- Home

- »

- Next Generation Technologies

- »

-

Automated Guided Vehicle Market, Industry Report, 2033GVR Report cover

![Automated Guided Vehicle Market Size, Share & Trends Report]()

Automated Guided Vehicle Market (2026 - 2033) Size, Share & Trends Analysis Report By Vehicle Type (Tow Vehicle), By Navigation Technology (Laser Guidance), By Application (Logistics and Warehousing), By Industry, By Component, By Battery Type, By Mode of Operation, And Segment Forecasts

- Report ID: GVR-1-68038-153-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automated Guided Vehicle Market Summary

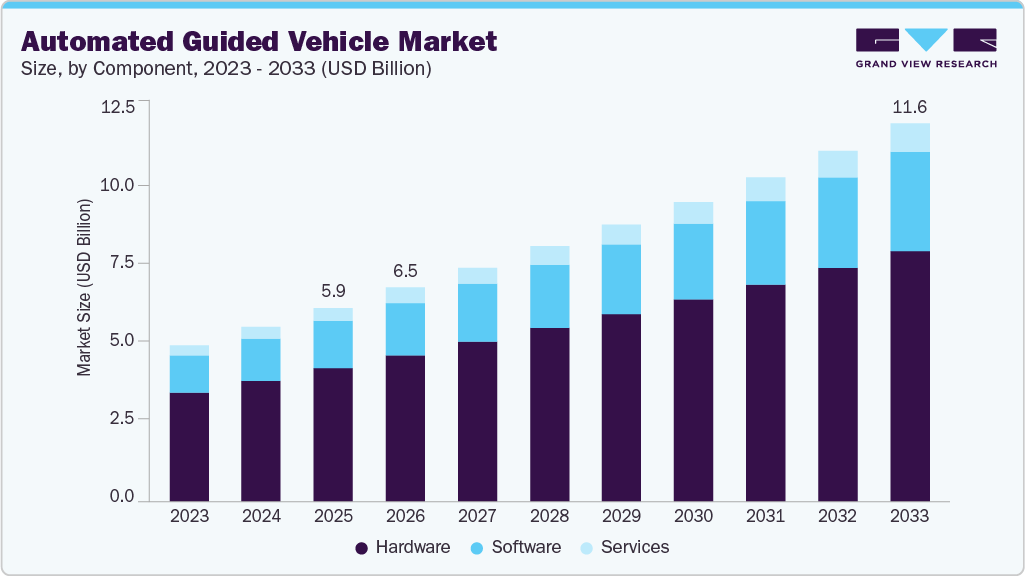

The global automated guided vehicle market size was estimated at USD 5.93 billion in 2025 and is projected to reach USD 11.58 billion by 2033, growing at a CAGR of 8.5% from 2026 to 2033. The market is driven by increasing adoption of Industry 4.0 technologies, rising demand for warehouse automation, growth in e-commerce and logistics sectors, advancements in robotics and AI integration, and the need for labor cost reduction and operational efficiency.

