- Home

- »

- Pharmaceuticals

- »

-

U.S. Pharmaceutical Market Size, Industry Report, 2030GVR Report cover

![U.S. Pharmaceutical Market Size, Share & Trends Report]()

U.S. Pharmaceutical Market Size, Share & Trends Analysis Report By Molecule Type, By Product, By Type, By Disease, By Formulation, By Age Group, By Route Of Administration, By End Market, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-210-9

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Pharmaceutical Market Size & Trends

The U.S. pharmaceutical market size was estimated at USD 574.37 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.48% from 2024 to 2030. This growth can be attributed to rising chronic disease prevalence, escalating geriatric population, increasing healthcare expenditure by government organizations globally, and extensive efforts to improve the affordability and accessibility of pharmaceuticals. According to an article published in May 2022, U.S. officials are focusing on prescription drug affordability, as unsustainable high prescription drug prices risk consumer purchase and thereby increasing health concerns.

The major driving factor attributing to the growth of the U.S. pharmaceutical market is the high healthcare expenditure provided by government bodies. Moreover, the complex healthcare system that is largely driven by public as well as private insurance schemes significantly impacts the availability and affordability of certain medications. Programs such as Medicare offer insurance to geriatric people of more than 65 years of age, while Medicaid D serves outpatient prescription drug coverage through private agents. These schemes not only enhance patients drug affordability but also escalate the overall market growth.

In addition, the prevalence of dry eye syndrome in the U.S. is expected to surge over the forecast period. According to the National Health and Wellness Survey, 6.8% of the total population in the U.S. is diagnosed with dry eye disease (DED) every year. As the prevalence of this disease increases with age, around 2.7% of people aged between 18 and 34 had DED, and around 18.6% of those were above 75 years. Moreover, it is observed that the prevalence is higher in women than in men, with the prevalence being 8.8% in women and 4.5% in men.

As per the estimates of the Pharmaceutical Research & Manufacturers Association (PhRMA), over half of the global pharmaceutical R&D efforts are conducted by U.S. firms, which collectively hold the maximum number of intellectual property rights of new medicines. Moreover, the market is occupied by numerous highly skilled and educated professionals across various occupations, such as technical support, scientific research, and manufacturing. For instance, the U.S. leads in recruiting skilled professionals for the pharmaceutical sector creating around 3.2 million indirect jobs and over 800,000 direct jobs.

In addition, the country has a supportive domestic environment to introduce and commercialize new therapeutics with minimal market barriers. For instance, in April 2022, BeiGene Ltd., a global biotechnology company, established a new manufacturing and clinical R&D center in New Jersey. The increased scientific research base, by numerous academic institutions and supportive government research funding, further strengthens the country’s position in the global market. addition additionally, a rigorous science-based regulatory system, continuous innovations in patent & data protection, and robust capital markets are expected to drive market growth.

The aging population will contribute to the increased drug demand in the medium and long term. Rapid technological advancements, U.S. FDA approvals for antiviral drugs, and intense competition among companies are expected to boost the market over the forecast period. For instance, in March 2023, Pfizer Inc. entered a research collaboration with Emory University to advance and develop novel antiviral agents. Furthermore, in May 2023, Pfizer, Inc. received FDA approval for PAXLOVID, an oral treatment for COVID-19.

A rising chronic disease prevalence coupled with the aging population is fueling demand for pharmaceuticals. With the rising incidence of chronic diseases such as cancer and diabetes, the requirement for effective treatments is also on the rise. As per WHO’s April 2021 report chronic diseases accountfor around 41 million deaths globally, comprising 71% of all fatalities. Cardiovascular diseases are the most NCDs, followed by cancer, respiratory diseases, and diabetes, with low- and middle-income nations accounting for 77% of all NCD deaths.

Furthermore, according to a December 2021 report from the International Diabetes Federation (IDF), approximately 537 million adults aged between 20-79 years have diabetes. Moreover, the total number of diabetics globally is expected to rise to 643 million by 2030 and 783 million by 2045. These numbers have led some U.S. Pharmaceutical companies to expand their manufacturing facilities to satisfy rising demand. As a result, the increased burden of chronic diseases is propelling overall market growth.

