- Home

- »

- Next Generation Technologies

- »

-

Mining Equipment Market Size, Share, Industry Report, 2033GVR Report cover

![Mining Equipment Market Size, Share & Trends Report]()

Mining Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Equipment Type, By Power Source (Gasoline, Electric), By Power Output, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-017-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mining Equipment Market Summary

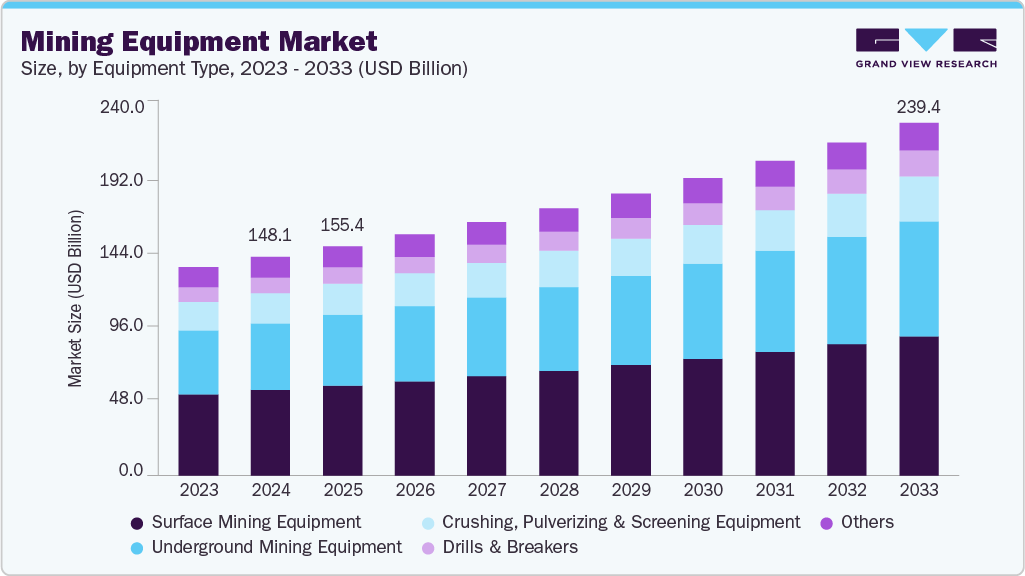

The global mining equipment market size was estimated at USD 148.10 billion in 2024, and is projected to reach USD 239.44 billion by 2033, growing at a CAGR of 5.6% from 2025 to 2033. The mining equipment industry is experiencing steady growth driven by rising global demand for minerals, metals, and critical raw materials essential for construction, energy transition, and advanced manufacturing.

Key Market Trends & Insights

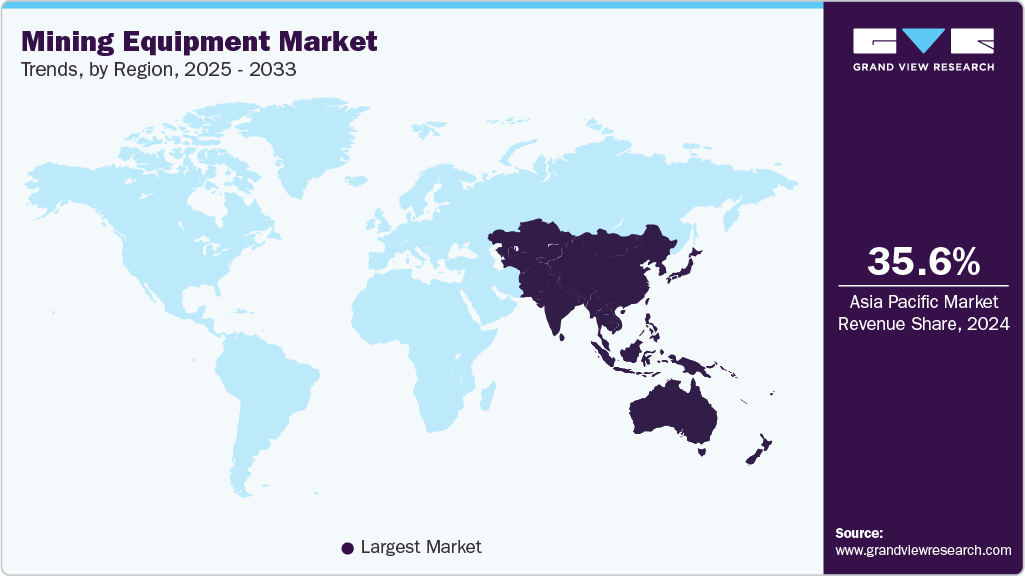

- Asia Pacific dominated the global mining equipment market with the largest revenue share of 35.6% in 2024.

