- Home

- »

- Plastics, Polymers & Resins

- »

-

Food Packaging Market Size & Share, Industry Report, 2033GVR Report cover

![Food Packaging Market Size, Share & Trends Report]()

Food Packaging Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Flexible, Rigid, Semi-rigid), By Material, By Application (Bakery & Confectionery, Dairy Products, Fruits & Vegetables), By Packaging Type, By Food Type, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-365-2

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Food Packaging Market Summary

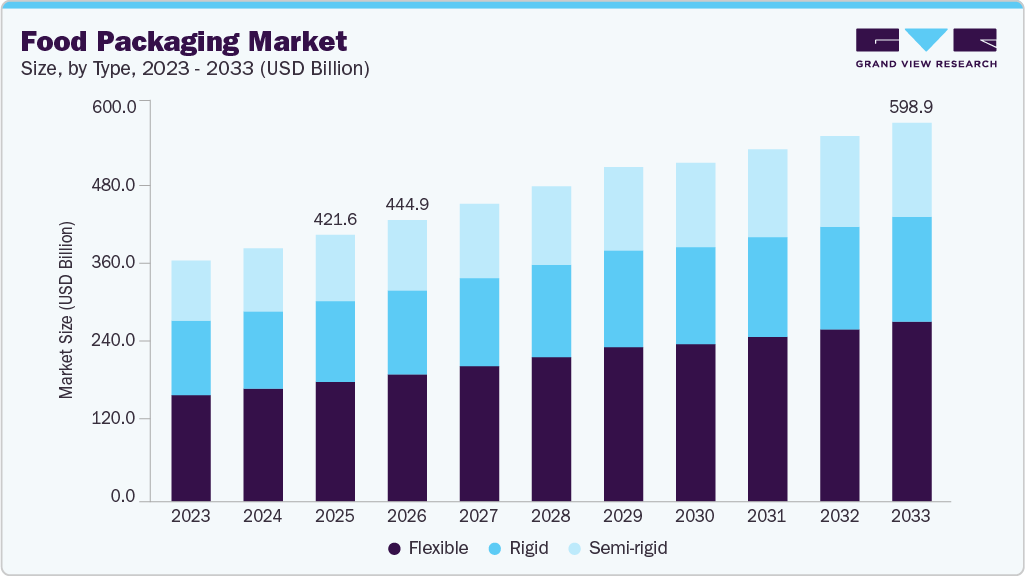

The global food packaging market size was estimated at USD 421.60 billion in 2025 and is projected to reach USD 598.98 billion by 2033, growing at a CAGR of 4.3% from 2026 to 2033. The surge in online grocery shopping, meal kit subscriptions, and food delivery services has fueled the demand for durable and temperature-controlled food packaging solutions.

