- Home

- »

- Medical Devices

- »

-

Prefilled Syringes Market Size & Share, Industry Report 2033GVR Report cover

![Prefilled Syringes Market Size, Share & Trends Report]()

Prefilled Syringes Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Disposable, Reusable), By Material (Glass Syringes, Plastic Syringes), By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-309-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Prefilled Syringes Market Summary

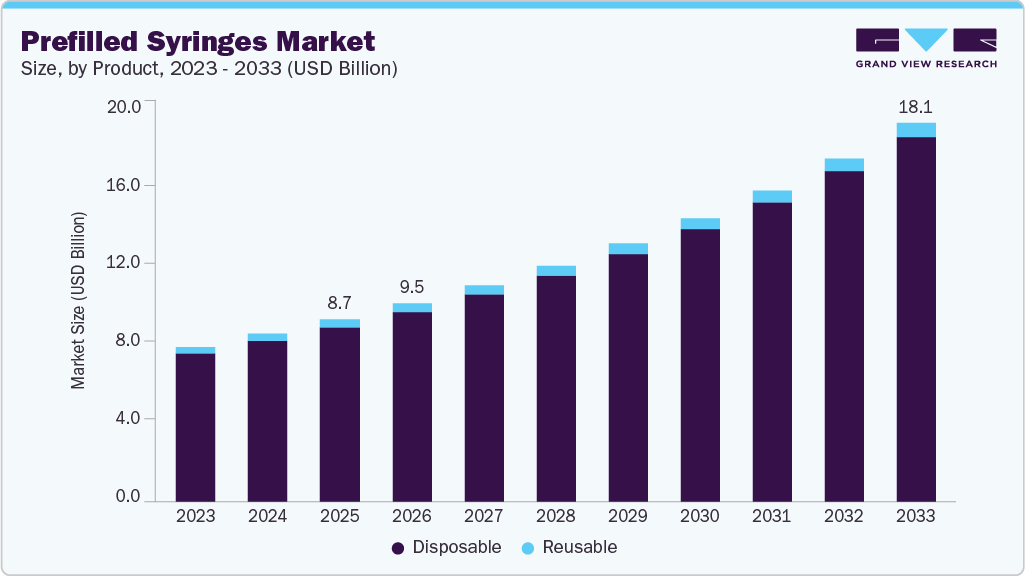

The global prefilled syringes market size was estimated at USD 8.72 billion in 2025 and is projected to reach USD 18.12 billion by 2033, growing at a CAGR of 9.7% from 2026 to 2033. The growing elderly population has led to an increase in the demand for prefilled syringes for the primary diagnosis and treatment of numerous chronic health ailments.

Key Market Trends & Insights

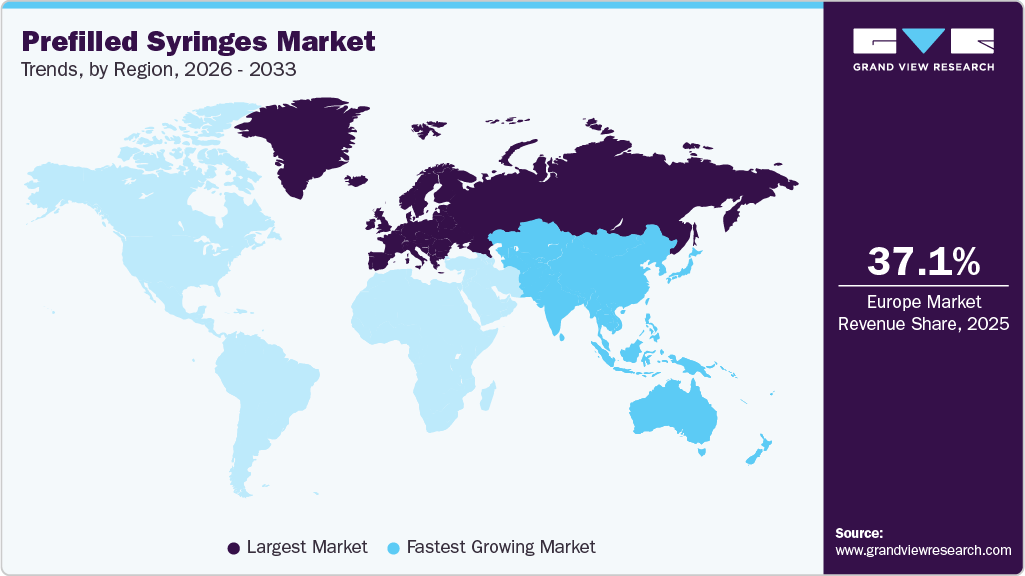

- Europe’s prefilled syringes market held the largest share of 37.1% of the global market in 2025.

