- Home

- »

- Next Generation Technologies

- »

-

Weather Forecasting Services Market Size Report, 2030GVR Report cover

![Weather Forecasting Services Market Size, Share & Trends Report]()

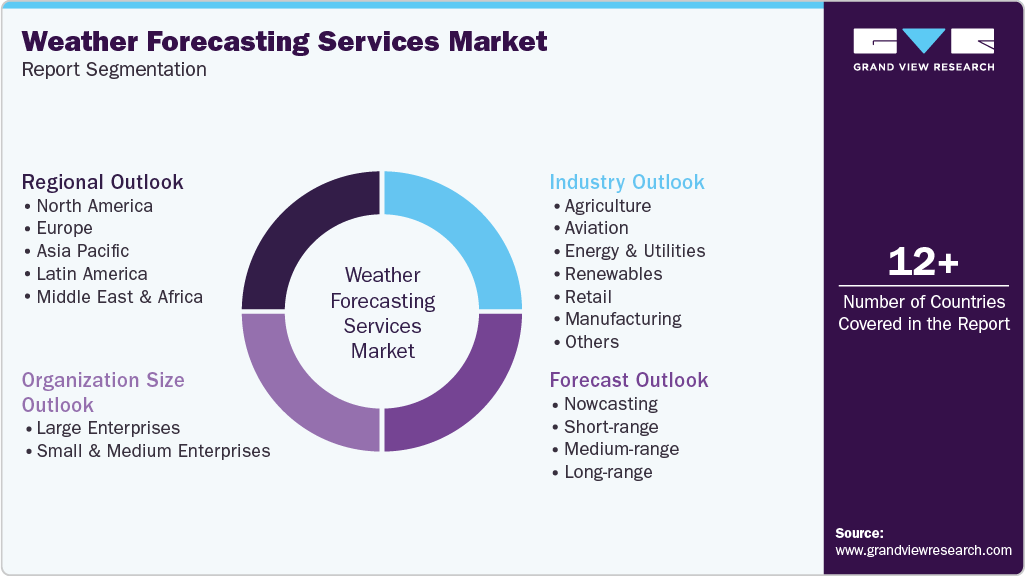

Weather Forecasting Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Forecast (Nowcasting, Short-range, Medium-range, Long-range), By Organization Size, By Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-944-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Weather Forecasting Services Market Summary

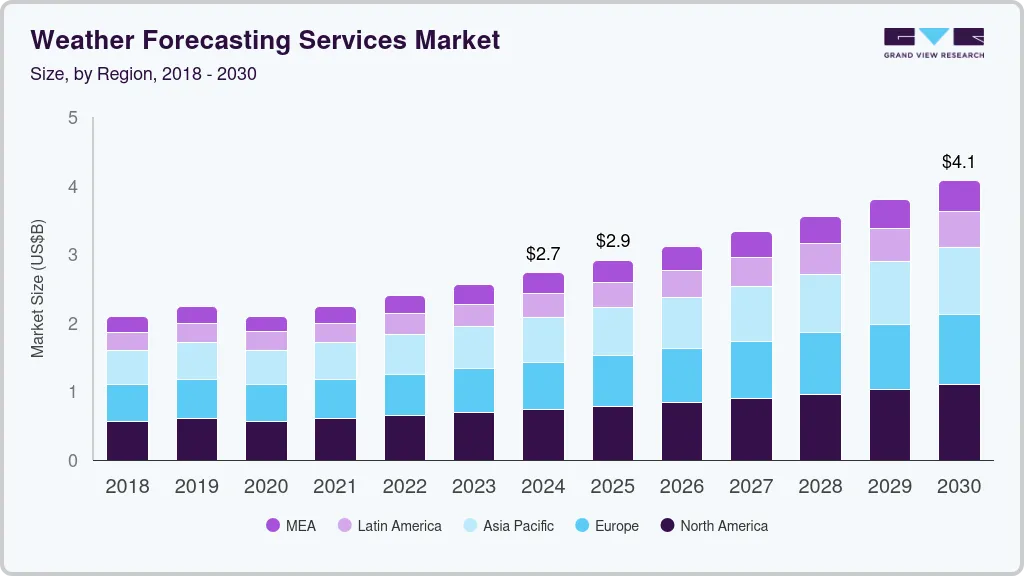

The global weather forecasting services market size was estimated at USD 2.73 billion in 2024 and is projected to reach USD 4.07 billion by 2030, growing at a CAGR of 6.9% from 2025 to 2030. This growth is primarily driven by increasing demand from sectors such as agriculture, aviation, energy, and logistics, which rely heavily on accurate weather data for operational efficiency and safety.