Key Market Trends & Insights

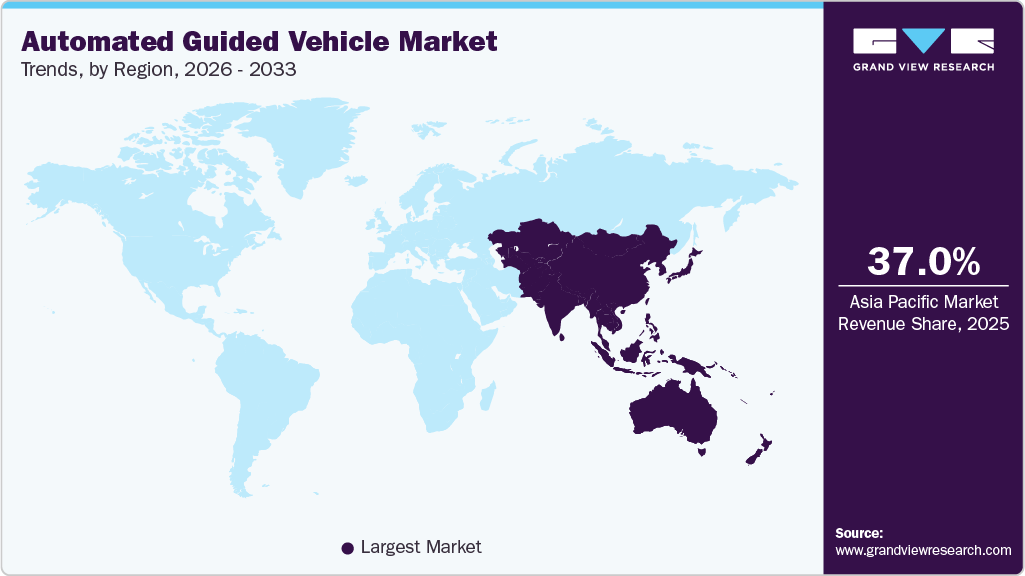

- The Asia Pacific region holds the largest share of the global automated guided vehicle market, accounting for over 37% of the revenue share in 2025.

- The automated guided vehicle (AGV) market in the U.S. led the North America Market and held the largest revenue share in 2025.

- By vehicle type, tow vehicle led the market and held the largest Revenue share of over 38% in 2025.

- By navigation technology, laser guidance segment held the dominant position in the market and accounted for the leading revenue share of over 39% in 2025.

- By industry, wholesale and distribution sector segment is expected to grow at the fastest CAGR of over 10% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 5.93 Billion

- 2033 Projected Market Size: USD 11.58 Billion

- CAGR (2026-2033): 8.5%

- Asia Pacific: Largest Market in 2025

The market is witnessing significant growth, driven by the integration of artificial intelligence (AI) and Internet of Things (IoT) technologies that enable smarter navigation, predictive maintenance, and real-time fleet optimization. Rising demand for warehouse automation and efficient material handling is accelerating adoption across manufacturing, logistics, and e-commerce sectors. Hybrid systems combining AGVs with autonomous mobile robots (AMRs) are enhancing operational flexibility, scalability, and interoperability in complex environments. Cloud-based fleet management and centralized control systems are facilitating real-time monitoring, remote diagnostics, and rapid deployment of robotic fleets. In addition, labor shortages, cost reduction imperatives, and the push for higher throughput are reinforcing the strategic importance of AGVs in modern supply chains.

Advancements in LiDAR, machine vision, and AI-based navigation are enabling AGVs to perform complex tasks with greater precision and adaptability. The adoption of AGV-as-a-Service (AGVaaS) is lowering barriers for small and medium enterprises, making automation accessible without significant upfront investment. AGVs are also becoming more versatile, with applications spanning warehouse automation and production line optimization. Global emphasis on Industry 4.0 and smart manufacturing continues to drive demand for AGVs.

Innovations in battery technology, such as lithium-ion systems, are improving AGV runtime and efficiency. Integration with advanced software, including Warehouse Management Systems (WMS) and IoT platforms, is expanding AGV functionality by enabling real-time inventory management and predictive maintenance. AGV use is increasing in specialized environments like cold storage and hazardous material handling, highlighting their adaptability. Growing demand for customized AGV solutions is driving product innovation among market leaders. As organizations focus on supply chain resilience, AGVs are becoming essential to automation strategies and supporting long-term growth.

Component Insights

The hardware segment dominated the market in 2025, capturing the largest revenue share due to the increasing adoption of automation technologies requiring advanced components for efficiency and scalability. Critical components such as sensors, motors, controllers, and batteries directly impact AGV performance, reliability, and operational efficiency. Technological advancements, including more precise sensors and robust battery systems, have significantly enhanced AGV capabilities and versatility. Industries like manufacturing, logistics, and warehousing are increasingly deploying AGVs to streamline operations, reduce labor costs, and boost productivity. This growing adoption is driving strong demand for high-quality hardware solutions that offer improved accuracy, speed, and durability.

