- Home

- »

- Pharmaceuticals

- »

-

COVID-19 Vaccines-Production Capacity & Development TimelineGVR Report cover

![COVID-19 Vaccines Market Production Capacity & Development Timeline: (By Type: Virus-Like Particle (VLP), Whole Virus, Protein, Antibodies, Viral Vector, mRNA/DNA)Report]()

COVID-19 Vaccines Market Production Capacity & Development Timeline: (By Type: Virus-Like Particle (VLP), Whole Virus, Protein, Antibodies, Viral Vector, mRNA/DNA)

- Report ID: GVR451011

- Number of Report Pages: 50

- Format: PDF, Horizon Databook

- Historical Range: 2020

- Forecast Period: 2021 - 2027

- Industry: Healthcare

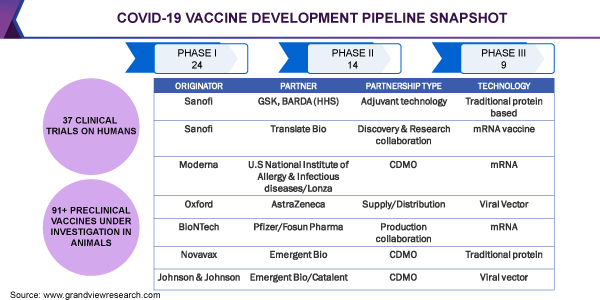

The introduction of a safe and effective product by 2021 seems highly possible as multiple candidates have entered Phase II trials. Unprecedented research efforts, in terms of both speed and scale, by hundreds of research groups are anticipated to bring a fundamental and necessary change in the traditional pathway for vaccine development and commercialization. COVID-19 vaccine development did not seem to be an encouraging prospect as historically, the general time duration required to develop a vaccine has been about 20 years. For instance, the development of the Human Papilloma Virus (HPV) vaccine took around 26 years, the rotavirus vaccine was developed in 25 years. It took more than 50 years of research to introduce a vaccine for the Respiratory Syncytial Virus (RSV).

Several initiatives undertaken by the government regulatory bodies and the World Health Organization (WHO) can be attributed to the rapid research in vaccine development. The Who and the Coalition for Epidemic Preparedness Innovations (CEPI) have led the COVAX Vaccine initiative for accelerating the development and increasing equitable access to each participating economy. The bodies are also jointly working toward enhancing manufacturing capabilities and efficient management of the buyer-supplier chain, well ahead of time to enable a fair distribution of over 2 billion doses by the end of 2021. As of August 2020, 172 countries are involved in the discussion for potential participation in the COVAX. The initiative also aims at filling key funding gaps by providing a way to support the participation of lower-income economies in the COVAX Facility.

In addition to COVAX, Operation Warp Speed (OWS)-the U.S. administration's national program for the countermeasure associated with coronavirus detection, therapeutics, and vaccine development-holds the key objective of launching a safe vaccine by the end of January 2021. This is a public-private partnership between private firms, federal agencies, the Departments of Defense, Energy, & Veteran Affairs, and major operating components of Health & Human Services, such as the Centers for Disease Control and Prevention (CDC), National Institutes of Health (NIH), and the U.S. FDA (Food and Drug Administration), among others.

The market is also marked by several controversies, such as the United States’ decision of non-participation in the COVAX initiative. However, at the start of September 2020, the European Commission confirmed its interest in participation in the COVAX initiative and also announced about USD 478 million contributions. Countries such as South Africa are urging the nations for active participation in the initiative. India’s Serum Institute is expected to receive USD 150 million at-risk funds for the rapid manufacturing of vaccines co-developed by the University of Oxford, drug-maker AstraZeneca, and a vaccine development company Novavax. This collaboration also involves GAVI, the vaccine alliance that leads to COVAX. GAVI will be providing Pune-based manufacturers with upfront capitals through the foundation’s Strategic Investment Funds.

Since the COVID-19 vaccine is not a commercial market, funding remains a major concern in the pandemic situation. Small companies can benefit through guidance received from the Biomedical Advanced Research and Development Authority (BARDA). BARDA can aid in the facilitation of dialogue between regulatory agencies and guide trial design and expectations of regulatory agencies. Sanofi has partnered with BARDA and GSK for its traditional protein-based vaccine based on the baculovirus expression system.

