- Home

- »

- Food Additives & Nutricosmetics

- »

-

Food Additives Market Size & Share, Industry Report, 2030GVR Report cover

![Food Additives Market Size, Share & Trends Report]()

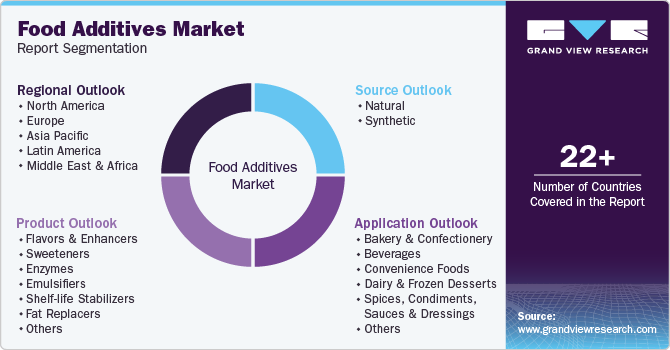

Food Additives Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Flavors & Enhancers, Sweeteners), By Source (Natural, Synthetic), By Application (Bakery & Confectionery, Beverages), By Region, And Segment Forecasts

- Report ID: 978-1-68038-187-0

- Number of Report Pages: 126

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Food Additives Market Summary

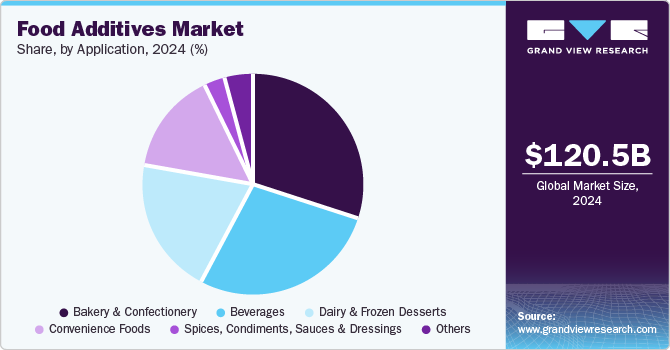

The global food additives market size was estimated at USD 120.5 billion in 2024 and is projected to reach USD 169.22 billion by 2030, growing at a CAGR of 5.9% from 2025 to 2030. This is attributed to the expanding size of key end-use sectors, including bakery and confectionery, beverages, dairy, and convenience foods, and the growing penetration of organized and e-retail.

Key Market Trends & Insights

- North America food additives market is expected to grow at a CAGR of 6.0% over the forecast period.

- The food additives market in the U.S. led the North American market and accounted for the largest revenue share in 2024.

- By product, sweeteners segment led the market with the largest revenue share of 52.7% in 2024.

- By source, natural sources segment led the market with the largest revenue share of 82.7% in 2024.

- By application, the bakery & confectionery segment led the market with the largest revenue share of around 29.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 120.5 Billion

- 2030 Projected Market Size: USD 169.22 Billion

- CAGR (2025-2030): 5.9%

- Asia Pacific: Largest market in 2024

Specialty food ingredients are utilized in products to enhance their properties, such as taste, shelf life, texture, and health benefits. The industry is classified as sensory ingredients and functional ingredients. Sensory ingredients enhance products' taste, smell, flavor, and texture. Functional ingredients include vitamins, acidulates, antioxidants, and other constituents that add nutritional qualities to food.

Higher expenditure on food & beverage products in the U.S. due to the overall high disposable income has increased the production of food & beverage products in the country. This can be attributed to increasing demand, which is likely to result in the growing consumption of additives in these products. Increased demand is expected to support the consumption of fat replacers and high-intensity sweeteners that lower the fat and sugar content of food or drinks. The flavors offered are inspired by regional flavors such as Catalan Crush, Arctic Gem, Pacific Blossom, Thai Treat, and California Dreamin.

The consumption of packaged food products and beverages is rising globally. This is expected to contribute to the surging demand for additives used during the processing of various packaged products and beverages. For instance, according to the USDA Economic Research Service report published in April 2025, global consumption of packaged foods increased by 6.1% between 2023 and 2024. This growth reflects rising incomes and changing consumer preferences toward convenience and processed products in international markets worldwide. Rising demand for packaged products and beverages is expected to fuel the market growth worldwide.

Companies operating in the industry are subjected to various laws, regulations, and guidelines imposed by government authorities operating in a particular region. Some of the regulatory bodies governing additives and their end-use industries include the U.S. Food and Drug Administration (FDA), the Food and Agriculture Organization (FAO), and the World Health Organization (WHO). These regulatory bodies have become increasingly active in ensuring the use of safe food additives in consumer products.