The services segment is projected to grow significantly, driven by increased demand for AGV maintenance, operational support, and employee training. As AGVs become more advanced and essential to industrial operations, comprehensive services are vital for maintaining performance and reliability. Core offerings include preventive and corrective maintenance, system upgrades, installation support, and health monitoring. These services help businesses improve efficiency, reduce downtime, and extend AGV fleet lifespan. As a result, the complexity and strategic role of AGVs are prompting greater investment in service-based solutions.

Vehicle Type Insights

The tow vehicle segment led the market, generating over 38% of global revenue. This growth is driven by increased demand for efficient material handling in the automotive, manufacturing, and logistics sectors, where moving heavy loads is crucial. Tow vehicles provide high load capacity and operational flexibility, supporting automated transport across large facilities while reducing manual labor and disruptions. Their ability to integrate with existing systems and adapt to diverse tasks makes them a preferred solution for scalable automation. As industries focus on productivity and cost efficiency, tow vehicles remain a primary driver of market growth.

The forklift truck segment is projected to experience significant growth over the forecast period. This growth is driven by increasing demand for improved productivity and operational efficiency. These vehicles automate complex tasks, such as high-level pallet stacking, material handling, and inventory management. These tasks usually require substantial manual effort. Automated forklifts help businesses reduce labor costs and minimize human error. They also increase throughput across operations. Workplace safety and regulatory compliance are increasingly important. Automated systems enhance precision and reduce the risk of accidents. As a result, automated forklifts are a strategic solution for industries seeking to optimize efficiency, safety, and operational efficiency.

Navigation Technology Insights

The laser guidance segment led the market in 2025. The high growth is attributed to the increasing demand for precise navigation solutions that ensure operational efficiency and safety in industrial environments. Laser guidance technology provides precise, reliable, and adaptable navigation solutions, which are essential for optimizing the performance of AGVs in complex industrial environments. Laser-guided AGVs utilize laser scanners to map and navigate their surroundings with high precision, enabling them to follow predefined paths and avoid obstacles with minimal errors. This high level of accuracy is essential for applications that require intricate maneuvering and consistent performance, such as in large warehouses, manufacturing facilities, and distribution centers.

The natural navigation segment is expected to experience significant growth in the forecast years due to its advanced capabilities in leveraging environmental features for navigation, which significantly enhance operational efficiency and adaptability. Natural navigation technology, which includes techniques such as Simultaneous Localization and Mapping (SLAM) and vision-based systems, enables AGVs to navigate by interpreting and mapping their surroundings in real-time, without relying on predefined paths or physical markers. Unlike traditional guidance systems that require physical infrastructure or predefined tracks, natural navigation AGVs utilize sensors and cameras to dynamically analyze and understand their environment. This capability enables them to operate in highly variable and unstructured environments, such as changing warehouse layouts or evolving production lines, without the need for extensive reconfiguration.

Application Insights

The logistics and warehousing segment led the market in 2025, driven by the growing need to optimize material handling processes within warehouses and distribution centers. AGVs equipped with advanced technologies are increasingly used to automate repetitive tasks such as transporting goods, sorting items, and replenishing stock, significantly reducing manual labor and operational errors. This automation enhances productivity and accelerates order fulfillment, enabling faster and more efficient warehouse operations. By improving accuracy and workflow efficiency, AGVs contribute to cost savings and higher operational performance. As businesses continue to prioritize supply chain optimization, the adoption of AGVs in logistics and warehousing is expected to expand steadily.

The assembly segment is expected to experience significant growth in the forecast years, driven by the increasing demand for efficiency, precision, and flexibility in manufacturing and assembly processes. AGVs tailored for assembly applications are essential in modern production environments due to their ability to streamline complex workflows, reduce manual labor, and enhance overall operational efficiency. The ability to automate repetitive and labor-intensive tasks, such as transporting parts and components between different stages of the assembly line, is also driving the segment's growth. AGVs equipped with advanced navigation and handling systems can seamlessly integrate with existing assembly lines, improving the flow of materials and optimizing the assembly process.

