- Home

- »

- Next Generation Technologies

- »

-

Precision Farming Market Size, Share, Industry Report, 2030GVR Report cover

![Precision Farming Market Size, Share & Trends Report]()

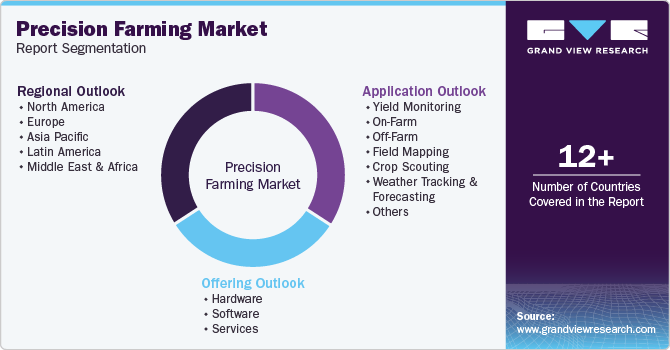

Precision Farming Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Hardware, Software, Services), By Application (Yield Monitoring, Field Mapping, Crop Scouting), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-376-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Precision Farming Market Summary

The global precision farming market size was estimated at USD 11.67 billion in 2024 and is projected to reach USD 24.09 billion by 2030, growing at a CAGR of 13.1% from 2025 to 2030. The rise of precision farming is largely driven by the rapid expansion of the Internet of Things (IoT) and farmers' increasing use of advanced analytics.

Key Market Trends & Insights

- North America accounted for the largest revenue share of over 43.0% in 2024.

- The precision farming market in the U.S. is expected to grow during the forecast period due to favorable government initiatives.

- By offering, the hardware segment accounted for the largest market share of over 66.0% in 2024 in the precision farming industry.

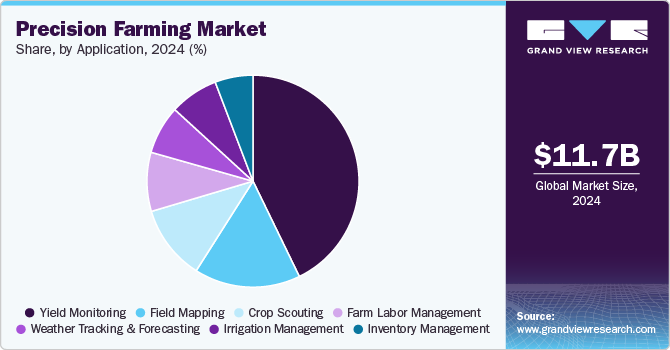

- By application, the yield monitoring segment accounted for the largest market share of over 42.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.67 Billion

- 2030 Projected Market Size: USD 24.09 Billion

- CAGR (2025-2030): 13.1%

- North America: Largest market in 2024

As a key offering of data science, advanced analytics employs a variety of tools and techniques to predict data trends and ensure optimal care for crops and soil. This enables farmers to make well-informed decisions and plan their activities more effectively. Modern technologies such as the Internet of Things (IoT), GPS, and remote sensing application control are widely utilized to gain a comprehensive understanding of various farming practices like irrigation and plowing. IoT is crucial in helping farmers overcome challenges associated with effective crop monitoring. IoT provides real-time data on environmental temperature and soil moisture levels by using sensors placed across the farmland. This information empowers farmers to make more informed decisions regarding harvesting schedules, crop pricing, and soil management, making it a significant driver in expanding the precision farming industry.

Several other factors are also contributing to the adoption of sustainable agricultural technologies. These include improved farmer education and training, easier access to information, availability of financial support, and the rising demand for organic produce. Environmental degradation and natural resource depletion are major concerns hindering crop production. As a result, there is a growing emphasis on sustainable farming practices that focus on conserving natural resources. This trend fuels the need for enhanced crop nutrition and protection, accelerating market growth.

