- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastics In Electrical And Electronics Market Report, 2030GVR Report cover

![Plastics In Electrical And Electronics Market Size, Share & Trends Report]()

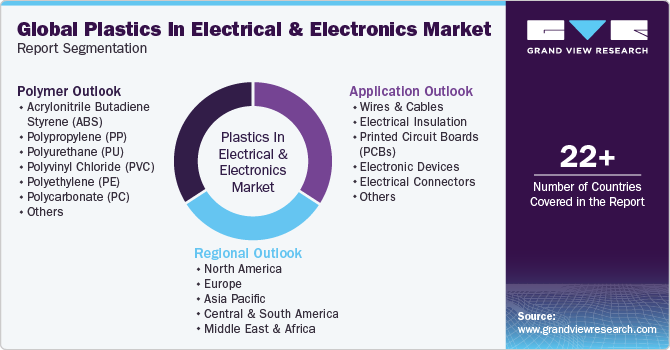

Plastics In Electrical And Electronics Market Size, Share & Trends Analysis Report By Polymer (ABS, PP), By Application (Wires & Cables, Electrical Insulation), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-180-3

- Number of Report Pages: 117

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

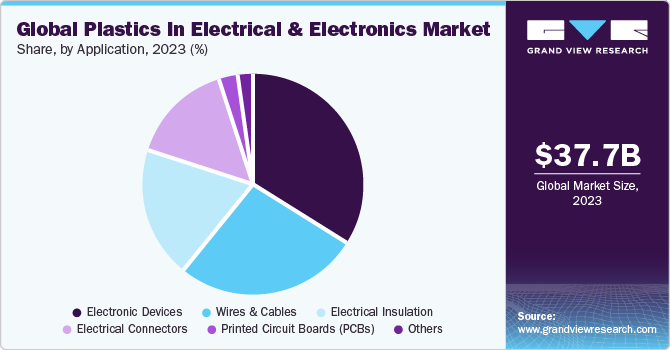

The global plastics in electrical and electronics market size was estimated at USD 37.72 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. An expansion of electronics industry, driven by emergence of 5G, IoT, and AI technologies, has driven the demand for the market. Moreover, increasing demand from building & construction industry globally is anticipated to boost demand for plastics across electrical & electronics industry.

Players across plastics in the market maintain a high market competition with the implementation of various strategic initiatives such as new Polymer launch, Polymerion expansion, merger & acquisitions, among others. For instance, in may 2023, SABIC announced its expansion of high-heat ULTEM resin portfolio by introducing new glass fibre-reinforced grades that would deliver high flow, custom colour ability, and high strength. This Polymer is well suited for electronic components such as fibre optics and electrical connectors.

According to the World Economic Forum (WEF), Japan has the highest percentage of 29.8% of the total population of people aged 65 years or above. Additionally, by the end of the third quarter of 2023, the proportion of individuals aged 80 years or older in the country surpassed the 10% level overall population count, indicating a significant demographic shift in Japan with a continuously increasing aging population. With its continuously expanding elderly population base, the demand for medical monitoring devices is surging in Japan. This is expected to drive the growth of market in the country over the forecast period. Patients use medical monitoring devices to monitor vital information such as blood sugar and heart rate per minute.

These devices require PCBs, electrical casings, and wires & cables manufactured from polymers such as polycarbonate (PC), polypropylene (PP), and polyvinyl chloride (PVC). As the demand for medical monitoring devices is surging in the country, the consumption of these polymers is also expected to increase in Japan in the coming years. This, in turn, is anticipated to lead to the growth of the market in the country during the forecast period.

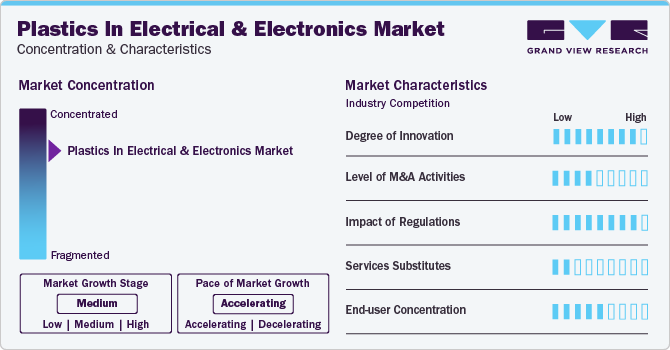

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating owing to the highly consolidated market. In line with the increasing popularity of recycled plastics, virgin plastic manufacturers are actively implementing challenging strategic initiatives such as mergers & acquisitions, new product launches, production expansion, among others.

For instance, in June 2023, BASF SE and Avient Corporation collaborated to offer colored grades of ultrasonic high-performance polymers to the international market. The partnership aims to provide customers with colored ultrasound solutions across various industries, encompassing electrical and electronics (E&E), healthcare, household, and catering.

