- Home

- »

- Advanced Interior Materials

- »

-

Rare Earth Elements Market Size, Industry Report, 2030GVR Report cover

![Rare Earth Elements Market Size, Share & Trends Report]()

Rare Earth Elements Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Dysprosium, Neodymium), By Application (Magnets, Metallurgy), By Region (North America, Europe, APAC, Central & South America, MEA), And Segment Forecasts

- Report ID: 978-1-68038-075-0

- Number of Report Pages: 95

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Rare Earth Elements Market Summary

The global rare earth elements market size was estimated at USD 3.95 billion in 2024 and is projected to reach USD 6.28 billion by 2030, growing at a CAGR of 8.6% from 2025 to 2030. The price spike in 2022, owing to the supply glut and geopolitical tensions between China and developed countries, and the gradual decline in prices thereafter resulted in higher revenue gains for the market in 2022 and 2023.

Key Market Trends & Insights

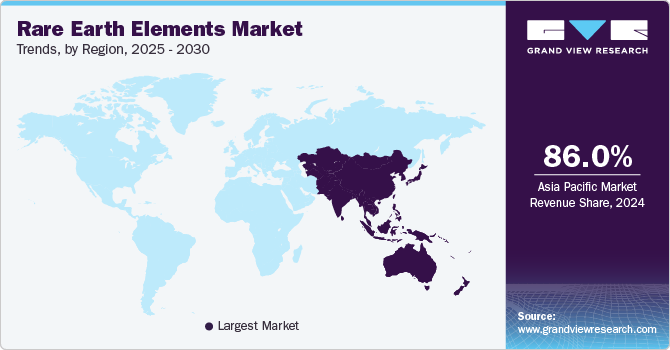

- Asia Pacific was the dominant region, with a revenue share of over 86% in 2024.

- The rare earth elements market in China is the largest producer and consumer of REE in the world, producing about 60% of the global output, and processing nearly 90%.

- By product, neodymium is used in the production of permanent magnets and accounted for the highest revenue share of 30.3% in 2024.

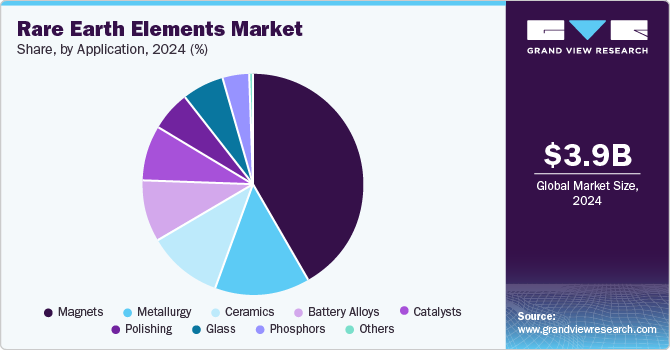

- By application, magnets was the largest application segment in 2024 and accounted for about 41.0% of the global revenue share.

Market Size & Forecast

- 2024 Market Size: USD 3.95 Billion

- 2030 Projected Market Size: USD 6.28 Billion

- CAGR (2025-2030): 8.6%

- Asia Pacific: Largest market in 2024

The growing demand for permanent magnets and catalysts in the automotive industry is anticipated to drive the market over the forecast period.

REEs are used to produce permanent magnets and battery alloys that are used in electric vehicle (EV) batteries, smart-phones, defense technology and other applications that require a very high strength-to-weight ratio and performance at high temperatures. For instance, neodymium and praseodymium based rare earth permanent magnets are used in manufacturing EV batteries. As per the International Energy Agency (IEA), the global sales of electric vehicles (EV) were about 14.2 million in 2023, compared to 10.5 million in the previous year. Rising demand for electric vehicles to reduce CO2 emissions is expected to propel the use of permanent magnets in the production of batteries.

Drivers, Opportunities & Restraints

The usage of permanent magnets in the production of EV batteries is expected to drive the demand for rare earth elements over the forecast period. Neodymium and praseodymium based rare earth permanent magnets are majorly used for this purpose. The efforts by governments to align their countries with the global decarbonization goals, in line with the 2021 Paris Agreement, have surged the global production of EVs.

