- Home

- »

- Automotive & Transportation

- »

-

Drilling Rig Market Size, Share, Growth, Industry Report 2033GVR Report cover

![Drilling Rig Market Size, Share & Trends Report]()

Drilling Rig Market (2025 - 2033) Size, Share & Trends Analysis Report By Deployment (Onshore, Offshore), By Type (Jack-ups, Submersible, Drill Ships), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-761-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Drilling Rig Market Summary

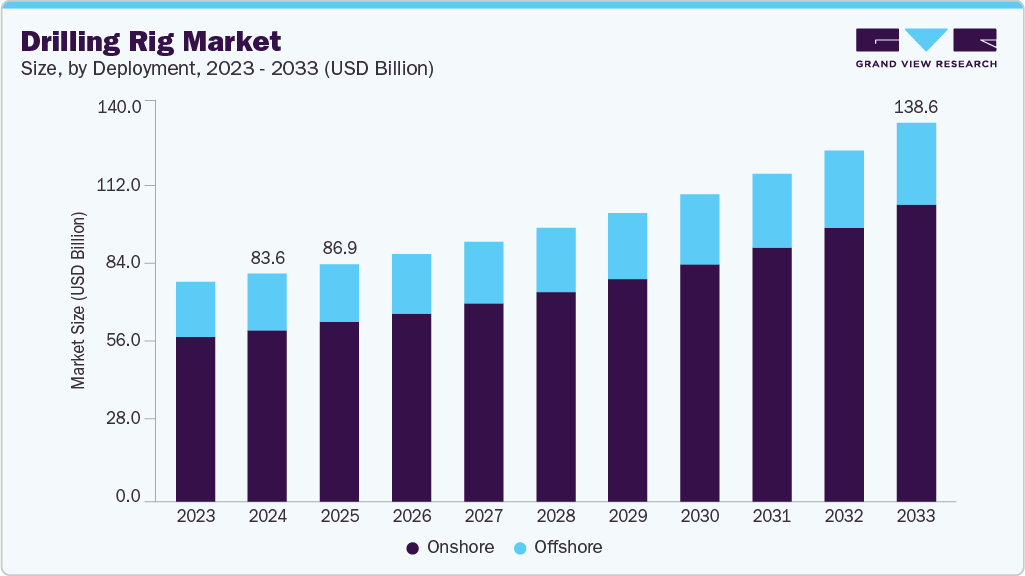

The global drilling rig market size was estimated at USD 83.58 billion in 2024 and is projected to reach USD 138.61 billion by 2033, growing at a CAGR of 6.0% from 2025 to 2033. One of the most prominent drivers of the global market is the growing demand for oil and gas, particularly in emerging economies.

Key Market Trends & Insights

- North America dominated the drilling rig market with the largest revenue share of 38.5% in 2024.

- The drilling rig market in the U.S. accounted for the largest market revenue share in 2024.

- By deployment, the onshore segment led the market with the largest revenue share of 75.2% in 2024.