- The France prefilled syringes industry is expected to grow significantly over the forecast period.

- By type, the disposable segment held the highest market share of 95.6% in 2025.

- By material, the glass syringes segment held a leading market share in 2025.

- By application, the vaccines and immunizations segment held a leading market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 8.72 Billion

- 2033 Projected Market Size: USD 18.12 Billion

- CAGR (2026-2033): 9.7%

- Europe: Largest market in 2025

- Asia Pacific: Fastest gowing market

It has been recognized that people above 65 years of age are at a higher risk of developing severe health problems, such as heart disease, common asthma, cold & flu, COPD, diabetes, and other medical conditions. This is because aging weakens the immune system and increases an individual’s susceptibility to various disorders.The rising geriatric population and its associated burden of chronic conditions are propelling hospital admission rates. According to the CDC, adults aged 65 years & above are more likely to suffer from heart disease, COPD, diabetes, cancer, neurological problems, and other chronic illnesses. Patients with such illnesses require emergency & nonemergency hospital services and surgeries. The rising prevalence of chronic diseases globally is a key factor expected to drive market growth. Factors such as antimicrobial resistance, unhealthy & sedentary lifestyles, and tobacco & alcohol consumption are contributing to the rising prevalence of Non-communicable Diseases (NCDs). For instance, as per WHO data published in September 2023, around 41 million people succumb to NCDs annually, corresponding to 74% of all deaths worldwide. These factors are expected to drive the demand for prefilled syringes in the market. Prefilled sterile water syringes are increasingly used in healthcare settings for drug reconstitution, catheter flushing, and wound irrigation, as they eliminate manual preparation and reduce contamination risks, thereby supporting efficient clinical workflows and improving patient safety.

Needle-stick Injuries (NSIs) are percutaneous piercing wounds caused by needle tips. These injuries can occur while using, handling, disassembling, or disposing of syringes. The high incidence rate of NSIs and associated consequences is prompting healthcare professionals to use syringes with a safety mechanism. This is expected to boost the market over the forecast period. An intravenous cannula (33.0%) followed by a hypodermic needle (18.7%) were the most common devices involved in most NSIs. More than half of NSIs occurred during the use of sharp devices (52.7%), while 22.0% occurred after use and before disposal. About 42.9% of injuries happened in the patient room.

Furthermore, unsafe injections can lead to abscesses, septicemia, nerve damage, and hemorrhagic fevers. The rise in concerns regarding NSIs among both patients and healthcare professionals is one of the major factors expected to drive market growth. For instance, Sharps Technology, Inc. patented the best-in-class, single-use smart safety syringe products. In the same year, the company announced the acquisition of Safeguard Medical’s syringe manufacturing facility in Hungary. These recent developments by pharmaceutical companies are expected to ensure safe injection practices, minimizing the chances of contamination. Double-chamber prefilled syringes further support safe injection practices by allowing the drug and diluent to be stored separately and mixed just before administration, reducing handling steps and contamination risk. This design is especially beneficial for lyophilized drugs and biologics, improving drug stability, dosing accuracy, and overall patient safety.

In addition to these factors, the growing number of approvals for prefilled syringes by regulatory bodies, such as the U.S. FDA, along with market expansion, is predicted to contribute to industry expansion actively. For instance, in September 2022, Owen Mumford Pharmaceutical Services, a company of Owen Mumford Ltd., received approval as a combination product in Asia for their safety device, 1mL UniSafe, for prefilled syringes. Moreover, the 1mL UniSafe has received regulatory approval in Europe, and the medicine is currently available on the market as a combination product with a rheumatoid arthritis drug. This safety device is a revolutionary, spring-free, patented safety mechanism for prefilled syringes that delivers a variety of benefits to pharmaceutical firms and their patients. Such developments are anticipated to increase the demand for prefilled syringes over the forecast period.