Industry Insights

The manufacturing sector led the market in 2025, driven by the rising demand for automated solutions that streamline production workflows and reduce reliance on manual labor. AGVs efficiently transport materials, components, and finished products across different stages of production, ensuring timely and accurate delivery. This automation mitigates bottlenecks, minimizes downtime, and optimizes overall production efficiency, which is critical for meeting growing market demands and sustaining a competitive edge. Integration with Industry 4.0 technologies, including IoT and real-time data analytics, allows manufacturers to monitor and enhance operational performance continuously. As a result, AGVs are becoming essential tools for manufacturers seeking to improve productivity, reduce costs, and maintain operational excellence.

The wholesale and distribution sector is expected to experience significant growth over the forecast period, fueled by the increasing need for operational efficiency, accuracy, and scalability in handling large volumes of goods. Rising e-commerce activity, global trade, and complex supply chains are driving demand for AGVs to optimize warehouse and distribution operations. AGVs automate tasks such as moving products from receiving docks to storage, picking and sorting items for order fulfillment, and transporting goods to shipping areas, reducing manual labor and minimizing errors. This automation accelerates processing times, enhances accuracy, and supports high-speed operations essential for modern supply chains. Consequently, AGVs are becoming a strategic solution for wholesale and distribution companies aiming to improve efficiency, reduce costs, and meet customer expectations.

Mode of Operation Insights

The indoor segment dominated the market in 2025, capturing the largest revenue share due to the growing focus on automation in controlled environments where precision and efficiency are critical. Industries such as warehousing, manufacturing, and distribution are increasingly adopting indoor AGVs to optimize space, enhance operational efficiency, and maintain high accuracy in material handling. The surge in e-commerce and the emphasis on streamlined warehouse operations are driving demand for AGVs capable of transporting, sorting, and storing goods with minimal error. Reduced human intervention, improved safety, and better inventory management further reinforce the adoption of indoor AGVs. Consequently, indoor automation solutions are becoming central to operational optimization in high-volume, precision-focused environments.

The outdoor segment is expected to witness substantial growth in the coming years, driven by rising demand for AGVs capable of managing logistics and material transport in open, unstructured environments such as construction sites, ports, and large industrial facilities. Expansion in supply chain and logistics operations requiring efficient material handling across vast outdoor areas is fueling this growth. Outdoor AGVs are engineered to navigate complex terrains and perform tasks such as transporting goods between loading docks, managing outdoor storage yards, and supporting construction site operations. Their ability to operate reliably under varying environmental conditions enhances operational continuity and efficiency. As industries increasingly seek scalable and versatile automation solutions, the outdoor AGV segment is positioned for significant adoption and long-term market expansion.

