- Home

- »

- Plastics, Polymers & Resins

- »

-

Pharmaceutical Glass Packaging Market Size Report, 2030GVR Report cover

![Pharmaceutical Glass Packaging Market Size, Share & Trends Report]()

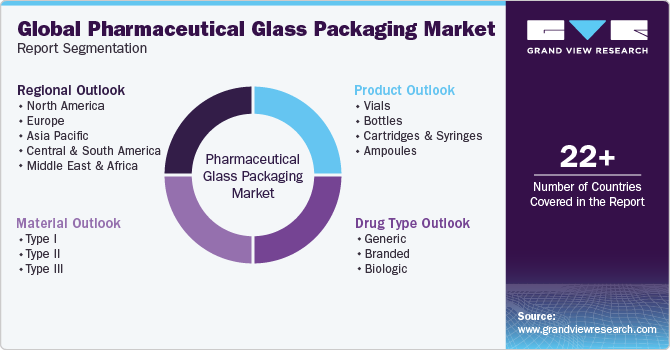

Pharmaceutical Glass Packaging Market Size, Share & Trends Analysis Report By Material (Type I, Type II, Type III), By Product (Vials, Bottles, Ampoules), By Drug Type (Generic, Branded, Biologic), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-175-7

- Number of Report Pages: 165

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

The global pharmaceutical glass packaging market size was estimated at USD 19.75 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.8% from 2024 to 2030. Extensive utilization of generic injectable drugs coupled with high demand from the pharmaceutical industry is anticipated to drive market growth. Limestone (CaCO3), soda ash (Na2CO3), cullet, and sand (SiO2) comprise the overall chemical composition of glass. For pharmaceutical packaging applications, the most common cations found in glassware are barium, zinc, ferrous, magnesium, calcium, potassium, sodium, boron, aluminum, and silicon. These materials influence the properties of glass such as chemical resistance, hardness, and durability.

According to the U.S. Centers for Medicare & Medicaid Services, the national health spending of the country is expected to grow at an annual rate of 5.4% and expected to reach USD 6.2 trillion by 2028. The federal government healthcare expenditure supporting programs such as the Veterans Administration, U.S. Department of Defense healthcare programs, Affordable Care Act (ACA), Children’s Health Insurance Program (CHIP), Medicaid, and Medicare are expected to support the healthcare-related aid to the U.S. population can increase the consumption for pharmaceuticals, thereby positively impacting the market in the country.

The growing significance of cost-sensitivity and biotech drugs in the healthcare sector has resulted in the establishment of strict regulations related to the drug delivery products. Multiple manufacturers working in pharmaceutical glass manufacturing market are focused on packaging aimed at increasing shelf life of a product and are therefore investing in vials.

Pharmaceutical glass packaging developers have been enhancing their product capabilities in order to cater to the changing pharmaceutical industry, which can further contribute to the market in the U.S. For instance, in November 2023, Corning Incorporated introduced coated specially engineered Type I borosilicate vials known as Corning Velocity Vials. These vials exhibit effective hardness compared to conventional borosilicate vials, reducing the probability of cracking and breaking.

The additional impact of COVID-19 pandemic has left the pharmaceutical industry with a steadily growing high demand for medicines and other healthcare facilities. The surge in demand for pharmaceutical drugs, as a result of the pandemic, has affected the market positively. The demand is expected to reach a new peak in the case of approval for COVID-19 vaccines developed by different institutions and companies in various countries.

For instance, the U.S. produces millions of surplus doses of vaccines that are packaged in large, multi-dose vials. These vials are either used domestically or distributed to other countries of the world. The U.S. is expected to have approximately 500 million doses of the Johnson & Johnson, Moderna, and Pfizer-BioNTech vaccines by 2022 Despite the demand from state officials in U.S., there have been various challenges for manufacturers in switching from large multi-dose vials to single-dose vials for supplying vaccines.

Presently, most vaccines in the U.S. are distributed in the form of single-dose vials or prefilled syringes, but the COVID-19 vaccines are being distributed through multi-dose vials owing to the requirement of their quick manufacturing in the early months of the inoculation campaign carried out in the country.

Glass poses as a hindrance to atmospheric gases such as carbon dioxide and oxygen from entering the primary pharmaceutical glass container, mitigating the risk of contamination of the drugs. Glass packaging lowers the drug’s susceptibility to degradation, such as hydrolysis and oxidation. Moreover, glass packaging helps in resisting escape of volatile ingredients, thereby increasing the drug stability. All these factors are anticipated to surge the product demand in near future.

The Pharmaceutical Glass Packaging Market is poised for significant growth and innovation. Given its recyclable nature, the industry's increasing focus on sustainability and environmentally friendly packaging solutions positions glass as an attractive choice, which aligns well with pharmaceutical companies' heightened emphasis on sustainable practices. Integrating intelligent packaging technologies, such as RFID tags and tamper-evident features, enhances the appeal and functionality of pharmaceutical glass packaging. In response to tightening regulations on pharmaceutical packaging, manufacturers that offer inventive, compliant, and cost-effective glass packaging solutions are well-positioned to capture substantial market share.

Market Concentration & Characteristics

Pharmaceutical glass packaging market is witnessing growth owing to high product demand in pharmaceutical industry and extensive utilization of glass in generic injectable drugs. The glass used for primary pharmaceutical packaging has a well-established production system and supply chain. A large number of suppliers are mainly concentrated in the developed regions, such as North America and Europe, owing to the presence of a well-established pharmaceutical industry here.

