- Home

- »

- Medical Devices

- »

-

Retinal Implants Market Size, Share, Industry Report, 2030GVR Report cover

![Retinal Implants Market Size, Share & Trends Report]()

Retinal Implants Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Retina Implant Alpha AMS, Implantable Miniature), By End Use (Hospitals, Outpatient Facilities), By Region, And Segment Forecasts

- Report ID: 978-1-68038-728-5

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Retinal Implants Market Summary

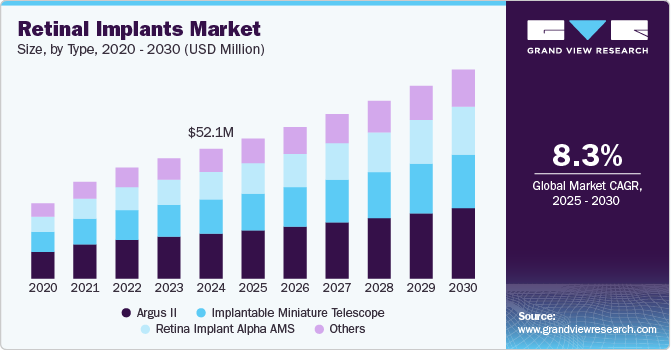

The global retinal implants market size was estimated at USD 52.1 million in 2024 and is projected to reach USD 84.1 million by 2030, growing at a CAGR of 8.3% from 2025 to 2030. The ability to restore vision, the growing senior population, and the increasing prevalence of target illnesses are driving the demand for retinal implants.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Japan is expected to register the highest CAGR from 2025 to 2030.

- Based on the device type, the Argus II segment accounted for the largest revenue share of around 34.7% in 2024.

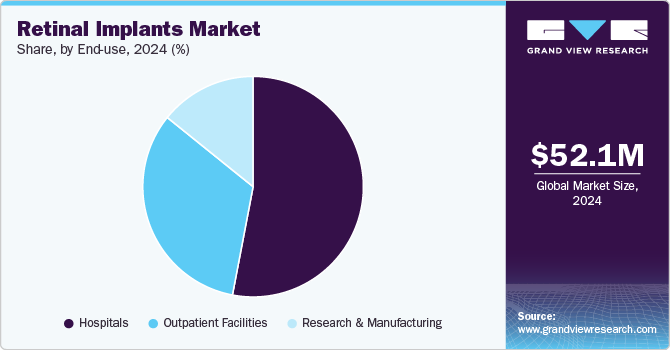

- Based on end use, the hospitals segment accounted for the largest revenue share of over 53.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 52.1 Million

- 2030 Projected Market Size: USD 84.1 Million

- CAGR (2025-2030): 8.3%

- North America: Largest market in 2024

The market is expanding owing to the rising frequency of retinal disorders worldwide. Blindness or loss of vision may result from many illnesses. Age-related macular degeneration (AMD), diabetic retinopathy, and retinitis pigmentosa are some of the most prevalent retinal disorders.

Retinitis pigmentosa (RP) remains one of the most debilitating retinal diseases, with no effective treatment currently available. RP is an inherited disorder that gradually destroys photoreceptor cells in the retina, ultimately leading to blindness. Around two million people worldwide are affected by RP, with no cure on the horizon. However, groundbreaking research from Johns Hopkins University in February 2024 may provide a solution. Researchers developed a biocompatible nanocomposite material that, when used in retinal implants and activated by laser illumination, has shown potential to acoustically stimulate cells in the damaged retina, sending signals to the brain's visual cortex. This material, containing palladium nanoparticles, converts light into sound waves, effectively stimulating retinal cells to restore some level of vision. The discovery represents a significant step forward in retinal implant technology, with the potential to change the course of treatment for RP patients.

In addition to RP, diabetic retinopathy (DR) is another major contributor to the growing demand for retinal implants. Diabetic retinopathy is a microvascular complication of diabetes that can cause vision impairment or blindness if left untreated. According to the World Health Organization, DR accounts for approximately 4.8% of the 37 million blindness cases worldwide. In the United States, an estimated 4.1 million adults aged 40 and older have diabetic retinopathy, with nearly 900,000 individuals suffering from vision-threatening DR. The prevalence of DR is expected to rise significantly, particularly with the growing number of diabetic patients globally. By 2030, over 11 million people in the U.S. are expected to be affected by diabetic retinopathy, contributing to a substantial market for retinal implants that can mitigate the vision loss caused by this condition.

