- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Soy And Dairy Protein Ingredients Market Size Report, 2030GVR Report cover

![Soy And Dairy Protein Ingredients Market Size, Share & Trends Report]()

Soy And Dairy Protein Ingredients Market (2023 - 2030) Size, Share & Trends Analysis Report By Soy Protein (Soy Protein Concentrate), By Dairy Protein, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-030-9

- Number of Report Pages: 138

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Soy And Dairy Protein Ingredients Market Summary

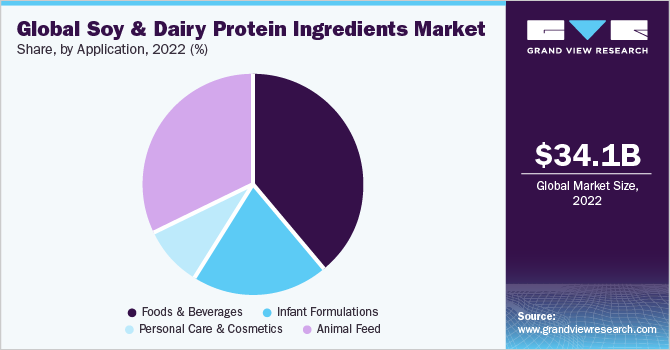

The global soy and dairy protein ingredients market size was valued at USD 34.1 billion in 2022 and is projected to reach USD 51.86 billion by 2030, growing at a CAGR of 5.4% from 2023 to 2030. Rise in usage of several proteins by manufacturers that include wide range of amino acids and help in weight loss, muscle repair, energy balance, and satiety.

Key Market Trends & Insights

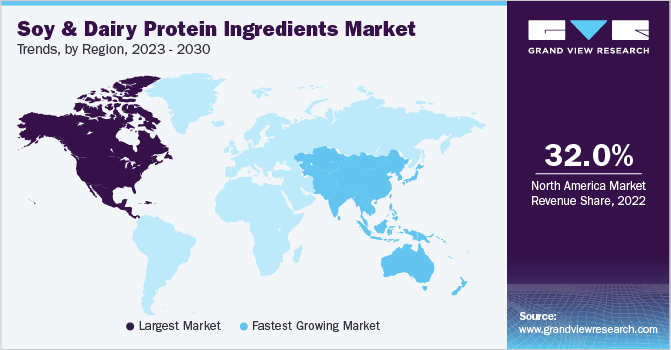

- North America led the market and accounted for around 32% share of the global revenue in 2022.

- Asia Pacific is anticipated to witness at the CAGR of over 6% during the forecast period.

- By dairy protein, the whey protein concentrate dominated the dairy protein segment accounting for the highest revenue share of 32.15% in 2022.

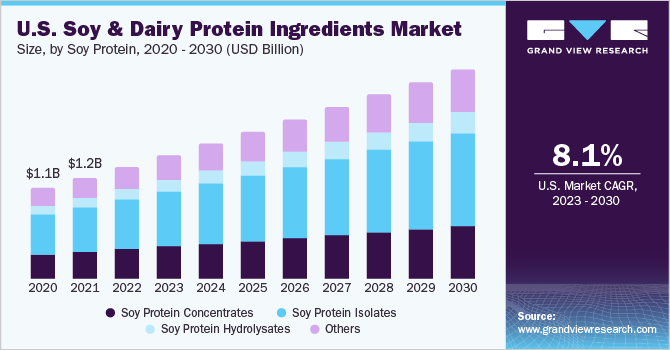

- By soy protein, the soy protein isolates segment dominated the soy protein segment with the largest share of around 44%.

- By application, the food and beverage segment dominated the application segment with the largest revenue share of 39.2%.

Market Size & Forecast

- 2022 Market Size: USD 34.1 Billion

- 2030 Projected Market Size: USD 51.86 Billion

- CAGR (2023-2030): 5.4%

- North America: Largest market in 2022

Additionally rising demand for protein-rich food is expected to drive the market for soy & dairy over the forecast period. Owing to increasing health awareness, consumers are opting for low-carb and low-fat foods, which is also driving the product demand. Growing acceptance of soy and dairy based products in baked items owing to its nutritional qualities including gluten-free, trans-fat free, and whole-grain food products are fueling the market growth. Increasing demand for processed foods including cakes, pastries, donuts, pies, and bread at a global level is expected to expand the scope of soy flour soon. Furthermore, several baked goods manufacturers are launching products made of gluten free flours to cater to the increasing demand for gluten free products. For instance, Britannia Industries Ltd offer product offers ‘Vita Rich Slice’ made of soy flour. In addition, the growing popularity of vegan diet coupled with rising demand for plant-derived products owing to its nutritional value such as dietary fiber and bioactive components including isoflavones is acting as an opportunity for soy and dairy protein ingredients.

