- Home

- »

- Plastics, Polymers & Resins

- »

-

Polytetrafluoroethylene Market Size, Industry Report, 2030GVR Report cover

![Polytetrafluoroethylene Market Size, Share & Trends Report]()

Polytetrafluoroethylene Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Granular, Micro-powder, Fine-powder), By Application (Industrial & Chemical Processing, Electrical & Electronics), By Region, And Segment Forecasts

- Report ID: 978-1-68038-031-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polytetrafluoroethylene Market Summary

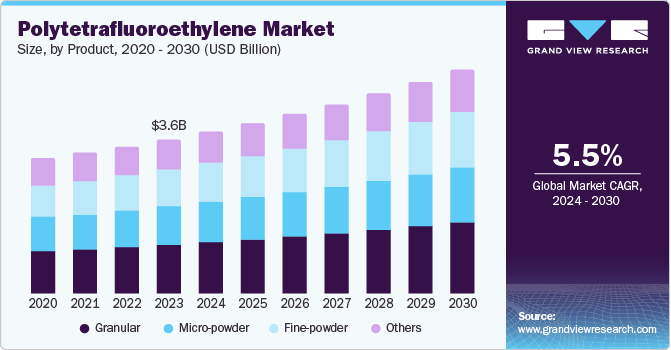

The global polytetrafluoroethylene market size was valued at USD 3.63 billion in 2023 and is projected to reach USD 5.25 billion by 2030, growing at a CAGR of 5.5% from 2024 to 2030. This growth is driven by its physical properties and advantages due to which it is utilized in key industries such as automotive and aerospace for its high-temperature resistance and chemical inertness, enhancing performance in components such as gaskets and seals.

Key Market Trends & Insights

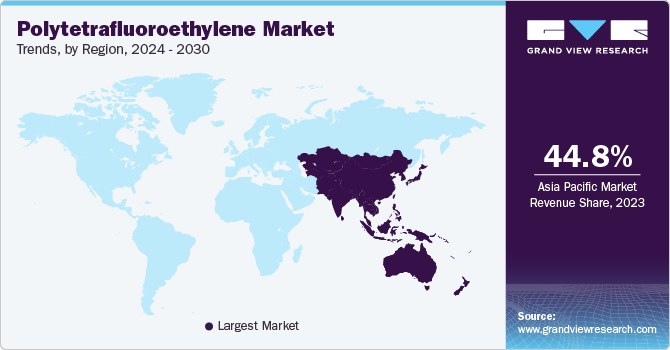

- The Asia Pacific polytetrafluoroethylene market had the largest revenue share of 44.8% in 2023.

- The polytetrafluoroethylene market in China accounted for the largest revenue share in Asia Pacific.

- Based on product, the granular polytetrafluoroethylene segment dominated the market and accounted for the largest revenue share of 31.7% in 2023.

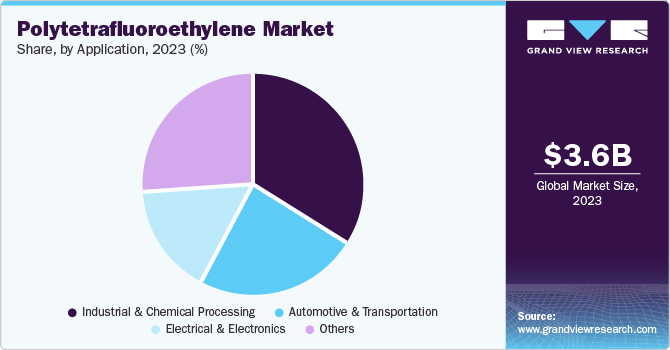

- Based on application, the industrial & chemicals processing applications dominated the market and accounted for the largest revenue share of 33.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.63 Billion

- 2030 Projected Market Size: USD 5.25 Billion

- CAGR (2024-2030): 5.5%

- Asia Pacific: Largest market in 2023

In addition, the electronics sector also boosts demand due to polytetrafluoroethylene’s (PTFE's) superior insulating properties essential for cable insulation and circuit boards. Furthermore, the consumer products market, particularly nonstick cookware, contributes significantly to PTFE's expansion, as its coatings provide ease of use and cleaning. Polytetrafluoroethylene is a synthetic fluoropolymer known for its nonstick properties and chemical resistance. Commonly recognized by Teflon, PTFE is widely used in nonstick cookware and industrial applications such as seals, gaskets, and bearings due to its low friction and high thermal stability. It is also an electrical insulator in wiring and cable applications, making it valuable in various sectors, including automotive, aerospace, and electronics.

