- Home

- »

- Next Generation Technologies

- »

-

U.S. Precision Farming Market Size, Industry Report, 2030GVR Report cover

![U.S. Precision Farming Market Size, Share & Trends Report]()

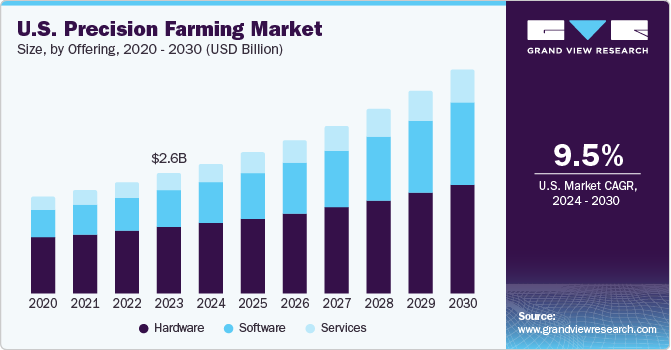

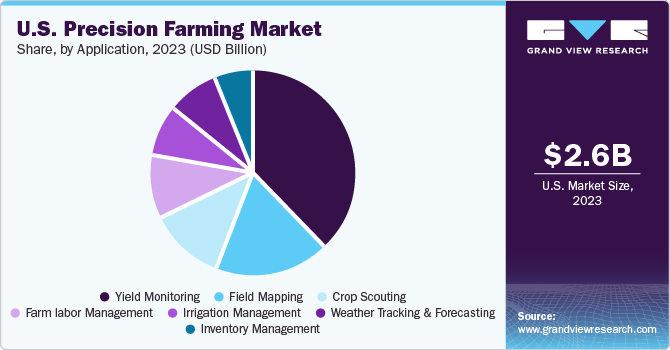

U.S. Precision Farming Market Size, Share & Trends Analysis Report By Offering (Hardware, Software, Services), By Application (Yield Monitoring, Field Mapping, Crop Scouting), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-213-6

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Precision Farming Market Size & Trends

The U.S. precision farming market size was estimated at USD 2,615.0 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.5% from 2024 to 2030. The growth of the market for precision agriculture is attributed to the increasing adoption of the Internet of Things (IoT) and the use of advanced analytics by farmers in the U.S. The primary focus of precision farming is to optimize labor, time, costs, and inputs within sustainable farming systems. Advanced analytics is a part of data science that uses numerous tools and methods to forecast data and ensure that the crop and soil receive adequate nurturing. The farmers having access to these data can make better decisions to increase crop yield, which in turn, can aid in the market growth for precision farming.

The U.S. market for precision farming accounted for approximately 24.9% of the global precision farming market. IoT helps farmers address various challenges involved in the proper monitoring of crops. It provides real-time data about environment temperature and water content in the soil through sensors placed on the farm, which assists farmers in making improved decisions about harvesting times, crop market rate, and soil management. This is one of the key factors contributing to the growth of the market for precision farming.

The advancements in electronics technologies such as GPS and GIS are expected to positively impact the agriculture sector over the projected period. In addition to GPS and GIS, there is a wide range of monitors, controllers, and sensors that form a part of agricultural equipment. The increasing government support for adopting modern agricultural techniques and the growing need for monitoring crop health for yield production is expected to drive the market demand. Moreover, increasing investments in technologies such as driverless tractors, guidance systems, and GPS sensing systems are also expected to contribute to the growth of the precision agriculture market.

Automation in agriculture is gaining traction owing to labor crises such as a lack of skilled farmers, an increasing number of aging farmers, and a growing trend of large-scale farms. Innovations in GPS mapping and related applications concerning farms along with advances in precision agriculture are also helping farmers to operate more efficiently and increase their profit margins. Drones are expected to witness enormous growth in the agriculture field as companies and farmers manufacturing and designing systems for collecting data are eager to incorporate their business models. According to the Association for Unmanned Vehicles Systems International (AUVSI), around 80% of commercial drones will eventually be used for agriculture.

Robotics and drones are widely used to enhance e-commerce operations. The growing technological advancement and innovation in robotics have increased the sale of precision farming technologies. However, a high initial capital investment is anticipated to restrain the market growth over the forecast period. Robots for agricultural purposes require additional application-specific advanced processing equipment, which results in an increased capital investment.