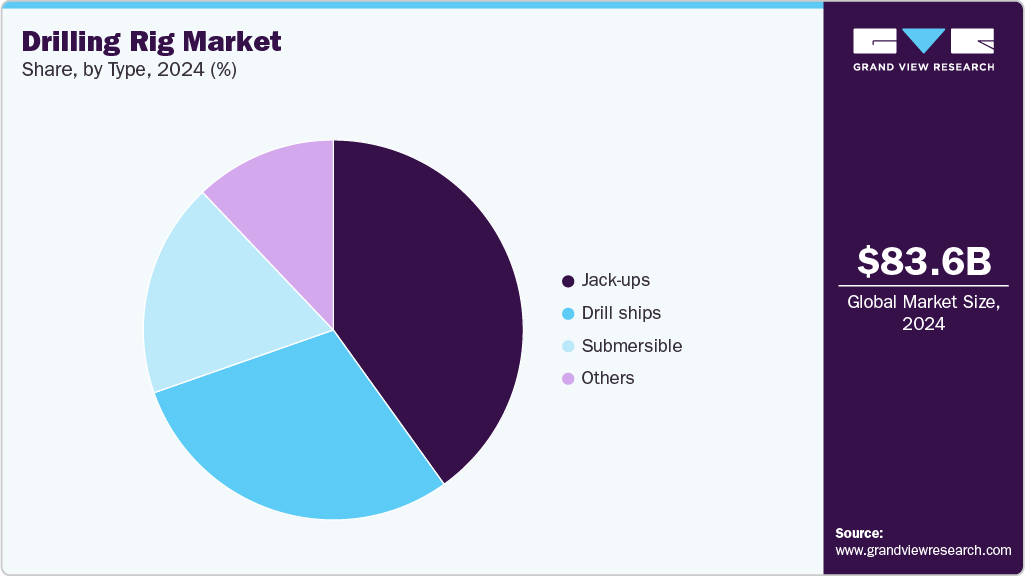

- By type, the jack-ups segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 83.58 Billion

- 2033 Projected Market Size: USD 138.61 Billion

- CAGR (2025-2033): 6.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Nations such as China, India, and several African countries are experiencing rapid industrialization and urbanization, which is pushing up energy consumption across transportation, manufacturing, and power generation sectors. While developed economies are accelerating their transition toward renewable energy, fossil fuels remain a critical part of the global energy mix, especially in regions with expanding middle-class populations and infrastructure needs. Offshore drilling is evolving rapidly, with the industry increasingly targeting deepwater and ultra-deepwater reserves. Traditional shallow-water exploration is gradually giving way to projects located in water depths exceeding 1,500 meters, particularly in resource-rich regions such as Brazil’s pre-salt fields, Guyana, and West Africa. These frontier basins hold vast untapped hydrocarbon reserves that require highly advanced rigs, such as drill ships and semisubmersibles, equipped with dynamic positioning, advanced blowout preventers, and robust safety features.

The economics of deepwater drilling are improving as oil prices stabilize above breakeven levels for high-spec offshore projects. Moreover, governments in resource-abundant regions are incentivizing offshore exploration with favorable regulatory and licensing regimes, further boosting demand. As a result, the deepwater and ultra-deepwater segment is becoming one of the most critical growth engines for the drilling rigs industry.

Technological innovation is reshaping drilling operations by making rigs more efficient, safer, and cost-effective. Automation tools are increasingly being integrated into rig systems, reducing human intervention in hazardous environments and enabling remote-controlled drilling operations. The adoption of real-time data analytics and digital twins allows operators to simulate drilling environments, optimize well planning, and improve drilling precision. Predictive maintenance powered by artificial intelligence (AI) and advanced sensors helps minimize unplanned downtime, thereby extending rig life and reducing operational expenses. Robotics and machine learning are also transforming repetitive tasks such as pipe handling, further enhancing efficiency.

Environmental sustainability has emerged as a major theme in the global drilling rigs industry. With mounting pressure from regulators, investors, and the public, drilling contractors are under increasing scrutiny to reduce the carbon footprint of their operations. Hybrid power systems that integrate conventional diesel with battery storage, more fuel-efficient engines, and emission-reducing rig designs are being adopted to align with global climate goals. Technologies aimed at reducing flaring, capturing methane, and supporting carbon capture and storage (CCS) initiatives are being implemented alongside drilling projects. Offshore operators, in particular, are exploring synergies with renewable energy sources such as offshore wind to partially power rig operations.

The drilling rigs industry is also undergoing structural transformation through consolidation and modernization. Mergers, acquisitions, and strategic partnerships are becoming more common as contractors aim to achieve economies of scale, diversify geographically, and strengthen their financial resilience. At the same time, the industry is retiring older, less efficient rigs and replacing them with modern, high-spec rigs designed to meet today’s technical, safety, and environmental requirements. Offshore fleets are particularly benefiting from modernization, with newer rigs offering better efficiency, automation capabilities, and suitability for deepwater operations. This rationalization of fleets ensures higher utilization rates, improved day rates, and stronger profitability.

Deployment Insights

The onshore segment led the market with the largest revenue share of 75.2% in 2024, continues to dominate the global market due to the abundance of accessible reserves, lower operational costs compared to offshore projects, and the concentration of shale and tight oil production in regions such as North America and the Middle East. The resurgence of unconventional drilling, particularly horizontal drilling and multistage hydraulic fracturing, has significantly boosted the efficiency of onshore operations. In addition, the adoption of digitalization, automation, and predictive analytics in land rigs is driving productivity gains and reducing downtime, making onshore drilling increasingly cost-competitive.