The evolving healthcare industry and the growing use of PTFE in medical devices such as catheters, implants, and surgical instruments, and for making internal and external life-saving equipment such as bio-containment vessels, syringes, and sutures are other factors boosting the demand for polytetrafluoroethylene. This fluoropolymer is also ideal for electrical insulation and the protection of various electronic components, utilized for manufacturing semiconductors and medical devices, coatings for bulk chemical containers, etc. The robust growth of the chemical processing, automotive, and electronic industries in many countries worldwide influences the expansion of the polytetrafluoroethylene market.

In addition, in the chemical industry, PTFE is used in many products, from gaskets to vessel linings and chemical tanks, in the automotive industry for high-temperature applications, from fire-critical applications to aerospace industry in terminal insulation on heating components, jet engines, and external fittings of aircraft improving the overall operational work and reducing the downtime of machines or components enhancing its utilization across wide industries which impacts the positive market growth of market.

Product Insights

In 2023, granular polytetrafluoroethylene dominated the market and accounted for the largest revenue share of 31.7%. Granular polytetrafluoroethylene is a high-performance fluoropolymer known for its exceptional properties, driving demand across various industries. It boasts excellent chemical resistance, a wide range of service temperatures, low-friction characteristics, high thermal and electrical stability, flame resistance, and low-temperature toughness. These attributes make it invaluable in chemical and industrial processing for components such as gaskets and seals and in the electronics sector for insulating wiring and cables. Granular PTFE enhances performance and reliability in complex environments in the automotive and aerospace industries. At the same time, its biocompatibility and non-reactive nature render it suitable for medical applications such as catheters and prosthetics.

Fine-powder polytetrafluoroethylene is projected to experience a (CAGR) of 6.3% during the forecast period. This material is distinguished by its low surface energy and excellent self-lubricating characteristics, making it ideal for use as a lubricant, coating, or filler in various applications. Fine PTFE powders can be paste-extruded to create continuous products such as tubes, tapes, and membranes. They are particularly favored in applications such as breathable hydrophobic membranes, hoses for aerospace and automotive industries, and high-performance wires and cables. Furthermore, fine PTFE powders are commonly used in high-quality hoses and wires for the aerospace and automotive sectors, pipe liners and transfer hoses for handling corrosive substances in the chemical industry, and membranes for filtration and apparel.

Application Insights

Industrial & chemicals processing applications dominated the market and accounted for the largest revenue share of 33.4% in 2023. Polytetrafluoroethylene is widely demanded in industrial and chemical processing because of its chemical resistance and non-stick properties. It is preferred for producing components such as bearings, seals, gaskets, and other equipment. In addition, PTFE’s ability to survive toxic chemicals and extreme temperatures ensures the longevity and reliability of these components, assisting manufacturers satisfy stringent industry criteria for product purity, durability, and low maintenance costs. Furthermore, PTFE is used in the lining of pipes and tanks to prevent corrosion and contamination, in filtration systems to improve efficiency and longevity, and in the production of non-stick coatings for industrial machinery, further underscoring its versatility and critical role in maintaining operational integrity and efficiency in critical industrial environments leading to its market growth.

Electrical & electronics application is expected to grow at a CAGR of 6.1% over the forecast period. PTFE's superior insulating properties, high thermal stability, and chemical resistance make it ideal for cable insulation, printed circuit boards, and semiconductor manufacturing. In addition, the rapid pace of technological innovation in electronic products drives consistent demand for new and advanced electrical and electronic products, which hold a significant market share. Furthermore, the rise of emerging technologies such as 5G, IoT, and digitalization is expected to further boost demand for PTFE in the electronics industry during the forecast period.

Regional Insights

The Asia Pacific polytetrafluoroethylene market had the largest revenue share of 44.8% in 2023. This growth is driven by the presence of major manufacturers and rapid industrialization. In addition, the product is being used more extensively in chemical and industrial processing in countries such as China, India, and Japan. The rising middle-class population boosts consumer product demand, particularly for non-stick cookware. Technological advancements and increased foreign investments further enhance PTFE applications, positioning Asia Pacific as a significant market for this versatile polymer.

China Polytetrafluoroethylene Market Trends

The polytetrafluoroethylene market in China accounted for the largest revenue share in Asia Pacific attributed to rising demand in the electrical and electronics sectors, increased usage of non-stick cookware, and expanding industrial and chemical processing applications. Furthermore, the growth is supported by advancements in PTFE derivatives and a surge in infrastructure development. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% through 2027, reflecting robust industrialization in the region.

North America Polytetrafluoroethylene Market Trends

The North America polytetrafluoroethylene market region is expected to grow significantly over the forecast period. The market is characterized by its diverse applications across multiple industries, including industrial coatings, where its non-stick properties and chemical resistance are highly valued for coating industrial equipment and surfaces. Furthermore, PTFE is extensively used in the automotive and transportation sectors for its superior thermal and electrical insulation properties, as well as in the chemical processing industry due to its excellent chemical inertness and durability.