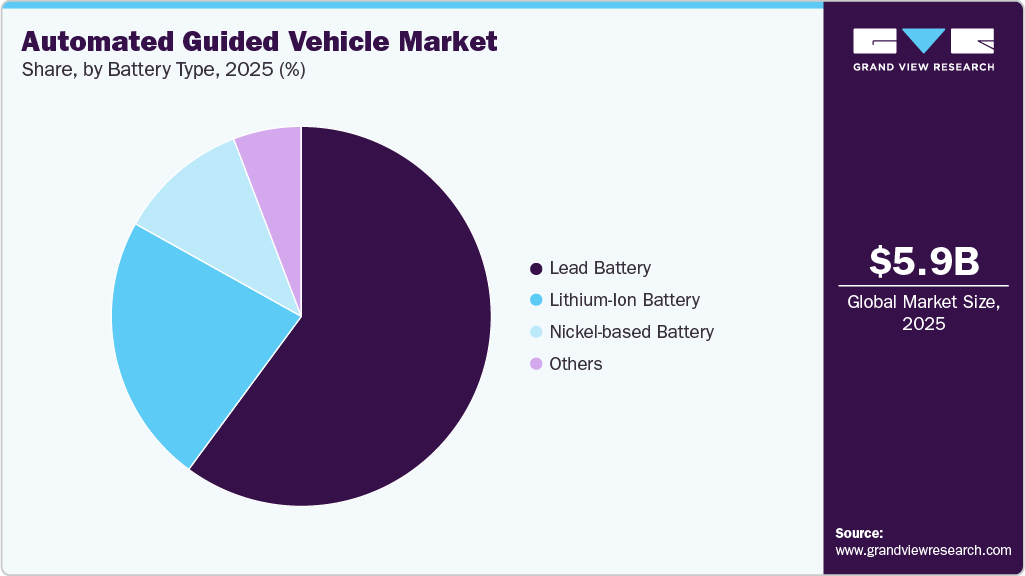

Battery Type Insights

The lead battery segment accounted for the largest market revenue share in 2025, driven by the widespread use of AGVs in cost-sensitive industries. The affordability and reliability of lead-acid batteries make them well-suited for organizations seeking to balance operational efficiency with budgetary constraints. These batteries provide a stable power source, ensuring consistent AGV performance and durability under varying operational conditions. Their robust technology supports industries that depend on AGVs for critical material handling and production tasks. In addition, the lower upfront cost compared to alternative battery technologies makes lead-acid batteries an attractive choice for businesses aiming to optimize capital expenditure while maintaining effective automation.

The lithium-ion battery segment is projected to experience significant growth in the coming years, driven by the rising demand for high-performance, energy-efficient solutions in automated operations. Lithium-ion batteries offer superior energy density, enabling AGVs to operate for extended periods and maintain high productivity without frequent recharging. Their faster charging times support flexible deployment and quick turnaround, particularly in high-demand environments. Industries prioritizing sustainability and operational efficiency are increasingly adopting lithium-ion batteries to reduce downtime and improve workflow continuity. As a result, lithium-ion technology is becoming a key driver of AGV performance and long-term market expansion.

Regional Insights

The North America automated guided vehicle (AGV) market accounted for a significant revenue share of 24% in 2025, reflecting strong regional adoption of automation technologies. Market growth is primarily driven by the e-commerce boom, increasing demand for workplace safety and operational efficiency, and a growing focus on environmental sustainability. AGVs are being deployed across industries to optimize material handling, enhance inventory management, and automate order fulfillment processes. Leading e-commerce players, including Amazon and Walmart, are accelerating AGV adoption to meet rising consumer expectations for faster and more reliable deliveries.

U.S. Automated Guided Vehicle (AGV) Market Trends

The automated guided vehicle (AGV) market in the U.S. is poised for growth in 2025, driven by the widespread adoption of automation to address labor shortages and improve operational efficiency across various sectors. The rapid expansion of the e-commerce industry, fueled by increasing consumer demand for faster deliveries, is a major driver of market growth. AGVs play a critical role in optimizing warehouse operations, including inventory management, order fulfillment, and material handling. As businesses prioritize speed, accuracy, and cost efficiency, the deployment of AGVs is becoming increasingly essential for maintaining a competitive advantage in the U.S. market.

Europe Automated Guided Vehicle (AGV) Market Trends

The automated guided vehicle (AGV) market in Europe is projected to witness strong growth over the forecast period, driven by increasing automation across key industries. The region’s automotive sector, particularly in Germany and the UK, extensively deploys AGVs for automated assembly lines, material transport, and parts handling. European companies are placing greater emphasis on energy-efficient and sustainable solutions, with electric-powered AGVs supporting environmental goals and reducing carbon footprints. As operational efficiency and sustainability become top priorities, AGVs are emerging as essential tools for modernizing industrial and manufacturing processes in Europe.

