- Home

- »

- Pharmaceuticals

- »

-

Antiviral Drugs Market Size, Share & Growth Report, 2030GVR Report cover

![Antiviral Drugs Market Size, Share & Trends Report]()

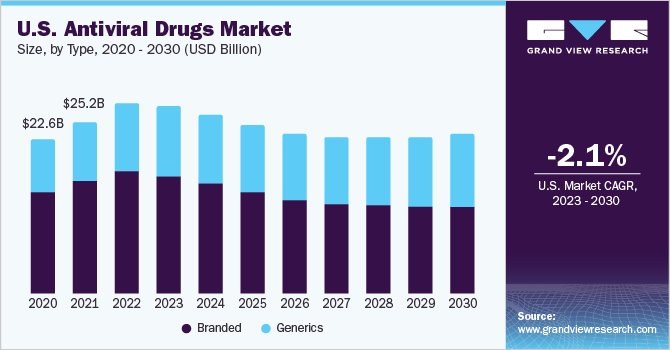

Antiviral Drugs Market Size, Share & Trends Analysis Report By Type (Branded, Generics), By Drug Class, By Distribution Channel (Hospital Pharmacy, Retail Pharmacy), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-389-8

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

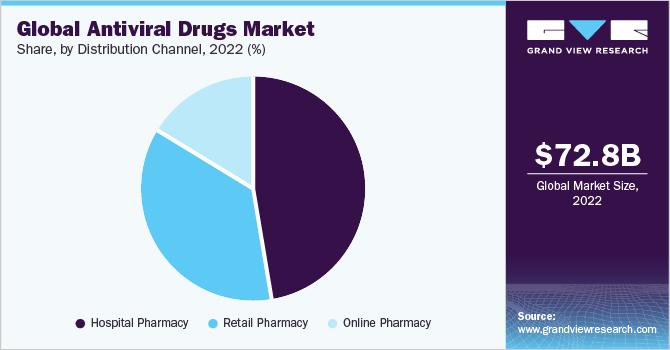

The global antiviral drugs market size was estimated at USD 72.84 billion in 2022 and is expected to decline at a compound annual growth rate (CAGR) of -1.99% from 2023 to 2030. The decline in revenue can be attributed to a surge in revenue from COVID-19 drug sales whose demand is anticipated to decline during the forecast period. However, the increasing prevalence of viral diseases, leading to the introduction of generic versions of antiviral medicines, and growing awareness about the availability of various vaccines for viral infections, is expected to have a positive impact on the market growth during the forecast period. According to the WHO, globally, an estimated 325 million people suffer from hepatitis infection, and out of these, around 71 million have chronic Hepatitis C Virus (HCV) infection.

Moreover, the U.S. Department of Health and Human Services estimated that 2.4 million people live with hepatitis C in the U.S., and around 850,000 individuals in the country have hepatitis B infection. Hence, an increasing pool of patients is anticipated to increase the demand for antiviral drugs globally. The outbreak of the COVID-19 pandemic has significantly increased the demand for antiviral medicines globally. The treatment of novel coronavirus has increased the demand for broad-spectrum antiviral drugs to manage the disease. Remdesivir, oseltamivir, favipiravir, and other combination medications are prescribed for treating COVID-19. Moreover, governments are increasing funding to pharmaceutical companies to develop novel therapeutics against COVID-19.

For instance, in June 2021, the U.S. government announced an investment of more than USD 3 billion to fasten the discovery, development, and manufacturing of antiviral medicines for COVID-19 treatment. In addition, in September 2022, Zenara Pharma Pvt. Ltd., launched the antiviral pill Paxzen for the treatment of COVID-19 viral infection. The rising incidence of disease coupled with increasing R&D will increase the demand for antiviral drugs in the next 2 to 3 years. Increasing approval and commercialization of novel medicines for viral infections are anticipated to drive market growth. For instance, in November 2020, the U.S. FDA approved a supplemental New Drug Application for Roche’s Xofluza for the treatment of influenza in patients 12 years of age and older.