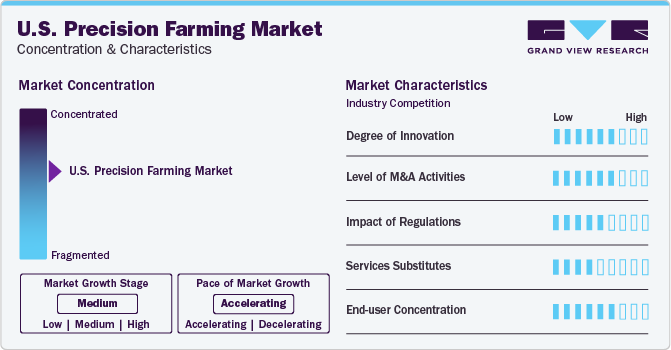

Market Concentration & Characteristics

The market growth stage is medium, and the rate of growth is accelerating. The degree of innovation in the U.S. precision farming industry is significant with the recent advances in the implementation of Wi-Fi technology, Zigbee technology, and RF technology and equipment that are integrated with sensors and cameras. These technologies try to meet the evolving needs of farmers. Advancements in technology, particularly the accessibility of high-resolution satellite imagery and the recent swift growth of unmanned aerial vehicle (UAV) technology, indicate that the use of remote sensing data sources in precision agriculture is anticipated to surge in the next ten years.

The U.S. market is highly competitive with various large and small companies yearning for an increased revenue share and acquiring latest technologies in precision farming to boost their respective competitiveness.

The U.S. market is subject to increasing regulatory scrutiny. The Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) monitors the loading, mixing, and application of pesticides and other tasks that involve exposure to pesticides. The increasing regulatory scrutiny ensures enhanced transparency, protection of intellectual property, and safeguarding the data and environment. Stricter law implementation measures and evolving legal frameworks are shaping the regulatory landscape, necessitating adaptability and compliance from companies operating in the dynamic agriculture sector.

The substitutes for precision farming are low. However, conventional methods of farming can impact the market for precision farming. Farmers may choose conventional farming without integrating extensive technologies, which may involve fewer technological investments.

Offering Insights

The hardware segment held the largest revenue share of 55.5% in 2023. The hardware segment has been further bifurcated into automation and control systems, sensing devices, antennas and access points. Hardware components such as automation and control systems, sensing devices, and drones play a major role in helping farmers. For instance, the availability of high-resolution satellite imagery along with the rapid development of unmanned aerial vehicle technology (UAV), suggest that the adoption of remote-sensing data sources in precision farming is likely to rapidly increase in the coming years. Furthermore, in variable rate technology (VRT), collections of field variable information and other input data are helpful in defining suitable quantities of chemical inputs required for the fields.

The software segment is anticipated to register the fastest CAGR of 12.2% over the forecast period. The segment is further sub-segmented into web-based and cloud-based precision farming. Cloud computing focuses on shared networks, servers, and storage devices, owing to which the high costs incurred in maintaining hardware and software infrastructure is eliminated. Predictive analytics software is used to provide guidance to farmers about crop rotation, soil management, optimal planting times, and harvesting times. For instance, GIS software provides detailed vegetation and productivity maps, including crop information, for making reasonable decisions. Agriculture GIS tools can identify vegetation levels in your field or any of its areas. Agriculture machinery can then use this information to adjust seed, nutrients, herbicides, and fertilizer amounts for each plot.

Application Insights

In terms of application, the yield monitoring segment held the largest revenue share of 38.41% in 2023. The large share is attributed to the fact that it helps the farmers make decisions about their fields. The segment is further segregated into on-farm yield monitoring and off-farm yield monitoring. On-farm yield monitoring obtains real-time information during harvest and creates a historical spatial database. This subsegment held the largest market share in 2023 as it offers equitable landlord negotiations, documentation of environmental compliance, and track records for food safety.

The weather forecasting and tracking segment is anticipated to witness the fastest CAGR of 13.9% over the forecast period. The use of sensors helps weather forecasters to provide accurate weather reading and forecasting. In addition, the introduction of machine learning techniques and advanced data analytics services have increased the reliability and accuracy of weather forecasts.

Key U.S. Precision Farming Company Insights

Some of the key companies operating in the U.S. precision farming market include Ag Leader Technology; AgJunction, Inc.; CropMetrics LLC; AGCO Corporation; Raven Industries Inc.; AgEagle Aerial Systems Inc. (Agribotix LLC); etc.

-

Ag Leader Technology is an American agro-based technology company. It develops and provides agricultural products for precision farming. It offers a broad range of solutions based on precision farming technology.

-

AgJunction, Inc., the auto-steering Company, is a U.S.-based company engaged in the auto-steering and advanced guidance solutions for precision agriculture applications. It is involved in developing and manufacturing agricultural products required for precision farming.

