- Home

- »

- Organic Chemicals

- »

-

Acetic Acid Market Size, Share, Growth, Trends Report, 2030GVR Report cover

![Acetic Acid Market Size, Share & Trends Report]()

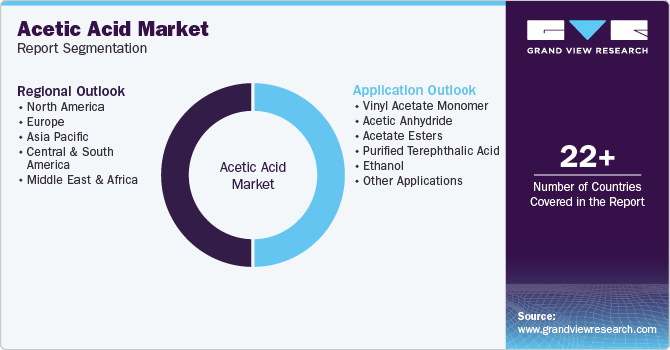

Acetic Acid Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Vinyl Acetate Monomer, Acetic Anhydride, Acetate Esters, Purified Terephthalic Acid), By Region (Central & South America, Europe), And Segment Forecasts

- Report ID: 978-1-68038-077-4

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Acetic Acid Market Summary

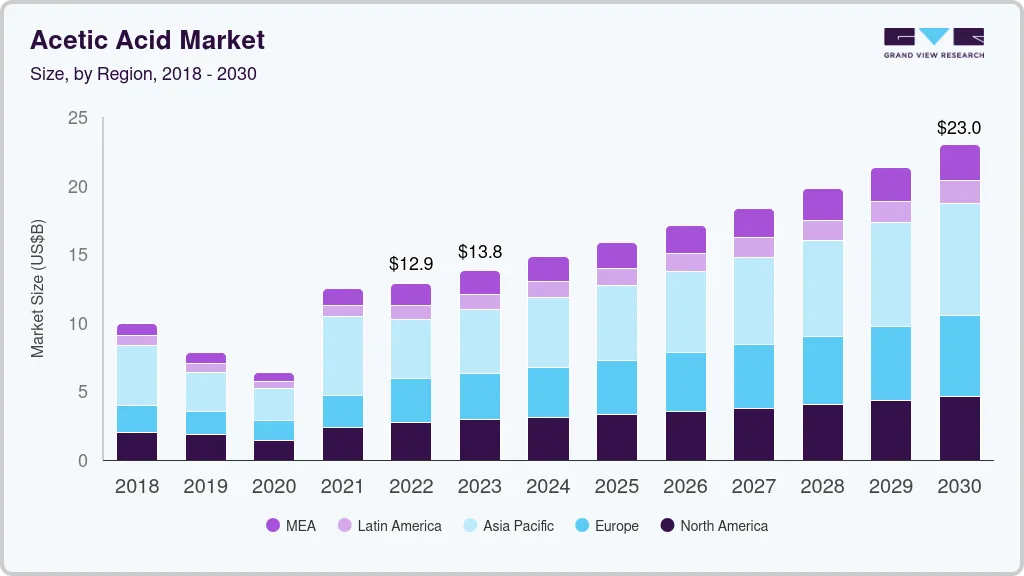

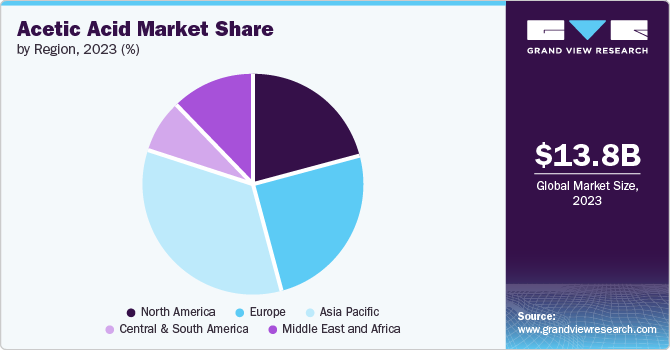

The global acetic acid market size was estimated at USD 13.80 billion in 2023 and is projected to reach USD 23.02 billion by 2030, growing at a CAGR of 7.6% from 2024 to 2030. The growth is attributed to its importance in building blocks for manufacturing several chemicals and usability in various industries such as plastic, rubber, ink, and textile. The rising growth in industries including plastic, textiles, and chemicals across the globe is expected to drive demand for the product over the forecast years.

