- Home

- »

- Plastics, Polymers & Resins

- »

-

Polylactic Acid Market Size, Share & Growth Report, 2030GVR Report cover

![Polylactic Acid Market Size, Share & Trends Report]()

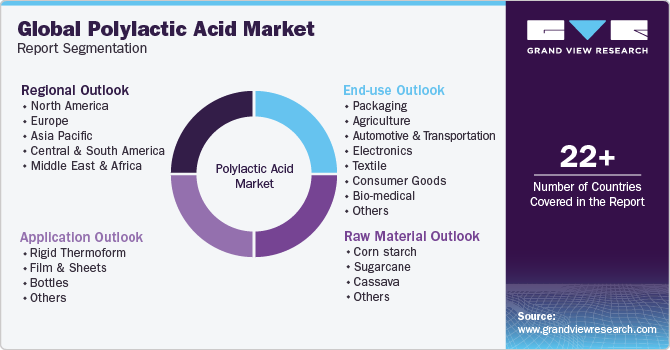

Polylactic Acid Market (2024 - 2030) Size, Share & Trends Analysis Report By Raw Material (Corn Starch, Sugarcane, Cassava), By Application (Rigid thermoform, Films & sheets, Bottles), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-669-1

- Number of Report Pages: 135

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Polylactic Acid Market Summary

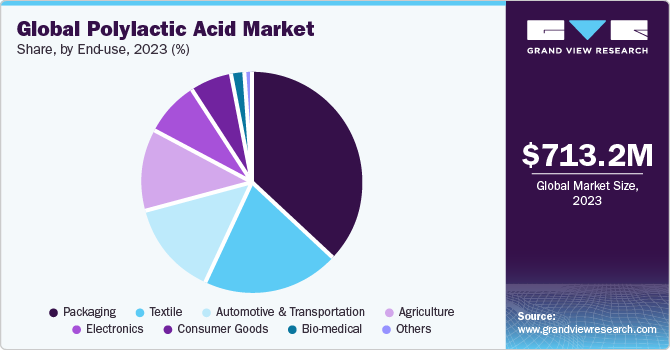

The global polylactic acid market size was estimated at USD 713.22 million in 2023 and is anticipated to reach USD 2,772.93 million by 2030, growing at a CAGR of 21.4% from 2024 to 2030. The growth of the PLA market is mainly driven by the growing demand for polylactic acid (pla) biodegradable resin in packaging across emerging economies such as China, India, Italy, and others.

Key Market Trends & Insights

- North America dominated the market and held a revenue share of over 41.0% in 2023.

- The PLA market in Mexico is expected to witness substantial growth over the forecast period.

- By raw material, corn starch dominated the raw material segmentation in 2023 with a market revenue share of above 64.0%.

- By application, rigid thermoform dominated the application segmentation in 2023 with a market revenue share of above 44.0%.

- By end-use, packaging sub-segment dominated the end-use segmentation in 2023 with a market revenue share above 36.0%.

Market Size & Forecast

- 2023 Market Size: USD 713.22 Million

- 2030 Projected Market Size: USD 2,772.93 Million

- CAGR (2024-2030): 21.4%

- North America: Largest market in 2023

Bioplastics are environmentally friendly alternatives to traditional plastics, notably in flexible and rigid packaging applications, because they are bio-based, compostable, and biodegradable in nature. Bioplastics are materials in which all the carbon is derived from renewable Raw Materials such as algae, corn, sugarcane, bacteria, potatoes, seashells, and starch. The growing transition toward developing energy-efficient vehicles and electric vehicles has pushed global automotive manufacturing companies toward including plastics in automotive components to reduce the overall weight of a vehicle. Thermoplastic plastic manufacturers are collaborating to develop plastics suitable for use in the automotive industry, which, in turn, is expected to drive the overall market growth.