Global EV sales have experienced a substantial surge from 2017 to 2023. They rose from approximately 1 million units in 2017 to over 10 million units sold in 2023. To provide context, the sales of EVs grew from 100,000 units to 1 million units from 2012 to 2017, thereby emphasizing their exponential expansion. This phenomenal growth has transformed into a significant increase in the industry share of EVs that has risen from 9% in 2021 to 14% and 35% in 2022 and 2023, respectively. This marks a tenfold increase in the share of these vehicles in the global market since 2017.

Also, the product life cycles of consumer electronics and electronic gadgets are becoming shorter. Constant technology upgrades have resulted in either reuse or recycling of electronic gadgets and consumer durables. However, recycling to retrieve rare earth is in a nascent stage, which is expected to result in increasing mining and exploration activities to cope with demand. Hence, the shorter life cycles of electronic components are expected to remain a driver for rare earth elements at a time when they are faced with a steep price decline.

A key growth opportunity for the rare earth elements industry is the concentration of rare earth elements in China, and the country’s ongoing monopolistic policies with regards to supply and prices. In addition to the supply dominance, the ongoing geopolitical tensions between China, the U.S., and Europe, new opportunities open up for producers from other countries such as the U.S., European countries, Australia, and Africa.

The high degree of price decline, recently tending to the downside, is becoming a key restraint to rare earth supply. Historically, the price of rare earth elements has witnessed a high, increasing year-on-year from 2018-2022, to reach its highest levels in 2022. This was also the case for rare earth oxides (REO), the most sold form of REE. Thereafter there was a price decline from 2023, owing to a softening of demand from green energy companies and the automotive industry. Moreover, the increasing supply of REO from the world’s largest producer, China, resulted in a drastic reduction in prices.

Product Insights

Neodymium is used in the production of permanent magnets and accounted for the highest revenue share of 30.3% in 2024. Neodymium was the leading segment and is anticipated to witness a CAGR of 8.1% over the forecast period. The growth in the automotive and energy industries is anticipated to drive demand. They are especially used in EVs and wind turbines within motors and generators, besides which they find applications in consumer electronics. The growing demand for hybrid vehicles is expected to have a positive influence on demand for rare earth over the forecast period.

Dysprosium is majorly used as an alloying agent in neodymium-iron-boron (Neo) permanent magnets. Neo magnets are widely used in various application industries, including transportation, power generation, aerospace & defense, medical and industrial. Its increasing demand is expected to drive dysprosium demand over the forecast period.

Gadolinium demand is expected to be driven by the increasing demand for nuclear reactors. It is used as a neutron absorber in fresh fuel to control and regulate the reactivity of the nuclear reactor core. It is also used in alloys for producing electronic components, data storage disks, and magnets.

Praseodymium is anticipated to witness a revenue CAGR of 10.7% over the forecast period. It is used as an alloying agent with magnesium to produce high strength metals for aircraft engines. The International Air Transport Association (IATA) announced that air traffic increased by 36.9% in 2023, as compared to 2022. Globally, traffic in 2023 was at 94.1% of pre-pandemic (2019) levels. Hence, the rebound in travel and tourism, and foreign worker participation in the global workforce is expected to augment the demand for overseas travel and aircraft production, and positively influence praseodymium demand over the forecast period.

Application Insights

Magnets was the largest application segment in 2024 and accounted for about 41.0% of the global revenue share. Most REEs possess magnetic properties, which make them the strongest permanent magnets. Properties such as field strength, remanence, Curie temperature, energy product, and coercivity, are used to compare permanent magnets.

Rare earths such as samarium, neodymium, and dysprosium are important constituents of magnets. They are used in various applications such as in computer hard disc drives, linear actuators, servo motors, speakers & headphones, and sensors. The increasing demand from automobiles, turbines, and consumer electronics is anticipated to boost consumption of REEs over the forecast period.