Key players in the market include Gerresheimer AG, Corning Incorporated, Nipro Corporation, Schott AG, SGD Pharma, Shandong Pharmaceutical Glass Co., Ltd., Bormioli Rocco Pharma, Ardagh Group, West Pharmaceutical Services, Inc., Şişecam Group, Stölzle Oberglas GmbH, and Beatson Clark. In terms of revenue, the top ten manufacturers in the market hold a share of over 75.0%, while the other manufacturers account for the rest.

Companies such as Gerresheimer AG, Corning Incorporated, and Schott AG are pioneers of a majority of the research initiatives undertaken in pharmaceutical glass packaging market. These companies are engaged in introducing new technologies and products to better cater to drug manufacturing companies across the globe. An increasing number of innovative biotech drugs, which have to be injected, are being introduced in the market and must be supplied in the necessary concentrations in vials and prefilled syringes.

Manufacturers of glass packaging for pharmaceuticals are constantly striving to offer a wide range of technologies covering as much of the value chain as possible. For instance, On July 13, 2023, Corning Inc. launched the innovation in the pharmaceutical glass packaging portfolio “Viridian Vials”. The new technology can improve filling-line efficiency by up to 50% while reducing vial-manufacturing carbon dioxide equivalent emissions by up to 30%. These new product uses 20% less glass material than conventional glass vials, with no impact on the quality or safety of the vial. This reduction in glass material lowers manufacturing and transportation-related emissions by up to 30% and decreases the total amount of glass entering the waste stream. Viridian’s low-friction external coating minimizes cracks, breaks, and cosmetic rejects while improving filling-line efficiency by up to 50%.

Material Insights

Based on material, market is segmented into the Type I, Type II, and Type III.

Type I Glass (Borosilicate Glass) is accounted for the major share of the market in 2023, and it is anticipated that it will maintain its attractiveness during the forecast period. As the glass has exceptional resistance to chemical interactions. It is commonly used for parenteral drug products, injectables, and other formulations that demand a high level of chemical durability and stability.

Pharmaceutical glass type II is soda-lime glass treated to enhance its chemical resistance. While not as inert as Type I, it still provides a suitable barrier for many pharmaceutical products.

Product Insights

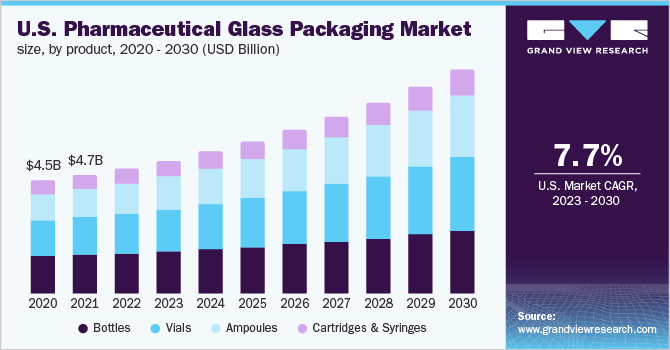

Pharmaceutical glass bottles were the largest market segment, accounting for more than 34.2% in 2023 in terms of global revenue. The pharmaceutical glass packaging market has been segmented on the basis of product as ampoules, bottles, vials, syringes, and cartridges. Vials have high analytical performance and great sustainability, which is expected to drive the segment with second fastest growth rate after ampoules. Therefore, the vials segment is expected to witness a rise in market share over the forecast period from 33.3% in 2023.

Pharmaceutical glass vials are made from Type 1 borosilicate glass which imparts the desired chemical resistance properties to the glass vials. Ampoules is expected to witness the fastest growth, whereas the largest market share is anticipated to be held by bottles. It also accounted for a volume share of over 75.0% in 2023 owing to its better analytical performance and suitability.

Glass bottles used for pharmaceutical packaging are categorized into two types depending on their size, namely, small bottles and large bottles. The large size glass bottles are used for packaging of reagents as well as transfusion and infusion bottles. The small glass bottles is used for packaging of syrup bottles and other oral liquids. The small-sized sized bottles segment is expected to witness growth on account of numerous new opportunities including the rising consumption of oral tablets that are packaged in small bottles.

Ampoules that are largely developed from glass are anticipated to grow with the most attractive CAGR, in terms of revenue, during the forecast period from 2024 to 2030 owing to the ability of glass to filter specific wavelengths, high microbiological control, and high chemical resistance. Large number of ampoules are produced in compliance with the DIN ISO EN 9187-1/2 standard in sealed designs, funnel-type, and straight-stem.

Drug Type Insights

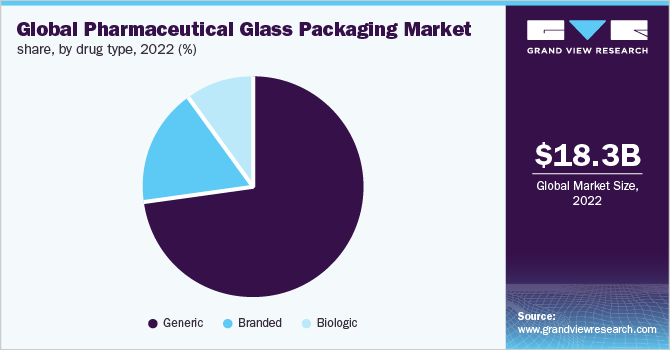

Generic drug type led the market and accounted for more than 72.9% share of the global revenue in 2023. The global market for generic drugs has seen a rise in the past several years due to increasing cases of chronic diseases, aging population, and the rise in the expiration of drug patents.

Furthermore, the efforts from governments and healthcare service providers to reduce healthcare expenditure & drug prices and provision of health insurance coverage are also anticipated to fuel the consumption of generic drugs. The increased consumption of generics is expected to ascend the demand for pharmaceutical glass packaging owing to its regulatory ease and extraordinary barrier property.

