- Home

- »

- Plastics, Polymers & Resins

- »

-

Silicone In Electric Vehicles Market Size & Share Report 2030GVR Report cover

![Silicone In Electric Vehicles Market Size, Share & Trends Report]()

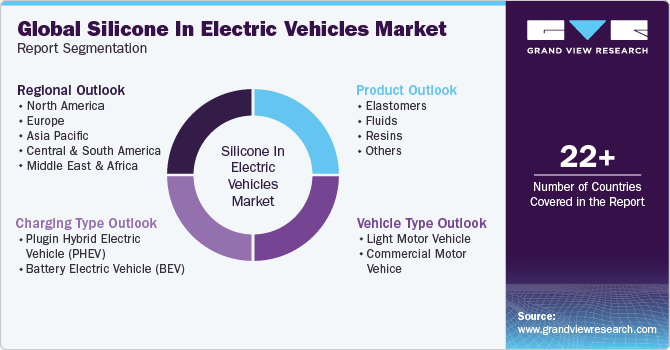

Silicone In Electric Vehicles Market (2024 - 2030) Size, Share & Trends Analysis By Product (Elastomers, Fluids, Resins), By Charging Type (PHEV, BEV), By Vehicle Type (LMV, CMV), By Region And Segment Forecasts

- Report ID: GVR-2-68038-605-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Silicone In Electric Vehicles Market Trends

The global silicone in electric vehicles market size was valued at USD 6.66 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.4% from 2024 to 2030. Surging demand for electric vehicles is one of the primary growth stimulants for the market. This is further supported by increasing favorable regulations toward reducing greenhouse gas emissions and lowering the impact of air pollution that are influencing the growth outlook for electric vehicles. Different financial measures such as tax incentives, purchase incentives, tax rebates, tax waivers, bonuses, and others also support the rise in electric vehicles.

In addition, electric vehicle rollout plans are also supported by non-financial measures, including fast charging stations available in public areas, free parking, separate lanes for EVs, and other similar measures. These financial and non-financial measures together are expected to drive the growth of electric vehicles, which in turn is projected to drive silicone demand growth in the electric vehicle market over the forecast period. However, silicone substitutes, such as plastics and other types of rubber products used in electric vehicles, may lead to an increase in silicone content in electric vehicles during the forecast period.

Several US states, including New Jersey, California, Washington, and Louisiana, provide tax credits, incentives, and rebates for the purchase of electric vehicles (EVs). New Jersey and Washington are exempt from the tax on the sale and use of electric vehicles, and California is offering discounts on plug-in hybrid electric vehicles (PHEVs) and other zero-emission passenger cars. Tax credit programs being implemented by various US states are likely to boost demand for electric vehicles, which in turn is projected to drive silicon growth in the electric vehicle market during the forecast period.

Electric vehicles (EVs) are expected to be widely used in Europe, Asia-Pacific, and North America due to stringent government initiatives in these regions to curb air pollution. It is predicted that the growing demand for environment-friendly transport will also drive the demand for electric vehicles in the coming years. The growing use of silicone in various electric vehicles such as plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs) is driving the growth of the market.

Market Concentration & Characteristics

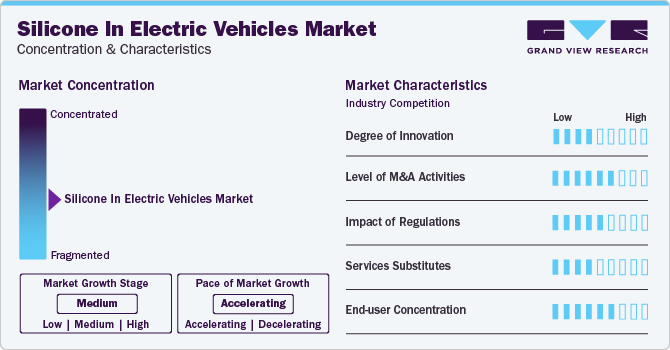

Market growth stage is medium, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to the rapid technological advancements.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new production technologies and talent, need to consolidate in a rapidly growing market.

The market is also subject to increasing regulatory scrutiny. The global silicone in electric vehicles market is subject to numerous regulations, guidelines, and restrictions such as The United States of America: FMVSS 305, UN Regulation No. 12, UN Regulation No. 94, Canada Motor Vehicle Safety Standards: CMVSS 305, NATIONAL STANDARD OF THE PEOPLE’S REPUBLIC OF CHINA: National Technical Committee of Auto Standardization (SAC/TC 114): GB/T 31498:2015, among others.

Organic rubber substitutes are likely to pose a threat to the demand for silicone, which may challenge the consumption of silicone in electric vehicles. Ethylene Propylene Diene Monomer (EPDM) rubber chloroprene rubber, and natural rubber are some of the key rubber polymers used in various automotive applications such as sealing and gasketing. Their ability to provide resistance to corrosion, harmful chemicals, and wear, as well as offer durability at comparatively lower costs in comparison to silicone can pose a threat to the growth of silicone over the coming years.

