- Home

- »

- Advanced Interior Materials

- »

-

Underground Mining Equipment Market Size Report, 2033GVR Report cover

![Underground Mining Equipment Market Size, Share & Trends Report]()

Underground Mining Equipment Market (2026 - 2033) Size, Share & Trends Analysis Report By Equipment (Shuttle Cars, Scooptrams), By Mining Technique (Room & Pillar, Longwall Mining), By Application (Coal Mining, Metal Mining), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-492-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Underground Mining Equipment Market Summary

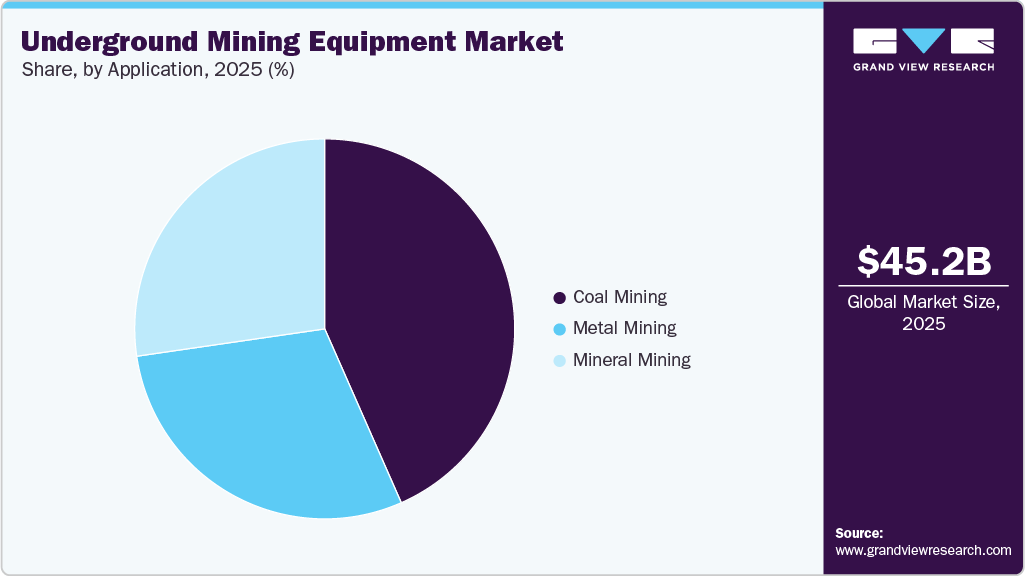

The global underground mining equipment market size was estimated at USD 45.17 billion in 2025 and is projected to reach USD 72.9 billion by 2033, growing at a CAGR of 6.4% from 2026 to 2033. Growing demand for coal, metals, and minerals is significantly driving underground mining equipment adoption as industries expand power generation, construction, and manufacturing capacity.

Key Market Trends & Insights

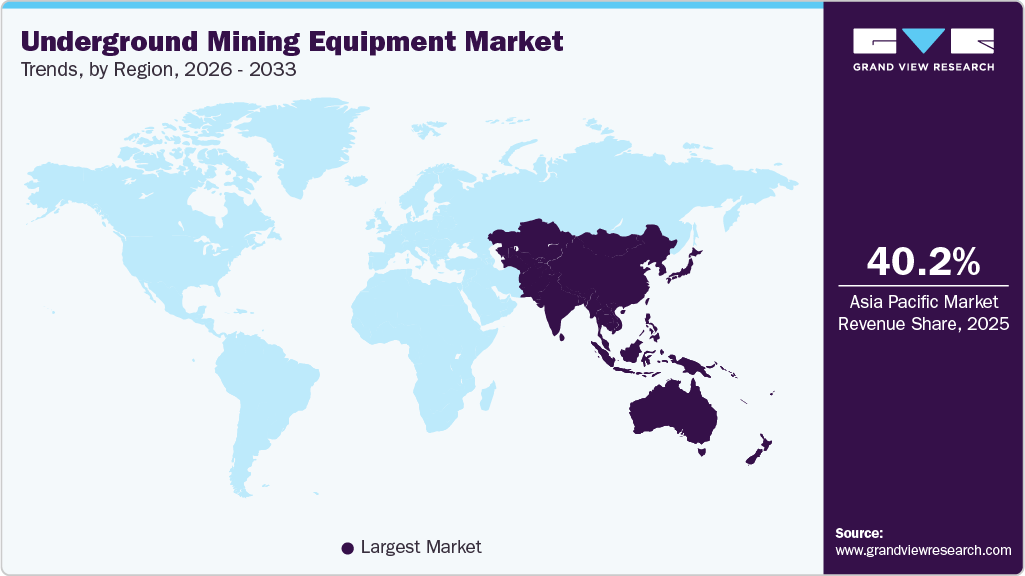

- Asia Pacific dominated the global underground mining equipment industry with the largest revenue share of 40.2% in 2025.