The growth of biologic drugs is majorly due to their ability to treat major chronic diseases, especially certain forms of autoimmune diseases and cancer. However, glass delamination and chipping that results from surface degradation is anticipated to lower the growth of primary glass packaging for the biologic drugs.

The generic drug segment in North America is expected to witness a higher growth than branded segment, both in terms of volume and revenue, as it is affordable, whereas the patent expirations are going to further led the branded segment to have a moderate growth rate. The primary glass packaging is expected to show a sluggish growth on account of decreased volume sales of branded drugs.

The pharmaceutical industry is expected to largely benefit from biologics as they cater to therapeutic aspects that are underserved. The biosimilar competition for biologics has remained low resulting in moderate growth of the segment, thereby slowing the growth of the segment in the market.

The U.S. boasts presence of pharmaceutical giants and therefore is expected to stay a core region for various business activities related to pharmaceutical glass packaging. The customer consolidation and increased competitive intensity in the country is expected to result in a significant increase in the volume of generic drug sales causing rapid change in market dynamics. This change coupled with patent expirations of numerous drugs is expected to constrain branded product sales in the U.S.

Regional Insights

North America dominated the market and accounted for more than 35.5% share of global revenue in 2023. The developing markets are expected to witness a surge in spending in the pharmaceutical industry over the upcoming years. The U.S. is expected to remain a key driver and most important market for the growth of the pharmaceutical sector in the region with innovative products leading the growth. This growth is expected to be aided by the rise in generics in the region that are anticipated to witness consistently high demand in terms of volume and sales.

Emerging markets are expected to show higher growth rates compared to developed markets due to the rapid increase in consumer base and spending. Increased cases of chronic ailments, increased healthcare awareness, and rising income levels are expected to further aid the growth of emerging markets in the Asia Pacific. The governments in the Asia Pacific region are expanding their private and public healthcare coverage as a result of increased awareness. The efforts of the government in developing regions to promote low-cost generic drugs and reduce healthcare costs is expected to result in an increased volume of pharmaceutical products further fueling the growth of the market in the region.

Europe region accounted for more than 19.0% of the volume share in 2023. The research-based pharmaceutical industry is a key asset of the European economy. The pharmaceutical glass packaging industry is on the rise owing to the growth in medical progress by means of research, development, and introduction of new medicines aimed at improving the health and quality of life of patients in the region.

The national regulation that holds down prices & profits and results in market fragmentation is anticipated to be a major factor that differentiates the strengths of the European research-based industry and its American counterparts in the pharmaceutical sector.

The current Russia and Ukraine conflict has negatively impacted the energy supplies consisting of natural gas and electricity, thereby progressing its impact on the glass production in the Europe. Since glass manufacturing involves melting of limestone, soda ash, and sand, the temperatures required for melting the mixture depend on the energy generated from the natural gas supplied by Russia. The natural gas shortage has led to the halting of operations by European bottle manufacturers, automobile manufacturers, and skyscraper builders.

Asia Pacific is anticipated to be the fastest-growing region in terms of revenue. This growth in demand can be ascertained by the presence of numerous small and medium scaled production units in the region. The region also enjoys lenient regulatory regimes which work out to support the manufacturers, along with attracting foreign investment. Usually, companies like Corning Incorporated and Schott AG partners up with small scaled production units in the region which provides them a platform to expand their regional presence along with gaining higher market share.

Saudi Arabia Pharmaceutical Glass Packaging Market:

International pharmaceutical players' rising interest in setting up their offices to capture the attractive markets in the Middle East & North Africa is further expected to impact the market growth positively. The Saudi Arabian pharmaceutical market reach to USD 10.74 billion in 2023, according to the Ministry of Health and Prevention (MoHaP). In an event, the Ministry of Health and Prevention (MoHaP) laid out the kingdom's planning of rapid reforms in the field of healthcare at both service provision and regulatory levels, which is in line with the National Transformation Program and Saudi Arabia's Vision 2030.

Key Companies & Market Share Insights

Numerous pharmaceutical glass manufacturing companies are primarily concentrated in the developed regions such as Europe and North America resulting in well-established supply chain and production system in the regions. However, manufacturers are shifting their base to countries such as Brazil, India, and China due to low labor costs and growth of opportunities offered by these countries. The generic sector is expected to drive the demand for pharmaceutical glass packaging in these countries over the forecast period.

-

In June 2023, Müller + Müller, the manufacturer of primary packaging materials made of tubular glass for the pharmaceutical industry, has invested 15 million EUR at its vial manufacturing site in Holzminden. The investment includes up to 14 new production lines as well as a corresponding clean room.

-

In June 2023, Corning and SGD Pharma with joint venture open a new glass tubing facility and expand access to Corning Velocity Vial technology in in Telangana, India. Manufacturing of Velocity Vials at SGD Pharma’s facility in Vemula, India, is expected to begin in 2024. Pharmaceutical tubing production is expected to begin in 2025.

Key Pharmaceutical Glass Packaging Companies:

- Corning Incorporated

- Nipro Corporation

- SGD S.A.

- Stoelzle Oberglas GmbH

- Bormioli Pharma S.p.A.

- West Pharmaceutical Services, Inc.

- Schott AG

- Gerresheimer AG

- Shandong Medicinal Glass Co., Ltd.

- Beatson Clark

- Ardagh Group S.A

- Arab Pharmaceutical Glass Co.

- Piramal Enterprises Ltd.

- Şişecam Group

- Owens-Illinois, Inc.

- DWK Life sciences

Recent Developments

-

In June 2023, SDG SA announced its partnership with Corning Incorporated to establish a glass tubing facility in Telangana, India. The partnership combined SDG’s expertise with Corning’s glass coating technology to enhance fine-line productivity, thus initiating expansion in pharmaceutical manufacturing.

