- Home

- »

- Plastics, Polymers & Resins

- »

-

Adhesives And Sealants Market Size, Industry Report, 2033GVR Report cover

![Adhesives And Sealants Market Size, Share & Trends Report]()

Adhesives And Sealants Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Solvent Based, Hot Melt, Water Based), By Product (Acrylic, PVA, Polyurethane, Styrenic block, Epoxy), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-081-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Adhesives And Sealants Market Summary

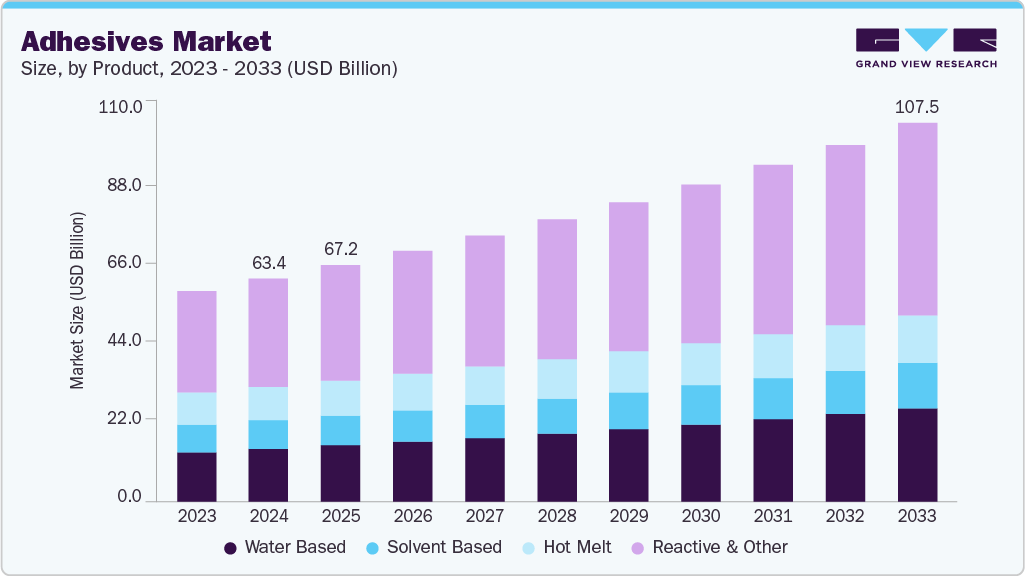

The global adhesives and sealants market size was estimated at USD 72.76 billion in 2024 and is projected to reach USD 123.20 billion by 2033, growing at a CAGR of 6.0% from 2025 to 2033. The market growth is driven by the broad application of adhesives and sealants in assembling materials such as glass, metal, rubber, and other components used in automotive manufacturing and construction projects.