Key Market Trends & Insights

- The acetic acid market in Asia Pacific dominated the global industry with a revenue share of 33.9% in 2023.

- The U.S. is the largest consumer of acetic acid in North America, accounting for a significant revenue share.

- Based on application, the vinyl acetate monomer application segment dominated the market with the largest revenue share of 41% in 2023.

- In terms of application, acetic anhydride captured the second largest share globally in 2023 with a share of 19.2%.

Market Size & Forecast

- 2023 Market Size: USD 13.80 billion

- 2030 Projected Market Size: USD 23.02 billion

- CAGR (2024-2030): 7.6%

- Asia Pacific: Largest market in 2023

Furthermore, the substitution of glass bottles for PET bottles in the alcoholic beverages industry is expected to drive the need for terephthalic acid, thereby positively influencing the growth of the product industry in the forecast period. Additionally, the presence of multinational corporations and their consistent efforts in expanding and forming joint ventures related to the product are likely to contribute to the market's growth in the foreseeable future. The substitution of PET bottles with glass bottles for alcoholic beverages is expected to increase the demand for terephthalic acid, which will have a positive impact on the industry in the coming years.

Furthermore, the involvement of multinational companies and their continuous efforts in expanding and forming joint ventures related to this product are likely to enhance market growth in the foreseeable future.

Furthermore, the substitution of PET bottles with glass bottles for alcoholic beverages is anticipated to drive the demand for terephthalic acid, which positively impacts the industry. The presence of multinational corporations actively engaged in research, development, and strategic initiatives such as expansions and collaborations also contributes to the growth of the market. These companies strive to bolster their market position and address the global demand for market.

Additionally, the versatility of acetic acid and its utilization in various high-growth industries such as food and beverages, plastics and polymers, and pharmaceuticals further drives the demand for product. The rapid expansion of the textile industry globally, driven by rising income levels in developing countries, increased standards of living, and changing fashion trends, also plays a significant role in the growth of the market.

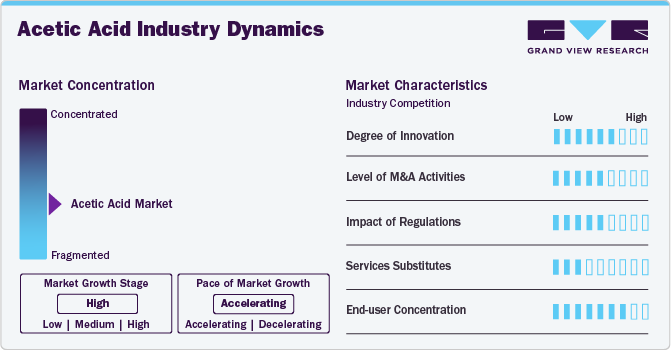

Industry Dynamics

The acetic acid market is characterized as a highly competitive market, influenced by various factors. The competitive landscape features multinational corporations that focus on research, development, and strategic initiatives such as expansions and collaborations to strengthen their market position and address the global demand for market.

Regulatory factors also play a significant role in shaping the competitive dynamics of the ] market. Compliance with regulations and standards, particularly in the food and beverage sector, where "food-grade" quality is crucial, ensures the safety and quality of acetic acid used in food applications.

Technological advancements and changing consumer preferences are additional factors that impact on the competitive landscape. Advancements in technology can lead to the development of more efficient or sustainable production methods for the product, influencing market dynamics and competition. Shifts in consumer preferences towards sustainable and eco-friendly products also influence the demand for industry.

The competitive nature of the market is further influenced by factors such as brand reputation, customer service, and marketing efforts. Companies strive to differentiate themselves through various means, including style, brand name, location, packaging, advertisement, and pricing strategies.

Application Insights

Based on application, the vinyl acetate monomer application segment dominated the market with the largest revenue share of 41% in 2023. Its high share is attributed to the increasing demand for paints & coatings, paper coatings, and printed products which are driving the demand for vinyl acetate monomer. Acetic acid is a major raw material used in the production of vinyl acetate monomer which is further used for the production of polyvinyl acetate. Polyvinyl acetate is further used in the manufacturing of paints & coatings. Improvements in consumer lifestyles and the increasing number of house renovations and redecoration are driving demand for paints and coatings, thereby directly influencing the demand for vinyl acetate monomer.