- The mining equipment market in Japan is expected to grow at a rapid CAGR during the forecast period.

- By equipment type, the surface mining equipment segment led the market with the largest revenue share of 39.0% in 2024.

- By power source, the gasoline segment accounted for the largest market revenue share in 2024.

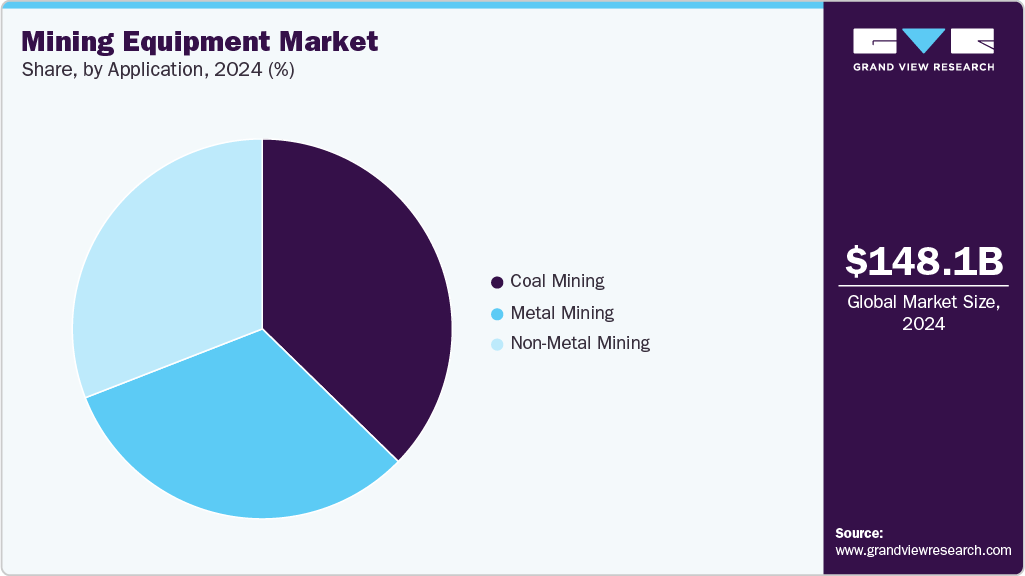

- By application, the coal mining segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 148.10 Billion

- 2033 Projected Market Size: USD 239.44 Billion

- CAGR (2025-2033): 5.6%

- Asia Pacific: Largest market in 2024

The expansion of mining activities, particularly in emerging economies, continues to drive demand for new machinery across both surface and underground applications. The increasing focus on productivity, operational efficiency, and cost optimization is prompting mining companies to replace their aging fleets with more efficient, high-capacity equipment. In addition, the growing emphasis on worker safety and stricter compliance standards is encouraging the adoption of advanced equipment with improved automation and monitoring capabilities.Technological advancements are reshaping the mining equipment landscape, with automation, electrification, and digital integration at the forefront. Autonomous haulage systems, remote-operated drilling rigs, AI-based fleet management platforms, and predictive maintenance solutions are increasingly becoming mainstream. The push toward low-emission and zero-emission mining is accelerating the development of battery-electric loaders, trucks, and hybrid powertrains. Integration of IoT sensors, real-time data analytics, and advanced control systems is enhancing asset performance and reducing downtime, making technology-driven solutions a key differentiator in the competitive landscape.

Investment activity in the mining equipment sector remains strong as mining companies prioritize fleet modernization, sustainability, and expansion into high-growth mineral categories such as lithium, copper, cobalt, and rare earth elements. Equipment manufacturers are increasing capital allocation toward R&D, electrification technologies, and digital platforms to respond to evolving customer needs. Governments in mineral-rich regions are also investing heavily in mining infrastructure, transportation networks, and technology hubs to attract private exploration and mining projects, which further supports equipment demand. Strategic collaborations between OEMs, technology providers, and mining companies are becoming more common to accelerate innovation and commercial deployment of next-generation machinery.