Key Market Trends & Insights

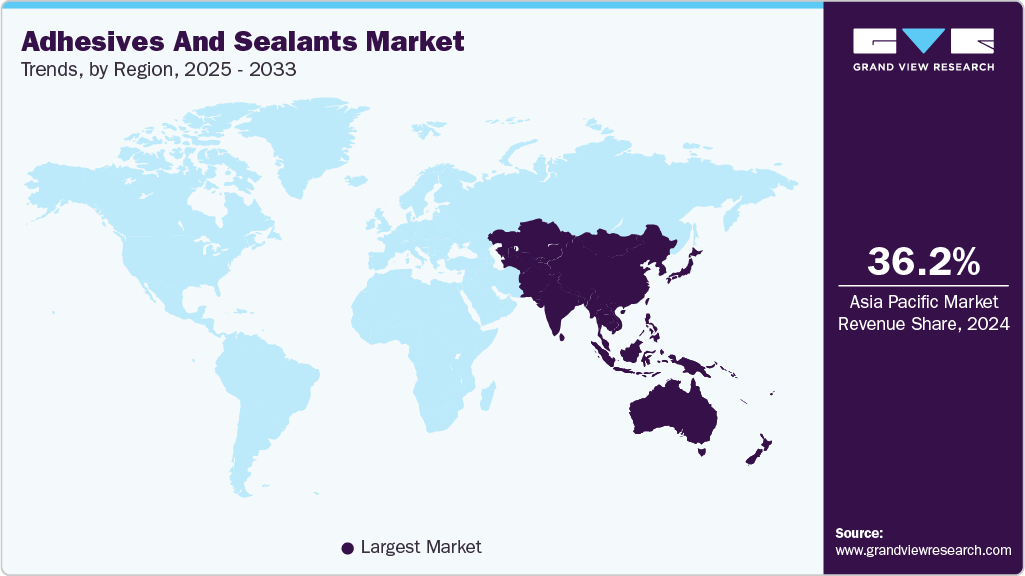

- Asia Pacific dominated the Adhesives & Sealants market with the largest revenue share of 36.2% in 2024.

- China held over 52.9% revenue share of the Asia Pacific Adhesives & Sealants market.

- By adhesives technology, the water based segment dominated the market and accounted for the largest revenue share of 23.7% in 2024.

- By adhesives product, the acrylic segment dominated the market and accounted for the largest revenue share of 36.7% in 2024.

- By adhesives application, the paper & packaging-based adhesives application dominated the market and accounted for the largest revenue share of 29.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 72.76 Billion

- 2033 Projected Market Size: USD 123.20 Billion

- CAGR (2025-2033): 6.0%

- Asia Pacific: Largest market in 2024

The increasing adoption of high-performance sealants in the production of lightweight vehicles also contributes to economic efficiency and supports the reduction in the reliance on traditional materials such as metals and plastics. Furthermore, the expanding use of adhesive technologies in industries such as packaging, automotive, textiles, and construction-particularly for carton sealing and assembly processes, further propelling market expansion.

The growing pace of urbanization and global infrastructure development is significantly boosting the demand for adhesives in construction-related applications. In the automotive industry, increasing vehicle production and the shift toward lightweight designs are further driving the adoption of adhesives in place of traditional fastening methods.

In construction industry, adhesives are primarily used for flooring installations, offering strong and durable bonding for materials such as tiles, vinyl, wood, and carpets. These adhesives ensure long-lasting performance by withstanding heavy foot traffic and resisting moisture. In addition, they play a crucial role in assembling and installing facades and curtain walls by bonding components like glass, metal panels, and composite materials. This not only improves the structural stability of buildings but also enhances their aesthetic appeal.

The growing demand for EVA-based hot melt adhesives is driven by their exceptional versatility, quick setting time, and ability to bond a wide variety of substrates, including paper, plastics, metals, and textiles. Their customizable formulations allow for flexibility, low-temperature performance, and thermal stability, making them ideal for high-speed industrial applications across packaging, automotive, woodworking, electronics, textiles, and construction sectors. Moreover, their solvent-free, low-VOC nature supports environmental compliance and safety, while their cost-effectiveness and ease of application enhance operational efficiency, making them a preferred choice for sustainable and scalable bonding solutions.

There is a growing demand for environmentally friendly market products, opening opportunities for products with low VOC (volatile organic compounds) and renewable materials. The expanding medical device market and increasing adoption of adhesives in medical applications offer new avenues for market growth.