Market Concentration & Characteristics

The introduction of new products serves a wide variety of consumer needs and preferences thereby expanding market size and overall demand. Launching new drugs for specific diseased conditions can improve effectiveness and fulfill unmet needs, engaging patients who seek more advanced treatment. Cancer is highly prevalent in the U.S. According to an American Cancer Society report published in 2021, approximately 1.9 million people are likely to be diagnosed with cancer, and probably cause 608,570 deaths due to cancer in the U.S. Launching cancer-specific drugs can have a significant impact on the U.S. pharmaceutical market. For instance, In 2023, four of the eight new molecular entities (NMEs) approved by the U.S. Food and Drug Administration (FDA) show evidence of launch based on supply in channels or active websites. In 2022, the FDA approved 36 NMEs, of which 33 NMEs were launched successfully in the market.

Regulations can potentially influence the market in several ways affecting demand as well as supply chain of products. The U.S. Pharmaceutical market is heavily regulated by the Food and Drug Administration (FDA), which sets strict standards for the safety and efficacy of drugs. This has resulted in a highly competitive market, with companies investing heavily in research and development to bring new drugs to market. For instance, in 2022, U.S.-based Merck & Co. invested about 13.5 billion dollars in R and D activity and created an animal health unit.

Several macroeconomic factors, including varying government healthcare policies and regulations, technology advancements, and shifting consumer demographics, influence the U.S. Pharmaceutical Market. Additionally, the COVID-19 pandemic has had a significant impact on the market, with increased demand for medications and disruptions in supply chains. Overall, the market is expected to continue to grow over the forecast years, driven by innovation and increasing demand for personalized treatments.

Several key market players focus on regional expansion to accommodate a high range of customers and leverage market growth geographically. For instance, in February 2024, Indian U.S. Pharmaceutical company Alembic Pharmaceuticals decided to launch five to six novel U.S. Pharmaceutical products in the U.S. This launch is likely to enhance the volume gains of existing as well as newly launched products and thereby increase the market growth

Most of the market pharmaceutical companies have been involved in mergers and acquisitions to increase their share in the market and provide innovative solutions to the consumers that are anticipated to boost the market growth during the forecast period. For instance, in 2022, Sanofi announced the acquisition of Amunix Pharmaceuticals, Inc. This move will strengthen the company’s portfolio by expanding the manufacturing of cytokine therapy and T-cell therapeutic products through its collaboration.

Several key market players focus on regional expansion to accommodate a high range of customers and leverage market growth geographically. For instance, in February 2024, Indian U.S. Pharmaceutical company Alembic Pharmaceuticals decided to launch five to six novel U.S. Pharmaceutical products in the U.S. This launch is likely to enhance the volume gains of existing as well as newly launched products and thereby increase the market growth.

Molecule Type Insights

Based on molecule type, the market for conventional drugs (small molecules) dominated the market with a revenue share of 55.2 % in 2023. This growth can be attributed to a well-structured manufacturing facility, predictable pharmacokinetics, and oral bioavailability. Considering the emergence of cancer in the U.S., conventional drugs can be a good option for cancer treatment. In addition, proven significance, diverse applications, and patent expirations enable manufacturers to contribute to their widespread adoption. Moreover, these small molecules are preferred due to features such as the presence of good membrane penetration and better target delivery of drug

The biologics& biosimilar segment is expected to witness growth with the fastest CAGR from 2024 to 2030. This is likely due to steady demand, its significance, and therapeutic advances of these molecules. Biologics & biosimilars can have a significant impact on the immune interactions showcasing its importance in immune disorders. As per the PubMed Central report, the Biologics segment received the highest percentage of FDA approvals in 2022, thereby indicating steady growth in the forecast period.

Product Insights

The branded segment dominated the pharmaceutical market with a revenue share of 67.60% in 2023. The growth of the segment is attributed to the rising prevalence of chronic diseases, increasing R&D and approval of novel pharmaceuticals, and the rising demand for innovative therapies to treat various conditions. Major players operating in the market are constantly focusing on introducing novel pharmaceuticals, further propelling segment growth. In December 2023, the US FDA approved two gene therapies namely Lyfgenia Lyfgenia from Bluebird Bio and Casgevy by partners Vertex Pharmaceuticals and CRISPR therapeutics for sickle cell anemia(SCA). This innovative treatment is based on Crispr-gene editing technology. This promising therapy will deliver the targeted and effective treatment for patients suffering through SCA.