Innovations such as vertical farming, designed to optimize yield and minimize waste, have opened up new avenues for growth. Increased investment in technologies like autonomous tractors, GPS-based guidance systems, and sensing technologies is expected to further propel the precision agriculture market. Sensors for soil, climate, and water monitoring are strategically deployed across fields to give farmers real-time insights, enabling them to maximize yields and minimize losses. These sensor technologies are also gaining traction in industries beyond agriculture, including healthcare, automotive, pharmaceuticals, and sports.

In the post-COVID-19 era, the adoption of precision farming and remote sensing solutions is expected to rise. Companies are increasingly shifting toward wireless platforms that support real-time decision-making for crop health monitoring, yield assessment, irrigation planning, field mapping, and harvest management.

Offering Insights

The hardware segment accounted for the largest market share of over 66.0% in 2024 in the precision farming industry. The hardware segment has been further segmented into automation and control systems, sensing devices, antennas, and access points. Hardware offerings such as automation and control systems, sensing devices, and drones play a major role in helping farmers. For instance, the GIS guidance system is very beneficial for growers as it can visualize agricultural workflows and the environment. Furthermore, VRT technology helps farmers determine areas that need more pesticides and seeds, distributing them equally across the field.

The services segment is anticipated to grow at a CAGR of 15.7% during the forecast period. Cloud computing focuses on shared networks, servers, and storage devices, owing to which the high costs incurred in maintaining hardware and software infrastructure are eliminated. As a result, the software segment is anticipated to register a CAGR of over 15.5% during the forecast period. Predictive analytics software guides farmers about crop rotation, soil management, optimal planting times, and harvesting times.

Application Insights

The yield monitoring segment accounted for the largest market share of over 42.0% in 2024. The segment is further segregated into on-farm yield monitoring and off-farm yield monitoring. On-farm yield monitoring allows farmers to obtain real-time information during harvest and create a historical spatial database. This segment is expected to account for the largest share of the market for precision farming as it offers equitable landlord negotiations, environmental compliance documentation, and track records for food safety.

The weather tracking & forecasting segment is anticipated to grow at a CAGR of 17.6% during the forecast period. The use of sensors helps weather forecasters to provide accurate weather readings and forecasting. In addition, the introduction of machine learning techniques and advanced data analytics services has increased the reliability and accuracy of weather forecasts, thus propelling the market's growth.

Regional Insights

North America accounted for the largest revenue share of over 43.0% in 2024. The region is an early adopter of technologies. Factors such as increasing government initiatives that support the adoption of modern agriculture technologies and developed infrastructure have contributed to the high revenue of the regional market. Furthermore, in May 2022, the Government of Canada announced an investment of USD 441.9 thousand to develop an integrated system for precision fruit tree farming. The investment also aimed to achieve sustainable solutions to tackle the rising challenges in Canada’s apple industry.

U.S. Precision Farming Market Trends

The precision farming market in the U.S. is expected to grow during the forecast period due to favorable government initiatives. For instance, the National Institute of Food and Agriculture (NIFA)-part of the U.S. Department of Agriculture-conducts geospatial, sensor, and precision technology programs to create awareness among farmers. In partnership with Land-Grand universities, NIFA helps farmers develop robust sensors, associated software, and instrumentation for modeling, observing, and analyzing a wide range of complex biological materials and processes.

Europe Precision Farming Market Trends

The European Union’s focus on sustainable agriculture through the Common Agricultural Policy (CAP) and the European Green Deal is driving the market growth in Europe. These policies encourage farmers to adopt more environmentally responsible practices, including the use of precision technologies that minimize input usage and reduce environmental impact. By using satellite-guided equipment, drones, and sensor-based systems, farmers can apply fertilizers and pesticides more accurately, improving efficiency while meeting strict environmental regulations. These policy frameworks provide financial support and incentives for adopting precision farming, making it economically viable for both large and small-scale farmers.

The precision farming market in the UK is expected to account for a significant revenue share in the Europe precision farming industry. Precision farming in the UK is gaining traction as technology advances and farmers seek more efficient and sustainable agricultural practices. This approach uses various technologies such as GPS, sensors, drones, and data analytics to optimize crop yields, minimize input usage, and reduce environmental impact.