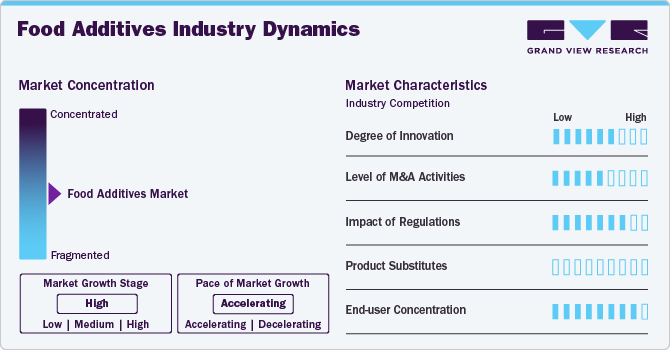

Market Concentration & Characteristics

The concentration of the food additives industry is characterized by the presence of many players and their role in driving market dynamics. This gives the additive market a highly fragmented nature, with key industry participants such as ADM, Chr. Hansen Holding A/S, Ingredion Incorporated. These companies contribute to the market's concentration through their significant market share, product offerings, and research and development initiatives. These major players often play a crucial role in shaping industry trends, technological innovations, and market strategies, thereby influencing the overall concentration of the market growth.

Technological advancements and ongoing innovations in food additives contribute to the industry concentration by creating barriers to entry for new players and reinforcing the competitive positions of established industry leaders. The role of key players in driving innovation and product development further solidifies their influence on market concentration, as they continue to introduce novel additives, enhance production processes, and expand their product portfolios. Although the variety of end use applications and low level of technological requirements aid the entry of new players into the market. These factors collectively contribute to the low market concentration of the food additives industry.

Moreover, the characteristics of the food additives industry are influenced by the multifunctional roles served by additives, including their ability to enhance taste, texture, appearance, and shelf life of products. This aligns with the increasing consumer inclination towards clean-labelled products, driving the demand for additives that contribute to product quality and safety. The industry's focus on compliance with regulatory standards and safety assessments, such as those conducted by the Joint FAO/WHO Expert Committee on Food Additives (JECFA), underscores the importance of ensuring the safety and efficacy of food additives for consumer consumption.

Product Insights

Sweeteners led the market with the largest revenue share of 52.7% in 2024. This is attributed to rising demand for sweet products, such as confections and soft drinks, which has resulted in an increased demand for high fructose corn syrup. High fructose corn syrup, which has a high glycemic index, is considered a high-calorie sweetener as it increases the calorie content of food products to which it is added. According to the Food & Agriculture Organization (FAO), global caloric sweeteners production is expected to reach 218 million tons by 2029. However, rising awareness among the population regarding health concerns due to excessive intake of high-calorie foods is expected to limit the demand for HFCS.

Prebiotics are expected to grow at the fastest CAGR of 7.6% over the forecast period, driven by rising consumer awareness of gut health and demand for functional, natural, and clean-label ingredients. In addition, increasing preference for plant-based and digestive health-supporting products boosts adoption. Technological advances enable easier incorporation of prebiotics into various foods and beverages, expanding applications. Furthermore, growing interest in preventive healthcare and wellness fuels market growth by encouraging manufacturers to develop innovative prebiotic-enriched products that meet evolving consumer needs.

Flavors and enhancers are another major product segment in the global market. The segment includes flavoring agents, enhancers, carriers, modulators, bitterness suppressors, and flavor emulsions, among others. Flavoring agents effectively mask unpleasant tastes and improve the taste of food and beverages. Rising health consciousness and awareness regarding the side effects of artificial flavors, such as allergies and the risk of cancer, have encouraged market players to focus on naturally derived ingredients.

Source Insights

Natural sources led the market with the largest revenue share of 82.7% in 2024. This is attributable to consumers' growing preference for natural and organic products. The natural segment comprises additives that are derived from naturally available sources, like various parts of plants, such as dietary fibers derived from fruit peels; animal sources such as milk or egg proteins, or microorganisms such as probiotic strains, including lactic acid bacteria. The rising trend of veganism is expected to augment the demand for plant-based ingredients globally. Therefore, the market players are also shifting to this trend by launching several plant-based meat products.

The synthetic source segment is expected to grow at a CAGR of 5.7% over the forecast period, as it comprises additives that are chemically synthesized from raw materials. Different food additives are synthesized from different raw materials following different chemical reactions. For instance, sweeteners such as saccharin are synthesized by the oxidation of o-toluene sulfonamide to the corresponding carboxylic acid by reacting with potassium permanganate or chromic acid.

Application Insights

The bakery & confectionery segment led the market with the largest revenue share of around 29.0% in 2024. Its high share is attributable to rising usage of Bakery & confectionery products, including bread, cakes, biscuits, tortillas, and sugar & chocolate confections, among others. Sweeteners, flavors, sweeteners, fat replacers, and shelf-life stabilizers are the food additives commonly used in bakery and confectionery products. Rising utilization of enzymes to enhance dough stability and increase the shelf life of bakery products is anticipated to fuel the market growth. Dietary fibers such as cellulose with low water absorption ability are mainly used to offer fiber enrichment in bakery products such as tortillas and bread. Higher consumption of bread and bread-based products in North American and European countries is expected to drive the demand for dietary fibers in bakery products.