Asia Pacific Automated Guided Vehicle (AGV) Market Trends

The Asia Pacific region holds the largest share of the global automated guided vehicle market, accounting for over 37% of the revenue share in 2025. The automated guided vehicle (AGV) market in the Asia Pacific is expected to register the highest CAGR over the forecast period, driven by rapid industrialization and growing automation adoption. The region is experiencing a surge in e-commerce, particularly in countries like China and India, where online retail has become a dominant sales channel. AGVs are increasingly deployed in warehouses and fulfillment centers to manage high order volumes, streamline inventory management, and optimize order processing. As businesses focus on efficiency, scalability, and faster delivery, AGVs are becoming critical to supporting the region’s expanding logistics and manufacturing operations.

Key Automated Guided Vehicle Company Insights

Some key market players, such as BALYO, Bastian Solutions, LLC, and Daifuku Co., Ltd., are actively working to expand their customer base and gain a competitive advantage. To achieve this, they are pursuing various strategic initiatives, including partnerships, mergers and acquisitions, collaborations, and the development of new products and technologies. This proactive approach allows them to enhance their market presence and innovate in response to evolving security needs.

-

BALYO specializes in designing, engineering, and manufacturing autonomous forklifts by converting standard trucks into intelligent, self-driving vehicles. Their technology enables conventional forklifts to operate independently, assisting human operators without the need for reflectors or ground lines. BALYO offers a diverse range of AGVs designed to automate warehouse and factory operations, enhancing efficiency and productivity. The company plays a key role in the market by providing innovative solutions that support seamless material handling and operational automation.

-

Bastian Solutions LLC is a provider of material handling and automation solutions, offering integrated systems that include AGVs, robotics, conveyor systems, and Warehouse Management Systems (WMS). The company focuses on helping businesses optimize operations, boost productivity, and enhance supply chain efficiency through customized automation solutions. Its offerings are broadly divided into solutions and services, covering system design, implementation, and ongoing support. In the market, Bastian Solutions supports companies in deploying automated material handling systems that improve operational performance and scalability.

Key Automated Guided Vehicle Companies:

The following are the leading companies in the automated guided vehicle market. These companies collectively hold the largest market share and dictate industry trends.

- Swisslog Holding AG

- KION GROUP AG

- Bastian Solutions, LLC

- Daifuku Co., Ltd.

- Dematic

- JBT

- Seegrid Corporation

- TOYOTA INDUSTRIES CORPORATION

- Hyster-Yale Materials Handling, Inc.

- BALYO

- E&K Automation GmbH

- Kollmorgen

- KMH Fleet Solutions

- ELETTRIC80 S.P.A.

- inVia Robotics, Inc.

- Locus Robotics

- Schaefer Systems International, Inc.

- System Logistics Spa

- Transbotics (A division of Scott Systems International Incorporated)

- Zebra Technologies Corp.

Recent Developments

-

In November 2025, Dematic expanded its AGV portfolio with the launch of the RTS 120 Reach Truck, a driverless vehicle designed for high-bay, single-selective racking environments. The RTS 120 can be deployed in both new and existing warehouse layouts without major infrastructure modifications, enabling seamless and cost-effective automation. With lifting capacities up to 1,200 kg and reaching heights of 10 meters, it enhances high-bay handling, improves safety, and reduces manual labor requirements. Integrated with Dematic’s MANAGE+ AGV Warehouse Control Software, the RTS 120 provides end-to-end operational visibility and data-driven optimization, boosting overall warehouse efficiency.

-

In June 2025, enVista launched enMotion, an end-to-end warehouse optimization platform designed to manage multiple robotic systems, including AGVs, cobots, and goods-to-person technologies. The platform uses an AI-powered orchestration engine combined with enVista’s WES and WCS to optimize the flow of orders, inventory, and automation assets in real time. Its autonomous robotic solutions, featuring lidar-guided SLAM navigation and 360° safety scanners, can reduce travel and search times by up to 80%, enhancing throughput and operational safety. Offered through a Robotics-as-a-Service (RaaS) model, enMotion enables scalable deployment without heavy upfront investment, helping businesses improve efficiency and reduce labor dependency.