-

In May 2023, Bormioli Pharma S.p.A renewed its partnership with Desall.com to develop new innovation and ideas about pharmaceutical packaging by focusing on augment reality solutions for drug delivery, and biometric recognition solutions to transform child-resistant closure systems.

-

In March 2023, Schott AG launched the production of FIOLAX®amber pharma glass in India with the aim to meet its increasing demand in Asia. This production will improve the reliability, planning, availability, and cost-efficiency of pharmaceutical converters.

-

In October 2022, Gerresheimer AG in collaboration with Merck developed a digitalized twin solution to ensure trust and traceability in the pharmaceutical supply chain. This solution aimed to create a digital representation of packaging for syringes and vials.

-

In January 2022, West Pharmaceutical Services Inc. partnered with Corning to make advancements in drug delivery and drug containment by developing pharmaceutical packaging solutions.

-

In May 2021, Nipro Corporation acquired all shares of Piramida d.o.o to make expansion in the European market, and strengthen its position in the pharmaceutical glass packaging sector.

Pharmaceutical Glass Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 21.46 billion

Revenue forecast in 2030

USD 37.62 billion

Growth rate

CAGR of 9.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in million units; revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, drug type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Switzerland; Denmark; Belgium; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; UAE; and South Africa

Key companies profiled

Amcor plc; Becton, Dickinson, and Company; AptarGroup, Inc.; Drug Plastics Group; Gerresheimer AG; Schott AG; Owens Illinois, Inc.; West Pharmaceutical Services, Inc.; Berry Global, Inc.; WestRock Company; SGD Pharma; International Paper; Comar, LLC; CCL Industries, Inc.; Vetter Pharma International

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Glass Packaging Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the pharmaceutical glass packaging market report on the basis of material, product, drug type, and region:

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Type I

-

Type II

-

Type III

-

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Vials

-

Small vials

-

Large vials

-

-

Bottles

-

Small bottles

-

Large bottles

-

-

Cartridges & Syringes

-

Ampoules

-

-

Drug Type Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Generic

-

Branded

-

Biologic

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Switzerland

-

Belgium

-

Denmark

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical glass packaging market was estimated at USD 18.27 billion in the year 2022 and is expected to reach USD 19.7 billion in 2023.

b. The global pharmaceutical glass packaging market is expected to grow at a compound annual growth rate of 9.6% from 2023 to 2030 to reach USD 37.6 billion by 2030.

b. North America emerged as a dominating region with a volume share of over 36.0% in the year 2022 owing to the presence of a strong pharmaceutical industry and the introduction of new & innovative pharmaceutical products requiring glass packaging.

b. The key market player in the global pharmaceutical glass packaging market includes Corning Incorporated, Nipro Corporation, SGD S.A., Stölzle-Oberglas GmbH, Bormioli Pharma S.p.A., West Pharmaceutical Services, Inc., Schott AG, Gerresheimer AG, Shandong Medicinal Glass Co., Ltd., Beatson Clark, Ardagh Group S.A, Arab Pharmaceutical Glass Co., Piramal Enterprises Ltd., and Şişecam Group.

b. Increasing demand for generic drugs in developing as well as emerging markets owing to higher consumer healthcare awareness and low-cost initiatives carried out by governments is expected to drive the pharmaceutical glass packaging market growth

b. The bottles segment dominated the global pharmaceutical glass packaging market accounting for the largest share of over 34.0% in terms of revenue in 2022.

Table of Contents

Chapter 1. Pharmaceutical Glass Packaging Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

1.7. List of Abbreviations

Chapter 2. Pharmaceutical Glass Packaging Market: Executive Summary

2.1. Market Outlook, 2023 (USD Million)

2.2. Segmental Outlook

2.2.1. Material Outlook

2.2.2. Product Outlook

2.2.3. Drug Type Outlook

2.3. Competitive Landscape Snapshot

Chapter 3. Pharmaceutical Glass Packaging Market: Variables, Trends, and Scope

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Trends

3.2.1.1. Type 1 - Borosilicate Glass

3.2.1.2. Boric Oxide

3.2.1.3. Type II Treated Soda Lime

3.2.1.4. Type III Regular Soda Lime

3.2.2. Manufacturing Trends

3.2.3. Profit Margin Analysis

3.2.4. Sales Channel Analysis

3.3. Technology Trends / Timeline

3.4. Regulatory Framework

3.4.1. Standard & Compliance

3.4.2. Safety

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Market Challenges Analysis

3.5.4. Market Opportunity Analysis

3.6. Business Environment Analysis

3.6.1. Industry Analysis - Porter’s

3.6.1.1. Supplier Power

3.6.1.2. Buyer Power

3.6.1.3. Substitution Threat

3.6.1.4. Threat from New Entrant

3.6.1.5. Competitive Rivalry

3.6.2. PESTEL Analysis

3.6.2.1. Political Landscape

3.6.2.2. Environmental Landscape

3.6.2.3. Social Landscape

3.6.2.4. Technology Landscape

3.6.2.5. Economic Landscape

3.6.2.6. Legal Landscape

3.6.3. Market Entry Strategies

3.7. Unmet Needs & Challenges in Pharmaceutical Glass Packaging Industry

3.8. Impact of Environmental, Social, and Governance (ESG) initiatives on the Pharmaceutical Glass Packaging Market

3.8.1. Market Differentiation

3.8.2. Regulatory Compliance

3.8.3. Industry Collaboration

3.8.4. Enhanced Brand Value

3.8.5. Addressing Consumer Demands

3.9. Impact 0f Covid-19 Pandemic on the Pharmaceutical Glass Packaging Market

Chapter 4. Pharmaceutical Glass Packaging Market: Market Supplier Intelligence

4.1. Kraljic Matrix (Portfolio Analysis)

4.1.1. Non-Critical Items

4.1.2. Leverage Items

4.1.3. Bottleneck Items

4.1.4. Strategic Items

4.2. Engagement Model

4.3. Negotiation Strategies

4.4. Sourcing Best Practices

4.5. Vendor Selection Criteria

Chapter 5. Pharmaceutical Glass Packaging Market: Price Trend Analysis

5.1. Pricing Trend Analysis, by Material, 2018 - 2030 (USD/Units)

5.2. Factors Affecting the Pricing Deviation

Chapter 6. Pharmaceutical Glass Packaging Market: Material Estimates & Trend Analysis