The global diabetic population is projected to reach 700 million by 2045, highlighting the scale of the problem. As the number of individuals at risk for diabetic retinopathy increases, so does the need for retinal implants and advanced treatment options. Diabetic retinopathy is the leading cause of blindness among adults with diabetes, and retinal implants may offer a critical solution to prevent vision loss in these individuals.

The advancements in retinal implant technology, particularly in terms of biocompatible materials and light-activated treatments, are crucial in addressing the growing demand for vision restoration. Furthermore, the integration of retinal implants with emerging technologies such as AI and machine learning will further enhance diagnostic accuracy and treatment effectiveness.

Market Concentration & Characteristics

The retinal implants industry is characterized by rapid technological advancements and increasing demand due to rising cases of retinal diseases like retinitis pigmentosa and diabetic retinopathy. Key players are focusing on developing biocompatible, light-responsive materials and advanced retinal prosthetics. High research and development investments drive innovation, particularly in areas such as nanocomposite materials, AI integration, and gene therapy. The market is highly concentrated, with prominent players like Nidek Co., Ltd. and Pixium Vision leading the way. Regulatory approval, clinical trials, and cost-effectiveness remain crucial factors influencing market growth and widespread adoption, and increasing diabetic populations further fuel demand for vision restoration solutions.

The degree of innovation in the retinal implants industry is significant, driven by advancements aimed at improving patient comfort, safety, and ease of use. For instance, in July 2021, recent studies in Nature and Scientific American highlighted the development of an artificial eye featuring compact light-sensing nanowires, offering a promising breakthrough. Though these nanowires could be densely packed compared to natural photoreceptor cells, connecting the artificial eye to the optic nerve or directly to the brain's visual cortex will require years of further research.

Regulations in the retinal implants industry play a crucial role in ensuring patient safety and the effectiveness of devices. Regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) establish stringent guidelines for clinical trials, product approval, and post-market surveillance. These regulations ensure that retinal implants, such as bionic eyes and retinal prosthetics, meet high standards for quality, safety, and performance. However, the evolving nature of this technology requires continuous updates to regulations, especially as innovations, such as advanced materials and nanotechnology, emerge. Regulatory hurdles can delay market entry, but they protect patient health.

Mergers and acquisitions (M&A) in the retinal implants industry have been growing as companies seek to expand their technological capabilities, product portfolios, and market presence. In April 2024, Science Corporation, a brain-computer interface company, acquired the intellectual property and assets related to Pixium Vision's Prima retinal implant. Founded by Neuralink co-founder Max Hodak, Science focuses on visual prosthetics for conditions like retinitis pigmentosa (RP) and dry age-related macular degeneration (AMD). The Prima System, already FDA breakthrough device-designated, uses a photovoltaic substitute for photoreceptors. Such strategic moves enable companies to improve operational efficiency and accelerate innovation, further driving competition and growth within the industry.

In the retinal implants industry, product substitutes are emerging in the form of non-invasive therapies, such as gene therapy, stem cell treatments, and retinal prosthetics. Gene therapies aim to restore retinal function by introducing genetic material into the retina, while stem cell treatments focus on regenerating damaged retinal cells. In addition, visual aids like wearable devices and smart glasses, which enhance vision for those with retinal degeneration, serve as alternatives to implants. These substitutes offer potential benefits, such as lower risk and broader patient applicability, although retinal implants remain a leading option for restoring sight in advanced cases of blindness.

The retinal implants industry is seeing substantial regional expansion, driven by advancements in medical technology and increasing healthcare investments. In North America, particularly the U.S., regulatory approvals and research funding are fueling growth, while Europe is witnessing the adoption of retinal implants through collaborations and clinical trials. In Asia-Pacific, countries like Japan and China are experiencing rising demand due to the aging population and increasing prevalence of retinal diseases. In addition, regions in the Middle East and Latin America are developing healthcare infrastructure, expanding access to advanced retinal treatments, thus enhancing the global reach.

Type Insights

Based on the device type, the market is segmented into retina implant alpha AMS, implantable miniature telescope, Argus II, and others. The Argus II segment accounted for the largest revenue share of around 34.7% in 2024. The primary purpose of the epiretinal implant Argus II is to treat retinitis pigmentosa. A highly prevalent condition affecting the retina is retinal pigments. As per the National Institute of Health in Europe and the U.S., one out of every 4,000 to 4,500 persons suffer from this eye disorder.

The retina implant alpha AMS segment is expected to grow at the fastest CAGR during the forecast period. The high prevalence of AMD, a leading cause of blindness in older adults, creates a substantial patient pool seeking treatments such as IMTs. Ongoing technological advancements in IMT design and functionality can make these devices more effective and attractive to patients and healthcare providers.

