- Home

- »

- Medical Devices

- »

-

Diabetic Retinopathy Market Size, Industry Report, 2030GVR Report cover

![Diabetic Retinopathy Market Size, Share & Trends Report]()

Diabetic Retinopathy Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Proliferative Diabetic Retinopathy), By Management (Anti-VEGF, Intraocular Steroid Injection, Laser Surgery, Vitrectomy), By Region And Segment Forecasts

- Report ID: 978-1-68038-466-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Diabetic Retinopathy Market Summary

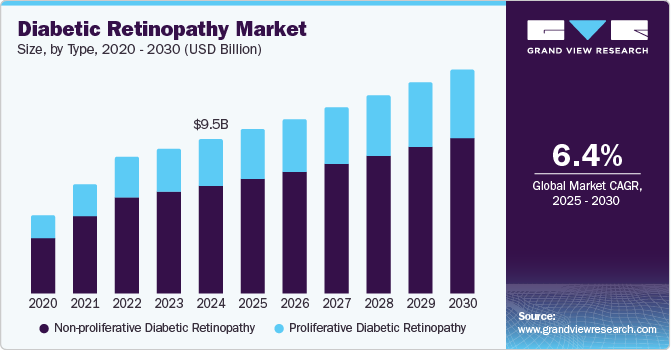

The global diabetic retinopathy market size was estimated at USD 9.48 billion in 2024 and is expected to grow at a CAGR of 6.4% from 2025 to 2030. One of the main factors expected to fuel market expansion is the growing incidence of diabetes in older individuals and the rising prevalence of blindness caused by diabetes.

Key Market Trends & Insights

- North America dominated the global diabetic retinopathy market with the largest revenue share of 37.8% in 2024.

- The diabetic retinopathy market in the U.S. led the North America market and held the largest revenue share in 2024.

- By type, the non-proliferative diabetic retinopathy segment led the market, holding the largest revenue share of 70.2% in 2024.

- By management, the laser surgery segment is expected to grow at the fastest CAGR from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 9.48 Billion

- 2030 Projected Market Size: USD 13.77 Billion

- CAGR (2025-2030): 6.4%

- North America: Largest market in 2024

The introduction of novel diagnostic technologies and treatments and the increased awareness are driving the market expansion.

Diabetes is a globally prevalent health concern. It can result in Diabetic Retinopathy (DR), which is caused by damage to the blood vessels in the retina. DR leads to blurred vision and vision loss in most cases. International Diabetes Federation estimates that 1 in 8 adults will be living with diabetes in 2050. It also states urbanization, an aging population, decreasing physical activity, and the growing prevalence of obesity are some of the key aspects contributing to the rise in type 2 diabetes.

DR is a serious microvascular complication of type I and type II diabetes. It is often caused by prolonged high blood sugar levels that damage the blood vessels in the retina. It can progress to sight-threatening stages, which can cause blindness and visual impairment if not treated. According to a report published by the WHO, DR is responsible for 4.8% of the 37 million blindness cases in the world. The prevalence of this condition in the U.S. is expected to increase rapidly. Despite all the necessary measures adopted by the diabetic population, DR can lead to permanent blindness based on the disease stage and severity of the condition.

Individuals with diabetes are at risk for diabetes-related eye diseases, such as cataracts, DR, macular edema, and glaucoma. DR is one of the main causes of blindness in the U.S. The same organization also states that up to 21.0% of type 2 diabetes patients have DR at the time of their initial diabetes diagnosis. In addition, a majority of them may develop DR over time. This condition is a leading cause of blindness in working-age adults. According to the National Eye Institute (NEI), nearly 11 million people in the U.S. are estimated to have DR by 2030.

According to a CDC analysis, early detection and treatment can prevent more than 90.0% of diabetes-related visual impairment. Intensive blood glucose management can reduce the risk of DR by 27.0%; therefore, the rising prevalence of blindness is expected to be one of the major drivers of the diabetic retinopathy industry.