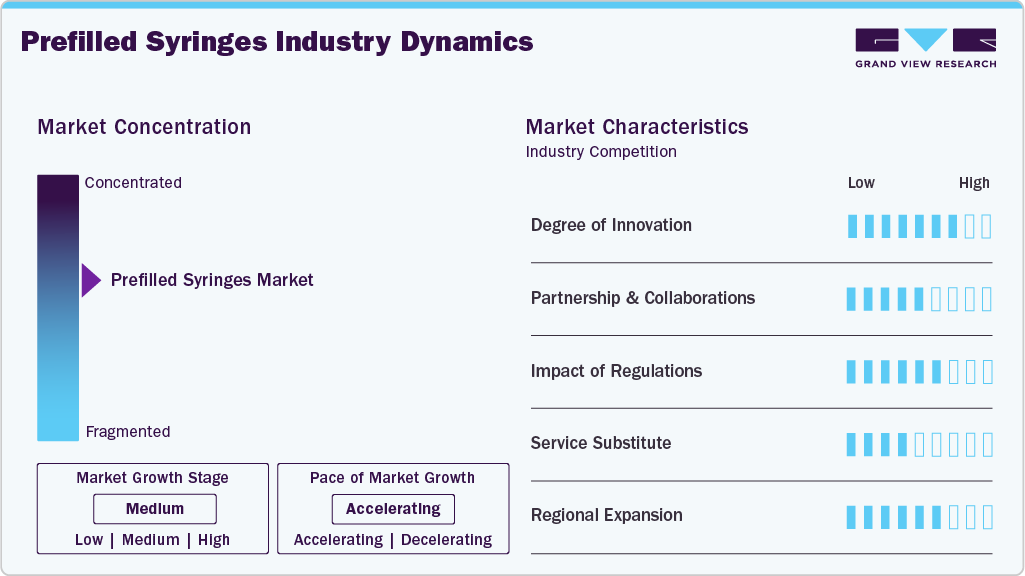

Market Concentration & Characteristics

The prefilled syringes industry is moderately concentrated, with leading companies such as Gerresheimer AG, Becton, Dickinson and Company (BD), SCHOTT Pharma, West Pharmaceutical Services, and Nipro Corporation holding a significant share of the market. These players offer advanced prefilled syringe solutions made from glass and polymer materials, supporting the safe and accurate delivery of biologics, vaccines, and specialty injectable drugs.

The market is continuously evolving due to advancements in syringe design, needle safety systems, and compatibility with sensitive biologic formulations. In addition, the rising prevalence of chronic diseases, growing demand for self-administration and home-based care, and increasing adoption of biologics and biosimilars are driving market growth and encouraging new entrants to introduce customized, application-specific prefilled syringe solutions for pharmaceutical and biotechnology companies.

The prefilled syringes industry is undergoing major innovations and advancements, such as integrated safety features, including needle shields and retractable needles. For instance, Hindustan Syringes and Medical Devices Ltd. partnered with Star Syringes from the UK to introduce safety needles that help prevent sharps injuries, available under the Disposjekt Needle brand. These needles can be converted to regular disposable syringes or attached to Kojak auto-disable safety needles. Similarly, in May 2023, Becton, Dickinson and Company announced broader customer access to an all-in-one prefilled flush syringe featuring an integrated disinfection unit. This innovation aimed to strengthen adherence to infection prevention guidelines and streamline nursing procedures.

Partnering and collaboration play a major role in the prefilled syringes industry. For instance, in October 2024, NAMSA, a medtech Contract Research Organization (CRO) specializing in end-to-end market access services, and TERUMO announced a strategic outsourcing partnership to expedite the regulatory approval and commercialization of Terumo's product portfolio. Similarly, in September 2024, Gerresheimer AG, in collaboration with Stevanato Group S.p.A. and SCHOTT Pharma AG & Co. KGaA, announced the formation of a strategic industry alliance, the "Alliance for RTU," to promote the market adoption of Ready-to-Use (RTU) vials and cartridges.

The regulatory approval landscape for the prefilled syringes industry is governed by stringent requirements from authorities such as the FDA, EMA, and other national agencies to ensure product safety, sterility, material compatibility, and compliance with medical device and combination product standards. For instance, in the U.S., the regulatory framework for prefilled syringes is overseen by the FDA Center for Devices and Radiological Health (CDRH). Medical devices, including prefilled syringes, are classified into three categories: Class I, Class II, and Class III, based on the level of control necessary to ensure safety & effectiveness. The classification impacts the regulatory requirements, with Class I devices generally being exempt from Premarket Notification 510(k), Class II devices requiring 510(k), and Class III devices necessitating Premarket Approval (PMA).