As of 2022, the U.S. was one of the major countries exporting large amounts of polylactic acid to other countries while other countries are exporting very small amounts of polylactic acid as compared to the U.S. Due to the availability of raw materials and the presence of major PLA manufacturers, the country experiences rapid expansion. The increasing food processing business is expected to stimulate demand for packaging materials, resulting in PLA demand in the country. Increasing demand for packaged food and ready-to-eat meals is significantly boosting the growth of the U.S. food processing market.

The favorable government laws and regulations implemented in the U.S. related to the applicationion of polylactic acid, along with the easy availability of raw materials for the synthesis of this acid in the country, are projected to boost the growth of the market in the U.S. from 2023 to 2030. The increased applicationion of polylactic acid in the country resulted to its increased usage in the packaging and healthcare industries in the U.S. Other significant factors contributing to the country's market growth include increased consumer awareness of the use of bioplastics and the presence of key enterprises in the country.

PLA packaging provides an environment-friendly solution and helps in enhancing the appearance of the final product. PLA packaging has become an essential part of green packaging of various food products, which is likely to improve its growth prospects over the forecast period. The increasing utilization of bio-based plastics in flexible packaging is expected to fuel the growth of the polylactic acid market. Growing demand for food, on account of increasing global population, is one of the key trends augmenting the market growth.

However, the polylactic acid pricing as compared to conventional polymers, including polypropylene (PP), polyethylene (PE), polyvinyl chloride (PVC), polyethylene terephthalate (PET), and polystyrene (PS), is one of the key factors restraining the growth of the global PLA market. One of the major cost factors is the raw material used in the fermentation process. Advancements in glucose fermentation have lowered the production costs of lactic acid and PLA

Market Concentration & Characteristics

The global polylactic acid market is fairly fragmented in nature with the presence of various key players such as TotalEnergies Corbion bv, NatureWorks LLC, JIANGSU SUPLA BIOPLASTICS CO., LTD., Futerro, COFCO, Jiangxi Keyuan Biopharm Co.,Ltd., Shanghai Tong-jie-liang Biomaterials Co.,LTD., Zhejiang Hisun Biomaterials Co., Ltd.. as well as a few medium and small regional players operating in different parts of the world. The global players face intense competition from each other as well as from the regional players who have strong distribution networks and good knowledge about suppliers & regulations.

The companies in the market compete on the basis of application quality offered and the technology used for the applicationion of plastics. Major players, in particular, compete on the basis of application development capability and new technologies used in application formulation. Established players such as BASF SE are investing in research & development activities to formulate new and advanced plastics compounds, which gives them a competitive edge over the other players.

To maintain strong and healthy competitive environment across the marketspace, the global polylactic acid companies have implemented various strategic initiatives such as acquisition & merger, new application launch, applicationion expansion, and various others. In April 2023, NatureWorks and Jabil joined forces to provide new Ingeo PLA-based powder for selective laser sintering 3D printing platforms. The new Jabil PLA 3110P application, advertised as a cost-effective alternative to the current PA-12, has a lower sintering temperature and an 89% lower carbon footprint.

Raw Material Insights

Corn starch dominated the raw material segmentation in 2023 with a market revenue share of above 64.0%. Since corn starch is readily available and is inexpensive, many PLA manufacturers utilize corn starch for the processing of polylactic acid. Furthermore, increasing environmental hazard due to the utilization of virgin plastics has increased the demand for bio-based plastics such as polylactic acid from various end-use industries such as automotive, packaging, electrical & electronics, and others.

Followed by sugarcane with a market revenue share of above 26.0% in 2023. Since various end-use industries are shifting towards sustainability and adopting circular economy, the demand for bio-based plastics such as polylactic acid (PLA) has increased tremendously. Hence various bio-based plastic manufacturers have adopted distinctive raw materials such as sugarcane for the manufacturing of PLA.

Furthermore, attributes such as high tensile strength and resistance towards thermal conditions are due to the fibrous properties of sugarcane bagasse. Additionally, as an alternative to corn starch, PLA is additionally manufactured using cassava. Cassava’s starch content is provides high yield and diversified adaptability to climatic changes, hence is utilized for the manufacturing of PLA.