Regional Insights

Asia Pacific was the dominant region, with a revenue share of over 86% in 2024. Asia Pacific rare earth elements market is driven by the growing economy, rising disposable income, and the subsequent increase in the production of automobiles, electronics, and wind power generators in the region. Moreover, the shift of manufacturing plants across industries from high-cost developed countries to low-cost developing countries is expected to be attributed to REE demand. Additionally, rising investments in the automotive industry and the production of electric motors for EVs are also expected to boost demand.

China Rare Earth Elements Market Trends

The rare earth elements market in China is the largest producer and consumer of REE in the world, producing about 60% of the global output, and processing nearly 90%. According to USGS, rare earth element production was 240,000 tons in 2023. In December 2023, China announced a ban on rare earth extraction and separation technologies. This comes in addition to its ongoing export restrictions on REEs. Such measures have a significant and critical impact on the world’s REE supply. Mining activities are ongoing in other parts of the world to mitigate the adverse impact of supply shortage of this critical element group, which will eventually spike prices in future.

Europe Rare Earth Elements Market Trends

Europe rare earth elements market accounts for about 5% of the global production of permanent magnets, a key application of REEs. The region is, however, vastly dependent on Chinese rare earth imports. Due to the ongoing export restrictions, Europe is looking at alternative REE sources. A lot of R&D is underway to find suitable alternatives, and also source REEs from sustainable mines and producers in other parts of the world.

North America Rare Earth Elements Market Trends Trends

The rare earth elements market in North America is a frontrunner in ongoing R&D for REE substitutes. The region is also exploring alternative mining options to reduce its dependency on Chinese supply. The U.S. has been witnessing a significant rise in the adoption of plug-in EVs, offered by key players such as Tesla, Chevy, Nissan, Ford, Audi, and BMW, among others. Thus, rising demand for EVs is expected to drive the demand for REEs over the forecast period.

Central & South America Rare Earth Elements Market Trends

Central & South America rare earth elements market has significant potential for REE production. Brazil accounts for 0.2% of global REE production. The region is yet to attract sufficient investment in the upper level of the value chain, i.e., mining and exploration, with only about 7% of the global exploration budget for REE being allocated to the region.

Middle East & Africa Rare Earth Elements Market Trends

The rare earth elements market has potential reserves of about 4 million tons, concentrated in Africa. The region has some high-grade deposits in the world. Two of the deposits, Lofdal in Namibia and SKK in South Africa, have high content of critical rare earth oxides (CREO). This is a driver for value chain development in the region. Demand is low and is currently not the significant focus in the region.

Key Rare Earth Elements Company Insights

Some key players operating in the industry include Lynas Corporation Ltd. and Arafura Resources Ltd.

-

Lynas Corporation Limited, together with its subsidiaries, engages in the exploration, development, mining, and processing of rare earth elements. It was incorporated in 1983, and is headquartered in Perth, Western Australia. It undertakes exploration, development, mining and processing activities. It is located in Mt Weld -35km south of Laverton at Mt Weld in Western Australia. Its concentration plant is located 1.5km from the mine site. Additionally, Lynas Malaysia, located in the Gebeng Industrial Estate near the Port of Kuantan.

-

Arafura Rare Earths Limited is an Australian mineral exploration company focusing on rare earth elements. It was incorporated in 1997, and is headquartered in Perth, Western Australia. The company's flagship project is the Nolans Rare Earths Project, located in Australia's Northern Territory.

Key Rare Earth Elements Companies:

The following are the leading companies in the rare earth elements market. These companies collectively hold the largest market share and dictate industry trends.

- Alkane Resources Ltd

- Arafura Resources Ltd

- Avalon Advanced Materials Inc.

- China Northern Rare Earth (Group) High-Tech Co., Ltd.

- Greenland Minerals Ltd

- Hitachi Metals Ltd.

- Iluka Resources Limited

- Indian Rare Earth Limited

- Lynas Corporation Ltd

- Northern Minerals Ltd

- Rare Element Resources Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Ucore Rare Metals Inc.