In the prefilled syringes industry, product substitutes include vials & ampoules with conventional syringes, autoinjectors, and cartridge-based drug delivery systems. These alternatives can replace prefilled syringes in certain therapies due to lower upfront cost, wider availability, or flexibility in dosing. For example, glass vials combined with disposable syringes are still widely used in hospitals for injectable drugs, while autoinjectors are preferred in self-administration therapies such as insulin or biologics.

Regional expansion in the prefilled syringes industry is gaining momentum across all major regions, driven by the rising prevalence of chronic diseases, increasing adoption of self-injectable therapies, and growing demand for safe and convenient drug delivery systems. For instance, in March 2024, SCHOTT Pharma announced its expansion in the U.S. with the establishment of a prefillable syringe manufacturing facility in Wilson, North Carolina.

Type Insights

The disposable segment dominated the market in 2025 and accounted for the largest share of 95.6% of the overall revenue. Prefilled disposable syringes are single-use, pre-filled devices containing a specific medication, eliminating the need for healthcare professionals or patients to manually draw the drug from vials or ampoules. This innovation offers notable advantages, particularly in terms of convenience, accuracy, and safety. As patient empowerment and the demand for self-administration continue to rise, the market for prefilled disposable syringes has expanded rapidly. The increasing need for simple, reliable, and safe drug delivery systems drives this growth. Significant improvements in materials, such as glass and plastic, have enhanced the syringes' functionality, while innovations like integrated safety features (e.g., needle shields and retractable needles) have further bolstered their safety profile. For instance, Hindustan Syringes and Medical Devices Ltd. partnered with Star Syringes from the UK to introduce safety needles that help prevent sharps injuries, available under the Disposjekt Needle brand. These needles can be converted to regular disposable syringes or attached to Kojak auto-disable safety needles.

The reusable segment is expected to witness the second fastest CAGR of 7.0% over the forecast period. Reusable prefilled syringes are designed to be used multiple times, offering an eco-friendly alternative to single-use syringes. They are typically used in situations that require ongoing drug administration, such as chronic disease management or hormone therapy. The main benefit of reusable prefilled syringes is their sustainability. By reducing the need for constant disposal and repurchasing of new syringes, they help cut down on medical waste and overall healthcare costs. These syringes are often made from durable materials like stainless steel or high-quality plastics, ensuring they are long-lasting and resistant to wear. Many products feature replaceable cartridges or reservoirs, allowing for continuous treatment cycles without the need for a completely new syringe. Reusable prefilled syringes are especially useful for biologics, insulin, and other injectable therapies that require precise dosage and ease of use. To improve the user experience, manufacturers often include advanced features such as dose counters, safety shields, and ergonomic designs, ensuring accurate and safe medication administration. These factors collectively drive market growth.

Material Insights

The glass syringes segment dominated the market in 2025 and accounted for the largest share of the overall revenue. Glass prefilled syringes provide a reliable and efficient solution for the packaging and administration of injectable medications. Constructed from high-quality borosilicate glass, these syringes are suitable for a wide range of drugs and formulations, including sensitive biologics, vaccines, and other therapeutic agents. Their transparent design allows healthcare providers to easily inspect the contents, ensuring accurate dosing and minimizing the potential for drug interaction or contamination. The durability of borosilicate glass also offers superior protection for the medication, maintaining the drug's integrity throughout storage and transportation. Industry advancements continue to improve the functionality and usability of glass prefilled syringes. For instance, in September 2024, Becton, Dickinson and Company (BD) announced the commercial release of the BD Neopak XtraFlow Glass Prefillable Syringe, along with a capacity expansion of its Neopak Glass Prefillable Syringe platform. This expansion highlights the increasing role of glass prefilled syringes in delivering biologic medications, which often require precise and reliable delivery systems.