The regulatory landscape is evolving rapidly as governments worldwide introduce more stringent environmental, safety, and emissions standards in the mining sector. Regulations aimed at reducing carbon footprints, improving air quality, and minimizing ecological impact are influencing equipment specifications, fueling demand for cleaner powertrains and energy-efficient solutions. Worker safety regulations are also becoming more rigorous, prompting wider adoption of automated systems, collision-avoidance solutions, and advanced monitoring technologies. Compliance requirements related to waste management, land rehabilitation, and sustainable mining practices are driving mining companies to adopt equipment that supports higher precision and reduced environmental disturbance.

Despite positive growth drivers, the market faces several restraints. High upfront capital costs associated with advanced and automated equipment can limit adoption, particularly among small- to medium-sized mining companies. Volatility in commodity prices affects cash flows and investment cycles, influencing procurement decisions and slowing equipment replacement during downturns. Supply chain disruptions, fluctuating raw material costs, and lengthy production lead times also pose challenges for OEMs and end users.

Equipment Type Insights

The surface mining equipment segment led the market with the largest revenue share of 39.0% in 2024. Growth in the surface mining equipment segment is primarily driven by the increasing demand for bulk minerals such as coal, iron ore, and bauxite, which rely heavily on large-scale surface operations. The expansion of open-pit mines in the Asia Pacific, Latin America, and Africa is creating sustained demand for high-capacity excavators, dump trucks, dozers, and loaders. Mining companies are also investing in fleet modernization to enhance productivity, reduce fuel consumption, and minimize downtime, thereby fueling the adoption of advanced equipment with improved efficiency and automation features.

The underground mining equipment segment is expected to grow at the fastest CAGR during the forecast period. The underground mining equipment segment is experiencing robust growth due to increasing exploration of deep mineral deposits and the global shift toward hard-to-access ores such as gold, copper, nickel, and rare earth elements. As surface reserves become depleted, mining activities are moving deeper underground, creating sustained demand for specialized equipment such as underground loaders (LHDs), continuous miners, roof bolters, and long wall systems. Safety regulations and the need to minimize worker exposure in confined environments are accelerating the adoption of battery-electric equipment, remote-operated machinery, and ventilation-reducing technologies.

Power Source Insights

The gasoline segment accounted for the largest market revenue share in 2024. Growth in the gasoline-powered segment of the mining equipment industry is primarily driven by its widespread availability, lower upfront cost, and suitability for light to medium-duty mining tasks. Gasoline engines remain popular in smaller equipment categories, such as portable tools, compact loaders, and auxiliary machinery, especially in regions where electrification infrastructure is limited. Their ease of maintenance, quick refueling, and proven performance in remote or temporary mining sites make gasoline-powered machines a practical choice for small and mid-sized mining operations.

The electric segment is expected to grow at the fastest CAGR during the forecast period. The electric-powered equipment segment is expanding rapidly, fueled by the global push toward sustainable mining practices and stricter emission regulations. Mining operators are increasingly adopting electric loaders, trucks, drills, and haulage systems to reduce carbon footprints, minimize ventilation requirements, and lower long-term operating costs. Advances in battery technology, including higher energy density, fast-charging systems, and improved cycle life, are making electric equipment more viable for both surface and underground operations. The reduced noise, heat, and emissions profile of electric machinery significantly enhances worker safety and compliance with environmental regulations.

Power Output Insights

The 500-2000 HP segment accounted for the largest market revenue share in 2024. Growth in the 500-2000 HP segment is driven by its broad applicability across both surface and underground mining operations, making it one of the most widely used power ranges in the mining equipment industry. Equipment in this category, including medium to large excavators, haul trucks, loaders, and drilling rigs, offers an optimal balance of power, versatility, and fuel efficiency. Mining companies increasingly prefer this segment because it supports a wide spectrum of ore-handling, overburden removal, and material transport activities without the higher capital and operating costs associated with ultra-high-horsepower machines.

