- Home

- »

- Medical Devices

- »

-

Ocular Implants Market Size & Share Report, 2022-2030GVR Report cover

![Ocular Implants Market Size, Share & Trends Report]()

Ocular Implants Market Size, Share & Trends Analysis Report By Product (Glaucoma Implants, Intraocular Lens), By Application (Glaucoma Surgery, Age-related Macular Degeneration), By End Use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-1-68038-647-9

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Healthcare

Report Overview

The global ocular implants market size was valued at USD 13.30 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2022 to 2030. Increasing incidence of eye disorders such as age-related macular degeneration, cataract, glaucoma, and scleritis is the major factor anticipated to drive the market. The increase in the incidence rate is leading to a rise in demand for surgical procedures that require ocular implants. For instance, according to a research article published by the U.S. National Library of Medicine, based on the earlier trends in cataract surgeries, it is anticipated that 3.7 million cataract surgeries must have been performed among the Medicare beneficiaries in 2020 in the U.S.

The novel COVID-19 disease has disrupted the overall flow and working of some of the major economies across the globe while having an equal impact on the emerging and smaller economies as well. The outbreak led to major loss of life and created a sense of panic among the population, globally. Therefore, in order to control the spread of the virus and reduce the mortality rate due to the infection of the virus, various restrictions and guidelines were imposed by different countries. Many countries observed a strict lockdown, which led to a postponement of elective surgeries, resulting in the reduction of demand for ocular implants. This implies that the pandemic had a negative impact on the market.

However, in the long run, the pandemic is expected to have a slightly positive impact on the sales of ocular implants. One major factor that indicates this is the major shift towards online education programs and work from home model. This is leading to a higher percentage of the population being exposed to a relatively high amount of screen time, which can lead to the risk of developing eye disorders. The pandemic resulted in major disruptions of the supply chain initially due to the lack of planning.

As a result, major losses were incurred, which compelled the manufacturers to create strategic plans that can help to avoid any similar situation in the future. Moreover, with the opening of the economies, the demand for these procedures has elevated to a great extent due to the earlier backlog surgeries and increasing focus on multiple awareness programs. Thus, although the COVID-19 pandemic did have a negative impact on the market initially, the market is expected to regain its growth and grow at an exponential rate over the forecast period.

Eye diseases such as cataracts and age-related macular degeneration are age-related diseases. An increase in the geriatric population is another factor contributing to the growth of the market. Additionally, increasing adoption of a sedentary lifestyle and the rising prevalence of diabetes may lead to diabetic retinopathy, which is anticipated to boost the sales of ocular implants. For instance, according to the International Diabetes Federation, in 2021, approximately 537 million individuals were living with diabetes and it is anticipated to rise to 643 million by 2030.

Technological advancement is yet another factor playing an important role in propelling market growth. The introduction of micro-invasive glaucoma devices for patients suffering from glaucoma is a classic example of the technology that has evolved over the last few years. For instance, Glaukos Corporation received FDA approval for its second-generation trabecular meshwork bypass stent, iStent Inject in June 2018. The device is indicated for the treatment of mild to moderate glaucoma and is approved for implantation at the time of phacoemulsification.

Product Insights

The glaucoma implants segment dominated the market with a revenue share of more than 25.0% in 2021. This is due to the rising incidence of glaucoma and the fact that it is one of the leading causes of blindness. According to a study by Bright Focus Foundation, about 20 million people across the globe had glaucoma in 2020. This number is expected to exceed over 111 million by the end of 2040. On the basis of product, the market for ocular implants is classified into intraocular lens, corneal implants, orbital implants, glaucoma implants, ocular prosthesis, and others.

Glaucoma implants are projected to continue dominating the market over the forecast period. This is due to the increase in awareness regarding glaucoma by the government and non-government organizations. For instance, the World Glaucoma Association has introduced an initiative called “World Glaucoma Week”, which is planned to happen from 6th -12th March 2022 in order to create awareness pertaining to glaucoma. The intraocular lens segment accounted for a significant revenue share in 2021. Intraocular lenses have gained significant popularity over the years owing to their extended use in the treatment of nearsightedness, farsightedness, and presbyopia.

Application Insights

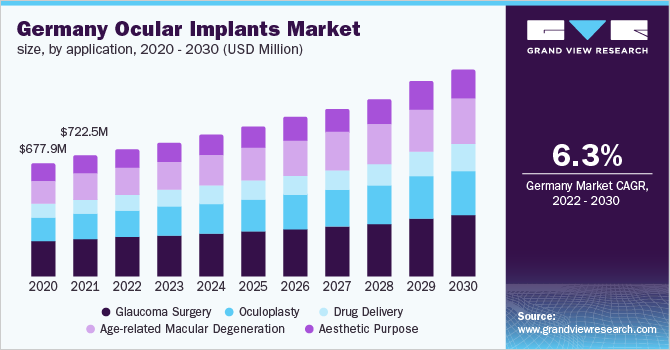

The glaucoma surgery segment accounted for the largest revenue share of over 30.0% in 2021 owing to the rising incidence of glaucoma, coupled with the growing awareness regarding the disease. Several organizations are focusing on creating awareness regarding glaucoma, which is helping to increase the treatment-seeking rate at an early stage. For instance, Prevent Blindness is an organization that works towards creating awareness regarding eye disorders and mainly focuses on glaucoma. The organization joined the National Glaucoma Awareness Month in January 2021 by offering a variety of free educational and awareness-building resources to help prevent glaucoma.