The plastic syringes segment is expected to witness the fastest CAGR over the forecast period. Plastic prefilled syringes are an increasingly popular choice for the packaging and delivery of injectable medications due to their lightweight, cost-effective, and versatile design. These syringes offer a more flexible and affordable option for pharmaceutical companies, especially when considering the need for large-scale production and the potential for shipping and handling without the risk of glass breakage. Plastic prefilled syringes, particularly those made from cyclic olefin polymer (COP), present significant opportunities in the aesthetic medicine sector. Their advantages include break resistance, high clarity, and compatibility with sensitive substances like hyaluronic acid and botulinum toxin. These features make them ideal for precise, safe, and user-friendly administration in cosmetic procedures, enhancing both practitioner efficiency and patient comfort.

Application Insights

The vaccines and immunizations segment dominated the market and held the largest revenue share in 2025. The growth is driven by the extensive use of disposable syringes in vaccination campaigns aimed at controlling disease spread. As global immunization efforts expanded to include COVID-19 (historically), influenza, and other diseases, the demand for syringes is expected to rise. This surge is driving innovations in syringe technology, particularly in safety features to prevent needlestick injuries and advancements ensuring precise dosage delivery. Manufacturers are investing significantly in research and development to create safer, more efficient, and user-friendly syringes, contributing to the growth of the market. The widespread use of syringes is also influenced by healthcare regulations that mandate immunizations and government-led vaccination initiatives. Many healthcare facilities are encouraged or required to adopt high-quality syringes for these programs, which further accelerates market expansion.

The autoimmune diseases segment is expected to witness the fastest CAGR over the forecast period. Prefilled syringes are increasingly important in the treatment of autoimmune diseases, where the immune system mistakenly attacks the body's tissues, causing chronic inflammation and damage. The growing demand for prefilled syringes for autoimmune diseases is driven by the increasing prevalence of these conditions and the rise in biologic therapies. Biologic drugs, such as monoclonal antibodies, require highly accurate dosing to ensure their effectiveness, and prefilled syringes are specifically designed to meet this need. These syringes often include safety features like needle shields and retractable needles, reducing the risk of accidental needlestick injuries and enhancing overall patient safety. As advancements in biologics continue and the number of people diagnosed with autoimmune diseases rises, the role of prefilled syringes in delivering safe, reliable, and precise medication will continue to expand.

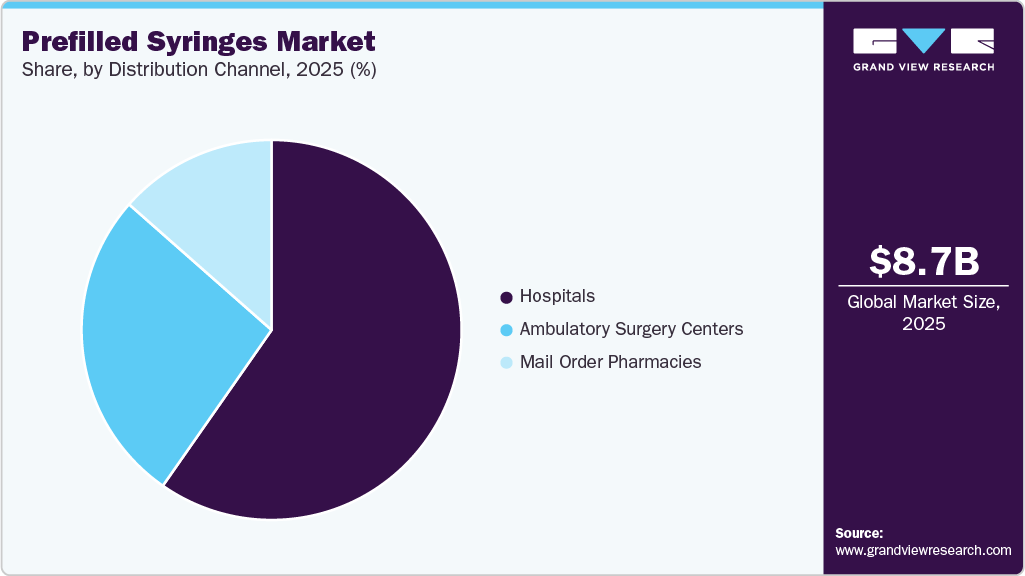

Distribution Channel Insights

The hospitals segment dominated the industry and held the largest revenue share in 2025. Hospitals serve as the primary centers for diagnosis, management, and various types of illness & disorder treatment. Hospitals are crucial in the healthcare sector due to their advanced technologies, specialist medical knowledge, and extensive infrastructure, which are necessary for managing this condition. Since hospitals cater to a large portion of the population, they represent the biggest market for prefilled syringes. Hospitals are also considered important buyers as they have long-term agreements with syringe suppliers, giving them additional negotiating power and expanding their market for product after-sales services.