Acetic anhydride captured the second largest share globally in 2023 with a share of 19.2%. This growth is attributed to its extensive utilization of photographic films and various other coated materials. It is also used for the manufacturing of cigarette filters. It is considered a key raw material for the development of medicines such as aspirin, which helps in the treatment of headaches. Acetic acid is used extensively in the preservation of wood.

Regional Insights

The acetic acid market in North America, particularly in the United States and Canada, is driven by various factors. In the food and beverage industry, acetic acid is widely used in the preservation of meat, making it a prominent application market in the region. The rising life expectancy and increasing dependence on medicinal tablets have also contributed to the demand for the product in the pharmaceutical industry.

U.S. Acetic Acid Market Trends

The acetic acid market in the U.S. is growing, as the product consumption is significant, especially in the food and beverage sector, where the "food-grade" quality of acetic acid is crucial. The U.S. is the largest consumer of acetic acid in North America, accounting for a significant revenue share. For example, the product is used in the production of vinegar, a widely consumed food product.

Canada acetic acid market is influenced by factors such as industrial growth and the expanding manufacturing sectors. The country has witnessed an increase in chemical production, leading to a higher demand for intermediates like acetic acid. Additionally, the market finds application in various industries, including construction, automotive, and textiles, which further contribute to its demand.

Asia Pacific Acetic Acid Market Trends

The acetic acid market in Asia Pacific dominated the global industry with a revenue share of 33.9% in 2023. The demand for the product is experiencing significant growth across industries including construction, pharmaceuticals, automotive, and textiles. This growth can be attributed to the expanding pharmaceutical industry in the region, where acetic acid plays a major role in the development of medicines. With an increasing reliance on medicinal tablets among consumers, the overall demand for the product in the region is expected to rise.

The China acetic acid market is rising due to various factors. In China, the growth of the pharmaceutical industry has contributed to the increasing demand for acetic acid. Acetic acid is a key raw material used in the development of medicines, and the growing dependence of consumers on medicinal tablets has driven the overall demand for acetic acid in the region.

The acetic acid market in India is rising as the demand for the product has been influenced by factors such as industrial growth and expanding manufacturing sectors. The country has witnessed a significant increase in chemical production, which has led to a higher demand for intermediates like acetic acid. Additionally, the construction, automotive, and textile industries in both China and India have contributed to the rising demand for acetic acid.

Europe Acetic Acid Market Trends

The acetic acid market in Europe, including Germany and the UK, is influenced by various factors. In Germany, the demand for the product has experienced fluctuations due to factors such as the availability and cost-effectiveness of primary feedstock, Methanol, and the demand from downstream industries like Ethyl Acetate and Butyl Acetate, which are predominantly used in the construction sector. However, there is an anticipation of a reversal in prices driven by increasing import prices from the Chinese market and elevated prices of feedstock Methanol.

UK acetic acid market is driven by industries such as food and beverage, pharmaceuticals, and personal care products, as well as the textile, automotive, and construction sectors. Acetic acid is widely used in the production of a range of chemicals and materials, including vinegar, plastics, and chemicals. For example, the product is a key component used in the manufacture of polymers and resins for textiles, paints, films, coatings, and adhesives.

Central & South America Acetic Acid Market Trends

The acetic acid market in Central & South America is rising, as the production of vinegar, a widely consumed food product, relies on acetic acid. The construction and automotive industries in the region utilize the product in the production of adhesives, coatings, and other applications.

MEA Acetic Acid Market Trends

The acetic acid market in the Middle East & Africa is growing, as the demand for the product is primarily driven by the improved pharmaceutical industry and the increased demand for medicines. The presence of a large number of patients suffering from diabetes, cardiovascular diseases, and ailments related to the aging population has led to an increased demand for the product in the pharmaceutical sector. Additionally, the food and beverage industry in Saudi Arabia utilizes acetic acid in the preservation of meat and other food products

Key Acetic Acid Company Insights

Some of the key players operating in the market include Eastman Chemical Company, Celanese Corporation, LyondellBasell Industries Holdings B.V. among others.