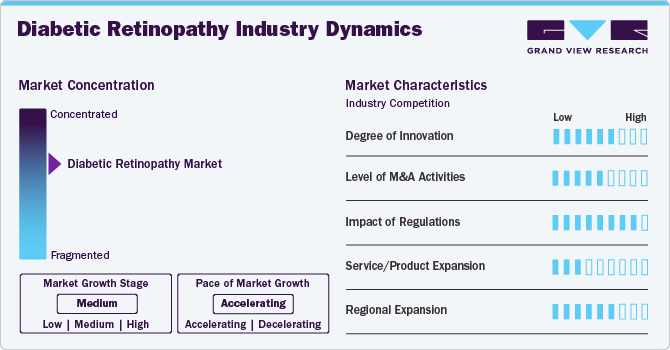

Market Concentration & Characteristics

The industry growth stage is medium, and the pace of industry growth is accelerating. The global diabetic retinopathy industry has witnessed significant innovation, marked by regulatory approvals, partnerships, and collaborations. For instance, in October 2024, Google announced that it had licensed its DR AI model to healthcare providers and health-tech partners, including Perceptual in Thailand and Forus Health and AuroLab in India. This strategic advancement and novel technology is expected to support nearly 6 million AI-assisted screenings for diabetic retinopathy.

Multiple companies focused on improving market share and accessibility to modern technologies have led to a fragmented market scenario. Conversely, significant R&D expenditure and new launches driven by research-based product developments are anticipated to facilitate market expansion. In February 2025, Roche, a global healthcare company, announced it received approval for Susvimo (ranibizumab injection) 100 mg/mL from the U.S. FDA. This product is designed to assist in the treatment of Diabetic Macular Edema (DME), which is one of the leading causes of vision loss in diabetic patients.

Technological advancements and new product launches fuel market growth. For instance, in January 2023, a Ukrainian startup Healthi developed an innovative AI solution to address DR. Healthi's AI technology utilizes Machine Learning (ML) algorithms to analyze retinal images and detect early signs of DR, enabling timely intervention and preventive measures. This advancement can revolutionize diabetes care by providing a cost-effective and efficient means of early diagnosis, ultimately improving the management of eye health.

The global market is characterized by a high degree of innovation owing to rapid technological advancements and an increase in research and development activities. For instance, in November 2023, Ocuphire Pharma, a biopharmaceutical company focused on ophthalmic treatments, announced the positive outcome of its meeting with the U.S. FDA on oral APX3330 for the treatment of DR. The FDA has supported the advancement of the medication into Phase 3 studies based on the successful results of the recently completed Phase 2 ZETA-1 trial.

Prominent players in the market are involved in a moderate level of Merger and Acquisition (M&A) activities, which can be attributed to factors such as the need to acquire new product development facilities, enhance capabilities, and expand product portfolios. Devices and drugs in the diabetic retinopathy industry are subjected to regulatory scrutiny. Manufacturers and suppliers must comply with various regulations, including product development and clinical trials. In case of non-compliance with the regulations, the regulatory bodies may issue warnings against the companies.

Ongoing technological advancements in devices and continuous R&D efforts are expected to replace conventional products, such as laser therapy and corticosteroids, with newer alternatives, such as anti-VEGF injection and vitrectomy procedures. For instance, in August 2023, Regeneron Pharmaceuticals, Inc. announced that the U.S. FDA approved EYLEA HD (aflibercept) Injection 8 mg for the treatment of DR, DME, and wet Age-related Macular Degeneration (wAMD). Regional expansion is expected to have a moderate to high impact on market growth. With the growing adoption of DR devices for effective management, industry players are investing in regional expansion to increase manufacturing capacity. In addition to meeting the growing demand, regional expansion provides companies with an opportunity to tap into previously untapped customer bases. This strategy enables them to strengthen their position in the market and increase their market shares.

Type Insights

The non-proliferative diabetic retinopathy segment dominated the market and accounted for the largest revenue share of 70.2% in 2024. The growing geriatric population and rising incidence of blindness caused by diabetes are the key factors that account for its large share. Non-proliferative Diabetic Retinopathy (NPDR), or background retinopathy, is a common diabetes-related eye condition and one of the leading causes of blindness in adults. It typically progresses from mild to moderate. NPDR is primarily characterized by microaneurysms (microscopic blood-filled bulges in artery walls) that leak into the retina. Although non-proliferative retinopathy is not a vision-threatening condition, it may lead to diabetic macular edema (swelling in the macula), resulting in vision loss. With the growing severity of NPDR, the risk of developing vision-threatening proliferative DR also increases.