The generic segment's growth is attributed to an increasing number of ANDA approvals and generic drug launches. Furthermore, the COVID-19 pandemic has led to a surge in demand for antibiotics and other medications. Several key players aim to focus on the development of generics to increase earnings and expand their market position. In 2022, Dr. Reddy’s Laboratories launched its generic lenalidomide capsules in the U.S. to enhance its product expansion geographically.

Type Insights

The prescription segment held a dominant revenue share of 87.23% in 2022 in the market for pharmaceuticals. This dominance is owing to the increasing R&D investments by major players in the market for developing new pharmaceuticals, which are majorly used in the treatment of chronic diseases. With the rising prevalence of such disorders, there has been an increase in patient demand due to unmet clinical needs and a desire for favorable therapeutic outcomes.

A number of these chronic diseases are frequently observed in the patient population, necessitating the use of several recommended therapies. As a result, large U.S. Pharmaceutical Market companies are involved in clinical trials for the development and, eventually, approval of new products. Moreover, the rising hospitalization and increasing prescription rates are factors that are further propelling the growth of the overall pharmaceuticals market.

The OTC segment is expected to witness the fastest growth, with the high cost of Rx pharmaceuticals causing a shift towards OTC drugs, aided by the rising approval of OTC pharmaceuticals. According to Bloomberg, in July 2022 , Americans were expected to spend a yearly average of USD 1,300 per person on prescription medications. In the U.S., the average launch price for a new medicine in 2021 was USD 180,000 for an annual supply. Surging prescription drug prices are fueling the demand for self-medication with OTC pharmaceuticals. As per a Frontiers Media S.A. article published in August 2021, self-medication with OTC drugs is becoming an increasingly widespread global practice.

Disease Insights

Based on disease, the cancer segment dominated the overall market with share of 16.7 % in 2023. The dominance of this segment in the U.S. pharmaceutical market is contributed by several key factors such as the rising prevalence of cancer, which has resulted into an increased demand for innovative & effective treatments, driving significant investment and research in this space. Also, advancements in personalized medicine & targeted therapies have revolutionized cancer treatment, offering higher efficacy and fewer side effects. For instance, in February 2024, U.S. FDA approved Amtagv, the first cellular therapy for treating metastiatic an dunresected melanoma. This drug consist of tumor-deprived autologous T-cell immunotherapy.

Furthermore, the neurological disorders segment is expected to witness growth with fastest CAGR from 2024 to 2030. Fcators such as higher prevalence of geriatric people with neurological conditions, rising premature mortality due to neurological disbalance and increasing drug launches to treat neurological conditions, will accelerate growth over the forecast period. For instance, in March 2022, US FDA approved Donepezil for mild, moderate, and severe dementia caused due to Alzheimer disease.

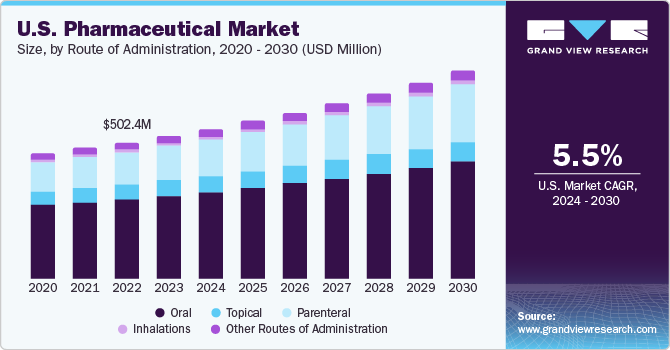

Route of Administration Insights

Based on the route of administration, the oral route dominated the market with a revenue share of 57.9 % in 2022. This can be attributed to several key factors such as convenience of usage, rapid bioavailability, and patient compliance due to their noninvasive nature, leading to higher adherence rates. In addition, the oral route's familiarity & established safety profile further contribute to its dominance, as both patients and healthcare providers prefer this well-understood mode of drug delivery.