6.1. Definition & Scope

6.2. Material Movement Analysis & Market Share, 2023 & 2030

6.3. Type I

6.3.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

6.4. Type II

6.4.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

6.5. Type III

6.5.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Chapter 7. Pharmaceutical Glass Packaging Market: Product Estimates & Trend Analysis

7.1. Definition & Scope

7.2. Product Movement Analysis & Market Share, 2023 & 2030

7.3. Vials

7.3.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

7.4. Bottles

7.4.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

7.5. Cartridges & Syringes

7.5.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

7.6. Ampoules

7.6.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Chapter 8. Pharmaceutical Glass Packaging Market: Drug Type Estimates & Trend Analysis

8.1. Definition & Scope

8.2. Drug Type Movement Analysis & Market Share, 2023 & 2030

8.3. Generic

8.3.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

8.4. Branded

8.4.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

8.5. Biologic

8.5.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Chapter 9. Pharmaceutical Glass Packaging Market: Regional Estimates & Trend Analysis

9.1. Key Takeaways

9.2. Regional Movement Analysis & Market Share, 2023 & 2030

9.3. North America

9.3.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.3.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.3.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.3.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.3.5. U.S.

9.3.5.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.3.5.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.3.5.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.3.5.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.3.6. Canada

9.3.6.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.3.6.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.3.6.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.3.6.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.3.7. Mexico

9.3.7.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.3.7.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.3.7.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.3.7.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.4. Europe

9.4.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.4.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.4.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.4.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.4.5. Germany

9.4.5.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.4.5.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.4.5.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.4.5.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.4.6. U.K.

9.4.6.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.4.6.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.4.6.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.4.6.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.4.7. Italy

9.4.7.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.4.7.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.4.7.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.4.7.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.4.8. Spain

9.4.8.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.4.8.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.4.8.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.4.8.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.4.9. Switzerland

9.4.9.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.4.9.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.4.9.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.4.9.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.4.10. Denmark

9.4.10.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.4.10.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.4.10.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.4.10.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.4.11. Belgium

9.4.11.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.4.11.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.4.11.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.4.11.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.5. Asia Pacific

9.5.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.5.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.5.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.5.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.5.5. China

9.5.5.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.5.5.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.5.5.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.5.5.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.5.6. India

9.5.6.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.5.6.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.5.6.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.5.6.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.5.7. Japan

9.5.7.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.5.7.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.5.7.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.5.7.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.5.8. South Korea

9.5.8.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.5.8.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.5.8.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.5.8.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.5.9. Australia

9.5.9.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.5.9.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.5.9.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.5.9.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.5.10. Southeast Asia

9.5.10.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.5.10.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.5.10.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.5.10.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.6. Central & South America

9.6.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.6.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.6.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.6.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.6.5. Brazil

9.6.5.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.6.5.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.6.5.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.6.5.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.6.6. Argentina

9.6.6.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.6.6.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.6.6.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.6.6.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.7. Middle East & Africa

9.7.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.7.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.7.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.7.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.7.5. Saudi Arabia

9.7.5.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.7.5.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.7.5.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.7.5.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.7.6. UAE

9.7.6.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.7.6.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.7.6.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.7.6.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

9.7.7. South Africa

9.7.7.1. market estimates and forecasts, 2018 - 2030 (USD million) (Million Units)

9.7.7.2. market estimates and forecasts, by material, 2018 - 2030 (Million Units) (USD Million)

9.7.7.3. market estimates and forecasts, by product, 2018 - 2030 (Million Units) (USD Million)

9.7.7.4. market estimates and forecasts, by drug type, 2018 - 2030 (Million Units) (USD Million)