Market Size & Trends:

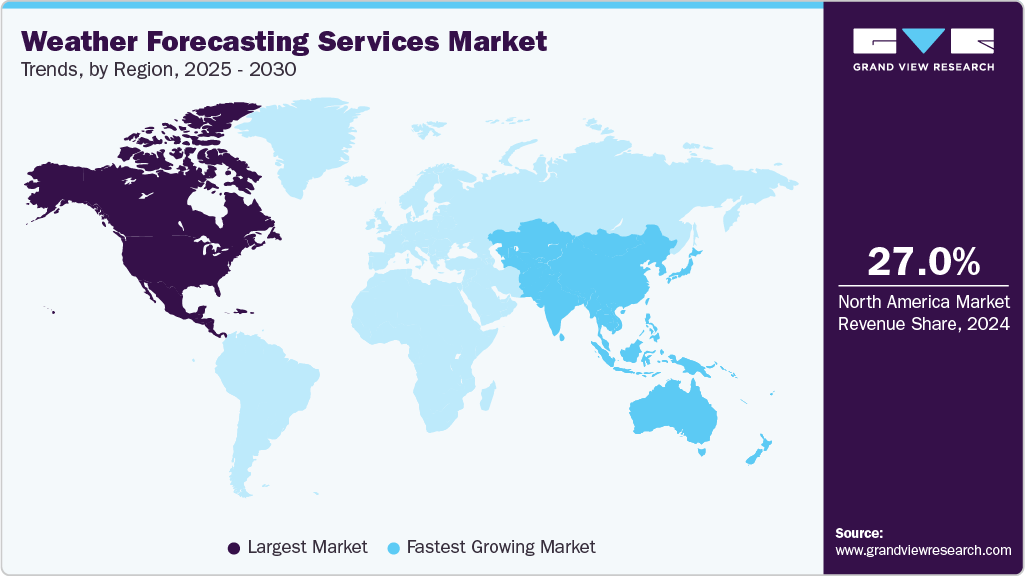

- North America dominated the weather forecasting services market with the largest revenue share of 27% in 2024.

- The weather forecasting services market in the U.S. accounted for the largest revenue share of 88% in North America in 2024.

- By organization size, the large enterprises segment accounted for the largest revenue share in 2024.

- By forecast, the medium-range segment led the market with the largest revenue share of 28.2% in 2024.

- By industry, the media segment accounted for the largest market revenue share in 2024.

Key Market Statistics:

- 2024 Market Size: 2.73 Billion

- 2030 Projected Market Size: 4.07 Billion

- CAGR (2025-2030): 6.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Advancements in satellite technology, data analytics, and machine learning are enhancing forecast accuracy and expanding application scope. Additionally, the rising frequency of extreme weather events due to climate change is prompting both governments and private enterprises to invest in real-time forecasting solutions. These factors, combined with the growing integration of weather data into IoT platforms, are expected to propel market growth over the forecast period.The growing demand for real-time weather updates is significantly driving innovation within the weather forecasting services industry. Businesses across transportation, agriculture, and energy sectors are increasingly reliant on precise, timely data to mitigate operational risks. This urgency has led to heightened investment in high-resolution radar systems and IoT-based sensors. Consequently, service providers are under pressure to deliver faster, more dynamic forecasts than ever before.

The increasing demand for climate risk analytics is transforming how companies approach long-term strategic planning. As climate change intensifies, businesses are turning to the weather forecasting services industry to assess vulnerabilities in their supply chains, infrastructure, and assets. Insurance, real estate, and agriculture firms are particularly dependent on predictive modeling to anticipate weather-induced losses. This trend is pushing forecasting providers to integrate climate science into standard weather solutions.

The expansion of global air and sea traffic is heightening the need for precise weather forecasting in the aviation and maritime sectors. Safety, fuel efficiency, and route optimization are directly tied to reliable weather data. Consequently, the weather forecasting services industry is prioritizing specialized offerings for airlines, cargo fleets, and port authorities. The industry is also benefiting from regulations that require standardized meteorological reporting.