End-user concentration is a significant factor in the silicone in electric vehicles industry. Automobile manufacturers are expected to use them on a larger scale owing to the several benefits and the advantages offered by silicone.

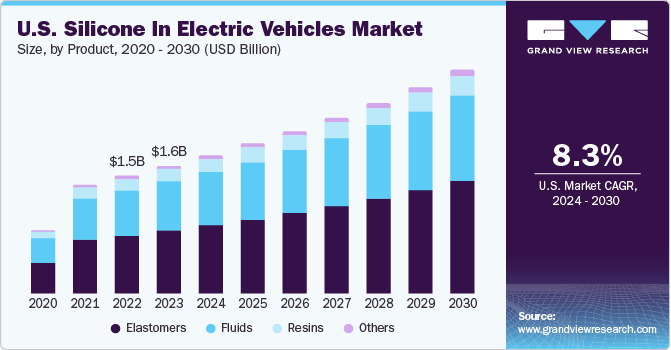

Product Insights

In terms of revenue, elastomers emerged as the largest product segment and accounted for over 47.3% of the market share in 2023. Elastomers help protect EV components from battery heat dissipation and shield them from electromagnetic interference. They also provide effective temperature management for the battery, which is one of the main components of electric vehicles.

The fluids segment is expected to grow at a CAGR of 9.2% over the forecast period. Fluids are used as a fan clutch to improve thermal stability and torque transmission in electric vehicles. These fluids are also used to coat high-voltage cables and as tire modifiers. Various fiscal and non-fiscal incentives offered by countries, including Norway, Sweden, the UK, and Germany, are poised to boost the growth of the segment. Resins have beneficial properties including weather resistance, water and fire resistance, and dielectric properties. Due to these properties, silicone resins are used in the impregnation of rolls.

Vehicle Type Insights

The light motor vehicle segment dominated the market and accounted for more than 92.0% of the revenue share in 2023. The transportation industry is in need of a paradigm shift from fossil fuel energy to electric energy. This change is estimated to be supported by government regulations, rising concerns regarding air pollution, a social perspective on pollution control, and technological advancements in the light motor electric vehicle industry. Currently, Asia Pacific is leading the light motor vehicle industry on account of increasing demand for light motor vehicles from emerging economies such as China, India, and others. This is anticipated to render Asia Pacific a promising destination for silicone products in light motor electric vehicles.

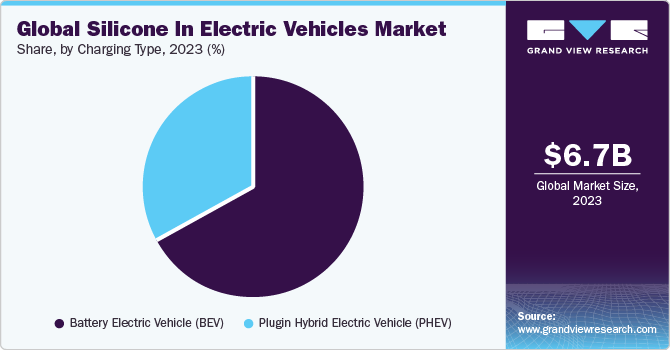

Charging Type Insights

The battery electric vehicle (BEV) segment dominated the market and accounted for over 66.0% of the revenue share in 2023. Silicone provides better heat resistance at both high and low temperatures, compared to other rubbers. It can withstand higher temperature limits of up to 150°C and lower temperature limits of up to -40°C.

The temperature resistance property exhibited by silicone expands its application in battery electric Vehicles (BEVs). These useful properties of silicone are likely to drive the demand for it in various vehicle types for use in electric vehicles in the coming years. However, organic rubber substitutes are predicted to pose a threat to silicone demand, which could cause product consumption problems in battery-electric vehicles.

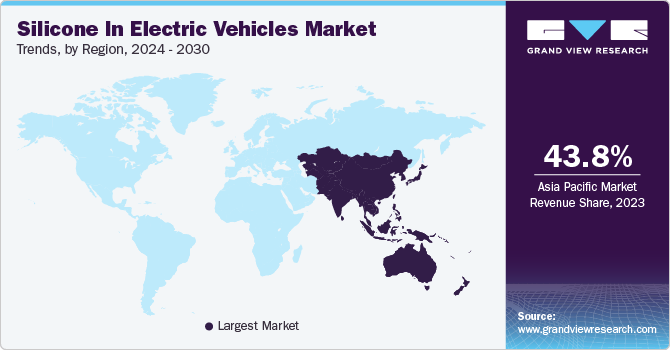

Regional Insights

Asia Pacific region dominated the market and accounted for the largest revenue share of 43.8% in 2023. Rapid urbanization in the region has led to an increase in the number of vehicles and increased traffic congestion, which leads to problems of noise and air pollution. These challenges create an urgent need to promote the use of low-emission vehicles such as electric vehicles. Therefore, the rise in electric vehicles may in turn increase the demand for silicone products over the forecast period. The boom of the electric vehicle industry in China, Japan, and other countries, thanks to growing domestic consumption and favorable government policies, is expected to complement the growth of the market in the coming years.