The mail order pharmacies segment is anticipated to grow at the fastest CAGR over the forecast period. The growth is due to their ability to provide convenience and accessibility for patients requiring regular injectable medications. Mail-order pharmacies cater to individuals managing chronic conditions, such as diabetes, rheumatoid arthritis, and autoimmune diseases, by delivering prefilled syringes directly to their homes. This reduces the need for frequent visits to physical pharmacies, saving time and effort for patients. In addition, the growing adoption of e-commerce platforms in healthcare and advancements in cold chain logistics ensure the safe delivery of temperature-sensitive medications, such as biologics and vaccines. The increasing preference for home healthcare solutions, driven by an aging population and the demand for user-friendly drug delivery systems, further supports the growth of this segment.

Regional Insights

The North America prefilled syringes market is being reshaped by the presence of a well-established healthcare sector, commitment to innovation, advanced infrastructure, a strong emphasis on Research & Development (R&D), and the high prevalence of chronic conditions, such as diabetes, autoimmune disorders, & cardiovascular diseases. The American Diabetes Association reported 38.4 million Americans, representing 11.6% of the population, living with diabetes. Among these, 2 million individuals had type 1 diabetes, including approximately 304,000 young people aged between 0 and 19. The majority of those affected by diabetes, 29.7 million adults, were diagnosed, whereas 8.7 million cases remained undiagnosed. This data highlights the significant impact of diabetes on the American population, highlighting the critical need for accessible and effective management tools, including prefilled syringes, to address both diagnosed & undiagnosed cases.

U.S. Prefilled Syringes Market Trends

The prefilled syringes market in the U.S. is experiencing steady growth, driven by the high prevalence of diabetes and prediabetes, with an estimated 136 million adults affected in the U.S., as of November 2023, according to the CDC. This demographic presents a vast opportunity for prefilled syringes, especially for insulin administration. The CDC's report emphasizes the need for effective diabetes management tools, highlighting the market's potential for growth. The competitive landscape is shaped by the ability of these devices to cater to the diverse needs of the diabetic population, considering factors such as race, ethnicity, socioeconomic status, and education level. The market is highly competitive, dominated by key players like Becton, Dickinson and Company (BD), West Pharmaceutical Services, and Gerresheimer.

Europe Prefilled Syringes Market Trends

The prefilled syringes market in Europe accounted for the largest revenue share of 37.1% in 2025. Growth in the region can be attributed to the increasing prevalence of chronic diseases, such as diabetes, which require regular medication. According to the International Diabetes Federation, around 66 million adults in Europe were living with diabetes in 2024, and this number is expected to surge by 10% by 2050, highlighting the growing patient population. This is expected to drive the demand for prefilled syringes to improve medication compliance and overall treatment outcomes. Moreover, patients are increasingly looking for treatment options that are easy to use, painless, and noninvasive. This growing demand for patient-centric drug delivery methods has contributed to the expansion of the market in Europe.

The UK prefilled syringes market is steadily growing. High per capita income, the presence of an established healthcare system, a significant number of healthcare professionals, proper access to healthcare services, availability of advanced devices, and favorable reimbursement policies are among the major factors expected to drive the market in the UK. Furthermore, the presence of well-trained & skilled surgeons, technological advancements, favorable government initiatives, rising healthcare expenditure, and high adoption of minimally invasive surgeries are expected to contribute to market growth.

The prefilled syringes market in Spain is experiencing significant growth in the global market. Spain has the highest life expectancy in the European Union, averaging 82 years, resulting in a patient population with a higher prevalence of chronic ailments and health challenges associated with old age. Data from the Spanish National Statistics Institute reveals that as of June 2022, over 20% of Spain's population, totaling 47 million, is aged over 65. According to data from the International Diabetes Federation in 2021, Spain has a total adult population of 34,841,300. Diabetes prevalence among adults was 14.8%, resulting in approximately 5,141,300 cases of diabetes. Highlighting the increasing demand for prefilled syringes.