End Use Insights

Based on end use, the market is segmented into hospitals, outpatient facilities, and research & manufacturing. The hospitals segment accounted for the largest revenue share of over 53.0% in 2024. This leadership is attributed to the availability of advanced surgical infrastructure and specialized ophthalmic care in hospitals, enabling successful implantation procedures. Hospitals are also preferred for their multidisciplinary expertise, ensuring comprehensive preoperative and postoperative care.

The hospitals segment is expected to grow at the fastest CAGR during the forecast period. There is a rise in the number of independent eye hospitals across the globe. This trend is expected to continue during the forecast period owing to the availability of specialists, cost efficiency, and technologically advanced equipment.

Regional Insights

North American retinal implants market held a dominant position, capturing 37.5% of the global revenue share in 2024. Many leading pharmaceutical companies in the region are investing in the development of retinal implants, which is driving the growth of the market. The market is expanding because of the increasing number of product launches.

U.S. Retinal Implants Market Trends

The retinal implants market in the U.S. held a significant share in the North America region in 2024. The U.S. plays a leading role in the retinal implants industry, supported by its robust healthcare infrastructure and extensive immunization programs. In this region, significant innovations, technological improvements, partnerships, and agreements are being made. For instance, on September 6, 2021, U.S.-based MedTech business Cirtec Medical and Bionic Vision Technologies (BVT) announced their strategic alliance. Because of this collaboration, Cirtec gained a strategic share in Bionic and is likely to help that company further create and refine its newest retinal implants.

Europe Retinal Implants Market Trends

Europe retinal implants market held a global revenue share of 29.5% in 2024 driven by advanced healthcare systems and strong public health initiatives. In October 2024, Science Corporation reported successful outcomes from a European clinical trial of the PRIMA retinal implant. This wireless device restores vision in patients with geographic atrophy (GA), enabling them to read and recognize faces post-implantation.

The UK retinal implants market is steadily growing, supported by a rise in diabetes-related eye diseases. An NHS Digital report indicates a 5% increase in cases over the past two years. Diabetic retinopathy affects about one-third of individuals with Type 1 diabetes and one in ten with Type 2 diabetes.

The retinal implants market in France is expanding, supported by advanced healthcare infrastructure and increasing adoption of innovative technologies. Clinical trials, such as the CALIPSO study, have demonstrated the potential of retinal implants in treating conditions like geographic atrophy and retinitis pigmentosa. French institutions are actively contributing to research and development, fostering innovation in vision-restoring devices. In addition, the government’s strong healthcare policies and public funding for ophthalmic treatments are driving market growth.

The German retinal implants market is anticipated to expand, driven by the rising prevalence of diabetes. Germany faces a significant healthcare challenge with high rates of undiagnosed type 1 and type 2 diabetes among adults. An aging population and unhealthy lifestyle choices are expected to further elevate type 2 diabetes cases in the next decade. Diabetic retinopathy, a major complication of diabetes, remains a critical health concern, impacting a substantial portion of the population. These factors underscore the growing demand for advanced retinal implant solutions to address vision-related complications associated with diabetes in Germany.

Asia Pacific Retinal Implants Market Trends

The Asia Pacific region retinal implants market is expected to register the fastest CAGR of 9.3% during the forecast period. The region has experienced significant growth in healthcare expenditure, resulting in a greater investment in R&D activities concerning retinal implants. This has helped in the development of new and innovative products and technologies, boosting market growth. Conditions such as age-related macular degeneration (AMD) and retinitis pigmentosa (RP) are becoming more prevalent globally. In addition, with the rapidly increasing aging population, consumers are becoming more aware of government policies. Furthermore, the healthcare infrastructure is undergoing modernization, while the medical tourism industry is rapidly expanding in developing economies such as China and India. Regional market expansion is also anticipated to be fueled by leading market participants spending more on healthcare in the public and private sectors to reach unexplored regions.

Japan's retinal implants market is poised for growth, driven by innovative advancements and successful clinical developments. In February 2024, Japan introduced a novel retinal implant system and completed a pilot clinical trial, showcasing its technological expertise. Additionally, Japanese researchers have successfully performed suprachoroidal retinal implantations on blind patients, marking a significant step in restoring vision.