The rise in working population coupled with rapid urbanization coupled with rising demand for meat analogue products is boosting market growth. Moreover, several health benefits offered by plant-based products such as low-cholesterol and gluten free aid in reducing the risk of chronic diseases among consumers thereby boosting the growth of the overall market. For instance, in 2019, U.S. based Morning Star Farms, announced the launch of vegan products thereby generating demand for soy and dairy based products.

Furthermore, easy availability of dairy and soy substitutes is boosting the demand for the overall market. Manufacturers are also focusing on expanding awareness about their products via marketing campaigns. Companies operating in the market are also introducing several flavors for both soy & milk protein isolates such as chocolate, strawberry, and vanilla to mask the nutty taste of plant based ingredients such as soy. Key manufacturers are also increasingly investing in R&D activities to curb the nutty taste by introducing unique flavors and adopting the usage of attractive packages to sell via multiple distribution channels.

Dairy Protein Insights

Whey protein concentrate dominated the dairy protein segment accounting for the highest revenue share of 32.15% in 2022. Whey protein concentrates contains minerals, lipids, lactose, and several other proteins. Moreover, whey protein concentrates is a low-cost alternative for obtaining high flavor and is employed in several applications such as manufacturing of beverages, dairy products and other food applications. Furthermore, the concentrates also help in fortifying infant nutrition and several other food products with protein when dissolved in water thereby acting as an excellent gelling agent in meat substitute industries.

The whey protein isolate segment is predicted to expand at a CAGR of 6.5% during the forecast period 2022-203O by revenue. Consumer preferences for incorporating proteins in regular foods, as well as rising demand for high-protein and low-fat weight management products, are expected to drive segment growth. Whey protein isolate is also used in production of protein-fortified foods, low-calorie and baked goods. In addition, favorable support from the Food and Drug Administration (FDA), is expected to boost the demand for the market.

Soy Protein Insights

The soy protein isolates segment dominated the soy protein segment with the largest share of around 44%.The key reason for the high share is the fact that being edible, soy has a negligible amount of cholesterol and saturated fats. Soybeans are vegetable foods which comprise of all the eight amino acids essential for the growth of the human body.Soy protein isolates are a refined form of soy protein comprising of 90% protein content. It is utilized in meat products for improvising the eating quality and texture. It is rarely found in stores and majorly used in the food industries.

Soy protein isolate has less usage owing to allergenic potential in the human body. Moreover, the rising demand in the functional drinks industry is expected to support market growth over the forecast period. Increasing demand for Ready-to-Eat (RTE) food products owing to a hectic lifestyle is projected to drive the market further. Also, the growing popularity of soy protein as a meat substitute is likely to contribute to market expansion.

Several market players are launching new producing soy-based products owing to the growing popularity of the ingredient. For example, In March 2021, BASF announced the launch of Plantapon Soy, a surfactant derived from soy protein. The product is ideal for both natural cosmetics and vegan formulations. Through the launch of the product, the company aims to cater to the growing demand for natural cosmetics among eco-conscious consumers.

The soy protein hydrolysate segment is anticipated to expand at a CAGR of around 8% by revenue during the forecast period.As more consumers are looking to reduce their meat consumption or eliminate animal products from their diets altogether, there is a growing demand for alternative protein sources. Soy protein hydrolysate is an attractive option because it is derived from a plant source, making it a good choice for those who are looking for plant-based protein options.Soy protein hydrolysate has been shown to have several health benefits, including reducing cholesterol levels, improving cardiovascular health, and potentially reducing the risk of certain types of cancer. Soy protein hydrolysate is also a good source of amino acids, which are important for building and repairing tissues in the body. This has led to increased demand from consumers who are looking for functional foods and supplements that can help support their health.

Application Insights

The food and beverage segment dominated the application segment with the largest revenue share of 39.2%. Soy and dairy protein ingredients are a reasonable source of protein and are therefore significantly used in the bakery and confectionery industry. Furthermore, advancements in process design and technology have improved the quality of whey products that are highly refined, including demineralized whey, whey protein concentrates, and isolates. These advancements have resulted in the increased incorporation of protein ingredients in various functional food products to make them nutrient-rich.The ready-to-drink protein-rich beverages are becoming highly popular among health-conscious consumers, spearing the consumption of food and beverages over the forecast period.

The personal care and cosmetics segment is anticipated to expand at a CAGR of 5.9% by revenue during the forecast period. Changing lifestyles, widespread consciousness regarding the enhancement of the overall personality among consumers along with rising GDP and utilization of natural ingredients for manufacturing cosmetics are expected to drive the demand for the segment market. Countries, such as U.S., France, and U.K. are focusing on capturing business share across emerging regions. As per the International Trade Administration (ITA), the Asian countries offer a potential customer base of over three billion and acts as a fastest growing region for cosmetics and personal care products.