- China underground mining equipment industry dominated the Asia Pacific market in 2025.

- By equipment, the load haul dump (LHD) segment is expected to grow at a considerable CAGR of 7.2% from 2026 to 2033 in terms of revenue.

- By mining technique, the longwall mining segment is expected to grow at a considerable CAGR of 6.8% from 2026 to 2033 in terms of revenue.

- By application, the metal mining segment is expected to grow at a considerable CAGR of 7.1% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 45.17 Billion

- 2033 Projected Market Size: USD 72.9 Billion

- CAGR (2026-2033): 6.4%

- Asia Pacific: Largest market in 2025

Advancements in automation, tele-remote control, and electrification technologies are enhancing productivity and safety in confined underground environments.Stricter worker safety mandates and emission control regulations are pushing mining companies to adopt equipment with dust suppression, battery-electric propulsion, and improved ventilation efficiency. Investments in longwall mining and room-and-pillar operations are rising to extract high-quality coal and metals efficiently, fueling need for bolters, scooptrams, articulated vehicles, and other underground solutions. Major mining operators are also modernizing fleets to reduce operational downtime and improve asset utilization across coal mining, metal mining, and mineral mining applications.

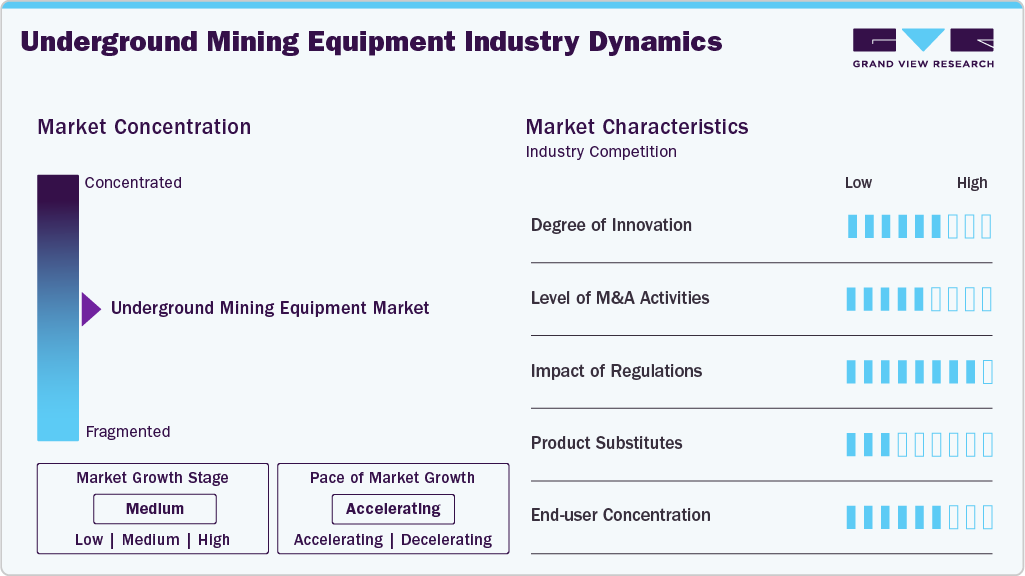

Market Concentration & Characteristics

The underground mining equipment industry is moderately concentrated, with a few global players holding strong influence due to advanced technology portfolios and long-term contracts with major mining operators. Companies investing in automation, battery-electric fleets, and digital mine solutions are capturing a larger share, strengthening competitive barriers. However, localized manufacturers continue to compete in cost-sensitive regions with conventional equipment offerings. As deeper ore extraction and safety mandates rise, leading OEMs are expected to widen their dominance through innovation and equipment lifecycle services.

Innovation in the underground mining equipment industry is accelerating, driven by the push for automation, electrification, and real-time monitoring systems. OEMs are focusing on battery-electric LHDs, autonomous haulage units, and predictive maintenance tools to reduce emissions and downtime. Digital twin models and remote-operation capabilities are improving decision-making in complex underground environments. Continuous R&D investment is creating differentiated product portfolios and reshaping operational efficiency benchmarks.