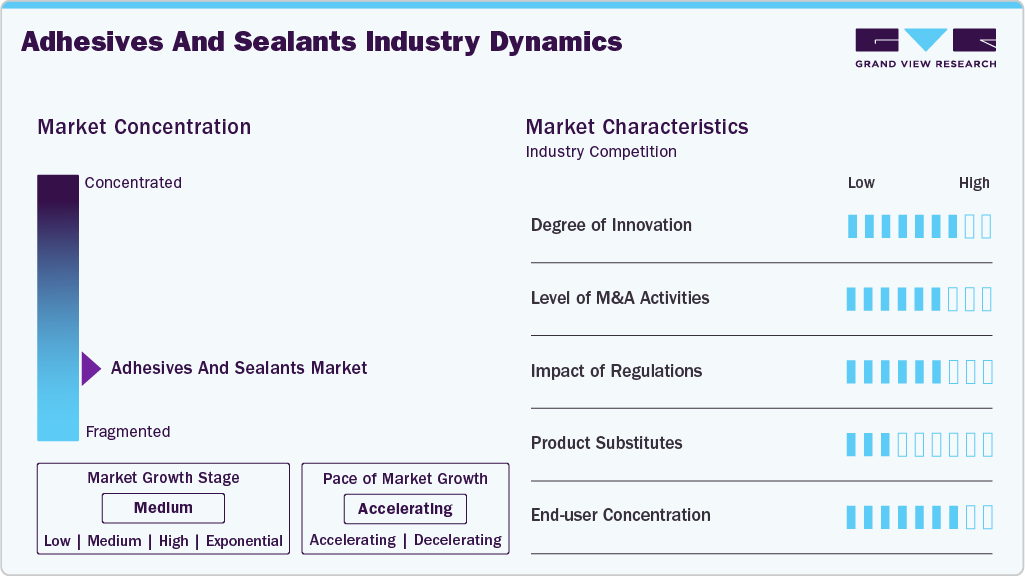

Market Concentration & Characteristics

The market is fragmented and competitive, with many small and medium-sized businesses operating. The market comprises small and medium-sized enterprises, with many continuously implementing strategies such as acquisitions, collaborations, and product launches.

Additionally, some companies are expanding their manufacturing facilities to improve their position within the market. The market is expected to grow due to the strategic initiatives that market players adopt, such as acquiring regional markets. For example, H.B. Fuller agreed to acquire Beardow Adams, a UK company, to expand its business in Europe.

Adhesives Technology Insights

Water based segment dominated the market and accounted for the largest revenue share of 23.7% in 2024. Water-based adhesive technology is highly versatile and provides strong bonding capabilities for a broad range of industrial uses. These adhesives are formulated using water, polymers, and various additives, making them suitable for both porous and non-porous surfaces. Typically applied in liquid form, they become effective as the water either evaporates or is absorbed by the substrate. Available in both natural and synthetic formulations, water-based adhesives are widely used due to their adaptability and environmental friendliness.

Solvent-based adhesives segment is expected to grow at the fastest CAGR of 5.2% from 2025 to 2033. This growth is primarily driven by their widespread application in industries such as packaging, medical, and tape, owing to their excellent resistance to environmental conditions and compatibility with various substrates. These adhesives are effective on both porous and non-porous surfaces, forming a strong bond once the solvent evaporates, leaving behind a durable adhesive layer. Their versatility supports their use across multiple sectors, including automotive, food packaging, household products, and graphic materials.

The demand for reactive or thermosetting adhesive technologies is driven by their ability to form strong, durable bonds across various materials, making them essential in structural and high-performance applications. These adhesives cure chemical reactions, triggered by mixing components or exposure to heat, moisture, or radiation, delivering exceptional mechanical strength, flexibility, and resistance to weathering, temperature fluctuations, and chemicals. Their solvent- and VOC-free formulations also support environmental compliance, making them suitable for diverse construction, automotive, electrical, and industrial uses. Continued innovation in MS polymers, epoxies, PURs, and silane-based systems is expanding their role in advanced assembly and structural bonding solutions.

Adhesives Product Insights

The acrylic segment dominated the market and accounted for the largest revenue share of 36.7% in 2024. The expansion of this market segment is largely due to the versatility of acrylic adhesives, which can effectively bond a wide range of materials such as metals, plastics, glass, ceramics, and wood. They also offer strong resistance to moisture, harsh temperatures, chemicals, and UV exposure, making them well-suited for use in both indoor and outdoor environments.

The EVA segment is expected to grow at the fastest CAGR of 6.5% from 2025 to 2033, due to their versatility, fast setting time, and capability to bond a wide variety of polar and non-polar substrates without the use of water or solvents. Their formulations can be customized to meet specific industrial requirements, offering features such as flexibility, high strength, low-temperature performance, and resistance to various conditions. Commonly utilized in industries like packaging, paper, woodworking, automotive, and mattress production, EVA adhesives are preferred for their durability, ease of use, and cost-efficiency across a broad temperature range. Their strong bonding capabilities and adaptability make them highly valuable in fast-paced manufacturing and assembly operations.