Moreover, the major players in the market have launched many novel medicines in 2 to 3 years for the treatment of viral infections. For instance, Gilead Sciences, Inc. has launched Biktarvy, Symtuza, and Veklury for the treatment of viral infections. Furthermore, GlaxoSmithKline plc. has launched Dovato, Cabenuva, and Juluca for the treatment of diseases caused by the virus. An increase in the introduction of novel products in the market will drive growth over the next 2 to 3 years. Increasing collaborations among industry players and research universities for developing and manufacturing antiviral drugs are expected to result in the development of a high number of novel drugs in the coming years.

For instance, in March 2023, Emory University and Pfizer, Inc. entered into a strategic collaboration to accelerate the development of COVID-19 antiviral medication. The key players in the market are collaborating for the R&D of new therapies to reduce the burden of viral infection treatment. For instance, in 2020, Gilead Sciences, Inc. signed licensing agreements with pharmaceutical manufacturers, such as Cipla Ltd., Hetero Labs Ltd., Dr. Reddy’s Laboratories Ltd., and Mylan, to expand the supply of remdesivir. However, the high cost of antiviral drug treatment is a significant barrier to access for many patients.

Factors driving these costs include R&D expenses, patent protection, limited competition, and complex manufacturing processes. The high prices of antiviral drugs can strain healthcare budgets and limit access, especially in low- and middle-income countries. For instance, just one pill of Sovaldi costs around USD 1,000. This brings the total cost of the 12-week treatment to USD 84,000. Olysio has a projected cost of USD 23,600 per month of treatment. However, the treatment period of Olysio is even longer than Sovaldi at 24 to 48 weeks.

Type Insights

The branded type segment held the largest share of 64.46% in 2022 of the global market. The dominance of the segment is attributed to the wide adoption of branded therapeutics due to their proven efficacy, safety profile, and rising endorsement by healthcare authorities. Numerous branded antiviral drugs are available on the market, each designed to target specific viral infections. Moreover, key players operating in the market are constantly focusing on developing novel therapeutics to reduce the spread of viral infection. For instance, in December 2021, Torrent Pharmaceutical Ltd., Cipla Inc., and Sun Pharmaceutical Industries Ltd. announced the branded versions of Molnupiravir, an oral pill used for the treatment of COVID-19 infection.

The antiviral medication is expected to be sold by Torrent under the brand name Molnutor, Cipla under Cipmolnu, and Sun Pharmaceuticals under Molxvir. However, the high cost associated with the branded medication is anticipated to restrain the growth of the overall market. The generic segment is anticipated to grow at the fastest growth rate over the forecast period. The segment's growth is attributed to the growing demand for cost-effective generic versions of antiviral drugs in developing countries.

The generic antiviral drugs segment is price-sensitive and highly competitive owing to the presence of many generic pharmaceutical manufacturers, such as Cipla Inc., Aurobindo Pharma, Dr. Reddy’s Laboratories Ltd., and Mylan.The growing presence of generic antivirals is expected to promote competition in the market, leading to lower drug prices and improved affordability, benefiting patients and public health. For instance, in January 2022, The Medicines Patent Pool (MPP) signed agreements with 27 generic drug manufacturers to manufacture the oral COVID-19 antiviral molnupiravir for supply in 105 low- and middle-income countries.

Drug Class Insights

The protease inhibitors segment dominated the market with a revenue share of 38.52% in 2022. Protease Inhibitors (PIs) are Antiretroviral Therapy (ART) medications. PIs work by blocking protease activity, thereby preventing functional viral protein formation and inhibiting viral replication. PIs as antiviral drugs involve the development of next-generation PIs with improved potency, better pharmacokinetic properties, and reduced side effects. There is a continuous focus on optimizing the effectiveness and tolerability of PIs to enhance treatment outcomes & patient adherence. Another significant trend is the combination of PIs with other classes of antiviral drugs, such as RTIs, to create Highly Active Antiretroviral Therapy (HAART) regimens. Combination therapies aim to target multiple stages of the viral replication cycle, reduce drug resistance risk, and achieve more potent viral suppression.

