- Home

- »

- Plastics, Polymers & Resins

- »

-

Poly Alpha Olefin Market Size & Share, Industry Report, 2030GVR Report cover

![Poly Alpha Olefin Market Size, Share & Trends Report]()

Poly Alpha Olefin Market (2024 - 2030) Size, Share & Trends Analysis Report By End Use (Automotive Lubricants, Industrial Lubricants, Aerospace Lubricants, Others), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-125-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Poly Alpha Olefin Market Summary

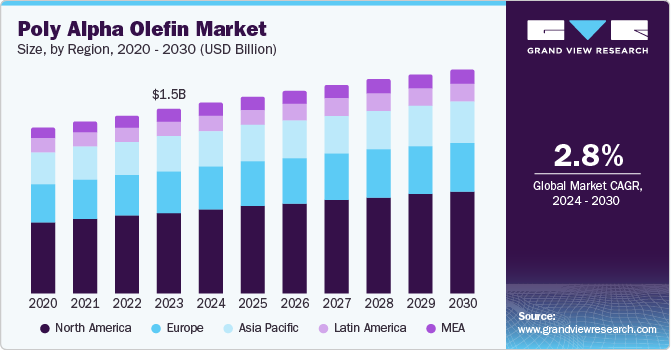

The global poly alpha olefin market size was estimated at USD 1.48 billion in 2023 and is projected to reach USD 1.80 billion by 2030, growing at a CAGR of 2.8% from 2024 to 2030. The key factors driving market growth are increasing adoption in the automotive industry, demand for high performance, and technological advancements backed by innovation and enhanced R & D.

Key Market Trends & Insights

- The Asia Pacific poly alpha olefin market dominated the market in 2023 and accounted for the largest revenue of 43.9% in 2023.

- The U.S. poly alpha olefin market dominate the North America region in 2023.

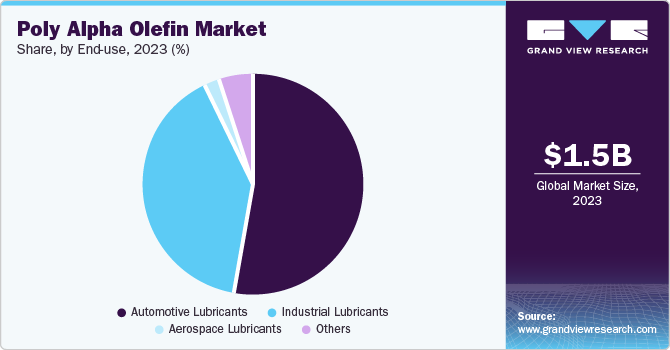

- Based on end-use, the automotive lubricants segment dominated the global industry and held the largest revenue of 53.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.48 Billion

- 2030 Projected Market USD 1.80 Billion

- CAGR (2024-2030): 2.8%

- Asia Pacific: Largest market in 2023

Rapid industrialization and the rising growth experienced by the oil and gas industry are expected to influence this market in coming years positively. Increasing demand for synthetic base oil in food-grade lubricants for packaging is likely to drive market growth. The growing sustainability and eco-friendly trends are anticipated to propel market growth.

Increasing demand for poly alpha olefins from automotive sectors is a significant factor driving the growth of this industry. Poly alpha olefin (POA) are synthetic hydrocarbons that are valued for their superior lubricating properties, including high thermal stability, low volatility, and excellent low-temperature fluidity, which makes POA ideal for engine oil, transmission fluids, and other automotive lubricants. As vehicles become more advanced, with enhanced engine designs and stricter emissions regulations, there is a growing need for lubricants that can offer improved performance and efficiency. Furthermore, the shift towards electric vehicles (EVs) and hybrid vehicles is also influencing the PAO market. These vehicles often use specialized lubricants for their electric drivetrains and battery cooling systems, where PAOs are employed owing to their superior thermal stability and electrical insulating properties.

