- Home

- »

- Petrochemicals

- »

-

Aerospace Lubricants Market Size And Share Report, 2030GVR Report cover

![Aerospace Lubricants Market Size, Share & Trends Report]()

Aerospace Lubricants Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Gas Turbine Oils, Piston Engine Oils, Hydraulic Fluids), By Region, And Segment Forecasts

- Report ID: 978-1-68038-845-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerospace Lubricants Market Size & Trends

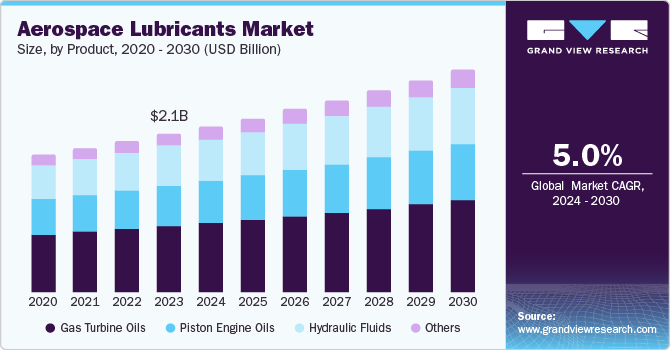

The global aerospace lubricants market size was valued at USD 2.13 billion in 2023 and is projected to reach USD 2.99 billion by 2030, growing at a CAGR of 5.0% from 2024 to 2030. The market growth is attributed to the increasing demand for air travel, and airline expansion necessitates enhanced aircraft maintenance and performance lubrication solutions. In addition, the focus on fuel efficiency and sustainability is prompting the development of high-performance, eco-friendly lubricants. Furthermore, technological advancements in aerospace systems and stringent regulatory standards further push the demand for specialized lubricants that can withstand extreme conditions.

Aerospace lubrication deals with cooling, sealing, clearing, and preventing corrosion in the engine. Private companies, commercial uses, and government initiatives for airport infrastructure investments result in lucrative prospects for lubricant-producing companies. In addition, selecting the proper lubricant for mechanisms requires a lightweight and highly functional lubricant. In addition, advancements and innovations in synthetic lubricant technology, an increasing global aircraft fleet to assist the mounting passenger travel demand, and stringent guidelines promoting high-performance and nature-friendly lubricants contributed to the market growth. However, innovative technology, evolving globalization, and modernization have resulted in significant change.

Moreover, lubricants reduce friction and wear in an aerospace engine; the aerospace industry has stricter demands for lubricants. The initiatives for innovation fulfill sustainability goals, and investments in eco-friendly products gain momentum in the competitive aerospace lubricant segment. Aircraft engines and components are utilized by lubricants, which are specialized fluids that are crucial in maintaining mechanical efficiency and safety. Their formulations are tailored to withstand extreme temperatures, varying pressures, and the rigors of flight, and lubricants reduce friction, protect against corrosion, and contribute to the extended lifespan of aerospace parts.

Product Insights

Gas turbine oils dominated the market and accounted for the largest revenue share of 41.9% in 2023 pertaining to its significance in aerospace, acting as a lubricant, especially for aircraft gas turbine engines. It also minimizes corrosion and sludge formation while the engine is working. These oils can withstand high temperatures and extreme operating environments related to jet engines. In addition, gas turbine oil helps inefficient cooling by providing thrust. Also, it benefits by reducing the overall engine working temperature, thereby increasing dependability, lowering operating expenditure, and ascertaining the enhanced operation of engines.

The hydraulic fluids are anticipated to grow at a CAGR of 5.1% over the forecast period. The rising demand for automation and aerospace industries drives this growth. Its adoption transmits power and motion in the hydraulic systems that function in different aircraft components, such as brakes, landing gear, steering systems, flight controls, and wing flaps. However, it is essential to safeguard the smooth operation of hydraulic systems in aircraft, providing the optimum lubrication, protection from corrosion, and thermal stability required for better performance. Furthermore, with the growing demand for enhanced and efficient aircraft performance, the aerospace hydraulic fluids market witnesses significant market expansion.