The >2000 HP segment is projected to grow at the fastest CAGR over the forecast period. The >2000 HP segment is expanding rapidly, driven by the growing need for high-capacity equipment capable of supporting large-scale open-pit mining operations. As major mining companies focus on maximizing throughput and operational efficiency, demand for ultra-powerful haul trucks, large hydraulic shovels, and high-tonnage excavators continues to rise. These machines are essential for handling massive overburden volumes, deeper pit geometries, and high-production environments, particularly in commodities such as iron ore, copper, and coal.

Application Insights

The coal mining segment accounted for the largest market revenue share in 2024. Growth in mining equipment demand for coal mining applications is driven by the continued reliance on coal for power generation and industrial purposes in several emerging economies. Countries in the Asia Pacific, particularly China, India, and Indonesia, are expanding or modernizing their coal mining operations to meet domestic energy needs, driving the adoption of high-capacity surface miners, continuous miners, longwall systems, and haulage equipment. The push to improve operational efficiency and reduce production costs in large open-cast coal mines is further stimulating demand for advanced drilling, blasting, and loading machinery.

The metal mining segment is expected to register the fastest CAGR over the forecast period.In metal mining applications, demand for mining equipment is increasing due to the global surge in metal consumption, particularly driven by energy transition technologies, infrastructure development, and manufacturing growth. The shift toward electrification, renewable energy systems, and battery technologies is significantly increasing the need for critical minerals, prompting mining companies to expand exploration and production activities. This trend drives demand for large excavators, high-tonnage haul trucks, drilling rigs, crushing and screening equipment, and underground machinery.

Regional Insights

The North America mining equipment market held a significant share in 2024. The mining equipment industry in North America is characterized by strong demand for high-capacity machinery, driven by ongoing investments in the extraction of metals, critical minerals, and industrial minerals. The region is witnessing increased adoption of automation, telematics, and electrified equipment as mining companies prioritize safety, productivity, and environmental compliance.

U.S. Mining Equipment Market Trends

The mining equipment market in the U.S. accounted for the largest market revenue share in North America in 2024, driven by rising production activities in metals, aggregates, and energy minerals. Mining operators are increasingly upgrading equipment fleets to meet stricter emissions standards and improve operational efficiency, fueling the adoption of electric, hybrid, and autonomous machines.

Europe Mining Equipment Market Trends

The mining equipment market in Europe was identified as a lucrative region in 2024. The growth in the region is driven by the region’s strategic push toward resource security, sustainability, and the development of circular economy initiatives. Demand is growing for low-emission, energy-efficient machinery as mining companies focus on reducing carbon footprints and meeting stringent EU environmental regulations.

The UK mining equipment industry is expected to grow at the rapid CAGR during the forecast period. The growth in the region is attributed to rising interest in domestic mineral exploration and the redevelopment of legacy mining assets. The government’s emphasis on securing local sources of lithium, cobalt, and other strategic minerals is encouraging investment in modern, efficient extraction equipment.

Asia Pacific Mining Equipment Market Trends

Asia Pacific dominated the mining equipment market with the largest revenue share of 35.6% in 2024 and is expected to grow at the fastest CAGR during the forecast period. Large-scale mining operations, rapid industrialization, and substantial investments in infrastructure and energy projects drive the growth in the region. Countries such as China, India, and Australia lead regional demand, supported by extensive production of coal, iron ore, base metals, and critical minerals.

The mining equipment market in Japan is expected to grow at a rapid CAGR during the forecast period. The growth of the market in the country is shaped by the country’s limited natural resources and the need to import most minerals, leading to a strong focus on efficiency and technological innovation.

The China mining equipment market held a substantial market share in 2024, due to its extensive mining operations and large domestic demand for coal, metals, and critical minerals. The country is rapidly modernizing its mining sector, with increasing adoption of intelligent mining systems, autonomous haulage, and fully electric underground equipment.

Key Mining Equipment Company Insights

Some of the key companies in the mining equipment industry include Epiroc, Boart Long Year Ltd,Caterpillar Inc., China Coal Energy Group Co. Ltd, Vipeak Mining Machinery Co. Ltd, and others. Organizations are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Epiroc is a manufacturer in the mining equipment industry, recognized for its wide-ranging portfolio of drilling rigs, rock excavation tools, haul trucks, loaders, rock reinforcement equipment, and advanced underground ventilation systems. The company supports both surface and underground mining operations with over 18,000 employees across 150 countries, backed by a robust service and aftermarket division.