The U.S. is at the forefront of the market in North America. A number of U.S. states, including California, New Jersey, Washington, and Louisiana, are using tax credits, incentives, and rebates to encourage sales of electric vehicles. California offers discounts on Plug-in Hybrid Electric Vehicles (PHEVs) and other zero-emission passenger vehicles. Tax credit programs implemented by various U.S. states are expected to strengthen the electric vehicle market, which in turn will stimulate the growth of the regional market.

Key Silicone In Electric Vehicles Company Insights

Some of the key playersoperating in the market include Wacker Chemie AG and LANXESS

-

Wacker Chemie AG operates through four business segments, namely Wacker Silicones, Wacker Polymers, Wacker Biosolutions, and Wacker Polysilicon. Approximately, 70% of the company’s revenue is obtained through the sales of silicone-based products and the rest 30% is obtained through ethylene-related products. Its overall product portfolio consists of over 3,200 products. Wacker Silicones offers over 2,800 products, along with silicone for standard and specialty applications in industries such as construction and automotive.

-

Elkem ASA operates through four business segments: silicones, silicone materials, foundry products, and carbon. Silicone segment is engaged in the production and marketing of silicones for use in a variety of applications such as engineering elastomers, specialty fluids, coatings, healthcare products, emulsions, and resins.

Nexeon Limited and Shin-Etsu Chemical Co., Ltd. are some of the emerging market participants in the silicone in electric vehicles market.

-

Nexeon Limited engaged in manufacturing silicon anodes for use in lithium-ion batteries using a patented technology. The new technology enables the company to achieve higher battery capacity in smaller size and longer lifetime. Silicon anode lithium-ion batteries find use in different applications including electric vehicles, aerospace, defense, medical, energy, and consumer electronics. Electric vehicles include battery electric vehicle (BEV), plug-in hybrid electric vehicles (PHEV), and hybrid electric vehicle (HEV), whereas consumer electronics include notebooks, mobiles, cameras, and portable game machines. In medical applications, the batteries are used in defibrillator machines, emergency lighting, and pacemaker devices.

-

Shin-Etsu Chemical Co., Ltd., operates through six business segments: polyvinyl chloride (PVC) & chlor-alkali, silicones, specialty chemicals, semiconductor silicon, electronics & functional materials, and processing, trading, & specialized services. PVC & chlor-alkali business segment of the company offers polyvinyl chloride (PVC), caustic soda, methanol, and chloromethane. Silicones business segment offers silicone products for use in automotive, construction, solar cells, paper production, detergents, additives, glass fiber coatings, marine coatings, and other applications.

Key Silicone In Electric Vehicles Companies:

The following are the leading companies in the silicone in electric vehicles market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these silicone in electric vehicles companies are analyzed to map the supply network.

- Wacker Chemie AG

- Elkem Silicones

- Dow

- H.B. Fuller Company

- Nexeon Limited

- ACC Silicones Ltd.

- KCC Corporation

- Rogers Corporation

- LORD Corporation

- Shin-Etsu Chemical Co., Ltd.

Recent Developments

-

In December 2022, Dow, a U.S.-based company, announced the launch of a new series of liquid silicone rubber (LSR) named SILASTIC SA 994X. The company introduced this series specifically for the mobility and transportation industry.

Silicone In Electric Vehicles Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7,282.1 million

Revenue forecast in 2030

USD 12.46 billion

Growth rate

CAGR of 9.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Volume in Kilotons, Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, charging type, vehicle type, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.: Canada; Mexico; Germany; France; UK; Italy; Spain; Netherlands; Norway; China; Japan; India; South Korea; Australia; Malaysia; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Wacker Chemie AG; Elkem Silicones;Dow; H.B. Fuller Company; Nexeon Limited; ACC Silicones Ltd.; KCC Corporation; Rogers Corporation; LORD Corporation; Shin-Etsu Chemical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silicone In Electric Vehicles Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global silicone in electric vehicles market report based on product, charging type, vehicle type and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Elastomers

-

Fluids

-

Resins

-

Others

-

-

Charging Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plugin Hybrid Electric Vehicle (PHEV)

-

Battery Electric Vehicle (BEV)

-

-

Vehicle Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Light Motor Vehicle

-

Commercial Motor Vehicle

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Central & South America (MEA)

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global silicone in electric vehicle market size was estimated at USD 6.66 billion in 2023 and is expected to reach USD 7,282.1 million in 2024.

b. The global silicone in electric vehicles market is expected to grow at a compound annual growth rate of 9.4% from 2024 to 2030 to reach USD 12.46 billion by 2030.

b. Asia Pacific dominated the silicone in the electric vehicles market with a share of 43.8% in 2023. This is attributable to rising urbanization in the region is leading to an increase in the number of vehicles.

b. Some key players operating in the silicone in electric vehicles market include Wackier Chemie AG, Elkem Silicones, ACC Silicones Ltd, Rogers Corporation, and Shin-Etsu Chemical Co., Ltd.

b. Key factors that are driving the market growth include support by different types of financial measures, such as tax incentives and purchase incentives, taken by governments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.