Application Insights

Rigid thermoform dominated the application segmentation in 2023 with a market revenue share of above 44.0%. PLA posses high thermoforming attributes, which implies that on exposure to high temperature conditions, PLA can be transformed into complex geometric designs without compromising its structural integrity. Hence, this makes its ideally suitable for variety of applications that require precise and intricate shapes.

Followed by films & sheets with a market revenue share of above 20.0% in 2023. PLA provides high clarity, durability & strength, and enhanced barrier attributes, hence making it highly suitable for the manufacturing of films & sheets to be utilized across various packaging applications. Furthermore, the ease of printability on the surface of the end-application has increased the demand for PLA-based films & sheets across the advertisement & branding industry.

Additionally, PLA is witnessed rise in demand from bottle manufacturers since it is manufactured using renewable reRaw Materials such as corn starch, sugarcane, and cassava. Furthermore, unlike traditional plastics, PLA is free of bisphenol-A (BPA) which is a component associated with serious health risks and concerns. However, since PLA doesn’t contain BPA, it is highly utilized across the food & beverage industry for the manufacturing of bottles.

End-use Insights

Packaging sub-segment dominated the end-use segmentation in 2023 with a market revenue share above 36.0%. PLA is widely utilized in packaging end-use such as food & beverage packaging, personal care packaging, and household care applications. The inclination of consumers toward sustainable packaging and the rising landfill issue across the globe is compelling manufacturers to use polylactic acid in packaging. In addition, a strict ban on single-use plastics in many countries, such as the UK, Zimbabwe, Taiwan, New Zealand, and several states of the U.S. (such as New York, California, and Hawaii), is significantly driving the demand for PLA in packaging end-use.

The demand for polylactic acid in the agriculture sector is expected to grow significantly on account of the increasing focus on reducing environmental pollution and providing a conducive environment for composting. Biodegradable applications are increasingly being utilized in nurseries and gardening owing to their superior properties such as propelling the growth of plant seedlings and preventing fruit rotting of fruit rotting. This is expected to influence the expansion and increase the penetration of PLA in agriculture sector.

In automotive industry, polylactic acid is used in various applications such as under the hood components and interior parts. PLA is very effective owing to its characteristic for reducing the carbon footprint due to its high bio-content. It offers impact resistance, UV resistance, high gloss and excellent colorability, and dimensional stability. These factors make it an alternative to traditional plastics such as Polylactic Acid, polyethylene terephthalate, polyamide, acrylonitrile butadiene styrene, and polybutylene terephthalate and are preferred for automotive interiors and engine compartments.

Regional Insights

North America dominated the market and held a revenue share of over 41.0% in 2023. The North American market is expected to be driven by the growing demand for bioplastics. Furthermore, the regional market is characterized by a strong demand for sustainable applications, which has resulted in a rising demand for sustainability in packaging. The overall demand for bioplastics in North America is also expected to be spurred by initiatives for promoting environment-friendly applications by the U.S. Department of Agriculture.

The growing demand for textiles in the region is expected to result in increased consumption of polylactic acid. Moreover, the increasing demand for technical textiles on account of their use in a broad range of end-use, including agriculture, transportation, construction, and medical, is expected to augment the demand for polylactic acid over the forecast period.

The PLA market in Mexico is expected to witness substantial growth over the forecast period owing to the rising demand from the packaging end-use sector for various applications such as bags, cups, lids, cutlery, straws, and containers, among others. These aforementioned applications are environment-friendly, sustainable, and compostable. Therefore, the growing demand for green and sustainable packaging solutions is projected to augment the demand for PLA in the Mexican market.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In October 2023, NatureWorks LLC, a PLA manufacturer announced it’s commencement of PLA facility in Thailand. The company announced that the applicationion facility will be completely functional by 2025 with a applicationion capacity of 75 kilotons per annum.

-

In April 2023, NatureWorks LLC, introduced their new PLA biopolymer Ingeo 6500D for non-wovens. The tensile strength of the newly introduced application provides enhanced processing for converters, boosting low basis weight fabric applicationion on the latest generation of spunbound equipment.

