- Home

- »

- Medical Devices

- »

-

Minimally Invasive Glaucoma Surgery (MIGS) Devices Market Report 2030GVR Report cover

![Minimally Invasive Glaucoma Surgery (MIGS) Devices Market Size, Share & Trends Report]()

Minimally Invasive Glaucoma Surgery (MIGS) Devices Market (And Segment Forecast 2024 - 2030) Size, Share & Trends Analysis Report By Product (Valves, Glaucoma Drainage Implant), By Surgery Method, By End-use, By Region

- Report ID: GVR-4-68040-161-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

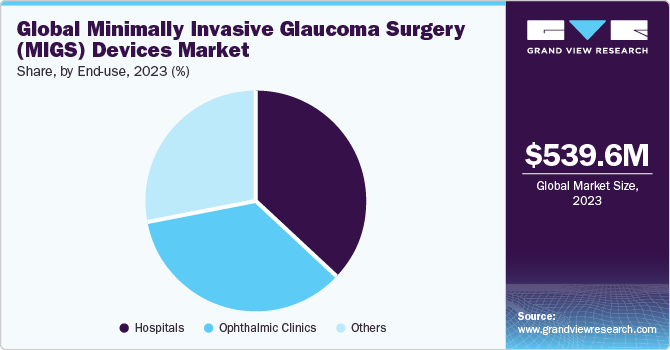

The global minimally invasive glaucoma surgery (MIGS) devices market size was estimated at USD 539.6 million in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.36% from 2024 to 2030. The growing awareness regarding minimally invasive surgery, technological advancements, rising geriatric population, and growing healthcare infrastructure are the major factors contributing to the market growth.

The increasing popularity of minimally invasive glaucoma surgery (MIGS) among healthcare providers and patients can be attributed to several factors. MIGS encompasses a range of surgical techniques aimed to address glaucoma while offering advantages such as reduced complications, faster recovery, and a decreased risk of side effects in contrast to conventional glaucoma surgeries. Moreover, the rising prevalence of glaucoma cases is anticipated to further contribute to the market's growth. For instance, according to national glaucoma research, there are about 80 million people worldwide with glaucoma, and this number is projected to reach 111 million by the year 2040. The increasing elderly population is another significant factor contributing to the growing prevalence of glaucoma surgeries. As people age, they are at a higher risk of developing glaucoma, which, when left untreated, can lead to vision impairment.

Advancements in technology have brought about a revolutionary shift in the management of glaucoma through minimally invasive glaucoma surgery (MIGS). These advancements offer safer and more effective treatment options with decreased invasiveness and shorter recovery periods. For instance, in August 2022, Glaukos received FDA clearance for the iStent Infinite Trabecular Micro-Bypass System. The iStent Infinite is designed for as a standalone procedure to lower elevated intraocular pressure (IOP) in patients with primary open-angle glaucoma that remains uncontrolled despite previous medical and surgical treatments.

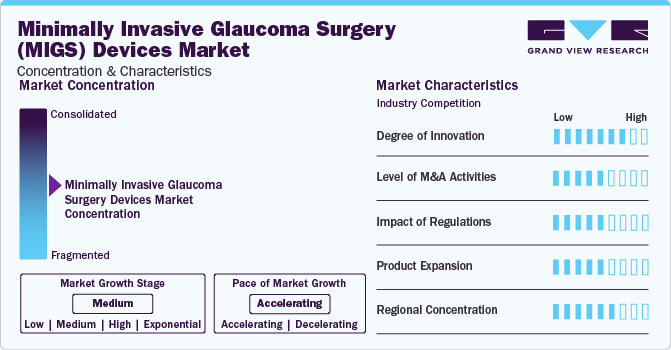

Market Concentration & Characteristics

The global minimally invasive glaucoma surgery (MIGS) devices market is characterized by a high degree of innovation, such as new product development and introduction of new technologies at regular intervals. For instance, in February 2023, Glaukos Corporation received FDA 510 (k) clearance for its product iStent Infinite'. The product is used in a standalone procedure to reduce elevated Intraocular Pressure (IOP) in patients with primary open-angle glaucoma.

