- Home

- »

- Petrochemicals

- »

-

Automotive Lubricants Market Size & Share Report, 2030GVR Report cover

![Automotive Lubricants Market Size, Share & Trends Report]()

Automotive Lubricants Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Engine Oil, Gear Oil, Transmission Fluids, Brake Fluids, Coolants, Greases), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-948-7

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Lubricants Market Summary

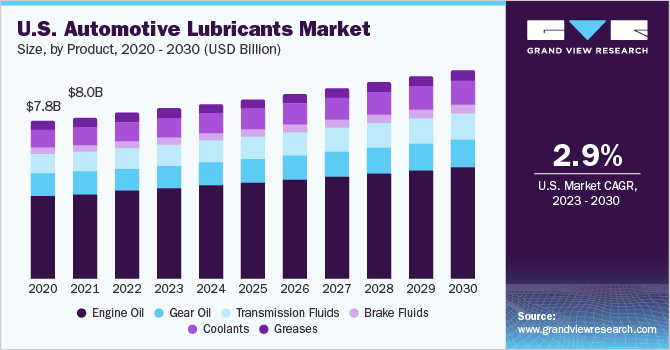

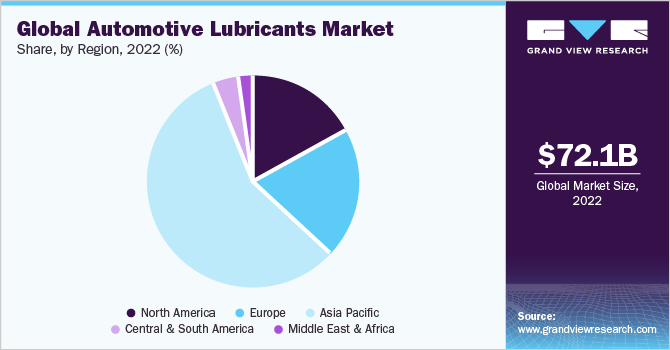

The global automotive lubricants market size was estimated at USD 72.05 billion in 2022 and is expected to grow at a CAGR of 3.5% from 2023 to 2030. Growing demand for high-performance and lightweight vehicles in emerging economies such as India and China, and a shift in consumer preference towards sustainable lubricants are the key factors driving market growth.

Key Market Trends & Insights

- Asia Pacific dominated the global automotive lubricants market with the largest revenue share of 57.2% in 2022.

- The automotive lubricants market in China led the Asia Pacific market and held the largest revenue share in 2022.

- By product, the Engine oil segment led the market, holding the largest revenue share of 54.8% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 72.05 Billion

- 2030 Projected Market Size: USD 94.87 Billion

- CAGR (2023-2030): 3.5%

- Asia Pacific: Largest market in 2022

Increasing automotive production coupled with a shift in trend from heavy vehicles to lightweight vehicles is a key driving factor since the latter contributes significantly to weight savings and lower carbon emissions. A 10% reduction in the weight of an automobile results in approximately 5% to 7% fuel savings. In addition, the reduced weight also aids in controlling the emission of CO2 throughout the life cycle of the vehicle. It further helps the overall performance of the vehicle in terms of acceleration and handling. Moreover, the reduction in mass at unhinged points provides for a reduction in noise and vibration, making it a smoother ride. Thus, growing concerns regarding fuel consumption and greenhouse gas (GHG) emissions are expected to boost the demand for lubricants in commercial as well as passenger vehicles.

The U.S. is the largest consumer of the product in North America with a revenue share of 67.7% in 2022. According to the International Trade Administration, the U.S. is the second largest market for sales and production of vehicles in 2022 with light vehicles accounting for 14.5 million units of sales. Additionally, according to the Motor & Equipment Manufacturers Association, the foreign direct investment for the automotive industry in the country amounted to USD 143.3 billion in 2019. Thus, the advancing automotive industry in the country is anticipated to be the major driving force for the product over the forecast period.

Product Insights

Engine oil in the product segment dominated the market with a revenue share of 54.8% in 2022. Engine oils are most commonly used for lubrication of internal combustion engines in automobiles. These high-performance lubricants are available in various categories including fully synthetic, part synthetic, and mineral oils. Engine oils exhibit a wide range of exceptional characteristics such as high viscosity, heat resistance, wear protection, and strength. Thus, all these factors are contributing to the growth of engine oils.