Key Market Trends & Insights

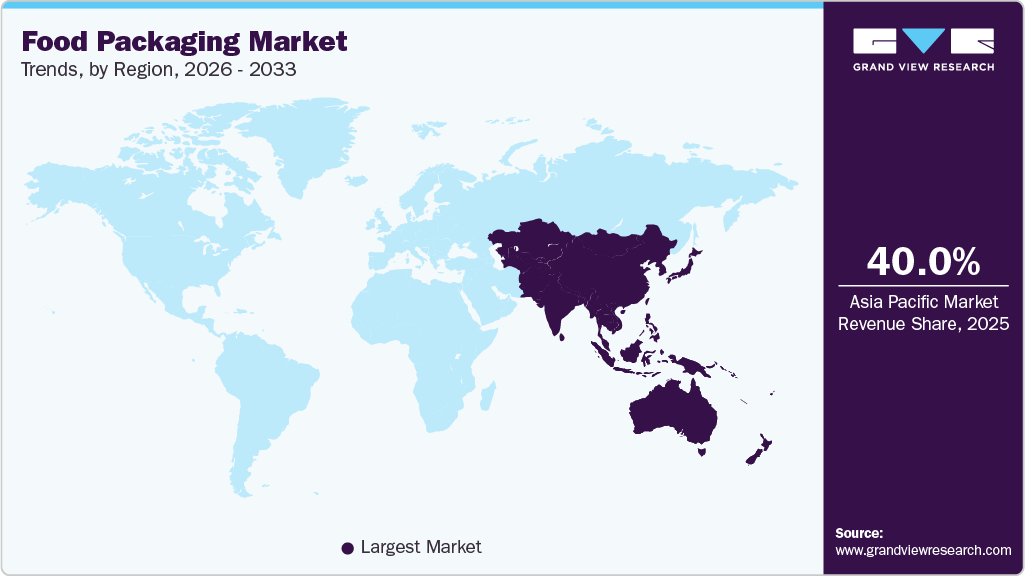

- Asia Pacific dominated the food packaging market with the largest revenue share of over 40.0% in 2025.

- The food packaging industry in India is expected to grow at a substantial CAGR of 6.9% from 2026 to 2033.

- By type, the flexible segment is expected to grow at a considerable CAGR of 5.1% from 2026 to 2033 in terms of revenue.

- By material, the paper & paper-based materials segment is expected to grow at a considerable CAGR of 5.2% from 2026 to 2033 in terms of revenue.

- By application, the dairy products segment is expected to grow at a considerable CAGR of 4.7% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 421.60 Billion

- 2033 Projected Market Size: USD 598.98 Billion

- CAGR (2026-2033): 4.3%

- Europe: Largest market in 2025

Additionally, the growth in urban populations and the middle-class segment worldwide has led to an increase in the consumption of processed and packaged food, driving the growth of the food packaging industry. Growing urbanization and changing lifestyles have significantly transformed food packaging demands in the emerging countries across the world. As more people live in cities with busy schedules, there is an increasing need for convenient, on-the-go packaging solutions. For example, portion-controlled snack packs, microwaveable containers, and ready-to-eat meal packaging have seen substantial growth in recent times.

Sustainability has emerged as a crucial driver, with consumers and regulations driving the demand for eco-friendly packaging solutions. This has led to innovations in biodegradable materials, reduced plastic usage, and the development of recyclable packaging designs. For instance, in November 2024, Greif, a U.S.-based packaging company, introduced a Coated Recycled Paperboard (CRB) specifically designed for the food industry, marking a significant advancement in sustainable packaging solutions. This new product is notable for its recycled and recyclable properties, aligning with the company’s commitment to sustainability and circular economy principles. Additionally, the rise of plant-based materials, such as polylactic acid (PLA) and mushroom-based packaging, demonstrates the industry's shift toward greater environmental responsibility.

Food safety and preservation requirements continue to drive technological advancements in packaging. Modified Atmosphere Packaging (MAP) and active packaging technologies help extend shelf life while maintaining food quality and freshness. Smart packaging with indicators for freshness, temperature, and tampering has gained traction.

Furthermore, e-commerce growth has revolutionized food packaging requirements, especially accelerated by recent global events. This has led to innovative designs that focus on durability during shipping, temperature control, and the unboxing experience. Amazon's frustration-free packaging program has influenced many food manufacturers to redesign their packaging for online retail. Additionally, the rise of meal kit services, such as HelloFresh, has created demand for specialized packaging solutions that ensure the delivery of fresh ingredients while minimizing environmental impact through portion control and the use of recyclable materials.

Market Concentration & Characteristics

The food packaging industry is characterized by high-volume demand and a strong linkage to the food & beverage sector, making it relatively stable and resilient even during economic slowdowns. Demand is largely non-discretionary, as packaging is essential for food safety, preservation, transportation, and branding. The industry serves a wide range of applications, including fresh food, processed food, beverages, dairy products, meat, and bakery products, resulting in diversified demand across various end-use categories.

The food packaging industry is also characterized by moderate to high regulatory oversight. Packaging manufacturers must comply with stringent food contact regulations, labeling standards, sustainability requirements, and waste management policies, particularly in regions such as North America and Europe. Regulatory compliance increases entry barriers and favors established players with strong technical capabilities, certifications, and long-term relationships with food producers and retailers.