Germany prefilled syringes market is steadily growing. The country’s healthcare system is considered a pioneer in public health support, with the oldest national social health insurance system. Schemes such as Statutory Health Insurance (SHI) are strengthening healthcare infrastructure, enabling people to undergo advanced treatment, which is expected to increase the demand for prefilled syringes. Cardiovascular diseases stand as the primary cause of mortality in Germany, accounting for approximately 40% of all fatalities. The rising prevalence of chronic conditions, such as cardiovascular diseases, cancer, and diabetes, is anticipated to boost the necessity for prefilled syringes, consequently fueling market expansion.

Asia Pacific Prefilled Syringes Market Trends

The prefilled syringes market in the Asia Pacific are gaining traction. The growth is driven by increasing disposable income, improving healthcare infrastructure, and rapidly growing economic conditions in emerging economies such as Japan, China, & India. The large population with low per capita income in Asia Pacific has led to a high demand for affordable treatment options. Multinational companies are looking to invest in developing economies, such as India and China, to create a strong position in the market. Hence, numerous collaborative partnerships and strategic alliances are underway between key companies in this region, which is expected to create lucrative growth opportunities.

China prefilled syringes market is benefiting due to the unmet needs of the growing population. According to the National Bureau of Statistics of China, in 2023, individuals aged 60 & above accounted for around 19.8% of the general population by 2022. Moreover, with several healthcare reforms in China, the market is expected to exhibit substantial growth. For instance, LifeSeeds, the China Rural Health Initiative (CRHI), is expected to provide healthcare access to unattended regions of China, creating opportunities for market players. Moreover, supportive regulatory and reimbursement policies are expected to boost the market growth.

The prefilled syringes market in South Korea is driven by the rising chronic disease burden and elderly population. According to the United Nations Population Fund’s published statistics for 2022, in South Korea, around 71% of the living population was between the ages of 15 and 64 years. In addition, according to the same source, 17% of the population in 2022 was recorded to be of age 65 or older. Hence, the increasing geriatric population is more likely to develop chronic diseases requiring proper monitoring and diagnosis, which is anticipated to improve the demand for prefilled syringes.

India prefilled syringes market is majorly driven by increasing healthcare spending. India is one of the top three countries in terms of diabetes prevalence. According to the International Diabetes Federation, in 2024, nearly 19.3 million people were suffering from diabetes, which is expected to rise to 45.8 million by 2050. Indians are more likely to develop diabetes than people in other parts of the world, such as the Americas & Europe. This is due to the Indian diet being high in carbohydrates and saturated fats, which adds more sugar & calories to the body than it needs. In addition, the growing prevalence of sedentary lifestyles and obesity is contributing to the high prevalence of diabetes. Hence, the high prevalence of chronic diseases in India is expected to drive the demand for prefilled syringes during the forecast period.

Latin America Prefilled Syringes Market Trends

The prefilled syringes market in Latin America is primarily driven by Brazil and Argentina. Growing investments by market players in the region, proximity to North America, and free-trade agreements with major countries such as the U.S., Canada, Japan, & several European countries are anticipated to boost the market during the forecast period. In addition, the geriatric population in Latin America is increasing, which is leading to a higher demand for healthcare services & products. Advancements in technology are also driving growth in this market. New drug delivery systems are being developed that are more efficient, accurate, and convenient for patients. This is leading to increased adoption of prefilled syringes in Latin America.

Brazil prefilled syringes market is growing. Presence of a large customer base and growing prevalence of chronic diseases, such as cancer, diabetes, gastrointestinal diseases, & neurological diseases, are some of the crucial factors propelling the market growth in Brazil. For instance, according to a study published in BMJ, the prevalence of Parkinsonism in Brazil is about 3.3% among people aged 65 & above, and several studies suggest that this number is expected to increase two-fold by 2030. In addition, according to the International Diabetes Federation, 1 in 10 adults in Brazil lives with diabetes. Such factors are projected to boost the adoption of prefilled syringes in Brazil, propelling the market growth.

Middle East & Africa Prefilled Syringes Market Trends

The prefilled syringes market in the Middle East is growing steadily due to high spending capacity & living standards, the presence of well-established medical infrastructure, and the increasing number of cancer cases. The high cancer prevalence, coupled with an increasing preference for early disease diagnosis, is expected to drive market growth. In addition, growing government initiatives to increase reimbursement coverage are expected to boost market penetration during the forecast period.