The rise in smartphone usage has spurred a wave of personalized weather applications aimed at both consumers and professionals. These apps offer hyper-local forecasts, real-time alerts, and integrated analytics for outdoor events, travel, and farming. As expectations grow, the weather forecasting services industry is enhancing user interfaces and backend infrastructure to deliver seamless mobile experiences. Monetization opportunities through subscriptions and targeted advertising are also expanding.

Precision agriculture is gaining traction, with farmers using weather data to make real-time decisions on irrigation, fertilization, and harvesting. The weather forecasting services industry is developing agronomic models that combine weather, soil, and crop data to improve yield and sustainability. These tailored forecasts reduce waste and enhance productivity, particularly for smallholder farmers. The growing digitization of agriculture is further accelerating this demand.

Organization Size Insights

The large enterprises segment accounted for the largest revenue share in 2024. The growing demand for seamless global operations and supply chain continuity is pushing large enterprises to seek hyper-accurate weather forecasting across multiple geographies. Multinational companies face complex logistical challenges and require reliable forecasts to optimize shipping, inventory, and field operations in diverse climate zones. The weather forecasting services industry is addressing this need by offering scalable, location-specific solutions that can be integrated across global enterprise systems. This capability supports more resilient and efficient multinational operations.

The small & medium enterprises segment is expected to witness at the fastest CAGR from 2025 to 2030, primarily driven by the need to enhance customer experience and service reliability. SMEs are leveraging short-term weather insights to align operations with client expectations better. For example, service-based businesses like landscaping, tourism, or ride-sharing are adjusting schedules and offerings based on accurate weather inputs. The weather forecasting services industry is capitalizing on this trend by offering sector-specific forecasting modules that can be quickly deployed and customized. This focus on customer-centric weather solutions is helping SMEs build trust and maintain a competitive advantage.

Forecast Insights

The medium-range segment led the market with the largest revenue share of 28.2% in 2024. Due to the increasing need for reliable planning in weather-sensitive industries such as agriculture, construction, and logistics, the demand for medium-range forecasts is steadily rising. These forecasts, typically covering 3 to 10 days, provide a critical window for operational adjustments and resource allocation. The weather forecasting services industry responds by enhancing model precision and integrating probabilistic forecasting to manage risk more effectively. This segment is gaining traction as businesses seek a balance between short-term responsiveness and long-term strategic planning.

The short-range segment is expected to witness at the fastest CAGR of 7% from 2025 to 2030, driven by rapid urbanization and smart city initiatives. Municipalities are increasingly relying on short-range forecasts to manage weather-dependent infrastructure and public safety. Applications such as traffic control, flood prevention, and air quality management require immediate, localized weather data. The weather forecasting services industry is responding with micro-forecasting capabilities and API-driven data delivery tailored for city-level applications. This demand is expected to escalate as cities prioritize climate adaptation and smart governance.

Industry Insights

The media segment accounted for the largest market revenue share in 2024, driven by the convergence of weather analytics and advertising strategies. Media companies are using weather forecasts to enhance contextual ad targeting. Brands are aligning product promotions, such as clothing, beverages, and travel, with forecast data to increase conversion rates. The weather forecasting services industry is supporting this evolution by providing predictive analytics that can be embedded into ad-tech platforms. This integration is unlocking new revenue opportunities and adding strategic value to weather data in the media segment.

The renewables segment is expected to witness at the fastest CAGR from 2025 to 2030, owing to the growing dependence on weather-sensitive energy generation. Renewable energy providers are placing greater emphasis on precise forecasting to optimize output from solar, wind, and hydro assets. Reliable short- and medium-term weather data is essential for accurately estimating power generation and maintaining a balance between supply and grid demand. The weather forecasting services industry is addressing this need by delivering high-resolution, location-specific forecasts that support more effective energy planning and storage management. As a result, renewable energy operators are achieving greater operational efficiency and smoother grid integration.

Regional Insights

North America dominated the weather forecasting services market with the largest revenue share of 27% in 2024. Due to increasing climate volatility and extreme weather events, businesses and governments in North America are prioritizing advanced weather forecasting to improve disaster preparedness and resilience. Enhanced predictive capabilities help mitigate economic losses in sectors such as agriculture, energy, and insurance. The weather forecasting services industry is growing as demand rises for more accurate, timely weather data across the region.