Type Insights

The flexible segment led the food packaging market, accounting for the largest share of over 44.0% in 2025. This positive outlook is due to an increasing demand for lightweight, eco-friendly, and convenient packaging solutions in the food industry. Additionally, flexible packaging’s adaptability and space efficiency make it ideal for enhancing consumer convenience and facilitating efficient transportation.

Rigid type of packaging provides durability and excellent protection, making it suitable for preserving food freshness and preventing contamination. Its structural strength is ideal for products requiring long shelf lives, including canned goods, beverages, and condiments.

Material Insights

The plastic segment led the food packaging industry, accounting for the largest share of over 39.0% in 2025. This positive outlook is due to its excellent flexibility, strength, and lightweight nature. They are widely used for packaging a variety of food products, from liquids to solids, as they provide excellent barrier properties that protect contents from contamination, moisture, and oxygen. Plastics can be easily molded into various shapes, making them suitable for flexible, rigid, and semi-rigid packaging formats.

Paper and paper-based materials are increasingly favored for food packaging due to their recyclability and eco-friendly appeal. Commonly used for dry food products, takeout containers, and bakery items, these materials are appreciated for their biodegradability and cost-effectiveness.

Glass is a high-barrier, chemically inert material widely used for packaging beverages, condiments, and preserved foods. Its non-porous surface preserves flavors, aromas, and freshness, making it suitable for products with a long shelf life. The glass segment is primarily driven by consumer preference for premium and sustainable packaging options.

Application Insights

The bakery & confectionery segment recorded the largest market share of over 27.0% in 2025. Bakery and confectionery packaging caters to a range of products, including breads, pastries, cakes, chocolates, and candies. The demand for convenient, ready-to-eat bakery and confectionery items is rising due to busier lifestyles and increased urbanization.

Dairy product packaging encompasses a range of products, including milk, cheese, butter, yogurt, and cream. This segment requires packaging that ensures product safety, freshness, and extended shelf life, given the perishable nature of dairy items. Aseptic, temperature-resistant packaging materials are commonly used to maintain product quality. Rising health consciousness and increasing dairy consumption globally boost demand in this segment. Advancements in cold chain logistics and innovations in sustainable packaging materials further support growth.

Packaging Type Insights

The bottles segment led the food packaging market, accounting for the largest share of over 24.0% in 2025. The increasing demand for dairy-based beverages is driving the demand for bottles in the food packaging industry. Health trends promoting hydration and specialty drinks drive growth in the bottle segment. Innovations in lightweight, eco-friendly bottle designs, along with the introduction of biodegradable options, further support market growth.

Cups in food packaging are favored for their portability, convenience, and suitability for single-serving sizes, which align well with the growing trend of on-the-go consumption. The popularity of ready-to-eat and grab-and-go food items is fueling the demand for cups, as they offer a practical, spill-proof option.

Pouches are flexible packaging solutions used for snacks, sauces, beverages, and pet foods. Their lightweight and customizable structure makes them highly versatile and easy to transport. Pouches can be resealable, stand-up, and made in various shapes, enhancing their appeal in the market.

Food Type Insights

The frozen food segment held the largest market share, exceeding 29.0% in 2025. The growth of the frozen food packaging segment is primarily driven by rising demand for convenient meal solutions among busy urban populations. Advances in packaging technologies, such as vacuum sealing and modified atmosphere packaging (MAP), enhance preservation, which also appeals to health-conscious consumers who prefer preservative-free frozen foods.

Chilled food packaging is used for items that require refrigeration but not freezing, such as dairy products, fresh meats, ready-to-eat salads, and deli products. Rising consumer demand for fresh, ready-to-eat, and minimally processed foods is a major driver for chilled food packaging.

Canned food packaging is primarily used for preserving shelf-stable products, including vegetables, fruits, soups, and fish. Metal cans, typically made of aluminum or tin, are common due to their ability to withstand high temperatures during sterilization, which ensures a long shelf life without the need for refrigeration. Additionally, the sustainability of recyclable metal cans aligns with environmental concerns, strengthening their market position.