Chapter 10. Start-up Ecosystem Evaluation, 2023

10.1. List of Start-up Companies

10.1.1. Progressive Companies

10.1.2. Responsive Companies

10.1.3. Dynamic Companies

10.1.4. Starting Blocks

10.2. Government Funding for Start-ups across the globe

Chapter 11. Competitive Landscape

11.1. Key Global Players & Recent Developments & Their Impact On the Industry

11.2. Key Company/Competition Categorization (Key innovators, Market leaders, emerging players)

11.3. List of key Raw Material Distributors and Channel Partners

11.4. List of Potential Customers, by End-use

11.5. Company Market Share & Position Analysis, 2023

11.6. Company Heat Map Analysis

11.7. Competitive Dashboard Analysis

11.8. Strategy Mapping

11.8.1. Capacity Expansion

11.8.2. Collaboration/ Partnerships/ Agreements

11.8.3. New Product launches

11.8.4. Mergers & Acquisitions

11.8.5. Innovation in Technology/ Material

11.8.6. Others

Chapter 12. Company Listing / Profiles

12.1. Corning Incorporated

12.1.1. Company Overview

12.1.2. Financial Performance

12.1.3. Product Benchmarking

12.2. Nipro Corporation

12.2.1. Company Overview

12.2.2. Financial Performance

12.2.3. Product Benchmarking

12.3. SGD S.A.

12.3.1. Company Overview

12.3.2. Financial Performance

12.3.3. Product Benchmarking

12.4. Stölzle-Oberglas GmbH

12.4.1. Company Overview

12.4.2. Financial Performance

12.4.3. Product Benchmarking

12.5. West Pharmaceutical Services, Inc.

12.5.1. Company Overview

12.5.2. Financial Performance

12.5.3. Product Benchmarking

12.6. Schott AG

12.6.1. Company Overview

12.6.2. Financial Performance

12.6.3. Product Benchmarking

12.7. Gerresheimer AG

12.7.1. Company Overview

12.7.2. Financial Performance

12.7.3. Product Benchmarking

12.8. Bormioli Pharma S.r.l

12.8.1. Company Overview

12.8.2. Financial Performance

12.8.3. Product Benchmarking

12.9. Shandong Medicinal Glass Co., Ltd.

12.9.1. Company Overview

12.9.2. Financial Performance

12.9.3. Product Benchmarking

12.10. Beatson Clark

12.10.1. Company Overview

12.10.2. Financial Performance

12.10.3. Product Benchmarking

12.11. Ardagh Group S.A.

12.11.1. Company Overview

12.11.2. Financial Performance

12.11.3. Product Benchmarking

12.12. Arab Pharmaceutical Glass Co.

12.12.1. Company Overview

12.12.2. Financial Performance

12.12.3. Product Benchmarking

12.13. Piramal Enterprises Ltd.

12.13.1. Company Overview

12.13.2. Financial Performance

12.13.3. Product Benchmarking

12.14. Şişecam Group

12.14.1. Company Overview

12.14.2. Financial Performance

12.14.3. Product Benchmarking

12.15. Owens-Illinois, Inc

12.15.1. Company Overview

12.15.2. Financial Performance

12.15.3. Product Benchmarking

12.16. DWK Life Sciences

12.16.1. Company Overview

12.16.2. Financial Performance

12.16.3. Product Benchmarking

List of Tables

Table 1 Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 2 Type I Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 3 Type II Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 4 Type III Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 5 Pharmaceutical Glass Packaging Market estimates and forecasts, by vials, 2018 - 2030 (USD Million) (Million Units)

Table 6 Pharmaceutical Glass Packaging Market estimates and forecasts, by bottles, 2018 - 2030 (USD Million) (Million Units)

Table 7 Tertiary Pharmaceutical Glass Packaging Market estimates and forecasts, by cartridges & syringes, 2018 - 2030 (USD Million) (Million Units)

Table 8 Pharmaceutical Glass Packaging Market estimates and forecasts, by ampoules, 2018 - 2030 (USD Million) (Million Units)

Table 9 Pharmaceutical Glass Packaging Market estimates and forecasts, in generic, 2018 - 2030 (USD Million) (Million Units)

Table 10 Pharmaceutical Glass Packaging Market estimates and forecasts, in branded, 2018 - 2030 (USD Million) (Million Units)

Table 11 Pharmaceutical Glass Packaging Market estimates and forecasts, in biologic, 2018 - 2030 (USD Million) (Million Units)

Table 12 North America Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 13 North America Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 14 North America Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 15 North America Pharmaceutical Glass Packaging Market estimates and forecasts, by drug type, 2018 - 2030 (USD Million) (Million Units)

Table 16 U.S. Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 17 U.S. Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 18 U.S. Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 19 U.S. Pharmaceutical Glass Packaging Market estimates and forecasts, by drug type, 2018 - 2030 (USD Million) (Million Units)

Table 20 Canada Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 21 Canada Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 22 Canada Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 23 Canada Pharmaceutical Glass Packaging Market estimates and forecasts, by Drug Type, 2018 - 2030 (USD Million) (Million Units)

Table 24 Mexico Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 25 Mexico Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 26 Mexico Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (Million Units)

Table 27 Mexico Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 28 Mexico Pharmaceutical Glass Packaging Market estimates and forecasts, by Drug Type, 2018 - 2030 (USD Million)

Table 29 Europe Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 30 Europe Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 31 Europe Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 32 Europe Pharmaceutical Glass Packaging Market estimates and forecasts, by Drug type, 2018 - 2030 (USD Million)

Table 33 Germany Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 34 Germany Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 35 Germany Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 36 Germany Pharmaceutical Glass Packaging Market estimates and forecasts, by Drug type, 2018 - 2030 (USD Million) (Million Units)

Table 37 UK Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 38 UK Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 39 UK Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 40 UK Pharmaceutical Glass Packaging Market estimates and forecasts, by Drug type, 2018 - 2030 (USD Million)

Table 41 France Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 42 France Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 43 France Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 44 France Pharmaceutical Glass Packaging Market estimates and forecasts, by Drug type, 2018 - 2030 (USD Million) (Million Units)

Table 45 Italy Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 46 Italy Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 47 Italy Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 48 Italy Pharmaceutical Glass Packaging Market estimates and forecasts, by Drug type, 2018 - 2030 (USD Million) (Million Units)

Table 49 Spain Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 50 Spain Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 51 Spain Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 52 Spain Pharmaceutical Glass Packaging Market estimates and forecasts, by Drug type, 2018 - 2030 (USD Million) (Million Units)

Table 53 Switzerland Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 54 Switzerland Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million)

Table 55 Switzerland Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 56 Switzerland Pharmaceutical Glass Packaging Market estimates and forecasts, by Drug type, 2018 - 2030 (USD Million)

Table 57 Denmark Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 58 Denmark Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 59 Denmark Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 60 Denmark Pharmaceutical Glass Packaging Market estimates and forecasts, by Drug type, 2018 - 2030 (USD Million) (Million Units)