The offshore segment is expected to grow at the fastest CAGR during the forecast period.Global energy companies are increasingly investing in offshore basins such as Brazil’s pre-salt reserves, Guyana, and West Africa, which hold substantial untapped hydrocarbon potential. The growing demand for high-specification rigs, including modern drill ships and semisubmersibles equipped with dynamic positioning and advanced safety systems, is accelerating offshore market growth. Moreover, higher oil prices and improving project economics are reviving postponed offshore projects, while technological advancements are enabling operators to drill in harsher environments with greater efficiency. As sustainability becomes central, offshore operators are also adopting hybrid power systems and low-emission rigs, aligning with global energy transition goals while expanding offshore capacity.

Type Insights

The jack-ups segment accounted for the largest market revenue share in 2024, largely due to its suitability for shallow-water operations, which remain the most widely explored and cost-effective offshore environments. Jack-ups are particularly in demand across the Middle East, Southeast Asia, and parts of Africa, where shallow-water reserves account for a significant portion of offshore production. Their lower day rates compared to floaters, faster mobilization, and adaptability for workover and development drilling make them the preferred choice for national oil companies (NOCs) and independent operators alike. The modernization of jack-up fleets with enhanced automation, digital monitoring systems, and improved safety features is also extending their operational life and boosting utilization rates.

The drill ships segment is projected to grow at the fastest CAGR of 6.4% over the forecast period.These rigs are designed for operations in water depths exceeding 3,000 meters. They are increasingly deployed in high-potential offshore basins such as Brazil’s pre-salt fields, the Gulf of Mexico, and West Africa. Equipped with advanced dynamic positioning systems, high-spec blowout preventers, and automated drilling technologies, drill ships are capable of handling complex drilling programs in challenging environments. The improving economics of deepwater exploration, coupled with higher oil prices and advances in rig efficiency, are encouraging oil companies to prioritize deepwater projects.

Regional Insights

North America dominated the drilling rig market with the largest revenue share of 38.5% in 2024. The growth in the region is driven by high upstream investment in the U.S. shale industry and offshore Gulf of Mexico projects. The region benefits from mature oilfield infrastructure, advanced rig technologies, and a strong base of independent exploration & production (E&P) companies. Increasing redeployment of rigs in both onshore unconventional basins and offshore deepwater fields is driving growth, alongside regulatory support for energy security and domestic production.

U.S. Drilling Rig Market Trends

The drilling rigs market in the U.S. accounted for the largest market revenue share in 2024, due to large-scale shale drilling activities across the Permian, Bakken, and Eagle Ford basins. Offshore activity in the Gulf of Mexico also continues to add to rig demand, particularly for high-specification floaters. The country’s focus on strengthening domestic oil & gas output, coupled with a strong push from private operators, is keeping rig utilization rates high.

Europe Drilling Rig Market Trends

The drilling rig market in Europe was identified as a lucrative region in 2024, largely driven by the North Sea basin. Rising demand for offshore drilling projects in Norway and the UK is sustaining rig deployment, while energy transition policies are simultaneously encouraging efficiency upgrades in rig fleets. Investments in marginal field development and extended reach drilling are also boosting activity.

The UK drilling rig market is expected to grow at a steady CAGR during the forecast period, backed by North Sea redevelopment projects and investments in offshore wind-to-hydrocarbon hybrid infrastructure. Despite a broader push for renewable energy, continued reliance on oil & gas is driving drilling campaigns in mature fields.

The Germany drilling rig market is smaller in scale, supported by onshore natural gas exploration and geothermal drilling initiatives. Sustainability-driven policies are pushing operators to deploy advanced rigs with lower emissions and higher energy efficiency.

Asia Pacific Drilling Rig Market Trends

The drilling rig market in Asia Pacific is anticipated to grow at the fastest CAGR of 6.8% during the forecast period, supported by rising offshore exploration in Southeast Asia, Australia, and India. The region’s growing energy demand, coupled with government-backed upstream investments, is boosting the utilization of both jack-ups and drillships. Rapid industrialization and national oil company (NOC) activity are key growth drivers.

The Japan drilling rig market is gaining traction through offshore gas exploration and technology exports to regional operators. Growing interest in energy security and exploration of domestic resources is shaping demand.