Saudi Arabia prefilled syringes market growth ismajorlydriven by the growing incidence of cancer. Changes in lifestyle due to rapid Westernization include increased consumption of processed food and sedentary habits. These lifestyle changes are likely to be responsible for the increase in the incidence of several diseases, including cancer. Noncommunicable Diseases (NCDs) account for 73% of all deaths in Saudi Arabia. The major source of NCD deaths, accounting for 37% of total deaths, is cardiovascular disease, followed by other NCDs at 20%, cancer at 10%, diabetes at 3%, and respiratory diseases at 3%. The increasing prevalence of chronic diseases is expected to increase the demand for prefilled syringes and propel market growth.

Key Prefilled Syringes Company Insights

The market is highly competitive and has several key players. Major players in the market are increasingly focused on expanding their geographical presence, forming strategic partnerships with pharmaceutical and healthcare companies to improve drug delivery efficiency and patient safety, and leveraging technological advancements such as safety-engineered and ready-to-use syringes.

Key Prefilled Syringes Companies:

The following are the leading companies in the prefilled syringes market. These companies collectively hold the largest Market share and dictate industry trends.

- Becton, Dickinson and Company (BD)

- Gerresheimer AG

- SCHOTT Pharma

- Stevanato Group

- Nipro Corporation

- Terumo

- MedXL Inc

- West pharmaceuticals

- Fresenius Kabi

- B. Braun SE

Recent Development

-

In October 2025, Becton, Dickinson and Company announced a strategic partnership with Ypsomed, a leading provider of injection systems, to enhance self-injection solutions for high-viscosity biologic drugs. Through a joint initiative, BD and Ypsomed have pre-assessed and optimized the integration of the BD Neopak XtraFlow Glass Prefillable Syringe with Ypsomed’s YpsoMate 2.25 autoinjector platform. This collaboration addresses existing challenges by enabling the delivery of biologic drugs with viscosities exceeding 15cP in an autoinjector format.

-

In March 2024, B. Braun SE collaborated with Orlando Health to co-create innovative solutions that enhance access to care for patients and clinicians. This collaboration will prioritize addressing disruptions within the pharmacy and infusion therapy sectors, emphasizing gathering early clinician feedback to identify needs and develop tailored solutions.

-

In September 2024, Becton, Dickinson and Company announced the launch of the BD Neopak XtraFlow Glass Prefillable Syringe and the latest capacity expansion of the BD Neopak Glass Prefillable Syringe platform to support the increasing demand for biologic therapies.

Prefilled Syringes Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 9.48 billion

Revenue forecast in 2033

USD 18.12 billion

Growth rate

CAGR of 9.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway: Japan; China India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Becton, Dickinson and Company (BD); Gerresheimer AG; SCHOTT Pharma; Stevanato Group; Nipro Corporation; Terumo; MedXL Inc; West pharmaceuticals; Fresenius Kabi; B. Braun SE

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Prefilled Syringes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global prefilled syringes market report based on type, material, application, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Disposable

-

Reusable

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Glass Syringes

-

Plastic Syringes

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Vaccines and immunizations

-

Anaphylaxis

-

Rheumatoid Arthritis

-

Diabetes

-

Autoimmune diseases

-

Oncology

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Mail Order Pharmacies

-

Ambulatory Surgery Centers

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Thailand

-

Australia

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global prefilled syringes market size was estimated at USD 8.72 billion in 2025 and is expected to reach USD 9.48 billion in 2026.

b. The global prefilled syringes market is expected to grow at a compound annual growth rate of 9.7% from 2026 to 2033 to reach USD 18.12 billion by 2033.

b. Europe dominated the prefilled syringes market with a share of 37.1% in 2025. This is attributable to growing adoption of prefilled syringes in the UK and development of advanced technologies.

b. Some key players operating in the prefilled syringes market include Gerresheimer AG, Schott Group, BD, Unilife Corporation, Nipro Medical Corporation, Owen Mumford, and Haselmeier AG.

b. The growing elderly population has led to an increase in the demand for prefilled syringes for the primary diagnosis and treatment of numerous chronic health ailments. It has been recognized that people above 65 years of age are at a higher risk of developing severe health problems, such as heart disease, common asthma, cold & flu, COPD, diabetes, and other medical conditions. This is as aging weakens the immune system and increases an individual’s susceptibility to various disorders.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.