- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Plastic Compounding Market, Industry Report, 2030GVR Report cover

![U.S. Plastic Compounding Market Size, Share & Trends Report]()

U.S. Plastic Compounding Market Size, Share & Trends Analysis Report By Resin (PP, PE), By Technology (Injection Molding, Extrusion), By Filler (Unfilled, Calcium Carbonate-filled), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-212-3

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2019 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

U.S. Plastic Compounding Market Trends

The U.S. plastic compounding market size was estimated at USD 10.25 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.4% from 2024 to 2030. Factors including the growth of various end use industries such as electronics, healthcare, wire and cable, construction, and automotive, and the substitution of glass and metal by PVC, PET, and other plastic raw materials are driving the market expansion.The use of plastic compounds in automobile parts makes it lightweight, making it fuel-efficient.

Automotive, packaging, construction, and electronic industries have showcased high demand for plastic compounding in the U.S. The gradual shift toward lightweight vehicles to foster fuel savings and decrease carbon emission levels is driving plastics adoption in the manufacturing processes. For instance, in 2022 plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs) in the U.S. observed a record-high sale despite supply chain disruptions, macro-geopolitical and economic uncertainty, and high commodity and energy prices.

Furthermore, mandates and regulations by the Environmental Protection Agency (EPA) to improve fuel economy calculations have driven the demand for lightweight automobiles. Other major regulatory bodies in the U.S. plastics body include The Underwriters Laboratories, Inc. (UL), The International Code Council (ICC), and the National Fire Protection Association (NFPA).

Market Concentration & Characteristics

The market has a medium pace of growth and is consolidated with the presence of prominent players such as Kingfa Science & Technology Co. Ltd., Kraton Corporation, Kuraray Co. Ltd., Polykemi AB, Citadel Plastics, DSM N.V., Arkema Group, Sumitomo Bakelite Co. Ltd., Nova Polymers Inc., Europlas (PVCu) Ltd., US Plastics Recovery, and A. Schulman Inc. the players are highly competitive and have a strong distribution network.

The market has showcased huge growth potential owing to the development of nano-composite reinforcing agents for advanced compounding capabilities, and technological advancements introducing color-matching plastics with FDA-approved pigments that provide consistent tolerances, bio-based polymers, and resins from renewable resources. Continuous technological and product innovations are set to foster the manufacturing and consumption of plastics during the forecast period.

The threat of substitutes is relatively high owing to the growing concerns regarding the carbon footprint and adverse effects of plastics in the U.S. For instance, the production of biodegradable plastics, engineered metals recyclable eWood, and bio-based composites have emerged as potential plastic substitutes.

Product Insights

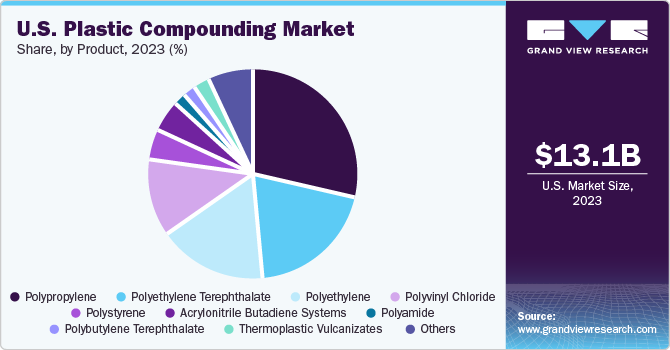

Polypropylene (PP) accounted for the largest revenue share of 28.69% in 2023 due to its widespread adoption in the manufacturing of automotive parts. It offers dimensional fire resistance, and high heat distortion temperature. Numerous PP combinations and integration with other artificial, natural fibres, and biodegradable polymers including thermoplastic starch (TPS) and polylactic acid (PLA) are gaining significance due to their mechanical and thermal properties.

Polyethylene Terephthalate (PET) is projected to register the fastest CAGR during the forecast period owing to the rising demand for sustainable and recyclable plastics. The segment has high penetration in the U.S. food packaging industry as it exhibits superior barrier properties.

Application Insights

The automotive segment dominated the market in 2023 due to the supportive government regulations that promote the manufacturing of lightweight vehicles and EVs, enabling fuel efficiency. Plastics are replacing metal, steel, and glass used in automobiles, on account of their low weight and durability. The U.S. EPA, Corporate Average Fuel Economy (CAFE), and Beaches Environmental Assessment and Coastal Health (BEACH) regulations fostering fuel efficiency are driving the market demand in the automotive sector.

The optical media segment is expected to expand at the fastest CAGR from 2024 to 2030. Optical media including compact discs such as solid state drive, are primarily made of polycarbonate compounds. When compared to conventional storage media, optical discs offer high durability and storage capability. Polycarbonate is often blended with other additives and polymers to ensure optical media preservation.

Key U.S. Plastic Compounding Company Insights

The companies in the market are competing on product quality offered and innovations in the production of plastics. Major players are adopting new technologies for product formulation. Established players are investing in research & development activities to formulate new and advanced plastics compounds, which gives them a competitive edge over the other players.