Beverages are expected to grow at a significant CAGR of 6.2% from 2025 to 2030, driven by rising consumer demand for functional and enhanced drinks that offer improved taste, texture, and nutritional benefits. In addition, increasing health consciousness is fueling interest in low-sugar, low-calorie, and fortified beverages. Urbanization, changing lifestyles, and higher disposable incomes are boosting the consumption of packaged and convenience drinks. Furthermore, innovations in natural and clean-label additives are meeting evolving consumer preferences, further accelerating market expansion in the beverage sector.

Dairy & frozen products use food additives in various products, such as yogurt, flavored milk, smoothies, ice cream, whipped cream, and sweetened cream cheese, among others. Rising awareness of animal welfare and shifting consumer preferences toward vegan products, such as non-dairy alternatives, including oat milk and soy milk, are expected to hamper the consumption of dairy beverages. This, in turn, is anticipated to limit the demand for additives, specifically developed for dairy products.

Regional Insights

North America food additives market is expected to grow at a CAGR of 6.0% over the forecast period. This is attributed to the rise in chemical consumption by numerous industries, such as pharmaceuticals, industrial, and food and beverages. In addition, the expanding pharmaceutical industry in countries such as the U.S., Mexico, and Canada is anticipated to surge the demand in North America. Furthermore, heightened health awareness and regulatory scrutiny encourage the adoption of natural and low-calorie additives.

U.S. Food Additives Market Trends

The food additives market in the U.S. led the North American market and accounted for the largest revenue share in 2024, driven by its large, diverse consumer base and a robust processed food industry. Demand for healthier, fortified, and ready-to-eat products is rising, prompting manufacturers to use additives for nutritional enhancement, taste, and preservation. Furthermore, trends toward organic and non-GMO products are shaping the market, driving growth in natural additives segments.

Asia Pacific Food Additives Market Trends

The food additives market in Asia Pacific dominated the global market with the largest revenue share of 32.7% in 2024. This growth is attributed to the rising disposable incomes, urbanization, and busy lifestyles that increase demand for processed and convenience foods. In addition, consumers are increasingly aware of food safety and shelf life, driving the use of additives for preservation and quality. Furthermore, the region’s diverse food cultures create demand for specialized additives. At the same time, regulatory support and technological innovation encourage the development of natural and clean-label solutions, making the market dynamic and highly competitive.

China food additives market led the Asia Pacific region and held the largest revenue share in 2024, primarily driven by its vast population, rapid urbanization, and evolving dietary habits that favor packaged and processed foods. Furthermore, the growing middle class is fueling demand for premium and diverse food products, while manufacturers focus on improving taste, appearance, and shelf life through additives. Moreover, regulatory emphasis on food safety and quality further supports market growth, and domestic companies are investing in innovation and production efficiency to meet both local and international standards.

Europe Food Additives Market Trends

The food additives market in Europe is expected to grow significantly over the forecast period. There gionis run by major industrial economies such as the UK, Germany, France, and Italy. It is characterized by an increasing number of manufacturers and suppliers of food and beverage and bakery, and confectionery products penetrating the regional ecosystem.

Key Food Additives Companies Insights

Key players operating in the food additives market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Food Additives Companies:

The following are the leading companies in the food additives market. These companies collectively hold the largest market share and dictate industry trends.

- ADM

- Ingredion

- Tate & Lyle Plc

- DSM

- Ajinomoto Co., Inc.

- Cargill, Incorporated

- BASF SE

- Givaudan

- International Flavors & Fragrances Inc. IFF

- Biospringer

- Palsgaard

- Lonza

- Sensient Technologies Corporation

- Kerry Group plc

- Corbion

- Fooding Group Limited

- DuPont

- The Kraft Heinz Company

- Novonesis

Food Additives Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 127.20 billion

Revenue forecast in 2030

USD 169.22 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, application, and region

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East and Africa.

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Belgium; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

ADM; Ingredion; Tate & Lyle Plc; DSM; Ajinomoto Co., Inc.; Cargill Incorporated; BASF SE; Givaudan; International Flavors & Fragrances Inc. IFF; Biospringer; Palsgaard; Lonza; Sensient Technologies Corporation; Kerry Group plc; Corbion; Fooding Group Limited; DuPont; The Kraft Heinz Company; Novonesis

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Additives Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global food additives market report based on product, source, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flavors & Enhancers

-

Sweeteners

-

HIS

-

HFCS

-

Sucrose

-

Others

-

-

Enzymes

-

Emulsifiers

-

Mono, Di-Glycerides & Derivatives

-

Lecithin

-

Stearoyl Lactylates

-

Sorbitan Esters

-

Others

-

-

Shelf-life Stabilizers

-

Fat Replacers

-

Protein

-

Starch

-

Fat

-

-

Prebiotics

-

Probiotics

-

Dietary Fibers

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bakery & confectionery

-

Beverages

-

Convenience foods

-

Dairy & frozen desserts

-

Spices, condiments, sauces & dressings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Belgium

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Southeast Asia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.