-

Eastman Chemical Company is a global specialty materials company that produces a broad range of advanced materials, chemicals, and fibers. It was founded in 1920 by George Eastman as Tennessee Eastman, with a focus on organic chemicals and acetyls. Over the years, Eastman Chemical has become an independent company and is no longer a subsidiary of Kodak.

-

LyondellBasell Industries Holdings B.V. is a global chemical company that operates, develops, and distributes polypropylene and advanced polyolefin products. The company has a presence in Europe, North America, and the Asia-Pacific region. It is one of the largest chemical companies in the world and is headquartered in Houston and Rotterdam.

HELM AG, Indian Oil Corporation Ltd. are some of the emerging market participants in the market.

-

HELM AG is a Hamburg-based family-owned company with a history spanning over 120 years. It is a multifunctional distribution company specializing in various sectors, including Chemicals (Feedstocks and Derivatives), Crop Protection, Fertilizers, Active Pharmaceutical Ingredients, and Pharmaceuticals. The company operates globally, with subsidiaries and sales offices in more than 30 countries across Europe.

-

Indian Oil Corporation Ltd (IOCL) is an India-based oil company. It is the largest company in India in terms of turnover and is the only Indian company to rank in the Fortune "Global 500" listing. IOCL is a Maharatna company controlled by the Government of India and has business interests across the entire hydrocarbon value chain. The company operates in segments including Petroleum Products, Petrochemicals, and Other Business Activities.

Key Acetic Acid Companies:

The following are the leading companies in the acetic acid market. These companies collectively hold the largest market share and dictate industry trends.

- Eastman Chemical Company

- Celanese Corporation

- LyondellBasell Industries Holdings B.V.

- SABIC

- HELM AG

- Indian Oil Corporation Ltd.

- Gujarat Narmada Valley Fertilizers & Chemicals Limited

- DAICEL CORPORATION

- Dow

- INEOS

Recent Developments

-

In September 2023, INEOS announced the acquisition of Eastman Chemical Company's Eastman Texas city site which also includes an acetic acid plant of 600 kilotons.

-

In January 2023, Kingboard Holdings Limited has announced that its subsidiary, Hebei Kingboard Energy Development Co., Ltd., plans to submit the "Environmental Impact Report of Hebei Kingboard Energy Development Co., Ltd. Acetic Acid Expansion and Transformation Project" for approval.

-

In January 2021, INEOS completed the acquisition of aromatics and acetyls business of BP Plc. The deal was valued USD 5 billion.

Acetic Acid Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.80 billion

Revenue forecast in 2030

USD 23.02 billion

Growth Rate

CAGR of 7.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Volume in kilotons; revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Belgium; Netherlands; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; Egypt

Key companies profiled

Eastman Chemical Company; Celanese Corporation; LynodellBasell Industries Holding B.V.; SABIC; HELM AG; Airedale Chemical Company Limited; Indian Oil Corporation Ltd; Gujrat Narmada Valley Fertilizers & Chemicals Limited; Pentokey Organy; Ashok Alco Chem Limited; DAICEL CORPORATION; The Dow Chemical Product; DubiChem; INEOS.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Acetic Acid Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global acetic acid market report based on application, and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Vinyl Acetate Monomer

-

Acetic Anhydride

-

Acetate Esters

-

Purified Terephthalic Acid

-

Ethanol

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Netherlands

-

Belgium

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global acetic acid market size was estimated at USD 13.80 billion in 2023 and is expected to reach USD 14.80 billion in 2024.

b. The global acetic acid market is expected to grow at a compound annual growth rate of 7.6% from 2024 to 2030 to reach USD 23.02 billion by 2030.

b. The Asia Pacific dominated the market and accounted for 33.9% of the global revenue in 2023. This is attributable to the increasing penetration of polymer formulators in the region.

b. Some key players operating in the acetic acid market include Eastman Chemical Company, Celanese Corporation, LynodellBasell Industries Holding B.V., SABIC, HELM AG, Airedale Chemical Company Limited, Indian Oil Corporation Ltd, Gujrat Narmada Valley Fertilizers & Chemicals Limited, Pentokey Organy, Ashok Alco Chem Limited, DAICEL CORPORATION, The Dow Chemical Product, DubiChem, INEOS.

b. Key factors that are driving the acetic acid market growth include rising demand for the product from vinyl acetate monomer (VAM) producers worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.