The proliferative diabetic retinopathy segment is expected to grow at the fastest CAGR over the forecast period. Some of the key trends in this segment include the development of new drugs and therapies, the adoption of innovative diagnostic tools, and the expanding healthcare infrastructure in emerging markets. In addition, there is a growing interest in using AI and ML to improve the accuracy of Proliferative Diabetic Retinopathy (PDR) diagnosis and treatment. PDR is an advanced stage of retinopathy where the delicate blood vessels grow inside the retina and the vitreous humor, resulting in blurred vision and blindness. It may lead to macular edema, showing no symptoms at the early stages. It is diagnosed through thorough eye checkups, such as visual acuity tests and tonometry. It is also treated with the help of laser surgery, which facilitates shrinkage of blood vessels.

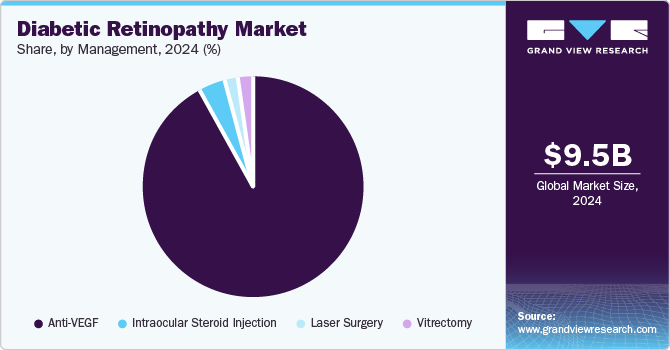

Management Insights

The anti-VEGF drugs segment dominated the diabetic retinopathy industry in 2024. The efficiency and efficacy of these drugs is a key growth driver of the segment. Anti-VEGF drugs are used for the treatment of PDR. Anti-VEGF agents were more beneficial in PDR, especially in cases with vitreous hemorrhage and neovascular glaucoma and before the vitrectomy procedure. These agents are injected into the eye to block the formation of weak blood vessels and slow down the progress of retinopathy. Currently, four major anti-VEGF agents-Eylea, Avastin, Lucentis, and Macugen-are available in the market. These agents were approved by the U.S. FDA in 2011 for treating DME.

The laser surgery segment is expected to experience the fastest growth over the forecast period. Laser treatment helps impede the spread or even stop the progression of DR, especially when employed in the early stages. The treatment involves a 20- to 40-minute procedure, which is often carried out through an outpatient approach. This eliminates costly hospitalizations and limits the number of visits to treatment centers. The growing availability of treatment and the less invasive nature of the procedure are expected to fuel the growth of this segment.

Regional Insights

North America diabetic retinopathy industry dominated the global market with a revenue share of 37.8% in 2024. The presence of sophisticated healthcare infrastructure, favorable government initiatives about drug development, and high patient & practitioner awareness levels are some of the factors driving market growth. Moreover, the high market penetration of novel products, such as anti-VEGF drugs, including Lucentis, Avastin, and Eylea, is a major factor contributing to this region's large share. Some of the major drivers are high healthcare expenditure and awareness, the presence of well-established healthcare infrastructure, and favorable reimbursement frameworks.

U.S. Diabetic Retinopathy Market Trends

The U.S. diabetic retinopathy market dominated the regional market with a largest revenue share in 2024. The favorable reimbursement scenario provides access to healthcare services to a large portion of the population. Subsequently, it creates a demand for cost-effective and efficient diabetes management devices. This also increases the need for cost-effective treatment and integration of digital health in the care delivery system. Hence, many companies seek U.S. FDA approval to launch their products in the U.S. market. For instance, in February 2023, Regeneron received FDA approval for Eylea, which is intended for preterm infants with retinopathy of prematurity.

Europe Diabetic Retinopathy Market Trends

Europe diabetic retinopathy market held significant revenue share in 2024. Factors such as the rising prevalence of diabetes and increasing awareness of the importance of its management and treatment are fueling the market growth. According to WHO, nearly 64 million adults and approximately 300,000 children and adolescents are estimated to be living with diabetes in the WHO’s European region.

Asia Pacific Diabetic Retinopathy Market Trends

Asia Pacific diabetic retinopathy market is expected to register the fastest CAGR of 7.1% over the forecast period. This growth can majorly be attributed to the Chinese and Japanese markets. The improving healthcare services and the growing presence of multiple global market participants are likely to create lucrative growth opportunities. In addition, the high prevalence of diabetes drives the market. Technological advancements in DR treatments, the increasing geriatric population, and the rising prevalence of lifestyle diseases, such as obesity, are anticipated to promote regional market growth.