Another key growth factor is the increasing use of poly alpha olefin (POA) in industrial applications such as gear oils, hydraulic fluids, and compressor oils. PAO's superior performance and durability make it an ideal choice for these applications, leading to increased demand. In addition, advancements in technology and production processes have improved the efficiency and cost-effectiveness of PAO production, further driving market growth. Moreover, the growing focus on sustainability is also driving demand for PAO. As manufacturers seek to reduce their environmental footprint, PAO's biodegradability and recyclability make it an attractive option.

End-use Insights

The automotive lubricants segment dominated the global industry and held the largest revenue of 53.4% in 2023. The segment growth is driven by increasing demand for high-performance lubricants and the adoption of synthetic oils. POA-based lubricants offer superior performance through improved fuel efficiency, wear and tear protection, minimized emission, and high-temperature stability, making them an attractive choice for automotive manufacturers. Furthermore, the growing adoption of electric vehicles is expected to influence the industry in approaching years. POA-based lubricants provide excellent thermal stability, electrical insulation properties, and compatibility with various materials. For instance, according to the International Energy Agency (IEA), approximately 14 million EV cars were registered in 2023.

Aerospace lubricants segment is anticipated to witness the significant CAGR of 3.2% during the forecast period. The key factor driving segment growth is attributed to the increasing global aircraft fleet, which includes cargo, passengers, and military. PAO-based lubricants are widely used in aircraft engines, gearboxes, and hydraulic systems due to their superior thermal stability, oxidation resistance, and lubricity. The unique properties of PAO-based lubricants, such as their ability to withstand extreme temperatures and pressures, make them an ideal choice for aerospace applications. As a result, aerospace manufacturers are increasingly adopting PAO-based lubricants contributing to significant increase in the demand. In addition, the increasing use of composite materials in aircraft construction is projected to drive demand for PAO-based lubricants as these lubricants are compatible with these materials and offer excellent corrosion protection, making them an essential component in the aerospace industry.

Regional Insights

North America poly alpha olefin market is anticipated to hold a substantial CAGR over the forecast period. The growing need for lubricants in various industries such as automotive, oil & gas, industrial manufacturing, and others that can withstand extreme temperatures and pressures driving demand for POA lubricants. The U.S. and Canada are significant contributors to the region's growth as these countries comprise some of the biggest manufacturers of various industries including Automotive, oil & gas, aerospace, and others. The U.S. is 2nd largest automotive manufacturer worldwide, producing around 10.6 million units in 2023. In addition, the region possesses one of the largest oil and gas offshore in the Gulf of Mexico and Alaska region, driving demand for POA-based lubricants.

U.S. Poly Alpha Olefin Market Trends

U.S. poly alpha olefin market dominate the North America region in 2023. The region's dominance can be attributed to a strong manufacturing hub and advancement in technology. The U.S. is the largest manufacturer of aerospace globally. Furthermore, the robust presence of military aircraft in the region further creates demand for efficient lubricants that can reduce emissions and maintain mechanical efficiency and safety such as POA.

Europe Poly Alpha Olefin Market Trends

Europe poly alpha olefin market held a significant revenue in 2023. The region's growth is driven by the rising industrial and automotive sector and a growing focus on energy efficiency and reducing emissions. The increasing adoption of POA-based lubricants in European automotive manufacturers owing to their superior performance, fuel efficiency, and environmental benefits. Furthermore, Europe's rising industrial sector in central and western Europe particularly in manufacturing and trading activities driving demand for POA, led to region growth. in addition, stringent government regulations such as the European Union’s REACH and Ecolabel program drive the adoption of sustainable and environmentally friendly lubricants such as POA.

Germany poly alpha olefin market dominated in Europe region in 2023. Thriving automotive sectors and growing demand for environmental based lubricants accelerated region growth. Germany is considered to be best automobile manufacturer across the world owing to its long standing reputation of producing luxurious and comfort cars such as Audi, BMW and Porsche, which demand for high performance and fuel efficient lubricants driving region growth. Rising sustainability trend and increasing investment and adoption of technology innovation in additives and POA market driving region growth.