The market has witnessed mergers & acquisitions, and capacity expansion in the global market in the past few years. Strategic partnerships and new product developments are popular strategies adopted by a majority of the players operating in the U.S. plastic compounding industry. For instance, in July 2020, Dow Inc. introduced INNATE TF Polyethylene resin to provide higher mechanical properties, material rigidity, and optical & printing performance to Tenter Frame Biaxial Orientation. This product offers sustainable advantages including PE-recyclability for the packaging industry.

Key U.S. Plastic Compounding Companies:

- Adell Plastics Inc.

- Asahi Kasei Corporation

- Celanese Corporation

- DuPont de Nemours Inc.

- Solvay SA

- LyondellBasell Industries Holdings B.V.

- Dow Inc.

- RTP Company

- Avient Corporation

- Polyvisions Inc.

- ingfa Science & Technology Co. Ltd.

- Kraton Corporation

- Kuraray Co. Ltd.

- Polykemi AB

- Citadel Plastics

- DSM N.V.Arkema Group

- Sumitomo Bakelite Co. Ltd.

- Nova Polymers Inc.

- Europlas (PVCu) Ltd.

- US Plastics Recovery

- A. Schulman Inc.

- Teknor Apex Company

- Cabot Corporation

- Tosaf Group

- Mexichem Specialty Compounds Ltd.

- Ravago Manufacturing Americas

- Plastics Color Corporation

- AmeriLux International LLC

- Astra Polymers Compounding Co. Ltd.

Recent Developments

-

In January 2024, LyondellBasell announced that China Coal Shaanxi Yulin Energy & Chemical Co., Ltd. will use the Lupotech T and LyondellBasell Spherizone, Hostalen

-

Advanced Cascade Process technology licenses for its new facility towards manufacturing of 300 KTPA of Polypropylene, 300 KTPA of HDPE, 250 KTPA of vinyl acetate monomer respectively.

-

In January 2024, LyondellBasell launched Petrothene T3XL7420 for optimizing wire manufacturing processes in automotive and appliances industry. The product caters to offer properties such as enhanced cure kinetics, stiffness, barrier properties for working with small gauge wire assembly.

U.S. Plastic Compounding Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.87 billion

Revenue forecast in 2030

USD 16.69 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Actual data

2019 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, application

Key companies profiled

Adell Plastics Inc.; Asahi Kasei Corporation

Celanese Corporation; DuPont de Nemours Inc.; Solvay SA; LyondellBasell Industries Holdings B.V.; Dow Inc.; RTP Company

Avient Corporation; Polyvisions Inc.;

ingfa Science & Technology Co. Ltd.; Kraton Corporation; Kuraray Co. Ltd.; Polykemi AB;

Citadel Plastics; DSM N.V.Arkema Group; Sumitomo Bakelite Co. Ltd.;Nova Polymers Inc.; Europlas (PVCu) Ltd.; US Plastics Recovery; A. Schulman Inc.; Teknor Apex Company; Cabot Corporation; Tosaf Group;

Mexichem Specialty Compounds Ltd.; Ravago Manufacturing Americas; Plastics Color Corporation; AmeriLux International LLC; Astra Polymers Compounding Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Plastic Compounding Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of latest industry trends in each of sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the U.S. plastic compounding market report based on product and application:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Thermoplastic Vulcanizates (TPV)

-

Thermoplastic Polyolefins (TPO)

-

Polyvinyl Chloride (PVC)

-

Polystyrene (PS)

-

Polyethylene Terephthalate (PET)

-

Polybutylene Terephthalate (PBT)

-

Polyamide (PA)

-

Polycarbonate (PC)

-

Polyurethane (PU)

-

Polymethyl Methacrylate (PMMA)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Automotive

-

Building & construction

-

Electrical & electronics

-

Packaging

-

Consumer goods

-

Industrial machinery

-

Medical devices

-

Optical media

-

Aerospace & defense

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. plastic compounding market was valued at USD 10.25 billion in the year 2023 and is expected to reach USD 10.87 billion in 2024.

b. The U.S. plastic compounding market is expected to grow at a compound annual growth rate of 7.4% from 2024 to 2030 to reach USD 16.69 billion by 2030.

b. Polypropylene emerged as a dominating segment with a value share of over 28% in the year 2023 due to various automotive applications that include exterior components, interior trims, seating components, boot liners, lamp housing, electrical housings, and other injection molded parts.

b. The key market player in the U.S. plastic compounding market includes Asahi Kasei Corporation; Celanese Corporation; DuPont de Nemours Inc.; Solvay SA; LyondellBasell Industries Holdings B.V.; Dow Inc.; RTP Company Avient Corporation; Polyvisions Inc.; Kingfa Science & Technology Co. Ltd.; Kraton Corporation; Kuraray Co. Ltd.; Polykemi AB; Citadel Plastics; DSM N.V.Arkema Group; Sumitomo Bakelite Co. Ltd.;Nova Polymers Inc.; Europlas (PVCu) Ltd.; US Plastics Recovery; A. Schulman Inc.; Teknor Apex Company; Cabot Corporation; and Tosaf Group.

b. The key factors that are driving the U.S. plastic compounding market include, considerable demand for compounds as a replacement for metals and alloys across various industries such as industrial machinery, medical devices, and consumer goods.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."