The precision farming market in Germany is expected to account for a significant revenue share in the European precision farming market. Farmers in Germany are increasingly adopting precision farming techniques to enhance productivity, reduce costs, and mitigate risks associated with unpredictable weather patterns and soil variability.

The precision farming market in France is expected to account for a significant revenue share in the European precision farming market. Government support and incentives, such as grants for adopting precision farming technologies and subsidies for sustainable farming practices, further encourage uptake among France farmers.

Asia Pacific Precision Farming Market Trends

Asia Pacific is expected to witness significant growth over the forecasted period, with a CAGR of over 15.5% from 2025 to 2030. Numerous government initiatives are being undertaken in developing countries such as India, Sri Lanka, and Nigeria to encourage the implementation of modern precision farming technologies, thereby maximizing productivity. Moreover, an effective administrative framework also enables farmers to gain adequate knowledge of the proper use and maintenance of precision farming equipment.

The precision farming market in China is expected to account for a significant revenue share in the Asia Pacific precision farming market. It is experiencing significant growth, driven by the increasing adoption of advanced agricultural technologies and growing emphasis on sustainable farming practices.

The precision farming market in India is expected to account for a significant revenue share in the Asia Pacific precision farming market. With a large agricultural sector and rising demand for food security, Indian farmers are turning to precision farming techniques to improve crop yields, optimize resource utilization, and reduce environmental impact.

The precision farming market in Japan is expected to account for a significant revenue share in the Asia Pacific precision farming market. Integrating artificial intelligence (AI), drones, and big data analytics further enhances the efficiency and effectiveness of precision farming practices in Japan.

Key Precision Farming Company Insights

Some of the key players operating in the market include Trimble, Inc., AGCO Corporation, Raven Industries Inc., and Deere and Company, among others, are leading participants in the precision farming market.

-

Deere & Company manufactures and constructs agricultural and forestry machinery, drivetrains, diesel engines for heavy equipment, and lawn care machinery. It also manufactures and provides other heavy manufacturing equipment. The company serves diverse industries, such as agriculture, forestry, construction, landscaping and grounds care, engines and drivetrains, government and military, and sports turf.

-

AGCO Corporation is a U.S.-based manufacturer of agricultural equipment. The Company develops and sells products and solutions such as tractors, combines, foragers, hay tools, self-propelled sprayers, smart farming technologies, seeding equipment, and tillage equipment.

Prospera Technologies and Agrible, Inc. are some of the emerging market participants in the precision farming market.

-

Porspera Technologies is a global service provider of agriculture technology for managing and optimizing irrigation and crop health. The company provides AI-based sensors and cameras that aid farmers in crop monitoring.

-

Agrible is a U.S.-based agriculture solution provider. The company helps customers in more than 30 countries optimize water use, crop protection, fertilization, fieldwork, research trials, food supply chains, and sustainability initiatives.

Key Precision Farming Companies:

The following are the leading companies in the precision farming market. These companies collectively hold the largest market share and dictate industry trends.

- Ag Leader Technology

- AgJunction, Inc.

- CropMetrics LLC

- Trimble, Inc.,

- AGCO Corporation

- Raven Industries Inc.

- Deere and Company

- Topcon Corporation

- AgEagle Aerial Systems Inc. (Agribotix LLC)

- DICKEY-john Corporation

- Farmers Edge Inc.

- Grownetics, Inc.

- Proagrica (SST Development Group, Inc.)

- The Climate Corporation

Recent Developments

-

In February 2025, Topcon Corporation partnered with Bonsai Robotics to advance automation in the agricultural sector, specifically for permanent crops. This partnership will integrate Bonsai Robotics' cutting-edge vision-based autonomous driving technology with Topcon Agriculture's leading expertise in sensors, connectivity, and smart implements. Combining Bonsai's autonomous navigation systems with Topcon's advanced autosteering, telematics, and integration, the joint effort aims to deliver comprehensive solutions that streamline labor-intensive tasks, enable data-driven decision-making, and enhance precision harvesting even in the most challenging environments.