-

Caterpillar Inc. is a manufacturer of mining equipment, renowned for its extensive range of heavy machinery. Caterpillar produces products including autonomous mining trucks, hydraulic excavators, loaders, and advanced telemetry systems that optimize mining operations through real-time data analytics. The company invests heavily in research and development to drive innovation, focusing on digitalization, automation, and sustainability through the use of energy-efficient and zero-emission equipment.

Key Mining Equipment Companies:

The following are the leading companies in the mining equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Epiroc

- Boart Long Year Ltd

- Caterpillar Inc.

- China Coal Energy Group Co. Ltd

- Vipeak Mining Machinery Co. Ltd

- Guangdong Leimeng Intelligent Equipment Group Co. Ltd

- Henan Baichy Machinery Equipment Co. Ltd

- Komatsu Ltd

- Liebherr

- Metso Qutotec

Recent Developments

-

In September 2025, Cummins Inc. and Komatsu Ltd. signed a memorandum of understanding to jointly develop hybrid powertrains for heavy mining equipment used in surface haulage, marking a major step in advancing decarbonization solutions within the mining industry. This partnership combines Cummins’ legacy in diesel engine technology with Komatsu’s expertise in mining equipment, with Wabtec serving as the drive system supplier. The collaboration will focus on integrating hybrid technologies, such as regenerative braking and advanced powertrains, into existing and future mining fleets to deliver significant fuel savings, reduce greenhouse gas emissions, and boost fleet productivity by enabling faster cycle times.

-

In April 2025, Hitachi Construction Machinery launched the LANDCROS Connect Insight solution, a cutting-edge platform designed to boost mining operation efficiency by analyzing the operational data of mining equipment in near real-time. This solution enables dealers and mining operators to remotely monitor machinery status, fuel consumption, and location in near real-time, providing detailed dashboards and predictive analysis capabilities for asset health.

Mining Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 155.41 billion

Revenue forecast in 2033

USD 239.44 billion

Growth rate

CAGR of 5.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment type, power source, power output, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Norway; Sweden; Finland; China; Japan; India; South Korea; Australia; Brazil; KSA; South Africa

Key companies profiled

Epiroc; Boart Long Year Ltd; Caterpillar Inc.; China Coal Energy Group Co. Ltd; Vipeak Mining Machinery Co. Ltd; Guangdong Leimeng Intelligent Equipment Group Co. Ltd; Henan Baichy Machinery Equipment Co. Ltd; Komatsu Ltd; Liebherr; Metso Qutotec

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mining Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global mining equipment market report based on equipment type, power source, power output, application, and region.

-

Equipment Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Underground Mining Equipment

-

Surface Mining Equipment

-

Crushing, Pulverizing & Screening Equipment

-

Drills & Breakers

-

Others

-

-

Power Source Outlook (Revenue, USD Billion, 2021 - 2033)

-

Gasoline

-

Electric

-

-

Power Output Outlook (Revenue, USD Billion, 2021 - 2033)

-

<500 HP

-

500-2000 HP

-

>2000 HP

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Metal Mining

-

Non-metal Mining

-

Coal Mining

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Norway

-

Sweden

-

Finland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Asia Pacific dominated the mining equipment market with a revenue share of over 35.6% in 2024. The ongoing industrialization and urbanization in countries such as China, India, and South Korea expected to positively affect the growth of the market in the region during the forecast period

b. Some of the key players operating in the mining equipment market include Epiroc; Boart Long year Ltd; Caterpillar Inc.; China Coal Energy Group Co. Ltd; Vipeak Mining Machinery Co. Ltd; Guangdong Leimeng Intelligent Equipment Group Co. Ltd; Henan Baichy Machinery Equipment Co. Ltd; Komatsu Ltd; Liebherr; Metso Qutotec.

b. The mining equipment market is experiencing steady growth driven by rising global demand for minerals, metals, and critical raw materials essential for construction, energy transition, and advanced manufacturing.

b. The global mining equipment market size was estimated at USD 148.10 billion in 2024 and expected to reach USD 155.41 billion in 2025.

b. The mining equipment market, in terms of revenue, expected to grow at a compound annual growth rate of 5.6% from 2025 to 2033 to reach USD 239.44 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.