- Home

- »

- Organic Chemicals

- »

-

N-Methyl-2-Pyrrolidone Market Size & Share Report, 2030GVR Report cover

![N-Methyl-2-Pyrrolidone Market Size, Share & Trends Report]()

N-Methyl-2-Pyrrolidone Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Oil & Gas, Pharmaceuticals, Electronics, Paints & Coatings, Agrochemicals, Others), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-334-8

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

N-Methyl-2-Pyrrolidone Market Size & Trends

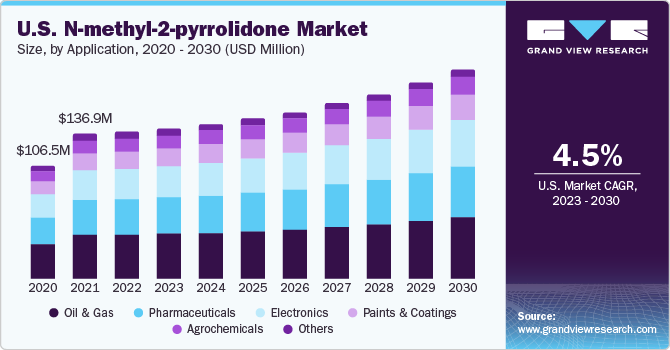

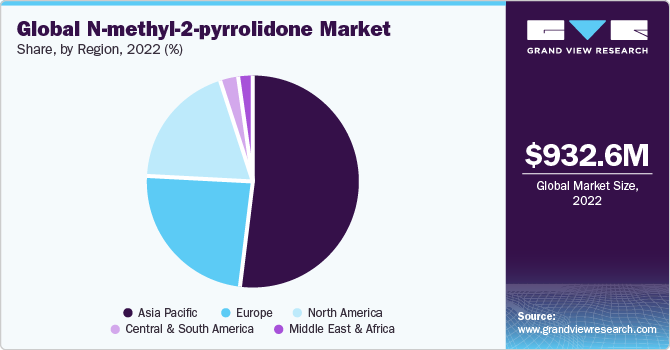

The global N-methyl-2-pyrrolidone market size was valued at USD 932.6 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030. The steady industry expansion is owing to the rising product demand in key application areas such as oil & gas, pharmaceuticals, and electronics, among others. This growth can be majorly attributed to the expansion of the global petrochemical industry. Oil & gas refers to the petrochemical industry, where downstream operations mainly consume N-methyl-2-pyrrolidone (NMP). Though the oil & gas market is not performing well due to piled up inventories and low crude prices, downstream operations are expected to grow in the coming years. NMP is increasingly being used for the purpose of re-refining the lubricating oil. It further helps in improving the viscosity index and oil performance.

NMP is also responsible for improving oil efficiency and solvent extraction. However, its usage in an excess amount poses several potential health threats to humans. Owing to these factors, certain regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and ECHA (European Chemicals Agency) have imposed restrictions on its use in particular products over certain limits. Asia has been converted into a hub for this sector, with developing economies such as China and India leading the growth. New refinery projects and expansion in current ones are further fueling regional business expansion.

Application Insights

The oil & gas segment held the largest revenue share of 27.4% in 2022 in the N-Methyl-2-Pyrrolidone (NMP) market. The segment has been further classified into butadiene recovery, BTX extraction, and lube oil purification. The refining business has capitalized on low oil prices and hence the petrochemical market is booming. NMP is used as an extraction medium in various applications such as butadiene recovery, extraction of BTX (benzene-toluene-xylene), and lube oil purification. The growth of these industries will directly provide the market with expansion opportunities.

The electronics segment is expected to expand at the fastest CAGR of 5.8% over the forecast period. The segment is divided into solvent and photoresist stripper. N-Methyl-2-Pyrrolidone is used as a cleaning agent in electronic components and surfaces. It is used to remove contaminants and residues from the surface of PCBs. NMP is also used in the pharmaceutical sector as a solvent and penetration enhancer. It is further used to dissolve and process various polymers that are used in the production of adhesives and coatings. Additionally, N-Methyl-2-Pyrrolidone is used in manufacturing lithium-ion batteries.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 51.8% in 2022 and is estimated to further expand at the fastest CAGR of 4.8% during the forecast period. This steady regional growth is due to technological advancements, industrial growth, economic growth, and low costs of production in countries such as China, Japan, India, and others. Moreover, end-user industries such as oil & gas (petrochemical), pharmaceuticals, and electronics have been witnessing significant growth in these countries in recent years.