Asia Pacific Poly Alpha Olefin Market Trends

Asia Pacific poly alpha olefin market dominated the market in 2023 and accounted for the largest revenue of 43.9% in 2023. Rapid urbanization and increasing economic growth in countries such as China, India, Japan, and others driving regional growth. The rising growth in these countries fuels various sectors and activities including the automotive, construction, shipping, and packaging industries. The rising automotive industry in the region is flourishing growth. Countries such as China, South Korea, and India are the largest manufacturers of automobiles in the region, driving demand for high-performance solutions such as POA lubricants. Furthermore, rising economic growth led to increasing construction and industrialization activities that propelled the demand for poly alpha olefin. In addition, Innovation in POA production and formulation has enhanced their performance and application range, driving regional growth. Moreover, Stringent environmental regulations in the region encourage the use of poly alpha olefin owing to their lower volatility and higher biodegradability compared to other petrochemical lubricants.

China poly alpha olefin market dominated and registered the largest share in 2023. The region's growth is driven by expanding economic growth, rising automotive sector, and industrialization in the country. China is the largest producer of automotive worldwide, the expanding vehicle production and sales create significant demand for POA used in engine oil and other automotive lubricants. Moreover, the increasing industrial expansion including manufacturing, machinery, and equipment creates demand for high-quality lubricants such as POA. Furthermore, rapid economic growth and urbanization in the country lead to increased construction activities and infrastructure, driving regional growth, as construction machinery and equipment need effective lubricants for maintenance and performance.

Key Poly Alpha Olefin Company Insights

Some key companies involved in the poly alpha olefin market include Exxon Mobil Corporation, INEOS, Laxness,Shanxi Lu'an, and others in the market are focusing on the development of new products and solutions to gain a competitive edge in the industry.

-

Exxon Mobil Corporation is a multinational company in the integrated fuels, chemicals, and lubricants industry. Its diverse brand portfolio encompasses a wide range of products and services. One of its products is SpectraSyn Plus PAO, offered in three viscosity grades: 3.6 cSt, 4 cSt, and 6 cSt.

-

INEOS, a chemical company operating in the global industry, specializes in producing a wide range of products in key segments such as polymers, oil and gas, and other chemicals. The company operates approximately 36 businesses, focusing on different aspects of the chemical industry. Some of the group's major businesses include styrenics, chlorovinyls supply, acetic acid

and a range of derivatives, aromatics (purified terephthalic acid), oil, gas, power, LNG, and others.

Key Poly Alpha Olefin Companies:

The following are the leading companies in the poly alpha olefin market. These companies collectively hold the largest market share and dictate industry trends.

- Exxon Mobil Corporation

- INEOS

- Chevron Phillips Chemical Company LLC

- Shanxi Lu'an

- Dowpol Corporation

- PetroChina Company Limited

- APALENE TECHNOLOGY

- LANXESS

- NACO Corporation

Recent Developments

-

In September 2023, ExxonMobil announced a USD 2 billion investment for the expansion of its chemical production at Baytown, Texas. The expansion is part of ExxonMobil's growth plans to produce high-quality products from its gulf refining and chemical facilities, located in the U.S. ExxonMobil's expansion of chemical production includes two new chemical production units, Vistamaxx and Exact-branded polymer, to enhance the performance of its wide range of chemical products.

Poly Alpha Olefin Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.53 billion

Revenue Forecast in 2030

USD 1.80 billion

Growth Rate

CAGR of 2.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume kilo tons and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

End-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, France, Sweden, Poland, Hungary, China, India, Japan, Brazil, Saudi Arabia

Key companies profiled

Exxon Mobil Corporation; INEOS; Chevron Phillips Chemical Company LLC; Shanxi Lu'an; Dowpol Corporation; PetroChina Company Limited; APALENE TECHNOLOGY; LANXESS; NACO Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Poly Alpha Olefin Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global poly alpha olefin market report based on end-use, and region.

-

End-use Outlook (Revenue, USD Million, Volume Kilo Tons, 2018 - 2030)

-

Automotive Lubricants

-

Industrial Lubricants

-

Aerospace Lubricants

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume Kilo Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Sweden

-

Poland

-

Hungary

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.