Regional Insights

The Asia Pacific dominated the food packaging market, accounting for the largest revenue share of over 40.0% in 2025 and is expected to grow at the fastest CAGR of 5.9% during the forecast period. The Asia Pacific's dominance in the food packaging segment is primarily driven by its massive population base, rapidly growing middle class, and changing consumer lifestyles. Countries such as China, India, Indonesia, and Vietnam are experiencing significant urbanization, leading to increased demand for convenient, packaged food products. For example, the rise of nuclear families and working professionals in cities such as Shanghai, Mumbai, and Jakarta boosted the demand for single-serve portions, ready-to-eat meals, and on-the-go food packaging solutions.

India Food Packaging Market Trends

The India food packaging market is growing due to the exponential growth of e-commerce and food delivery services has further accelerated the need for food packaging solutions. Companies such as Swiggy and Zomato have revolutionized food delivery in the country, creating a surge in demand for sustainable, leak-proof, and temperature-resistant packaging. Local manufacturers have responded by developing specialized packaging solutions, such as modified atmosphere packaging (MAP) for fresh produce and multi-layer flexible packaging for traditional Indian snacks, including namkeen and bhujia. The success of food brands such as Haldiram's and Britannia has also contributed to the market growth.

Europe Food Packaging Market Trends

Europe stands at the forefront of the food packaging industry primarily due to its stringent regulatory framework and strong emphasis on sustainability. The European Union's packaging regulations, particularly the European Green Deal and Circular Economy Action Plan, have pushed manufacturers to develop innovative, eco-friendly food packaging solutions. For instance, in June 2024, Saica Group and Mondelez International partnered to launch a new paper-based packaging solution aimed at the confectionery, biscuit, and chocolate markets. This initiative is significant in the context of sustainability, as the new packaging is designed to be recyclable within the paper waste stream and is suitable for heat-sealable packing processes.

The food packaging market in Germany is primarily driven by its robust manufacturing infrastructure and strong emphasis on sustainability. The country's packaging industry benefits from the adoption of advanced technology. Besides, the German market's strength is also attributed to strict regulatory standards and consumer preferences for high-quality, sustainable packaging.

North America Food Packaging Market Trends

The North America food packaging industry is primarily driven by shifting consumer preferences and lifestyle changes. The region's increasing demand for convenient, on-the-go food options has led to innovations in single-serve packaging, resealable containers, and portable formats. Additionally, the region's strong economic position and high consumer spending power have enabled food manufacturers to invest in premium packaging solutions, such as modified atmosphere packaging (MAP) for fresh produce and meats, which has become increasingly popular in upscale supermarket chains across the U.S. and Canada.

U.S. Food Packaging Market Trends

The growth of the U.S. food packaging industry is primarily driven by its growing demand for convenience foods, single-serve portions, and on-the-go meals. The popularity of meal-kit services such as HelloFresh and Blue Apron has spurred innovation in portion-controlled, sustainable packaging solutions. Additionally, the rise of e-commerce food delivery during and after the COVID-19 pandemic has accelerated the development of tamper-evident and temperature-controlled packaging solutions.

Key Food Packaging Company Insights

The competitive environment of the food packaging market is highly fragmented and intensely competitive, characterized by the presence of large multinational players alongside numerous regional and local manufacturers. Global companies such as Amcor plc, Tetra Pak, Sealed Air, Mondi, Smurfit WestRock, and Huhtamaki compete on the basis of scale, product breadth, technological innovation, and long-term relationships with major food and beverage brands, while smaller players focus on niche formats, cost competitiveness, or regional customization.

Competition is increasingly shaped by sustainability initiatives, including recyclable, bio-based, and lightweight packaging solutions, as well as compliance with evolving food safety and environmental regulations. Innovation in barrier materials, smart and active packaging, and high-speed automation further intensifies rivalry. In contrast, price pressures from large FMCG customers and volatility in raw material costs continue to influence margins and strategic positioning across the market.