The drilling rig market in China held a substantial share in 2024, fueled by both onshore and offshore developments. Investments in the Bohai Bay and South China Sea are boosting offshore rig demand, while continued shale gas exploration in Sichuan and other basins support onshore rig activity. The government’s focus on energy independence and technology innovation is further accelerating rig deployment.

Key Drilling Rig Company Insights

Some of the key companies in the drilling rig industry include Transocean Ltd., Seadrill Limited, Nabors Industries Ltd., and others. Key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Transocean Ltd. is one of the prominent offshore drilling contractors worldwide. It owns and operates a fleet of mobile offshore drilling units, including ultra-deepwater and harsh-environment floaters, semisubmersibles, and drillships. The company is positioned in technically demanding segments of the offshore market, which tend to command higher day-rates and require more specialized rigs.

-

Seadrill Limited is another major offshore drilling contractor, with operations in harsh-environment rigs, drillships, jack-ups, and floaters. The company emphasizes a modern fleet with relatively young rigs compared to competitors, which helps with reliability, regulatory compliance, and operational efficiency. Seadrill also focuses on safety, reactivation/upgrade of rigs, and cost control.

Key Drilling Rig Companies:

The following are the leading companies in the drilling rig market. These companies collectively hold the largest market share and dictate industry trends.

- Nabors Industries Ltd.

- Transocean Ltd.

- SAIPEM SpA

- Seadrill Limited

- Schlumberger NV (SLB)

- Valaris Limited

- Noble Corporation

- China Oilfield Services Ltd. (COSL)

- Baker Hughes

- ADNOC Drilling

Recent Developments

-

In August 2025, Clean Rig Power unveiled a battery-powered well service rig, designed to cut emissions, fuel costs, and noise compared to traditional diesel rigs. The rig can run for more than a full shift on a single charge, with auxiliary battery packs and multiple charging options, including grid connection and on-site recharging. It is currently in prototype assembly and testing, with major interest from operators in the Permian Basin and regions with strict emissions regulations such as California, Colorado, and overseas markets. The design emphasizes safety and quiet operation, allowing crews to work more efficiently and safely. Manufacturing and assembly will take place in McGregor, Texas, with Clean Rig also planning to license its patented technology.

-

In September 2024, Komatsu launched its new Z3 series of medium-sized class underground hard rock mining machines, including the ZJ32 drill and ZB31 bolter. Built on a universal modular platform, the Z3 line emphasizes efficiency, easier maintenance, and interchangeable parts to boost productivity. The machines feature simplified operator controls and innovative technology such as a ground support system co-developed with JENNMAR, along with drilling attachments designed for smoother operation and reduced downtime. Future models will include battery-powered and intelligent machine control versions, supporting the shift toward autonomous underground mining.

Drilling Rig Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 86.97 billion

Revenue forecast in 2033

USD 138.61 billion

Growth rate

CAGR of 6.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report frequency

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Nabors Industries Ltd.; Transocean Ltd.; SAIPEM SpA; Seadrill Limited; Schlumberger NV (SLB); Valaris Limited; Noble Corporation; China Oilfield Services Ltd. (COSL); Baker Hughes; ADNOC Drilling

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Drilling Rig Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global drilling rig market report based on deployment, type, and region:

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Onshore

-

Offshore

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Jack-ups

-

Submersible

-

Drill ships

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global drilling rig market size was estimated at USD 83.58 billion in 2024 and is expected to reach USD 86.97 billion in 2025.

b. The global drilling rig market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2033 to reach USD 138.61 billion by 2033.

b. The onshore segment accounted for the largest share of 75.2% in 2024, continues to dominate the global drilling rigs market due to the abundance of accessible reserves, lower operational costs compared to offshore projects, and the concentration of shale and tight oil production in regions such as North America and the Middle East.

b. Some prominent players in the drilling rig market include Nabors Industries Ltd., Transocean Ltd., SAIPEM SpA, Seadrill Limited, Schlumberger NV (SLB); Valaris Limited, Noble Corporation, China Oilfield Services Ltd. (COSL), Baker Hughes, and ADNOC Drilling.

b. A key driving trend in the drilling rig market is the rising demand for advanced, automated, and energy-efficient rigs to support deeper exploration and maximize drilling productivity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.