Stringent regulations related to worker safety, ventilation standards, and underground emissions strongly influence equipment design and procurement strategies. Mining operators are compelled to shift toward low-emission propulsion systems, advanced dust suppression, and high-reliability safety systems. Compliance costs drive the adoption of newer machinery over refurbishment of aging fleets. As more regions reduce surface mining permits, regulatory trends are indirectly encouraging underground mining expansion.

The market exhibits high end user concentration, as large mining companies dominate procurement volumes through multi-equipment orders and long-term service agreements. Their strong purchasing power accelerates demand for automated LHDs, underground trucks, bolters, and drilling equipment tailored to deep-ore extraction. Smaller operators typically focus on cost-efficient or refurbished units, creating a distinct budget-driven segment. Consolidation within metal and coal mining industries further increases reliance on top-tier OEMs with global support networks.

Drivers, Opportunities & Restraints

Rising demand for metals, minerals, and coal to support manufacturing, construction, and energy sectors is accelerating underground mining operations. The shift toward deeper ore extraction, where surface mining is no longer viable, is boosting equipment adoption. Automation, battery-electric machinery, and digital mine solutions are improving efficiency and worker safety in confined environments. Expansion of mining activities in emerging economies is further propelling fleet modernization and new equipment purchases.

Growing focus on zero-emission mining presents strong opportunities for electric LHDs, hybrid haulage equipment, and intelligent ventilation systems. Increasing investment in high-grade metal mining, especially copper and rare earth elements for clean energy technologies, is opening new underground project pipelines. Retrofit and automation upgrades for existing fleets create recurring revenue potential for OEMs and service providers. Technology partnerships between equipment manufacturers and mining companies are fostering customized, high-value equipment solutions.

High capital expenditure and maintenance costs of underground mining equipment limit adoption for small and mid-sized miners. Harsh geological conditions and limited space increase wear, breakdown risks, and the need for reliable support services. Skilled labor shortages restrain deployment of advanced, autonomous equipment in certain regions. In addition, volatile commodity prices can delay underground expansion plans and reduce procurement budgets.

Equipment Insights

Load Haul Dump (LHD) held the largest share in the market, accounting for 27.6 % share in 2025, because they are essential for ore transportation in narrow and deep tunnels. Their increasing shift toward battery-electric propulsion is improving ventilation efficiency and reducing operational emissions. Automation and tele-remote functionalities are strengthening adoption in large-scale metal and coal mines. Continuous fleet upgrades for higher payload capacity and durability keep LHDs at the center of underground material handling.

Drills segment is expected to grow at a considerable CAGR of 7.0% from 2026 to 2033 in terms of revenue. Drilling equipment is seeing strong growth as underground expansion requires precise borehole development for blasting, rock support, and exploration activities. Demand is rising in longwall and room-and-pillar operations where productivity depends on fast and accurate drilling cycles. Technology upgrades like automated drill rigs and real-time rock condition monitoring are enhancing mining efficiency. Increased exploration spending for copper, gold, and rare earth metals is further driving drill equipment investment.

Mining Technique Insights

Room and pillar mining dominated the underground technique landscape and accounted for 39.9% share in 2025, due to its widespread use in coal and industrial mineral extraction with stable ground conditions. The method allows continuous operations with lower equipment complexity, making it cost-effective for high-volume production. Minimal surface disturbance supports regulatory compliance in environmentally sensitive regions. Its compatibility with haulage equipment like mining trucks and LHDs sustains strong adoption across mature mining markets.

The longwall mining segment is expected to grow at a notable CAGR of 6.8% from 2026 to 2033 in terms of revenue, as mining companies seek higher productivity and fully automated extraction of deep coal seams. Continuous cutting systems, remote-controlled shearers, and real-time monitoring significantly reduce labor exposure and boost safety. High recovery rates and operational efficiency make it attractive for large-scale mines transitioning from surface mining. Investments in electrified conveyors and intelligent support systems are further accelerating longwall technique deployment.

Application Insights

Coal mining continued to dominate equipment demand and accounted for 43.5% share in 2025, owing to its large global production scale and reliance on underground extraction in deeper reserves. Countries focusing on thermal power generation and steel manufacturing sustain steady coal output despite renewable growth. Room-and-pillar and longwall operations drive high consumption of underground trucks, LHDs, and bolting systems. The need to enhance safety and productivity in aging coal mines further boosts fleet modernization.

