- Home

- »

- Pharmaceuticals

- »

-

Age-related Macular Degeneration Market Size Report, 2030GVR Report cover

![Age-related Macular Degeneration Market Size, Share & Trends Report]()

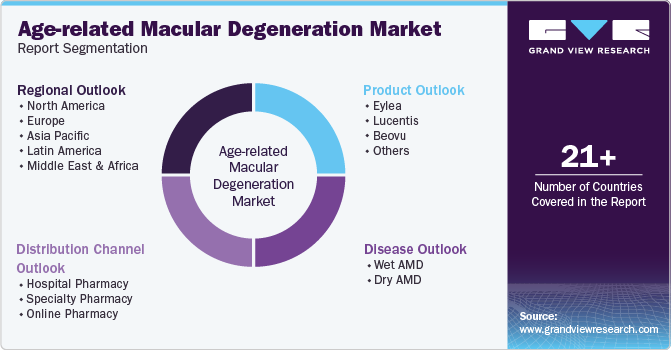

Age-related Macular Degeneration Market Size, Share & Trends Analysis Report By Product (Eylea, Lucentis), By Disease (Wet AMD, Dry AMD), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-971-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

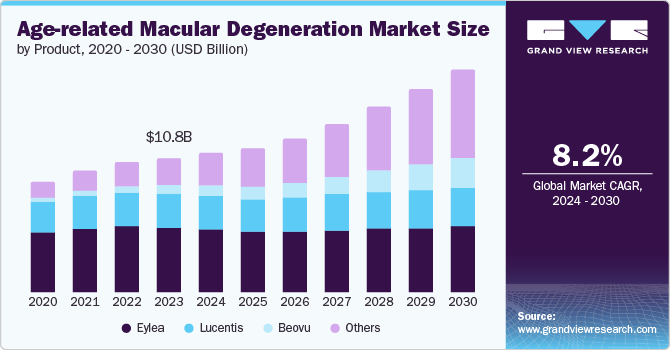

The global age-related macular degeneration market size was valued at USD 10.82 billion in 2023 and is projected to grow at a CAGR of 8.2% from 2024 to 2030. The launch of new products, strong product pipeline, and increase in the prevalence rate of AMD are anticipated to be the major drivers for the market. As per the Population Reference Bureau, it is estimated that the population of Americans aged 65 and above will grow from 58 million in 2022 to 82 million by 2050, representing a 47% increase. The population in the U.S. is currently older than it has ever been.

During the initial phase of the COVID-19 pandemic, the market for age-related macular degeneration was negatively impacted due to missed or delays in follow-up for AMD treatment leading to non-adherence to medications. For instance, in July 2020, Roche witnessed low growth in the sale of its AMD drug Lucentis to USD 401 million in the second quarter over the same period in the previous year.

Product Insights

The Eylea segment accounted for the largest market share of 47.7% in 2023. The market growth is attributed to patent protection and high market penetration. Eylea is prescribed for eye conditions that harm the retina or macula leading to impaired vision. Eylea seems to be better at maintaining long-term vision improvement and enabling more patients to discontinue treatment because of stabilized eyes.

The Beovu segment is expected to register the fastest CAGR of 21.7% during the forecast period owing to the patent protection, superior drying efficacy, and positive results in the treatment of severe cases of wet AMD. However, in some cases after receiving an injection of Beovu, patients have developed adverse effects such as eye pain, sudden vision loss, blurred or decreased vision, worsening eye redness, and other effects.

Disease Insights

The wet AMD segment accounted for the largest market share in 2023. The growing geriatric population is one of the major factors influencing segment growth. According to Genentech, approximately 200,000 new instances of wet AMD are identified annually in North America. Wet AMD is responsible for around 10 percent of incidents, yet leads to 90 percent of legal blindness. This advanced type can lead to quick and serious vision deterioration due to uncontrolled new blood vessel growth in the eye, causing fluid leakage into the macula.

The dry AMD segment is projected to grow at the fastest CAGR over the forecast period. According to Genentech, the early stage of AMD, known as dry AMD, makes up 90 percent of confirmed cases. This type is identified by the existence of fatty deposits known as drusen in the macula, leading to the segment growth.

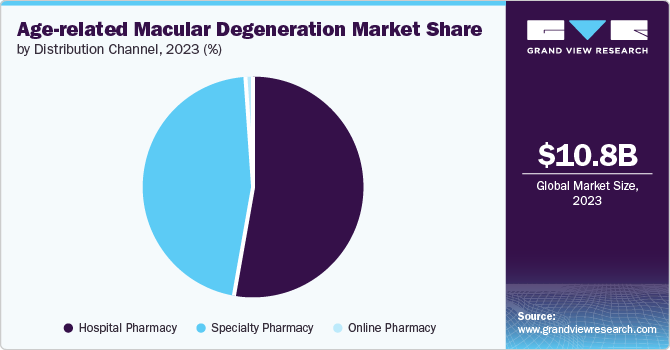

Distribution Channel Insights

The hospital pharmacy segment dominated the market and accounted for the largest share in 2023. This dominance can be attributed to the rise in the prevalence of age-related macular degeneration (AMD) and hospitalization for treatment. Age plays a major role in affecting eye health and vision loss. According to the Royal National Institute of Blind People (RNIB), almost 80 percent of individuals are aged 65 or above, and around 60 per cent are more than 75 years.