The reverse transcriptase inhibitors segment is expected to grow at the fastest growth rate over the forecast period.Reverse Transcriptase Inhibitors (RTIs) are a class of antiviral drugs that target the enzyme reverse transcriptase, which is essential for the replication of retroviruses like Human Immunodeficiency Virus (HIV).With the rising prevalence of HIV/AIDS, various companies have produced medications to reduce the spread and potentially cure HIV. RTIs are at the forefront of these drugs and have been licensed by the FDA for treating two primary viral diseases: HIV-1 strain and Hepatitis B. When a patient contracts HIV, RTIs are used for post-exposure prophylaxis. Furthermore, these RTIs reduce HIV transmission from mother to child during pregnancy and childbirth.

Distribution Channel Insights

The hospital pharmacy segment held the largest share of 47.64% of the overall revenue in 2022. The increasing prevalence of diseases, the growing aging population, and the rising number of hospitalizations are the key factors driving the segment's growth. Hospital pharmacies are focusing on improving their supply chain management to ensure an adequate and consistent supply of antiviral drugs, especially during times of high demand and global health emergencies. The unprecedented outbreak of COVID-19 significantly increased the demand for antiviral drugs in hospital settings, particularly for drugs, such as remdesivir and monoclonal antibodies, used in the treatment of COVID-19.

Moreover, hospital pharmacies are adapting their protocols and guidelines to incorporate the use of new antiviral drugs for specific viral infections, ensuring appropriate prescribing, administration, monitoring, and patient safety. The online pharmacy segment is expected to register the fastest CAGR from 2023 to 2030. A prevalent trend in online pharmacies is the availability of antiviral drugs for viral infections, such as influenza, herpes, and COVID-19. Online pharmacies offer convenience, quick access, and home delivery of prescribed antiviral medications, allowing patients to easily gain necessary treatment without leaving their homes or visiting physical pharmacies. Growth in the segment can be attributed to the rising popularity of online pharmacies and increased trust in this mode of purchase. The segment is expected to exhibit the fastest growth in the market during the forecast period.

Application Insights

The HIV segment held a significant share of the market in 2022 with 34.23%. Antiviral drugs used for HIV are collectively known as Antiretroviral Therapy (ART). These medications work by targeting different stages of the HIV lifecycle to suppress viral replication, reduce the viral load, and slow down the progression of the disease.The trend in the market for antiviral drugs used for HIV has been the development of newer and more effective medications with improved tolerability and convenience. One significant trend is the shift toward Single-Tablet Regimens (STRs) that combine multiple antiviral drugs into one pill, simplifying treatment and improving adherence.

For instance, in March 2022, the US FDA approved Triumeq PD, developed by ViiV Healthcare, the first dispersible single tablet regimen containing dolutegravir, a once-daily treatment for children with HIV.A Supplemental New Drug Application (sNDA) for Triumeq tablets was authorized, lowering the minimum weight requirement for a child to receive this medication for Human Immunodeficiency Virus Type 1 (HIV-1) from 40 kg to 25 kg. The company gained EU marketing approval for Triumeq in February 2023. The herpes segment is expected to register the fastest growth rate during the forecast period.

Antiviral drugs play a crucial role in the management of herpes infections caused by Herpes Simplex Virus (HSV) and Varicella-Zoster Virus (VZV). Some examples of antiviral drugs used for herpes are Acyclovir, Valacyclovir, and Famciclovir. Although the current first-in-line therapy with acyclovir and its derivatives can control infection, however, drug-resistant HSV strains may evolve as no known treatment completely eradicates HSV from the human body. In long-term preventive ACV treatment, as is necessary for herpes keratitis, the formation of resistant strains is particularly possible. The numerous recurrences caused by the ACV-resistant strains, which are resistant to other nucleoside-based chemotherapies, might result in serious exacerbations.

Regional Insights

North America accounted for the largest share of the market in 2022 with 41.51% owing to the region's launch of effective products and technologically advanced production facilities. In addition, the increasing prevalence of diseases, such as tuberculosis, RSV, influenza A & B, and COVID-19, is expected to drive market growth. For instance, according to CDC, in the flu season of 2021–2022, influenza was estimated to affect 9 million people. Furthermore, increasing strategic partnerships among manufacturers and companies for developing novel therapeutics is anticipated to drive market growth.