Regional Insights

North America led the market and accounted for around 32% share of the global revenue in 2022. The strong presence of the key players in the region coupled with favorable support for new technological advancement in soy and dairy protein are factors contributing towards high market share in the region. The vegan populace has increased the demand for soy and dairy based products over the past few years. Major manufacturers are adopting several strategies including switching to all-vegan product portfolio and new product launch to cater to the rising demand from the consumers. Moreover, numerous health benefits such as gluten-free and low-cholesterol products help to reduce the risk of cardiovascular diseases as well as a reduction in menopausal symptoms and lower blood cholesterol. These health benefits are likely to boost the market growth in the foreseeable future.

On the other hand, Asia Pacific is anticipated to witness at the CAGR of over 6% during the forecast period. The Asia Pacific market is expected to witness a surge in demand for soy & dairy protein ingredients as major players in the industry are employing strategies such as launching their brands in untapped markets of Southeast Asian countries. Major companies are offering new products to gain a competitive edge in the market as well as to cater to the changing food preferences of the consumers. For instance, Otsuka Pharmaceutical Co., Ltd. offers ‘SOYJOY’, whole soy nutrition bars. These new products are anticipated to increase the scope of soy-based products in the food industry over the forecast period.

Key Companies & Market Share Insights

The global market is expected to witness competition among the companies due to the presence of several players across the industry. Key players have increasingly focused on the Southeast Asian market over the years because of the presence of a target consumer base in the region. Key players in the soy & dairy protein ingredients are gauging the changing demand of the food and beverage industry, which is leading them to increase their investments in research and development and frequent product launches. Manufacturers are expanding their production capacities to meet the growing demand for soy & dairy protein ingredients from the application industry. For instance, in March 2020, Sun Nutrafood announced the launch of soy protein isolate which available for food and beverage sector. Some of the prominent players in the global soy and dairy protein ingredients market include:

-

DuPont Solae

-

ADM

-

Cargill, Incorporated

-

Bunge

-

Mead Johnson

-

Scoular

-

Danone

-

Arla Foods amba

-

CHS

Soy And Dairy Protein Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 31.4 billion

Revenue forecast in 2030

USD 51.86 billion

Growth rate

CAGR of 5.4% from 2022 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

April 2023

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Soy protein, dairy protein, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain, China; India; Japan; Australia; Brazil; Argentina, Saudi Arabia, South Africa

Key companies profiled

DuPont Solae; ADM; Cargill Incorporated; Bunge; Mead Johnson; Scoular; Danone; Arla Foods amba; CHS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

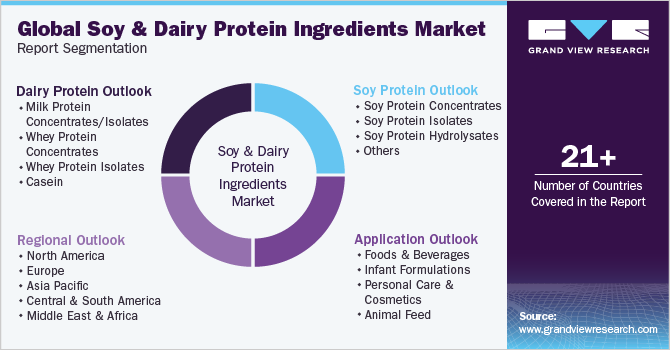

Global Soy And Dairy Protein Ingredients Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global soy and dairy protein ingredients market report on the basis of soy protein, dairy protein, and application, region:

-

Dairy Protein Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Milk Protein Concentrates/Isolates

-

Whey Protein Concentrates

-

Whey Protein Isolates

-

Casein

-

-

Soy Protein Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Soy Protein Concentrates

-

Soy Protein Isolates

-

Soy Protein Hydrolysates

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Foods & Beverages

- Infant Formulations

-

Personal Care & Cosmetics

-

Animal Feed

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global soy & dairy protein ingredients market size was estimated at USD 34.1 billion in 2022 and is expected to reach USD 31.4 billion in 2023

b. The Soy & Dairy Protein Ingredients market is expected to grow at a compound annual growth rate of 5.4% from 2022 to 2030 to reach USD 51.9 billion by 2030.

b. Whey protein concentrate dominated the dairy protein segment accounting for the highest revenue share of 32.15% in 2022

b. Some of the key market players in the Soy & Dairy Protein Ingredients market are DuPont Solae, ADM, Cargill, Incorporated, Bunge, Mead Johnson, Scoular, Danone, Arla Foods amba, and CHS

b. Key factors that are driving the Soy & Dairy Protein Ingredients market growth is increasing consumer awareness regarding meat substitute products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.