Brake fluids are another segment witnessing the fastest growth over the forecast period. Braking fluids are hydraulic fluids that are frequently used in car hydraulic braking and clutch applications. The basic function of brake fluids is to produce an incompressible medium through which the driver's foot pressure on the brake pedal is transmitted in order to lock the friction material against the discs.

Regional Insights

Asia Pacific region dominated the market with a revenue share of 57.2% in 2022. This growth is majorly attributed to the advancing commercial automotive lubricants market in India, Japan, and China. According to OICA, India produced a total of 5,456,857 vehicles including commercial vehicles, three-wheelers, passenger vehicles, and two-wheelers, witnessing a growth of 24% in 2022, compared to 2021. Additionally, the automotive sector in Japan is the third largest in the world comprising 78 factories in 22 prefectures. Thus, all these factors are contributing to the growth of the product market in the region.

Europe is another region witnessing growth over the forecast period. According to the European Commission, the automotive industry employs around 2.6 million individuals who are directly involved in car manufacturing, accounting for approximately 8.5% of overall manufacturing employment in the European Union. Furthermore, the Society of Motor Manufacturing and Traders (SMMT) estimates that the UK will produce around 775,014 cars and 101,600 commercial vehicles in 2022.

Key Companies & Market Share Insights

The automotive lubricants industry is highly competitive with the presence of a large number of players in the market. Companies are investing huge amounts in research & development activities and innovations so as to gain a competitive advantage. For instance, in March 2021, Nissan Motors India and ExxonMobil signed a contract to supply lubricants for passenger car aftermarket. ExxonMobil will increase its lubricant output by offering a selection of engine oils suited for BS3, BS6, and BS4 models from OEMs. On March 2023, ExxonMobil announced that it is investing nearly USD $110 million to build a lubricant manufacturing plant that will produce 159,000 kiloliters of lubricants, in Maharashtra, India. Some prominent players in the global automotive lubricants market include:

-

Exxon Mobil

-

Castrol

-

Shell

-

Repsol

-

LUKOIL

-

Sasol

-

Indian Oil Corporation Ltd

-

HP Lubricants

-

Philipps 66

-

Fuchs

-

Cepsa

Automotive Lubricants Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 72.05 billion

Revenue forecast in 2030

USD 94.87 billion

Growth rate

CAGR of 3.5 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million, volume in kilo tons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Switzerland; France; Italy; Spain; Netherlands; Russia; China; India; Japan; South Korea; Southeast Asia; Oceania; Kyrgyzstan; Brazil; Argentina; Chile; Colombia; Iran; Oman; UAE; Qatar; Kuwait; Saudi Arabia; South Africa; Angola; Nigeria

Key companies profiled

Exxon Mobil; Castrol; Shell; Repsol; LUKOIL; Sasol; Indian Oil Corporation Ltd; HP Lubricants; Philipps 66; Fuchs; Cepsa

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Lubricants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive lubricants market report based on product and region:

-

Product Outlook (Revenue, USD Million; Volume, Kilo tons; 2018 - 2030)

-

Engine Oil

-

Gear Oil

-

Transmission Fluids

-

Brake Fluids

-

Coolants

-

Greases

-

-

Regional Outlook (Revenue, USD Million, Volume; Kilo tons; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Switzerland

-

France

-

Italy

-

Spain

-

Netherlands

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Southeast Asia

-

Oceania

-

Kyrgyzstan

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

-

Middle East & Africa

-

Iran

-

Oman

-

UAE

-

Qatar

-

Kuwait

-

Saudi Arabia

-

South Africa

-

Angola

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The global automotive lubricants market size was estimated at 72.05 billion in 2022.

b. The global automotive lubricant market is expected to grow at a compound annual growth rate of 3.5% from 2023 to 2030

b. Engine oil dominated the automotive lubricant market with a share of 54.8% in 2022. This is attributable to the increasing demand from passenger cars, heavy-duty trucks, and light-duty trucks. They help to maintain the viscosity, ensure dependability and reduce engine wear.

b. Some key players operating in the automotive lubricants market include • Exxon Mobil • Castrol • Shell • Repsol • LUKOIL

b. Key factors that are driving the automotive lubricants market growth include increasing demand for lightweight vehicles and passenger cars and a shift in consumer preference toward sustainable lubricants.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.