Key Polylactic Acid Companies:

- TotalEnergies Corbion bv

- NatureWorks LLC

- JIANGSU SUPLA BIOPLASTICS CO., LTD.

- Futerro

- COFCO

- Jiangxi Keyuan Biopharm Co.,Ltd.

- Shanghai Tong-jie-liang Biomaterials Co.,LTD.

- Zhejiang Hisun Biomaterials Co., Ltd.

- BASF SE

- Danimer Scientific

- Mitsubishi Chemical America, Inc.

- UNITIKA LTD.

Recent Developments

-

In May 2023, TotalEnergies Corbion collaborated with Bluepha Co. Ltd for making advanced sustainable biomaterials solutions in China. This is possible by combining polyhydroxyalkanoates (PHA) of Bluepha® with Luminy® polylactic acid technology

-

In May 2023, TotalEnergies Corbion announced an agreement with Xiamen Changsu Industrial Pte Ltd. For making advancements in the polylactic acid market. Both companies will operate together for market promotion, research and development, and product development of the latest applications and technologies of biaxially oriented polylactic acid (BOPLA)

-

In April 2023, NatureWorks LLC declared its collaboration with Jabil Inc. to provide the latest polylactic acid-based powder for particular laser sintering 3D printing platforms

-

In December 2022, Futerro initiated plans to set up an integrated biorefinery in Normandy for the production and recycling of polylactic acid. The purpose is to make a generous contribution towards the achievement of a green economy, thus creating a transition from fossil carbon to carbon from biomass

-

In November 2022, NatureWorks LLC collaborated with CJ Biomaterials to develop a novel biopolymer solution with the use of polylactic acid technology. This intended to replace fossil fuel plastics from compostable food service ware and packaging to personal care, and other end products

Polylactic Acid Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 842.05 million

Revenue forecast in 2030

USD 2,772.93 million

Growth rate

CAGR of 21.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Raw material, application, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Netherlands; Turkey; China; India; Japan; South Korea; Singapore; Malaysia; Indonesia; Philippines; Thailand; Vietnam; Australia; Brazil; Argentina; Saudi Arabia; United Arab Emirates (UAE); South Africa

Key companies profiled

TotalEnergies Corbion bv; NatureWorks LLC; JIANGSU SUPLA BIOPLASTICS CO., LTD.; Futerro; COFCO; Jiangxi Keyuan Biopharm Co.,Ltd.; Shanghai Tong-jie-liang Biomaterials Co.,LTD.; Zhejiang Hisun Biomaterials Co., Ltd.; BASF SE; Danimer Scientific; Mitsubishi Chemical America, Inc.; UNITIKA LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polylactic Acid Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Polylactic Acid market report based on raw material, application, end-use, and region:

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Corn starch

-

Sugarcane

-

Cassava

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Rigid thermoform

-

Film & sheets

-

Bottles

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Agriculture

-

Automotive & transportation

-

Electronics

-

Textile

-

Consumer goods

-

Bio-medical

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Malaysia

-

Indonesia

-

Philippines

-

Thailand

-

Vietnam

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global polylactic acid market size was estimated at USD 624.97 million in 2022 and is expected to reach USD 713.22 million in 2023.

b. The global polylactic acid market is expected to grow at a compound annual growth rate of 21.4% from 2023 to 2030 to reach USD 2,772.93 million by 2030.

b. The North American region dominated the polylactic acid market with a share of 47.5% in 2022. This is attributable to the growing product demand in various end-use including packaging, transport, agriculture, electronics, and textiles availability of raw materials.

b. Some of the key players operating in the polylactic acid market include NatureWorks LLC, Total Corbion PLA, Zheijiang Hisun Biomaterials Co., Ltd., COFCO, Jiangsu Supla Bioplastics Co., Ltd., and Shanghai Tong-jie-liang Biomaterials Co., Ltd.

b. Key factors driving the polylactic acid market growth include growing demand for bioplastics, and growing demand from flexible packaging industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.