Table 61 Belgium Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 62 Belgium Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 63 Belgium Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 64 Belgium Pharmaceutical Glass Packaging Market estimates and forecasts, by Drug type, 2018 - 2030 (USD Million) (Million Units)

Table 65 Asia Pacific Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 66 Asia Pacific Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 67 Asia Pacific Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 68 Asia Pacific Pharmaceutical Glass Packaging Market estimates and forecasts, by drug type, 2018 - 2030 (USD Million) (Million Units)

Table 69 China Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 70 China Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (Million Units) (Million Units)

Table 71 China Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 72 China Pharmaceutical Glass Packaging Market estimates and forecasts, by drug type, 2018 - 2030 (USD Million) (Million Units)

Table 73 India Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 74 India Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 75 India Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 76 India Pharmaceutical Glass Packaging Market estimates and forecasts, by drug type, 2018 - 2030 (USD Million) (Million Units)

Table 77 Japan Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 78 Japan Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 79 Japan Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 80 Japan Pharmaceutical Glass Packaging Market estimates and forecasts, by drug type, 2018 - 2030 (USD Million) (Million Units)

Table 81 South Korea Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 82 South Korea Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 83 South Korea Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 84 South Korea Pharmaceutical Glass Packaging Market estimates and forecasts, by drug type, 2018 - 2030 (USD Million) (Million Units)

Table 85 Australia Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 86 Australia Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 87 Australia Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 88 Australia Pharmaceutical Glass Packaging Market estimates and forecasts, by drug type, 2018 - 2030 (USD Million) (Million Units)

Table 89 Southeast Asia Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 90 Southeast Asia Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 91 Southeast Asia Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 92 Southeast Asia Pharmaceutical Glass Packaging Market estimates and forecasts, by drug type, 2018 - 2030 (USD Million) (Million Units)

Table 93 Central & South America Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 94 Central & South America Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 95 Central & South America Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 96 Central & South America Pharmaceutical Glass Packaging Market estimates and forecasts, by drug type, 2018 - 2030 (USD Million) (Million Units)

Table 97 Brazil Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 98 Brazil Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 99 Brazil Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 100 Brazil Pharmaceutical Glass Packaging Market estimates and forecasts, by drug type, 2018 - 2030 (USD Million) (Million Units)

Table 101 Argentina Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 102 Argentina Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 103 Argentina Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 104 Argentina Pharmaceutical Glass Packaging Market estimates and forecasts, by drug type, 2018 - 2030 (USD Million) (Million Units)

Table 105 Middle East & Africa Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 106 Middle East & Africa Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 107 Middle East & Africa Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 108 Middle East & Africa Pharmaceutical Glass Packaging Market estimates and forecasts, by drug type, 2018 - 2030 (USD Million) (Million Units)

Table 109 Saudi Arabia Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 110 Saudi Arabia Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 111 Saudi Arabia Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 112 Saudi Arabia Pharmaceutical Glass Packaging Market estimates and forecasts, by drug type, 2018 - 2030 (USD Million) (Million Units)

Table 113 UAE Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 114 UAE Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 115 UAE Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 116 UAE Pharmaceutical Glass Packaging Market estimates and forecasts, by drug type, 2018 - 2030 (USD Million) (Million Units)

Table 117 South Africa Pharmaceutical Glass Packaging Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Units)

Table 118 South Africa Pharmaceutical Glass Packaging Market estimates and forecasts, by material, 2018 - 2030 (USD Million) (Million Units)

Table 119 South Africa Pharmaceutical Glass Packaging Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Units)

Table 120 South Africa Pharmaceutical Glass Packaging Market estimates and forecasts, by drug type, 2018 - 2030 (USD Million) (Million Units)

List of Figures

Fig. 1 Information procurement

Fig. 2 Primary research pattern

Fig. 3 Primary Research Process

Fig. 4 Market research approaches - Bottom-Up Approach

Fig. 5 Market research approaches - Top-Down Approach

Fig. 6 Market research approaches - Combined Approach

Fig. 7 Pharmaceutical Glass Packaging Market- Market Snapshot

Fig. 8 Pharmaceutical Glass Packaging Market- Segment Snapshot (1/2)

Fig. 9 Pharmaceutical Glass Packaging Market- Segment Snapshot (2/2)

Fig. 10 Pharmaceutical Glass Packaging Market- Competitive Landscape Snapshot

Fig. 11 Pharmaceutical Glass Packaging Market: Penetration & Growth Prospect Mapping

Fig. 12 Pharmaceutical Glass Packaging Market: Value Chain Analysis

Fig. 13 Pharmaceutical Glass Packaging Market: Porter’s Five Force Analysis

Fig. 14 Pharmaceutical Glass Packaging Market: PESTEL Analysis

Fig. 15 Pharmaceutical Glass Packaging market: Material movement analysis, 2023 & 2030

Fig. 16 Pharmaceutical Glass Packaging market: Product movement analysis, 2023 & 2030

Fig. 17 Pharmaceutical Glass Packaging market: Drug type movement analysis, 2023 & 2030

Fig. 18 Pharmaceutical Glass Packaging market: Regional movement analysis, 2023 & 2030

Fig. 19 Pharmaceutical Glass Packaging Market: Competitive Dashboard AnalysisWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Material Outlook (Volume, Million Units; Revenue, USD Million; 2018 - 2030)

- Type I

- Type II

- Type III

- Product Outlook (Volume, Million Units; Revenue, USD Million; 2018 - 2030)

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Vials

- Large Vials

- Cartridges & Syringes

- Ampoules

- Drug Type Outlook (Volume, Million Units; Revenue, USD Million; 2018 - 2030)

- Generic

- Branded

- Biologic

- Regional Outlook (Volume, Million Units; Revenue, USD Million; 2018 - 2030)

- North America

- North America Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- North America Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small bottles

- Large bottles

- Cartridges & Syringes

- Ampoules

- North America Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- U.S.