For instance, in December 2021, Merck partnered with Ridgeback Biotherapeutics and received FDA approval for molnupiravir, an oral antiviral for emergency use to treat mild to moderate COVID-19. Asia Pacific is estimated to grow at the fastest rate during the forecast period. The factors contributing to the market growth are the increasing geriatric population, improving healthcare infrastructure, and entry of new players. Some of the major players operating in the market include GSK plc, AstraZeneca, and Sanofi. In addition, owing to the region’s large population, the rate of viral infection transmission is also higher.

For instance, according to the Singapore Ministry of Health, the country has a higher burden of respiratory infections, such as influenza, than other diseases. Increasing initiatives for scientific research and positive economic growth coupled with high unmet needs are among the drivers of this market. Moreover, improving the healthcare regulatory scenario in high-growth countries is expected to attract international players to invest and capitalize on the available opportunities. Positive changes, such as healthcare benefits by the government, Increased awareness among the population, and an urge to avail high-end medical treatment are also expected to drive regional market growth.

Key Companies & Market Share Insights

Companies are indulging in strategic initiatives, such as collaborations, mergers, acquisitions, clinical studies, and strategic agreements, for product portfolio expansion to maximize their market share. To sustain their presence in the market, industry players are also concentrating on geographic expansion and product releases for food allergies. For instance, in March 2022, Scripps Research, a non-profit research & technology and drug discovery organization, and AbbVie Inc. established a strategic collaboration to investigate novel drugs, to provide immediate treatments for COVID-19. Some of the key players in the global antiviral drugs market include:

-

F. Hoffmann-La Roche Ltd.

-

GSK plc.

-

AbbVie, Inc.

-

Merck & Co., Inc.

-

Johnson & Johnson Services, Inc.

-

Bristol-Myers Squibb Company

-

Cipla Inc.

-

Aurobindo Pharma

-

Dr. Reddy’s Laboratories Ltd.

Antiviral Drugs Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 71.35 billion

Revenue forecast in 2030

USD 62.05 billion

Growth rate

CAGR of -1.99% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Revenue in USD billion/million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, drug class, distribution channel, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

F. Hoffmann-La Roche Ltd.; GSK plc; AbbVie, Inc.; Merck & Co., Inc.; Johnson & Johnson Services, Inc.; Bristol-Myers Squibb Company; Cipla Inc.; Aurobindo Pharma; Dr. Reddy’s Laboratories Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antiviral Drugs Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the antiviral drugs market report on the basis of type, drug class, distribution channel, application, and region:

-

Type Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Branded

-

Generics

-

-

Drug Class Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

DNA Polymerase Inhibitors

-

Reverse Transcriptase Inhibitors

-

Protease Inhibitors

-

Neuraminidase Inhibitors

-

Others

-

-

Distribution Channel Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Application Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

HIV

-

Hepatitis

-

Herpes

-

Influenza

-

Others

-

-

Regional Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global antiviral drugs market size was estimated at USD 72.84 billion in 2022 and is expected to reach USD 71.35 billion in 2023.

b. The global antiviral drugs market is expected to grow at a compound annual growth rate of -1.99% from 2023 to 2030 to reach USD 62.05 billion by 2030 .

b. Based on drug class, reverse transcriptase inhibitors dominated the antiviral drugs market with a share of 38.52% in 2022 owing to their effectiveness in slowing down or preventing viral infection.

b. Key players in the antiviral drugs market include Gilead Sciences; F. Hoffmann-La Roche AG; GlaxoSmithKline plc; AbbVie; Merck & Co., Inc.; Johnson & Johnson Services, Inc.; Bristol-Myers Squibb Company; Cipla Inc.; Aurobindo Pharma; and Dr. Reddy’s Laboratories Ltd.

b. The antiviral drugs market decline has been attributed to competitive dynamics and lower patient starts, increasing preventive measures, and growing awareness about the availability of various vaccines for viral infections.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."