Polymer Insights

Polyvinyl chloride (PVC) resin dominated the polymer segmentation for 2023 in terms of revenue share above 28.0%. Polyvinyl chloride (PVC) is a high-strength thermoplastic material that offers numerous beneficial properties, such as non-conductivity, heat-resistance, durability, and cost-effectiveness. In various electrical and electronic applications, PVC is commonly used for insulation, cable sheathing, and wire coatings. Its fire resistance and excellent electrical properties make it an ideal material for ensuring safety and reliability in electrical systems. Additionally, PVC’s versatility, cost-effectiveness, and ability to meet demanding specifications make it a popular choice for electrical and electronic Polymers.

Followed by polycarbonate (PC) at a market revenue share of above 19.0% in 2023. Polycarbonate (PC) is a highly versatile material used in the electrical and electronics industry, owing to its exceptional characteristics such as high impact resistance, transparency, and heat resistance. PC is an ideal choice for ensuring safety and reliability of electrical and electronic Polymers. It is commonly used in electrical insulators, connectors, and LED light covers on account of its excellent electrical insulating properties. Additionally, PC's transparency allows higher light transmission, making it ideal for applications where optical clarity is essential.

Application Insights

Electronic devices dominated application segmentation for 2023 in terms of revenue share above 34.0%. Electronic devices form essential components of consumer electronics, medical, industrial, automotive, and aerospace applications. Consumer electronics such as smartphones, tablets, and computers, which are used for communication, entertainment, etc. are based on different electronic components. Medical devices meant for diagnostic, monitoring, and treatment purposes rely on electronic components for their accurate and reliable performance.

Followed by wires & cables with a market revenue share of above 26.0% in 2023. Electrical & electronics industries rely increasingly on wires & cables for use in diverse applications as they are essential for ensuring seamless operations. Wires & cables are utilized for power transmission and data transmission. They are also used in control systems, mechanical equipment, and instruments in different industrial, commercial, and residential settings. They are also employed in telecommunications, consumer electronics, building automation, and industrial applications.

Demand for plastics in electrical and electronics in agriculture sector is expected to grow significantly on account of increasing focus on reducing environmental pollution and providing a conducive environment for composting. Biodegradable Polymers are increasingly being utilized in nursery and gardening owing to their superior properties such as promoting growth of plant seedlings and preventing rotting of fruits. This is expected to influence expansion and increase penetration of plastics in electrical and electronics in agriculture sector.

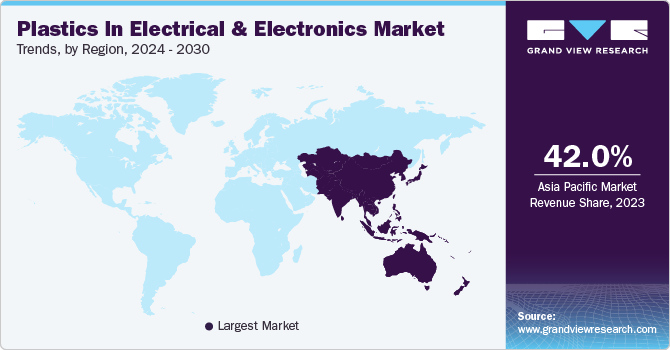

Regional Insights

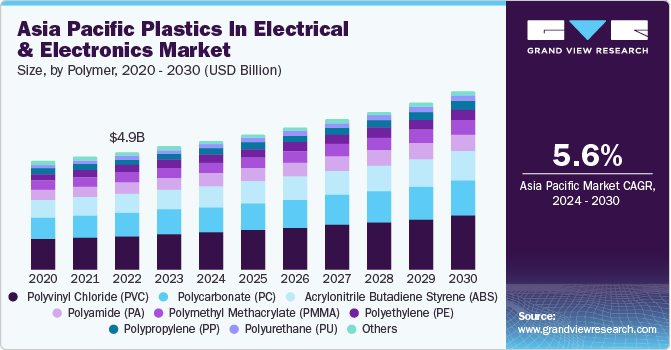

In 2023, Asia Pacific dominated global market with a market share of above 42.0%. The market in Asia Pacific is projected to witness substantial growth during the forecast period owing to rising disposable income in emerging economies of the region. Moreover, demand for high-quality medical devices is surging in China, India, Singapore, etc. due to rising healthcare expenditure. This fuels the demand for plastics used for developing polymers, PCBs, electrical casings, etc. that are utilized in medical devices.

According to National Bureau of Statistics (NBS) of China, disposable income of China stood at USD 5,487 in 2022 witnessing a 5% year-on-year increase in nominal terms from per capita disposable income of 2.9% in 2021. In first three quarters of 2023, per capita disposable income of China was approximately USD 4,094.7 representing a nominal year-on-year growth of 6.3% in it.

Presently, India is one of fastest-growing economies in world. As such, it is witnessing a significant increase in demand for commercial spaces. According to Government of India, flexible office spaces market in country is growing rapidly. It is expected to reach USD 80 million square feet by 2026. This expansion in commercial spaces in country has resulted in a rise in demand for plastics used for manufacturing electrical & electronic systems & components, including LED displays, Internet cables, optic fibers, wires & cables, electrical casings, etc. that are based on polymers.

Key Companies & Market Share Insights

Some of the key players operating in the market include BASF SE; SABIC; Covestro AG; Trinse S.A.; among others.