- U.S. Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- U.S. Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- U.S. Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- U.S. Pharmaceutical Glass Packaging Market, By Material

- Canada

- Canada Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- Canada Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- Canada Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- Canada Pharmaceutical Glass Packaging Market, By Material

- Mexico

- Mexico Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- Mexico Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- Mexico Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- Mexico Pharmaceutical Glass Packaging Market, By Material

- North America Pharmaceutical Glass Packaging Market, By Material

- Europe

- Europe Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- Europe Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small bottles

- Large bottles

- Cartridges & Syringes

- Ampoules

- Europe Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- UK

- UK Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- UK Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- UK Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- UK Pharmaceutical Glass Packaging Market, By Material

- Germany

- Germany Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- Germany Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- Germany Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- Germany Pharmaceutical Glass Packaging Market, By Material

- France

- France Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- France Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- France Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- France Pharmaceutical Glass Packaging Market, By Material

- Italy

- Italy Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- Italy Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- Italy Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- Italy Pharmaceutical Glass Packaging Market, By Material

- Spain

- Spain Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- Spain Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- Spain Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- Spain Pharmaceutical Glass Packaging Market, By Material

- Switzerland

- Switzerland Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- Switzerland Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- Switzerland Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- Switzerland Pharmaceutical Glass Packaging Market, By Material

- Belgium

- Belgium Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- Belgium Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- Belgium Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- Belgium Pharmaceutical Glass Packaging Market, By Material

- Denmark

- Denmark Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- Denmark Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- Denmark Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- Denmark Pharmaceutical Glass Packaging Market, By Material

- Europe Pharmaceutical Glass Packaging Market, By Material

- Asia Pacific

- Asia Pacific Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- Asia Pacific Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small bottles

- Large bottles

- Cartridges & Syringes

- Ampoules

- Asia Pacific Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- China

- China Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- China Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- China Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- China Pharmaceutical Glass Packaging Market, By Material

- Japan

- Japan Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- Japan Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- Japan Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- Japan Pharmaceutical Glass Packaging Market, By Material

- India

- India Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- India Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- India Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- India Pharmaceutical Glass Packaging Market, By Material

- South Korea

- South Korea Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- South Korea Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- South Korea Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- South Korea Pharmaceutical Glass Packaging Market, By Material

- Australia

- Australia Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- Australia Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- Australia Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- Australia Pharmaceutical Glass Packaging Market, By Material

- Southeast Asia

- Southeast Asia Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- Southeast Asia Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- Southeast Asia Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- Southeast Asia Pharmaceutical Glass Packaging Market, By Material

- Asia Pacific Pharmaceutical Glass Packaging Market, By Material

- Central & South America

- Central & South America Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- Central & South America Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- Central & South America Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- Brazil

- Brazil Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- Brazil Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- Brazil Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- Brazil Pharmaceutical Glass Packaging Market, By Material

- Argentina

- Argentina Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- Argentina Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- Argentina Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- Argentina Pharmaceutical Glass Packaging Market, By Material

- Central & South America Pharmaceutical Glass Packaging Market, By Material

- Middle East & Africa

- Middle East & Africa Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- Middle East & Africa Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- Middle East & Africa Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- Saudi Arabia

- Saudi Arabia Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- Saudi Arabia Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- Saudi Arabia Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- Saudi Arabia Pharmaceutical Glass Packaging Market, By Material

- United Arab Emirates

- United Arab Emirates Pharmaceutical Glass Packaging Market, By Material

- Type I

- Type II

- Type III

- United Arab Emirates Pharmaceutical Glass Packaging Market, By Product

- Vials

- Small Vials

- Large Vials

- Bottles

- Small Bottles

- Large Bottles

- Cartridges & Syringes

- Ampoules

- United Arab Emirates Pharmaceutical Glass Packaging Market, By Drug Type

- Generic

- Branded

- Biologic

- United Arab Emirates Pharmaceutical Glass Packaging Market, By Material

- Middle East & Africa Pharmaceutical Glass Packaging Market, By Material

- North America

Pharmaceutical Glass Packaging Market Dynamics

Driver: Growth of the Pharmaceutical Industry in Emerging Economies

Emerging economies including China, India, and Brazil are providing an outstanding opportunity for the growth of the pharmaceutical industry. These economies showcase a huge market potential in the global pharmaceutical industry. The growing population focus on increasing life expectancy, and increasing disposable income are some of the factors expected to provide companies with attractive opportunities in the coming years as several companies are struggling with the stagnation of mature markets, expiration of patents, and a rise in regulatory hurdles. The healthcare infrastructure in the abovementioned economies has observed a drastic change and therefore, the one-size-fits-all approach cannot be applied to emerging markets. Even among the three main market clusters - the BRICMT economies, namely Brazil, Russia, India, China, Mexico, and Turkey and the second-tier countries in Southeast Asia and Africa — there are local idiosyncrasies that make bespoke approaches to these markets essential.

Driver: Commodity Value of Glass Increased with Recyclability

Glass is 100% recyclable in nature and can be reprocessed limitlessly without loss in quality or purity. The recycled glass can be substituted for up to 95.0% of raw materials such as sand, soda ash, limestone, and cullet (recycled glass). The recycling of glass products aids manufacturers as it decreases the amount of raw material used and helps in reducing emissions. Furthermore, the recycling of glass extends the life of plant equipment such as furnaces and saves energy. According to data published in May 2014 by Glass Packaging Institute, a trade association representing the North American glass container industry, 40.0% of glass beer and soft drink bottles, 32.0% of wine and liquor bottles, 15.0% of food jars, and around 32.5% of all glass containers were recycled in the U.S. This helped the developers of glass containers to save approximately 1,300 pounds of sand, 410.0 pounds of soda ash, 380.0 pounds of limestone, and 160.0 pounds of feldspar.

Restraint: Increased Relevance of Alternate Sources