Adhesives Application Insights

The paper & packaging-based adhesives application dominated the market and accounted for the largest revenue share of 29.4% in 2024. As the paper and packaging industry increasingly depends on adhesives, these materials play a vital role in enhancing the strength, durability, and efficiency of products throughout the entire value chain. Adhesives are used at multiple stages, from processing raw materials to assembling finished paper and packaging products. One of their primary applications in this sector is the production of corrugated cardboard and boxes, where adhesives are essential for bonding the layers of corrugated board securely, ensuring structural integrity and stability. These specialized adhesive formulations provide strong bonding performance while also resisting moisture and temperature fluctuations, facilitating efficient and reliable packaging solutions.

Furniture & woodworking segment is expected to grow at the fastest CAGR of 7.4% from 2025 to 2033, driven by the demand for improved product durability, efficient production processes, and environmentally sustainable solutions. Adhesives are essential in a variety of woodworking applications, such as edge banding, vacuum lamination, cabinet joint bonding, and solid wood assembly, where they enhance structural integrity, reduce manufacturing time and costs, and support complex design features. Today's advanced woodworking adhesives, including hot melt EVA, PUR, water-based polyurethanes, polyamides, and EPI systems, are engineered to meet a wide range of performance needs, such as waterproofing, heat resistance, rapid curing, and low VOC emissions.

Sealants Product Insights

The silicone sealants dominated the market and accounted for the largest revenue share of 33.0% in 2024, driven by regulatory support promoting the use of these products across various industries. For instance, the implementation of TAFE (Tractors and Farm Equipment Limited) regulations, which require reducing the overall weight of vehicles to help control pollution, has led to a rise in the use of silicone sealants in automotive applications.

The acrylic sealants segment is expected to grow at the fastest CAGR of 6.3% during the forecast period, driven by their versatility, ease of application, and environmental compatibility, making them ideal for various construction and interior applications. As a water-based, paintable, and low-VOC solution, acrylic sealants are increasingly preferred for sealing gaps in trim, molding, cabinetry, windows, and doors, particularly in indoor environments requiring clean air standards. Their strong adhesion, flexibility, quick curing, and ease of cleanup make them cost-effective and user-friendly for professionals and DIY users. The rising demand for sustainable and safe building materials further accelerates their adoption in residential, commercial, and general construction sectors.