The parenteral route of administration is expected to expand at the fastest CAGR over the forecast period. Recent advancements in parenteral drug delivery have transformed the U.S. Pharmaceutical Market landscape. For instance, the rise of biological therapies has led to the development of advanced injectable formulations, enabling the delivery of complex proteins and peptides. Notable examples include monoclonal antibodies used in cancer treatments & novel vaccines.

Formulation Insights

Tablets held the largest market share in 2023 in the pharmaceuticals market. The diverse use of tablets in oral solid dosage form contributes to their substantialr manufacturing and sales. This formulation is adopted at a higher rate owing to tamper resistance, cost-effectiveness, ease of handling and packing, and high manufacturing efficiency. Tablets are the simplest to produce for a wide range of specializations, including anti-diabetics, anti-inflammatories, antacids, vitamins, and antiallergics.

The sprays segment is expected to grow at the fastest CAGR over the forecast period. Accelerating approvals for auto-injectors and prefilled syringes fuels segment expansion. Subcutaneous injections provide a variety of advantages and convenience of use, including self-administration, dependability, precision, fixed doses in prefilled syringes, compliance, compact form, and high patient comfort, favoring the demand in the market.

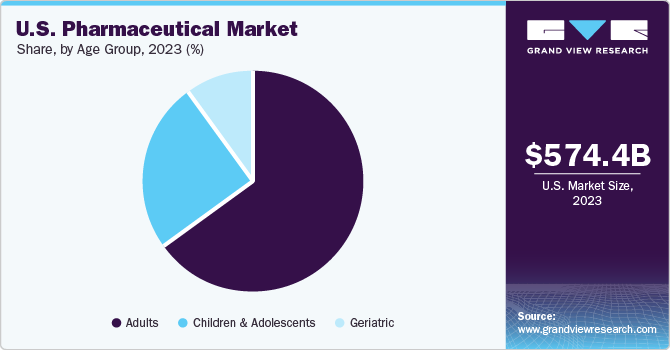

Age Group Insights

The adult segment held the largest share in the pharmaceuticals market in 2023 and is further expected to advance at the fastest growth rate over the forecast period. The higher prevalence of geriatric as well as adult population is likely to increase the demand of prescription medicines. As per the CDC, in the U.S., around 69.0%, and in Canada, around 65.5% (nearly 7 in 10 persons) aged 40-79 years used at least one prescription drug. The most commonly used drugs among the adult population include lipid-lowering drugs, ACE inhibitors, analgesics, and antidepressants.

The children & adolescent segment is expected to witness steady growth from 2024 to 2030. This growth is likely due to the rising number of medication approvals for the pediatric population. For instance, in June 2023, Pfizer Inc., in collaboration with OPKO Health Inc., received FDA approval for NGENLA, a human growth hormone medication used to treat pediatric patients. It is expected to be available for prescription in August 2023. A rising prevalence of various disorders in this population, including respiratory conditions, infectious diseases, and rare conditions, is further anticipated to fuel segment growth.

End Market Insights

Based on the end market, the hospitals segment dominated the pharmaceuticals market, with a revenue share of 51.6% in 2023. This growth is attributed to escalating healthcare demands owing to the geriatric population, increased chronic conditions, and advancements in medical treatments. The hospital serves as a centralized care provider and plays a pivotal role in theefficient procurement and distribution of pharmaceuticals, solidifying hospitals'position as a prominent market segment in the industry.

Clinics are estimated to expand at the fastest CAGR from 2024 to 2030. This segment plays a crucial role in preventive care, early diagnosis, and managing common illnesses. For instance, clinics often serve as the first initial point of contact for individuals seeking medical attention, allowing for timely intervention & reducing the burden on hospitals. Moreover, certain key players prioritize the health of their employees and make high efforts to provide necessary healthcare facilities to them. For instance, in October 2023, KFF opened a healthcare clinic facility for their employees to offer improved primary care.