The polytetrafluoroethylene market in the U.S. is expected to witness substantial growth supported by its robust automotive, chemical processing, electronics, and electrical sectors. These sectors are continually evolving due to advancements in material science and expanding applications across various industries. This evolution is driven by the persistent demand for high-performance, durable materials essential for manufacturing and industrial processes. In addition, the market’s growth is significantly influenced by technological advancements, growing demand, and regulatory changes that foster innovation and the adoption of PTFE in wider applications.

Europe Polytetrafluoroethylene Market Trends

Europe polytetrafluoroethylene market is expected to witness significant growth over the forecast period. This growth is driven by the rising demand for improved materials concerning the surge in demand for chemical processing, electrical and electronics, expansion of the electric vehicle industry, robotics, and defense technologies led to the demand for PTFE in the region.

The polytetrafluoroethylene market in Germany is experiencing significant growth, driven by its huge demand and its expanding aerospace, automotive, industrial, and machinery sectors. The increasing production in these sectors, fueled by climate-conscious policies, is anticipated to further boost the demand for PTFE.

Key Polytetrafluoroethylene Company Insights

Some of the key companies in the polytetrafluoroethylene market include Dow, Arkema, Resonac Holdings Corporation., Weifang Yaxing Chemical Co., Ltd., Sundow Polymers Co., Ltd., NIPPON SHOKUBAI CO., LTD., INEOS Group Limited, Shandong Novista Chemicals Co., Ltd.;in the market focusing on development & innovation for enhancement of product categories.

-

Zhejiang Juhua Co., Ltd. is a multinational chemical company specializing in the production and sales of fluorine chemicals products. The company's primary business includes research, production, and sales of fluorine chemicals, fine chemicals, new materials, and fluoropolymer resins, among other chemical products. The company caters to various industries such as automotive, aerospace, pharmaceuticals, food and packaging, electronics, etc. The company operates in over 50 countries and has several subsidiaries, including Juhua New Materials Co. Ltd., Juhua U.S. Inc., Juhua Fluoropolymers Co., Ltd., and others.

-

The Chemours Company is a global chemical company that provides solutions to various industries and markets, such as automotive, electronics, construction, and energy. The key business segments are Titanium technologies, Fluoroproducts, chemical solutions, advanced performance materials, and others.

Key Polytetrafluoroethylene Companies:

The following are the leading companies in the PTFE market. These companies collectively hold the largest market share and dictate industry trends.

- Chemours Company

- Daikin Industries, Ltd.

- 3M (Dyneon)

- Solvay S.A.

- AGC Inc.

- Gujarat Fluorochemicals Ltd. (GFL)

- HaloPolymer OJSC

- Jiangsu Meilan Chemical Co., Ltd.

- Shandong Dongyue Group

- Zhejiang Juhua Co., Ltd.

- Shanghai 3F New Materials Company Ltd.

- Arkema S.A.

- Shamrock Technologies, Inc.

- Micro Powders, Inc.

- Saint-Gobain Performance Plastics.

Recent Developments

-

In August 2024, AGC Inc., a manufacturer based in Tokyo, developed a groundbreaking process for producing fluoropolymers without surfactants. This innovative technology addresses the rising demand for environmentally friendly manufacturing methods by eliminating fluorinated surfactants, which can generate harmful byproducts. The new process maintains the high-performance characteristics of traditional fluoropolymers, which are essential for various industries, including semiconductors and electronics. AGC aims to commence industrial-scale production by 2030 as part of its commitment to sustainability and innovation to support a carbon-neutral society.

Polytetrafluoroethylene Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.81 billion

Revenue forecast in 2030

USD 5.25 billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, India, Japan, South Korea, Australia, Indonesia, Vietnam, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Chemours Company; Daikin Industries, Ltd.; 3M (Dyneon); Solvay S.A.; AGC Inc.; Gujarat Fluorochemicals Ltd. (GFL); HaloPolymer OJSC; Jiangsu Meilan Chemical Co., Ltd.; Shandong Dongyue Group; Zhejiang Juhua Co., Ltd.; Shanghai 3F New Materials Company Ltd.; Arkema S.A.; Shamrock Technologies, Inc.; Micro Powders, Inc.; Saint-Gobain Performance Plastics.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polytetrafluoroethylene Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polytetrafluoroethylene market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Granular

-

Micro-powder

-

Fine-powder

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Industrial & Chemical Processing

-

Electrical & Electronics

-

Automotive & Transportation

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East And Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.