Market players such as Alcon, Inc., Glaukos Corporation, and Carl Zeiss Meditec AG are adopting mergers and acquisitions to strengthen their positions. This strategy enables companies to increase their capabilities, expand product portfolios, and improve competencies. For instance, in November 2022, Alcon, Inc. acquired Ivantis, Inc. to develop, manufacture, and sell high-quality minimally invasive glaucoma surgery (MIGS) devices.

Market players are dedicating significant resources to clinical trials and regulatory processes to secure approval for their pipeline products. These efforts, however, might elevate the expenses associated with developing innovative minimally invasive glaucoma surgery devices.

Product expansion involves developing more advanced implantable devices, refining existing technologies to improve efficacy, or creating devices that target specific types of glaucoma. Market players are focused on innovations that reduce intraocular pressure more effectively, enhance patient comfort, or streamline surgical procedures.

End-use Insights

Based on end-use, the hospitals segment dominated the market in 2023. Ophthalmic surgeries are commonly performed by well-trained surgical teams within hospital environments, consisting of both inpatient and outpatient settings. Hospitals provide a controlled, sterile environment that is highly conducive to such surgeries. To ensure the successful and safe execution of these operations, surgeons, anesthesiologists, nurses, and other medical specialists collaborate within the hospital setting. Hospitals are also known for adhering to strict regulatory and safety standards, thereby guaranteeing a high level of patient safety during ophthalmic surgeries. This assurance is beneficial for both patients and surgeons. Moreover, hospitals are equipped to handle any potential complications and offer comprehensive care to patients undergoing glaucoma surgery. Thus, all these factors contribute to the segment growth.

The ophthalmic clinic segment is expected to grow at the fastest CAGR over the forecast period. Ophthalmic clinics provide several benefits, including convenience, and shorter waiting periods, and are patient-centric, leading to increased patient satisfaction. Moreover, these clinics are often more cost-effective due to their reduced overhead expenses, potentially making eye surgeries more accessible and affordable for patients. The specialized concentration on eye care within these clinics allows for a higher level of expertise and precision in the field. In addition, outpatient settings may lower the risk of hospital-acquired infections, making them a preferred choice for surgeries that can be safely performed outside of a hospital.

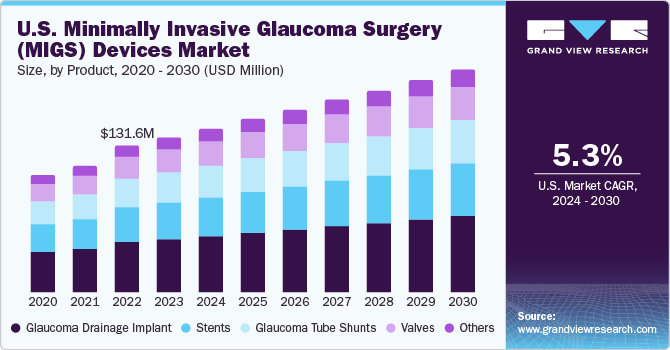

Product Insights

The glaucoma drainage implant segment held the largest market share of around 33.18% in 2023. Glaucoma drainage implants are very efficient as it is a viable surgical approach to address glaucoma. These devices are typically suggested when alternative treatments like medications and laser therapy prove insufficient in managing the condition. These implants help in improved surgical techniques, targeted medication delivery, and patient comfort. The Ahmed Glaucoma Valve (AGV), Baerveldt Glaucoma Implant, Molteno Implant, Krupin Valve, and other glaucoma drainage devices are a few examples of the numerous types of glaucoma drainage devices available.

The stent segment is anticipated to grow at the fastest CAGR during the forecast period. The purpose of these stents is to establish an alternative route for the drainage of aqueous humor, the fluid present within the eye, to lowering intraocular pressure (IOP). However, the stent is not suitable for all glaucoma patients. The decision regarding treatment options, including the use of the stent, is based on an individual's particular condition, and the type of glaucoma they have.