Key U.S. Pharmaceutical Company Insights

Leading companies in the U.S. Pharmaceutical market and drug development industries are always focusing on developing and upgrading existing technologies to enhance patient outcomes and significantly increase healthcare effectiveness and efficiency. For instance, in May 2023, Pfizer Inc. received FDA approval for PAXLOVID (nirmatrelvir tablets and ritonavir tablets), used to treat patients with mild-to-moderate COVID-19. Moreover, M&A activities undertaken by market players, innovative product launches and regional product expansion initiatives further leverage the growth of the market.

Key U.S. Pharmaceutical Companies:

- Abbvie

- Astrazeneca

- Bristrol Myers Squibb

- GSK

- Johnson & Johnson

- Merck & Co

- Novartis

- Pfizer

- Roche Holding

- Sanofi

Recent Developments

-

In December 2023, Pfizer received all regulatory approvals for the acquisition of Seagen. This initiative aims to bring commercial changes in the organization thereby creating a new space, the Pfizer Oncology Division to integrate oncology commercial and R&D operations from both the companies.

-

In January 2023, Sun Pharma announced the launch of a new drug, SEZABY for treating neonatal seizures in the U.S. This is the first USFDA-approved drug for term and pre-term babies.

U.S. Pharmaceutical Market Report Scope

Report Attribute

Details

Revenue Forecast in 2030

USD 764.06 billion

Growth rate

CAGR of 5.48% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Molecule type, product, type, disease, route of administration, formulation, age group, end market

Country scope

U.S.

Key companies profiled

Abbvie; Astrazeneca; Bristrol Myers Squibb; GSK

Johnson & Johnson; Merck & Co; Novartis

Pfizer; Roche HoldingSanofi

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pharmaceutical Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pharmaceutical market report based on molecule type, product, type, disease, route of administration, formulation, age group, and end market:

-

Molecule Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biologics & Biosimilars (Large Molecules)

-

Monoclonal Antibodies

-

Vaccines

-

Cell & Gene Therapy

-

Others

-

-

Conventional Drugs (Small Molecules)

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Branded

-

Generics

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Prescription

-

OTC

-

-

Disease Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cardiovascular diseases

-

Cancer

-

Diabetes

-

Infectious diseases

-

Neurological disorders

-

Respiratory diseases

-

Autoimmune diseases

-

Mental health disorders

-

Gastrointestinal disorders

-

Women’s health diseases

-

Genetic and rare genetic diseases

-

Dermatological conditions

-

Obesity

-

Renal diseases

-

Liver conditions

-

Hematological disorders

-

Eye conditions

-

Infertility conditions

-

Endocrine disorders

-

Allergies

-

Others

-

-

Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oral

-

Topical

-

Parenteral

-

Intravenous

-

Intramuscular

-

-

Inhalations

-

Other Route of Administration

-

- Formulation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tablets

-

Capsules

-

Injectable

-

Sprays

-

Suspensions

-

Powders

-

Other Formulations

-

-

Age Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

Children & Adolescents

-

Adults

-

Geriatric

-

-

End Market Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The U.S. pharmaceutical market size was estimated at USD 0.52 billion in 2023 and is expected to reach USD 551.64 million in 2024.

b. The U.S.pharmaceutical market is expected to grow at a compound annual growth rate of 5.48% from 2024 to 2030 to reach USD 0.76 billion by 2030.

b. The branded segment dominated the pharmaceutical market with a revenue share of 67.60% in 2023. The dominance of the segment is attributed to the rising prevalence of chronic diseases, increasing R&D and approval of novel pharmaceuticals, and the rising need for the development of novel therapeutics to treat various conditions.

b. Some key players operating in the U.S. pharmaceutical market include F. Hoffmann-La Roche Ltd.; Novartis AG; AbbVie Inc.; Johnson & Johnson Services, Inc.; Merck & Co., Inc.; Pfizer Inc.; Bristol-Myers Squibb Company; Sanofi; GSK plc; Takeda Pharmaceutical Company Limited.

b. Key factors that are driving the market growth include increasing chronic disease prevalence, rising geriatric population, increasing healthcare spending by government organizations globally, and extensive efforts to improve the affordability of pharmaceuticals.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."