The specialty pharmacy segment is expected to register the fastest CAGR during the forecast period due to the ease of drug availability and reimbursement coverage offered by specialty pharmacies. CVS Caremark offers Eylea, Lucentis, Avastin, and Beovu prescription coverage to eligible retirees and employees who are enrolled in the Public Employees Insurance Program (PEIP) program.

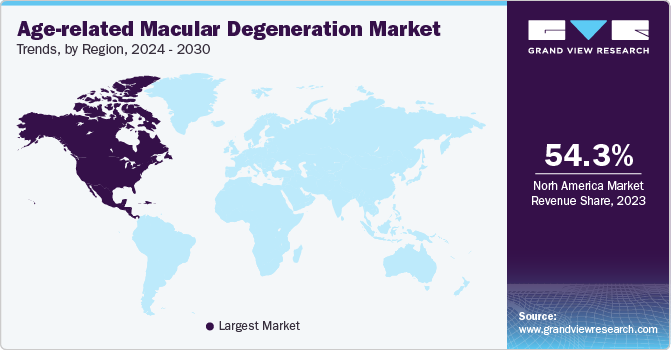

Regional Insights

North America age-related macular degeneration market dominated the market in 2023. According to the American Academy of Ophthalmology, approximately 1.5 million Americans have late AMD, which is the vision-threatening type of AMD and 18.3 million Americans are affected by early AMD. Additionally, the increased public awareness about AMD and its symptoms has led to early identification and diagnosis, leading to market expansion.

U.S. Age-related Macular Degeneration Market Trends

The U.S. age-related macular degeneration market dominated the North America market with a share of 92.1% in 2023 due to the high penetration of eye care facilities in the region.

Europe Age-related Macular Degeneration Market Trends

Europe age-related macular degeneration market identified as a lucrative region in 2023 due to the growing elderly population in the region. According to British Journal of Ophthalmology, around 67 million individuals in the EU are presently impacted by AMD and, due to the population ageing, this figure is projected to rise by 15% by 2050. The improved standard of living is resulting in longer life expectancy which is leading to the rise in demand for AMD treatment.

Asia Pacific Age-related Macular Degeneration Market Trends

Asia Pacific age-related macular degeneration market anticipated to witness significant growth in the coming years. The growth can be attributed to the high geriatric population and disease burden. The favorable government initiatives to support the affordability of costly anti-VEGF products may contribute to the market growth.

Key Age-related Macular Degeneration Company Insights

Some key companies in the age-related macular degeneration market include Bayer AG, Pfizer Inc., Biogen, F. Hoffmann-La Roche Ltd, and others.

-

Pfizer Inc. is involved in the discovery, development, production, and marketing of biopharmaceuticals. It also offers sterile injectable drugs, biosimilar products, APIs, and manufacturing services on a contractual basis.

Key Age-related Macular Degeneration Companies:

The following are the leading companies in the age-related macular degeneration market. These companies collectively hold the largest market share and dictate industry trends.

- Novartis AG

- Bayer AG

- Pfizer Inc.

- F. Hoffmann-La Roche Ltd

- Bausch Health Companies Inc.

- Regeneron Pharmaceuticals Inc.

- Amgen Inc.

- Biogen

- Samsung Bioepis

View a comprehensive list of companies in the Age-related Macular Degeneration Market.

Recent Developments

-

In July 2024, Genentech (Roche) reintroduced Susvimo (100 mg/mL ranibizumab injection) for intravitreal use via ocular implant in the U.S., for treating neovascular or 'wet' age-related macular degeneration (nAMD).

Age-related Macular Degeneration Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.21 billion

Revenue forecast in 2030

USD 17.99 billion

Growth rate

CAGR of 8.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, disease, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Mexico; Canada; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

F. Hoffmann-La Roche Ltd; Novartis AG; Bayer AG; Pfizer Inc.; Bausch Health Companies Inc.; Regeneron Pharmaceuticals Inc.; Amgen Inc.; Biogen; Samsung Bioepis

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Age-related Macular Degeneration Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global age-related macular degeneration market report based on product, disease, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Eylea

-

Lucentis

-

Beovu

-

Others

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Wet AMD

-

Dry AMD

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Specialty Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."