China diabetic retinopathy market accounted for the largest revenue share of the Asia Pacific diabetic retinopathy industry in 2024. This share can be attributed to the increasing diagnosis of diabetes in the country and the availability of advanced healthcare infrastructure. For instance, in 2021, China had 140.9 million people living with diabetes, and this number is expected to reach 174.4 million by 2045. The prevalence of diabetes in China has been increasing rapidly due to a shift in lifestyle and a large share of the aging population. In addition, the number of people receiving regular eye exams and early detection of DR has increased, which drives the demand for treatment options.

Key Diabetic Retinopathy Company Insights

Some key companies operating in the diabetic retinopathy industry include Bayer AG; AbbVie Inc.; Novartis AG; Oxurion NV.; Sirnaomics, Inc.; Alimera Sciences and others. Major market players have been focusing on innovation, novel product launches, and adoption of advanced technologies.

-

AbbVie Inc. specializes in the discovering, developing, manufacturing, and commercialization of medicines and solutions for a wide range of diseases and health problems. It primarily focuses on therapeutic areas such as oncology, immunology, eye care, neuroscience, and aesthetics. Pivotal data regarding the safety and efficacy of its novel gene therapy designed for wet AMD, ABBV-RGX-314, is expected to be available by 2026.

-

Bayer AG is one of the key companies operating in the healthcare products and technology solutions industry. Aflibercept (Eylea), designed to provide treatment for the neovascular wAMD and complications caused by DME, is one of its key products related to diabetic retinopathy.

Key Diabetic Retinopathy Companies:

The following are the leading companies in the diabetic retinopathy market. These companies collectively hold the largest market share and dictate industry trends.

- Bayer AG

- AbbVie Inc.

- Novartis AG

- Oxurion NV.

- Sirnaomics

- Alimera Sciences

- Ampio Pharmaceuticals Inc.

- BCNPeptides

- Kowa Company, Ltd.

- Genentech, Inc.

Recent Developments

-

In May 2024, AEYE Health and Optomed Oyj entered into a commercial collaboration, which resulted in the FDA clearance for the Optomed Aurora handheld fundus camera. This will enable rapid, AI-assisted retinal imaging for diabetic retinopathy, revolutionizing patient care and diagnosis.

-

In April 2024, AEYE Health received FDA approval for its first-ever fully autonomous AI-driven tool, the AEYE-DS system. It autonomously detects diabetic retinopathy through a handheld retinal camera, which helps streamline the screening process.

-

In June 2023, Eyenuk, a global leader in AI digital health, obtained FDA clearance to integrate its EyeArt AI system with the Topcon NW400 retinal camera. This will help automatically detect diabetic retinopathy. EyeArt v2.2.0 is the first FDA-cleared AI system to work with multiple retinal cameras from different manufacturers. It solidifies the technology’s position as the only AI technology approved to detect both mild and vision-threatening diabetic retinopathy.

Diabetic Retinopathy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.08 billion

Revenue forecast in 2030

USD 13.77 billion

Growth rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, management, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Thailand; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Bayer AG; AbbVie Inc.; Novartis AG; Oxurion NV.; Sirnaomics, Inc.; Alimera Sciences; Ampio Pharmaceuticals Inc.; BCN Peptides.; Kowa Company, Ltd.; Genentech, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

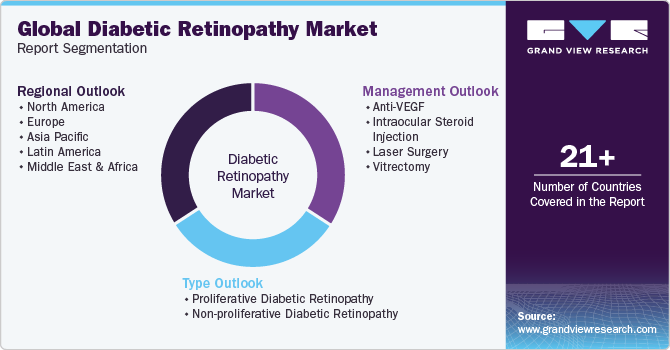

Global Diabetic Retinopathy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels as well as provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the diabetic retinopathy market report on the basis of type, management, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Proliferative Diabetic Retinopathy

-

Non-proliferative Diabetic Retinopathy

-

-

Management Outlook (Revenue, USD Million, 2018 - 2030)

-

Anti-VEGF

-

Intraocular Steroid Injection

-

Laser Surgery

-

Vitrectomy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.