-

In April 2024, AGCO Corporation and Trimble announced a joint venture (JV) agreement, forming a new company called PTx Trimble. This venture merges Trimble’s precision agriculture division with AGCO’s JCA Technologies, aiming to deliver enhanced solutions for factory-installed and aftermarket applications in the mixed-fleet precision agriculture sector. With PTx Trimble, AGCO strengthens its advanced technology portfolio across key areas such as guidance systems, autonomy, precision spraying, connected farming, data management, and sustainable agricultural practices.

-

In July 2023, Deere & Company, a global agriculture and construction equipment manufacturer, announced the acquisition of Smart Apply Inc., an agriculture technology solution provider. Deere & Company is focused on using Smart Apply’s precision spraying solution to assist growers in addressing the challenges related to regulatory requirements, input costs, labor, etc. The acquisition is expected to help the Company attract new customers.

-

In April 2023, AGCO Corporation, a global agriculture equipment provider, and Hexagon, an industrial technology solution provider, declared their strategic collaboration. The collaboration is focused on expanding AGCO’s factory-fit and aftermarket guidance offerings.

-

In May 2023, AgEagle Aerial Systems Inc., a global agriculture technology solution provider, announced the establishment of a new supply agreement with Wingtra AG. The two-year agreement is expected to securely supply RedEdge-P sensor kits for incorporation with WingtraOne VTOL drones.

Precision Farming Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.02 billion

Revenue forecast in 2030

USD 24.09 billion

Growth rate

CAGR of 13.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Offering, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Ag Leader Technology; AgJunction, Inc.; CropMetrics LLC; Trimble, Inc.; AGCO Corporation; Raven Industries Inc.; Deere and Company; Topcon Corporation; AgEagle Aerial Systems Inc. (Agribotix LLC); DICKEY-john Corporation; Farmers Edge Inc.; Grownetics, Inc.; Proagrica (SST Development Group, Inc.); The Climate Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Precision Farming Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global precision farming market report based on offering, application, and region:

-

Offering Outlook (Revenue, USD Million; 2018 - 2030)

-

Hardware

-

Automation & Control Systems

-

Drones

-

Application Control Devices

-

Guidance System

-

GPS

-

GIS

-

-

Remote Sensing

-

Handheld

-

Satellite Sensing

-

-

Driverless Tractors

-

Mobile Devices

-

VRT

-

Map-based

-

Sensor-based

-

-

Wireless Modules

-

Bluetooth Technology

-

Wi-Fi Technology

-

Zigbee Technology

-

RF Technology

-

-

-

Sensing Devices

-

Soil Sensor

-

Nutrient Sensor

-

Moisture Sensor

-

Temperature Sensor

-

-

Water Sensors

-

Climate Sensors

-

Others

-

-

Antennas & Access Points

-

-

Software

-

Web-based

-

Cloud-based

-

-

Services

-

System Integration & Consulting

-

Maintenance & Support

-

Managed Types

-

Data Types

-

Analytics Types

-

Farm Operation Types

-

-

Assisted Professional Types

-

Supply Chain Management Types

-

Climate Information Types

-

-

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Yield Monitoring

-

On-Farm

-

Off-Farm

-

-

Field Mapping

-

Crop Scouting

-

Weather Tracking & Forecasting

-

Irrigation Management

-

Inventory Management

-

Farm Labor Management

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global precision farming market size was estimated at USD 11.67 billion in 2024 and is expected to reach USD 13.02 billion in 2025.

b. The global precision farming market is expected to grow at a compound annual growth rate of 13.1% from 2025 to 2030 to reach USD 24.09 billion by 2030.

b. North America dominated the precision farming market with a share of 43.6% in 2024. This is attributable to the increasing government initiatives for the adoption of modern agriculture technologies and developed agricultural infrastructure in the region.

b. Some key players operating in the precision farming market include Ag Leader Technology (U.S.); AgJunction, Inc. (U.S.); CropMetrics LLC (U.S.); Trimble, Inc. (U.S.); AGCO Corporation (U.S.); and Raven Industries Inc. (U.S.).

b. Key factors that are driving the precision farming market growth include the increasing proliferation of the Internet of Things (IoT) and the growing use of advanced analytics by farmers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.