Recent Developments

-

In April 2024, U.S.-based MP Materials received USD 58.5 million for furthering the construction of the country’s first integrated rare earth magnet manufacturing facility. The plant is located in Forth Worth, Texas, and is expected to begin commercial production by late 2025.

-

In April 2023, India-based IREL (India) Ltd. announced that it plans to boost its mining capacity by 400% in the coming decade, thereby increasing its production to 13,000 tons from the existing 5,000 tons.

-

In July 2023, USA Rare Earth announced its plans to invest USD 100 million to set up a neodymium magnet production facility in Stillwater, Oklahoma, with an initial 1,200 tons per annum capacity. Production is expected to commence by early 2026 and will be ramped up to 4,800 tons per annum.

Rare Earth Elements Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.15 billion

Revenue forecast in 2030

USD 6.28 billion

Growth rate

CAGR of 8.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative Units

Volume in Tons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Germany; UK; France; China; Japan; India

Key companies profiled

Alkane Resources Ltd; Arafura Resources Ltd; Avalon Advanced Materials Inc.; China Northern Rare Earth (Group) High-Tech Co., Ltd.; Greenland Minerals Ltd; Hitachi Metals Ltd.; Iluka Resources Limited; Indian Rare Earth Limited; Lynas Corporation Ltd; Northern Minerals Ltd; Rare Element Resources Ltd.; Shin-Etsu Chemical Co., Ltd.; Ucore Rare Metals Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

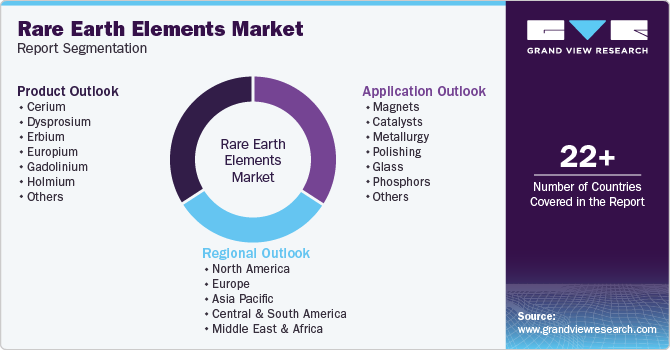

Global Rare Earth Elements Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rare earth elements market report based on product, application and region.

-

Product Outlook (Volume, Tons; Revenue, USD Million; 2018 - 2030)

-

Cerium

-

Dysprosium

-

Erbium

-

Europium

-

Gadolinium

-

Holmium

-

Lanthanum

-

Lutetium

-

Neodymium

-

Praseodymium

-

Promethium

-

Samarium

-

Scandium

-

Terbium

-

Thulium

-

Ytterbium

-

Yttrium

-

-

Application Outlook (Volume, Tons; Revenue, USD Million; 2018 - 2030)

-

Magnets

-

Catalysts

-

Metallurgy

-

Polishing

-

Glass

-

Phosphors

-

Ceramics

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global rare earth elements market size was estimated at USD 3.95 billion in 2024 and is expected to reach USD 4.15 billion in 2025.

b. The global rare earth elements market is expected to witness a compound annual growth rate of 8.6% from 2025 to 2030 to reach USD 6.28 billion by 2030.

b. Based on application segment, magnets accounted for the largest revenue share of about 42.0% in 2024 owing to growth in the EV and wind turbine segments

b. Some of the key vendors of the global rare earth elements market are Lynas Corporation Ltd, Alkane Resources Ltd, Northern Minerals Ltd, Arafura Resources Ltd, Ucore Rare Metals Inc., Hitachi Metals Ltd., Shin-Etsu Chemical Co., Ltd., Greenland Minerals Ltd, Iluka Resources Limited, Indian Rare Earth Limited, Avalon Advanced Materials Inc., Rare Element Resources Ltd., and China Northern Rare Earth (Group) High-Tech Co., Ltd.

b. Growth in the wind energy sector and increasing requirement for EVs as part of the global green energy transition are the key factors driving the global rare earth elements market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.