Regional Insights

North America dominated the overall market in 2023. The significant factors driving the regional market growth include the rapidly expanding geriatric population and the increasing incidence of glaucoma. Furthermore, the adoption of reimbursement models for ophthalmic care and the implementation of stringent regulatory measures focused on ensuring patient safety are anticipated to stimulate the demand for ophthalmic devices in this region. Also, the presence of key market players in the region involved in developing advanced products is expected to boost the regional market growth.

U.S. dominated the market in North America region. The presence of key market players in the country, a favorable reimbursement scenario that provides access to healthcare services to a large portion of the population, and the presence of skilled healthcare professionals in the country are among the major factors contributing to the market growth.

Asia Pacific region is expected to grow at the fastest CAGR during the forecast period. This growth is primarily attributed to several factors, including the advancements in healthcare infrastructure, the increasing prevalence of eye disorders like glaucoma, and growing patient awareness in the region. In addition, the growth can be linked to the growing outsourcing activities for ophthalmology devices by major industry players like Alcon, Inc. Furthermore, the growing awareness surrounding advanced corrective vision treatments plays a pivotal role in the expansion of emerging economies, particularly in countries such as China and India.

In 2023, China held the greatest share of the Asia Pacific region's market for minimally invasive glaucoma surgery devices. In China, the regulatory process for product approvals is less stringent, allowing innovative products to enter the market more easily. Furthermore, the availability of resources enables innovations in technology at lower costs, resulting in an expansion in the number of manufacturing facilities in the country.

Surgery Method Insights

The trabecular meshwork bypass segment accounted for the largest revenue share in 2023. In cases of glaucoma, the trabecular meshwork may become obstructed or less effective, resulting in elevated intraocular pressure (IOP). This increased pressure can harm the optic nerve and lead to vision loss. Bypassing the trabecular meshwork offers numerous advantages and applications in the treatment and management of glaucoma, such as lowering intraocular pressure, and preserving optic nerve health. This segment is further sub-segmented as stent placement and by tissue excision, in which the stent placement segment dominated the segment in 2023.

Schlemm’s canal implants segment is estimated to register the fastest CAGR during the forecast period. Schlemm's canal implants, also recognized as micro-invasive glaucoma surgery (MIGS) devices that focus on Schlemm's canal, constitute a group of surgical procedures tailored to address intraocular pressure (IOP) in individuals with glaucoma. These implants are utilized to establish a fresh route for the drainage of aqueous humor, the transparent fluid within the eye, by utilizing Schlemm's canal, an integral part of the eye's natural drainage system.

Key Companies & Market Share Insights

-

Corza Ophthalmology, Carl Zeiss Meditec AG, and Glaukos Corporation are some of the dominant players operating in the minimally invasive glaucoma surgery (MIGS) devices industry.

-

A business unit of Corza Medical, Corza Ophthalmology, is dedicated to vision care globally. Its portfolio includes diagnostic lenses, biologics, punctum plugs, devices, knives, instruments, and sutures.

-

The Zeiss group comprises four business segments- industrial quality & research, medical technology, semiconductor manufacturing technology, and consumer markets. The medical technology segment is bifurcated into ophthalmology and microsurgery.

-

Glaukos Corporation is an ophthalmic medical and pharmaceutical company focused on developing and manufacturing novel therapeutic products to treat corneal disorders, glaucoma, and retinal disease.

-

Ziemer Ophthalmic Systems AG, and Iridex Corporation, are some of the emerging market players functioning in the minimally invasive glaucoma surgery (MIGS) devices industry.

-

Ziemer Ophthalmic Systems AG offers solutions in areas of cataract, refractive, and therapeutic. Furthermore, its line of business includes wholesalers distributing surgical and other medical instruments, equipment, & apparatus.

-

IRIDEX products are sold directly in the United States and internationally through a combination of direct sales and a network of approximately 60 independent distributors in over 100 countries.

Key Minimally Invasive Glaucoma Surgery (MIGS) Devices Companies:

- Alcon, Inc.

- Glaukos Corporation.

- Johnson & Johnson Vision

- AbbVie Inc. (Allergan Plc.)