U.S. Weather Forecasting Services Market Trends

The weather forecasting services market in the U.S. accounted for the largest revenue share of 88% in North America in 2024, primarily driven by regulatory requirements for environmental monitoring. The U.S. government is investing heavily in weather forecasting technologies to support climate action plans and reduce disaster risks. Agencies and private sector players collaborate to enhance forecast precision and data accessibility. The weather forecasting services industry benefits from these initiatives through increased demand for tailored solutions.

Europe Weather Forecasting Services Market Trends

The weather forecasting services market in Europe is expected to grow at a substantial CAGR of 6% from 2025 to 2030. Due to the rise of smart city initiatives across Europe, local governments are leveraging hyperlocal weather forecasts to enhance urban resilience and improve public safety. Integrated weather services support flood prevention, traffic management, and air quality monitoring. This is stimulating growth in the weather forecasting services industry focused on municipal applications.

The UK weather forecasting services market is expected to grow at a significant CAGR during the forecast period, primarily driven by the UK’s vulnerability to frequent and unpredictable weather changes. The public and private sectors emphasize the need for reliable medium-range forecasts to mitigate operational risks. Industries such as transportation and insurance increasingly depend on enhanced weather intelligence. The weather forecasting services industry in the UK is growing as these demands intensify.

The weather forecasting services market in Germany is owed to strong industrial and manufacturing bases; German businesses depend on medium- and short-range weather forecasts to optimize supply chains and protect assets. Weather intelligence aids in minimizing operational disruptions caused by adverse weather conditions. The weather forecasting services industry is responding with tailored, sector-specific forecasting solutions.

Asia Pacific Weather Forecasting Services Market Trends

The weather forecasting services market in Asia Pacific is expected to grow at the fastest CAGR of 7% from 2025 to 2030, owing to expanding agricultural activities and climate variability. Weather-sensitive sectors in Asia Pacific rely heavily on medium-range forecasts for crop planning and resource management. Improved forecast accuracy helps mitigate the impact of extreme weather events on food production. The weather forecasting services industry is growing to meet this critical demand.

The Japan weather forecasting services market is gaining traction, primarily driven by Japan’s exposure to frequent natural disasters such as typhoons and earthquakes. There is significant emphasis on developing accurate short- and medium-range forecasts to improve disaster preparedness. Both government agencies and private firms utilize advanced forecasting tools for risk management. This has resulted in the robust market growth in Japan.

The weather forecasting services market in China is rapidly expanding, owing to increasing investment in renewable energy capacity. China’s energy sector demands high-precision weather forecasts to optimize power generation and grid stability. Accurate weather intelligence aids in reducing operational risks linked to weather variability. The weather forecasting services industry is expanding in response to these energy sector requirements.

Key Weather Forecasting Services Company Insights

Some of the key players operating in the global market are The Weather Company LLC, and AccuWeather Inc. with among others.

-

AccuWeather Inc. is a leading global provider of weather data, forecasts, and analytics, serving media, government, and enterprise clients worldwide. The company specializes in delivering hyper-local and highly accurate weather forecasting through proprietary technology and advanced algorithms. AccuWeather’s services extend beyond basic forecasts to include risk management solutions tailored for industries such as agriculture, transportation, and energy. Their extensive global reach and reliable data infrastructure make them a preferred partner in critical decision-making processes.

-

The Weather Company LLC (Owned by IBM) leverages big data and artificial intelligence to provide actionable weather insights to businesses and consumers. It specializes in delivering advanced weather models and forecasts that help industries like insurance, retail, and utilities optimize operations and mitigate weather-related risks. The company’s cloud-based platform, powered by IBM’s Watson, enables scalable, data-driven decision-making with predictive analytics. Its robust data assets and technological capabilities underpin its leadership in the digital weather services market.

Climavision and Pelmorex Corp. are some of the emerging market participants in the weather forecasting services industry.

-

Climavision is an innovative weather intelligence firm focused on delivering hyper-local forecasts through a network of proprietary weather stations and advanced machine learning models. The company aims to disrupt traditional forecasting by providing precise, real-time weather data tailored to enterprise needs. Climavision is rapidly gaining traction in sectors such as energy, agriculture, and insurance by enabling more granular weather risk assessments. Its investment in edge computing and data analytics marks it as a promising player in next-generation weather services.

