Pacific benefits from abundant feedstock availability, rapid industrialization, and expanding manufacturing ecosystems for food, personal care, and PLA-based materials. Rising focus on sustainable product development among regional producers is boosting lactic acid usage. Government-backed incentives for bioplastics production further enhance market momentum.

China’s lactic acid market is accelerating due to massive PLA production expansion and strong domestic demand for biodegradable packaging. Its robust manufacturing base and competitive cost structure give local producers a global advantage. Government policies promoting green materials continue to strengthen market growth prospects.

Middle East & Africa Lactic Acid Market Trends

The lactic acid market in the Middle East & Africa is gaining pace as industries diversify toward value-added chemicals and sustainable materials. Growing food processing activities and healthcare modernization are increasing the demand for high-quality lactic acid. Strategic investments in bio-based production capacities are gradually reshaping the region’s competitive landscape.

Latin America Lactic Acid Market Trends

The lactic acid market in Latin America is supported by strong agricultural resources that ensure a consistent and cost-effective feedstock supply for lactic acid production. The expanding food, beverage, and packaging sectors are fueling local consumption. Sustainability-focused corporate initiatives are encouraging broader adoption of bio-based ingredients across industries.

Key Lactic Acid Companies Insights

Key players operating in the lactic acid market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. BASF SE and Galactic dominate the market through their advanced fermentation technologies, high-purity product portfolios, and strong global distribution capabilities. Their focus on sustainable, application-specific solutions enables them to consistently meet evolving industry demands and maintain competitive leadership.

-

BASF SE is actively expanding its presence in the lactic acid market by focusing on bio-based chemistry and high-purity ingredients for industrial and consumer applications. The company leverages its advanced process technologies and global production ecosystem to support scalable, sustainable lactic acid solutions. Its strategic emphasis on performance, regulatory compliance, and supply reliability positions it as a key contributor to the market’s growth.

-

Galactic is a leading player in the lactic acid market, recognized for its deep expertise in fermentation technologies and high-quality lactic acid derivatives. The company delivers specialized grades for food, pharmaceuticals, personal care, and biopolymer applications, emphasizing purity, efficiency, and sustainability. Its continuous innovation in biotechnology and customer-specific formulations strengthens its competitive edge in global markets.

Key Lactic Acid Companies:

The following are the leading companies in the lactic acid market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Galactic

- Musashino Chemical (China) Co., Ltd.

- Futerro

- Corbion

- Dow

- TEIJIN LIMITED

- NatureWorks LLC

- Henan Jindan Lactic Acid Technology Co. Ltd.

- thyssenkrupp AG

- Cellulac

- Jungbunzlauer Suisse AG

- Vaishnavi Bio Tech

- Danimer Scientific

Recent Developments

-

In December 2023, Sulzer’s launch of the SULAC technology addresses growing market demand for lactic acid by enabling its efficient conversion into lactide, a critical intermediate for producing polylactic acid (PLA). This advancement enhances the availability of high-quality biopolymers and supports wider adoption of sustainable plastics, reinforcing Sulzer’s leadership in the PLA value chain and circular manufacturing.

-

In May 2023, The partnership between Sulzer and Jindan New Biomaterials highlights growing market demand for lactic acid, driven by its use in producing polylactic acid (PLA), a biobased plastic. With a planned annual PLA output of 75,000 tonnes for packaging, molded goods, and fiber applications, the agreement reflects strong momentum toward sustainable, circular manufacturing practices and the expanding bioplastics market in China.

Lactic Acid Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3,997.4 million

Revenue forecast in 2033

USD 6,653.7 million

Growth rate

CAGR of 7.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2025

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; UK; Italy; Spain; Netherlands; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF; Galactic; Musashino Chemical (China) Co., Ltd.; Futerro; Corbion; Dow; TEIJIN LIMITED; NatureWorks LLC; Henan Jindan Lactic Acid Technology Co. Ltd.; thyssenkrupp AG; Cellulac; Jungbunzlauer Suisse AG; Vaishnavi Bio Tech; Danimer Scientific

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lactic Acid Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global lactic acid market report based on raw material, application, and region:

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Corn

-

Sugarcane

-

Cassava

-

Yeast Extract

-

Other Crops

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Industrial

-

Food & Beverages

-

Beverages

-

Bakery & Confectionary Products

-

Dairy Products

-

Meat Products

-

Other Food Products

-

-

Pharmaceuticals

-

Personal Care

-

Polylactic Acid

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lactic acid market size was estimated at USD 3,682.4 million in 2025 and is expected to reach USD 3,997.4 million in 2026.

b. The global lactic acid market is expected to grow at a compound annual growth rate of 7.7% from 2026 to 2033 to reach USD 6,653.7 million by 2033.

b. The sugarcane lactic acid segment led the market and accounted for the largest revenue share of 38.6% in 2025, due to its low-cost availability, high sugar yield, and efficient fermentation performance.

b. Some of the key players operating in the Lactic Acid Market include BASF, Galactic, Musashino Chemical (China) Co., Ltd., Futerro, Corbion, Dow, TEIJIN LIMITED, NatureWorks LLC, Henan Jindan Lactic Acid Technology Co. Ltd., thyssenkrupp AG, Cellulac, Jungbunzlauer Suisse AG, Vaishnavi Bio Tech, Danimer Scientific.

b. The growth is attributed to Lactic Acid’ is increasing usage of this form in various end use industries including pharmaceuticals, food & beverages.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.