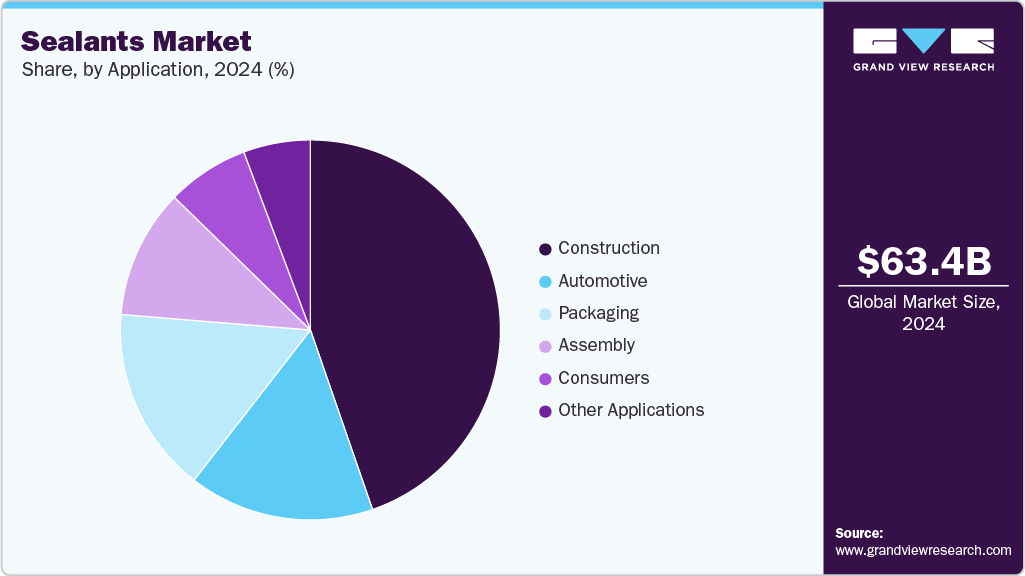

Sealants Application insights

Construction sealants-based application dominated the market and accounted for the largest revenue share of 44.7% in 2024. They are used in construction applications for concrete road joints, expansion joints, sealing cracks, and filling concrete gaps. Sealants are vital in joining and sealing various materials within a structure, such as metals, concrete, wood, and prefabricated components. They are essential for filling gaps, forming impermeable barriers, and preventing water, air, humidity, dust, and UV rays infiltration. Sealants ensure structural integrity and weather resistance in sandwich panels, windows, doors, partitions, or precast concrete slabs.

The packaging segment is expected to grow at the fastest CAGR of 6.4% from 2025 to 2033 during the forecast period, for sealants is increasingly recognized as a critical factor in maintaining product integrity, extending shelf life, and ensuring safe and efficient handling. As these formulations are often sensitive to environmental factors such as moisture, oxygen, and temperature, there is a growing demand for specialized barrier packaging solutions that can preserve the chemical stability of the products throughout storage and distribution. Moreover, by eliminating the need for expensive modified-atmosphere warehousing, these packaging solutions support cost control and sustainability goals. As sealant technologies continue to advance, barrier packaging plays a key role in ensuring product reliability, user safety, and optimized performance across construction, automotive, industrial, and electronics sectors.

Regional Insights

Asia Pacific adhesives and sealants market is a prominent consumer of products in the world with revenue share of 36.2% in 2024, largely driven by the rising use of adhesives and sealants in the building and construction sector across key countries such as India, Indonesia, and Sri Lanka. In India and Indonesia, government initiatives like the Smart Cities Mission, Pradhan Mantri Awas Yojana (PMAY), and Indonesia’s National Medium-Term Development Plan (RPJMN) are significantly boosting demand for these products in residential, commercial, and infrastructure projects. Additionally, the expanding middle class in countries such as India and Vietnam is fueling demand for modern housing and home renovations, leading to higher usage of adhesives and sealants in applications such as tiling, insulation, and waterproofing. The region is also witnessing rapid growth in manufacturing and automotive production, particularly in India and ASEAN nations, driven by initiatives like “Make in India” and supportive foreign investment policies, further contributing to the increased demand for adhesives and sealants.

China held over 52.9% revenue share of the Asia Pacific Adhesives & Sealants market. The China adhesives & sealants market has been experiencing steady growth in recent years due to the increasing demand for automotive production. The rising demand for vehicles in China has significantly increased the need for adhesives and sealants. As Chinese manufacturers prioritize the production of fuel-efficient and electric vehicles (EVs), there is a noticeable transition from traditional welding and mechanical fasteners to advanced adhesive solutions. These adhesives offer key advantages such as reducing overall vehicle weight, improving fuel efficiency, enhancing crash safety, and minimizing vibration, factors essential for the performance of modern vehicles. For instance, Tesla’s Gigafactory in Shanghai, along with major domestic EV producers like BYD and NIO, are increasingly utilizing structural adhesives in body-in-white (BIW) construction and battery pack assembly. In addition, the growth of China’s automotive aftermarket sector is driving demand for sealants in applications like windshield installation, body repair, and engine component servicing. To capitalize on this growing market, multinational companies including Henkel, 3M, and Sika are expanding their production facilities and operations in China.

Europe Adhesives And Sealants Market Trends

The demand for adhesives and sealants in Europe has been experiencing steady growth in recent years. The growth can be attributed to a surge in construction activities, increased automotive production, and continuous technological advancements across the region. As infrastructure development and renovation projects rise, there is an increasing demand for reliable and durable bonding solutions. The renovation of older buildings offers significant growth prospects for construction adhesive suppliers. According to a report by the European Parliament, nearly 90% of buildings in Europe were constructed before 1990, with more than 40% built prior to 1960, highlighting the urgent need for renovation and modernization. Adhesives and sealants are essential in various applications such as structural bonding, insulation, flooring, and waterproofing. Consequently, the robust construction sector in the region is a key driver of demand for these products.