According to the India Brand Equity Foundation, India's pharmaceutical industry holds a significant share of over 50% in the global demand for various vaccines, making it one of the largest in the world. Moreover, the Indian Economic Survey reports that the pharmaceutical market in India was valued at USD 42 billion in 2021, with the size expected to reach USD 65 billion by 2024.

To further support this sector, the Government has introduced the Strengthening of Pharmaceuticals Industry (SPI) scheme, which has offered a financial assistance of USD 60.9 million to existing pharma clusters and Micro-, Small, and Medium-sized Enterprises (MSMEs) across the country. As a result, the country’s promising pharmaceutical industry is expected to drive the demand for pharmaceutical products in the coming years, thus propelling the growth of the NMP market.

Europe is another region anticipated to drive the demand for the product over the forecast period. According to the Germany Trade & Invest agency, the electronics sector in Germany was valued at USD 195.79 billion, contributing to 3% of the country’s GDP, with electronics accounting for 13% of the total German exports in 2021. The rapidly growing electronics industry will lead to an increase in demand for n-methyl-2-pyrrolidone, as it is used for cleaning electronic components such as printed circuit boards, and removing flux residues, soldering flux, and other contaminants.

Key Companies & Market Share Insights

The market is highly competitive, with a large number of manufacturers accounting for a majority of the market share. Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and expand their global footprint.

Key N-Methyl-2-Pyrrolidone Companies:

- Abtonsmart Chemicals (Group) Co., Ltd.

- BASF SE

- Hefei TNJ Chemical Industry Co., Ltd.

- Shandong Qingyun Changxin Chemical Science-Tech Co., Ltd.

- LyondellBasell Industries Holdings B.V.

- DuPont

- BALAJI AMINES

- Ashland

- Puyang Guangming Chemicals Co., Ltd.

- Zhejiang Realsun Chemical Industry Co., Ltd.

- Mitsubishi Chemical Corporation

- Taizhou Yanling Fine Chemicals Co., Ltd.

- Eastman Chemical Company

Recent Developments

- In August 2022, BASF SE announced its intention to increase the production of N-Octyl-2-Pyrrolidone (NOP) and N-(2-Hydroxyethyl)-2-Pyrrolidone (HEP) at its Louisiana facility. This strategic initiative is anticipated to enable the company to meet the growing product demand from the coatings, agricultural products, digital inks, and automotive industries

N-Methyl-2-Pyrrolidone Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 953.9 million

Revenue forecast in 2030

USD 1.33 billion

Growth Rate

CAGR of 4.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Volume in kilo tons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; Netherlands; China; Japan; India; South Korea; Australia; Vietnam; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Abtonsmart Chemicals (Group) Co., Ltd.; BASF SE; Hefei TNJ Chemical Industry Co., Ltd.; Shandong Qingyun Changxin Chemical Science-Tech Co., Ltd.; LyondellBasell Industries Holdings B.V.; DuPont; BALAJI AMINES; Ashland; Puyang Guangming Chemicals Co., Ltd.; Zhejiang Realsun Chemical Industry Co., Ltd.; Mitsubishi Chemical Corporation; Taizhou Yanling Fine Chemicals Co., Ltd.; Eastman Chemical Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global N-Methyl-2-Pyrrolidone Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global N-methyl-2-pyrrolidone (NMP) market report on the basis of application and region:

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Oil & gas

-

Butadiene Recovery

-

BTX Extraction

-

Lube Oil Purification

-

-

Pharmaceuticals

-

Solvent

-

Penetration Enhancer

-

-

Electronics

-

Solvent

-

Photoresist Stripper

-

-

Paints & Coatings

-

Agrochemicals

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Vietnam

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global N-methyl-2-pyrrolidone market size was estimated at USD 932.6 million in 2022 and is expected to reach USD 953.9 million in 2023.

b. The global N-methyl-2-pyrrolidone market is expected to grow at a compound annual growth rate of CAGR of 4.6% from 2023 to 2030 to reach USD 11.33 billion by 2030.

b. Asia Pacific dominated the N-methyl-2-pyrrolidone market with a share of 51.8% in 2022. This is attributable to the technological advancements, industrial growth, economic growth, and low costs of production in countries such as China and India.

b. Some key players operating in the N-methyl-2-pyrrolidone market include BASF SE, E. I. du Pont de Nemours and Company, Eastman Chemical Company, Mitsubishi Chemical Corporation, and Ashland Inc.

b. Key factors that are driving the market growth include high growth in end-user industries and increasing demand from Asia Pacific region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.