The growth of the metal mining segment is expected to grow at a fastest CAGR of 7.1% from 2026 to 2033 in terms of revenue, as the demand for copper, nickel, and rare earth elements increases to support electric vehicles and clean energy technologies. Deepening ore bodies require sophisticated drilling, hauling, and support equipment with autonomous and electric capabilities. Investments in battery-metal exploration across regions such as Australia, Latin America, and Africa strengthen underground infrastructure development. High mineral value and efficiency-focused mining strategies accelerate the shift toward advanced underground fleets.

Regional Insights

North America underground mining equipment market is experiencing steady growth and is anticipated to grow at CAGR of 6.2% over the forecast period, as miners shift toward automation, electrified haulage, and digital mine solutions to meet strict safety norms. The region benefits from strong exploration spending in metals like copper and gold for clean energy and electronics industries. Replacement of aging fleets with low-emission equipment is accelerating procurement cycles. Presence of major mining technology innovators enhances long-term growth prospects.

U.S. Underground Mining Equipment Market Trends

The U.S. underground mining equipment industry dominated the North American market in 2025 due to large-scale production of coal, gold, and industrial minerals. Strong adoption of automation and battery-electric machinery is driven by stringent worker safety and emission standards. Mature mine operations are undergoing fleet modernization to improve efficiency and reduce downtime. Continuous investment in digital mine infrastructure reinforces the U.S. as the region’s largest revenue contributor.

Canada underground mining equipment industry is witnessing strong growth supported by high exploration spending and expansion of deep metal mines, especially for copper, nickel, and precious metals. Government initiatives promoting electrification in underground environments are accelerating demand for electric LHDs and mining trucks. Increasing focus on supplying critical minerals for global clean-energy supply chains continues to boost market momentum.

Europe Underground Mining Equipment Market Trends

Europe’s underground mining equipment industry growth is fueled by increased demand for battery metals such as lithium and nickel supporting EV and renewable energy sectors. Miners are rapidly adopting electric LHDs and low-ventilation underground fleets to comply with environmental regulations. Technological upgrades in mature mines enable higher productivity from deeper reserves. The region also prioritizes safer and more energy-efficient underground systems through automation investments.

Germany underground mining equipment industry led the European market in 2025, owing to advanced mechanization in metal and industrial mineral extraction. The country prioritizes automated haulage, real-time monitoring, and safety-focused technologies to maximize productivity in deeper mines. Strong OEM presence and ongoing investments in sustainable, battery-electric fleets strengthen market leadership. Additionally, demand for machinery upgrades remains high to support efficient underground operations in environmentally regulated zones.

The underground mining equipment industry in the United Kingdom is showing steady growth as renewed focus on critical mineral production supports underground development projects. Adoption of compact, electric equipment is rising to reduce ventilation load and meet decarbonization goals in confined mining spaces. The shift toward digital mine infrastructure is improving diagnostics and reducing operational downtime. Increased interest from global investors in new resource exploration enhances the UK’s underground equipment demand outlook.

Asia Pacific Underground Mining Equipment Market Trends

Asia Pacific underground mining equipment industry dominated the global market, accounting for 40.2% share in 2025, driven by extensive coal production and expanding metal mining activities in China, India, and Australia. Rapid infrastructure development and industrialization boost demand for iron ore, copper, and other minerals. Governments are supporting deeper mine development and fleet automation to enhance productivity. Regional OEM investments in cost-efficient and electric equipment strengthen market dominance.

China underground mining equipment industry dominated the Asia Pacific market due to its extensive underground coal mining operations and strong investment in deep metal extraction. Rapid adoption of automation and electrified machinery supports production efficiency and worker safety in increasingly complex mines. Domestic OEMs offer a wide range of equipment at competitive prices, further strengthening market penetration. Government policies encouraging resource security and modernization continue to drive high equipment procurement.

The underground mining equipment industry in India is witnessing fast growth as deeper coal and metal mines are developed to meet rising industrial and power sector demand. State-owned and private miners are increasing mechanization levels by deploying modern LHDs, underground trucks, and drilling systems. Focus on reducing workplace accidents is accelerating upgrades to safer, technology-enabled equipment. Infrastructure expansion and foreign partnerships in mining projects further enhance the country’s underground equipment demand.