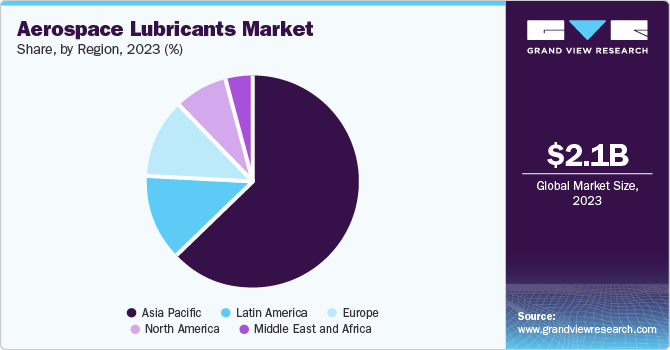

Regional Insights

The North America aerospace lubricant market is expected to grow substantially over the forecast period owing to the robust aerospace industry, including the commercial and defense sectors. Moreover, the demand for aerospace lubricants in North America is driven by rising revenue in passenger kilometers year-on-year.

U.S. Aerospace Lubricants Market Trends

The aerospace lubricants market in the U.S. is expected to grow substantially over the forecast period driven by high spending on defense by the government for military aviation, which is a significant aspect of market rise, augmented by stringent performance necessities and the need for lubricants that are efficient to face extreme conditions and high operational demands encompassing lubricants adopted in smaller aircraft and private jets for wide applications, comprising engines and airframe components. Furthermore, helicopters also require specialized lubricants for the rotor mechanism, transmissions, and hydraulic systems, highlighting durability and performance in diverse operating conditions and boosting the market.

Asia Pacific Aerospace Lubricants Market Trends

Asia Pacific aerospace lubricant market dominated the global market and accounted for the largest revenue share of 62.4% in 2023. Significant companies in China, India, and Japan have been present, and new formulations of lubricants with higher quality performance have been continuously developed in these regions. They are utilized widely in aerospace applications, boosting the market. In addition, increasing air travel demand and the expansion of airline fleets are significant contributors, as they necessitate enhanced lubrication solutions for maintenance and efficiency. Furthermore, technological advancements in lubricant formulations, including a shift towards eco-friendly and synthetic options, are gaining traction.

The aerospace lubricants market in China dominated the Asia Pacific market and accounted for the largest revenue share of 49.6% in 2023 attributed to the rising defense expenditures for aerospace lubricants to enhance the operational effectiveness of engines by minimizing friction between two coated surfaces. This results in more distance traveled with the same quantity of fuel, thereby driving the market growth.

The India aerospace lubricants market is expected to grow significantly over the forecast period. Indian economic growth is backed by evolving demographics and growth in flight travel for businesses, educational purposes, etc. Furthermore, India’s lubricant demand is growing due to the rising government expenditure on defense and increasing traveling across the country, resulting in demand for commercial or private planes, a significant aspect of the market growth.

Europe Aerospace Lubricants Market Trends

The Europe aerospace lubricant market is projected to grow significantly with broad applications in day-to-day life. However, the market for aerospace lubricants witnessed newer trends, such as increasing demand for more lightweight and durable products and rising emphasis on performance-oriented lubricants, which boost the market for aerospace lubricants.

The UK aerospace lubricants market growth is driven by the extensive use of lubricants in aircraft engines, landing gears, and critical components of engines for stable operation and better performance. Furthermore, the UK is an economically strong region, which has resulted in people traveling for business purposes and tourism. Also, due to increased employment and sophisticated cities, urbanization and migration of people from other countries have resulted in a rising capacity for uninterrupted flight, leading the market for aerospace lubricants.