-

In November 2025, Mondi expanded its food packaging portfolio with new corrugated and solid board solutions following the acquisition of Schumacher Packaging, adding digital printing capabilities and strengthening its European supply network. The range serves key food segments, including fresh produce and meat, as well as snacks and beverages, and features innovations such as ventilated trays, leakproof boxes, retail-ready packs, and lightweight multipacks. This expansion aligns with major industry trends, focusing on sustainability, improved handling efficiency, enhanced shelf visibility, and stronger brand differentiation.

-

In May 2025, Graphic Packaging International introduced a new paperboard sushi packaging portfolio to support European foodservice operators in complying with the EU Single Use Plastics Directive while addressing rising demand for sustainable alternatives to plastic packaging. The recyclable solutions, produced from FSC-certified paperboard, include plastic-free formats or designs with less than 5% plastic, such as clamshells, trays, pagoda-style boxes, and packs featuring fog-free cellulose windows for enhanced product visibility and freshness.

-

In October 2024, ProAmpac launched the RotiBag, an innovative packaging solution designed for hot-to-go food items, such as rotisserie chicken. This new offering integrates several advanced features designed to enhance usability and sustainability in the food retail sector. The packaging incorporates a fog-resistant window that minimizes condensation, ensuring optimal product visibility regardless of temperature. This feature helps maintain the aesthetic appeal of the food inside.

-

In February 2024, Amcor plc partnered with Stonyfield Organic and Cheer Pack North America to introduce the first all-polyethylene (PE) spouted pouch. The pouch is engineered to provide high moisture and oxygen barrier properties, ensuring the freshness of the yogurt. It also features durable seals that maintain product integrity throughout its lifecycle.

Key Food Packaging Companies:

The following are the leading companies in the food packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Huhtamaki

- Sealed Air

- Sonoco Products Company

- International Paper Company

- Mondi

- Smurfit Westrock

- Graphic Packaging International, LLC

- DS Smith

- Packaging Corporation of America

- Clearwater Paper Corporation

- Coveris

- Pactiv Evergreen Inc.

- ProAmpac

Food Packaging Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 444.90 billion

Revenue forecast in 2033

USD 598.98 billion

Growth rate

CAGR of 4.3% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, material, application, packaging type, food type, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Key companies profiled

Amcor plc; Huhtamaki; Sealed Air; Sonoco Products Company; International Paper Company; Mondi; Smurfit Westrock; Graphic Packaging International, LLC; DS Smith; Packaging Corporation of America; Clearwater Paper Corporation; Coveris; Pactiv Evergreen Inc.; ProAmpac

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global food packaging market report based on type, material, application, packaging type, food type, and region:

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Flexible

-

Rigid

-

Semi-rigid

-

-

Material Outlook (Revenue, USD Billion, 2021 - 2033)

-

Plastics

-

Paper & Paper-Based Materials

-

Glass

-

Metal

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Bakery & Confectionery

-

Dairy Products

-

Fruits & Vegetables

-

Meat & Seafood

-

Sauces & Dressings

-

Others

-

-

Packaging Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cups

-

Bottles

-

Cans

-

Pouches

-

Trays

-

Others

-

-

Food Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Frozen Food

-

Chilled Food

-

Canned Food

-

Shelf Stable Food

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global food packaging market was estimated at USD 421.60 billion in 2025 and is expected to reach USD 444.90 billion in 2026.

b. The global food packaging market is expected to grow at a compound annual growth rate of 4.3% from 2026 to 2033, reaching USD 598.98 billion by 2033.

b. Flexible packaging was the dominant type of segment, occupying over 44.0% share in 2025, and is expected to experience significant growth over the forecast period.

b. Some of the key players in the food packaging market are Amcor plc; Huhtamaki; Sealed Air; Sonoco Products Company; International Paper Company; Mondi; Smurfit Westrock; Graphic Packaging International, LLC; DS Smith; Packaging Corporation of America; Clearwater Paper Corporation; Coveris; Pactiv Evergreen Inc.; and ProAmpac.

b. The key factors driving food packaging include the high penetration of retail chains offering convenience food products, the busy lifestyle of consumers inclined toward ready-to-eat food and beverages, and the large number of food service chains offering food and beverage products according to changing customer needs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.