-

In March 2025, Scott Technology launched NexBot, a modular Automated Guided Vehicle (AGV) designed to reduce deployment costs and accelerate automation adoption. Its flexible architecture allows configuration with various functional modules, including counterbalance forks, tugger units, and conveyor decks, to meet diverse material handling needs. NexBot integrates seamlessly with Scott’s Maestro+ platform and features advanced navigation, safety systems, and fast-charging lithium-ion power for continuous operation. The AGV provides scalable, efficient automation solutions that address labor shortages and optimize workflow across warehousing, logistics, manufacturing, and e-commerce operations.

Automated Guided Vehicle Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 6.54 billion

Revenue forecast in 2033

USD 11.58 billion

Growth rate

CAGR of 8.5% from 2026 to 2033

Base year

2025

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, navigation technology, application, industry, component, battery type, mode of operation, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Swisslog Holding AG; KION GROUP AG; Bastian Solutions, LLC; Daifuku Co., Ltd.; Dematic; JBT; Seegrid Corporation; TOYOTA INDUSTRIES CORPORATION; Hyster-Yale Materials Handling, Inc.; BALYO; E&K Automation GmbH; Kollmorgen; KMH Fleet Solutions; ELETTRIC80 S.P.A.; inVia Robotics, Inc.; Locus Robotics; Schaefer Systems International, Inc.; System Logistics Spa; Transbotics; Zebra Technologies Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automated Guided Vehicle Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global automated guided vehicle (AGV) market report based on vehicle type, navigation technology, application, industry, component, battery type, mode of operation, and region:

-

Vehicle Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Tow Vehicle

-

Unit Load Carrier

-

Pallet Truck

-

Forklift Truck

-

Hybrid Vehicles

-

Others

-

-

Navigation Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

Laser Guidance

-

Magnetic Guidance

-

Vision Guidance

-

Inductive Guidance

-

Natural Navigation

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Logistics and Warehousing

-

Transportation

-

Cold Storage

-

Wholesale & Distribution

-

Cross-Docking

-

-

Assembly

-

Packaging

-

Trailer Loading and Unloading

-

Raw Material Handling

-

Others

-

-

Industry Outlook (Revenue, USD Billion, 2021 - 2033)

-

Manufacturing Sector

-

Automotive

-

Aerospace

-

Electronics

-

Chemical

-

Pharmaceuticals

-

Plastics

-

Defense

-

FMCG

-

Tissue

-

Others

-

-

Wholesale and Distribution Sector

-

E-commerce

-

Retail Chains/Conveyance Stores

-

Grocery Stores

-

Hotels and Restaurants

-

-

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Battery Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Lead Battery

-

Lithium-Ion Battery

-

Nickel-based Battery

-

Others

-

-

Mode of Operation Outlook (Revenue, USD Billion, 2021 - 2033)

-

Indoor

-

Outdoor

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global automated guided vehicle market size was estimated at USD 5.34 billion in 2024 and is expected to reach USD 5.93 billion in 2025.

b. The global automated guided vehicle market is expected to grow at a compound annual growth rate of 9.2% from 2025 to 2030 to reach USD 9.18 billion by 2030.

b. Asia Pacific dominated the automated guided vehicle market in 2024 and accounted for a revenue share of over 36%.

b. Some key players operating in the AGV market include Swisslog Holding AG; Dematic; Bastian Solutions, Inc.; Daifuku Co., Ltd.; JBT; Seegrid Corporation; Hyster-Yale Materials Handling, Inc.; Kollmorgen; and KMH Fleet Solutions.

b. The lead battery segment dominated the AGV market in 2024 and accounted for a revenue share of over 60%.

b. The tow vehicle segment dominated the AGV market in 2024 and accounted for a revenue share of over 38%.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.