North America Adhesives And Sealants Market Trends

North America is market has been experiencing steady growth in recent years due to the increase in building and construction activities. The growing number of building and construction projects in the region has increased the demand for adhesives and sealants. In addition, the automotive industry in North America is leading in technological innovation, emphasizing the use of lightweight materials and improved vehicle performance. Adhesive sealants are increasingly utilized in automotive manufacturing as alternatives to traditional mechanical fasteners and welding. Their strong bonding properties and lightweight nature help enhance fuel efficiency and boost overall vehicle performance.

Middle East & Africa Adhesives And Sealants Market Trends

The Middle East & Africa is a significant contributor to global oil & gas production. As manufacturers expand operations and establish new production facilities in select countries, combined with rising investments in the construction sector across the Middle East and Africa, the demand for adhesives and sealants in the region is expected to grow steadily over the forecast period. In addition, governments in the Middle East and Africa are implementing measures to boost the automotive sector and attract foreign investment. These initiatives include tax incentives, the development of specialized economic zones, and infrastructure enhancements. For example, in April 2022, Morocco secured substantial investments from global automotive companies, supported by its strategic geographic location, political stability, and favorable government policies. The country has also established the Kenitra Atlantic Free Zone, a dedicated automotive hub, to further encourage investment in the sector.

Latin America Adhesives And Sealants Market Trends

The Latin American is projected to be an emerging market for adhesives & sealants that is expected to grow continuously during the forecast period. Countries like Brazil and Argentina are actively encouraging new building and construction initiatives, leading to a rising demand for adhesives and sealants in the region. The adhesives and sealants market in Brazil is anticipated to expand over the forecast period, driven by the growth of key industries such as automotive, construction, and packaging. This industrial development has significantly contributed to the increasing need for adhesive and sealant products.

Key Adhesives And Sealants Company Insights

Some of the key players operating in the adhesives & sealants market include Henkel AG, Dow, Kuraray Co., and Ashland Inc., among others.

-

Henkel AG is a multinational company that operates in various industries including adhesives, sealants, surface treatments, and other industrial chemicals. The company is known for its well-known brands such as Loctite, Bonderite, Teroson, Technomelt, Aquence, and Schwarzkopf. The company holds leading positions in both industrial and consumer businesses, offering a diverse portfolio that includes hair care products, laundry detergents, fabric softeners, adhesives, sealants and functional coatings.

-

Dow, Inc. specializes in material science. The company’s product portfolio includes plastics, performance materials, coatings, silicones, and industrial intermediates. It offers a wide range of products and solutions in packaging, infrastructure, mobility, and consumer care segments. Dow’s products are used in various sectors such as homes and personal care, durable goods, adhesives and sealants, coatings and food & specialty packaging.

Pidilite Industries, Sika AG, and RPM International Inc., among others, are some of the emerging market participants in the adhesives & sealants market.

-

RPM International Inc. is a multinational company with subsidiaries that specialize in specialty coatings, sealants, and building materials. They have a diverse portfolio of brands, RPM operates in various segments, including construction products, performance coatings, and specialty products. DAP, a subsidiary of RPM International Inc., is a well-known brand. They manufacture and markets products such as caulk, sealants, spackling and glazing compounds, contact cement, and other specialty adhesives. The company has a significant global presence. They sell their products in 170 countries and operate 121 manufacturing facilities in 26 countries.

-

Sika AG is a specialty chemical company offering products for bonding, sealing, damping, reinforcing, and protection in the construction and automotive industry. The company has subsidiaries in 103 countries around the world and operates in over 400 factories, producing innovative technologies for consumers worldwide.

Key Adhesives And Sealants Companies:

The following are the leading companies in the adhesives and sealants market. These companies collectively hold the largest market share and dictate industry trends.

- 3M Company

- Ashland Inc.

- Avery Denison Corporation

- H B Fuller

- Henkel AG

- Sika AG

- Pidilite Industries

- Huntsman

- Wacker Chemie AG

- RPM International Inc.