Middle East & Africa Underground Mining Equipment Market Trends

Middle East & Africa underground mining equipment industry is growing due to rising mineral extraction, particularly copper, cobalt, and platinum in nations such as South Africa and the DRC. Lower mining mechanization levels create significant opportunities for equipment upgrades and fleet expansion. International companies are investing in accessing strategic mineral resources for global supply chains. Enhanced safety regulations and workforce modernization are further boosting underground equipment adoption.

South Africa underground mining equipment industry dominated the Middle East & Africa market in 2025, owing to large-scale extraction of gold, platinum group metals, and diamonds. Deep and mature mines require high-performance drilling, hauling, and support systems to ensure operational reliability. Adoption of advanced safety technologies and electrified equipment is rising to improve ventilation efficiency and worker protection. Ongoing investment from global mining companies sustains strong demand for modern underground machinery.

Latin America Underground Mining Equipment Market Trends

Latin America’s underground mining equipment industry expansion is supported by major copper, gold, and silver projects in countries like Brazil, Argentina, Chile, and Peru. Investments from global mining companies are rising to unlock deep ore bodies and improve operational reliability. Demand for heavy-duty underground trucks and advanced drilling equipment is increasing with high-grade deposits. Infrastructure improvements and policy support for mining development contribute to steady market growth.

Brazil underground mining equipment industry is experiencing strong growth in underground mining equipment demand driven by expanding gold, iron ore, and base metal extraction projects. Investments from global miners are rising to unlock deeper, high-grade reserves and improve operational efficiency. Modernization of existing mines is increasing the adoption of advanced hauling, drilling, and ground-support systems. Infrastructure development and a stable pipeline of resource exploration activities continue to boost equipment procurement in the country.

Key Underground Mining Equipment Company Insights

Some of the key players operating in the market include Caterpillar Inc., Getman Corporation and XCMG Group among others.

-

Caterpillar is a leading supplier of underground mining trucks, LHDs, and electric drive haulage systems tailored for deep ore extraction. The company is expanding its battery-electric equipment portfolio to reduce ventilation costs and emissions in confined mining environments. Its MineStar platform enables remote operation, real-time equipment health insights, and improved asset productivity. Strategic collaborations with major miners support large fleet replacement programs and technology integration. Strong aftermarket support and lifecycle services reinforce Caterpillar’s competitive edge in mechanized underground mining.

-

Getman specializes in purpose-built underground support equipment, including scalers, concrete sprayers, and personnel carriers optimized for narrow headings. Its focus on safety-critical functions such as ground support and explosive handling differentiates it from traditional haulage-focused OEMs. Customizable designs allow efficient operation in mid-size and hard-rock mines where maneuverability is crucial. The company is increasingly integrating digital diagnostics and emissions-compliant drivetrains to improve reliability and sustainability. Strong presence in service-driven niche segments positions Getman as a preferred partner for productivity enhancement in underground mines.

Key Underground Mining Equipment Companies:

The following are the leading companies in the underground mining equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Caterpillar Inc

- Getman Corporation

- Sandvik AB

- Komatsu

- Sany Group

- XCMG Group

- Boart Longyear

- Epiroc AB

- J.H. Fletcher & Co.

- SMT Scharf GmbH

- Schmidt Kranz & Co. GmbH

- Zibo God Rock Mining Machinery Co., Ltd

- AB Volvo

- RDH Mining Equipment

Recent Developments

-

In October 2025, Caterpillar acquired RPMGlobal to expand its digital mining portfolio by integrating advanced fleet, maintenance, and autonomy software into its equipment ecosystem. The agreement supports Caterpillar’s strategy to boost connected mining capabilities and enhance productivity for deep and complex underground operations. The acquisition has been valued at a premium, reflecting the strategic importance of RPMGlobal’s technology offerings. The deal awaits required approvals and is targeted to close in early 2026.

-

In August 2025, Sandvik introduced a training simulator designed to help miners practice autonomous surface drilling operations in a controlled digital environment. The system mirrors real drilling functions and allows multiple rigs to be operated virtually, strengthening operator readiness. It is engineered as a portable solution so mines can train workers without using fuel or equipment. The goal is to build autonomy skills faster and improve drilling performance in live operations.