-

BASF SE has a versatile product portfolio for plastics including polyamide (PA), polybutylene terephthalate (PBT), polyethersulfone (PESU), polysulfone (PSU), and polyphenylsulfone (PPSU).

-

SABIC’s product portfolio for plastics caters to industries including electrical & electronics, automotive, building & construction, consumer goods, among others. The company’s portfolio includes polypropylene (PP), acrylonitrile butadiene styrene (ABS), polybutylene terephthalate (PBT), and linear-low density polyethylene (LLDPE).

Most of key players operating in market have integrated their raw material Polymerion and distribution operations to maintain Polymer quality and expand their regional presence. This provides companies a competitive advantage in form of cost benefits, thus increasing profit margins. Companies are undertaking research and development activities to develop new industrial plastics to sustain market competition and changing end-user requirements.

Research activities focused on development of new materials, which combine several properties, are projected to gain wide acceptance in this industry in coming years. Furthermore, active players implement strategic initiatives for maintaining competitive environmental. For instance, in October 2023, RadiciGroup launched a new Polymerion plant in Gujarat, India. Plant manufactures engineering polymers and high-performance polymers for various industries such as electrical and electronics, telecommunications, automotive, consumer, and industrial goods.

Key Plastics In Electrical And Electronics Companies:

- BASF SE

- Ensinger, Inc.

- Covestro AG

- TORAY INDUSTRIES, INC.

- Radici Partecipazioni SpA

- RTP Company

- LOTTE Chemical Corporation

- Trinseo S.A.

- SABIC

- Evonik Industries AG

- Mitsubishi Chemical Group Corporation

- Arkema

- LyondellBasell Industries Holdings B.V.

- Celanese Corporation

- Exxon Mobil Corporation

- LG Chem

- INEOS Group

- CHIMEI

Recent Developments

Some of the key players operating in the market include BASF SE; SABIC; Covestro AG; Trinse S.A.; among others.

-

In May 2023, SABIC announced its expansion of high-heat ULTEM resin portfolio by introducing new glass fiber-reinforced grades that would deliver high flow, custom color ability, and high strength. This product is well suited for electronic components such as fiber optics and electrical connectors.

-

In May 2022, BASF SE launched Ultradur B4335G3 HR HSP to their existing polybutylene terephthalate (PBT) portfolio. The company manufacturers PBT for industries such as electrical & electronics and automotive.

-

In May 2021, LyondellBasell Industries Holdings B.V. initiated the production of virgin polymers utilizing raw materials from plastic waste in line with the circular economy initiative at its site in Germany. This production facility will be producing polymers including polypropylene (PP) and polyethylene (PE) which are further utilized across electrical appliances, detergent bottles, and others.

Plastics In Electrical And Electronics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 39.94 billion

Revenue forecast in 2030

USD 53.27 billion

Growth rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Polymer, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; China,; India; Japan; Southeast Asia; Brazil; Saudi Arabia; United Arab Emirates (UAE); South Africa

Key companies profiled

BASF SE; Ensinger, Inc.; Covestro AG; TORAY INDUSTRIES, INC.; Radici Partecipazioni SpA; RTP Company; LOTTE Chemical Corporation; Trinseo S.A.; SABIC; Evonik Industries AG; Mitsubishi Chemical Group Corporation; Arkema; LyondellBasell Industries Holdings B.V.; Celanese Corporation; Exxon Mobil Corporation; LG Chem; INEOS Group; CHIMEI

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastics In Electrical and Electronics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented plastics in electrical and electronics market report based on polymer, application, and region:

-

Polymer Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Acrylonitrile butadiene styrene (ABS)

-

Polypropylene (PP)

-

Polyurethane (PU)

-

Polyvinyl Chloride (PVC)

-

Polyethylene (PE)

-

Polycarbonate (PC)

-

Polymethyl Methacrylate (PMMA)

-

Polyamide (PA)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Wires & cables

-

Electrical insulation

-

Printed circuit boards (PCBs)

-

Electronic devices

-

Electrical connectors

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global plastics in electrical and electronics market is valued at USD 37.72 billion in 2023 and is anticipated to grow to a value of USD 39.94 billion in 2024.

b. The global plastics in electrical and electronics market is anticipated to propel at a CAGR of 5.2% from 2024 to 2030 to reach USD 53.27 billion by 2030.

b. Polyvinyl Chloride (PVC) dominated the polymer segmentation in 2023 with a market revenue share of 28.83%. Followed by electronic devices dominating the application segmentation in 2023 with a market revenue share of 34.36%.

b. Key players actively present across the market space include BASF SE: Ensinger, Inc.; Covestro AG; TORAY INDUSTRIES, INC.; Radici Partecipazioni SpA; RTP Company; LOTTE Chemical Corporation; Trinseo S.A.; SABIC; Evonik Industries AG; Mitsubishi Chemical Group Corporation; Arkema; LyondellBasell Industries Holdings B.V.; Celanese Corporation; Exxon Mobil Corporation; LG Chem; INEOS Group; and CHIMEI.

b. Factors influencing propulsive growth for the plastics in electrical and electronics market include rising demand for solar photovoltaic (PV) panels for renewable energy and increasing traction from building & construction industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."