The China's retinal implants market is advancing, highlighted by significant milestones. In July 2024, Samsara Vision successfully implanted a miniature telescope in a patient, with ongoing monitoring for visual rehabilitation as the patient adapts to their enhanced vision. In addition, the Shenzhen Institutes of Advanced Technology (SIAT) at the Chinese Academy of Sciences (CAS) is actively researching micro/nanotechnologies to develop high-density retinal implants, further driving innovation in the field.

The retinal implants market in India is experiencing significant growth, driven by increasing cases of diabetic retinopathy and advancements in healthcare technology. In May 2022, Chhattisgarh introduced OCT-guided coronary angioplasty, signaling a shift toward advanced ophthalmic care. The rising prevalence of diabetes, coupled with a growing geriatric population, has escalated demand for innovative retinal solutions. Government initiatives and increased healthcare funding are bolstering the adoption of retinal implants.

Latin America Retinal Implants Market Trends

The Latin American retinal implants market is expanding rapidly, supported by widespread vaccine distribution and increasing type 2 diabetes prevalence. Genetic predisposition and rising obesity rates have fueled a steady growth in diabetes cases over the past four decades, with approximately 10% of the global population affected. Key contributors to the market’s growth include Brazil, Mexico, Argentina, and Colombia. Investments by industry players, geographic proximity to North America, and free-trade agreements with countries like the U.S., Canada, Japan, and several European nations further boost market development. These factors position Latin America as a promising region for retinal implant advancements.

The retinal implants market in Saudi Arabia is set for rapid growth, fueled by the rising prevalence of diabetes and a rapidly aging population. The International Diabetes Federation (IDF) reports that the Middle East has the second-highest number of diabetes-related deaths in patients under 60. Additionally, IDF projects a 134% increase in the region's 24 million diabetic population by 2045.

Key Retinal Implants Company Insights

The market is very competitive, with several manufacturers holding a majority of the market share. For instance, in January 2018, Pixium Vision received approval from the U.S. FDA to initiate clinical trials for PRIMA, which is a sub-retinal implant. The implant was approved for practice in patients with atrophic dry age-related macular degeneration (AMD). Product launches, approvals, strategic acquisitions, and innovations are just a few of the critical business strategies market participants use to maintain and grow their global reach. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain market avenues.

Key Retinal Implants Companies:

The following are the leading companies in the retinal implants market. These companies collectively hold the largest market share and dictate industry trends:

- Vivani Medical

- Pixium Vision

- Boston Retinal Implant Project

- Nano Retina

- Labtician Ophthalmics, Inc.

- LambdaVision, Inc.

- Bionic Vision Technologies

- Nidek Co., Ltd.

- Retina Implant AG

- Optobionics

- VisionCare Ophthalmic Technologies

Recent Developments

-

In February 2024 , Yonsei University researchers developed a soft retinal prosthesis using ultrathin phototransistor arrays and liquid metal electrodes. Unlike rigid implants, this design, made with low-toxicity gallium–indium alloy, aligns with the retina's curved surface and reduces tissue damage, offering a safer, more adaptable solution for restoring vision in degenerative retinal diseases.

-

In February 2022 , Stanford researchers demonstrated that a retinal chip, combined with specialized glasses, restores central vision in macular degeneration patients. The prosthetic vision naturally integrates with patients' peripheral vision, creating coherent images without distortion. This breakthrough, published in Nature Communications, offers hope for restoring functional vision in the 200 million affected globally

Retinal Implants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 56.3 million

Revenue forecast in 2030

USD 84.1 million

Growth Rate

CAGR of 8.3% from 2025 to 2030

Actual Data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Vivani Medical; Pixium Vision; Boston Retinal Implant Project; Nano Retina; Labtician Ophthalmics, Inc.; LambdaVision, Inc.; Bionic Vision Technologies; Nidek Co., Ltd.; Retina Implant AG; Optobionics; VisionCare Ophthalmic Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Retinal Implants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global retinal implants market report based on type, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Retina Implant Alpha AMS

-

Implantable Miniature Telescope

-

Argus II

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient facilities

-

Research & Manufacturing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global retinal implants market size was estimated at USD 52.1 million in 2024 and is expected to reach USD 56.3 million in 2025.

b. The global retinal implants market is expected to grow at a compound annual growth rate of 8.3% from 2025 to 2030 to reach USD 84.1 million by 2030.

b. North America dominated the retinal implants market with a share of 37.5% in 2024. This is attributable to the high prevalence of degenerative conditions and technological advancements.

b. Some key players operating in the retinal implants market include Second Sight Medical Products, Inc.; Retina Implant AG; and VisionCare, Inc.

b. Key factors that are driving the market growth include rising prevalence of target diseases and growing demand for vision correction.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.