Underground Mining Equipment Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 47.3 billion

Revenue forecast in 2033

USD 72.9 billion

Growth rate

CAGR of 6.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Equipment, mining technique, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Russia; Poland; Sweden; Germany; France; Spain; China; India; Japan; Indonesia; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Caterpillar Inc; Getman Corporation; Sandvik AB; Komatsu; Sany Group; XCMG Group; Boart Longyear; Epiroc AB; J.H. Fletcher & Co.; SMT Scharf GmbH; Schmidt Kranz & Co. GmbH; Zibo God Rock Mining Machinery Co., Ltd; AB Volvo; RDH Mining Equipment

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Underground Mining Equipment Market Report Segmentation

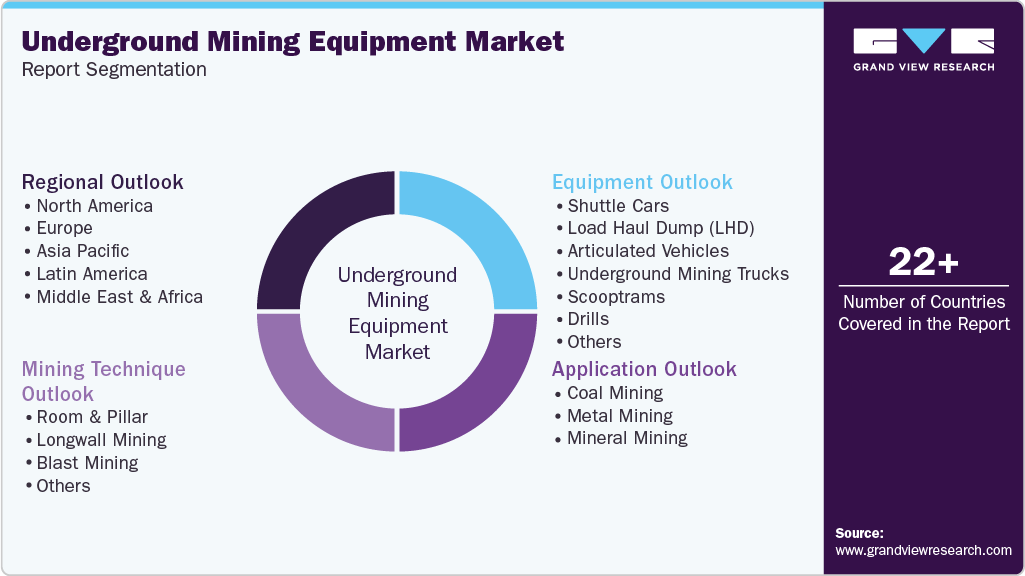

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global underground mining equipment market report based on equipment, mining technique, application, and region:

-

Equipment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Shuttle Cars

-

Load Haul Dump (LHD)

-

Articulated Vehicles

-

Underground Mining Trucks

-

Scooptrams

-

Drills

-

Bolters

-

Others

-

-

Mining Technique Outlook (Revenue, USD Billion, 2021 - 2033)

-

Room and Pillar

-

Longwall Mining

-

Blast Mining

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Coal Mining

-

Metal Mining

-

Mineral Mining

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Poland

-

Germany

-

France

-

Russia

-

Spain

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The the global underground mining equipment size was estimated at USD 45.17 billion in 2025 and is expected to reach USD 47.3 billion in 2026.

b. The global underground mining equipment, in terms of revenue, is expected to grow at a compound annual growth rate of 6.4% from 2026 to 2033 to reach USD 72.9 billion by 2033.

b. Asia Pacific leads the underground mining equipment market and accounting for 40.2% share in 2025, driven by extensive coal production and expanding metal mining activities in China, India, and Australia. Rapid infrastructure development and industrialization boost demand for iron ore, copper, and other minerals.

b. Some of the key players operating in the underground mining equipment Caterpillar Inc, Getman Corporation, Sandvik AB, Komatsu, Sany Group, XCMG Group, Boart Longyear, Epiroc AB, J.H. Fletcher & Co., SMT Scharf GmbH, Schmidt, Kranz & Co. GmbH, and Zibo God Rock Mining Machinery Co., Ltd, AB Volvo, RDH Mining Equipment.

b. Rising demand for metals, minerals, and coal is pushing miners to expand underground extraction as surface deposits decline. Automation, electrification, and digital monitoring systems are boosting productivity and safety in deep mining environments. Growing investments in modern fleets and stricter emission and safety standards are further driving equipment adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.