AgEagle Aerial Systems Inc. and Agrible are some of the emerging companies in the U.S. precision farming market.

-

AgEagle Aerial Systems Inc. (Agribotix LLC), based in the U.S., is an agricultural intelligence company that offers drone-based technologies and services for precision agricultural applications. The company analyzes and processes agricultural data collected by drones. The solutions provided by the company include fixed-wing drones & quadcopters and Farm Lens, a cloud-based data reporting and analysis solution.

-

Agrible is a developer of innovative, easy-to-use products intended to help farmers and companies improve their production. The company's predictive analytics tools deliver field-specific data and forecasts while being sustainable and accurate, thereby enabling customers to quantify impacts and make smarter decisions with field-level insights.

Key U.S. Precision Farming Companies:

- Ag Leader Technology

- AgJunction, Inc.

- CropMetrics LLC

- Proagrica (SST Development Group, Inc.)

- AGCO Corporation

- Raven Industries Inc.

- Deere and Company

- AgEagle Aerial Systems Inc. (Agribotix LLC)

- DICKEY-john Corporation

- Grownetics, Inc

Recent Developments

-

In September 2023, AGCO Corporation, a worldwide manufacturer and distributor of agricultural machinery and Precision Ag technology, announced it has entered into a Joint Venture (JV) with Trimble, where AGCO will acquire an 85% interest in Trimble’s portfolio of Ag assets and technologies for cash consideration of $2.0 billion and the contribution of JCA Technologies.

-

In January 2024, Deere & Company announced it has entered into an agreement with SpaceX to provide cutting-edge satellite communications service to farmers. Utilizing the industry-leading Starlink network, this solution will allow farmers facing rural connectivity challenges to fully leverage precision agriculture technologies. This partnership, an industry first, will enable John Deere customers to be more productive, profitable, and sustainable in their operations as they continue to provide food, fuel, and fiber for their communities and a growing global population.

U.S. Precision Farming Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,824.8 million

Revenue forecast in 2030

USD 4,865.9 million

Growth rate

CAGR of 9.5% from 2024 to 2030

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Offering, application

Country scope

U.S.

Key companies profiled

Ag Leader Technology; AgJunction, Inc.; CropMetrics LLC; Proagrica (SST Development Group, Inc.); AGCO Corporation; Raven Industries Inc.; Deere and Company; AgEagle Aerial Systems Inc. (Agribotix LLC); DICKEY-john Corporation; Grownetics, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Precision Farming Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. precision farming market report based on offering, and application:

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Automation & Control Systems

-

Drones

-

Application Control Devices

-

Guidance System

-

GPS

-

GIS

-

-

Remote Sensing

-

Handheld

-

Satellite Sensing

-

-

Driverless Tractors

-

Mobile Devices

-

VRT

-

Map-based

-

Sensor-based

-

-

Wireless Modules

-

Bluetooth Technology

-

Wi-Fi Technology

-

Zigbee Technology

-

RF Technology

-

-

-

Sensing Devices

-

Soil sensors

-

Nutrient Sensor

-

Moisture Sensor

-

Temperature Sensor

-

-

Water Sensor

-

Climate Sensor

-

Others

-

-

Antennas & Access Points

-

-

Software

-

Web-based

-

Cloud-based

-

-

Services

-

System Integration & Consulting

-

Maintenance & Support

-

Managed Services

-

Data Services

-

Analytics Services

-

Farm Operation Services

-

-

Assisted Professional Services

-

Supply Chain Management Services

-

Climate Information Services

-

-

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Yield Monitoring

-

On-farm

-

Off-farm

-

-

Field Mapping

-

Crop Scouting

-

Weather Tracking & Forecasting

-

Irrigation Management

-

Inventory Management

-

Farm labor Management

-

Frequently Asked Questions About This Report

b. The U.S. precision farming market size was estimated at USD 2,615.0 million in 2023 and is expected to reach USD 2,824.8 million in 2024.

b. The U.S. precision farming market is expected to grow at a compound annual growth rate of 9.5% from 2024 to 2030 to reach USD 4,865.9 million by 2030.

b. The hardware segment dominated the U.S. precision farming market with a share of over 55.55% in 2023.

b. Some key players operating in the U.S. precision farming market include Ag Leader Technology; AgJunction, Inc.; CropMetrics LLC; Proagrica (SST Development Group, Inc.); AGCO Corporation; Raven Industries Inc.; and Deere and Company.

b. Key factors driving the market growth include the continuous innovations in precision farming technologies, such as GPS guidance systems, drones, and sensors

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."