Case Fatality Ratio (CFR) and Quality Adjusted Life Year (QALY) are to be taken into consideration from the payors’ and manufacturers’ perspective. Pricing for the vaccines is usually set differently form the drug-pricing equation. The pricing also depends on the presence of COVID-19, which has encouraged immunologists to develop exciting platforms to increase focus on infections, for a change. The industry has been motivated toward investments and research about cancer therapies and, thus, the diversified global biopharmaceutical business needs favorable investments in the vaccinology domain.

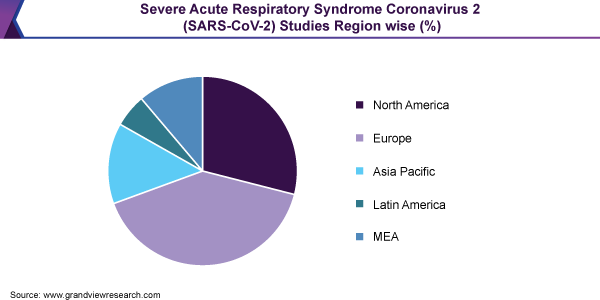

Geographically, leading developers of the COVID-19 vaccine are majorly located across 19 countries; dominated by countries in North America, followed by China, and European and Asian countries (excluding China) in the league. Private entities and academic institutes are leading profiles in the vaccine development across the globe. Researchers are incorporating novel technologies that never have been implemented as a licensed vaccine previously.

Viral vector vaccines, virus vaccines, nucleic acid-based vaccines, and protein-based vaccines are being tested in the clinical trials. Virus vaccines include weakened and inactivated viruses. Protein-based vaccines are dominating in terms of the number of clinical trials. Most of the developers are focusing on receptor binding domain or spike protein. Determination of the initial clinical efficacy of the vaccine under development is difficult. Identification of a vaccine platform that provides durable protection against SARS-CoV-2 along with optimal immunogenicity needs to be found and manufactured on a large scale. However, other challenges that would arise post-approval include quality assurance, reliable distribution, standing high on cold-chain requirements, and other bottlenecks such as medical glass shortage that can affect timely vaccine packaging and delivery. Thus, companies are collaborating to scale-up their production facilities. For instance, the collaboration of Moderna with Lonza, BioNTech with Pfizer, and AstraZeneca with Serum Institute of India and Pfizer.

Furthermore, the risk of virus mutation is being evaluated by several researchers. Most of the researchers are focused on monitoring and evaluating Spike (S) protein, as this protein mediates infection in the human cells and is the target of most vaccine/ antibody strategies. Theories also suggest that a vast majority of mutations are less advantageous to the virus and generally reduce its transmissibility and pathogenesis.

MAJOR PRE-CLINICAL & CLINICAL CANDIDATES

Companies

Platform

Moderna/NIH

LNP-mRNA that encodes for the full spike S protein

Sanofi/Translate Bio

LNP-mRNA.

Sanofi/GSK

GSK (AS03 adjuvant, Shingrix vaccine)

Sanofi (Recombinant Antigen Proteins, Flublok vaccine platform)

University of Oxford/Vaccitech/ AstraZeneca

Nonreplicating chimpanzee adenovirus vector (ChAdOx1).

Johnson & Johnson

Adenovirus

Gamaleya Research Institute

Combination of two adenoviruses, Ad5 and Ad26

Shionogi

Recombinant Protein vaccine - BEVS (baculovirus based cell culture).

CanSino Biologics

Adenoviral vector

BioNTech/Pfizer

mRNA formats

Antigen vaccine for receptor binding domain and spike-antigen whole protein

Companies are working in collaborations to achieve the best possible results and introduce a vaccine as early as possible. GSK has adopted a strategic approach for supporting the rapid development of vaccines. Major companies include, but are not limited to, Pfizer, Moderna, BioNtech, Sanofi, Zydus Cadila, CureVac, Imperial College London, Takara Bio, CanSino Biologics, Beth Israel Deaconess Medical Center, ReiThera, Novartis, Anhui Zhifei Longcom, Novavax, and the University of Queensland. Sanofi is working via two approaches targeting different pandemic capacities. Moderna is developing vaccines that make use of messenger-RNAs to deliver viral proteins in the body. The company is also funded with USD 1 billion by the government.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."