-

Pelmorex Corp. is a Canadian-based weather services company best known for operating The Weather Network and Weather Network websites, delivering weather data and forecasts to consumers across North America. It specializes in broadcast and digital weather content, supported by proprietary forecasting models and real-time weather monitoring systems. Pelmorex leverages big data analytics and AI to enhance user engagement and provide personalized weather alerts. The company is expanding its enterprise services by targeting sectors such as agriculture, retail, and insurance with tailored weather risk solutions.

Key Weather Forecasting Services Companies:

The following are the leading companies in the global weather forecasting services market. These companies collectively hold the largest market share and dictate industry trends.

- AccuWeather Inc.

- Vaisala Oyj (Weather)

- Climavision

- DTN LLC

- ENAV S.p.A

- Fugro

- The Weather Company LLC

- Met Office

- Precision Weather Services

- StormGeo (Alfa Laval AB)

- AEM

- Pelmorex Corp

Recent Developments

-

In March 2025, Google Cloud introduced WeatherNext, an AI-powered weather forecasting solution developed by Google DeepMind and Google Research. WeatherNext offers two models: WeatherNext Gen, a probabilistic system providing forecasts up to 15 days in advance, and WeatherNext Graph, a deterministic system predicting medium-range weather conditions up to 10 days ahead. These models are now accessible to enterprise customers via Google BigQuery and Earth Engine, enabling industries such as energy, retail, and manufacturing to better prepare for extreme weather events and optimize operations.

-

In March 2025, G42 and NVIDIA unveiled a groundbreaking AI-powered weather forecasting system, achieving 200-meter resolution predictions for Abu Dhabi and other urban areas. Utilizing NVIDIA’s Earth-2 platform and the CorrDiff architecture, this system enables hyper-local, real-time forecasts, significantly enhancing safety and operational efficiency in sectors like transportation and energy. This collaboration underscores the transformative potential of AI in climate science and underscores G42's commitment to advancing sustainable, data-driven solutions.

-

In December 2024, Vaisala Corporation acquired Maxar Intelligence’s WeatherDesk business for USD 70 million to boost its AI-powered weather forecasting capabilities. WeatherDesk offers fast access to global weather forecasts and observations, primarily serving clients in commodity and energy trading as well as energy demand planning. This acquisition reinforces Vaisala’s leadership in measurement instruments and intelligence, supporting its strategy to grow in the energy transition sector and increase recurring data revenue.

Weather Forecasting Services Market Report Scope:

Report Attribute

Details

Market size value in 2025

USD 2.91 billion

Revenue forecast in 2030

USD 4.07 billion

Growth rate

CAGR of 6.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Forecast, organization size, industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; China; Australia; Japan; India; Brazil; Mexico; South Africa; Saudi Arabia; UAE.

Key companies profiled

AccuWeather Inc.; Vaisala Oyj (Weather); Climavision; DTN LLC; ENAV S.p.A; Fugro; The Weather Company LLC; Met Office; Precision Weather Services; StormGeo (Alfa Laval AB); AEM; Pelmorex Corp.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Weather Forecasting Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global weather forecasting services market report based on forecast, organization size, and industry:

-

Forecast Outlook (Revenue, USD Million, 2018 - 2030)

-

Nowcasting

-

Short-range

-

Medium-range

-

Long-range

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Aviation

-

Energy & Utilities

-

Renewables

-

Retail

-

Manufacturing

-

Media

-

Logistics & Transportation

-

Marine

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global weather forecasting services market size was estimated at USD 2.73 billion in 2024 and is expected to reach USD 2.91 billion in 2025.

b. The global weather forecasting services market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2030 to reach USD 4.07 billion by 2030.

b. Based on the forecast, the Medium-range segment dominated the market in 2024 with a share of over 28%, owing to the rising need for precise weather data to support agriculture, disaster management, and event planning, the Medium-range forecasting segment continues to lead market growth by providing accurate and actionable forecasts within a critical 3-to-10-day window.

b. Some key players operating in the weather forecasting services market include AccuWeather Inc., Vaisala Oyj (Weather), Climavision, DTN LLC, ENAV S.p.A, Fugro, The Weather Company LLC, Met Office, Precision Weather Services, StormGeo (Alfa Laval AB), AEM, and Pelmorex Corp.

b. Key factors that are driving the weather forecasting services market growth include the increasing need for weather solutions across industries and the rising demand for weather forecast solutions due to uncertain climate conditions and energy transitions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.