- Dow

- Kuraray Co., Ltd.

Recent Developments

-

In May 2024, H.B. Fuller, the world’s largest pure play adhesives company, announced the acquisition of ND Industries Inc., a U.S.-based leader in specialty adhesives and fastener locking and sealing solutions. This strategic move enhances H.B. Fuller’s product portfolio, especially in high-growth, high-margin segments like automotive, electronics, and aerospace, and adds ND’s Vibra-Tite brand to its range of epoxy, cyanoacrylate, UV-curable, and anaerobic technologies. The acquisition also includes ND’s network of pre-applied coating centers and custom equipment capabilities, which will now operate under H.B. Fuller’s Engineering Adhesives unit.

-

In January 2023, Avery Dennison has signed an agreement to acquire Thermopatch, a key player in textile labeling, heat transfers, and embellishments, particularly for the sports, workwear, and industrial laundry sectors. This acquisition aligns with Avery Dennison’s strategy to expand its presence in external embellishments and branded solutions, which are closely tied to adhesive and sealant technologies used in heat transfer labels and textile bonding. By integrating Thermopatch into its Apparel Solutions division, Avery Dennison strengthens its portfolio of adhesive-based branding solutions, supporting further growth and innovation in the global apparel and textile markets.

-

In February 2023, 3M introduced a new medical adhesive that offers a 28-day wear time. This product is designed to adhere to the skin for an extended period compared to the previous tape, which had a wear time of 14 days. It is intended for use with various sensors, health monitors, and long-term medical wearables. Prolonged wear time for devices and monitors may lead to cost savings, increased data collection for better decision-making, and reduced patient disruption. The new adhesive, 3M Medical Tape 4578, also provides liner-free stability and can be stored for up to one year, offering device makers more flexibility in the design process.

Adhesives And Sealants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 77.08 billion

Revenue forecast in 2033

USD 123.20 billion

Growth rate

CAGR of 6.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Turkey; China; India; Japan; South Korea; Indonesia; Brazil; Argentina; Colombia, South Africa; Saudi Arabia; UAE

Key companies profiled

3M Company; Ashland Inc.; Avery Denison Corporation; H B Fuller; Henkel AG; Sika AG; Pidilite Industries; Huntsman; Wacker Chemie AG; RPM International Inc.; Dow; Kuraray Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Adhesives And Sealants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global adhesives and sealants market report based on technology, product, application, and region:

-

Adhesives Technology Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

Water Based

-

Solvent Based

-

Hot Melt

-

Reactive & Others

-

-

Adhesives Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

Acrylic

-

PVA

-

Polyurethane

-

Styrenic block

-

Epoxy

-

EVA

-

Other Products

-

-

Adhesives Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

Paper & Packaging

-

Consumer & DIY

-

Building & Construction

-

Furniture & Woodworking

-

Footwear & Leather

-

Automotive & Transportation

-

Medical

-

Other Applications

-

-

Sealants Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

Silicones

-

Polyurethanes

-

Acrylic

-

Polyvinyl Acetate

-

Other Products

-

-

Sealants Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

Construction

-

Automotive

-

Packaging

-

Assembly

-

Consumers

-

Other Applications

-

-

Adhesives & Sealants Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global adhesives and sealants market size was estimated at USD 72,759.6 million in 2024 and is expected to reach USD 77,083.9 million in 2025.

b. The adhesives & sealants market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2033 to reach USD 123,202.2 million by 2033.

b. The construction adhesives & sealants segment by application led the market and accounted for the largest revenue share of 44.7% in 2024, attributed to its applications for concrete road joints, expansion joints, sealing cracks, and filling concrete gaps.

b. Some of the key players operating in the Adhesives & Sealants Market include 3M Company, Ashland Inc., Avery Denison Corporation, H B Fuller, Henkel AG, Sika AG, Pidilite Industries, Huntsman, Wacker Chemie AG, RPM International Inc., Dow and Kuraray Co., Ltd.

b. The growth is attributed to Adhesives & Sealants’ wide utilization for assembly of glass, metal, rubber, and other products during the manufacturing of automobiles and in construction projects

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.