Age-related macular degeneration is expected to be the fastest-growing segment over the forecast period. This is attributed to the growing geriatric population that is highly susceptible to developing this disorder. For instance, according to CDC, age-related macular degeneration is the leading cause of blindness and vision loss in Americans aged over 65 years of age. The above source also stated that the number of older Americans is predicted to nearly double from 48 million to 88 million in 2050.

End-use Insights

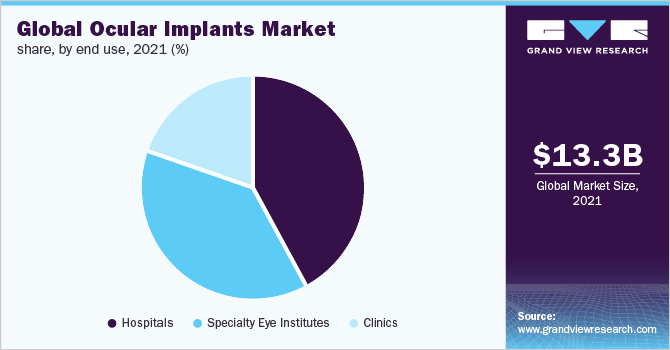

The hospitals segment dominated the market for ocular implants and held a revenue share of more than 40.0% in 2021. This is due to the increasing number of patients opting for ophthalmic surgeries in hospitals as compared to clinics and specialty eye institutes. The growing incidence of refractive disorders and increasing spending on healthcare infrastructure are factors expected to fuel the growth of the hospitals segment over the forecast period.

The specialty eye institutes segment is expected to witness significant growth during the forecast period owing to the rising need for eye care services in remote areas. The rising number of ophthalmologists in developing economies is anticipated to have a considerable impact on the market growth with a steep rise in the number of specialty eye institutes. Favorable government initiatives and increasing ease of doing business in several developing countries such as India, Thailand, the Philippines, and China are expected to accelerate the segment growth during the forecast period.

Regional Insights

North America dominated the market with a revenue share of over 35.0% in 2021. Increasing incidence of eye disorders, sedentary lifestyle, and increasing focus of key players to launch products in North America are factors that are majorly contributing to the market growth in this region. Additionally, a favorable reimbursement scenario and the availability of technologically advanced products in the region are factors that are likely to retain its lead over the forecast period.

The Asia Pacific market is expected to register the fastest CAGR of 7.1% during the forecast period. Developing countries such as China and India are expected to witness the fastest growth in Asia Pacific due to a massive increase in the geriatric population. According to China’s seventh population census, the country’s population in 2020 individuals aged 60 and above comprised 18.7% of the total population. Other factors that are contributing to the growth of the market include the growing diabetic population, increasing cataract surgeries, and rising expenditure by individuals and the government on eye care.

Key Companies & Market Share Insights

Key players in the market are focusing on carrying out strategic acquisitions, partnerships, and product launches that will help them to broaden their product portfolio and secure a strong position in the market. For instance, in August 2021, Alcon, Inc., a subsidiary of Novartis, acquired Ivantis, Inc. and its HydrusMicrostent for surgical glaucoma. The intended acquisition supports Alcon’s commitment to further strengthen its industry-leading portfolio across refractive, retina, cataract, and glaucoma. Some prominent players in the global ocular implants market include:

-

Alcon, Inc.,

-

Bausch & Lomb, Inc.

-

Carl Zeiss AG

-

Johnson & Johnson

-

STAAR Surgical Company

-

Morcher GmbH

-

Hoya Corporation

-

Glaukos Corporation

Ocular Implants Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 14.1 billion

Revenue forecast in 2030

USD 22.1 billion

Growth Rate

CAGR of 5.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; Japan; India; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Alcon; Bausch & Lomb, Inc.; Carl Zeiss AG; Johnson & Johnson; STAAR Surgical Company; Morcher GmbH; Hoya Corporation; Glaukos Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global ocular implants market report on the basis of product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Intraocular Lens

-

Corneal Implants

-

Orbital Implants

-

Glaucoma Implants

-

Ocular Prosthesis

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Glaucoma Surgery

-

Oculoplasty

-

Drug Delivery

-

Age-related Macular Degeneration

-

Aesthetic Purpose

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Hospitals

-

Specialty Eye Institutes

-

Clinics

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global ocular implants market size was estimated at USD 13.30 billion in 2021 and is expected to reach USD 14.1 billion in 2022.

b. The global ocular implants market is expected to grow at a compound annual growth rate of 5.8% from 2022 to 2030 to reach USD 22.1 billion by 2030.

b. North America dominated the ocular implants market with a share of 37.8% in 2021. This is attributable to growing geriatric population and favorable reimbursement in the region.

b. Some key players operating in the ocular implants market include Bausch & Lomb, Alcon, Carl Zeiss, Johnson & Johnson, MORCHER GmbH, and STAAR surgical.

b. Key factors that are driving the market growth include the increasing prevalence of ophthalmic disorders such as glaucoma, scleritis, and Age-Related Macular Degeneration (AMD), higher acceptance of vision correction procedures, and technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."