- Corza Ophthalmology

- Carl Zeiss Meditec AG

- Katalyst Surgical

- Lumenis Ltd

- Ziemer Ophthalmic Systems AG

- Iridex Corporation

Recent Developments

-

In November 2023, J&J Surgical Vision, Inc. and Alcon, Inc. entered into a settlement agreement to resolve their pending legal proceedings associated with femtosecond laser-supported cataract surgery devices.

-

In August 2023, Glaukos Corporation received FDA 510 (k) clearance for its product iStent Infinite'. The product is used in a standalone procedure to reduce elevated Intraocular Pressure (IOP) in patients with primary open-angle glaucoma.

-

In November 2022, Alcon, Inc. acquired Ivantis, Inc. to develop, manufacture, and sell high-quality Minimally Invasive Glaucoma Surgery (MIGS) devices.

Minimally Invasive Glaucoma Surgery (MIGS) Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 571.0 million

Revenue forecast in 2030

USD 781.2 million

Growth rate

CAGR of 5.36% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Report coverage

Revenue, competitive landscape, growth factors, and trends

Key companies profiled

Alcon, Inc.; Glaukos Corporation.; Johnson & Johnson Vision; AbbVie Inc. (Allergan Plc.); Corza Ophthalmology; Carl Zeiss Meditec AG; Katalyst Surgical; Lumenis Ltd; Ziemer Ophthalmic Systems AG; Iridex Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Minimally Invasive Glaucoma Surgery (MIGS) Devices Market Report Segmentation

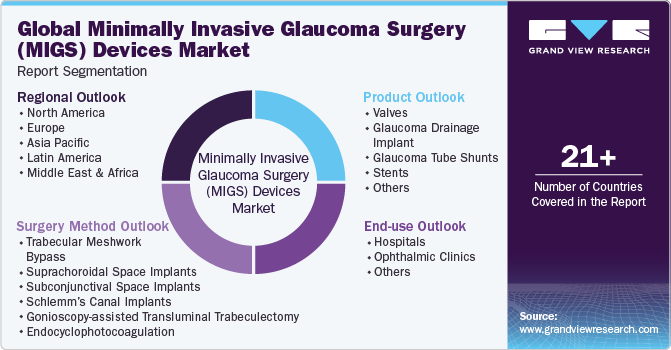

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global minimally invasive glaucoma surgery (MIGS) devices market report based on product, surgery method, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Valves

-

Glaucoma Drainage Implant

-

Glaucoma Tube Shunts

-

Stents

-

Others

-

-

Surgery Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Trabecular Meshwork Bypass

-

By Stent Placement

-

By Tissue Excision

-

-

Suprachoroidal Space Implants

-

Subconjunctival Space Implants

-

Schlemm’s Canal Implants

-

Gonioscopy-assisted Transluminal Trabeculectomy

-

Endocyclophotocoagulation

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ophthalmic Clinics

-

Others Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global minimally invasive glaucoma surgery devices market size was estimated at USD 539.6 million in 2023 and is expected to reach USD 571.0 million in 2024.

b. The global minimally invasive glaucoma surgery devices market is expected to grow at a compound annual growth rate of 5.36% from 2024 to 2030, reaching USD 781.2 million by 2030.

b. North America dominated the minimally invasive glaucoma surgery (MIGS) devices market with a share of 36% in 2023. This is attributable to the expanding geriatric population and the increasing incidence of glaucoma. Furthermore, the adoption of reimbursement models for ophthalmic care and the implementation of stringent regulatory measures focused on ensuring patient safety are anticipated to stimulate the demand for ophthalmic devices in this region.

b. Some key players operating in the minimally invasive glaucoma surgery (MIGS) devices market include TAlcon, Inc.; Glaukos Corporation.; Johnson & Johnson Vision; AbbVie Inc. (Allergan Plc.); Corza Ophthalmology; Carl Zeiss Meditec AG; Katalyst Surgical; Lumenis Ltd; Ziemer Ophthalmic Systems AG; Iridex Corporation.

b. Key factors that are driving the market growth include the rising global burden of glaucoma, government support, such as favorable reimbursement policies and foreign direct investment provisions, and rising demand for minimally invasive glaucoma surgery (MIGS) procedures is expected to drive the demand for minimally invasive glaucoma surgery (MIGS) devices market over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.