Middle East & Africa Aerospace Lubricants Market Trends

The aerospace lubricant market in the Middle East & Africa is expected to grow at a CAGR of 5.0% over the forecast period attributed to the increasing demand for air travel, spurred by rising disposable incomes and a growing tourism sector. In addition, fleet modernization and expansion among airlines necessitate advanced lubrication solutions to enhance efficiency and performance. Investments in military aviation and infrastructure development further contribute to market growth. Furthermore, the focus on sustainability and the adoption of eco-friendly lubricants also play a significant role in shaping the market dynamics in this region.

Key Aerospace Lubricants Company Insights

Some of the key companies in the aerospace lubricants market include Aerospace Lubricants, Inc., IKV Tribology Ltd, Nye Lubricants, Inc., Santie Oil Company, Idemitsu Kosan Co., Ltd., Fuchs, CASTROL LIMITED;in the market focusing on development & to gain a competitive edge in the industry.

-

Aerospace Lubricants, Inc. manufactures synthetic lubricants used in automotive, industrial, military, aerospace, and commercial markets. They offer custom formulations, private label manufacturing, and a variety of products comprising household spray grease, marine lubricants, motorcycle chain lubricants, musical instrument lubricants, racing oils, and SCUBA lubricants, thereby providing high-quality lubricants for harsh externalities.

-

Nye Lubricants, Inc. formulates, manufactures, and markets high-quality synthetic lubricants. Their products are based on a full range of synthetic chemistries, such as polyalphaolefins, esters, glycols, polyphenyl ethers, silicones, alkylated naphthalenes, and all types of perfluoropolyether (PFPE). The company serves many industries, such as automotive, in-vacuum manufacturing, appliance, aerospace, defense, medical device, photonics markets, and many more. They also manufacture lubricants for industrial maintenance for incident food contact, high temperatures, and other extreme environments.

Key Aerospace Lubricant Companies:

The following are the leading companies in the aerospace lubricant market. These companies collectively hold the largest market share and dictate industry trends.

- Aerospace Lubricants, Inc.

- IKV Tribology Ltd

- Nye Lubricants, Inc.

- Santie Oil Company

- Idemitsu Kosan Co., Ltd.

- Fuchs

- CASTROL LIMITED

- Eastman Chemical Company

- Shell

- Chevron Alkhalij

Recent Developments

-

In January 2024,Shell entered into a long-term agreement with Air Europa to become the airline’s preferred supplier of aerospace lubricants, providing AeroShell engine oils, greases, and hydraulic fluids for Boeing 737 and 787 Dreamliner aircraft. AeroShell confirmed its obligation to continually work to minimize carbon emissions by optimizing production and product design, improving the energy efficiency of facilities, and using renewable energy to lower emissions across the supply chain.

-

In April 2023, FUCHS Group announced its acquisition of the LUBCON Group, a manufacturer of high-performance specialty lubricants, aiming to enhance its product offerings and global competitiveness. Based in Maintal, Germany, LUBCON specializes in greases, oils, and pastes for various industries, including rail, food, and pharmaceuticals. This strategic move will leverage FUCHS's extensive network to maximize LUBCON's growth potential. The deal, pending regulatory approval, is expected to close in the third quarter of 2024, with LUBCON generating approximately EUR 40 million in revenue in 2023.

Aerospace Lubricants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.23 billion

Revenue forecast in 2030

USD 2.99 billion

Growth Rate

CAGR of 5.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Switzerland, Russia, China, India, Japan, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Aerospace Lubricants, Inc.; IKV Tribology Ltd; Nye Lubricants, Inc.; Santie Oil Company; Idemitsu Kosan Co., Ltd.; Fuchs; CASTROL LIMITED; Eastman Chemical Company; Shell; Chevron Alkhalij.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerospace Lubricants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aerospace lubricants market report based on product, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Gas Turbine Oils

-

Piston Engine Oils

-

Hydraulic Fluids

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Switzerland

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.